Global Contactless Payment Market Size, Share, Trends, & Growth Forecast Report Segmented By Device (Smartphones And Accessories, Point Of Sale Terminals And Smart Cards), Solution (Payment Terminal Solution, Transaction Management, Fraud Management, Hosted POS), Application (Retail, Transportation, Healthcare, Hospitality and Government) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Contactless Payment Market Size

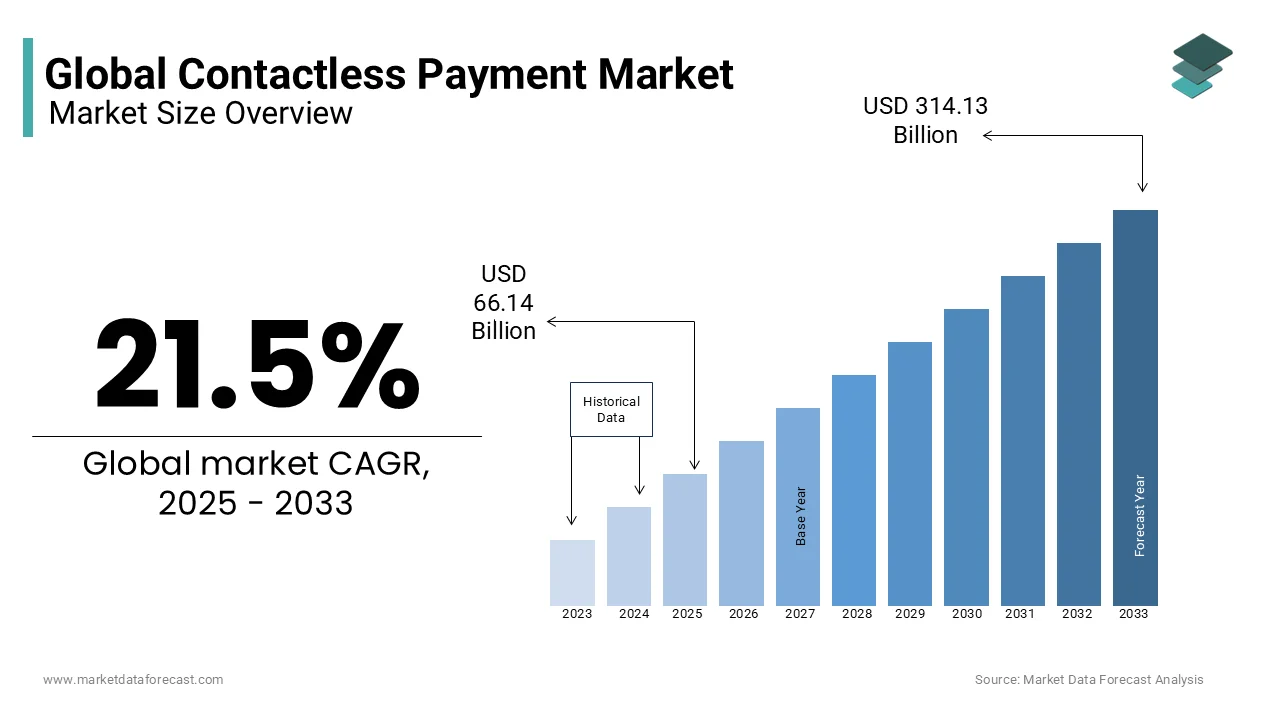

The global contactless payment market size was valued at USD 54.44 billion in 2024. The global market is estimated to grow at a CAGR of 21.5% from 2025 to 2033 and be worth USD 314.13 billion by 2033 from USD 66.14 billion in 2025.

Contactless payment is the way of secure payment transactions that are made using technologies such as Bluetooth, infrared (IR), radio frequency identification (RFID), and near-field communication (NFC). Contactless payment takes almost a tenth of the time that traditional electronic transactions take, making it easier for customers. The need to make payment safer and the convenience of paying quickly without cash or identity details make contactless payment a popular game changer. Initially, contactless cards were only used in the form of travel tickets; It has evolved and helps consumers make payments for almost everything. A point to be focused is that these payments will have an upper limit and restricted number of transactions per day. This allows the transaction to take place without any physical connection between the consumer's payment device and the point-of-sale terminal. Mobile phone payments, key chains, stickers and cards are some of the devices used to make contactless payments. Contactless payments offer efficient and fast payment solutions via an EMV contactless card, an NFC mobile phone or a standard contactless travel card Near Field Communication (NFC) technology allows contactless payments with the use of standards-based wireless communication technology for the exchange of information between a device and a point-of-sale terminal, providing a better and trouble-free customer experience. In addition, NFC is used in mobile wallets, which are handy for secure money transfers and ticket transactions.

MARKET TRENDS

Rising Penetration of the Internet

The global contactless payment market is primarily driven by the rising penetration of the Internet, as a robust Internet connection is vital for this kind of payment. The number of Internet users in 2023 has touched almost 4 billion, with a year-on-year growth rate of approximately 7%. In addition, with the rise of digitalization and smart cities, people will be more inclined to contactless payment methods, because they offer convenience and faster payment terms. Also, smartphone manufacturers are launching contactless payment methods like Samsung Pay. All of this will help develop the market for contactless payment terminals. Applications like Google Pay, Apple Pay, Samsung Pay and many others stimulate the market by offering money transfers, rewards and many other easy-to-use benefits. North America recorded the highest Internet penetration rate, trailed by Europe, Australia and Latin America. The average Internet penetration rate across the globe is 56.80%. With the increasing level of Internet penetration, people are adapting to new technologies and becoming more and more technology-oriented. This stimulates the contactless payment market.

MARKET DRIVERS

Advancements in Contactless Payment Technology

Several factors are contributing to the growth of contactless payment systems, such as advancements in contactless payment technology, a greater awareness of plastic money among buyers, a higher frequency of purchases, and a need for fast transaction time with no hassle of stay in long queues. Contactless payment continues to evolve, making it a useful interface between consumers and retailers, the advertiser and merchants. Increased penetration of the Internet also stimulates the market for contactless payment business in the coming years.

MARKET RESTRAINTS

The initial setup cost and government limitation on number of transactions per day.

The initial setup cost, the government limitation on the number of contactless payment transactions per day, and the limitation on the amount that can be done per day are some deficiencies of contactless payment that hinder the growth of the contactless payment market. The risk of spyware, malware and virus attacks from the use of multiple systems limits the adoption of contactless payments worldwide. The poor knowledge of this payment method, particularly in Asia-Pacific and Latin America, further restricts growth in the global contactless payments market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

21.5% |

|

Segments Covered |

By Device, Solution, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Gemalto (Netherlands), Infineon (Germany), Ingenico (France), Wirecard (Germany), Verifone (United States), Giesecke + Devrient (Germany), IDEMIA (France), On Track Innovations (Israel), Identiv (United States), CPI Card Group (United States), Bitel (South Korea), Setomatic Systems (United States), Valitor (Iceland), PAX Global Technology (China), MYPINPAD ( United Kingdom), Mobeewave (United Kingdom), Alcineo (South Africa), Castles (Taiwan), SumUp (United Kingdom), PayCore (Istanbul) and Others. |

SEGMENTAL ANALYSIS

By Device Insights

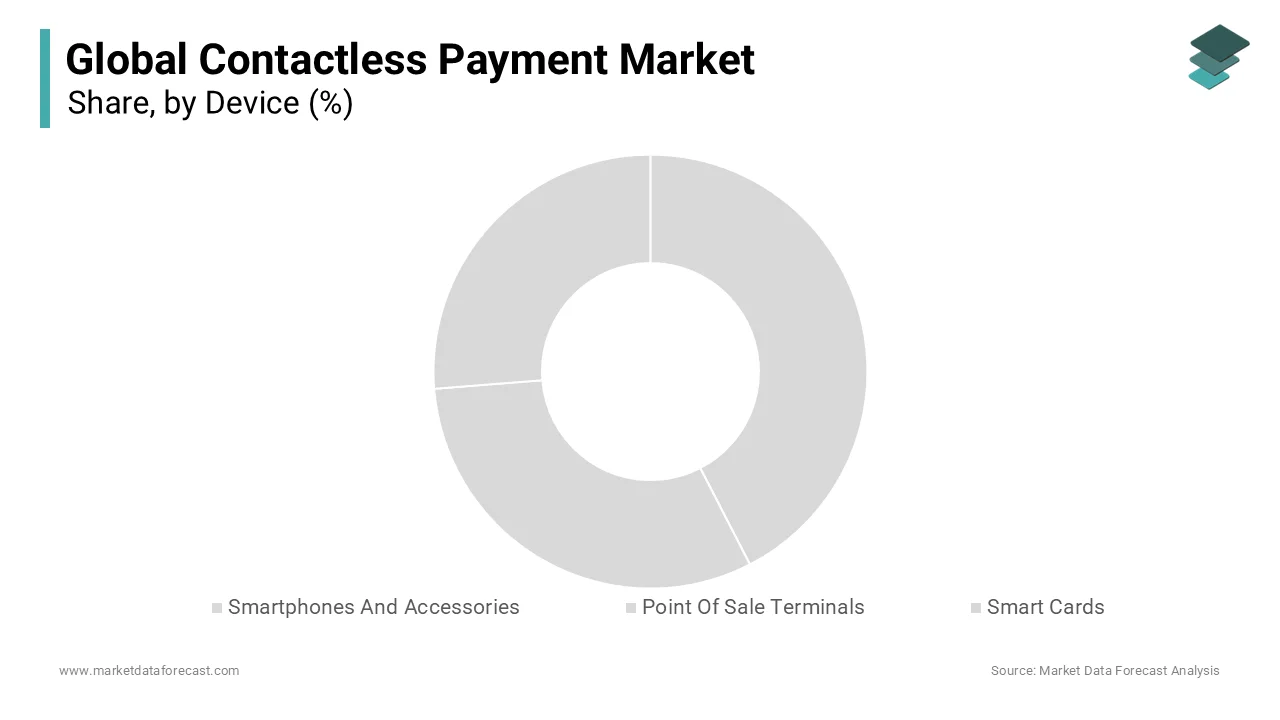

Several financial service providers offer a more convenient payment mechanism and transaction volumes through secure transaction devices. The use of smartphones has increased considerably in daily activities. For example, people now use smartphones to make payments in stores. Also, innovations in wearable devices such as payment bands and rings are expected to stimulate market demand during the forecast period.

By Solution Insights

The payment terminal solution accounted for a significant share and is expected to continue to grow over the forecast period. Transactions made through contactless payments are susceptible to fraud because people have become more aware of the use of these systems. Several contactless technology providers like Gemalto and Visa Inc., continually improve their security protocols to improve security management in the contactless payment market. As such, the fraud and security management segment is expected to grow over the outlook period.

By Application Insights

The retail and consumer goods sector offers quick transactions to speed up the payment process, which is likely to further stimulate demand in these segments. In addition, these payments also find uses in service companies, such as cinemas, service stations, restaurants, and convenience stores, which stimulate the demand for contactless payments in the retail industry.

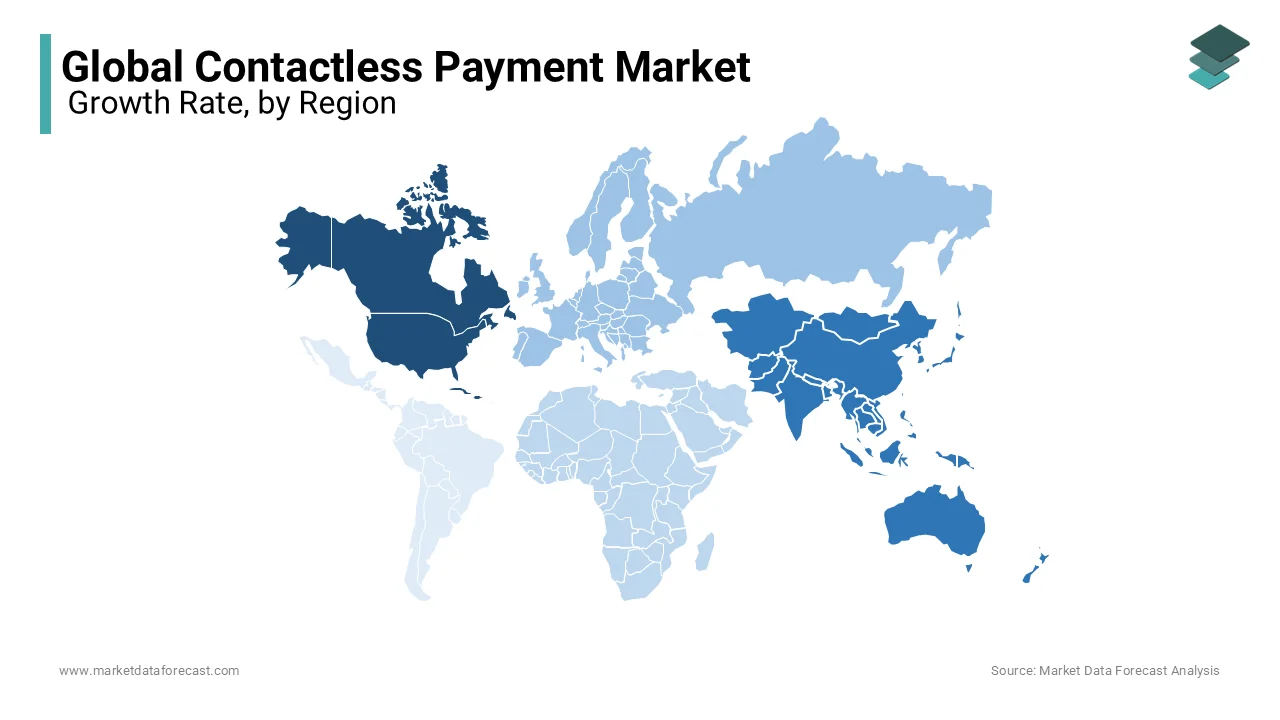

REGIONAL ANALYSIS

North America is anticipated to dominate the market over the prediction period due to various advances in smart chip technology. The strong penetration of smartphones should stimulate demand in Europe. The growth in this area is mainly credited to the surge in the adoption rate, regulatory policies like Euro MasterCard Visa (EMV), the adoption of NFC technology and the strong standards related to smart cards.

KEY MARKET PLAYERS

Gemalto (Netherlands), Infineon (Germany), Ingenico (France), Wirecard (Germany), Verifone (United States), Giesecke + Devrient (Germany), IDEMIA (France), On Track Innovations (Israel), Identiv (United States), CPI Card Group (United States), Bitel (South Korea), Setomatic Systems (United States), Valitor (Iceland), PAX Global Technology (China), MYPINPAD ( United Kingdom), Mobeewave (United Kingdom), Alcineo (South Africa), Castles (Taiwan), SumUp (United Kingdom), and PayCore (Istanbul) are some of the major players in the global contactless payment market.

RECENT HAPPENINGS IN THE MARKET

- In August 2024, Visa collaborated with Pick-n-Pay, a Nigeria-based company, to launch contactless payment solutions for consumers in Lagos. This partnership brings together unique payment technology by Visa with a comprehensive retail presence of Pick-n-Pay, giving users a persistent, effortless, secure, and effective payment method.

- In July 2024, it was reported that Worldline entered into a partnership with Selfly Store, an intelligent vending machine company. This partnership will see work with Antenor, a payment expert company, for incorporating a contactless payment solution with Solfly’s contactless vending machines.

MARKET SEGMENTATION

This research report on the global contactless payment market is segmented and sub-segmented into the following categories.

By Device

- Smartphones And Accessories

- Point Of Sale Terminals

- Smart Cards

By Solution

- Payment Terminal Solution

- Transaction Management

- Fraud Management

- Hosted POS

By Application

- Retail

- Transportation

- Healthcare

- Hospitality

- Government

By Region

- North America

- Europe

- Middle East & Africa

- Latin America

- Asia Pacific

Frequently Asked Questions

What are the primary benefits of using contactless payments?

The primary benefits of contactless payments include faster transaction times, increased convenience, enhanced security features such as encryption and tokenization, and reduced wear and tear on physical payment cards.

What regulatory considerations affect the contactless payment market?

Regulatory considerations include compliance with data protection laws such as GDPR in Europe, financial regulations to prevent fraud and money laundering, and standards set by payment networks and international bodies.

How is the contactless payment market expected to evolve in the next five years?

The market is expected to grow significantly, with increasing adoption of mobile wallets, integration with wearable devices, expansion in emerging markets, and advancements in security technologies to address consumer concerns.

What role do fintech startups play in the contactless payment market?

Fintech startups are driving innovation in the contactless payment market by developing new technologies, enhancing user experiences, providing competitive alternatives to traditional banking, and expanding access to underbanked populations.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]