Global Contact Center Outsourcing Market Size, Share, Trends, & Growth Forecast Report – Segmented by Service Type (Chat Support, Email Support, Voice Support, and Others), End User (IT and Telecom, BFSI, Healthcare, Retail, Government, and Others), & Region - Industry Forecast From 2024 to 2032

Global Contact Center Outsourcing Market Size (2024 to 2032)

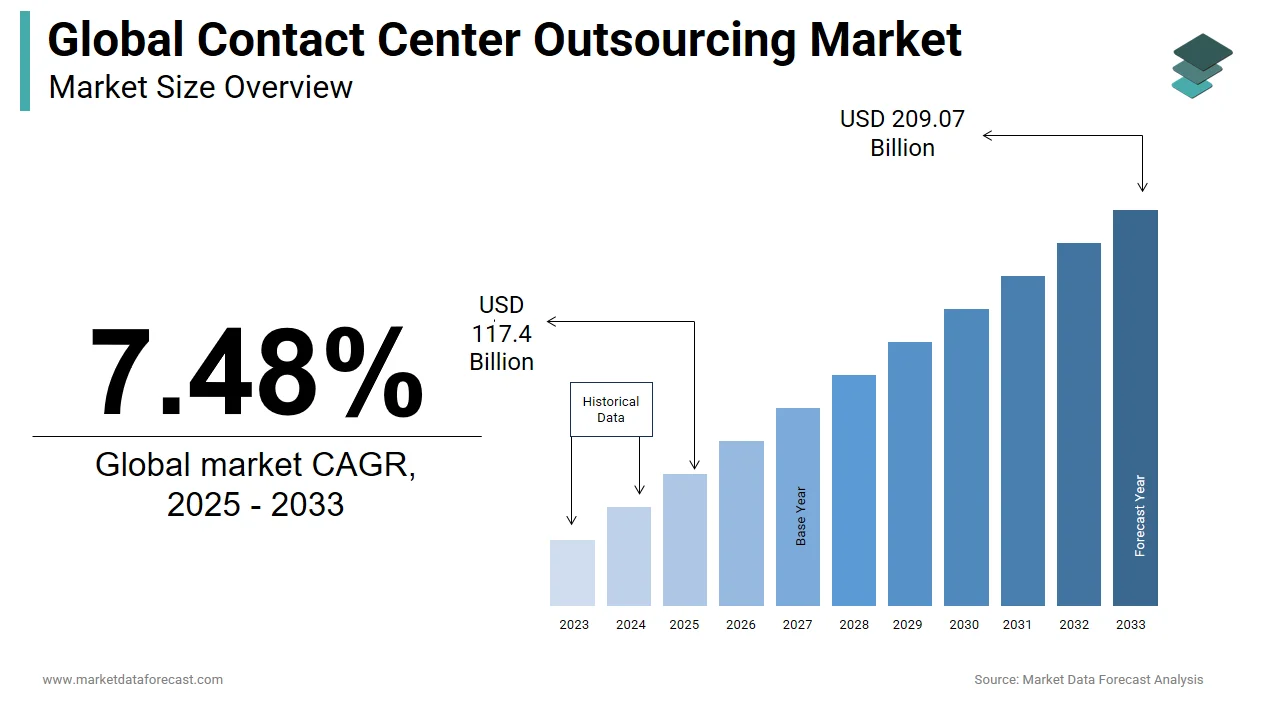

The global contact center outsourcing market was worth USD 101.63 billion in 2023. The global market is predicted to reach USD 109.23 billion in 2024 and USD 194.52 billion by 2032, growing at a CAGR of 7.48% during the forecast period.

Current Scenario of the Global Contact Center Outsourcing Market

The demand for contact center outsourcing has increased exponentially in recent years, and the global market has had a prominent growth. During the forecast period, the demand for contact center outsourcing services is anticipated to accelerate further due to the growing dependency of businesses on third-party providers to manage customer interactions effectively. This trend can be seen clearly in countries such as the Philippines, India, and the United States.

- For instance, the Philippines has been evolving as a leader in this industry, with a population of 1.3 million working in this sector. India is closely behind and leveraging its vast pool of English-speaking professionals and technological expertise to attract multinational clients

The shift towards cloud-based solutions and AI-driven customer interactions is one of the notable trends observed in the global contact center outsourcing market in recent years. Currently, the global contact center outsourcing market has intense competition, and companies such as Teleperformance, Concentrix, and Sitel Group are playing a dominating role. To gain a competitive advantage, companies that operate in the global contact center outsourcing market have been focussing on digital transformation strategies such as the integration of artificial intelligence and machine learning, the adoption of omnichannel platforms to provide seamless interactions across various communication channels, and stringent data security measures to build client trust.

MARKET DRIVERS

The cost reduction benefits associated with using contact center outsourcing services to businesses are one of the major factors propelling the global market growth.

The significant cost reduction that contact center outsourcing services offer to businesses is primarily boosting their adoption and demand. Companies can significantly reduce their operational expenses by outsourcing their contact center operations to service providers located in the countries that have lower labour costs. One of the reports from Deloitte confirms the same, as per it, approximately 59% of the businesses outsource their contact center operations to reduce their costs. The cost savings from outsourcing usually come from the spending on staffing, training, technology, and infrastructure.

- For example, companies face a cost of USD 22 to USD 31 per hour per agent in the U.S. if operated in-house contact centers, whereas the same costs as low as USD 8 to USD 14 per hour per agent if used an outsourced centers from Philippines or India.

The savings are substantial; hence, businesses have been increasingly focussing on outsourcing their contact center operations and allocating the saved costs to their critical areas.

Businesses can gain access to skilled labour by outsourcing their contact center operations, which is further boosting the global market growth.

Companies can gain access to a large pool of skilled labour by outsourcing their contact center operations, especially to countries that have well-established outsourcing centers. Countries such as India and the Philippines have developed numerous training programs to improve the customer service skills, language proficiency, and technical expertise of people to do well in the contact center industry. As of now, more than 3.9 million people in India are working in the contact center outsourcing market and Philippines has 1.3 million call center agents, which is offering the access to skilled and experienced workforce that can provide high-quality customer service to businesses.

By outsourcing their contact center operations, businesses will have a better chance to focus on their strategic plans, which is also promoting the growth of the global contact center outsourcing market.

Companies feel that they can focus better on their core competencies by outsourcing their contact center operations, which is another significant factor propelling the demand for these services and global market growth. By reducing the burden of non-core activities such as customer services, companies can also invest more resources in major departments such as product development, marketing, and sales, which can eventually provide better value to the companies. It was found in a survey conducted by PwC that 55% of the companies outsource their contact center operations majorly to gain access to expertise and save resources to invest in their strategic plans.

Furthermore, factors such as advancements in the technology and infrastructure, the scalability and flexibility offered by the contact center outsourcing centers, improved quality of customer service, 24/7 service availability and multilingual support capabilities of contact center outsourcing centers are favouring the global market growth. Y-o-Y rise in the demand for omnichannel solutions, rapid adoption of cloud-based services, improved data security measures and compliance with regulatory standards are further aiding the growth of the global market.

MARKET RESTRAINTS

Concerns over data security and privacy are restraining the growth of the global contact center outsourcing market.

In addition, factors such as high employee turnover rates in outsourcing firms, language and cultural barriers, negative perceptions of outsourced customer service, and dependency on external vendors are impeding the growth of the global market. Communication challenges and time zone differences, issues of regulatory compliance, hidden costs, loss of control over customer interactions and quality and consistency of service delivery are further affecting the growth of the contact center outsourcing market.

MARKET OPPORTUNITIES

Latin America and Africa present potential opportunities for the expansion of the contact center outsourcing market. In Africa, South Africa has risen as a good prospect for companies exploring outsourcing cost-effective and technically sound staff for BPO services. The country possesses a huge number of highly skilled, educated, and professional workforce, a high literacy rate, and English as a popular language for business communication. This makes the nation an alluring place for BPO services which need command in the English language, like back-office operations, technical assistance, and customer service. Additionally, it also has the benefit of time zone, which enables it to serve markets in Africa, the Middle East, and Africa.

Latin America stands as another attractive destination for market expansion. Organizations of all industries can gain from nearshoring. But, the technology sector, especially, has been using this subcontracting solution to its benefit. The U.S. companies are exploring Latin American nations as tactical nearshoring markets for tech outsourcing. This can be because of equivalent or closely similar time zones as US organizations, low frequency of work interruptions, simpler live collaboration, quick issue resolution, and budget-friendly recruitment for MNCs.

- As per industry experts, employees in Latin America earn 20 thousand less annually than those in Asian countries. As salaries rise universally, wages in this region have declined, decreasing by 4 per cent at the same time.

MARKET CHALLENGES

Prolonged wait times and high contact volumes are one of the primary challenges to the expansion of the contact center outsourcing market. Handling the massive amounts of customer contacts, particularly throughout rush hours, often results in prolonged waiting periods and customer dissatisfaction. This is the most common problem every customer faces.

- According to a survey by the Replicant contact center, hold time gained the first rank in customer complaints with 44 per cent of participants stating they get frustrated or furious with a wait time of 5 to 15 minutes.

These annoyed people are likely to get discouraged, changing their purpose elsewhere. Another study by Microsoft reveals that the median hold time of about 12 minutes, based on the time of day a customer contacts. The longest average waiting period was 85 minutes for the energy industry, while the shortest time was 2 minutes and 3 seconds.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

7.48% |

|

Segments Covered |

By Service Type, End User Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Conduent Inc., IBM, HP, Teleperformance SA, CGS Inc., HGS, Datamark, Inc., Infinit Contact, Five9 Inc, VADS, Alorica, Invensis, Transcosmos, Convergys, Arvato, Sykes Enterprises, Atento, and Others. |

SEGMENTAL ANALYSIS

Global Contact Center Outsourcing Market Analysis By Service Type

The voice support segment dominated the contact center outsourcing market in 2023 by accounting for 38.8% of the global market share and is expected to grow at a healthy CAGR throughout the forecast period. Despite the rapid adoption of digital channels in customer support, voice support remains a strong option to resolve complex issues and provide a human touch. The need for personalized customer interactions and immediate problem resolution is one of the factors propelling the expansion of the voice support segment in the global market. High satisfaction rates and high-resolution speed through voice support compared to other service types are further boosting segmental growth.

- For instance, according to CFI Group, voice support typically results in a customer satisfaction rate of 74%, which is the highest among all.

The chat support is another major segment in the global market. The chat support segment occupied a substantial share of the worldwide market in 2023 and is expected to grow at a promising CAGR during the forecast period. The rising demand for real-time customer assistance and rapid adoption of AI-driven chatbots are majorly driving the growth of the chat support segment in the global market.

- For instance, in a survey conducted by Tidio, more than 41% of the customers agreed that they prefer the live chat option as the primary channel to avail customer service.

Global Contact Center Outsourcing Market Analysis By End-User Industry

The IT and telecom segment led the market and held 29.7% of the global market share and is estimated to register a prominent CAGR during the forecast period. The growing need for robust customer support, technical assistance, and service optimization are some of the factors driving the growth of the IT and telecom segment in the global market.

- According to Gartner, more than 70% of the IT and telecom companies outsource their contact center operations to improve efficiency in customer service.

The BFSI segment is another notable segment and occupied 26.4% of the global market and is predicted to be a strong contender in the global market by end-user during the forecast period. The growing need to manage customer queries, fraud detection, and transaction support is primarily boosting the growth of the BFSI segment in the global market.

- As per PwC, more than 65% of the financial institutions outsource their contact center operations to make sure of compliance and security.

The healthcare segment is anticipated to post a noteworthy CAGR during the forecast period in the global market. Y-o-Y rise in the need to manage patient appointments, billing inquiries, and rapid adoption of telehealth services are contributing to the growth of the healthcare segment in the worldwide market.

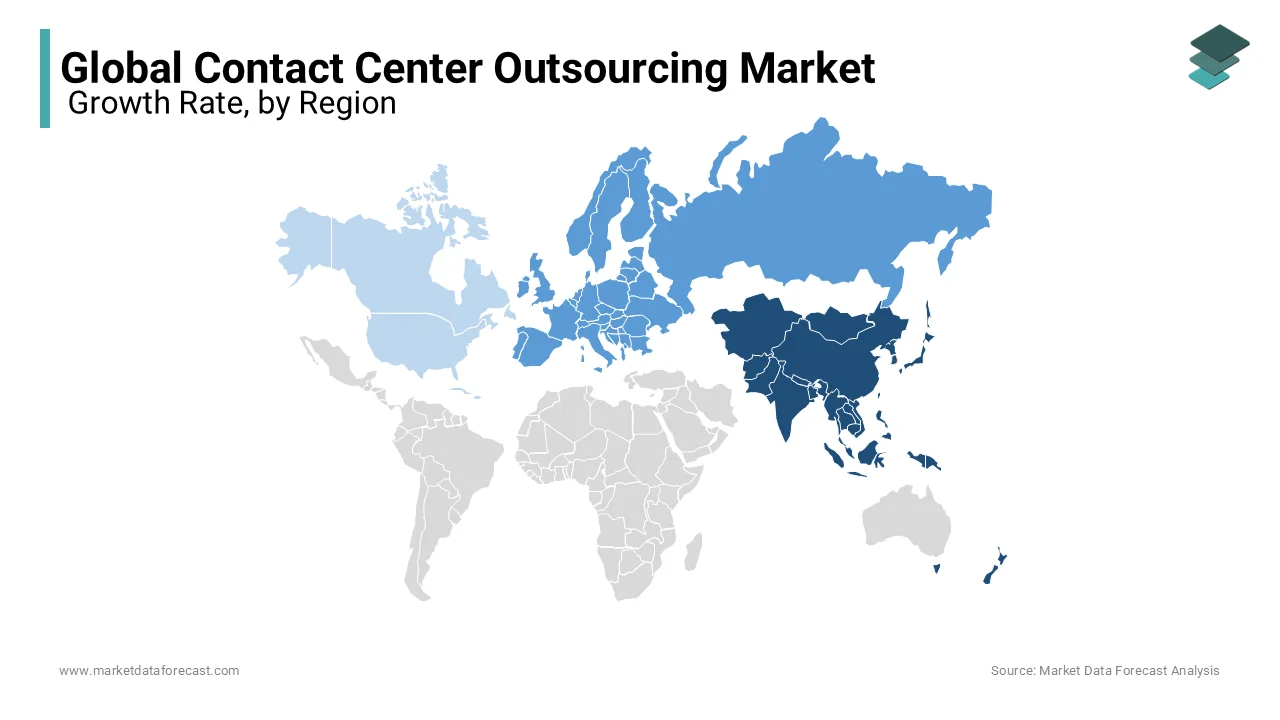

REGIONAL ANALYSIS

Asia-Pacific emerged as the most dominating region in the global market by accounting for the major share of the worldwide market share in 2023. The availability of skilled workforce, cost advantages, and increasing demand from global companies are primarily fuelling the contact center outsourcing market growth in the Asia-Pacific region. According to NASSCOM, India and the Philippines are the popular outsourcing destinations in the Asia-Pacific and these 2 countries account for the largest share of the Asia-Pacific market.

Europe is a lucrative regional segment in the worldwide market and is predicted to showcase a promising CAGR during the forecast period. The growth of the European market is majorly driven by the ability to address multilingual support requirements, stringent regulatory standards, and a growing need for cost-efficient customer service solutions.

- As per Frost & Sullivan, more than 65% of the businesses from Europe use outsourced contact center services for multilingual support. The UK and Germany are largest contributors to the European market and likely to hold a 50% of the share of the European market.

North America is predicted to witness a healthy CAGR during the forecast period owing to the Y-o-Y growth in the demand for customer service excellence, the availability of sophisticated technological infrastructure, and the presence of numerous large enterprises. The U.S. is a major contributor to the North American market and accounts for more than 70% of the North American market share.

Africa, in recent times, has experienced tremendous growth in the contact center outsourcing market and is expected to drive forward at a steady rate during the forecast period. The business process outsourcing (BPO) industry in South Africa has emerged as a leading market in the region. This progress is fuelled by the favourable business environment, highly trained workforce, and its strategic location. The country provides various benefits that position it as a perfect location for global players looking for BPO services. Furthermore, Egypt, Kenya, and South Africa are set to produce considerable advantages, and on the other hand, Rwanda, Ethiopia, and Ghana are also set for significant growth.

- According to Africa Business, presently in July 2024, the continent employs more than 1.2 million full-time corresponding positions throughout the over 400 contact centers managing international outsourcing agreements. Moreover, it is foreseen that in the next 6 years, the regional BPO industry is expected to see the creation of up to 1.5 million new jobs in the field.

The Middle East is a promising contact center outsourcing market and is anticipated to grow at a decent rate over the estimation period. The market in the region is accelerated by the rising collaboration between domestic and international companies, leveraging the positive efforts by major economies towards promoting other industries apart from energy. Moreover, the United Arab Emirates and the Kingdom of Saudi Arabia are leading the expansion of region’s market size.

- In September 2024, Tata Consultancy Service (TCS), GE, and Saudi Aramco reported the introduction of the first-of-its-kind all-female BPO call center in Riyadh. The facility will be manned by Saudi female nationals with GE and TCS holding equity of 24 per cent and 76 per cent in the new venture. In the beginning, it will service GE and Saudi Aramco as main clients.

The Latin American contact center outsourcing market holds immense growth potential and is projected to propel in the coming years. The global impact of the Ukraine-Russia war, the recent conflict in the Middle, and armed conflicts in certain African nations serve this region as an ideal spot for market players. It is also one of the rapidly rising tech outsourcing hubs in the world.

- As per the data released by Glassdoor, the average salary of a customer service representative in Latin America ranges from around 7 to 15 US dollars per hour. Whereas, the median salary of a call center representative in the USA is between 22 and 31 US dollars per hour.

KEY MARKET PARTICIPANTS IN THE GLOBAL CONTACT CENTER OUTSOURCING MARKET

The major companies operating in the global contact center outsourcing market include Conduent Inc., IBM, HP, Teleperformance SA, CGS Inc., HGS, Datamark, Inc., Infinit Contact, Five9 Inc., VADS, Alorica, Invensis, Transcosmos, Convergys, Arvato, Sykes Enterprises, Atento, and others.

RECENT HAPPENINGS IN THE GLOBAL CONTACT CENTER OUTSOURCING MARKET

- In May 2024, CCI Global, a prominent outsourcing company based in Africa, press released the inauguration of its Tatu City Call Centre in Kenya which is a 5-story building. This new premise has been built with the support of a 50 million US dollar investment into the BPO industry in the country. It is also the nation’s biggest call centre.

DETAILED SEGMENTATION OF THE GLOBAL CONTACT CENTER OUTSOURCING MARKET INCLUDED IN THIS REPORT

This research report on the global contact center outsourcing market has been segmented and sub-segmented based on the service type, end-user industry, and region.

By Service Type

-

Chat Support

-

Email Support

-

Voice Support

-

Others

By End-User Industry

-

IT and Telecom

-

BFSI

-

Healthcare

-

Retail

-

Government

-

Others

By Region

-

North America

-

Asia-Pacific (APAC)

-

Europe

-

Latin America

-

Middle East and Africa (MEA)

Frequently Asked Questions

How is technology impacting the contact center outsourcing market globally?

Automation and AI technologies are transforming the industry by enhancing efficiency and customer experiences. The integration of chatbots, virtual assistants, and analytics tools is becoming more prevalent.

What verticals are witnessing significant growth in contact center outsourcing services globally?

Industries such as healthcare, e-commerce, and technology are experiencing substantial growth in contact center outsourcing services due to increased customer demands and the need for specialized support.

What are the emerging trends in workforce management within the contact center outsourcing industry on a global scale?

Flexible work arrangements, upskilling programs, and employee engagement initiatives are emerging trends, reflecting a shift toward a more agile and skilled workforce in the contact center outsourcing sector.

How are sustainability and corporate social responsibility impacting the decision-making process for contact center outsourcing globally?

Companies are increasingly considering sustainability and CSR factors in their outsourcing decisions, leading to the adoption of eco-friendly practices and socially responsible initiatives within the contact center outsourcing market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]