Global Consumer Healthcare Market Size, Share, Trends & Growth Forecast Report By Product (OTC Pharmaceuticals and Dietary Supplements), Distribution Network (Departmental Stores, Independent Retailers, Pharmacies or Drugstores, Specialist Retailers and Supermarkets or Hypermarkets) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Consumer Healthcare Market Size

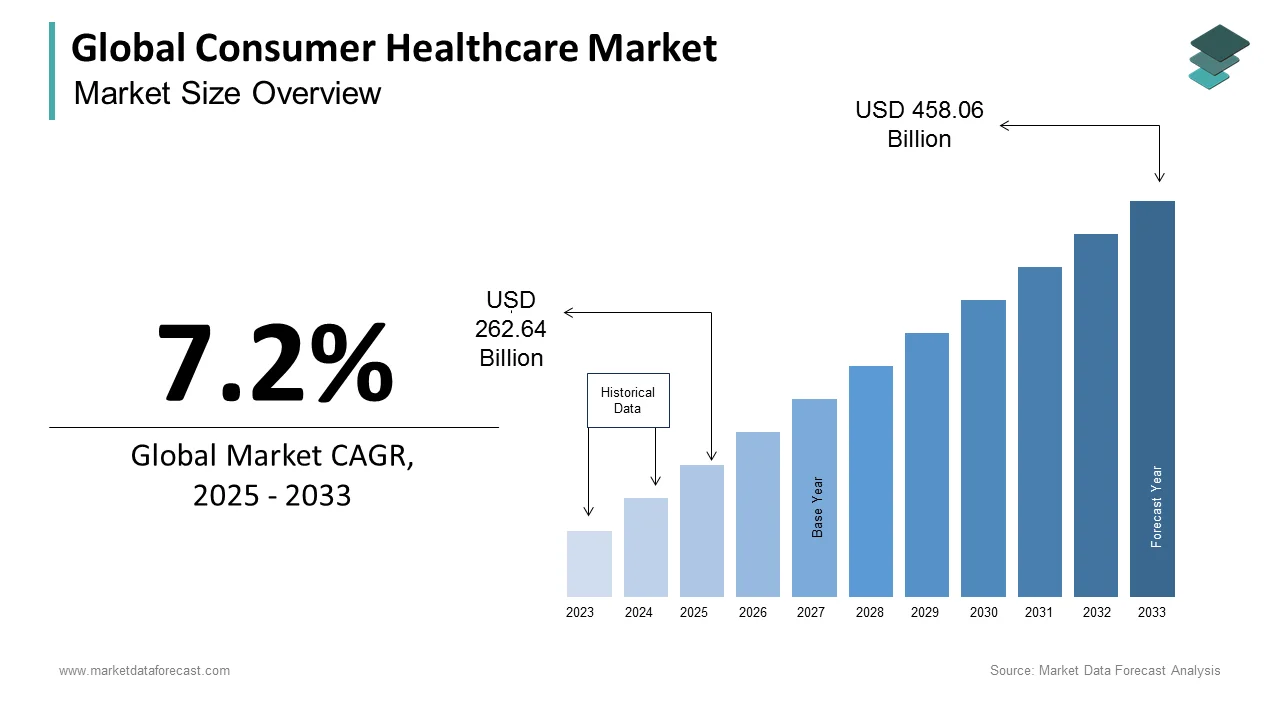

The size of the global consumer healthcare market was worth USD 245 billion in 2024. The global market is anticipated to grow at a CAGR of 7.2% from 2025 to 2033 and be worth USD 458.06 billion by 2033 from USD 262.64 billion in 2025.

Consumer healthcare is a branch of the healthcare industry that deals with wellness, nutrition, and skincare products. These consumer healthcare goods also include “over-the-counter” (OTC) medications available without a prescription from a licensed physician. Consumer healthcare products can be easily found in departmental stores, independent retailers, pharmacies or drugstores, specialist retailers, supermarkets, or hypermarkets. These medicines treat illnesses including pain, cough, itching, colds, sleeping issues, gastrointestinal issues, quitting smoking, weight difficulties, and tooth decay, all of which do not always necessitate a doctor.

MARKET DRIVERS

Rising inclination towards self-medication fuels the global consumer healthcare market.

The modern customer is health conscious. They're looking for new ways to maintain their health. As a result, they choose self-medication over other medications. Hence, the demand for consumer healthcare is being fuelled by preventative healthcare products such as over-the-counter (OTC) drugs. Consumer healthcare products, such as OTC products, do not require a prescription from a healthcare provider and can be purchased at any shop or pharmacy. Self-medication also provides easy access to OTC drugs at a reduced cost, which can be cheaper and faster than costly and time-consuming clinical consultations. For instance, patients suffering from a clogged nose, cold, nasal congestion, or cough can easily walk into a store and get inhalers, pills, or balms. Besides, these self-medication consumer healthcare products are readily available even in rural regions. Vitamins, nutrition, weight control, and fortified foods and beverages were among the other wellness categories that health-conscious customers demanded. In addition, this self-medication relieves financial and medical support pressures on customers. As a result, the consumer healthcare sector is seeing significant development.

The increasing trend of online resources is expected to accelerate the market growth.

The demands and behaviors of consumers are evolving throughout time. To stay relevant, the industry quickly finds innovative methods to fulfill shifting customer expectations, all while contending with aggressive and creative new market entrants in the OTC medications, nutritional supplements, and personal care industries. These findings are reflected in the utilization of online resources and e-commerce sites. Due to digitalization, consumers also prefer web-based media to buy medication and nutritional items. As a result, such websites as healthkart.com, vitacost.com, and vivavitamins.com sell various vitamin health drinks, protein smoothies, and supplements online. In addition, some websites feature live interactive chat sessions to provide immediate assistance to those who have difficulty purchasing such items.

Technological advancements are contributing to the global market growth.

Consumers are further empowered by technology developments such as wearables and virtual care, such as video chats with doctors, which allow people to identify answers independently. According to Slice Intelligence, vitamin and supplement transactions are growing rapidly. The category is growing at 12% more than the e-commerce average in 2019. According to Statista, revenue from the e-commerce personal care sector in the United States alone is estimated to cross $31.9 Billion in 2020. This growing tendency is driving the market growth.

The improved health outcomes among the people, as well as the wide accessibility to healthcare, influence people to make healthy choices, leading to better outcomes. This factor is expected to promote the market growth opportunities during the forecast period. The increased involvement of consumers in the healthcare industry leads to improved research and increased healthcare quality, boosting the expansion of the global market. Consumer healthcare involves saving costs from better choices, propelling market growth.

MARKET RESTRAINTS

Consumer abuse and misuse of healthcare products hamper market growth.

A consumer's misuse or abuse of a product is nothing uncommon. Many customers utilize products in unusual ways or in ways that are not intended. For example, the Consumer Healthcare Products Association (CHPA) discovered that a small but growing number of people are misusing loperamide to self-manage opiate withdrawal or attain a euphoric high. In addition, there have been instances of people abusing over-the-counter (OTC) drugs for recreational purposes. Even though the user did not utilize the goods as intended, a manufacturer may be held responsible for damage caused by the product in several situations. Similarly, government entities were obliged to impose various rules that may impact the market.

Various challenges, such as limited access to healthcare facilities for consumers and increased concerns regarding the privacy and security of digital health tools, restrict the expansion of the market growth. Most consumers need help with correct diagnostic output through mobile apps, leading to false treatments and reassurance, which impedes market growth. The high chances of misleading consumers from social media and various websites lead to false information, limiting the market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, Distribution Network & Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Johnson & Johnson, Boehringer Ingelheim GmbH, GlaxoSmithKline plc, Amway, Bayer AG, Pfizer Inc., Abbott Laboratories, Sanofi, BASF SE, DSM, American Health, Herbalife, The Himalaya Drug Company, Kellogg, Takeda Pharmaceuticals and Teva Pharmaceuticals. |

SEGMENTAL ANALYSIS

By Product Insights

The OTC pharmaceuticals segment dominated the market in 2024 and is anticipated to continue the domination during the forecast period. Over-the-counter drug usage has grown consistently over the last few years. OTC drugs can be purchased without a prescription from a healthcare provider, due to which the adoption is high. More people are purchasing these drugs for common problems such as pain, allergies, digestive disorders, cold, flu, and fever. The convenience and accessibility associated with OTC drugs are major factors accelerating their adoption and boosting segmental growth. In addition, OTC drugs are safe and effective for relieving symptoms associated with common health problems, such as pain, allergies, cold and flu, and digestive disorders. The cost-effective nature of OTC drugs compared to prescription drugs is another notable factor contributing to the growth of the OTC pharmaceuticals segment.

By Distribution Network Insights

The pharmacies and drugstore segment occupied the major share of the global market in 2024 and the domination of the segment will continue during the forecast period. As a result, the segment is also expected to register a healthy CAGR during the forecast period.

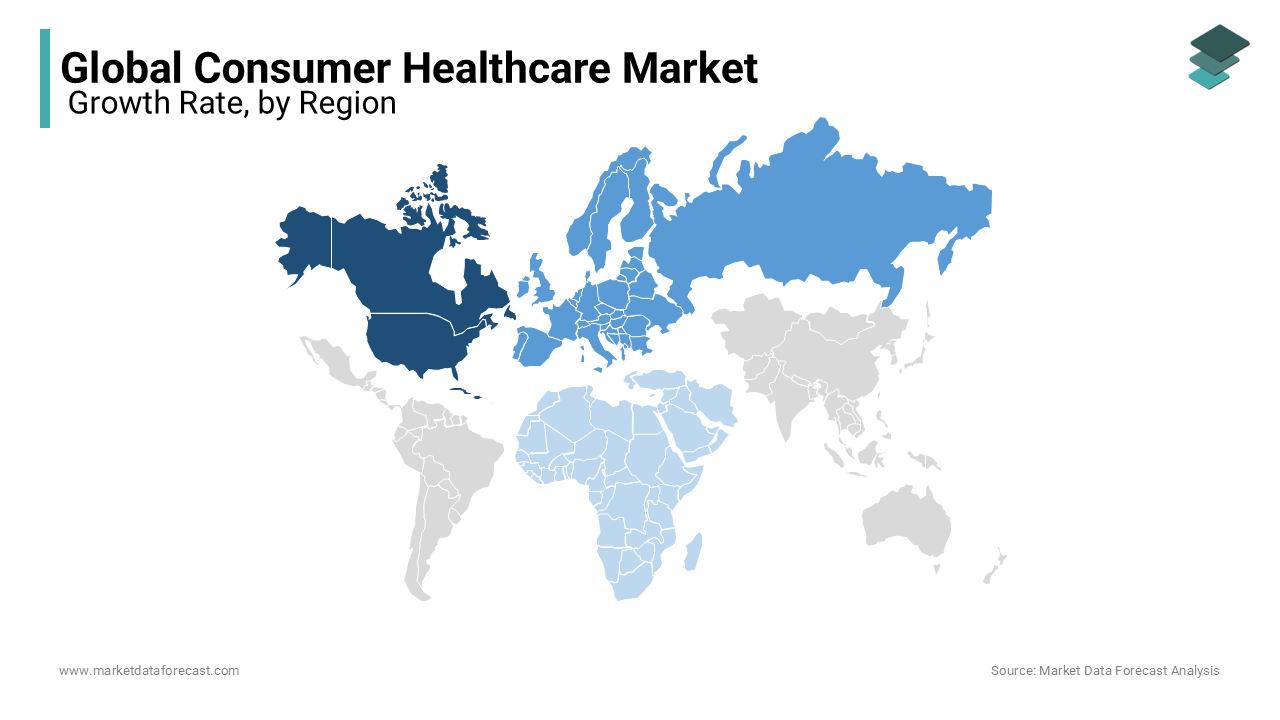

REGIONAL ANALYSIS

Geographically, the North American market was the largest regional market worldwide in 2024 and is expected to continue dominating the market in the coming years. The total worth of over-the-counter, non-prescription drugs and health and wellness products across North American countries reach billions every year. The market in the North American region is primarily driven by the growing aging population, rising healthcare expenditure, and increasing focus on self-care and the management of chronic conditions.

Europe captured a substantial share of the global market in 2024 and is forecasted to grow at a healthy CAGR during the forecast period. Johnson & Johnson, Reckitt Benckiser, and GlaxoSmithKline are notable players in the European market. Countries such as the UK and Germany accounted for the largest European market share in 2024. On the other hand, Eastern European countries are predicted to witness a faster pace owing to the growing usage of over-the-counter pharmaceuticals and rising adoption of self-care products.

The market in the Asia-Pacific region is predicted to showcase the fastest CAGR in the coming years. China, India, Japan, and Australia contribute considerably to the APAC region. Companies such as Johnson & Johnson, Procter & Gamble, and GlaxoSmithKline play a vital role in the APAC market. The growth of the APAC market is attributed to demographic and lifestyle trends and the growing adoption of technological developments in manufacturing new products.

Latin America is expected to record considerable growth during the forecast period. The expanding healthcare industry across the region and the escalating e-commerce sector are enhancing the distribution of consumer healthcare products, boosting the regional market growth rate. The growing advancements in the healthcare industry in the regional countries are fueling growth opportunities.

The Middle East and Africa region is projected to grow moderately in the coming years due to the expanding regional healthcare infrastructure. The rising disposable incomes of the people and the growing prevalence of chronic diseases are demanding consumer healthcare, leading to regional market share growth.

KEY MARKET PLAYERS

A few of the promising companies operating in the global market profiled in this report are Johnson & Johnson, Boehringer Ingelheim GmbH, GlaxoSmithKline plc, Amway, Bayer AG, Pfizer Inc., Abbott Laboratories, Sanofi, BASF SE, DSM, American Health, Herbalife, The Himalaya Drug Company, Kellogg, Takeda Pharmaceuticals and Teva Pharmaceuticals.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Amazon Inc. announced the debut of a nationwide online health clinic; the primary aim of the clinic is to make it accessible to patients through the mobile app or Amazon website. This facility has been launched across 50 states in the United States, connecting telemedicine partners with users.

- In April 2024, Cipla, a leading pharmaceutical company, announced its business transfer agreement (BTA) with Ivia Beaute, a French cosmetics brand. This legal agreement is to strengthen its consumer healthcare portfolio worldwide.

- In July 2023, Caremedico, a medical tourism network platform, announced the launch of its official access to over 300 healthcare institutions, along with 5000 skilled doctors and around 1000 technologies where this launch is expected to provide complex healthcare services to patients.

- In August 2023, Amazon launched a new online health clinic, which is available across the United States, and the company is expected to provide the services through its mobile app or website.

- In June 2021, Bayer, a multinational life sciences company, established its Consumer Health business in India, which includes ten products in allergy, dermatology, nutrition, and analgesics. Saridon, Supradyn, Becozym C Forte, Benadon, Alaspan, Canesten, and Bayer's Tonic are among these brands. In a statement, Bayer stated that these goods would be manufactured in India.

- In August 2020, Takeda Consumer Healthcare Company Limited, a subsidiary of Takeda Pharmaceutical Company Limited and a prominent seller of over-the-counter medications in Japan, entered into a final agreement to be acquired by The Blackstone Group Inc. and its affiliates.

MARKET SEGMENTATION

This research report on the global market has been segmented and sub-segmented based on product, distribution network, and region.

By Product

- OTC Pharmaceuticals

- Dietary Supplements

By Distribution Network

- Departmental Stores

- Independent Retailers

- Pharmacies or Drugstores

- Specialist Retailers

- Supermarkets or Hypermarkets

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

How big is the global consumer healthcare market?

The global market size was valued at USD 245 billion in 2024.

Does this report include the impact of COVID-19 on the consumer healthcare market?

Yes, we have studied and included the COVID-19 impact on the global market in this report.

Which segment by product type dominated the consumer healthcare market?

Based on the product type, the OTC segment had the major share of the market in 2024.

Who are the major players in the consumer healthcare market?

Johnson & Johnson, Boehringer Ingelheim GmbH, GlaxoSmithKline plc, Amway, Bayer AG, Pfizer Inc., Abbott Laboratories, Sanofi, BASF SE, DSM, American Health, Herbalife, The Himalaya Drug Company, Kellogg, Takeda Pharmaceuticals and Teva Pharmaceuticals are some of the notable companies in the market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]