Global Connector Market Size, Share, Trends, Growth Forecast Report - Segmented By Connector type ( Rectangular, Circular, Fibre optic, RF Product), End-use Industry(Automotive, Aerospace, Defense, Industrial machinery, Telecommunications, Consumer electronics, Medical devices), Application(Data and communication, Power supply, Lighting), and Region (North America, Europe, APAC, Latin America, Middle East and Africa) – Industry Analysis from 2024 to 2032

Global Connector Market Size (2024 to 2032):

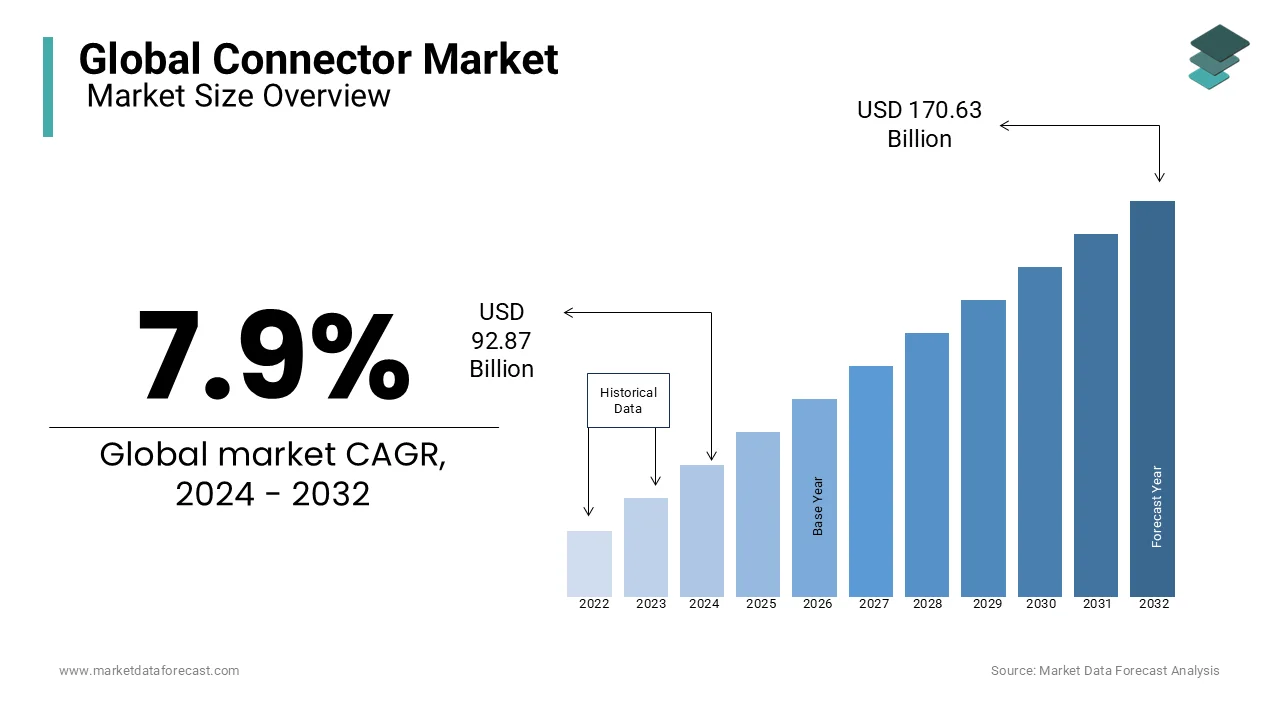

The global connector market valued at US$ 86.07 billion in 2023, is projected to reach US$ 170.63 billion by 2032 from US$ 92.87 billion in 2024 and registering a CAGR of 7.9% during the foreseen period from 2024 to 2032.

MARKET DRIVERS

Increasing demand for sophisticated connectivity solutions in emerging technologies such as 5G, the Internet of Things (IoT), and artificial intelligence (AI) presents an opportunity for the connector market.

As these technologies continue to advance and become more pervasive, the demand for connectors that can support high-speed data transfer rates and advanced features such as low latency, high reliability, and power efficiency increases. This presents a substantial opportunity for the connector market to develop and supply innovative connectors that meet these specifications.

An additional opportunity for the connector market is the expanding use of automation in a variety of industries. As the prevalence of automation systems increases, the demand for connectors that can support these systems and facilitate reliable communication between machines and systems increases. This presents an opportunity for connector manufacturers to create connectors specifically designed for automation applications. The increasing adoption of consumer electronics such as smartphones, laptops, and wearables creates a demand for smaller and more compact connectors, which presents a growth opportunity. This presents an opportunity for connector manufacturers to create miniature connectors that are compatible with these devices. Lastly, the growing emphasis on sustainability and environmental stewardship presents an opportunity for connector manufacturers to produce energy-efficient, recyclable, and environmentally responsible connectors.

Increasing demand for high-speed connectivity solutions is the most influential factor driving the connector market. As technology develops and becomes more prevalent, the demand for quicker and more reliable connectivity solutions increases. This increases the demand for connectors supporting advanced technologies such as 5G, the Internet of Things (IoT), and artificial intelligence (AI). The automotive and transportation industry is also a major driver of the connector market, as it relies increasingly on sophisticated connectivity solutions to enable features such as autonomous driving, vehicle-to-vehicle communication, and in-vehicle entertainment systems. This is fueling the demand for reliable connectors that can withstand harsh environments. The increasing adoption of automation in various industries is another factor driving the connector market, as automation systems require reliable machine-to-machine and machine-to-system communication. This increases the demand for connectors supporting automation systems and facilitating efficient data transfer.

MARKET RESTRAINTS

The connector market faces several obstacles that could limit its development and expansion.

The availability of low-cost alternatives to connectors, such as wireless communication technologies, is one of the primary constraints. Wireless communication technologies, such as Wi-Fi, Bluetooth, and cellular networks, are gaining popularity and replacing connectors in various applications. This is due to the fact that wireless technologies provide a more flexible and cost-effective solution than connectors, particularly for mobile-centric applications. However, the ongoing trade tensions and political instability among the world's leading economies represent a significant constraint. This has led to increased market uncertainty and volatility, which may have a negative effect on the connector market. In addition, the connector market is extremely competitive, with numerous competitors competing for market share. This can result in price conflicts and margin pressure, hindering the growth and profitability of connector market participants.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 – 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2032 |

|

CAGR |

7.9% |

|

Segments Covered |

By End-user, Connector type, Application, Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

TE Connectivity, Amphenol Corporation, Molex LLC, Yazaki Corporation, Aptiv PLC, JAE Electronics Inc., Hirose Electric Co. Ltd., Sumitomo Wiring Systems Ltd., HARTING Technology Group, Smiths Interconnect, and Others. |

SEGMENTAL ANALYSIS

Global Connector Market Analysis By Connector Type

- Rectangular

- Circular

- Fibre optic

- RF

The rectangular connectors segment is expected to account for the dominating share of the global connector market during the forecast period, whereas the circular connectors market is growing faster. Rectangular and circular connectors are two of the most prevalent connector designs and are utilized in a wide variety of applications. Rectangular connectors are frequently used in applications requiring multiple connections, such as computers, industrial apparatus, and automotive systems. Due to their rugged design, rectangular connectors are frequently used in severe environments and are available in a variety of sizes and configurations.

On the other hand, the circular connectors segment is expected to witness a steady growth rate during the forecast period. Circular connectors have a circular shape and are frequently used in applications that require a secure and impenetrable connection, including military and aerospace systems, medical equipment, and marine applications. Circular connectors are also available in a variety of sizes and configurations, and they are suitable for use in severe environments. In addition to these two connector types, other connector types, such as fiber optic connectors, RF connectors, and board-to-board connectors, are extensively used in a variety of applications.

Global Connector Market Analysis By End-user

- Automotive

- Aerospace

- Defense

- Industrial machinery

- Telecommunications

- Consumer electronics

- Medical devices

The automotive segment is predicted to grow at a promising CAGR in the global market during the forecast period. Applications for connectors in the automotive industry range from in-vehicle electronics and infotainment systems to powertrain and safety systems. The aerospace and defense industry utilizes connectors for critical applications such as avionics systems, communication apparatus, and weapon systems. Connectors are utilized in a variety of industrial apparatus applications, including robotics, automated assembly lines, and control systems. Connectors play a vital role in the telecommunications industry, where they are utilized in mobile devices and networking apparatus. With applications ranging from smartphones and laptops to home entertainment systems, the consumer electronics industry is a significant user of connectors.

Global Connector Market Analysis By Application

- Data and Communication

- Power Supply

- Lighting

With the increasing demand for high-speed data transmission and connectivity, the data and communication sector is leading with prominent share of the global connectors market. Connectors are essential components for data transmission in data centers, networking apparatus, fiber optic networks, and other applications. In recent years, there has also been a rise in demand for connectors in the power supply market, particularly in light of the increasing popularity of renewable energy and electric vehicles. Connectors play a crucial role in power distribution and control, and the demand for dependable and efficient power supply solutions is anticipated to continue to drive the expansion of this market segment. Thus, the dominant segment in the implementation of connectors can depend on factors such as market trends, technological advancements, and industry and application-specific requirements.

REGIONAL ANALYSIS

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

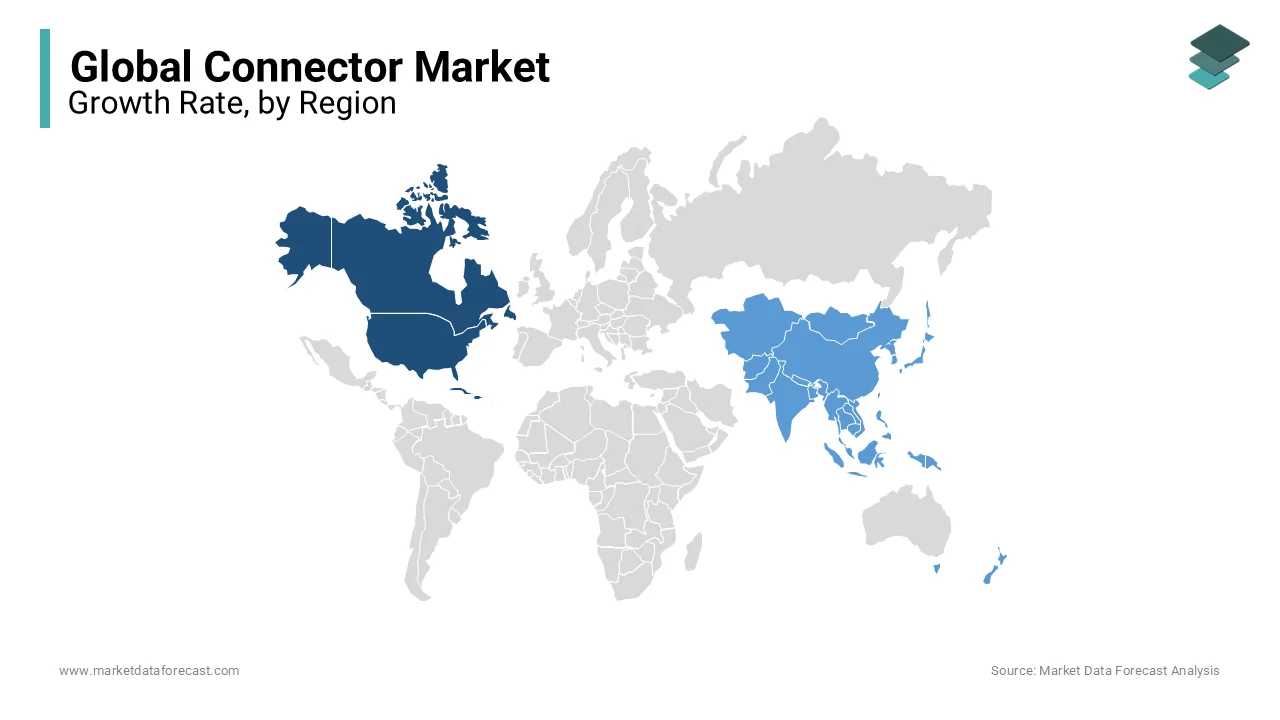

The North America market for connectors is one of the largest, with demand coming from a variety of industries, including automotive, aerospace, defense, and telecommunications. The demand for the connectors market in Europe is escalating with an increasing number of industries such as automotive, healthcare, and others.

The Asia-Pacific connector market is expanding swiftly, with growing investments from government authorities.

KEY MARKET PLAYERS

TE Connectivity, Amphenol Corporation, Molex LLC, Yazaki Corporation, Aptiv PLC, JAE Electronics Inc., Hirose Electric Co. Ltd., Sumitomo Wiring Systems Ltd., HARTING Technology Group, Smiths Interconnect, and Others.

RECENT HAPPENINGS IN THE MARKET

- In March 2021, TE Connectivity announced the release of its new STRADA Whisper backplane connectors. These connectors are intended for use in high-speed data centers and telecommunications infrastructure.

- In April 2021, Molex announced in May 2021 that it would acquire Fiber Guide Industries, a manufacturer of fiber optic products and solutions, to expand its capabilities in the optical fiber market.

- In June 2021, HARTING Technology Group announced the release of its new Han S connector series, which is compatible with existing Han connectors and designed for use in severe environments.

- In July 2021, Samtec announced that it had acquired RF Industries' connector business, which encompasses the production of coaxial connectors and cable assemblies.

Frequently Asked Questions

1. What is the Connector Market?

The term "connector market" typically refers to the market for electronic connectors. Electronic connectors are devices that join electrical circuits together. They play a crucial role in various electronic systems by facilitating the transmission of power, signals, and data between different components.

2. What is the market size of the Connector Market?

The global connector market, valued at $86.07 billion in 2023, is projected to reach $170.63 billion by 2032, with a growth rate (CAGR) of 7.9% from 2024 to 2032.

3. What are the segments covered in the Connector Market?

The segments of the connector market are by connector type, end-use industry, application, and region.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]