Global Connected Car Market Size, Share, Trends & Growth Forecast Report, Segmented By Technology (Embedded, Tethered and Integrated), Application (Driver Assistance, Mobility Management, Vehicle Telematics, and Infotainment System), Network (3G, 4G, 5G and Satellite), Sales Channel (OEM and Aftermath), Communication (Vehicle-to-Vehicle (V2V) and Vehicle-to-Infrastructure (V2I)) And Region (North America, Europe, Aisa-Pacific, Latin America, Middle East And Africa), Industry Analysis from 2025 to 2033

Global Connected Car Market Size

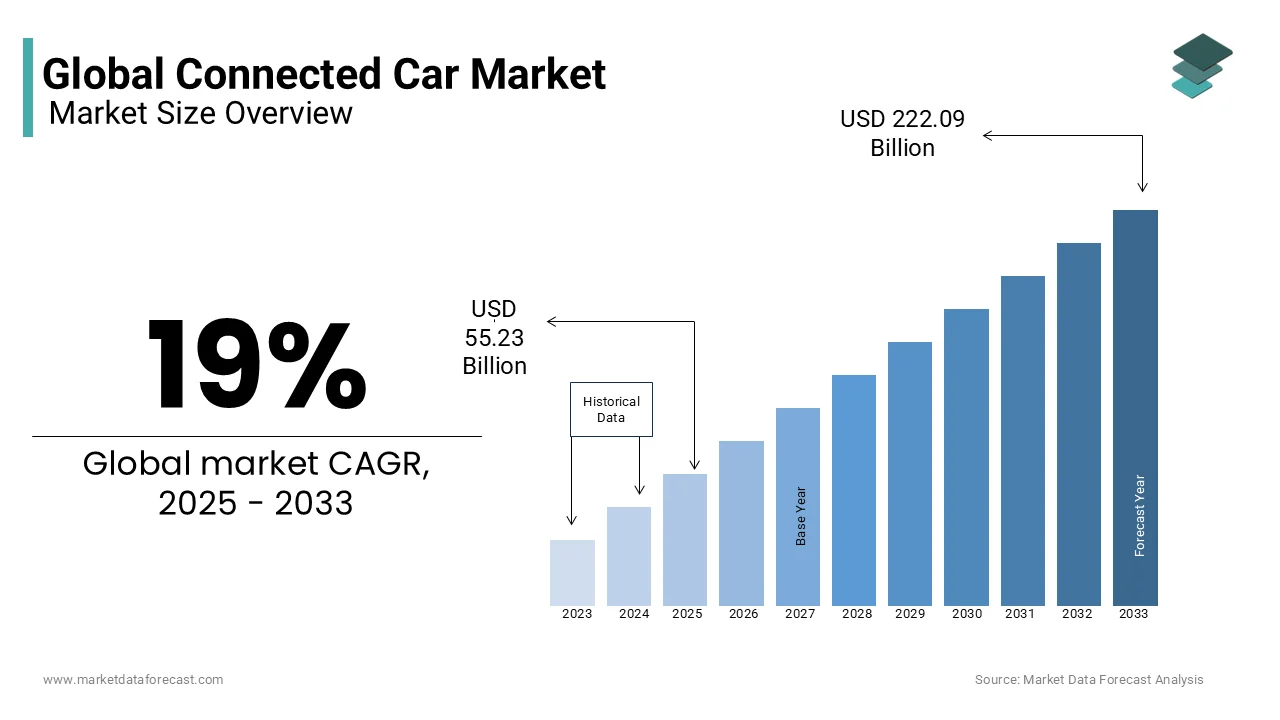

The global connected car market was valued at USD 46.41 billion in 2024 and is anticipated to reach USD 55.23 billion in 2025 from USD 222.09 billon by 2033, growing at a CAGR of 19% during the forecats period from 2025 to 2033.

Current Scenario of The Global Electric Vehicle Market

Connected cars feature a built-in wireless LAN and can communicate with entities both inside and outside the vehicle. Connected cars are built to receive remote software upgrades and relay diagnostic and operational data from onboard systems and components over the air (OTA). Connected automobiles can communicate not just with people and services but also with one another and the road infrastructure. As self-driving cars grow more common, these factors will become increasingly critical. This M2M (Machine-to-Machine) technology in an automobile allows two connected cars to communicate with each other. The connected car features some sensors and processors that give the driver accurate and real-time data.

MARKET DRIVERS

The growing usage of ADAS is primarily driving the growth of the global connected car market.

The increased use of software algorithms, sensors, cameras, processors, and advanced technologies in mapping road barriers has increased the application of ADAS in automobiles, which is expected to reduce road fatalities. Governments have imposed strict safety regulations on automakers to produce vehicles with ADAS systems in response to rising concerns about passenger safety and security...

Car buyers are growing more interested in surveillance devices that can track their vehicles and communicate real-time position updates as the number of vehicle thefts climbs. Once connected to the vehicle's entertainment system, the phone keeps track of the passenger's trip history, including where the passenger last traveled, how many stops were made in between, and so on, which might make travel risky. To prevent data theft, car owners have begun to install devices such as TravelEyes2, ProScout, and LoJack in their vehicles. These systems send a notification to the owners' phones, allowing them to lock the car with one touch. In addition, to counteract the increased number of occurrences of data theft, regulatory bodies have implemented rigorous restrictions. Automobile manufacturers are responding by acknowledging the gravity of the situation and engaging aggressively with industry experts.

MARKET RESTRAINTS

Issues associated with connectivity are hampering the growth of the connected car market.

Vehicles cannot connect to the cloud because network connectivity on highways is limited. The development of connected car infrastructure in underdeveloped economies lags behind that of affluent countries. Uninterrupted 3G and 4G networks are usually found in cities. This is a significant issue that would likely limit the market's expansion throughout the forecast period. Despite significant advancements in connected automotive technology, cybersecurity remains a significant concern that must be addressed. Each component of connected cars, including hardware, software, mobile apps, and Bluetooth, is vulnerable to hacks. There have been several instances where cybersecurity has caused a problem.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

19% |

|

Segments Covered |

By Application, Technology, Network, Sales Channel, Communication, and Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Harman International (US), Continental AG (Germany), AT&T (US), Robert Bosch GmbH (Germany), Daimler AG (Germany), Audi (Germany), TomTom (Netherlands), General Motors (US), Ford (US), Hyundai (South Korea), Volvo (Sweden), Nissan (Japan), and Others. |

SEGMENTAL ANALYSIS

By Application Insights

The driver assistance segment is likely to dominate the market over the forecast period. The sophisticated driver assistance system includes adaptive cruise control, lane keeps assisting, a 360-degree camera, park assist, and other technologically advanced capabilities that improve the vehicle's safety. Automakers are subject to stringent safety rules in many nations throughout the world.

The mobility management segment is the second largest segment in the global market and is expected to account for a substantial share of the global market during the forecast period. The technology of mobility management allows the driver to get to their destination safely in the shortest period while using the least amount of fuel feasible. It also delivers critical information, such as extreme weather and road conditions, as well as real-time alternate routes to avoid external dangers, resulting in a more enjoyable driving experience.

The vehicle telematics segment is expected to grow significantly in the industry. During the forecast period, demand for connected telematics solutions is likely to be driven by the growing IT infrastructure along roads that can effortlessly connect to mobile networks.

The infotainment system category is also likely to grow significantly over the forecast period. In recent years, automobile infotainment systems have become one of the most crucial components. As a result, automakers are gradually integrating infotainment features such as Wi-Fi hotspots, social media access, smartphone interfaces, and complicated mobile office systems into their vehicles.

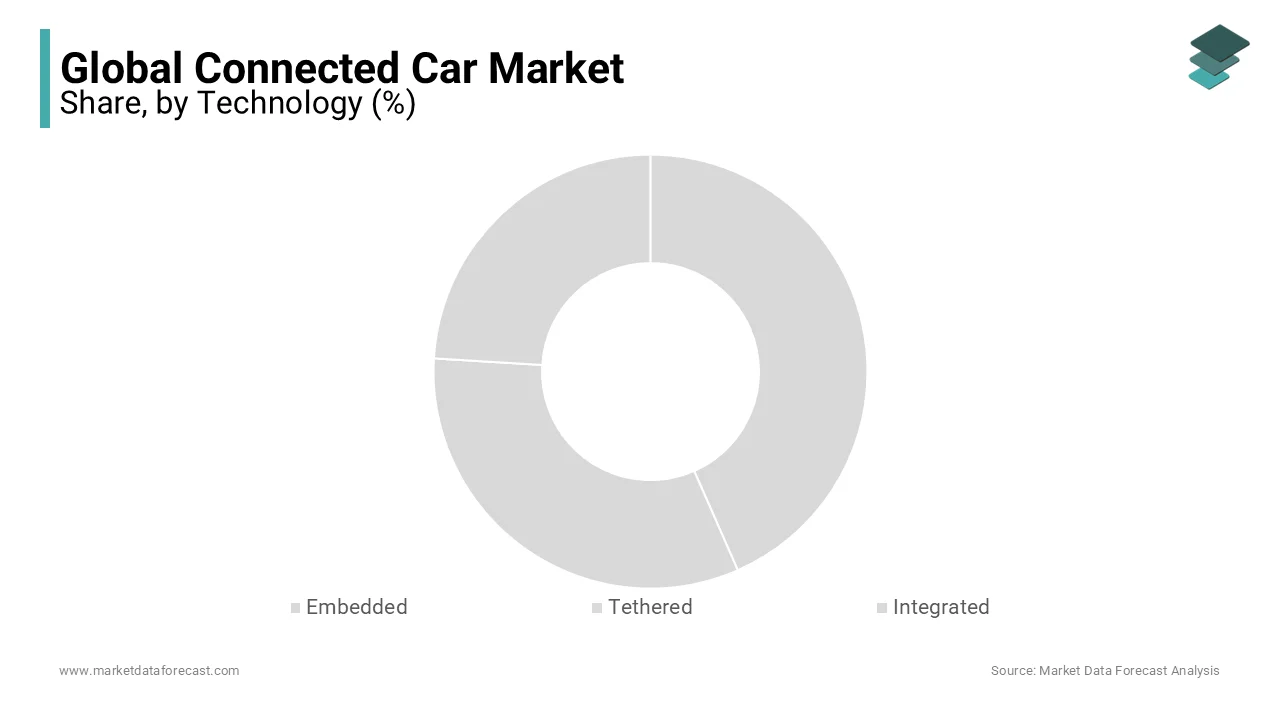

By Technology Insights

Over the forecast period, the integrated category is expected to dominate the market. These systems are more cost-effective than embedded and tethered systems since they allow for unrestricted data sharing. Various significant businesses have teamed with key OEMs around the world to develop innovative integrated systems for connected vehicles that give consumers seamless connectivity.

The embedded segment is expected to be the second-largest segment of the market. It is projected to preserve its market leadership through cost optimization of service plans, cloud services, and regulatory regulations. Furthermore, without an embedded system, critical functionalities such as remote diagnostics and eCall systems are hard to deliver. As a result, the rising use of embedded systems is expected to accelerate the adoption of connected autos over the forecasted period.

By Network Insights

During the projection period, the 5G sector is expected to dominate the market. Several telecommunication firms are working on sophisticated 5G networks to improve communication between linked vehicles and external equipment. According to the 5G Automotive Association, a seamless SG network can save more than 60% of road accidents.

Over the projected period, the satellite segment is expected to increase at the fastest rate. Only in regions where mobile towers are prevalent, such as urban areas, do cellular and Wi-Fi networks support connected automobiles. The network is entirely cut off once the vehicle departs the mobile tower's boundary, which could pose major problems for the occupants of the connected vehicles. To address this issue, several car OEMs, satellite operators, and mobile operators are working to construct hybrid satellite-terrestrial networks that would provide continuous connectivity.

By Sales Channel Insights

The OEM market comprises a large share of the global market. Increasing technological breakthroughs, such as uninterruptible connectivity, cybersecurity, and the development of driverless vehicles with highly secure software, are projected to aid OEMs in maintaining their market dominance over the projection period. Another aspect fueling the OEM segment's growth is an increased collaboration with key companies to develop high-quality, cost-effective components.

By Communication Insights

The V2V segment is estimated to lead the market during the forecast period. Vehicle-to-vehicle communication enhances road safety and occupant comfort while reducing traffic congestion in congested locations. Wireless technology advances and an increase in the use of advanced equipment such as sensors and GPS in V2V systems are projected to keep the sector dominating over the forecast period.

The Vehicle to Infrastructure category is predicted to grow substantially during the forecast period. Government initiatives to create a V2I framework are becoming increasingly common, assuring the segment's continued growth.

REGIONAL ANALYSIS

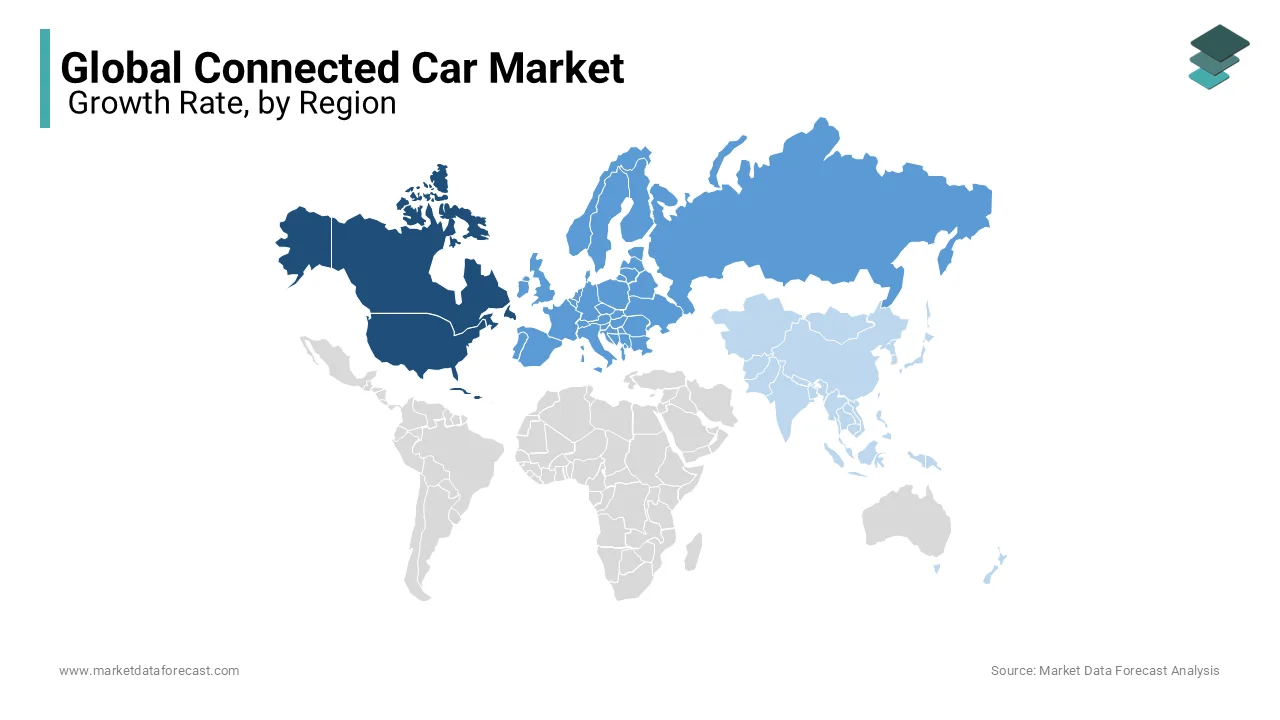

During the forecast period, the North American market, particularly in the United States, is predicted to hold the largest market share. Increased car safety and security requirements needed for V2V technology and the introduction of IoT into the automotive industry are driving market expansion in the United States. One of the primary factors driving demand for enhanced connected car features is the introduction of autonomous vehicle technology in the US connected car market. The market has already seen rapid growth in ADAS systems, with connected car penetration exceeding 80% in 2018. The US market will also be driven in the forecast period by an increase in demand for aftermarket services as a result of subscription renewals for connected car services.

The European market follows North America in terms of market share during the forecast period. The growth will be attributed to numerous development projects undertaken by the EU Governments. Multiple collaborations and partnerships among major companies will further drive the market across Europe.

The connected automotive sector is predicted to grow at the fastest rate in the APAC region in the coming years. This is due to the increased need for connected device integration in passenger cars, as well as the growing popularity of digital services like software updates and cybersecurity. Apart from the aforementioned factor, the growing number of strategic alliances announced between automotive and non-automotive companies for the development of better communication infrastructure and compliance with government regulations for automobile data security is expected to drive connected car sales in this region.

KEY MARKET PLAYERS

Tesla is the frontrunner in the world of connected car manufacturers. Meanwhile, Airbiquity is the global leader in providing Connected Car Software. Harman International (US), Continental AG (Germany), AT&T (US), Robert Bosch GmbH (Germany), Daimler AG (Germany), Audi (Germany), TomTom (Netherlands), General Motors (US), Ford (US), Hyundai (South Korea), Volvo (Sweden) and Nissan (Japan) are some of the other major players in the global connected car market.

RECENT HAPPENINGS IN THIS MARKET

- In January 2022, Continental will split its Rubber Technologies division into two separate group sectors Tires and ContiTech.

- Luxoft Romania, a software development and IT solutions company, revealed that it now has 2,000 employees in Bucharest and throughout Romania. By the end of the year, it intends to hire an additional 150 people.

- Qualcomm Technologies, Inc. announced Qualcomm® ultraBAW RF filter technology for bands up to 7 GHz today, a new invention that expands on Qualcomm's modem-to-antenna solution, which is powering high-performance 5G and connectivity systems across a wide range of wireless product sectors.

- Only 2,000 drivers were able to test the Full-Self Driving (FSD) program last year out of 150,000 Tesla cars that are part of the beta enrolment program. Tesla released version 10.2 to more than 1,000 additional owners in October 2021, with flawless safety scores.

MARKET SEGMENTATION

This research report on the global connected car market has been segmented and sub-segmented into the following categories.

By Technology

- Embedded

- Tethered

- Integrated

By Network

- 3G

- 4G

- 5G

- Satellite

By Sales Channel

- OEM

- Aftermath

By Communication

- Vehicle-to-Vehicle (V2V)

- Vehicle-to-Infrastructure (V2I)

By Application

- Driver Assistance

- Mobility Management

- Vehicle Telematics

- Infotainment Systems

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What factors are driving the growth of the connected car market?

The growing consumer demand for in-car connectivity, advancements in IoT technology, and the need for enhanced safety features are majorly driving the growth of the connected car market.

What are the key trends in the connected car market in 2025?

5G connectivity, AI-powered voice assistants, and the integration of augmented reality in car displays are some of the notable trends in the connected cars market.

What are the major challenges facing the connected car market?

Data privacy concerns, cybersecurity threats, and the high cost of implementing connected car technology are some of the major challenges to the growth of the connected car market.

Which region dominates the global connected car market in terms of market share?

North America currently dominates the connected car market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]