Global Concentrator Photovoltaic (CPV) Market Size, Share, Trends & Growth Forecast Report By Product (Reflector and Refractor), Application (Utility and Commercial), Concentration Level (High and Low) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis 2024 to 2033

Global Concentrator Photovoltaic (CPV) Market Size

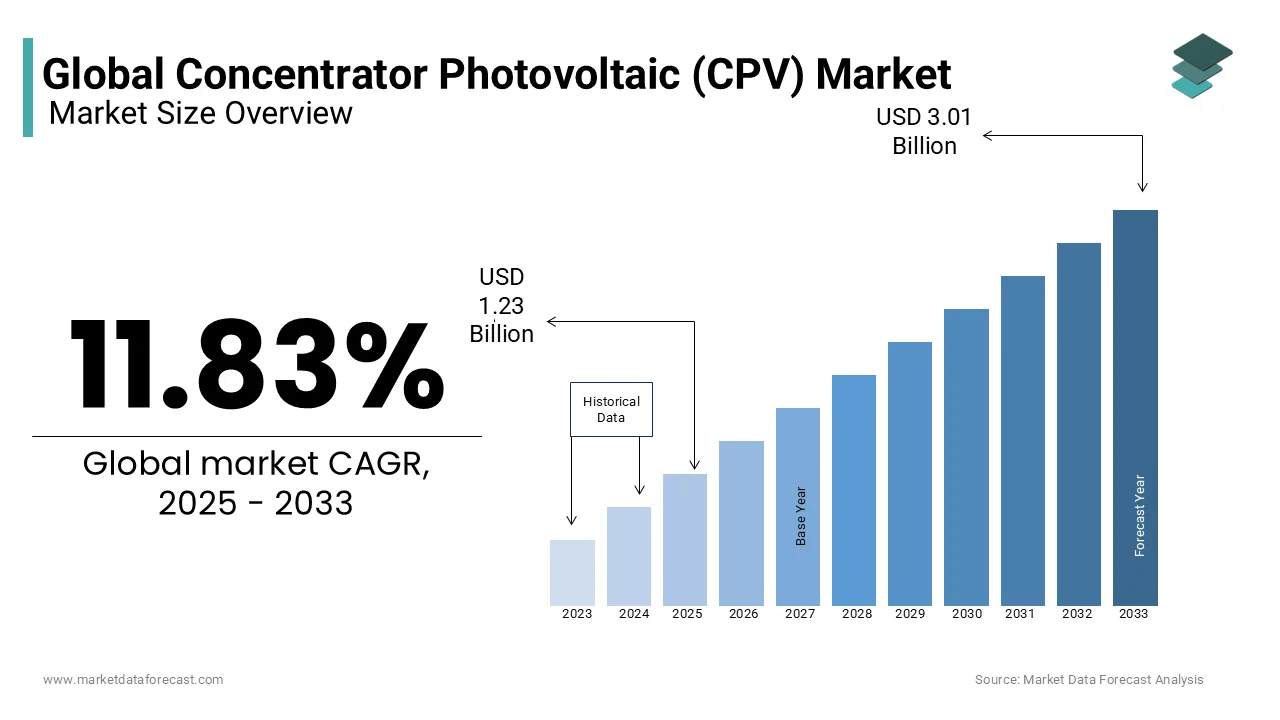

The size of the global concentrator photovoltaic (CPV) market was worth USD 1.10 billion in 2024. The global market is anticipated to grow at a CAGR of 11.83% from 2025 to 2033 and be worth USD 3.01 billion by 2033 from USD 1.23 billion in 2025.

A system that generates electricity from sunlight through photovoltaic technology is known as concentrator photovoltaic. This technology highly focuses on sunlight through lenses or curved mirrors that connect with the multijunction solar cells. Research and development are still ongoing, with the rising interest in the launch of innovative technologies that improve efficiency. The high concentration of photovoltaics is grabbing huge attention in this modern era due to its higher efficiency. These systems use very little space and have a smaller photovoltaic array with higher efficiency than any other photovoltaic technologies. The concentrator photovoltaic system with higher efficiency is best suited in regions with high direct irradiance, which are familiarly known as sun belt regions. The production of electricity is much more efficient using this technology, which is also cost-efficient and matters the most. According to recent reports, in the US, 5.6% of electricity will be directly generated through solar energy in 2023, and the demand is likely to surge in the coming years.

MARKET DRIVERS

The rapid adoption of concentrator photovoltaic (CPV) technology is majorly propelling the growth of the global market.

Installing low-concentration photovoltaic (LCPV) and high-concentration photovoltaic (HCPV) systems is likely to expand at significant expansion rates during the foreseen period. Furthermore, the combined installations were carried out in the United States and Central America, representing approximately 60 MW in 2015. Southern Europe accounted for more than 50 MW in the same year. Many large CPV companies have exited the market due to the increasing pressures from falling costs of other PV technologies, while many others are struggling to raise the capital to experiment and expand.

The price competitiveness of the CPV market, as well as improved reliability and efficiency, are expected to drive worldwide industry calls for years to come. Also, the boom in the concentrator PV market can be attributed to both incentives and subsidies offered by the government to meet renewable energy targets. However, these subsidies have been removed due to intensive photovoltaic installations. Furthermore, these subsidies are likely to prove too costly to sustain the regime for the next two decades. Low-cost, large-scale applications are the main drivers of CPV technology.

Increased efficiency with a low system cost coupled with renewable energy resources is predicted to be the main driver of cell expansion during the foreseen period. Additionally, the reduction in land requirements is also anticipated to boost cell expansion from 2024-2032. A huge pipeline of projects is likely to provide a potential expansion opportunity for the industry. In addition, several emerging countries with high irradiation and high electricity prices are supporting photovoltaic projects by signing direct electricity purchase agreements (PPAs) with local electricity consumers and utility manufacturers.

MARKET RESTRAINTS

Lack of acceptance of the technology and limited locations with high direct normal irradiation are likely to hamper the business expansion in the coming years.

Falling prices for PV silicon have prompted some players to leave the industry. Generation capacity was severely affected in 2015 after the French company Soitec and the Chinese company Suncore decided to stop manufacturing photovoltaic concentrators. The escalating popularity of photovoltaic modules and the rapidly falling prices of CPV modules have led manufacturers to abandon CPV production. The low popularity of CPV in the industry can also be attributed to its late introduction into a field largely dominated by photovoltaics.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

11.83% |

|

Segments Covered |

By Product, Application, Concentration level, and Region. |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Radical Sun Systems, Inc. (U.S.), SolAero Technologies Corp. (U.S.), Arzon Solar LLC. (U.S.), Cool Earth Solar (U.S.), Morgan Solar Inc. (Canada), ARIMA Group (Taiwan), Suncore Photovoltaic Technology Company Limited (China), Guangdong Redsolar Photovoltaic Technology Co. Ltd (China), Sumitomo Electric Industries, Ltd. (Japan), Saint-Augustin Canada Electric Inc. (STACE) (Canada), Sanan Optoelectronics Technology Co., Ltd (China), and Others. |

SEGMENTAL ANALYSIS

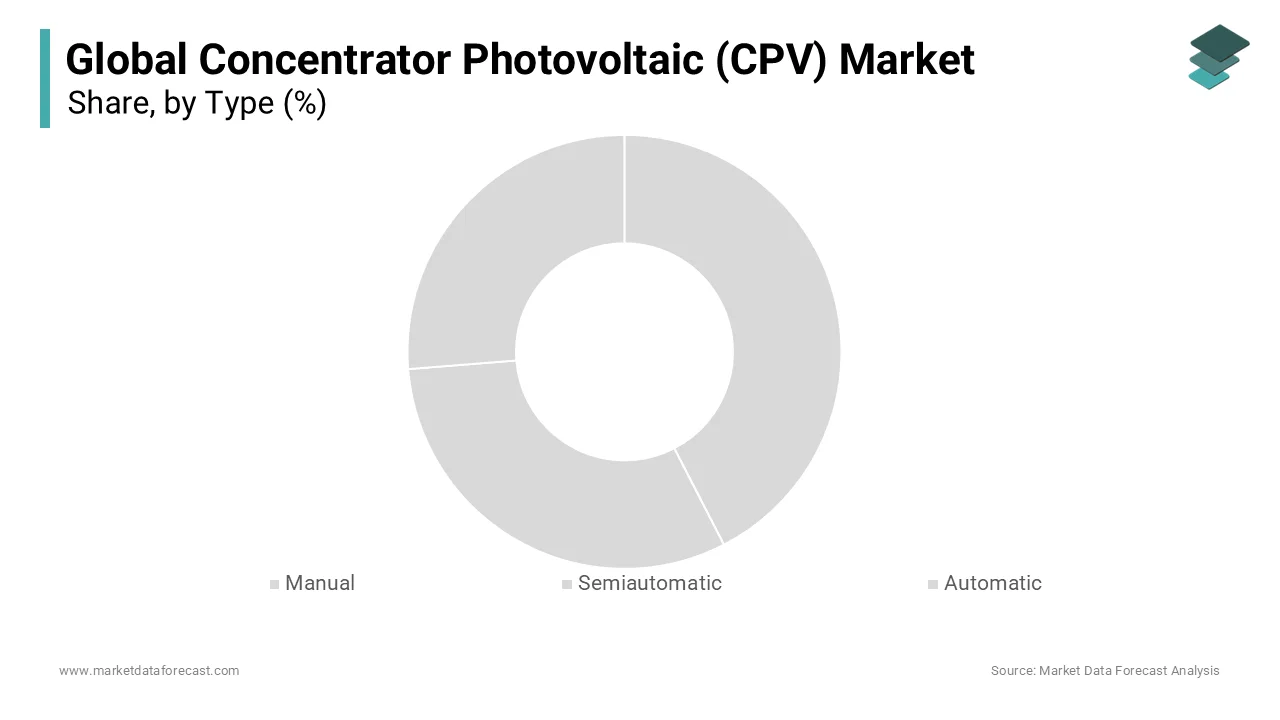

By Type Insights

The manual segment is leading with the dominant share of the concentrator photovoltaics (CPV) market. Manual concentrated photovoltaic systems have greatly emphasized producing electricity through solar energy at affordable prices for many years, which is one of the finest procedures for producing electricity at competitive prices. With the penetration of the most advanced technologies, the launch of automatic systems is gearing up to increase the overall efficiency in producing electricity at a higher rate. The automatic concentrate photovoltaic systems need very little human effort with minimized errors that can run smoothly and eventually leverage the overall production rate. The rising concern to level up the production rate of electricity through solar cells with the stringent rules and regulations by the government to reduce the carbon footprints is likely to promote the growth rate of the automatic concentrate photovoltaic market.

By Product Insights

The refractors segment occupied the largest share of the global concentrator photovoltaic market in 2024 and emerged as the most dominating segment in the global market. The growth of the refractors segment is majorly driven by the rising preference for the Fresnel lens. The Fresnel lens and high-concentration photovoltaic systems together provide maximum efficiency, so its call is predicted to remain high during the foreseen period.

By Application Insights

Crude oil tank application is leading with the dominant share of the market. One of the most important roles in the oil industry is to supply electricity to produce huge amounts of heat to process the crude oil. The increasing concern over the use of traditional methods that are creating environmental pollution by releasing greenhouse gases is attributed to bolstering the demand for the adoption of concentrator photovoltaic systems to supply electricity without any hurdles. The refinery petroleum product tank segment is expected to hit the highest CAGR by the end of 2033.

By Concentration Level Insights

The concentration ratio is directly proportional to the power output. High-concentration PV is predicted to see a strong call during the foreseen period.

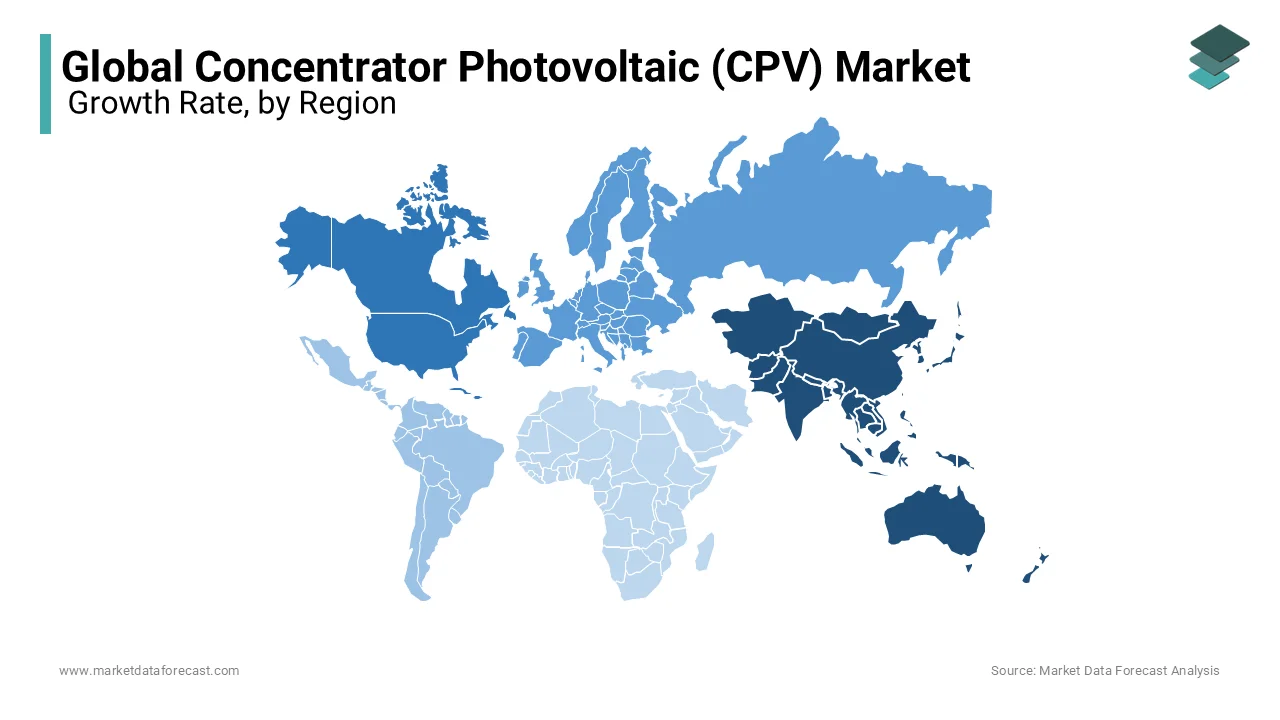

REGIONAL ANALYSIS

Asia Pacific concentrator photovoltaic (CPV) market share was positioned top in the past decade and is expected to showcase the same growth flow throughout the forecast period. China has been the most dominant country in installing the highest number of CPVs in the past few years. The unprecedentedly rising demand for energy generation with the growing population in China is posing huge growth opportunities for new innovations in solar cell installation. The generation of electricity through concentrator photovoltaics is becoming more popular even in residential areas. China, which is a highly populated country, is attributed to producing the highest greenhouse gases in the world. Therefore, the prominence of adopting new changes in energy that completely reduce carbon emissions is ascribed to fuelling the growth rate of the concentrator photovoltaic market in Asia Pacific.

North America is next in holding a prominent share of the concentrator photovoltaic market. The US and Canada are the major contributors to the market’s growth rate in this region. The government's plan to expand the installation of various technologies to produce electricity using solar cells is attributed to leveraging the market’s growth rate in the US. In 2024, the Department of the Interior announced that President Biden’s administration was ready to invest around USD 19 million in the America Agenda for Innovative Solar Panel Installation Over Canals. The America Agneda is to install a high number of solar panels to enhance the supply of electricity to the irrigation department, especially in California, Oregon, and Utah. This investment is also to level up the conservation of water and advance the clean energy goals.

The concentrator photovoltaic market growth rate is substantially growing in Europe, where it is deemed to hit the highest CAGR by the end of 2032. European Union is determined to achieve net zero emissions by 2050 and is going through various steps to reduce the emissions from many perspectives. According to the latest reports from the European Union, the strategic plan is to deliver 600 GW of solar photovoltaic by 2030, along with a set of initiatives to promote the installation of various concentrated photovoltaics that permit the leveraging of the process for renewable energy practices. Germany is leading with the highest share of the concentrator photovoltaic market, with 66.6GW of solar capacity installations carried out in 2022.

Latin America, and Middle East & Africa are likely to showcase huge growth opportunities for the concentrated photovoltaic market in the coming years. Emerging countries like Brazil, Chile, and others in the Latin American region are focusing on the installation of solar cells with increasing support from both the public and private sectors. United Arab Emirates is actively performing varied R&D activities to overcome big challenges, such as installing concentrated photovoltaic systems like water consumption, proper infrastructure, and others, and is showing great interest in promptly installing these systems with huge investments.

KEY PLAYERS IN THE MARKET

Companies playing a leading role in the global concentrator photovoltaic (CPV) market included in this report are Radical Sun Systems, Inc. (U.S.), SolAero Technologies Corp. (U.S.), Arzon Solar LLC. (U.S.), Cool Earth Solar (U.S.), Morgan Solar Inc. (Canada), ARIMA Group (Taiwan), Suncore Photovoltaic Technology Company Limited (China), Guangdong Redsolar Photovoltaic Technology Co. Ltd (China), Sumitomo Electric Industries, Ltd. (Japan), Saint-Augustin Canada Electric Inc. (STACE) (Canada), Sanan Optoelectronics Technology Co., Ltd (China), Suntrix Company Ltd (China) and Macsun Solar Energy Technology Co., Ltd. (China).

RECENT HAPPENINGS IN THE MARKET

- In 2024, Morgan Solar Inc. and Cisco collaborated together to unlock clean energy adoption in office spaces. Morgan is highly efficient in producing solar energy with the design involved in photovoltaic, algorithmically controlled window shades to capture green and clean energy is integrated with Cisco’s Power-over-Ethernet (PoE) switch, which distributes the solar energy to the room with the integration of WebEx. The approach is a major trend in many of the countries that are stepping towards net zero.

MARKET SEGMENTATION

This research report on the global concentrator photovoltaic (CPV) market has been segmented and sub-segmented based on type, product, application, concentration level, and region.

By Type

- Manual

- Semiautomatic

- Automatic

By Product

- Reflector

- Refractor

By Application

- Crude Oil Tank

- Refinery Petroleum Product Tank

- Depot & Gas Station

- Petroleum Product Trading Tanks

- Others (ISO Tank)

By Concentration Level

- High

- Low

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is the Concentrator Photovoltaic (CPV) Market growth rate during the projection period?

The Global Concentrator Photovoltaic (CPV) Market is expected to grow with a CAGR of 11.83% between 2025-2033.

What can be the total Concentrator Photovoltaic (CPV) Market value?

The Global Concentrator Photovoltaic (CPV) Market size is expected to reach a revised size of USD 3.01 billion by 2033

Name any three Concentrator Photovoltaic (CPV) Market key players?

SolAero Technologies Corp. (U.S.), Arzon Solar LLC. (U.S.), and Cool Earth Solar (U.S.) are the three Concentrator Photovoltaic (CPV) Market key players.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]