Global Computer Numerical Control Market Size, Share, Growth, Trends & Forecast Research Report – Segmented By Type (Lathe Machines, Milling Machines, Laser Machines, Grindings Machines, Welding Machines, Winding Machines & Others) End-Use (Automotive, Aerospace & Defence, Construction Equipment, Power & Energy, Industrial, Others) And By Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis From (2025 to 2033)

Global Computer Numerical Control Market Size

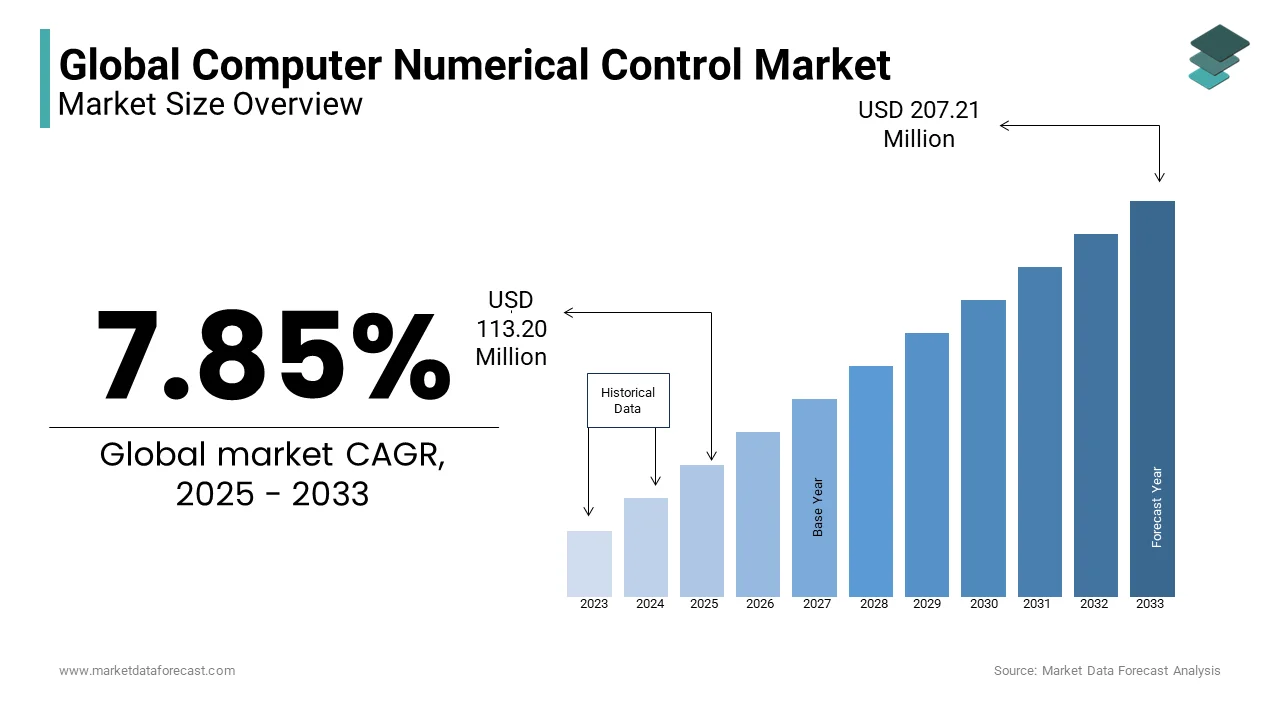

The global computer numeric control market was valued at USD 104.96 million in 2024 and is anticipated to reach USD 113.20 million in 2025 from USD 207.21 million by 2033, growing at a CAGR of 7.85% from 2025 to 2033.

Computer Numerical Control (CNC) machines are automated machines that are controlled by computer systems to perform precise machining tasks across various industries such as automotive, aerospace, electronics, and medical device manufacturing. CNC machines have revolutionized the manufacturing process by offering high-speed, high-accuracy, and repeatable operations that human operators cannot match. These systems utilize programmed instructions to control the movement of tools and machinery, enabling manufacturers to produce complex and intricate parts with minimal human intervention.

According to the National Institute of Standards and Technology, more than 70% of manufacturing companies in advanced economies have implemented some form of CNC technology into their operations. Moreover, CNC machinery is reported to reduce labor costs by up to 50% in high-volume production environments by making it an attractive option for cost-conscious manufacturers

Market Drivers

Increasing Demand for Automation in Manufacturing

The rising trend towards automation across industries has significantly fueled the growth of the CNC market. Automation through CNC machines enables manufacturers to achieve greater efficiency, precision, and speed in their operations, leading to reduced human error and improved production consistency. As industries strive for higher operational productivity, the adoption of CNC machines becomes critical. According to the U.S. Bureau of Labor Statistics, the implementation of automated systems like CNC has contributed to a 40% reduction in labor costs for high-volume production environments. CNC systems, by automating tasks such as milling, drilling, and turning, minimize the need for manual intervention by ensuring faster turnaround times and less variability in product quality. This drive for automation, particularly in the automotive and aerospace sectors, continues to accelerate by making CNC technology indispensable for staying competitive in global manufacturing markets.

Rising Demand for Precision and Complex Parts

The growing complexity of products and the need for precise with high-tolerance components are also key drivers propelling the CNC market forward. Industries such as aerospace, medical devices, and electronics demand increasingly sophisticated designs that require machining accuracy beyond the capabilities of traditional methods. The National Institute of Standards and Technology highlights that sectors like aerospace often require machining tolerances of 0.001 inches or less by making conventional techniques inadequate for these high-precision needs. CNC machines, especially advanced 5-axis systems shall provide the capability to produce intricate where high-tolerance parts required for these industries. The aerospace industry alone accounts for over 15% of global CNC machine utilization, reflecting the growing reliance on CNC technology for producing lightweight, durable, and high-performance components that meet rigorous safety and design standards. This demand for high-precision components ensures a steady growth trajectory for the CNC market.

Market Restraints

High Initial Investment Costs

One of the primary restraints affecting the growth of the Computer Numerical Control (CNC) market is the significant initial investment required for CNC machines and the associated infrastructure. The upfront capital expenditure can be prohibitive for small and medium-sized enterprises (SMEs) where CNC systems deliver long-term savings through automation and reduced labor costs. The U.S. Department of Commerce has reported that the average cost of a high-quality CNC machine can range from $50,000 to over $250,000 by depending on the complexity and specifications. This high initial investment can deter smaller manufacturers from adopting CNC technology, thereby limiting its market penetration in emerging economies where cost considerations are more critical.

Lack of Skilled Labor

The shortage of skilled labor is another key restraint in the growth of the CNC market. The advanced nature of CNC machines requires operators and technicians to possess specialized knowledge and expertise in areas such as machine programming, operation, and maintenance. According to the U.S. Bureau of Labor Statistics, the demand for skilled CNC machinists is expected to grow by 7% from 2020 to 2030 but the supply of qualified workers has been insufficient to meet this demand. This skills gap is a significant barrier, as manufacturers may struggle to find qualified personnel to operate and maintain sophisticated CNC systems by limiting their ability to fully utilize the potential of CNC technology and hindering market expansion.

Market Opportunities

Integration of Artificial Intelligence and IoT for Smart Manufacturing

The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) into CNC machines presents a significant opportunity for the market. These technologies enable the creation of "smart" CNC systems that can adapt to changing conditions, predict maintenance needs, and optimize production processes in real-time. According to the U.S. Department of Energy, AI and IoT integration can reduce manufacturing downtime by up to 30% and improve operational efficiency by up to 25%. The demand for CNC systems equipped with AI and IoT capabilities is expected to rise as industries move towards more connected and autonomous manufacturing solutions under Industry 4.0. This technological evolution opens new avenues for CNC market growth in precision-focused sectors such as aerospace and automotive.

Growing Demand for Additive Manufacturing Integration

Another promising opportunity for the CNC market is the growing demand for additive manufacturing (3D printing) integration. Combining CNC machining with additive manufacturing can offer manufacturers the ability to create highly customized, complex, and lightweight parts with enhanced capabilities. The U.S. National Institute of Standards and Technology has highlighted that hybrid systems that combine CNC with additive manufacturing technologies are increasingly being used in sectors such as aerospace and medical devices, where precision and part complexity are paramount. This integration enables the production of intricate geometries that are not feasible with traditional methods. The market for hybrid CNC-additive systems is projected to expand significantly as industries seek to innovate and optimize production to offer new opportunities for manufacturers and CNC suppliers alike.

Market Challenges

Technological Complexity and Maintenance Costs

One of the major challenges facing the CNC market is the increasing technological complexity of advanced systems. As CNC machines integrate more sophisticated features, such as multi-axis capabilities, automation, and AI, the complexity of their operation and maintenance rises. According to the U.S. Department of Energy, maintenance costs for advanced CNC systems can account for up to 15% of the total machine cost over its lifetime. This places a financial burden on manufacturers especially among small enterprises that may lack the resources to support complex maintenance needs. Furthermore, the rapid pace of technological advancements means that machines may become obsolete or require expensive updates to pose a challenge for companies to keep up with innovation while managing costs.

Supply Chain Disruptions and Material Shortages

Another significant challenge in the CNC market is the ongoing disruption in global supply chains, particularly in the availability of critical raw materials and components required for CNC machines. The U.S. Bureau of Labor Statistics reported that disruptions in semiconductor production and the shortage of key metals, such as aluminum and steel, have affected industries reliant on CNC machines. These shortages delay production schedules and increase material costs by putting pressure on manufacturers to maintain their competitive edge. As the CNC industry increasingly relies on specialized materials for machine parts and advanced components, supply chain instability poses a continuous challenge by forcing companies to find alternative suppliers or adjust production timelines to mitigate delays.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.85% |

|

Segments Covered |

ByType, End-use, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

AMADA MACHINERY CO., LTD, Amera Seiki, DMG MORI CO., LTD., General Technology Group Dalian, Machine Tool Corporation, DATRON AG, FANUC CORPORATION, Haas Automation, Inc, Hurco Companies, Inc., Mitsubishi Electric Corporation, OKUMA Corporation, Shenyang Machine Tool Part Co., Ltd, YAMAZAKI MAZAK CORPORATION. |

SEGMENT ANALYSIS

Global Computer Numerical Control Market By Type

The milling machines segment led the market and accounted for 30.6% of the global CNC market share in 2024. Their market leadership stems from their versatility in performing multiple functions, such as cutting, drilling, and shaping materials, which are essential in various industries. For example, the automotive industry relies on CNC milling machines to produce components like engine parts and chassis. According to the National Institute of Standards and Technology (NIST), milling machines provide high precision, which is crucial for achieving tight tolerances—often as low as 0.002 inches and is essential in safety-critical applications like aerospace and automotive manufacturing. Additionally, milling machines are used to machine materials such as aluminum, steel, and composites, with the global automotive industry contributing to over 17 million vehicle production annually, thus increasing demand for precision machining.

The laser machines segment is the fastest-growing segment in the CNC market and is expected to grow at a Compound Annual Growth Rate (CAGR) of 8.6% from 2024 to 2033. The demand for high-precision cutting, engraving, and marking drives this rapid growth in industries like electronics, automotive, and medical devices. Laser CNC machines offer significant advantages, including non-contact cutting, which minimizes material deformation and improves part quality. In aerospace, laser machines are used to cut advanced materials like titanium and carbon fiber, which are essential for lightweight and high-performance components. The Aerospace Industries Association reports that the U.S. aerospace sector alone generated $900 billion in 2022 by significantly contributing to the rising demand for laser machines in the production of complex aerospace components. The increasing need for customized and intricate parts further supports the growth of the laser machine segment.

Global Computer Numerical Control Market By End-use

The automotive segment remained the largest end-use segment for CNC in the global market and held 40.3% of the global CNC market share in 2024. This dominance is primarily due to the automotive sector’s reliance on precision manufacturing, where CNC systems are crucial for producing a wide range of high-precision parts, including engine components, chassis, and body panels. CNC machines are essential in automotive production for their ability to handle complex geometries and ensure consistency in mass production. According to the National Institute of Standards and Technology, the automotive sector's adoption of CNC technology significantly reduces manufacturing time and improves part accuracy by making it an indispensable tool in modern automotive manufacturing. Additionally, the industry's push for lightweight, fuel-efficient vehicles, particularly with the use of materials such as aluminum and composites, has further increased the demand for CNC systems capable of processing these advanced materials.

The aerospace & defense segment is the fastest-growing end-use segment in the global CNC market and is predicted to grow at a CAGR of 9.2% from 2025 to 2033. This growth is fueled by the continuous demand for high-precision and lightweight components used in aircraft, satellites, and defense systems. CNC machines are vital for producing these components, as they allow for extremely tight tolerances (down to 0.001 inches) and complex geometries that traditional machining methods cannot achieve. The increasing adoption of advanced materials, such as titanium and composites, which are integral to modern aerospace designs, is also driving the growth of this segment. The U.S. aerospace industry alone contributes over $900 billion annually further highlighting the sector's critical role in the global economy and the significant demand for CNC machines to meet its rigorous manufacturing needs. The rising global defense budgets and the push for more efficient and safer aircraft designs continue to fuel the increasing demand for advanced CNC systems in this sector.

REGIONAL ANALYSIS

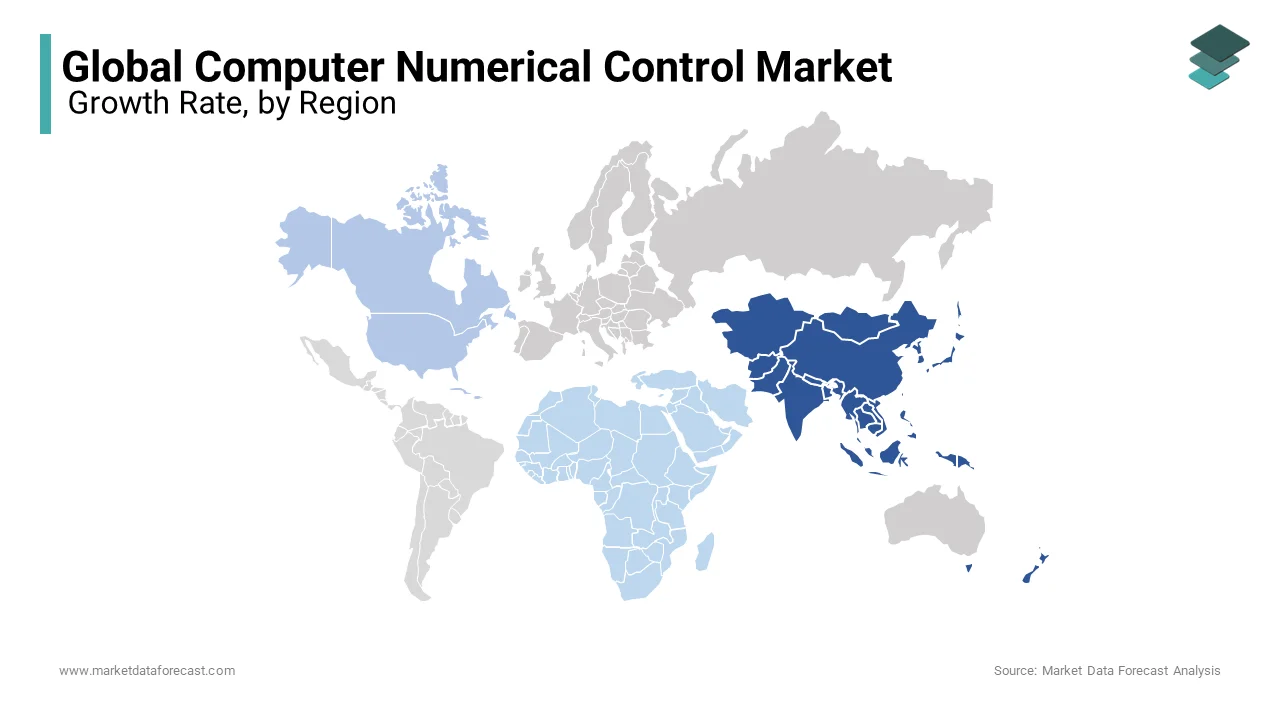

Asia-Pacific remained the largest region in the global CNC market in 2024 and occupied 45.6% of the global market share. This region's dominance is driven by the rapid industrialization of countries like China, Japan, and South Korea, which are key manufacturing powerhouses. China, in particular, contributes to over 28% of global manufacturing output due to the rising demand for CNC machines across industries such as automotive, electronics, and aerospace. Furthermore, the region is witnessing a strong push towards automation and smart manufacturing, increasing the adoption of CNC technology in advanced production lines. The combination of cost-effective production, high manufacturing output, and the rise of Industry 4.0 technologies ensures that Asia-Pacific remains the leader in the CNC market.

Latin America is projected to be the fastest-growing region in the CNC market and is projected to grow at a CAGR of 8.1% from 2025 to 2033. The demand for CNC machines is rapidly increasing, particularly in countries like Mexico and Brazil, where industries such as automotive, aerospace, and electronics are expanding. Mexico’s automotive sector is a key driver, with the country producing over 3.5 million vehicles annually. CNC machines become essential for producing high-precision components as these countries continue to modernize and expand their manufacturing capabilities. The region's integration into global supply chains and the growing need for high-quality, cost-effective manufacturing solutions further fuel the growth of the CNC market in Latin America.

North America is expected to experience steady growth in the CNC market. The strong automotive, aerospace, and medical device sectors of the U.S. is one of the factors propelling the North American CNC market growth. The U.S. Bureau of Labor Statistics forecasts a 5% annual growth in demand for CNC technologies due to innovations in aerospace manufacturing, especially in high-precision applications like turbine blade production and aircraft components. Additionally, the region’s strong focus on advanced manufacturing technologies by including 5-axis machining and automation, contributes to the sustained demand for CNC machines.

The European CNC market is projected to grow moderately, with key countries like Germany, Italy, and the U.K. driving demand, particularly in the automotive and aerospace sectors. Germany, the largest economy in Europe, has a robust automotive industry by producing millions of vehicles annually which significantly drives the demand for CNC machines. The region’s focus on high-precision machining in aerospace manufacturing for parts that require tight tolerances which also fuels the demand for advanced CNC systems.

The CNC market in the Middle East and Africa is expected to grow at a slower pace compared to other regions, but it will benefit from increasing industrialization and manufacturing investments in countries like Saudi Arabia, the United Arab Emirates (UAE), and South Africa. The UAE Ministry of Economy reports that the country is investing heavily in its manufacturing and industrial sectors as part of its economic diversification efforts. The demand for CNC machines is expected to rise with s these countries modernize and adopt more advanced manufacturing technologies,. However, challenges such as geopolitical instability and economic volatility could temper the region's growth, with CNC adoption occurring more gradually compared to more industrialized regions.

KEY MARKET PLAYERS

AMADA MACHINERY CO., LTD, Amera Seiki, DMG MORI CO., LTD., General Technology Group Dalian, Machine Tool Corporation, DATRON AG, FANUC CORPORATION, Haas Automation, Inc, Hurco Companies, Inc., Mitsubishi Electric Corporation, OKUMA Corporation, Shenyang Machine Tool Part Co., Ltd, YAMAZAKI MAZAK CORPORATION. These are the market players that are dominating the global computer numerical control market.

Top 3 Players in the market

1. FANUC CORPORATION

FANUC Corporation, headquartered in Japan, is a leading player in the global Computer Numerical Control (CNC) market, with a significant contribution to both the development and adoption of CNC technologies. FANUC specializes in providing high-quality CNC systems, robotic automation, and factory automation solutions, enabling industries to streamline production processes with precision and efficiency. The company is renowned for its advanced CNC systems, including high-performance CNC controllers and servo motors, which have become integral in manufacturing sectors such as automotive, aerospace, and metalworking. FANUC holds a substantial market share globally, largely due to its innovative technologies and robust portfolio of CNC products. According to industry reports, FANUC’s market share in the CNC sector is estimated to be over 15%, making it one of the largest providers of CNC solutions worldwide. Its ongoing investment in R&D ensures that FANUC remains at the forefront of the CNC market, introducing AI-driven machines and cutting-edge robotic automation solutions to enhance manufacturing efficiency and precision.

2. DMG MORI CO., LTD.

DMG MORI, a global leader in CNC technology, is a prominent player in the global CNC market. This German-Japanese company offers a wide range of CNC machines, including milling, turning, and hybrid models, that cater to industries such as automotive, aerospace, and medical device manufacturing. DMG MORI’s CNC machines are known for their advanced precision, flexibility, and ability to produce complex components with high accuracy. The company has a strong market presence across Europe, Asia, and North America, accounting for a significant share of the global CNC market, with an estimated share of 10-12%. DMG MORI's commitment to innovation is exemplified by its continuous development of advanced 5-axis machining centers, automation systems, and integration of digitalization and Industry 4.0 technologies into its CNC offerings. Its dedication to research and development ensures that DMG MORI remains a key driver of technological advancement in the CNC sector, helping industries improve manufacturing productivity and precision.

3. YAMAZAKI MAZAK CORPORATION

Yamazaki Mazak Corporation, based in Japan, is one of the largest and most influential players in the CNC market. The company has a strong presence globally, with its CNC machines widely used in industries such as automotive, aerospace, metalworking, and precision machinery. Mazak's product portfolio includes vertical and horizontal machining centers, CNC lathes, and laser cutting systems, all known for their high reliability, precision, and versatility. The company’s commitment to advanced technology and automation, including the integration of AI, IoT, and Industry 4.0 principles, has further strengthened its market leadership. Yamazaki Mazak has been a key contributor to the development of multi-tasking machines that combine milling, turning, and other processes into a single machine, greatly enhancing manufacturing efficiency. With an estimated 10% market share in the CNC industry, Mazak is a major player, consistently expanding its influence through innovative solutions that address the evolving needs of global manufacturers. The company’s focus on automation and smart factory solutions makes it a preferred choice for industries seeking cutting-edge CNC technology to optimize production and reduce costs.

Top strategies used by the key market participants

1. Innovation and Technological Advancements

One of the primary strategies used by key players in the CNC market is continuous innovation. Companies such as FANUC and DMG MORI heavily invest in research and development (R&D) to develop cutting-edge CNC technologies. FANUC, for example, has pioneered the development of AI-powered CNC systems that can adapt to changing production conditions, improving operational efficiency and predictive maintenance. DMG MORI focuses on developing advanced multi-axis and hybrid machines, including those with 5-axis capabilities, which allow for high-precision machining of complex parts. Additionally, the integration of Industry 4.0 technologies, such as the Internet of Things (IoT) and automation, into CNC systems allows these companies to stay ahead of market trends and meet the evolving demands for higher efficiency and customization in manufacturing.

2. Strategic Partnerships and Collaborations

Collaborations and partnerships are another key strategy employed by CNC market leaders. For instance, companies like Yamazaki Mazak have forged strategic alliances with software and automation firms to integrate digital solutions into their CNC machines. This integration improves machine performance, reduces downtime, and enhances predictive capabilities. In addition, DMG MORI collaborates with software companies to offer seamless integration with their CNC machines, enabling manufacturers to leverage advanced software tools for simulation, planning, and optimization. By forming partnerships with suppliers, technology developers, and other manufacturers, key players ensure access to the latest innovations, enabling them to offer comprehensive, state-of-the-art solutions to their customers.

3. Expanding Product Portfolio and Customization

To cater to diverse industry requirements, companies such as FANUC and Mazak have diversified their product portfolios. FANUC, for example, provides a wide range of CNC machines, including robotic automation systems, which are critical in industries like automotive and electronics. Mazak offers machines designed for multiple sectors, such as aerospace, medical, and industrial manufacturing, giving it a competitive edge in various niches. By expanding their product offerings and customizing their CNC machines to meet specific industry demands, these companies ensure they address the varying needs of manufacturers worldwide, which strengthens their market position.

Competitive landscape

The Computer Numerical Control (CNC) market is highly competitive, with numerous global and regional players vying for market share. Leading companies such as FANUC Corporation, DMG MORI, Yamazaki Mazak, and Haas Automation dominate the market, but competition remains intense due to the presence of many established and emerging players offering a wide range of CNC solutions. These key players compete on various factors, including technological advancements, product offerings, pricing, and after-sales services.

Technological innovation is a major differentiator, with companies investing heavily in research and development (R&D) to offer advanced features such as multi-axis machining, robotic integration, automation, and smart manufacturing solutions. FANUC, for example, is known for its advanced AI-driven CNC systems, while DMG MORI focuses on developing hybrid machines and automation solutions.

Pricing strategies also play a significant role, with companies offering competitive pricing to attract both large enterprises and small-to-medium-sized businesses (SMBs). Furthermore, after-sales services, including maintenance, training, and remote support, are crucial for retaining customers in this capital-intensive market.

Regional competition is also prominent, with Asian players like FANUC, Mitsubishi Electric, and Shenyang Machine Tool Co. holding a strong foothold in the Asia-Pacific region, while European companies like DMG MORI and Mazak lead in Europe and North America. The ongoing trend toward Industry 4.0 and automation presents opportunities for differentiation and growth within this dynamic and competitive market.

RECENT HAPPENINGS IN THIS MARKET

In June 2023, FANUC Corporation introduced advanced AI-driven CNC systems designed to improve predictive maintenance, optimize machining processes, and reduce downtime. This innovation is anticipated to strengthen FANUC's market position by enhancing automation and machine learning technologies.

In January 2022, DMG MORI acquired a major stake in Realizer GmbH, a leading additive manufacturing company. This acquisition is expected to enhance DMG MORI’s CNC product offerings by integrating 3D printing capabilities with traditional CNC machines, broadening their product portfolio.

In March 2023, Yamazaki Mazak launched the INTEGREX i-200ST multi-tasking machine, which combines turning, milling, and drilling functions. This launch aims to expand its hybrid machine offerings, boosting productivity and precision for complex machining tasks.

In May 2022, Haas Automation, Inc. expanded its CNC machine portfolio by introducing the new VF-2SS vertical machining centers. This expansion aims to cater to diverse manufacturing needs in automotive and aerospace sectors, strengthening Haas’s product offerings.

In July 2022, Okuma Corporation entered a strategic partnership with Microsoft to integrate its CNC systems with Azure cloud-based solutions. This partnership aims to offer advanced IoT-based CNC solutions, improving real-time monitoring and data analytics.

In February 2023, Mitsubishi Electric Corporation introduced the M70 series CNC controller designed to improve precision and control in industrial applications. This new product is expected to enhance Mitsubishi’s competitiveness in the high-precision aerospace and automotive industries.

In November 2022, Amera Seiki expanded its operations by establishing a new sales and service office in Mexico. This expansion aims to strengthen its market reach and customer base in the growing Latin American automotive manufacturing sector.

In June 2022, Shenyang Machine Tool Group invested in building a smart manufacturing plant to integrate CNC systems with AI and IoT technologies. This investment is expected to strengthen its position in the Chinese market by meeting the demand for smart manufacturing solutions.

In January 2023, DATRON AG launched the DATRON Neo high-speed milling machine specifically designed for the dental and medical device industries. This launch aims to expand DATRON’s product offerings in niche markets that require high-speed, high-precision CNC solutions.

In August 2023, General Technology Group Dalian Machine Tool Corporation launched a series of upgraded CNC machines specifically tailored for the aerospace industry. This launch is expected to enhance its presence in the aerospace sector by offering specialized CNC systems for complex parts production.

MARKET SEGMENTATION

This research report on the global computer numerical control market is segmented and sub-segmented into the following categories.

By Type

- Lathe Machines

- Milling Machines

- Laser Machines

- Grinding Machines

- Welding Machines

- Winding Machines

- Others

By End-use

- Automotive

- Aerospace & Defense

- Construction Equipment

- Power & Energy

- Industrial

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current market size of the global computer numerical control market?

The global computer numeric control market was valued at USD 113.20 million in 2025

What are the market drivers that are driving the global computer numerical control market?

Increasing Demand for Automation in Manufacturing and Rising Demand for Precision and Complex Parts are the market driving factors in the global computer numerical control market.

What challenges are faced in the global computer numerical control market?

The market challenges are Technological Complexity and Maintenance Costs and Supply Chain Disruptions and Material Shortages

who are the market players that are dominating the global computer numerical control market?

Asia-Pacific remained as the largest region in the global CNC market in 2024 and occupied 45.6% of the global market share.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]