Global Commercial Real Estate Market Size, Share, Trends, & Growth Forecast Report Segmented By Type (Offices, Retail, Industrial and Logistics, Hospitality), Channel (Rental, Lease, Sales), and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Commercial Real Estate Market Size

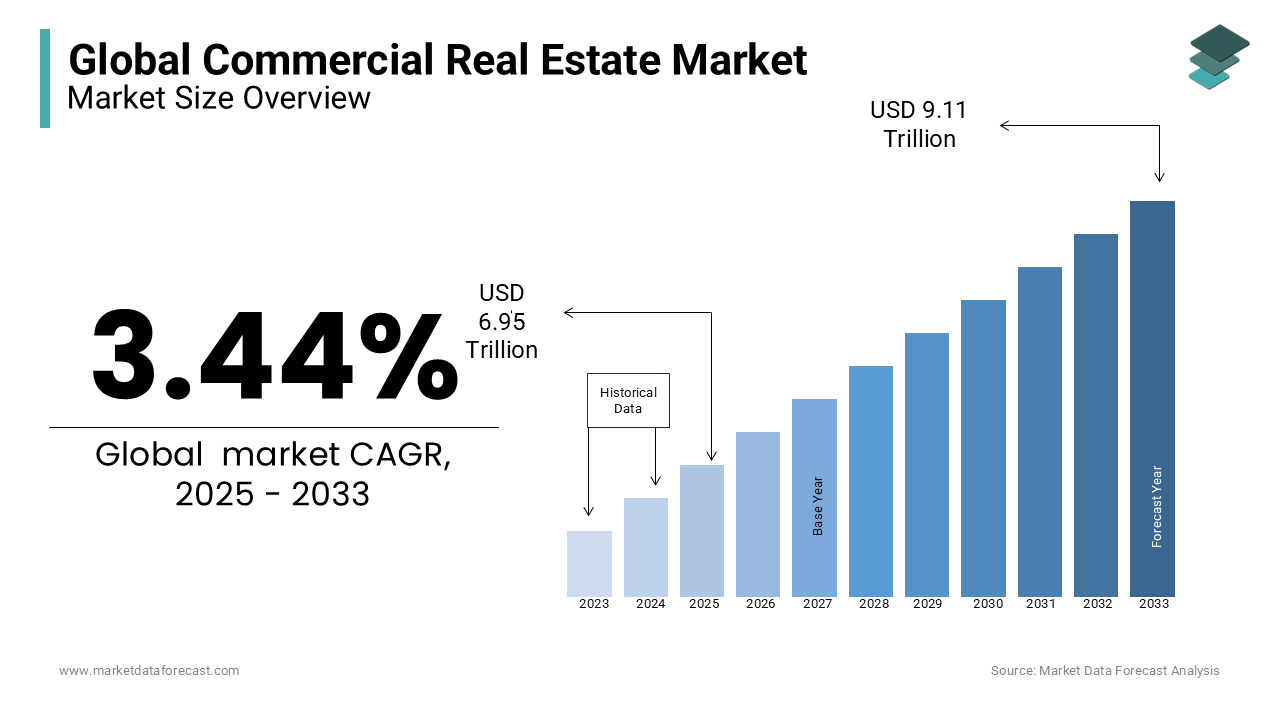

The global commercial real estate market size was valued at USD 6.72 trillion in 2024 and is expected to reach USD 9.11 trillion by 2033 from USD 6.95 trillion in 2025. The market is projected to grow at a CAGR of 3.44%.

Commercial real estate is a cornerstone of urban development comprising office spaces retail establishments industrial properties and multifamily housing. Globally commercial buildings consume approximately 30% of total energy use and contribute nearly 28% of greenhouse gas emissions driving a focus on sustainable practices. Urbanization is a key driver with 55% of the global population currently residing in cities a figure expected to reach 68% by 2050. This urban shift demands innovative designs like green roofs and energy-efficient systems which can reduce building operational costs by up to 20-30%. Technology integration is transforming the sector with IoT adoption in buildings expected to increase by 50% by 2030 enhancing asset management and tenant experiences.

MARKET DRIVERS

Urbanization and Population Growth

Urbanization continues to be a major driver of the commercial real estate market with 55% of the global population living in urban areas as of 2023 projected to reach 68% by 2050, according to United Nations (UN). This growth fuels demand for office spaces retail establishments and multifamily housing in metropolitan regions. Urban centers are also hubs for economic activities driving infrastructure development and increasing the need for industrial and logistics facilities. Cities like Tokyo New York and London are witnessing continuous redevelopment projects to accommodate population growth with a focus on mixed-use developments that combine residential commercial and recreational spaces for optimized land use.

Technological Advancements

The rise of smart buildings and IoT adoption is reshaping commercial real estate enhancing operational efficiency and tenant experiences. According to the Unites States Department of Energy, 50% of buildings globally are expected to integrate IoT technologies by enabling features like automated lighting energy monitoring and predictive maintenance by the end of 2030. Smart technology can reduce energy costs by up to 30% making properties more attractive to environmentally conscious tenants and investors. Additionally, advancements in virtual reality and digital twins allow stakeholders to visualize and manage properties more effectively streamlining leasing and management processes. This technological evolution supports sustainability goals while increasing the overall market value of assets.

MARKET RESTRAINTS

Economic Volatility

Economic fluctuations pose a significant restraint on the Commercial Real Estate Market as interest rate changes and inflation directly impact financing and operational costs. According to the Federal Reserve U.S. interest rates increased from 0.25% in 2020 to over 5% in 2023 leading to higher borrowing costs for developers and investors. Economic downturns also reduce leasing demand with Bureau of Labor Statistics data showing a decline in office occupancy by 16% post-pandemic. These factors limit investment flows delay construction projects and increase the risk of defaults particularly in markets heavily reliant on external financing or tenant-based revenues.

Regulatory and Environmental Compliance

Strict environmental and zoning regulations are another barrier to growth in the market. Governments worldwide are pushing for sustainability with EPA standards requiring buildings to cut emissions by 50% by 2030. Additionally, retrofitting older buildings to meet energy efficiency standards can increase costs by 20 to 30%, as per U.S. Energy Information Administration data. Zoning restrictions and lengthy approval processes further delay projects reducing overall market flexibility. Compliance costs particularly affect small and mid-size developers making it challenging for them to compete in urban centers with stricter regulations. These constraints slow market growth and development momentum.

MARKET OPPORTUNITIES

Growth in Green Building Adoption

The push for sustainability offers a significant opportunity in the Commercial Real Estate Market. The U.S. Green Building Council (USGBC) states that green-certified buildings can reduce operational costs by up to 20% and increase asset value by 10%. Additionally, government incentives such as tax credits under the Energy Policy Act encourage investment in energy-efficient construction. Globally, Energy Star and LEED-certified commercial spaces are witnessing heightened demand as tenants prioritize environmental responsibility. The EPA's goal to reduce building emissions by 50% by 2030 is likely to boost investments and developments in green infrastructure.

Rise of Flexible Workspaces

Flexible workspaces, driven by hybrid work models, are reshaping commercial real estate strategies. The International Labor Organization (ILO) reports that 20-30% of the workforce globally now operates in a hybrid setting with increasing demand for coworking spaces and adaptable office layouts. This trend is supported by government incentives promoting remote working infrastructure and business innovation hubs. For instance, programs by the U.S. Small Business Administration encourage startups to occupy flexible spaces contributes to a projected 7% annual growth in the coworking sector. This evolution opens lucrative avenues for developers to cater to shifting tenant preferences.

MARKET CHALLENGES

Rising Construction Costs

Escalating construction costs are a significant challenge for the Commercial Real Estate Market. According to the U.S. Census Bureau, construction material costs have surged by 25% from 2020 to 2023, driven by supply chain disruptions and labor shortages. The Bureau of Labor Statistics reports that the construction labor workforce has declined by 7.7% since 2020 with exacerbating delays and increasing project expenses. These factors limit new developments and put pressure on profit margins for developers especially in urban areas where land costs are already high. High construction costs also deter retrofitting older buildings to meet modern standards.

Office Space Vacancy Rates

The shift to hybrid and remote work models has led to a significant rise in office space vacancies. Data from the U.S. Energy Information Administration (EIA) indicates that office utilization rates remain 40% below pre-pandemic levels in major cities like New York and San Francisco. The National Association of Realtors (NAR) highlights that office vacancy rates exceeded 18% in 2023 which is the highest in over a decade. This trend reduces demand for traditional office leases, affecting rental income and reducing the market value of commercial properties in downtown and central business districts.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.44% |

|

Segments Covered |

By Type, Channel, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

CBRE Group, Inc., Cushman & Wakefield, JLL (Jones Lang LaSalle Incorporated), Colliers International, Newmark Group Inc., Prologis, Inc., Hines, Brookfield Properties, Simon Property Group, Inc., Vornado Realty Trust, and others |

SEGMENTAL ANALYSIS

By Type Insights

The offices segment accounted for 40.7% of the global commercial real estate market share in 2024. The growth of the offices segment is primarily attributed to the consistent demand for office spaces in urban and metropolitan areas. Companies prioritize office spaces to centralize their operations, enhance collaboration, and establish a professional presence. According to data from the U.S. Energy Information Administration (EIA), office buildings accounted for 19% of total commercial building floor space in the U.S. as of 2021. Moreover, the steady recovery of businesses post-pandemic, combined with hybrid work models, has reinvigorated demand for flexible office spaces. Major global financial hubs, such as New York, London, and Tokyo, continue to witness substantial investments in office real estate by reflecting its importance in the global market.

On the other hand, the industrial and logistics segment is gaining traction and is estimated to register a CAGR of 7.4% over the forecast period due to the the rapid expansion of e-commerce, which has increased the demand for warehousing, fulfillment centers, and distribution networks. According to the World Trade Organization (WTO), global e-commerce sales exceeded $26.7 trillion in 2022 with the leveraging importance for the critical role of logistics infrastructure. Additionally, advancements in supply chain technologies and the growing importance of last-mile delivery solutions are further driving demand for industrial properties. Emerging markets in Asia-Pacific and Latin America are experiencing significant growth in logistics real estate due to increasing trade activities and infrastructure development.

By Channel Insights

The rental segment held 45% of the global commercial real estate market share in 2024. This dominance is driven by the flexibility and affordability that rental agreements offer businesses in volatile economic conditions. Small and medium-sized enterprises (SMEs) and startups often prefer rental spaces as they allow them to conserve capital and avoid long-term commitments. Additionally, the rise of coworking spaces and flexible office models further supports the rental market's growth. According to data from the U.S. Census Bureau, commercial property rentals generate significant annual revenues by reflecting their critical role in the industry.

The lease segment is growing at steady pace and is predicted to exhibit a CAGR of 6.3% during the forecast period. Leasing is particularly attractive for larger corporations and logistics companies seeking longer-term stability and cost predictability for their operations. The rise in demand for industrial and logistics properties due to the e-commerce boom is driving leasing activity in this sector. Reports from the European Real Estate Outlook indicate that logistics property leases have seen a year-on-year increase of 12% in demand across key European markets. Additionally, corporate expansions in developing regions like Asia-Pacific further fuel the growth of the leasing channel.

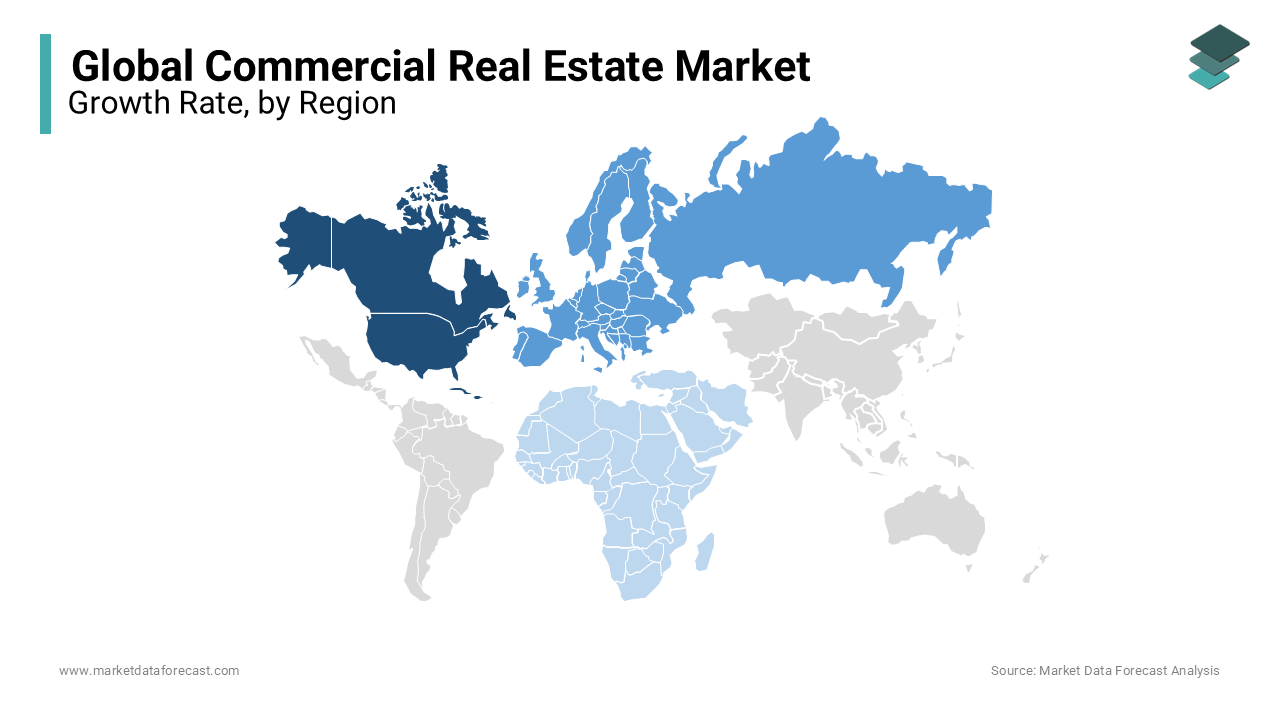

REGIONAL ANALYSIS

North America dominated the commercial real estate market by holding 36.8% of the global market share in 2024. The United States as the primary contributor to the North American market. Strong investments in office spaces, retail centers, and logistics properties continue to drive growth. According to the U.S. Census Bureau, commercial construction spending reached $115.8 billion in 2022 with the high demand for new developments. The Canadian market also plays a vital role with consistent investments in urban commercial hubs. The continued economic stability, urbanization, and advancements in property technology (PropTech) to enhance operational efficiency are further likely to boost the commercial real estate market in North America.

Europe is a prominent regional market for commercial real estate globally and is anticipated to account for a substantial share of the worldwide market during the forecast period owing to the increasing investments on smart buildings and energy-efficient commercial properties to comply with stringent European Union regulations. Leading markets in the region include Germany, the United Kingdom, and France. In 2024, the UK demonstrated strong recovery trends with a 26% increase in commercial property transactions of €14.2 billion, according to MSCI Real Assets. Germany and France are witnessing significant investments in green buildings and urban redevelopment projects with the commitment to sustainable real estate practices.

The Asia-Pacific region is the most lucrative regional market for commercial real estate worldwide and is projected to grow at a CAGR of 7.4% over the forecast period. The region is characterized by rapid urbanization, industrial expansion, and increasing foreign direct investments. Japan remains a key player, with commercial real estate transactions reaching $23.6 billion in 2024 which was the highest since 2007, according to Reuters. China’s initiatives, such as the Belt and Road Initiative (BRI) and industrial growth strategies, are driving significant demand for logistics and retail spaces. Australia is also experiencing robust growth in commercial real estate due to its focus on sustainable infrastructure and thriving industrial markets.

The Latin American market is predicted to showcase steady growth over the forecast period owing to the increasing number of government initiatives aimed at improving infrastructure and the growth of middle-class consumer spending. Brazil’s commercial hubs, such as São Paulo are seeing growing demand for retail and hospitality properties while Mexico is emerging as a logistics hub due to its proximity to the United States.

The market in Middle East and Africa is experiencing promising growth due to large-scale investments in infrastructure and economic diversification efforts. In the UAE, over $30 billion has been allocated to urban development projects, with significant contributions from Dubai and Abu Dhabi’s real estate sectors. Saudi Arabia’s Vision 2030 program includes the development of futuristic cities like NEOM which is driving commercial real estate investments. The MEA market is projected to grow at a CAGR of 5.2% from 2024 to 2032 due to foreign investments, increasing tourism, and infrastructure development in South Africa.

KEY MARKET PARTICIPANTS AND COMPETITIVE LANDSCAPE

CBRE Group, Inc., Cushman & Wakefield, JLL (Jones Lang LaSalle Incorporated), Colliers International, Newmark Group Inc., Prologis, Inc., Hines, Brookfield Properties, Simon Property Group, Inc., Vornado Realty Trust are playing a dominating role in the global commercial real estate market.

The Commercial Real Estate (CRE) Market is marked by robust competition among developers investors property managers and real estate investment trusts (REITs). Leading firms like CBRE Group JLL and Colliers International dominate through diverse portfolios strategic mergers and cutting-edge technology adoption. Regional companies excel by tailoring services to local demands enhancing their competitive advantage.

Emerging trends such as green building certifications IoT integration and tenant-focused innovations are transforming the market landscape. Competitors striving to meet these expectations differentiate themselves by embracing sustainability and leveraging data-driven insights. In niche areas like coworking spaces companies such as WeWork maintain prominence while Prologis leads in logistics-oriented properties.

Intense rivalry also stems from economic shifts and tenant preferences. Market leaders compete to provide flexible lease terms and smart infrastructure to attract tenants and investors. Meanwhile regions like Asia-Pacific and the Middle East are gaining momentum due to urban expansion and infrastructure advancements.

Adaptability to technological trends efficient asset management and alignment with regulatory standards are critical factors for maintaining a competitive edge. As markets evolve companies capable of anticipating changes and delivering value-driven solutions are better positioned to thrive in this dynamic sector

RECENT HAPPENINGS IN THE MARKET

- In August 2023, CBRE expanded its global footprint by increasing its office locations from 537 in 2019 to 657, focusing on growth in EMEA and Asia Pacific regions.

- In August 2023, Cushman & Wakefield re-evaluated its office space needs in response to the rise of remote work, adjusting its corporate real estate strategy to align with market trends.

MARKET SEGMENTATION

This research report on the global commercial real estate market has been segmented and sub-segmented based on type, channel, and region.

By Type

- Offices

- Retail

- Industrial and Logistics

- Hospitality

By Channel

- Rental

- Lease

- Sales

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]