Global Combat Management System Market Size, Share, Trends, & Growth Forecast Report Segmented By Component Type (Software and Hardware), Sub-System, Platform, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Combat Management System Market Size

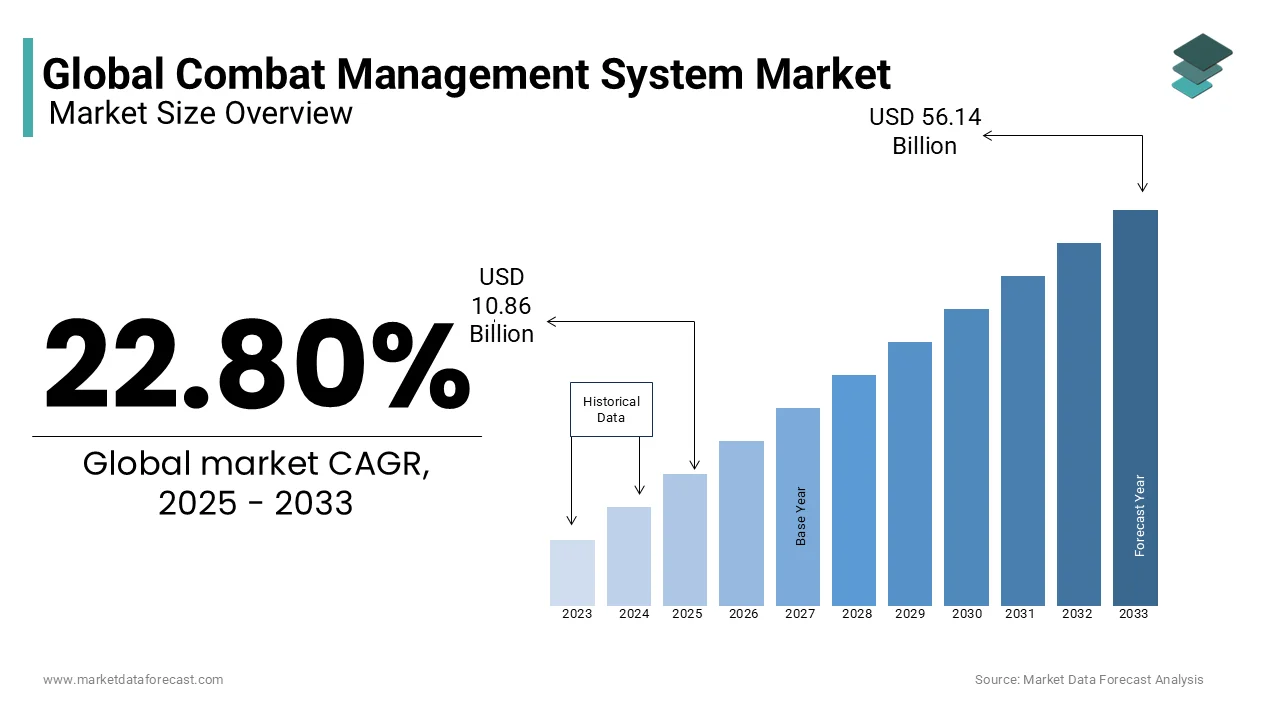

The global combat management system market was worth USD 8.84 billion in 2024. The global market is expected to reach USD 56.14 billion by 2033 from USD 10.86 billion in 2025, growing at a CAGR of 22.80% from 2025 to 2033.

The Combat Management System (CMS) serves as the nerve center for naval vessels, submarines, and increasingly, airborne and land-based operations, by consolidating data from sensors, weapons systems, communication networks, and other sources into a unified interface. This enables real-time coordination of resources, threat assessment, and mission execution. In an era defined by asymmetric warfare and multi-domain operations, combat management systems have become indispensable for modern armed forces seeking to maintain strategic superiority.

According to the Stockholm International Peace Research Institute, global military expenditure reached approximately $2.2 trillion in 2022 with the growing emphasis on defense modernization programs that include CMS integration. According to the U.S. Department of Defense, over 70% of its naval fleet is undergoing upgrades to incorporate next-generation CMS capabilities by reflecting the prioritization of network-centric warfare. As per a report by the International Institute for Strategic Studies, advancements in artificial intelligence and machine learning are driving innovation within CMS architectures by enabling predictive analytics and autonomous functionalities. These developments align with broader trends such as increased cyber threats; for instance, Cybersecurity Ventures estimates that cybercrime will cost the world $10.5 trillion annually by 2025 by prompting CMS developers to embed robust cybersecurity measures into their designs. Collectively, these factors illustrate the pivotal role of combat management systems in shaping contemporary defense strategies.

MARKET DRIVERS

Advancements in Multi-Domain Operations

The increasing complexity of modern warfare, characterized by multi-domain operations across land, sea, air, space, and cyberspace, is a significant driver for the Combat Management System (CMS) market. According to the U.S. Department of Defense's 2022 report on defense strategy, the need for integrated systems capable of managing cross-domain threats in real-time. For instance, the Pentagon allocated approximately $112 billion in 2023 to develop joint all-domain command and control (JADC2) capabilities, which rely heavily on CMS platforms. These systems enable seamless coordination between disparate units, reducing response times and enhancing mission effectiveness. According to the NATO’s Allied Command Transformation, over 60% of member nations are prioritizing CMS upgrades to meet evolving operational demands. The rise in unmanned systems; the Federal Aviation Administration projects that the global fleet of military drones will exceed 20,000 units by 2025 by necessitating robust CMS integration to ensure synchronized operations across domains.

Escalating Geopolitical Tensions and Defense Budgets

The rising geopolitical tensions and increased defense spending globally are propelling the growth of the combat management systems market. According to the Stockholm International Peace Research Institute, global military expenditure surged to $2.2 trillion in 2022, with countries like China, India, and the United States leading the charge. China’s defense budget alone grew by 7.1% in 2023 by reflecting its focus on naval modernization, including CMS-equipped vessels. According to the European Defence Agency, EU member states collectively raised their defense budgets by 13% in 2022 compared to the previous year, which is driven by security concerns stemming from regional conflicts. Furthermore, the U.S. Navy’s Shipbuilding Plan for 2023 ensure its plans to expand its fleet to 355 ships, many of which will require state-of-the-art CMS installations. These investments shows how escalating security challenges and arms race dynamics are accelerating CMS adoption worldwide.

MARKET RESTRAINTS

High Development and Implementation Costs

The substantial financial investment required for the development and deployment of combat management systems poses a significant restraint to market growth. According to the U.S. Government Accountability Office, the average cost of developing and integrating advanced CMS platforms can exceed $500 million per project by making it prohibitive for smaller nations with limited defense budgets. According to the Australian Department of Defence, its SEA 5000 program, which includes CMS integration for next-generation warships, is projected to cost approximately $35 billion over its lifecycle. According to the Congressional Research Service, budget overruns in defense projects are common, with nearly 30% of major programs exceeding initial cost estimates by more than 25%. These high costs often lead to delays or scaled-down implementations by limiting widespread adoption. Furthermore, the need for continuous upgrades to counter emerging threats adds to long-term expenses by creating financial strain on defense agencies already grappling with competing priorities.

Cybersecurity Vulnerabilities and Threats

The increasing reliance on networked systems within combat management platforms exposes them to heightened cybersecurity risks by acting as a critical restraint in the market. According to the U.S. Cybersecurity and Infrastructure Security Agency (CISA), cyberattacks on military systems have risen by 40% since 2020, with adversaries targeting vulnerabilities in integrated CMS architectures. A study by the United Kingdom’s Ministry of Defence revealed that over 60% of defense organizations experienced at least one significant cyber intrusion in 2022, underscoring the fragility of interconnected systems. Moreover, the European Union Agency for Cybersecurity warns that the sophistication of cyber threats is outpacing current defensive measures, with ransomware attacks alone costing governments an estimated $20 billion globally in 2023. These vulnerabilities necessitate substantial investments in cybersecurity protocols, diverting funds from other critical areas and slowing CMS adoption. The challenge is further compounded by the difficulty of retrofitting legacy systems to meet modern cybersecurity standards.

MARKET OPPORTUNITIES

Integration of Artificial Intelligence and Autonomous Systems

The incorporation of artificial intelligence (AI) and autonomous systems into combat management systems presents a transformative opportunity for the market. According to the U.S. Department of Defense’s Joint Artificial Intelligence Center, AI-driven systems could enhance operational efficiency by up to 30% by enabling faster decision-making and reducing human error in mission-critical scenarios. For instance, the Defense Advanced Research Projects Agency (DARPA) has allocated over $2 billion to AI research programs aimed at developing predictive analytics and autonomous functionalities for CMS platforms. Additionally, the United Kingdom’s Ministry of Defence forecasts that unmanned systems by including drones and autonomous vessels, will account for nearly 40% of all military assets by 2030, necessitating advanced CMS solutions to manage these assets effectively. According to the NATO’s Innovation Hub, AI integration can reduce sensor-to-shooter timelines by up to 50%, offering a significant tactical advantage in dynamic combat environments.

Expansion into Emerging Markets and Naval Modernization Programs

The emerging markets and ongoing naval modernization initiatives present substantial growth opportunities for the combat management system market. According to the Indian Ministry of Defence, India’s naval modernization program aims to construct 45 new warships by 2030, all of which will require state-of-the-art CMS installations. As per the African Union’s Peace and Security Council, defense spending across African nations has increased by 17% since 2020, with many countries prioritizing maritime security and CMS-equipped vessels to counter piracy and smuggling. The Japan Maritime Self-Defense Force also plans to expand its fleet with 22 new ships by 2027 by creating a robust demand for CMS technologies. According to the United Nations Conference on Trade and Development, global maritime trade volumes are projected to grow by 3.4% annually by driving investments in naval capabilities and CMS platforms to safeguard critical sea lanes and ensure regional stability.

MARKET CHALLENGES

Interoperability Issues Across Legacy and Modern Systems

Achieving seamless interoperability between legacy systems and modern combat management platforms remains a significant challenge. According to the U.S. Government Accountability Office, over 60% of existing military assets still rely on outdated technology, which often lacks compatibility with new CMS architectures. According to the Canadian Department of National Defence, integrating its aging Halifax-class frigates with next-generation CMS solutions has resulted in delays and cost overruns exceeding $500 million. As per NATO’s Allied Command Transformation, coalition operations involving multiple nations frequently encounter data-sharing issues due to incompatible communication protocols and software standards. As per the European Defence Agency, resolving interoperability gaps could require an additional investment of €10 billion annually across member states.

Workforce Training and Skill Gaps

The rapid evolution of combat management systems has created a widening gap in workforce expertise by posing a critical challenge for effective implementation. According to the U.S. Department of Labor’s Bureau of Labor Statistics, the demand for skilled cybersecurity and systems integration professionals will grow by 33% from 2020 to 2030, far outpacing the current supply. A study by the Australian Defence Force has shown that nearly 40% of personnel require additional training to operate advanced CMS platforms effectively. The United Kingdom’s Ministry of Defence further leverages this issue by reporting that only 25% of its technical workforce is fully proficient in managing AI-driven CMS functionalities. This skills deficit is compounded by the complexity of these systems, which often necessitate continuous retraining. According to the International Labour Organization, addressing such skill gaps could cost defense agencies approximately $15 billion globally by 2025 by diverting resources from other strategic priorities and slowing adoption timelines.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

22.80% |

|

Segments Covered |

By Component Type, Sub-System, Platform, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Leonardo S.p.A (Italy), SAAB AB (Sweden), Northrop Grumman Corporation (U.S.), Lockheed Martin Corporation (U.S.), BAE Systems plc (U.K.), Raytheon Technologies Corporation (U.S.), Kongsberg Gruppen ASA (Norway), ASELSAN A.S. (Turkey), ATLAS ELEKTRONIK GmbH (Germany), Thales Group (France), Terma AS (Denmark), Elbit Systems Ltd. (Israel), Israel Aerospace Industries Ltd. (Israel), L&T Ltd. (India), Hanwha Systems Co. Ltd. (South Korea), and Bharat Electronics Ltd. (BEL) (India). |

SEGMENT ANALYSIS

By Component Type Insights

The software dominated the Combat Management System market by capturing 46.1% of share in 2024 owing to the critical role software plays in integrating sensors, weapons, and communication systems into a unified platform. According to the International Institute for Strategic Studies, over 70% of CMS operational capabilities depend on advanced software algorithms for real-time data processing and decision-making. Software remains indispensable for enabling predictive analytics and AI-driven functionalities by ensuring superior situational awareness and mission success.

The control consoles segment is estimated to register a CAGR of 8.2% during the forecast period. This growth is driven by the rising demand for ergonomic and intuitive interfaces to manage complex combat operations. According to the U.S. Navy’s Shipbuilding Plan, modern consoles equipped with touchscreen and voice-command capabilities reduce operator workload by up to 40% by enhancing efficiency. According to the Australian Department of Defence, investments in next-generation consoles have surged by 25% since 2021, as these systems enable seamless interaction with AI-driven CMS platforms. Control consoles are pivotal in bridging human-machine interaction by making them integral to future-ready combat systems.

By Sub-System Insights

The Situational Awareness System held the largest share of the Combat Management System market with 35.1% of share in 2024 with the rising importance in consolidating data from radars, sonars, and other sensors to provide real-time battlefield insights. According to the European Defence Agency, over 70% of modern military operations rely on enhanced situational awareness to mitigate risks and improve decision-making. This segment remains pivotal for mission success with global military spending on sensor technologies exceeding $80 billion in 2022. Its ability to integrate with AI-driven analytics further amplifies its importance by ensuring superior operational efficiency.

The Unmanned Vehicle Control System segment is anticipated to exhibit a CAGR of 14.5% during the forecast period. This rapid growth is fueled by the increasing deployment of unmanned systems by including drones and autonomous vessels, for reconnaissance and combat missions. The U.S. Department of Defense stuideis have revealed that unmanned systems will constitute nearly 40% of all military assets by 2030 by driving demand for advanced control systems. Additionally, NATO’s Innovation Hub reports that unmanned systems reduce personnel risk by 60% in high-threat environments by making them indispensable. According to the United Nations Conference on Trade and Development, global investments in unmanned technologies will reach $150 billion by 2025 with their strategic importance. This segment’s integration with AI and machine learning further accelerates its adoption, positioning it as a cornerstone of future combat operations.

By Platform Insights

The principal Surface Combatants segment led the combat management system market with a notable share of 45.1% in 2024 due to their naval warfare and multi-mission capabilities such as air defense, anti-submarine operations, and missile deterrence. According to the Congressional Research Service, over 70% of global naval fleets prioritize CMS integration for these vessels due to their strategic importance. For instance, the U.S. Navy’s Arleigh Burke-class destroyers, equipped with Aegis CMS, represent a $23 billion investment. These platforms are indispensable for maintaining maritime superiority by ensuring interoperability across allied forces, and addressing rising geopolitical tensions.

The submarine segment is likely to exhibit a fastest CGAR of 8.2% from 2025 to 2033. This growth is driven by increasing investments in stealth technologies and undersea warfare capabilities. According to the U.S. Naval Institute, global submarine procurement is expected to grow by 25% over the next decade, with nations like China and India expanding their fleets. According to the NATO’s Maritime Unmanned Systems Initiative, advancements in sonar and AI-driven CMS are enhancing submarine detection and countermeasures. For example, Australia’s $90 billion Future Submarine Program emphasizes CMS integration to counter regional threats. Submarines’ ability to operate undetected makes them pivotal for strategic deterrence is driving rapid adoption of advanced CMS solutions.

REGIONAL ANALYSIS

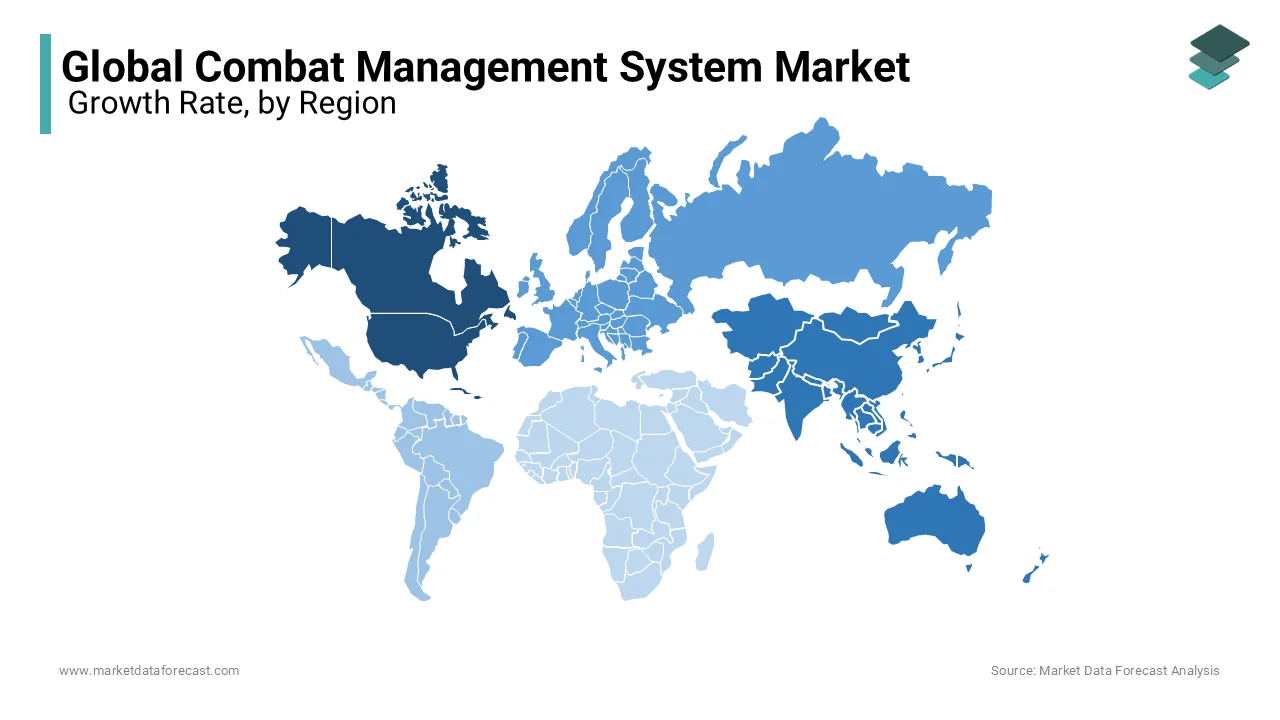

North America led the combat management system market with 38.6% of share in 2024. This dominance is driven by the United States’ focus on naval modernization and defense spending, which reached $877 billion in 2023. According to the Congressional Research Service, over 60% of U.S. naval vessels are equipped with advanced CMS platforms like Aegis by ensuring maritime superiority. Additionally, Canada’s National Shipbuilding Strategy allocates $103 billion for fleet upgrades that further boosting regional demand. North America’sfrom its technological innovation hubs and robust defense-industrial base by enabling rapid adoption of AI-driven CMS solutions.

The Asia-Pacific region is deemed to achieve an expected CAGR of 9.1% from 2025 to 2033. This growth is fueled by escalating territorial disputes and rising defense budgets. China’s defense expenditure grew by 7.1% in 2023, while India allocated $80 billion to modernize its armed forces. According to the Stockholm International Peace Research Institute, naval procurement in the region will account for 40% of global shipbuilding by 2025. Nations like Japan and South Korea are investing heavily in CMS-equipped submarines and destroyers to counter regional threats. Furthermore, Australia’s $90 billion Future Submarine Program emphasizes CMS integration by reflecting the region’s focus on enhancing maritime deterrence capabilities.

Europe, Latin America, the Middle East, and Africa are expected to witness steady growth in the combat management system market. The European Defence Agency forecasts a 5% annual increase in defense spending, with NATO members prioritizing CMS upgrades for interoperability. In Latin America, Brazil’s $35 billion naval modernization program will drive CMS adoption. The Middle East, facing persistent security challenges, is investing in advanced systems. Saudi Arabia’s Vision 2030 allocates $100 billion for defense modernization. Meanwhile, Africa’s maritime security initiatives, supported by the African Union, will spur demand for patrol boats with CMS capabilities. Collectively, these regions are projected to contribute approximately 30% to global CMS growth by 2030, as reported by the United Nations Conference on Trade and Development.

KEY MARKET PLAYERS

The major players in the global combat management system market include Leonardo S.p.A (Italy), SAAB AB (Sweden), Northrop Grumman Corporation (U.S.), Lockheed Martin Corporation (U.S.), BAE Systems plc (U.K.), Raytheon Technologies Corporation (U.S.), Kongsberg Gruppen ASA (Norway), ASELSAN A.S. (Turkey), ATLAS ELEKTRONIK GmbH (Germany), Thales Group (France), Terma AS (Denmark), Elbit Systems Ltd. (Israel), Israel Aerospace Industries Ltd. (Israel), L&T Ltd. (India), Hanwha Systems Co. Ltd. (South Korea), and Bharat Electronics Ltd. (BEL) (India).

TOP 3 PLAYERS IN THE MARKET

Lockheed Martin Corporation (U.S.)

Lockheed Martin is a global leader in the combat management system market, renowned for its Aegis Combat System, which is widely deployed across naval fleets worldwide. The company’s emphasis on integrating cutting-edge technologies like artificial intelligence and machine learning has set new standards in the market by enabling real-time threat detection and enhanced decision-making capabilities. Lockheed Martin’s commitment to innovation is reflected in its extensive R&D initiatives, ensuring its systems remain at the forefront of technological advancements. Its strategic partnerships with allied nations, including Japan and Australia, have further strengthened its dominant position. By addressing multi-domain operational needs, Lockheed Martin plays a critical role in shaping modern maritime security strategies and maintaining global deterrence.

Northrop Grumman Corporation (U.S.)

Northrop Grumman is a key player in the CMS market, offering advanced solutions tailored for both surface and subsurface platforms. The company’s expertise lies in developing systems that integrate cutting-edge cybersecurity measures and autonomous functionalities, addressing the evolving demands of modern warfare. Northrop Grumman’s focus on innovation ensures its systems remain adaptable to emerging threats, particularly in undersea warfare. Its collaboration with NATO allies and participation in major defense programs, such as the UK’s Dreadnought submarine initiative, amplifies its global influence. By enhancing interoperability and addressing complex security challenges, Northrop Grumman significantly contributes to strengthening defense capabilities worldwide.

Thales Group (France)

Thales Group is a prominent contributor to the CMS market, with a strong presence in Europe and the Asia-Pacific region. The company’s TACTICOS CMS is one of the most widely adopted platforms globally, known for its flexibility and scalability across diverse naval operations. Thales’ dedication to innovation is evident in its focus on AI-driven analytics and modular architectures, ensuring its systems meet varied operational requirements. Its partnerships with regional players, such as India’s Bharat Electronics Limited, elevates its commitment to fostering local defense ecosystems. Additionally, Thales’ involvement in European maritime security initiatives escalates its role in promoting regional stability. By delivering adaptable and future-ready CMS solutions, Thales addresses both traditional and asymmetric threats.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Strategic Partnerships and Collaborations

Companies like Lockheed Martin, Thales Group, and BAE Systems frequently engage in partnerships with governments, defense agencies, and private entities to co-develop advanced CMS solutions. For instance, Lockheed Martin collaborates with Japan and Australia to integrate its Aegis Combat System into their naval fleets, ensuring interoperability and regional security. Similarly, Thales Group partners with Bharat Electronics Limited (BEL) in India to develop indigenous CMS platforms, aligning with the "Make in India" initiative. Such collaborations not only expand market reach but also enable technology transfer and localization, meeting regional regulatory requirements.

Research and Development (R&D) Investments

Investing heavily in R&D is a cornerstone strategy for companies like Northrop Grumman and Raytheon Technologies. By focusing on cutting-edge technologies such as artificial intelligence, machine learning, and autonomous systems, these firms ensure their CMS platforms remain at the forefront of innovation. For example, Northrop Grumman’s advancements in undersea warfare systems and cyber-resilient architectures address emerging threats, while Raytheon’s integration of predictive analytics enhances operational efficiency. Continuous R&D efforts allow these players to offer future-ready solutions that cater to multi-domain operations.

Mergers, Acquisitions, and Joint Ventures

Mergers and acquisitions are pivotal for consolidating expertise and expanding product portfolios. For instance, BAE Systems has acquired smaller firms specializing in cybersecurity and sensor technologies to bolster its CMS offerings. Similarly, ASELSAN and Kongsberg Gruppen have formed joint ventures to combine their strengths in naval systems and maritime surveillance. These moves enable companies to leverage complementary capabilities, reduce development costs, and accelerate time-to-market for advanced CMS solutions.

Focus on Cybersecurity and Resilience

As cyber threats escalate, key players prioritize embedding robust cybersecurity measures into their CMS platforms. Companies like SAAB AB and Elbit Systems emphasize secure communication protocols and AI-driven threat detection to counter vulnerabilities. This focus on resilience ensures compliance with stringent defense standards while addressing growing concerns about data breaches and system integrity.

Global Expansion and Localization

To tap into emerging markets, firms like Hanwha Systems and L&T Ltd. adopt localization strategies, tailoring their CMS solutions to meet specific regional requirements. By establishing manufacturing hubs and R&D centers in regions like Asia-Pacific and the Middle East, these companies strengthen their presence and cater to local defense modernization programs.

COMPETITIVE LANDSCAPE

The combat management system (CMS) market is characterized by intense competition, driven by the growing demand for advanced defense technologies and the need for interoperable, multi-domain solutions. Key players such as Lockheed Martin, Thales Group, Northrop Grumman, and SAAB AB dominate the landscape, leveraging their expertise in integrating artificial intelligence, machine learning, and cybersecurity into CMS platforms. These companies compete to secure lucrative defense contracts from major naval powers, including the United States, NATO members, and emerging economies like India and South Korea. The competition is further intensified by the entry of regional players like ASELSAN, Bharat Electronics Ltd., and Hanwha Systems, which focus on cost-effective, localized solutions tailored to specific defense requirements.

Innovation remains a critical differentiator, with firms investing heavily in R&D to develop next-generation systems capable of addressing evolving threats such as cyberattacks and asymmetric warfare. Strategic partnerships and collaborations with governments and private entities also play a pivotal role, enabling technology transfer and enhancing market reach.

Despite the dominance of established players, smaller firms are gaining traction by offering modular and scalable CMS solutions. This has led to a fragmented yet dynamic market, where competition is not only about technological superiority but also about adaptability, affordability, and alignment with regional security priorities. As defense budgets rise and modernization programs expand, the competitive intensity in the CMS market is expected to escalate further.

RECENT MARKET DEVELOPMENTS

- In July 2024, Lockheed Martin Corporation secured a $5.2 billion contract to upgrade the Aegis Combat System for the U.S. Navy. This move is anticipated to enhance its missile defense capabilities and strengthen its position in multi-domain combat systems.

- In June 2022, Thales Group partnered with Bharat Electronics Limited (BEL) in India to co-develop indigenous CMS platforms under the "Make in India" initiative. This collaboration is expected to expand Thales’ presence in the Asia-Pacific defense market.

- In January 2023, Northrop Grumman Corporation integrated AI-driven autonomous functionalities into its CMS solutions for Virginia-class submarines. This advancement is anticipated to address emerging undersea warfare challenges and leverages its competitive edge.

- In September 2022, SAAB AB delivered its 9LV CMS to the Royal Australian Navy as part of a $1.5 billion contract. This delivery is expected to reinforce SAAB’s reputation for modular and scalable combat management systems.

- In July 2023, Raytheon Technologies Corporation launched an advanced predictive analytics module for its CMS platforms. This innovation is anticipated to improve real-time decision-making and operational efficiency for NATO allies.

- In November 2022, BAE Systems plc acquired a cybersecurity firm specializing in naval systems. This acquisition is expected to enhance its CMS offerings with robust cyber-resilience features and address growing security concerns.

- In February 2023, Kongsberg Gruppen ASA signed a joint venture with Japan’s Mitsubishi Heavy Industries to develop CMS solutions for next-generation naval vessels. This partnership is anticipated to expand Kongsberg’s footprint in the Indo-Pacific region.

- In May 2023, ASELSAN A.S. unveiled its GENESIS CMS tailored for fast attack craft. This development is expected to showcase ASELSAN’s focus on lightweight, cost-effective solutions for emerging markets.

- In August 2022, Elbit Systems Ltd. completed the acquisition of an AI-based maritime surveillance company. This move is anticipated to integrate advanced threat detection capabilities into its CMS platforms and strengthen its technological portfolio.

- In April 2023, Hanwha Systems Co. Ltd. partnered with South Korea’s Defense Acquisition Program Administration (DAPA) to develop CMS-equipped destroyers under the KDDX program. This collaboration is expected to promote Hanwha’s role in regional naval modernization efforts.

MARKET SEGMENTATION

This research report on the global combat management system market is segmented and sub-segmented into the following categories.

By Component Type

- Software

- Hardware

- Control Consoles

- Combat Data Center

- Data Network Switches

By Sub-System

- Self-Defense Management System

- Situational Awareness System

- Track Management System

- Weapon Management System

- Display System

- Identification System

- Unmanned Vehicle Control System

By Platform

- Principal Surface Combatants

- Submarine

- Amphibious Ships

- Fast Attack Craft (FAC)

- Patrol Boats & Crafts

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current size of the global Combat Management System (CMS) market?

The CMS market was valued at approximately USD 8.84 billion in 2024.

What factors are driving the growth of the CMS market?

Key drivers include increased procurement of naval vessels and the adoption of next-generation combat management technologies.

How has global military spending impacted the CMS market?

Rising global military expenditures have significantly boosted the demand for advanced combat management systems.

What technological advancements are influencing the CMS market?

The integration of artificial intelligence and data analytics is enhancing decision-making and operational efficiency in combat systems.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]