Global Colorants Market Size, Share, Trends & Growth Forecast Report By Type (Dyes, Pigments, Masterbatches And Colour Concentrates), End-use Industry (Packaging, Building And Construction, Automotive, Textiles, Paper And Printing, Other End Users) & Region (North America, Latin America, Asia Pacific, Europe, Middle East and Africa) - Industry Analysis, 2025 to 2033

Global Colorants Market Size

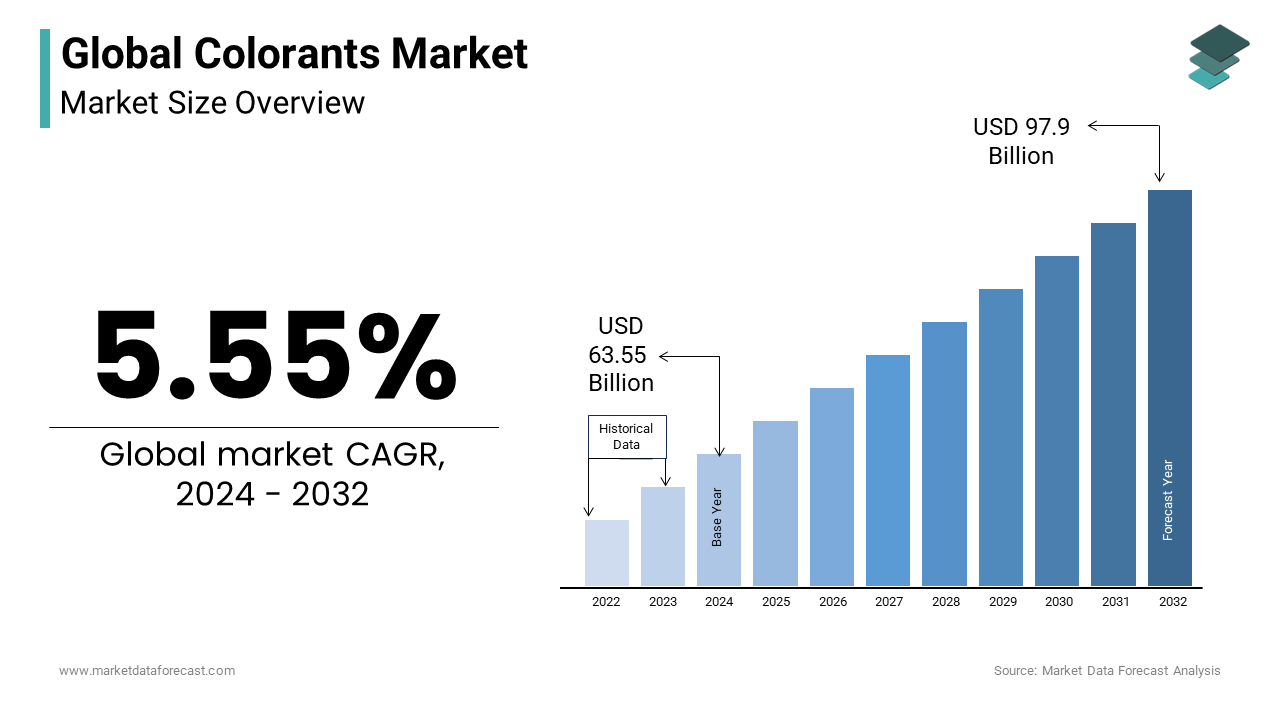

The global colorants market was valued at USD 63.55 billion in 2025 and is anticipated to reach from USD 67.08 billion in 2025 from USD 103.33 billion by 2033, growing at a CAGR of 5.55% from 2025 to 2033.

The global colorants market is poised for steady expansion. The growth of the market is driven by rising demand for vibrant, durable colors in consumer goods and high-performance coatings. The growth also reflects an increased focus on eco-friendly and sustainable colorant solutions as industries seek to reduce environmental impact.

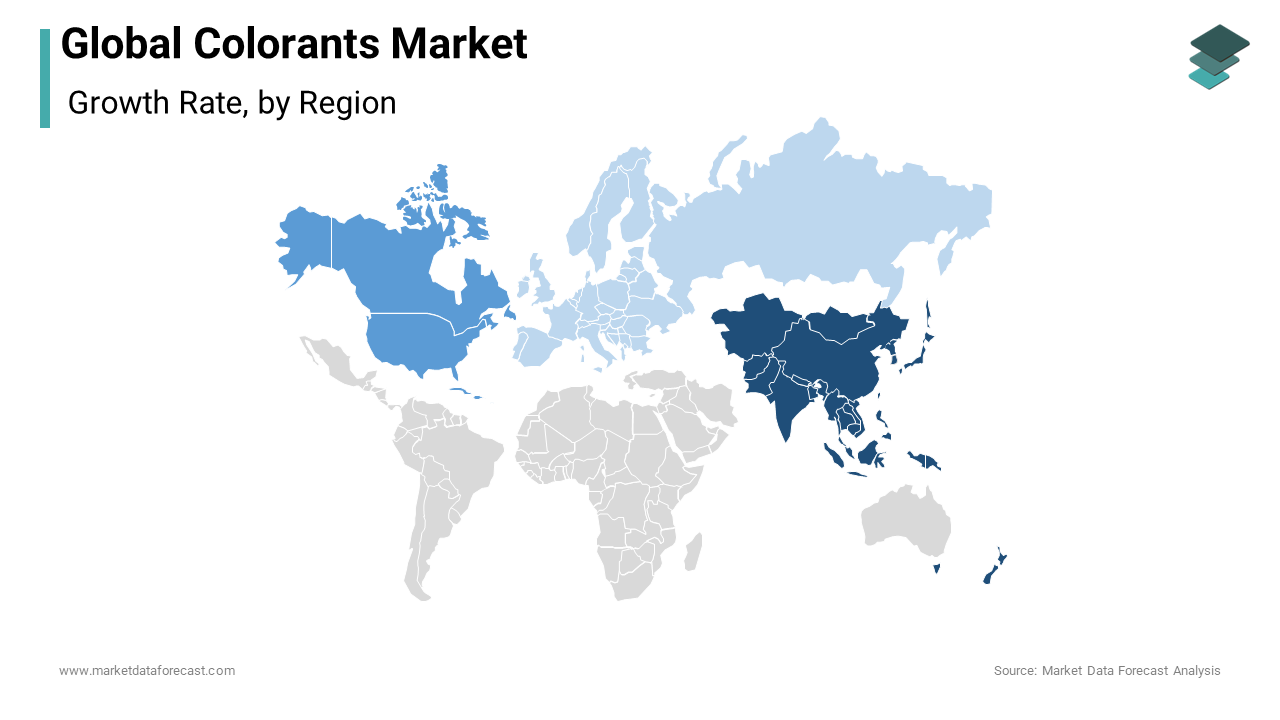

Asia-Pacific leads the global colorants market, capturing over 40% of the total share. This dominance is fueled by the region’s large manufacturing base and significant investments in infrastructure, especially in countries like China and India. The demand in these countries spans across multiple industries, from textiles to packaging, propelling growth in the colorants market. Europe represents another key market, with a strong focus on sustainable, bio-based colorants to comply with strict environmental standards. North America, led by the United States, is a mature market with substantial demand from the packaging, automotive, and construction sectors. As regulatory demands tighten worldwide, especially in Europe and North America, colorant manufacturers are increasingly developing eco-friendly and bio-based products to meet industry and consumer expectations for sustainability.

MARKET DRIVERS

The packaging industry is a significant driver in the colorants market due to increasing demand for visually appealing, brand-differentiated products. With the global packaging industry projected to reach over USD 1 trillion by 2026, colorants have become essential for product differentiation in retail. Specifically, the shift toward flexible packaging used in food and beverage, personal care, and healthcare has driven demand for vibrant, durable colorants that withstand various processing and environmental conditions. The push for sustainable packaging has also led to innovations in eco-friendly colorants, such as water-based inks and bio-based pigments, which align with consumer expectations and regulatory trends.

The Asia-Pacific region leads the colorants market, accounting for over 40% of global market share. The growth is supported by expanding manufacturing industries, particularly textiles, plastics, and automotive. Countries like China and India, with their vast production capabilities, are key drivers; China alone produces about 60% of global textile colorants. In addition, rapid urbanization and rising consumer spending in these regions are creating increased demand for colorful products, spurring the growth of dyes and pigments. Regulatory moves to limit pollution have also fostered investment in cleaner colorant technologies, adding momentum to this growth.

With growing environmental awareness, the market is experiencing a strong shift toward sustainable colorants. The global green dyes and pigments market, a segment of the colorants market, is anticipated to grow significantly as manufacturers adopt eco-friendly practices. Europe leads this shift due to stringent environmental regulations, while other regions are increasingly following suit. For instance, bio-based pigments produced from renewable sources like plants are gaining popularity as alternatives to traditional petrochemical-derived options.

MARKET RESTRAINTS

Environmental concerns surrounding synthetic dyes and pigments have led to stringent regulations, particularly in North America and Europe. Many synthetic colorants contain heavy metals and toxic chemicals that can pollute water sources and harm ecosystems. For instance, the European Union's REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) regulations impose strict requirements on colorant ingredients to limit environmental impact. Compliance can be costly for manufacturers, who need to invest in cleaner production methods or reformulate products. This has led to increased research and development costs, which can be challenging for smaller producers and could slow market growth. Additionally, environmental regulations are expanding globally, with countries like China and India adopting stricter policies, which limits the use of certain chemicals in colorants and raises production costs.

The cost of raw materials, especially petrochemical derivatives used in synthetic dyes and pigments, is highly volatile due to fluctuations in crude oil prices. The 2022 global energy crisis highlighted this vulnerability, driving up prices of key raw materials. For example, an increase in crude oil prices can directly impact the cost of azo pigments, which rely on petrochemicals. Manufacturers are often unable to fully pass these costs onto end consumers, squeezing profit margins and reducing investment in innovation. This volatility impacts on the market’s stability, with some producers forced to scale back production or shift to alternative, sometimes more expensive, bio-based sources, affecting overall growth and competitiveness.

The shift toward sustainable and bio-based colorants faces cost challenges, as eco-friendly options are generally more expensive to produce than traditional colorants. Bio-based dyes, for example, require specialized extraction and processing techniques, driving up production costs by an estimated 20-30% compared to conventional colorants. Additionally, establishing new production infrastructure or retrofitting existing facilities to handle bio-based inputs represents significant capital expenditure. As a result, while demand for sustainable options is rising, many end-users are hesitant to absorb the higher costs. This limits widespread adoption, especially in price-sensitive sectors like textiles, where cost constraints can hinder the switch to eco-friendly alternatives, slowing overall market growth.

MARKET OPPORTUNITIES

Growing consumer awareness around health and environmental issues has sparked interest in natural and organic colorants. Natural colorants derived from plants, minerals, and animals are seen as safer and eco-friendlier alternatives to synthetic dyes, especially in the food, cosmetics, and textile industries. The global natural dyes market is projected to grow at 11% CAGR over the next few years, with increasing demand for “clean label” products in these sectors. For instance, major food and beverage companies are increasingly replacing artificial dyes with plant-based options like beetroot red and turmeric yellow. The cosmetics industry is also moving toward naturally derived pigments, presenting a sizable opportunity for colorant manufacturers to innovate in these areas and expand into new, health-conscious consumer markets.

The global push for sustainable packaging, driven by both regulatory demands and consumer preferences, presents a robust opportunity for colorant manufacturers. Brands are seeking environmentally friendly and recyclable packaging, and colorants play a crucial role in this. Bio-based and water-soluble colorants, which align with the goals of compostable or biodegradable packaging, are in high demand. The global sustainable packaging market is projected to reach USD 470 billion by 2027, with a substantial portion requiring eco-friendly printing and colorants. Companies that focus on developing colorants that can meet recycling and biodegradability standards are well-positioned to capture market share as the demand for greener packaging solutions continues to expand.

Emerging markets, particularly in regions such as Asia, Latin America, and Africa, present substantial growth opportunities for colorants. These regions are experiencing rapid industrialization and urbanization, leading to increased demand for colorful products in construction, automotive, textiles, and consumer goods. For instance, Asia-Pacific is projected to grow significantly, with India expected to become one of the largest textile markets globally, thereby driving demand for textile dyes and pigments. Urbanization, which boosts the need for construction materials and consumer goods, further fuels demand for colorants. With more people moving to cities, the need for colorful, durable, and eco-friendly products increases, creating opportunities for colorant manufacturers to expand their presence in these high-growth regions and capitalize on local demand.

MARKET CHALLENGES

Synthetic colorants often contain chemicals that are harmful to the environment and human health, such as heavy metals and carcinogenic compounds. Waste from dye manufacturing, especially in countries with lax regulations, can pollute water bodies, impacting ecosystems and local communities. The textile industry alone is responsible for approximately 20% of global water pollution due to dye runoff. Consequently, many countries are implementing stricter environmental controls, which increase compliance costs for manufacturers and can lead to fines for non-compliance. This pressure to adopt eco-friendly practices can be financially taxing, especially for smaller manufacturers, creating a barrier to market entry and growth.

While there’s a growing shift toward eco-friendly, sustainable colorants, these options are often more expensive to produce than conventional synthetic dyes. Bio-based and organic dyes can cost 20-30% more due to specialized processing methods and raw material sourcing. These higher costs present a challenge for both manufacturers and end-users in industries where cost efficiency is critical, such as textiles. While sustainable colorants offer long-term environmental benefits, the immediate financial impact can deter widespread adoption. This challenge is particularly significant for producers in emerging economies, where margins are already slim and cost is a primary consideration.

While sustainable colorants meet environmental standards, they often struggle to match the performance characteristics of synthetic dyes, such as color intensity, UV stability, and resistance to washing or fading. For example, some natural dyes fade quickly under sunlight, making them less suitable for applications requiring long-term durability, such as outdoor paints or automotive finishes. Additionally, many bio-based colorants lack the vibrancy of synthetic pigments, which can impact their appeal in industries like fashion and consumer goods. Addressing these performance limitations requires ongoing research and development, adding to the costs and slowing the transition toward sustainable options.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.55% |

|

Segments Covered |

Type, End-Use Industry & Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

DIC Corporation, Dystar, BASF SE, Polyone Corporation, E. I. du Pont de Nemours and Company, Huntsman Corporation, Cabot Corporation, Clariant AG, Sun Chemical Corporation, and Lanxess. |

SEGMENTAL ANALYSIS

By Type Insights

The pigments segment accounted for the largest share of 45.6% of the global market in 2023. The dominance of dyes segment is majorly driven by their extensive use across industries such as paints and coatings, plastics, and construction. The durability, lightfastness, and opacity of pigments make them essential in applications where long-lasting and intense color is required, especially in outdoor products and automotive finishes. The growth in sectors like automotive and infrastructure where pigments are crucial for coatings and color consistency continues to drive demand. Additionally, the demand for high-performance pigments, particularly in Europe and North America, supports their dominance, as these regions emphasize regulations on safety and quality standards for colorant applications in plastics and packaging.

On the other hand, the masterbatches segment is the fastest-growing segment and is expected to grow at a CAGR of 6.22% over the forecast period. Masterbatches are concentrated mixtures of pigments or additives encapsulated during the plastic manufacturing process to add color or other properties to plastic products. This segment’s rapid growth is driven by the expanding plastics industry, particularly in Asia-Pacific, where demand for colorful, durable, and cost-effective plastic products is high. Additionally, masterbatches offer flexibility, easy handling, and cost efficiency, making them increasingly popular in packaging, consumer goods, and automotive sectors. The focus on sustainable, recyclable plastics is also boosting innovations in eco-friendly masterbatches, contributing to their accelerated growth.

By End-User Insights

The packaging segment occupied 37.2% of the global market share in 2023 and emerged as the dominating segment in the worldwide market. This dominance is driven by high demand for colorants in packaging applications, especially in food and beverage, personal care, and consumer goods sectors, where color plays a crucial role in branding and product appeal. With the global packaging industry projected to reach over USD 1 trillion by 2026, colorants are essential in creating vibrant, differentiated packaging that attracts consumers. Furthermore, as sustainable packaging gains popularity, there is increased demand for eco-friendly colorants, such as biodegradable and water-soluble options, particularly in North America and Europe. These regions have stringent regulations regarding packaging safety and recyclability, prompting manufacturers to adopt environmentally conscious colorant solutions.

The automotive industry is the fastest-growing end-use segment for colorants and is estimated to grow at a CAGR of 7.04% over the forecast period. This growth is fueled by rising global automotive production, especially in emerging markets like China, India, and Southeast Asia, where colorants are essential in automotive coatings for both exterior and interior applications. Colorants enhance the durability, aesthetic appeal, and UV resistance of automotive finishes, making them indispensable in the automotive sector. Additionally, as electric vehicle (EV) production rises, manufacturers are experimenting with unique color schemes and sustainable materials, driving demand for advanced colorant technologies, including eco-friendly and high-performance pigments. The trend toward customizable, vibrant automotive designs also boosts the growth of colorants in this sector.

REGIONAL ANALYSIS

Asia-Pacific is the largest market for colorants and accounted for 40.1% of the global market share in 2023. This region’s dominance is driven by high demand from key industries like textiles, plastics, and automotive manufacturing, particularly in China, India, and Japan. China alone contributes significantly due to its massive textile industry, which consumes around 60% of global dye production. Rapid urbanization, rising consumer spending, and increased industrial output further boost the colorant market growth in Asia-Pacific. The region is also seeing a shift toward sustainable colorants due to environmental regulations and rising consumer awareness.

Europe holds the second largest share in the global colorants market and is predicted to grow at a CAGR of 5.56% during the forecast period. The region is known for its stringent environmental regulations, especially regarding chemical safety, which drives demand for eco-friendly and bio-based colorants. Germany, the United Kingdom, and France are key markets within Europe, heavily influencing demand due to their strong automotive, construction, and packaging industries. The growth of the European market is largely driven by demand for sustainable and high-performance pigments, as well as by trends in sustainable packaging and the automotive industry’s shift toward electric vehicles.

North America is a potential regional segment in the global colorants market and accounted for a substantial share of the global market in 2023. The United States leads demand in the region, driven by strong markets in packaging, automotive, and construction. The focus on sustainability is significant here as well, with increasing regulations encouraging manufacturers to adopt eco-friendly practices. In particular, the packaging industry’s shift toward recyclable and biodegradable materials is fueling demand for sustainable colorants. North America also invests heavily in research and development, fostering innovations in high-performance pigments and bio-based dyes.

Latin America occupied a smaller share of the global market in 2023; however, this region is expected to progress at a steady CAGR over the forecast period. Brazil and Mexico are the primary drivers of demand in the region, driven by expanding industries in packaging, textiles, and automotive. The region’s growth is supported by rising consumer spending and industrialization, along with increasing awareness of sustainable colorants. However, economic instability in some parts of the region can pose challenges to market expansion.

KEY MARKET PLAYERS

Companies playing a major role in the global colorants market include DIC Corporation, Dystar, BASF SE, Polyone Corporation, E. I. du Pont de Nemours and Company, Huntsman Corporation, Cabot Corporation, Clariant AG, Sun Chemical Corporation, and Lanxess.

MARKET SEGMENTATION

This research report on the global colorants market is segmented and sub-segmented based on type, end-users and region.

By Type

- Dyes

- Pigments

- Masterbatches

- Colour Concentrates

By End-User

- Packaging

- Building And Construction

- Automotive

- Textiles

- Paper And Printing

- Other End-Users

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current market size and expected growth value of the global colorant market?

The global colorants market size was expected to be valued at USD 67.08 billion in 2025 and is anticipated to reach USD 103.33 billion by 2033

What are the factors driving the global colorant market?

The packaging industry is a significant driver in the colorants market due to increasing demand for visually appealing, brand-differentiated products.

Which region is projected to account for the largest share of the global colorant market?

The pigments segment accounted for the largest share of 45.6% of the global market in 2023.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]