Global Cold Storage Market Size, Share, Trends & Growth Forecast Report By Construction Type (Bulk Storage, Production Stores and Ports), Temperature (Chilled and Frozen), Application (Processed Foods, Dairy Products, Fruits and Vegetables, Meat and Seafood, and Pharmaceuticals), Warehouse Type (Public, Private and Semi-Private), And Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis (2025 to 2033)

Global Cold Storage Market Size

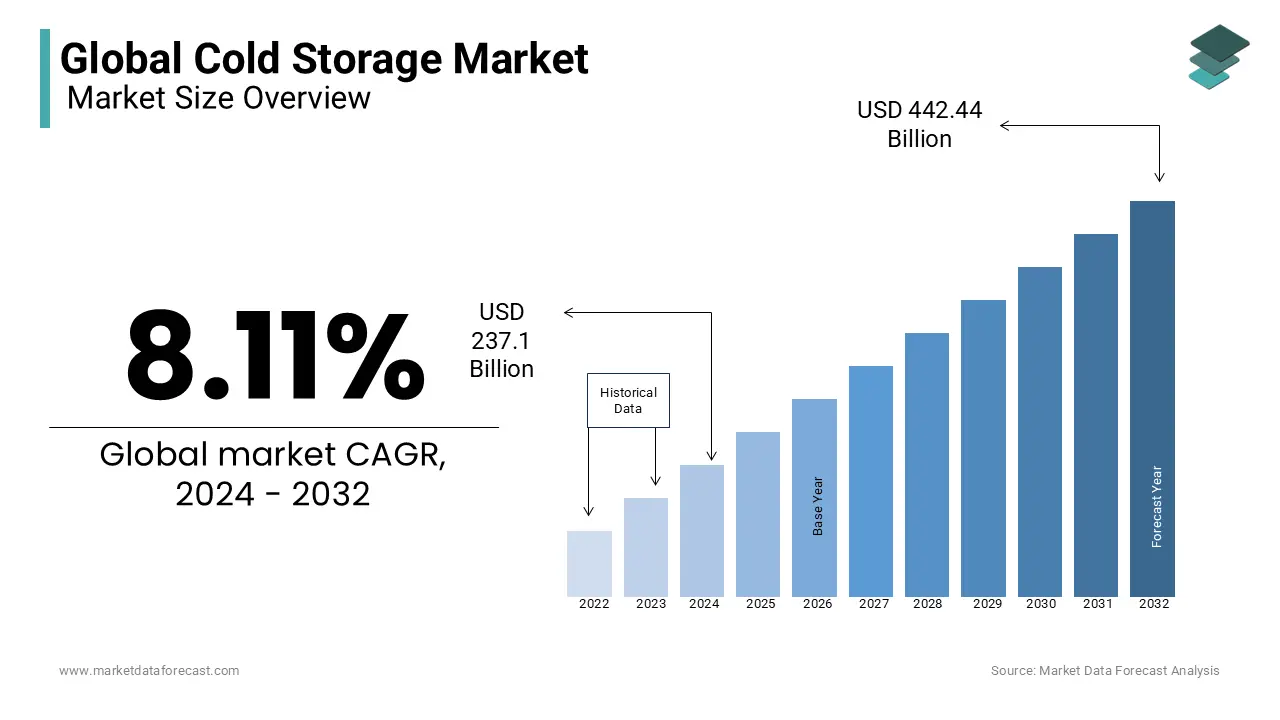

The size of the global cold storage market was valued at USD 237.19 billion in 2024 and is predicted to grow at a CAGR of 8.11% from 2025 to 2033 and be worth USD 478.52 billion by 2033 from USD 256.43 billion in 2025.

The growth of the market is majorly driven by the increasing efforts of the various federal governments around the world for infrastructure development. This is because of the supply chain disruption previously caused by the pandemic and now by the war in Europe and the Middle East in recent times and the effects of climate change. Cold storage technology offers advantages like advanced refrigeration technology and maintaining and tracking systems for various perishable and non-perishable products such as fruits and vegetables, which greatly reduce the possibility of wastage of temperature-sensitive products. The risk of damage during long-distance transportation of goods is another reason propelling the demand for refrigerated warehouses. Some products, like glass, can be damaged by physical impact, while other products are even affected by excessive temperature range. So, these storage facilities are built by properly closing the space and keeping the temperature low by removing heat using refrigeration equipment. Also, food producers that make perishable goods depend on cold storage to store their end products before delivery. The availability of independently managed offsite cold storage is also important if it is present near an area where an organization’s food and beverage can be further supplied.

MARKET DRIVERS

Growing Demand for Warehouse Automation and the Strict Regulations on Food Security and Waste

Stringent laws and regulations regarding the manufacturing and supply of temperature-sensitive products have fuelled the market growth. Besides this, the growing consumer awareness of reducing food wastage is pushing the industry forward. A considerable amount of food is spoiled due to the absence of proper storage infrastructure. Food security is a major problem for the world in 2024. For this, the World Bank has included food and nutrition safety in the eight global challenges to tackle at mass. It has allocated 45 billion dollars in resources to address problems and safeguard livelihoods around the world. It was earlier predicted to pledge 30 billion dollars in May 2022 initially. Furthermore, as the Automation of cold storage increases, the demand is expected to increase further. To counter labor shortages, worker productivity, and security, companies have started introducing artificial intelligence for smooth operation and management. This will assist in developing on-ground activities by supporting worker planning or modeling tools to raise efficiencies in the site by providing work optimization, inventory management, predictive maintenance, and smarter transportation. Warehouse automation includes cloud technology, robots, conveyors, truckload automation, and energy management. Thus, cold storage is a crucial part of supply chain management (SCM) when transporting heat-sensitive products.

Expanding Organized Retail Sector

The fast development of retail stores like hypermarkets, convenience stores, supermarkets, and other vendors is driving the market forward. This is even more prevalent in the developed economies in North America and Europe, which is further strengthening the market position. In addition, big grocery and general merchandise retailers such as Tesco, Walmart, and 7-Eleven need huge logistics fleets for a timely and safe supply of perishable products. The rising market penetration by large companies in emerging nations such as India, UAE, Saudi Arabia, Brazil, and Indonesia is likely to provide potential cold storage opportunities for producers in the coming years. Furthermore, the growing urban population, popularity of online grocery platforms and doorstep delivery services, infrastructure development, increased packaged food consumption, and rising spendable income in developing GDPs are believed to influence the need for perishable food items. This is ultimately propelling the cold storage market.

Rising Demand for Dairy Products and Medical Refrigeration Worldwide

The reduction of tariffs and removal of non-tariff barriers to international trade due to volatile global markets has led to rapid growth in the cross-border movement of perishable goods. Fresh milk and dairy products require careful handling while transporting them because of their spoilable nature. So, the industry is not severely impacted by back-to-back global events like COVID-19, the subsequent energy crisis, and the disruption of food grains and other items, including wheat, rice, etc. Also, population growth, the rising number of hospitals and clinics, and increased consumption of medicines have surged the demand for refrigeration equipment. Various medications, such as vaccines, insulin, and biotech products, need cold storage for preservation. Moreover, cold storage is important in some chemical industries, and manufacturers are installing such equipment. So, global companies are developing novel solutions or taking advantage of alternative energy sources to overcome the challenge of maintaining the required temperature in emerging markets. In addition, new vehicles, such as multi-purpose refrigerated containers, are being developed to address the lack of adequate transportation facilities. These solutions can provide access to international markets and provide opportunities for farmers and small businesses in your area.

MARKET RESTRAINTS

High Energy Costs Associated With Refrigeration Solutions

In cold storage facilities, traditional fluorescent lamps are used throughout the year because goods must be kept in refrigerated facilities. This leads to energy loss and high costs. In addition, the lack of the necessary infrastructure to maintain cold storage poses great challenges to expanding the company in emerging markets. Additionally, the absence of sufficient electrical backup for refrigerated trailers in transportation hubs and ports hinders market growth in this area. Another factor that is delaying the progress of the cold storage market is the requirement for a large initial investment. The expenditure in acquiring or leasing land, building infrastructure, granting legal permission, refrigeration technologies and installing fire and other security systems all need a significant amount of money to start and maintain this business.

MARKET OPPORTUNITIES

Technological Developments

The cold storage market is expected to thrive further during the forecast period. This is because of the necessity to upgrade the existing refrigerated warehouse technology and expansion of space by the companies. Those who will invest in increasing their current capacities will position themselves separately in the market. According to a study, approximately 225 million square feet was the size of entire US cold storage real estate in 2022. And, this included a gross capacity of around 3.7 billion cubic feet. Additionally, advanced monitoring technologies, blockchain and transparency, AI and ML for predictive analytics, Automation and robotics, energy-efficient technologies, cold plasma and sanitization, cloud-based solutions, and innovative delivery methods are projected to provide exponential growth opportunities for the cold storage industry. As per a study, the expected cost of constructing a fully incorporated cold storage infrastructure with 5000 pallets is about 3.4 million dollars.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.11% |

|

Segments Covered |

By Construction type, Temperature, Application, Warehouse Type, And Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Agro Merchants Group, Burris Logistics, Americold Logistics LLC, Wabash National Corporation, Preferred Freezer Services, Lineage Logistics Holding LLC, Nichirei Logistics Co., Ltd. Barloworld Limited, VersaCold Logistics Services, Henningsen Cold Storage, Nordic Logistics and United States Cold Storage. |

SEGMENTAL ANALYSIS

By Construction Type Insights

The bulk storage segment is the biggest subcategory of the cold storage market. The increased demand for perishable goods due to the rising number of free trade agreements between developed and developing countries is propelling the segment growth. Besides this, the swift advancement of the pharma and biotech industry in the North American region is another factor pushing forward the demand for bulk storage facilities.

By Temperature Insights

The frozen segment accounted for the maximum three-fourth share under this category of the cold storage market. The extensive consumption of convenience and frozen foods in developed countries, especially in emerging nations, is driving the segment market growth. Moreover, the changing and hectic lifestyles of customers in countries like India and developed economies have caused a growth in the need for ready-to-cook and eat meals. Therefore, it elevated the market share of the frozen segment.

By Application Insights

The fruits and vegetables segment is expected to dominate the cold storage market. It is a major element for the storage and preservation of edible and liquid items. The extensive consumption of canned food and the rising interest in cuisines from other countries are some of the factors boosting the demand for cold storage facilities. As per research, the food and drink sector made revenue of 1200 billion dollars and 248 billion dollars on a value basis in 2023. This positions it as one of the biggest production industries in the European Union.

REGIONAL ANALYSIS

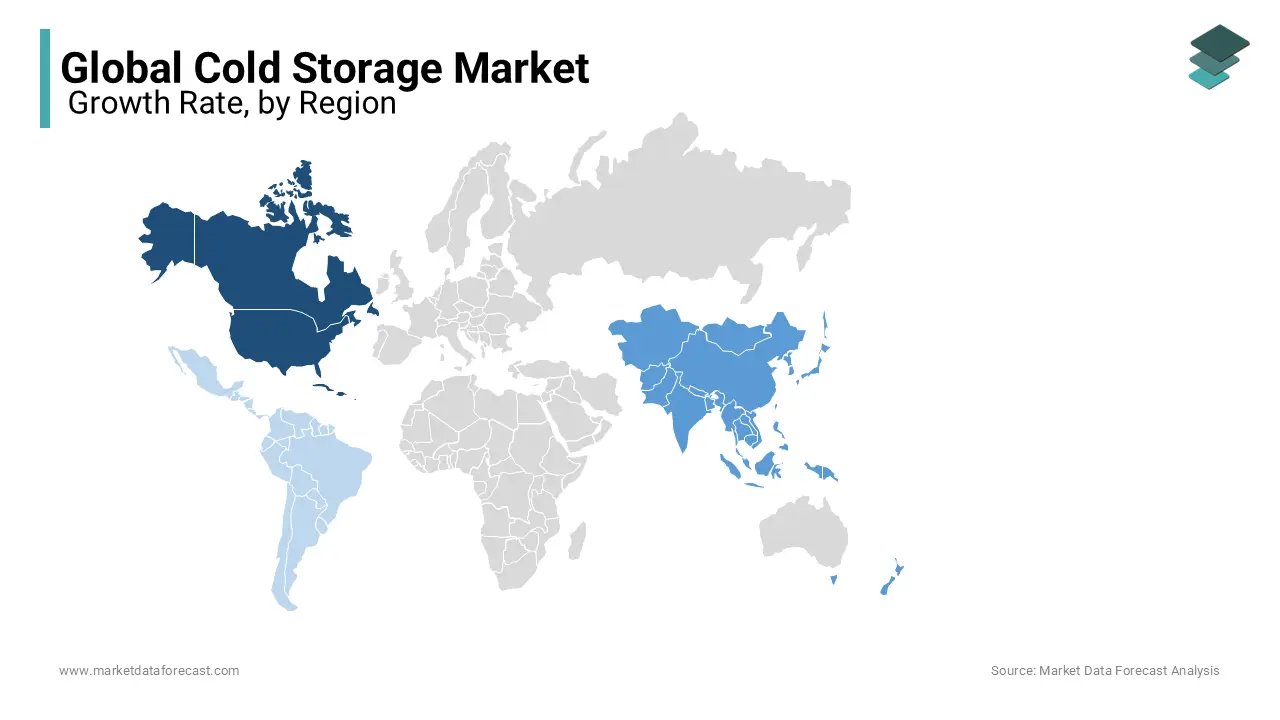

The North American region in the largest regional segment in the global cold storage market in terms of share in 2023. It is expected to expand further during the forecast period. The growth of connected devices for monitoring and regulating required temperature and worker management is driving the market expansion in the region along with the presence of a large consumer base. In addition, Mexico is projected to propel significantly in North America due to the strengthening of warehouse networks and increased investment in the development of logistics infrastructure. In addition, Mexico’s economic growth and changes in government regulations are likely to accelerate the demand in the coming years to streamline customs programs. Moreover, the cold spec is further expanding over the United States in several areas like Dallas and Chicago, and secondary markets are also rising, such as Columbus and Nashville. The development of such facilities is growing around ports. For instance, construction of a new cold storage facility is underway in Washington.

Asia Pacific is witnessing significant growth in the cold storage market. There has been a tremendous influx of capital investments in the wider industrial and logistics industry in the last few years. The cold storage industry turned out to be the biggest asset category, and it secured 4.9 billion dollars in investment in 2022. The increase in perishable goods consumption is due to the rising disposable income, increased urbanization, and middle-class population. Also, countries like China are turning to a consumer-centric economy. Therefore, they are believed to experience major growth in the coming years. Advances in warehouse management and refrigerated transportation in India and emerging Asian economies combined with government subsidies to develop this industry have enabled service providers to take advantage of these developing markets by integrating innovative solutions to overcome transportation-related complexities.

Europe is anticipated to experience an upward growth trajectory. The rising health awareness and shifting customer preferences have led to a consistent surge in consumption and demand for fresh vegetables and fruits needing additional storage facilities in the region. Apart from this, the strict EU laws and regulations about food hygiene, security, and quality parameters have compelled the application of cold chain transportation. Moreover, the European Union has several laws and bills requiring the reduction in carbon emissions from cold chain logistics and the development and adoption of environment-friendly and cost-wise feasible solutions for conserving foods and vegetables.

Latin America is not as big as other regional markets but is showing signs of development in the coming years. Since it is a major cultivator and manufacturer of agricultural and food products, it is driving the demand for cold storage with bigger capacity. However, electricity in Brazil is one of the major factors deciding the course of market growth. It is an organized but unstable market that relies upon investments, schemes, and climatic change, which have a substantial effect on supply and price.

KEY MARKET PLAYERS

Companies playing a major role in the global cold storage market include Agro Merchants Group, Burris Logistics, Americold Logistics LLC, Wabash National Corporation, Preferred Freezer Services, Lineage Logistics Holding LLC, Nichirei Logistics Co., Ltd. Barloworld Limited, VersaCold Logistics Services, Henningsen Cold Storage, Nordic Logistics and United States Cold Storage.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, InspiraFarms obtained a 1.09 million investment for off-grid energy cold storage ventures in Africa. Moreover, in 2023, they also secured 5.4 million dollars in financing from InfraCo with the goal of driving its groundbreaking Cooling-as-a-Service business model.

- In December 2023, IBM launched a new cold storage technology called Hyper Protect offline Signing Orchestrator. It provides an extra security level to safeguard high-value transactions. This comprises time-based security, disconnected network activities, and electronic transaction approval by different stakeholders.

MARKET SEGMENTATION

This research report on the global cold storage market has been segmented and sub-segmented based on construction type, temperature, application, warehouse type, & region.

By Construction Type

- Bulk Storage

- Production Stores

- Ports

By Temperature

- Chilled

- Frozen

By Application

- Processed Foods

- Dairy Products

- Fruits and Vegetables

- Meat and Seafood

- Pharmaceuticals

By Warehouse Type

- Public

- Private

- Semi-Private

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What are the key factors driving the growth of the cold storage market?

Factors driving growth in the cold storage market include increasing demand for perishable goods, advancements in refrigeration technology, globalization of food supply chains, and stricter food safety and quality regulations.

2. What are some challenges faced by the cold storage industry?

Challenges include high energy costs for maintaining low temperatures, continuous monitoring and maintenance of equipment, ensuring regulatory compliance, and managing inventory efficiently to minimize wastage.

3. What are some emerging trends in the cold storage market?

Emerging trends include the adoption of environmentally friendly refrigerants, the integration of blockchain technology for supply chain transparency, using robotics for warehouse automation, and the development of cold storage facilities near urban centers to reduce transportation costs.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]