Global Cobot Market Size, Share, Trends, & Growth Forecast Report – Segmented By Payload Capacity (Up to 5 Kg, Up To 10 Kg, And More Than 10 Kg), Application (Assembly, Handling, Packaging, Quality Testing), Vertical (Automotive, Food And Beverage, Furniture And Equipment, Plastics And Polymers, Metal And Machinery, Electronics, Pharmaceuticals, and Others), & Region - Industry Forecast From 2024 to 2032

Global Cobot (Collaborative Robots) Market Size (2024 to 2032)

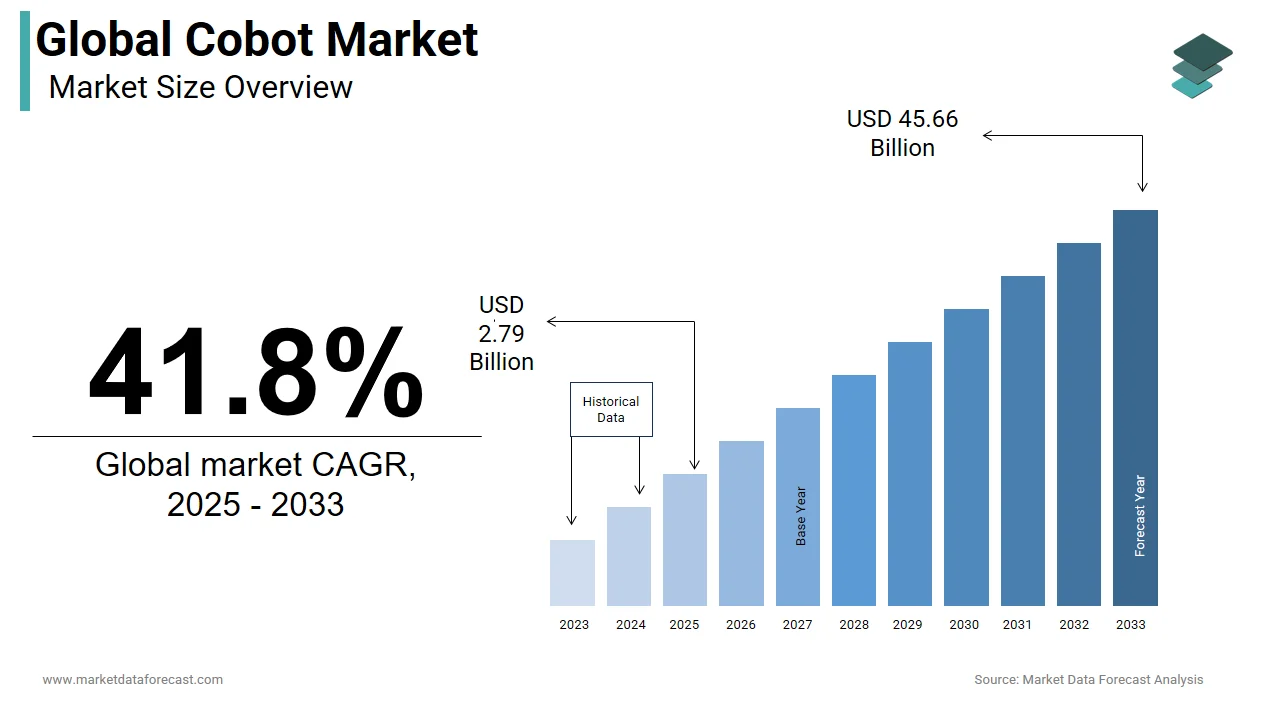

The global Cobot (collaborative robot) market was worth USD 1.39 billion in 2023. The global market is predicted to reach USD 1.97 billion in 2024 and USD 32.20 billion by 2032, growing at a CAGR of 41.8% during the forecast period.

Current Scenario of the Global Cobot Market

Cobots are new-generation robots used for different applications capable of performing complex tasks. In 2013, more than 65,000 units of industrial robots were delivered to the automotive industry. Countries like China, Japan, and Germany have the largest market share of industrial robots. As the expansion of collaborative robots in various sectors rises, many companies are investing in robotic solutions for high productivity and efficiency.

The collaborative robot or cobot is designed to interact physically with humans in a shared workspace. Growing adoption in small and medium-sized enterprises (SMEs) and investments in manufacturing process automation are the main growth drivers. The emergence of robots working alongside humans in fields such as the intelligent assembly of parts and the manufacture of electronic products is still fueling demand.

MARKET DRIVERS

High-performance accuracy and flexibility in programming for any task increase the rate of adoption of collaborative robots by different industries.

Increased investments in industrial automation and enhanced performance are driving demand for collaborative robots worldwide. The lack of skilled jobs and rising labor costs are the main factors that increase the inclination of manufacturing industries toward collaborative robots. Technological developments have led to remarkable advances in the robotics industry. Initially, these devices were overpriced and came with limited or restricted functionality, such as a fixed axis or fixed angles of rotation. However, with technological advancements, modern robots can perform incredible tasks efficiently and at a lower price. In addition, they offer a rapid return on investment (ROI) thanks to the optimization of overheads and the improvement in production rate.

MARKET RESTRAINTS

However, currency devaluation and the economic crisis in several countries are hampering the growth of the global cobot market.

As collaborative robots operate at a certain speed, changes in the work environment are depleting their productivity. Low-cost robots still face the challenge of meeting industrial demand at high speed. This is the main factor hindering small businesses' adoption of collaborative robots. To meet the requirement for productivity, maintaining their rate is a hurdle for collaborative robot manufacturers.

MARKET OPPORTUNITIES

In the coming years, the Cobot market is expected to experience robust growth due to the current trend of escalating sales and the development of new use cases. The industry's rapid expansion is believed to be driven forward by North America, China, South Korea, Europe and Japan. In addition, certain economies that can witness a sharp rise in market share are Germany, the United States, France, Italy, Canada, the United Kingdom, Russia, Japan, China, South Korea, etc. All the regional markets are aiming to build a collaborative ecosystem. Similarly, In May 2024, Doosan Robotics at Automate 2024 in Chicago reported its latest collaborative robot and will show its award-winning Dart-Suit robot ecosystem. It also uses AI to further optimize its offerings. Hence, it can be said that the cobot market value will elevate in future.

MARKET CHALLENGES

Interoperability and integration issues are decreasing the expansion of the cobot market. This is a major problem impeding the growth of the robotics industry. Its compatibility with existing processes, machinery and systems can be challenging. These problems originate from various factors including the complications in incorporating collaborative robots with labour-centric tasks, the requirement for standardized interfaces and varied communication protocols. A study conducted on Vietnamese garment manufacturing, it was discovered a sudden shift in clothing fashion and several unskilled workforces may restrict these robot’s adaptability, accuracy, and uniqueness. Additionally, the cobot integration is impacted by the high costs, facility improvements and danger of possible failure in implementation. Furthermore, speed and payload constraints and persistent workstation maintenance are the operational obstacles hindering the rise of the cobot market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

41.8% |

|

Segments Covered |

By Payload Capacity, Application, Vertical and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

ABB Group, Denso Robotics, EPSON Robots, Energy Technologies Corporation, F&P Robotics AG, Fanuc Corporation, KUKA AG, MRK-Systeme GmbH, Precise Automation, Inc., Rethinking Robotics, Inc., Robert Bosch GmbH, Universal A/S robots, Yaskawa Electric Corporation, MABI AG, Robot Techman from Quanta Storage, Inc., Franka Emika GmbH, AUBO Robotics Inc., Comau S.p.A. and other market players. |

SEGMENTAL ANALYSIS

Global Cobot Market Analysis By Payload Capacity

In 2018, cobots with a load capacity segment of up to 5 kilograms accounted for the largest market share, which is attributed to the machine's flexibility, lightness, and ability to optimize low-weight collaborative processes such as placement, sampling, and testing.

Cobots with a load capacity greater than 10 kg are expected to experience significant growth due to their ability to handle larger tasks that require precision, reliability, and collaboration with more cumbersome processes. Robots are supposed to experience an exponential CAGR of 46.2% during the forecast period.

Global Cobot Market Analysis By Application

In 2018, the assembly applications segment accounted for the largest market share due to the ability to combine repetitive and easy work with more complex assembly processes.

The adoption and growth of collaborative pick-and-place robot applications should spur segment growth during the outlook period. Co-robots are used in vertical positioning and selection applications to reduce shrinkage and increase accuracy when managing inventory. Pickup and drop robots are lightweight and small and can be deployed in a limited space.

Global Cobot Market Analysis By Vertical

The automotive industry accounted for a 24% market share in 2018 and is expected to lead the way in the forecast period. Key factors such as lower downtime cost and reduced floor space are presumed to drive growth during the forecast period.

REGIONAL ANALYSIS

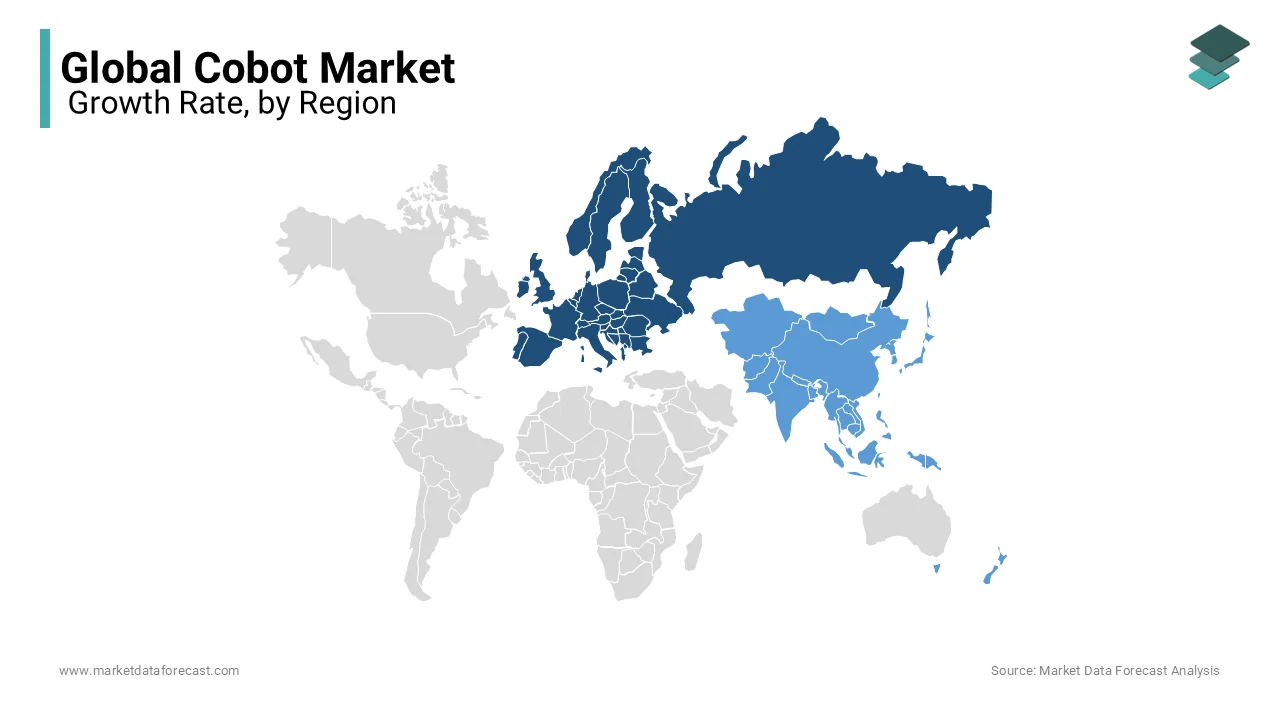

Europe is an income-generating region and accounted for a significant market share of around 37% in 2018. Regional growth is attributed to the extensive application of cobots in different vertical sectors such as electronics, logistics, and inspection. Additionally, the regional growth of cobot technology can be attributed to several benefits, such as increased collaboration and efficient manufacturing optimization solutions offered by workplace automation.

The increasing focus on the quality and precision of cobots in the Asia-Pacific required the implementation of maximum standards, increasing the deployment of cobots in the region. Technology's ability to produce better quality, higher efficiency, less waste, and standardized products is anticipated to significantly increase the adoption of collaborative robots during the projected period. Additionally, with a sharper focus on automation, the adoption of artificial intelligence, and all other necessary technological developments, the market has significant potential for rapid growth during the prediction period.

KEY PLAYERS IN THE MARKET

The major companies operating in the global cobot market include ABB Group, Denso Robotics, EPSON Robots, Energy Technologies Corporation, F&P Robotics AG, Fanuc Corporation, KUKA AG, MRK-Systeme GmbH, Precise Automation, Inc., Rethinking Robotics, Inc., Robert Bosch GmbH, Universal A/S robots, Yaskawa Electric Corporation, MABI AG, Robot Techman from Quanta Storage, Inc., Franka Emika GmbH, AUBO Robotics Inc., Comau S.p.A., and others.

RECENT HAPPENINGS IN THE MARKET

- In May 2024, United Robotics Group (URG) reported introducing its service robot series of uLink for manufacturing, warehouse logistics and retail sites at the Viva Tech Trade Show in Paris.

- In May 2024, Agility Robotics partnered with Zion Solutions Group, a systems integrator. This collaboration will provide its supply chain industry with Agility’s Digit bipedal humanoid mobile manipulation robot (MMR).

- In February 2024, Volvo Cars and FANUC inked a global contract to supply robots for automotive production factories worldwide. The deal will let FANUC deliver industrial robots across several manufacturing shops included in a modern car production facility. This involves battery-making plants in America, Europe and Asia.

- In September 2023, at EMO Hannover, FANUC launched its latest “Field system” version to assure compatibility with different products. Moreover, it also showcased an automated production cell for the automotive industry, other demonstrations, displays, and machine tools.

DETAILED SEGMENTATION OF THE GLOBAL COBOT MARKET INCLUDED IN THIS REPORT

This research report on the global cobot market has been segmented and sub-segmented based on the payload capacity, application, vertical, and region.

By Payload Capacity

- Up to 5 kg

- Up to 10 kg

- More than 10 kg

By Application

- Assembly

- Sampling and Placement

- Handling

- Packaging

- Quality Testing

- Machine Maintenance

- Bonding and Welding, etc

By Vertical

- Automotive

- Food and Beverage

- Furniture and Equipment

- Plastics and Polymers

- Metal and Machinery

- Electronics

- Pharmaceuticals

- Others

By Region

-

North America

-

The United States

-

Canada

-

Rest of North America

-

-

Europe

-

The United Kingdom

-

Spain

-

Germany

-

Italy

-

France

-

Rest of Europe

-

-

The Asia Pacific

-

India

-

Japan

-

China

-

Australia

-

Singapore

-

Malaysia

-

South Korea

-

New Zealand

-

Southeast Asia

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

Rest of LATAM

-

-

The Middle East and Africa

-

Saudi Arabia

-

UAE

-

Lebanon

-

Jordan

-

Cyprus

-

Frequently Asked Questions

How are collaborative robots being utilized across different industries?

Collaborative robots find applications in various industries such as automotive, electronics, healthcare, food and beverage, and logistics for tasks including assembly, pick-and-place, quality inspection, packaging, and material handling.

What are some challenges hindering the widespread adoption of collaborative robots?

Challenges include concerns about job displacement, the complexity of integrating collaborative robots into existing workflows, high initial investment costs, and the need for skilled technicians to operate and maintain these systems.

What role does artificial intelligence play in enhancing the capabilities of collaborative robots?

Artificial intelligence enables collaborative robots to adapt to changing environments, learn from human demonstrations, optimize task performance, and collaborate more effectively with human workers, thereby improving productivity and efficiency.

What are the future trends expected to shape the collaborative robots market?

Future trends include the integration of collaborative robots with Internet of Things (IoT) technologies for enhanced connectivity and data exchange, advancements in human-robot collaboration through natural language processing and gesture recognition, and the emergence of cloud-based robotics platforms for remote monitoring and control.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]