Cloud Storage Market Size, Share, Trends & Growth Forecast Report By Type (Solutions and Services), Deployment Model (Public Cloud, Private Cloud and Hybrid Cloud), Organization Size (Large Enterprises, Small and Medium-Sized Enterprises), Vertical & Region, Industry Forecast From 2024 to 2033

Global Cloud Storage Market Size

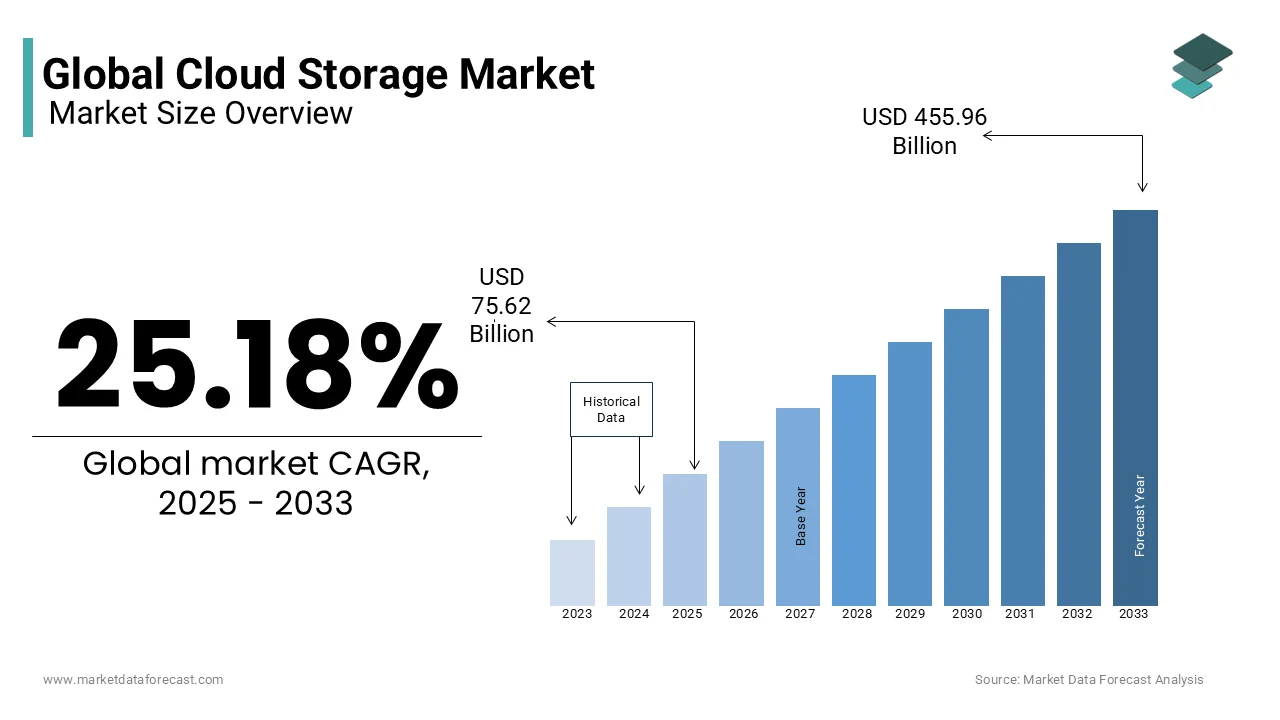

The global cloud storage market was worth USD 60.41 billion in 2024. The global market size is anticipated to grow from USD 75.62 billion in 2025 to USD 455.96 billion by 2033. The market is expected to move forward at a CAGR of 25.18% during the forecast period 2025 to 2033.

Cloud storage is an electronic data warehouse wherein digital information is stored on remote site servers. These offsite location servers are operated and managed by cloud storage services or computing providers. It is their responsibility to make sure that it is always accessible by using private or public internet connections. So, we can say that cloud storage is a virtual data storage mode. This eliminates the requirement for a personal information storage system or facility. It provides the company with benefits, including swiftness, cost-effectiveness, faster deployment, scalability, and durability at any given point in time and location.

Cloud storage is used in cases involving analytics and data lakes, backup and disaster recovery, software development and testing, cloud data migration, compliance, cloud-native application storage, archive, hybrid cloud storage, data storage, ML, and IoT. To make things clearer, according to a study, approximately 100 zettabytes of data will be kept in the cloud, and total global data storage is expected to be 200 ZB by 2025. Currently, around 60 percent of the world's business data is collected and kept in the cloud.

MARKET DRIVERS

The growing demand for cost-effective data storage and data protection across different organization types is driving the growth of the cloud storage market.

The growing amount of dynamic and unstructured data, the integration of modern technologies such as artificial intelligence and the Internet of Things, and the requirement for improved data availability and networking applications are fuelling these demands. So, the use of cloud storage has increased due to faster deployment, expandability, and flexibility. As per estimations, 72% of global organizations migrated from local data centers to the cloud, which considerably increased the demand for cloud storage services in the last few years. Apart from this, 76 percent of companies around the world work in multi-cloud environments, which comprise one shared and one private cloud. Interestingly, the majority of large organizations utilize multiple clouds, against which about 60 percent of small and 76 percent of mid-sized companies work on this type of cloud structure. This trend is likely to further accelerate and propel the market growth during the forecast period.

Moreover, the rising demand for cost-effective data protection, storage and security and the mounting data generated by mobile technologies are boosting the growth rate of the cloud storage market. Besides this, hybrid cloud storage and architecture are expected to contribute significantly to industry development over the next five years. This is due to their flexibility in public and private cloud storage.

The high application for hybrid cloud storage and the growing need for business mobility are further propelling the cloud storage market growth. The rapid pace of digitalization and the need for easy and cost-effective implementation are other factors that influence the expansion of the cloud storage market. One of the benefits of this is the low total cost of ownership. It allows companies to execute the development and testing of new applications on the public cloud and on-premises systems and equipment to carry out complex operations. This brings down the testing and development expenditure of new application services or products. In addition, the expanding need for colocation service providers is providing potential prospects for the industry players. Several companies are progressively shifting to cloud hosting or hosting facilities to attain the desired combination of security, control, flexibility, and scalability. Hence, it is globally the most extensively accepted cloud strategy.

MARKET RESTRAINTS

Data security is a major limitation for the growth of the cloud storage market.

Despite advances in protection technologies for countering malicious attacks, data security measures can easily or with little effort be compromised. This continues to cause major losses for the company when critical data is pirated or stolen. As a result, data loss, breaches, and unauthorized access have been compounded, stressing the significance of implementing strong security actions or steps throughout the cloud environment. According to a 2024 study, there will be a 71 percent growth in cyberattacks in 2023. The attacks were carried out with the help of stolen credentials to access valid accounts. Online criminals were more focused on "logging in" than on hacking the corporate network by utilizing these valid account details. Thus, this weakness is hindering the cloud storage market.

Other limiting factors in the cloud storage market would be regulatory compliance and the lack of a large bandwidth for data transmission. Moreover, higher salaries and more qualified staff are needed to build advanced SaaS applications, so companies will find it difficult as the recruitment process is slowed down to reduce expenditure. These problems hamper the growth of the cloud storage market.

MARKET OPPORTUNITIES

The integration of quantum computing is expected to benefit the cloud storage market in the coming years. Quantum storage technologies can provide exceptional data processing speeds and security. Moreover, because of its deep communication features, the cloud is viewed as perfect for quantum computing (QC). The amalgamation of these two technologies can assist address complex problems in domains like optimization, cryptography and materials science simulations. QC extends a broad variety of applications, from enhancing climate modelling or forecasting to improving drug discovery and maximizing supply networks. Moreover, quantum computing as a service is taking off, especially with cloud services alleviating the ability to approach its simulators and hardware.

MARKET CHALLENGES

Quantum computing integration is viewed as the next big thing for the cloud storage market, however, the biggest challenge is accessibility. Establishing or acquiring a physical computer or just a scheduled slot on one to propel projects or experiments is highly tough as only a limited number are available. In addition, transformative applications is another challenge for the market growth. Several practical uses, such as quantum computers, quantum-safe cryptography, and robotics, all remain in the developmental phase. So, data security problems, confidentiality concerns, integrity issues, and, most importantly, data breaches are the main challenges that persist regarding these applications are hindering the expansion of the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

25.18% |

|

Segments Covered |

By Type, Organization Size, Deployment, Model, Vertical, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

AWS (USA), IBM (USA), Microsoft (USA), Google (USA), Oracle (USA), HPE (US), Dell EMC (US), VMware (US), Rackspace (USA), Dropbox (US), and others. |

SEGMENT ANALYSIS

By Type Insights

The solutions segment of the cloud storage market is growing significantly because of its cost-efficiency, expandability, and adaptability. This makes them a preferred choice for the industry players. So, due to these benefits, solutions like public cloud storage allow fast accessibility, affordability, and the capacity to increase or decrease based on requirements. Hence, these are essential features for market players wanting to maximize their data storage and administrative operations.

By Organization Size Insights

The large enterprise segment accounts for more than half of the market share of cloud storage. This growth is due to the increase in the need for cloud computing services arising from remote working and the demand to enhance business operations, especially in large enterprises. These big companies are quickly accepting cloud services because of their fast availability. It allows them to administer and reduce capital spending and functional costs, along with improving data creation through websites and mobile apps. Furthermore,

By Deployment Model Insights

The public cloud segment holds a major share of the cloud storage market. The reason behind this growth is the increased consumer spending on publically available cloud services. The rapid infusion of financing from the public sector is another factor fueling the segment's development. State administration and other establishments are again now experiencing heightened interest in cloud adoption to provide people services in the isolated and socially distanced age. This resulted in a higher adoption rate in the public sector, particularly for government-to-citizen (G2C) services. Moreover, to build trust among partners, clients, and governments, environmental sustainability has become an industry requirement in the last 12 months. Besides this, companies are employing the public cloud to capitalize on the advantage of lowering carbon emissions. So, as per the estimates, expenditure on this is projected to be over 45 percent of enterprise spending in 2026. However, the hybrid cloud segment has already reached a considerable level but is quickly penetrating further across several industries.

By Vertical Insights

The banking, financial services, and insurance (BFSI) segment is the major revenue generator for the cloud storage market. This segment is driving forward because of the consistently increasing demand for safe storage facilities or systems, swift digitalization, and the rising application of e-wallets, online payments, and net banking. In addition, there is a rising preference for enterprise platforms that have intelligence, flexibility, agility, and expandability due to the mounting pressure on banking institutions to make informed decisions to be one step ahead of the competition. Also, big companies are building data centers nearby to accelerate the acceptance of different cloud storage models, enhance client service quality, and administer running costs for higher profits in the BFSI industry. Therefore, the segment's growth is driven by cost-effectiveness, flexibility, and better security.

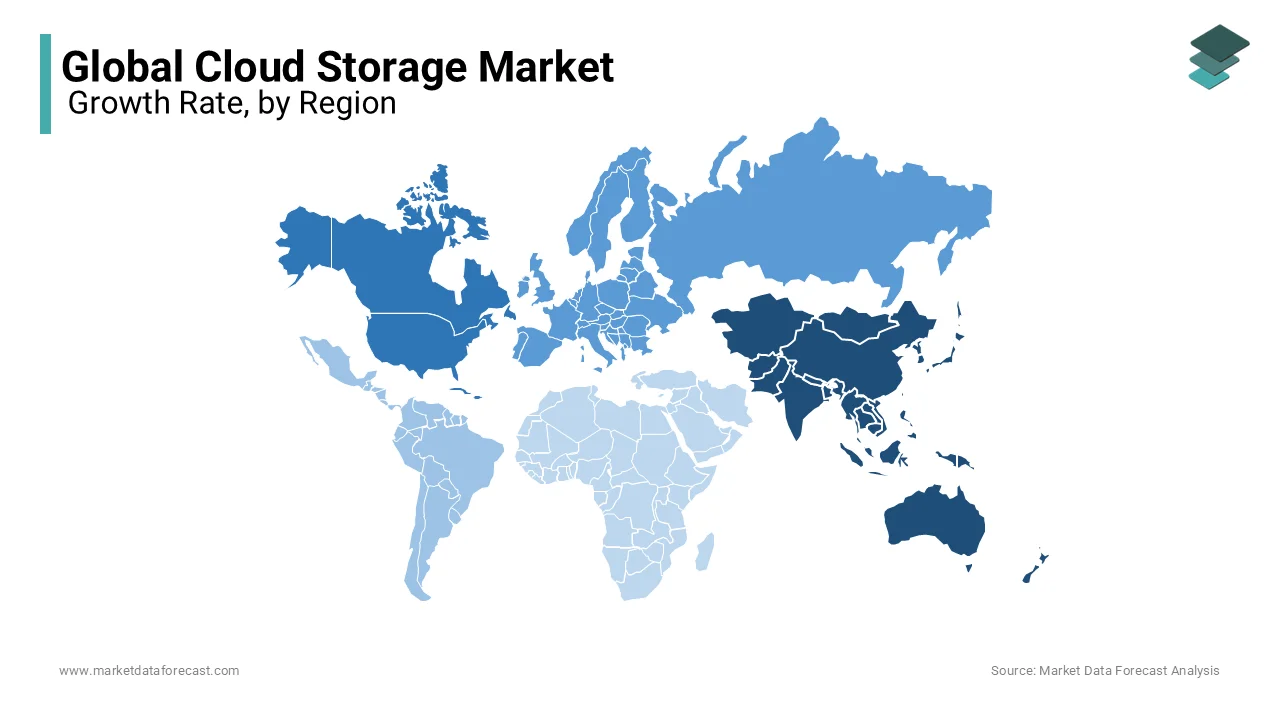

REGIONAL ANALYSIS

The Asia-Pacific region is expected to grow faster due to rapid developments in India and China's manufacturing and services sectors. In addition, India's public cloud services industry has experienced phenomenal growth in the last two years. As per a survey, around 93 percent of Asian companies 2024 are projected to increase the amount of data stored in the public cloud by 8 percent from the previous year. It also stated that about 47 percent of respondents spent the majority of cloud storage expenditure on data recovery and operation costs. But Australia and Japan had an even bigger percentage mix of more than 50 percent.

North America is the leading cloud storage market and is anticipated to drive forward in the coming years. This is due to the presence of a large pool of companies like AWS, Google, IBM, and Microsoft. Other factors growing the regional market are the intense rate of data creation and investment in data centers. Moreover, the extensive application ability and the emergence of next-generation technologies are believed to propel regional demand. Also, according to a study, the population in North America in 2021 was affected by a minimum of one account breach. One in two individuals in the region experienced an account breach.

Europe's cloud storage market is poised to grow significantly during the forest period. The regional industry's progress is due to Software as a Service (SaaS) and the demand for cheaper alternatives to traditional IT applications. In contrast, organizations in the area are seeking solutions that provide them with faster development as well as the launch of apps and products. Along with the US, the UK had a higher number of victims of online crime per million internet users around the world. Also, there was a 50 percent spile in cyberattacks in the Netherlands after 2020.

The Middle East and Africa cloud storage market is expected to drive at a steady pace in the projection period. This is attributable to the rising need for expandability and adaptability of IT infrastructure, considering the recent regional conflicts. Another major pattern in the MEA is the acceptance of multi-cloud strategies.

KEY PLAYERS IN THE MARKET

Companies playing a significant role in the global cloud storage market include AWS (USA), IBM (USA), Microsoft (USA), Google (USA), Oracle (USA), HPE (US), Dell EMC (US), VMware (US), Rackspace (USA) and Dropbox (US).

RECENT HAPPENINGS IN THE MARKET

-

In April 2024, NetApp broadened its collaboration with Google Cloud to provide a way for companies to use their data for generative AI and other hybrid cloud workloads. Moreover, earlier, they also launched the Flex service level. This is for the Google Cloud NetApp Volumes without any size limitations. Besides this, NetApp will further release a glimpse of its GenAI toolkit for source building for retrieval augmented generation utilizing the Google Cloud Vertex AI platform.

-

In October 2023, IBM launched its new Storage Scale System 6000, built to accommodate large data volumes and AI work requirements. It facilitates users with up to 7M IOPs and as fast as 256GB/s output for fixed storage workloads per system in a four-rack unit (4U) footprint. Also, it is conditioned for the storage of routinely generated unstructured and semi-structured data and speeds up the company's digital footprint in the hybrid environment.

MARKET SEGMENTATION

This research report on the global cloud storage market has been segmented and sub-segmented based on the type, organization size, deployment model, vertical, and region.

By Type

- Solutions

- Services

By Organization Size

- Large enterprises

- Small and Medium-sized Enterprises (SMEs)

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Vertical

- Banking, Financial Services and Insurance (BFSI)

- Healthcare and Life Sciences

- Telecommunications and Information Technology-Enabled Services (ITES)

- Government and Public Sector

- Manufacturing

- Consumer Goods and Retail

- Media And Entertainment

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What are the primary factors driving the growth of the cloud storage market?

Key factors include the increasing adoption of cloud services across businesses, the need for data backup and disaster recovery, the rise of big data and IoT, and the growing trend towards remote work, which has heightened the demand for accessible and scalable storage solutions.

What are the key trends shaping the future of the cloud storage market?

Emerging trends include the growing adoption of hybrid and multi-cloud strategies, increased focus on security and data privacy, the integration of AI and machine learning for data management, and the rise of edge computing, which necessitates more localized cloud storage solutions.

What impact is the rise of 5G technology expected to have on the cloud storage market?

The rollout of 5G is expected to significantly boost the cloud storage market by enabling faster data transfer speeds, lower latency, and the ability to support a higher density of connected devices. This will accelerate the adoption of cloud-based applications and services, leading to increased demand for storage solutions.

What role do startups and smaller players play in the cloud storage market?

Startups and smaller players play a crucial role by driving innovation, particularly in niche markets such as cloud security, data management, and specialized storage solutions. They often collaborate with larger cloud providers or offer complementary services that cater to specific industry needs, thus enhancing the overall ecosystem.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]