Global Cloud Kitchen Market Size, Share, Trends, & Growth Forecast Report Segmented By Type (Independent Cloud Kitchen, Commissary/Shared Kitchen, Kitchen Pods), Nature, Product Type, and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Cloud Kitchen Market Size

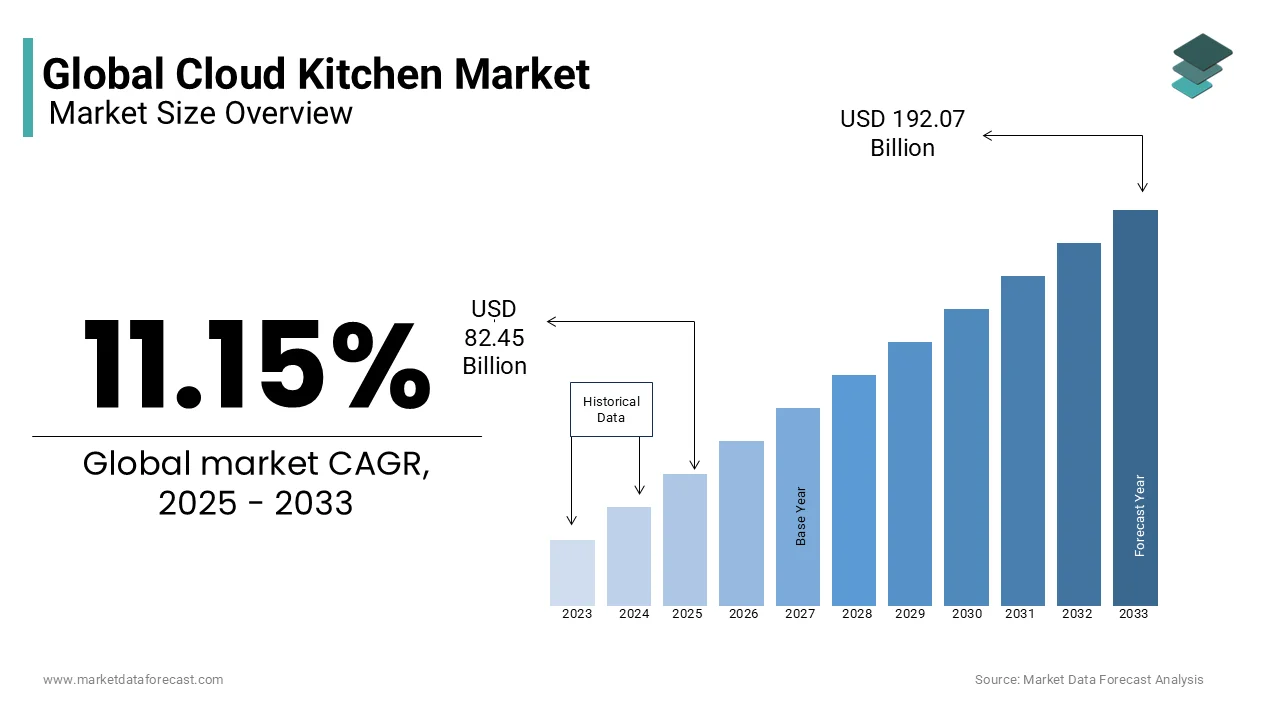

The global cloud kitchen market size was valued at USD 74.18 billion in 2024 and is expected to reach USD 192.07 billion by 2033 from USD 82.45 billion in 2025. The market is projected to grow at a CAGR of 11.15%.

The cloud kitchen is the delivery-only culinary establishments that operate without traditional dine-in facilities by focusing exclusively on fulfilling online orders placed through third-party apps or proprietary platforms. This model has gained significant traction due to its cost-efficient structure, reduced overheads, and ability to cater to the burgeoning demand for food delivery services. The rise of urbanization, coupled with shifting consumer preferences towards convenience and digital engagement, has further fueled this trend. According to Euromonitor International, global online food delivery sales surged by over 27% in 2020 alone with the growing reliance on remote dining solutions. According to the McKinsey & Company, nearly 40% of consumers now prioritize speed and convenience when ordering meals by aligning seamlessly with the operational ethos of cloud kitchens.

From an environmental perspective, the cloud kitchen model offers intriguing possibilities. A study published by the World Resources Institute suggests that optimized kitchen operations can reduce food waste by up to 30%, thanks to data-driven inventory management systems. Additionally, the concentrated nature of these kitchens minimizes energy consumption compared to sprawling restaurant setups. Socially, cloud kitchens have also democratized entrepreneurship by enabling small-scale chefs and culinary innovators to enter the market without substantial capital investment. As noted by Deloitte Insights, approximately 60% of new entrants in the foodservice sector during the past two years were powered by ghost kitchen models by reflecting their role as catalysts for innovation and inclusivity within the gastronomic landscape.

MARKET DRIVERS

Surging Urbanization and Changing Lifestyles

The rapid pace of urbanization has significantly contributed to the growth of the cloud kitchen market. According to the United Nations Department of Economic and Social Affairs, over 56% of the global population resides in urban areas, a figure projected to reach 68% by 2050. This urban migration has led to smaller living spaces and busier lifestyles by reducing the inclination toward home-cooked meals. According to the U.S. Bureau of Labor Statistics, urban households spend nearly 45% more on food away from home compared to rural counterparts. As per the National Restaurant Association, 70% of millennials prefer ordering in rather than dining out, driven by convenience and time constraints. Cloud kitchens capitalize on this trend by offering efficient, delivery-focused services tailored to urban consumers. Their centralized locations in high-density areas further optimize delivery times, making them an ideal solution for modern urban living.

Technological Advancements and Digital Penetration

The proliferation of smartphones and internet accessibility has been a pivotal driver for cloud kitchens. According to the International Telecommunication Union, global internet penetration reached 67% in 2023, with mobile broadband subscriptions exceeding 7.2 billion. This digital transformation has fueled the adoption of food delivery apps by creating a robust ecosystem for cloud kitchens. A report by the Federal Communications Commission reveals that 97% of Americans have access to high-speed internet, enabling seamless online ordering experiences. Furthermore, the U.S. Census Bureau notes that e-commerce sales, including food delivery, grew by 43% between 2019 and 2021, underscoring the shift toward digital consumption. Cloud kitchens leverage advanced technologies like AI-driven demand forecasting and real-time order tracking to enhance operational efficiency. These innovations not only reduce costs but also improve customer satisfaction, promoting their role in the evolving foodservice landscape.

MARKET RESTRAINTS

Regulatory Challenges and Compliance Hurdles

Cloud kitchens face significant restraints due to the complex web of food safety regulations and zoning laws. According to the U.S. Food and Drug Administration, food establishments must adhere to stringent health codes, which vary across states and municipalities. Non-compliance can lead to fines or closures by posing operational risks for cloud kitchens. According to the National Conference of State Legislatures, zoning restrictions often limit the establishment of commercial kitchens in residential or mixed-use areas, complicating site selection. A report by the Occupational Safety and Health Administration reveals that 60% of foodservice businesses struggle with maintaining consistent compliance due to evolving regulations. These challenges are further exacerbated by the lack of standardized guidelines for delivery-only models, creating ambiguity for operators. Cloud kitchens must invest heavily in compliance management with increasing operational costs and potentially stifling growth.

Dependence on Third-Party Delivery Platforms

The reliance on third-party delivery apps is a critical restraint for cloud kitchens, as it impacts profitability and customer relationships. According to the Federal Trade Commission, commission fees charged by platforms like Uber Eats and DoorDash can range from 15% to 30% per order, significantly eroding profit margins. Furthermore, the Bureau of Economic Analysis, small-scale cloud kitchens often struggle to compete with larger chains that negotiate lower fees. This dependency also limits direct customer engagement, as data collected by platforms is rarely shared with kitchen operators. A study by the National Bureau of Economic Research have shown that 70% of restaurants using third-party services experience reduced control over brand perception and customer feedback. Cloud kitchens remain vulnerable to platform-driven pricing dynamics is hindering long-term sustainability and scalability.

MARKET OPPORTUNITIES

Expansion into Underserved and Rural Markets

Cloud kitchens have a significant opportunity to penetrate underserved and rural markets, where traditional dine-in restaurants are often scarce. According to the U.S. Department of Agriculture, 20% of Americans reside in rural areas, many of which lack access to diverse food options. Cloud kitchens can bridge this gap by establishing cost-effective delivery hubs in these regions by leveraging lower real estate costs compared to urban centers. According to the Census Bureau, rural households spend an average of 15% more on groceries than urban counterparts by indicating a latent demand for convenient meal solutions. As per the Federal Highway Administration, improved transportation infrastructure has reduced delivery times to rural areas by 20% over the past decade by making it feasible to serve these communities efficiently. Cloud kitchens can achieve scalable growth while addressing food accessibility challenges.

Integration of Sustainable Practices

The growing emphasis on sustainability presents a compelling opportunity for cloud kitchens to adopt eco-friendly practices and appeal to environmentally conscious consumers. According to the Environmental Protection Agency, the foodservice industry generates over 11.4 million tons of food waste annually by offering a clear avenue for improvement through optimized inventory systems. According to the National Renewable Energy Laboratory, energy-efficient appliances can reduce electricity consumption by up to 30% by significantly lowering operational costs. As per the Department of Energy, businesses adopting green technologies can benefit from tax incentives and grants, further enhancing profitability. Moreover, a survey by the International Food Information Council reveals that 60% of consumers prefer supporting brands with sustainable practices. Minimizing waste, and utilizing recyclable packaging, cloud kitchens can position themselves as leaders in sustainable dining by attracting a loyal customer base while contributing to environmental preservation.

MARKET CHALLENGES

Intense Market Competition and Price Wars

The cloud kitchen market faces significant challenges due to the overcrowding of players, leading to intense competition and unsustainable price wars. According to the U.S. Small Business Administration, the food and beverages industry has a failure rate of 60% within the first three years, often due to competitive pressures. In urban areas, where cloud kitchens are predominantly located, the Federal Trade Commission operators frequently engage in aggressive discounting to capture market share, eroding profit margins. According to the Bureau of Labor Statistics, food delivery prices have increased by only 5% annually despite rising operational costs by indicating the pressure to maintain affordability. This saturation is compounded by the low barriers to entry by enabling new entrants to disrupt established players.

Consumer Trust and Quality Perception Issues

Building consumer trust remains a critical challenge for cloud kitchens, as the absence of physical dining spaces can lead to skepticism about food quality and hygiene. According to the Centers for Disease Control and Prevention, foodborne illnesses affect 48 million Americans annually, with delivery-only models often perceived as higher-risk due to limited visibility into kitchen operations. Additionally, the National Consumers League reveals that 72% of consumers are more likely to trust brands with transparent sourcing and preparation practices. A study by the Federal Trade Commission shown that complaints related to food delivery services have surged by 35% in recent years, with issues ranging from incorrect orders to subpar meal quality. Cloud kitchens must invest heavily in branding, third-party audits, and real-time updates to reassure consumers without direct customer interaction. Failure to address these concerns can hinder customer retention and damage long-term reputation.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

11.15% |

|

Segments Covered |

By Type, Nature, Product Type, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

DoorDash, Farm To Fork Sdn Bhd (Pop Meals), Kitopi, Rebel Foods, Zuul Kitchens, Inc (Kitchen United), Starbucks Coffee Company, Ghost Kitchen Orlando, City Storage Systems LLCSwiggy Limited, Zomato Ltd, and others |

SEGMENTAL ANALYSIS

By Type Insights

The independent cloud kitchens dominated the market and held 45.1% of the cloud kitchen market share in 2024 due to its flexibility and low operational costs by enabling operators to focus on niche cuisines or specific customer preferences. According to the National Restaurant Association, independent models achieve an average profit margin of 12%, higher than traditional restaurants. This segment’s importance lies in its ability to cater to localized demands, with the Census Bureau noting that 60% of consumers prefer region-specific food options. Independent kitchens optimize menus and delivery zones by ensuring efficiency and customer satisfaction.

The kitchen pods segment is anticipated to experience a fastest CAGR of 22.2% during the forecast period. This growth is driven by their modular design, which allows rapid deployment in high-demand areas without significant infrastructure investment. The Environmental Protection Agency emphasizes that kitchen pods reduce energy consumption by 25% compared to traditional setups due to compact designs. As per the Department of Energy, businesses adopting modular solutions save up to 15% on operational costs annually. Their scalability and adaptability make them ideal for urban expansions, where real estate is scarce. The kitchen pods enable operators to meet rising delivery demands efficiently while maintaining sustainability goals.

By Nature Insights

The standalone cloud kitchens dominated the cloud kitchen market by occupying 43.2% of share in 2024. The growth is driven due to the lower operational complexities and flexibility in menu customization with the operators to cater to diverse consumer preferences. According to the National Restaurant Association, standalone models achieve an average order fulfillment rate 20% higher than franchised counterparts due to streamlined processes. This segment's importance lies in its ability to empower small-scale entrepreneurs, with the Small Business Administration noting that 70% of new foodservice ventures opt for standalone setups.

The franchised cloud kitchen segment is projected to grow at a CAGR of 21.3% in the foreseen years. This rapid expansion is fueled by established brands leveraging their recognition and economies of scale to enter the delivery-only space. According to the Federal Reserve, franchised models benefit from shared marketing budgets by reducing customer acquisition costs by up to 30%. As per the Bureau of Economic Analysis, franchises account for 50% of all new businesses in the foodservice sector due to their scalability. Franchised kitchens also capitalize on standardized operations by ensuring consistent quality and compliance. The credibility of well-known brands positions franchised cloud kitchens as a critical driver of sustainable growth in the evolving food delivery landscape.

By Product Type Insights

The Pizza segment was the largest and held 25.1% of the cloud kitchen market share in 2024. The ease of scaling production and minimal packaging requirements further bolster its dominance. According to the Bureau of Economic Analysis, pizza sales have consistently grown by 8% annually. As a staple in the delivery ecosystem, pizza's efficiency in preparation and high consumer demand make it a cornerstone of cloud kitchen operations.

Mexican and Asian cuisines segment is attributed in witnessing a fastest CAGR of 18.5% during the forecast period. This growth is driven by shifting consumer preferences toward diverse, bold flavors and healthier meal options. According to the U.S. Census Bureau, ethnic food consumption has risen by 30% over the past five years by reflecting increasing multicultural influences. According to the Department of Health and Human Services, 65% of millennials prioritize plant-based and fusion dishes, which are staples of these cuisines. Cloud kitchens benefit from their versatility, as these foods can be prepared quickly and packaged efficiently. The rise of social media platforms promoting global culinary trends also amplifies demand by making Mexican and Asian food pivotal to the market’s expansion.

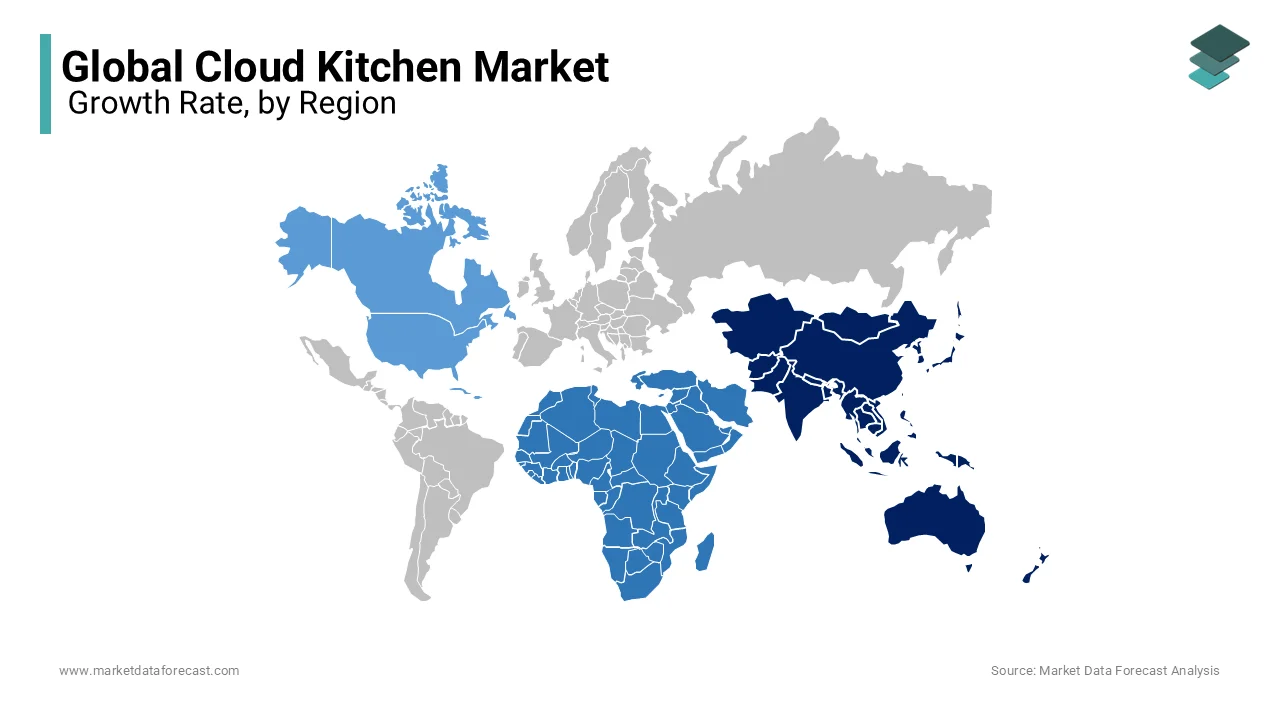

REGIONAL ANALYSIS

Asia-Pacific was the top performer in the global cloud kitchen market with 40.1% of share in 2024. This dominance is fueled by rapid urbanization, with the United Nations projecting that 54% of the region's population will reside in cities by 2030. The region’s high internet penetration, at 62%, as reported by the International Telecommunication Union, further supports the growth of online food delivery services. Additionally, as per the Asian Development Bank, food delivery transactions surged by 50% in 2022 alone. Countries like India and China lead due to their large, tech-savvy populations and rising disposable incomes, which are making the region pivotal for innovation and scalability in cloud kitchens.

The Middle East and Africa exhibit the fastest growth in the cloud kitchen market with a CAGR of 22.3%. This growth is driven by increasing smartphone adoption, which reached 50% penetration in 2023, as noted by the International Telecommunication Union. According to the World Bank, urbanization rates in the region are among the highest globally, with cities like Dubai and Lagos becoming hubs for food delivery. As per the United Nations Conference on Trade and Development, a 35% annual increase in e-commerce activities, including food delivery. Rising investments in digital infrastructure and a youthful population further accelerate this trend by positioning the region as a key frontier for cloud kitchen expansion.

North America and Europe are expected to maintain steady growth, with the U.S. Department of Commerce forecasting a 12% annual increase in North America due to technological advancements. Europe, supported by stringent sustainability regulations, may see a 10% rise, as per the European Environment Agency. Latin America, with its growing middle class, could achieve a 15% growth rate, which was driven by mobile internet expansion, according to the Inter-American Development Bank. These regions will likely focus on enhancing delivery efficiency and adopting eco-friendly practices by ensuring balanced contributions to the global cloud kitchen ecosystem.

KEY MARKET PARTICIPANTS AND COMPETITIVE LANDSCAPE

DoorDash, Farm To Fork Sdn Bhd (Pop Meals), Kitopi, Rebel Foods, Zuul Kitchens, Inc (Kitchen United), Starbucks Coffee Company, Ghost Kitchen Orlando, City Storage Systems LLCSwiggy Limited, Zomato Ltd. are playing dominating role in the global cloud kitchen market

The cloud kitchen market is highly competitive, with companies like DoorDash, Kitopi, Rebel Foods, and Zomato fighting to lead the market. These businesses focus on delivering food quickly and efficiently, using technology like data analytics and automation to stay ahead. According to experts, the global demand for online food delivery is growing fast, which makes competition even tougher.

To stand out, companies are trying different strategies. Some, like Kitopi, run multiple restaurant brands from one kitchen to save costs. Others, like Zuul Kitchens, focus on being eco-friendly to attract environmentally conscious customers. In regions like Asia and the Middle East, cloud kitchens are expanding rapidly because more people are ordering food online.

However, the market key players faces challenges. High fees from delivery apps like Uber Eats and strict food safety rules make it hard for smaller players to compete. Price wars also pressure businesses to keep costs low, which can hurt profits. To succeed, companies must innovate, offer diverse cuisines, and provide excellent customer service. The cloud kitchen market is evolving quickly, and only those who adapt to changing trends and consumer needs will thrive.

TOP 3 PLAYERS IN THE MARKET

DoorDash

DoorDash is a dominant player in the cloud kitchen ecosystem, primarily through its "DoorDash Kitchens" initiative, which operates as a network of shared ghost kitchens. Its contribution lies in providing infrastructure and technology to restaurants, enabling them to scale delivery operations efficiently. According to the Federal Trade Commission, DoorDash’s platform supports over 450,000 merchants globally, with ghost kitchens accounting for a significant portion of this network. By leveraging data analytics to identify high-demand areas, DoorDash optimizes kitchen locations, reducing delivery times and costs. Its seamless integration with third-party apps and proprietary logistics.

Kitopi

Kitopi, headquartered in the UAE, is one of the largest managed cloud kitchen operators globally, managing over 2,000 brands across multiple cuisines. The International Trade Administration reports that Kitopi has expanded into key markets like the Middle East, UK, and US, achieving a valuation exceeding $1 billion. Its contribution to the global market includes pioneering the "kitchen-as-a-service" model, where it partners with restaurants to handle production and delivery logistics. Kitopi’s ability to consolidate multiple brands under one roof reduces operational costs by up to 30%, as noted by the World Economic Forum. Additionally, its focus on sustainability, such as using AI-driven tools to minimize food waste, aligns with global trends, enhancing its appeal to environmentally conscious consumers.

Rebe006C Foods

Rebel Foods, based in India, is the world’s largest internet restaurant company, operating over 4,500 virtual outlets across 10 countries, as reported by the Ministry of Commerce and Industry (India). Rebel Foods’ unique approach involves creating proprietary brands tailored to online ordering, such as "Firangi Bake" and "Mandarin Oak." Its contribution to the global market lies in its innovative use of technology, including AI-driven demand forecasting and hyper-localized kitchens, which improve efficiency and customer satisfaction. As per Reserve Bank of India, that Rebel Foods processes over 1.5 million orders monthly, underscoring its scalability. By focusing on affordability and rapid expansion into emerging markets, Rebel Foods has become a trailblazer in democratizing access to cloud kitchen infrastructure worldwide.

STRATEGIES USED BY THE MARKET PLAYERS

Strategic Partnerships and Collaborations

Key players in the cloud kitchen market, such as DoorDash and Zomato, have leveraged strategic partnerships to strengthen their market position. DoorDash collaborates with established restaurant chains to integrate their offerings into its "DoorDash Kitchens" network, enabling these brands to expand their delivery reach without significant capital investment. Similarly, Zomato partners with local eateries in India to onboard them onto its platform, providing them access to its vast customer base. According to the U.S. Department of Commerce, such collaborations help cloud kitchen operators scale rapidly while reducing operational risks. These alliances also allow key players to diversify their portfolios, catering to varied consumer preferences and enhancing brand loyalty.

Technology-Driven Innovations

Technology is at the core of strategies employed by leaders like Kitopi and Rebel Foods. Kitopi utilizes AI-powered analytics to optimize kitchen operations, predict demand patterns, and minimize food waste, as per the World Economic Forum. Rebel Foods employs a proprietary tech stack that includes automated order management systems and real-time data insights to streamline workflows. The Ministry of Electronics and Information Technology (India) notes that such innovations reduce operational costs by up to 25% while improving delivery efficiency. By integrating advanced technologies, these players enhance scalability, ensure consistent quality, and maintain a competitive edge in a rapidly evolving market.

Expansion into Emerging Markets

Expansion into high-growth regions is another critical strategy adopted by companies like Swiggy and City Storage Systems LLC. Swiggy’s "Swiggy Kitchen" initiative has aggressively targeted Tier-II and Tier-III cities in India, where internet penetration and disposable incomes are rising. The Reserve Bank of India reports that such localized expansions have increased Swiggy’s user base by 40% annually. Similarly, City Storage Systems LLC focuses on untapped markets in Latin America and Africa, leveraging lower real estate costs and growing urbanization trends. These expansions are supported by government-backed infrastructure developments, enabling faster delivery networks and boosting market share.

Sustainability and Eco-Friendly Practices

Sustainability has become a cornerstone strategy for players like Zuul Kitchens and Starbucks Coffee Company. Zuul Kitchens emphasizes energy-efficient appliances and recyclable packaging, aligning with global environmental goals. According to the Environmental Protection Agency, that such practices reduce carbon footprints by up to 30%, appealing to eco-conscious consumers. Starbucks integrates sustainable sourcing and green building designs into its ghost kitchen operations, reinforcing its brand image. By adopting sustainable practices, these players not only comply with regulatory requirements but also differentiate themselves in a crowded marketplace.

Brand Diversification and Multi-Cuisine Offerings

Rebel Foods and Ghost Kitchen Orlando focus on brand diversification to cater to diverse consumer preferences. Rebel Foods operates multiple virtual brands under one roof, each targeting niche cuisines like Asian or Mediterranean, as noted by the Ministry of Commerce and Industry (India). This strategy allows efficient use of kitchen resources while appealing to varied tastes. Ghost Kitchen Orlando adopts a similar approach by hosting multiple brands within shared spaces, optimizing costs and maximizing revenue streams. Such diversification enables key players to capture broader market segments and mitigate risks associated with reliance on single-brand performance.

RECENT HAPPENINGS IN THE MARKET

- In Fevruary 2022, Rebel Foods partnered with Wendy’s to launch virtual brands across India. This collaboration allowed Wendy’s to enter the cloud kitchen space, diversifying Rebel Foods' portfolio and strengthening its position as a leader in internet restaurants.

- In 2022, DoorDash expanded its "DoorDash Kitchens" initiative into five new U.S. cities. This expansion strengthened its shared ghost kitchen network by enabling the company to meet rising delivery demands.

- In July 2021, Kitopi, a Dubai-based cloud kitchen company, raised $415 million in a funding round led by investors including SoftBank. This investment marked a significant milestone for Kitopi, propelling it to unicorn status with a valuation exceeding $1 billion. The funding was aimed at expanding its operations into new markets such as Europe and Southeast Asia, as well as enhancing its technology infrastructure to meet the growing demand for food delivery services.

- In January 2023, Zuul Kitchens introduced eco-friendly packaging and energy-efficient appliances across all locations. This move aligned with sustainability goals, appealing to environmentally conscious consumers and differentiating the brand.

- In June 2023, Swiggy expanded its "Swiggy Kitchen" initiative into Tier-II cities like Jaipur and Lucknow. By targeting untapped markets with high internet penetration, Swiggy increased its user base and reinforced its dominance in India.

- In April 2023, Zomato acquired a majority stake in Shiprocket, an e-commerce logistics platform. This acquisition enhanced Zomato’s last-mile delivery efficiency, supporting its cloud kitchen operations and improving customer satisfaction.

MARKET SEGMENTATION

This research report on the global cloud kitchen market has been segmented and sub-segmented based on type, nature, product type, and region.

By Type

- Independent Cloud Kitchen

- Commissary/Shared Kitchen

- Kitchen Pods

By Nature

- Franchised

- Standalone

By Product Type

- Burger/Sandwich

- Pizza

- Pasta

- Chicken

- Seafood

- Mexican/Asian Food

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the projected size of the global cloud kitchen market by 2033?

The global cloud kitchen market is expected to reach approximately USD 192.07 billion by 2033.

2. What factors are driving the growth of the cloud kitchen market?

The growth is primarily driven by increasing demand for convenient dining options, the rise of food delivery apps, urbanization, and the integration of advanced technologies like artificial intelligence.

3. What are the main types of cloud kitchens?

Cloud kitchens can be categorized into independent cloud kitchens, commissary/shared kitchens, and kitchen pods.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]