Global Cloud Gaming Market Size, Share, Trends & Growth Forecast Report By Type (File Streaming, Video Streaming), Device (Consoles, PCs & Laptops, Smartphones & Tablets, Connected Television), Business Model (Business-to-Consumer (B2C) & Business-to-Business (B2B)) & Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Cloud Gaming Market Size

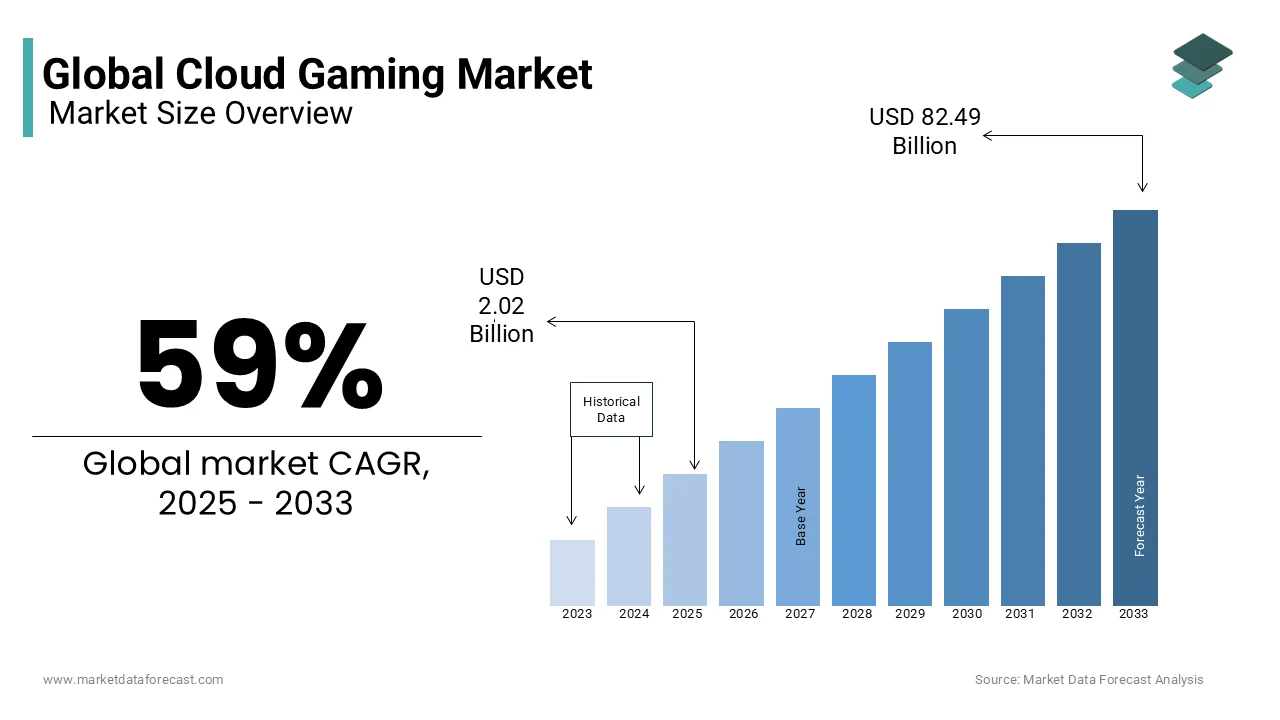

The global cloud gaming market size was valued at USD 1.27 Billion in 2024. The global market is predicted to be worth USD 2.02 billion in 2025 and USD 82.49 billion by 2033, growing at a remarkable compound annual growth rate (CAGR) of 59% from 2025 to 2033.

The advent of 5G technology ushered in the connectivity landscape and brought about a fundamental change in the gaming sector. Various countries are investing in 5G technology to achieve broader microeconomic benefits. Countries such as China, the United States, South Korea, and Japan have made significant progress in strengthening the 5G infrastructure in the country. 5G technology is a new generation of wireless technology that can enable faster data transmission speeds. Since cloud gaming technology requires high transmission speeds of over 10 Mbps, the deployment of 5G infrastructure is a crucial factor, allowing the companies to launch their platforms in the region. 5G technology also effectively addresses various latency issues, providing users with a seamless gaming experience and promoting the use of cloud gaming platforms.

MARKET DRIVERS

Cloud gaming offers a host of advantages, including remote access to interactive games and the ability to run high-quality games on devices with lower computing power. This accessibility and affordability have contributed to the widespread success of pioneers in the gaming industry, such as Sony and Microsoft. The market's growth is further fueled by factors like rising console prices, increased investment in 5G technology, and the availability of a wide range of games at affordable prices. With the growing adoption of smartphones worldwide, many companies are introducing cloud games for 5 G-compatible smartphones. According to the latest Cisco report, "Visual Networking Index (VNI)," India could have 800 million smartphone users by 2022. Hatch released smartphone games, initially released in Finland (November 2018), and is now spreading to other European countries. It has also partnered with DOCOMO to offer games on smartphones in Japan.

The commercialization of 5G, the increase in the number of players and the resurgence of immersive and competitive games on mobile devices are driving the cloud gaming market growth. An increase in the number of Internet users is also anticipated to spur the growth of the global cloud gaming market during the forecast period. With a significant decrease in the game access time and a reduction in the cost of purchasing games, cloud servers are very popular with game manufacturing companies. The increasing popularity of social media platforms, eSports promotion, and free game modes are considered dominant enhancers in the cloud gaming market.

MARKET RESTRAINTS

However, despite the increasing buzz and profitability of the cloud gaming market, it has not increased on a large scale in several regions. This could be because the masses of these regions lack the necessary funds and are distant. These are some of the main factors that may slow down the growth of the global cloud gaming market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

59% |

|

Segments Covered |

By Type, Device, Economic Model, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

NVIDIA (USA), Intel (USA), Google (USA), Microsoft (USA), Amazon (USA), Advanced Micro Devices (USA), Sony (Japan), IBM (USA), Tencent (China), Alibaba (China), NVIDIA (USA), and Others. |

SEGMENTAL ANALYSIS

By Type Insights

The market for cloud file streaming games will grow at an annual rate of over 25% over the expected timeline. The file streaming approach is generally applied by significant players in their product offerings, such as PlayStation Now and Xbox Game Pass, due to the presence of their compatible game consoles. The use of file streaming allows businesses to provide a seamless gaming experience to their users despite slower internet speeds. In addition, it enables users to personalize their game library, record their progress, and instantly access their profiles. The mandatory need for specialized game consoles restricts their uptake among cloud game providers, offering their services via smartphones, PCs, and laptops.

By Device Insights

The console segment held more than 60% of the global cloud gaming market, thanks to the extensive and robust distribution network of major players such as Sony and Microsoft. These large players mainly use their cloud gaming platforms to generate recurring revenue streams through their existing gaming clientele. The high price involved in buying each new game intrinsically limits its use by middle-class buyers. The introduction of cloud gaming platforms has provided console manufacturers with a lucrative opportunity to monetize their vast library of existing gaming content and expand the capabilities of their products.

By Economic Model Insights

The B2B cloud gaming market is assumed to show a CAGR of more than 40% over the outlook period. Cloud gaming platforms are focusing on partnering with Internet service providers and telecommunications companies to expand the distribution network for their services further. Also, decoder manufacturers and telecommunications operators are showing interest in monetizing their investments in fiber. With the increasing implementation of 5G services, especially in countries like South Korea, the United States, and the MEA region, telecommunications providers are concentrating on forming exclusive contracts with cloud gaming platforms to increase their service offerings.

REGIONAL ANALYSIS

North America dominated the global cloud gaming market in 2024, due to the early adoption of advanced infrastructure and technologies. The cloud gaming market in the Asia Pacific is anticipated to grow at an annual rate of more than 46% during the forecast period due to the growing number of 5G infrastructure development initiatives in the region. For example, in April 2019, the foremost South Korean telecommunications providers, Korea Telecom, LG Uplus, and SK Telecom, launched 5G mobile networks across the country. The increasing adoption of smartphones and game consoles and the constant increase in the online population have created many opportunities to boost the market size. Besides, the cost-effective nature of cloud gaming platforms encourages their use with various categories of new customers, who vary from investing in gaming systems due to their costly nature.

KEY MARKET PLAYERS

Companies playing a notable role in the global cloud gaming market include NVIDIA (USA), Intel (USA), Google (USA), Microsoft (USA), Amazon (USA), Advanced Micro Devices (USA), Sony (Japan), IBM (USA), Tencent (China), and Alibaba (China). NVIDIA (USA) is the market leader in cloud gaming. The company is developing GPUs to provide solutions to deep computing problems. It specializes in markets that use GPU-based visual computing and accelerated computing platforms. These platforms integrate processors, system software, programmable algorithms, systems, and services on the market. Driven by the continued demand for better 3D graphics and the size of the gaming market, the company is focusing on virtual reality (VR), high-performance computing (HPC), and artificial intelligence (AI).

MARKET SEGMENTATION

This research report on the global cloud gaming market has been segmented by type, device, economic model, and region.

By Type

-

File Streaming

-

Video Streaming

By Device

-

Consoles

-

PCs & Laptops

-

Smartphones & Tablets

-

Connected Television

By Economic Model

-

Business-to-Consumer [B2C]

-

Business-to-Business [B2B]

By Region

-

North America

-

Europe

-

Asia Pacific

-

Latin America

-

Middle East and Africa

Frequently Asked Questions

How do subscription-based cloud gaming services work, and what are the advantages for gamers?

Subscription-based cloud gaming services allow subscribers to access a library of games hosted on remote servers for a monthly fee. The advantages for gamers include instant access to a wide range of games without the need for expensive hardware, cross-device compatibility, and the ability to play games on the go.

What impact does cloud gaming have on traditional gaming platforms like consoles and PCs?

Cloud gaming poses both opportunities and challenges for traditional gaming platforms. While it may lead to increased competition, it also offers opportunities for collaboration and innovation. Some traditional gaming companies are embracing cloud gaming by integrating it into their platforms, while others are exploring new business models and partnerships.

How do cloud gaming services handle issues like piracy and cheating in games?

Cloud gaming services implement various measures to prevent piracy and cheating, including digital rights management (DRM) technologies, anti-cheat systems, and user authentication protocols. However, combating piracy and cheating remains an ongoing challenge for the industry.

What are the future trends and opportunities in the global cloud gaming market?

Future trends in the cloud gaming market include the continued expansion of 5G networks, advancements in cloud gaming technology such as edge computing and AI-driven optimizations, and the emergence of new business models and partnerships. Opportunities also exist in untapped markets, such as cloud gaming for enterprise applications and virtual reality gaming experiences.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]