Global Cloud-Based Contact Center Market Size, Share, Trends & Growth Forecast Report By Solution (ACD, APO, Dialers, IVR, CTI, Reporting and Analytics, and Security), Service (Professional and Managed), Application, Deployment Model, Organization Size, Vertical & Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa), Industry Analysis 2024 to 2033

Global Cloud-Based Contact Center Market Size

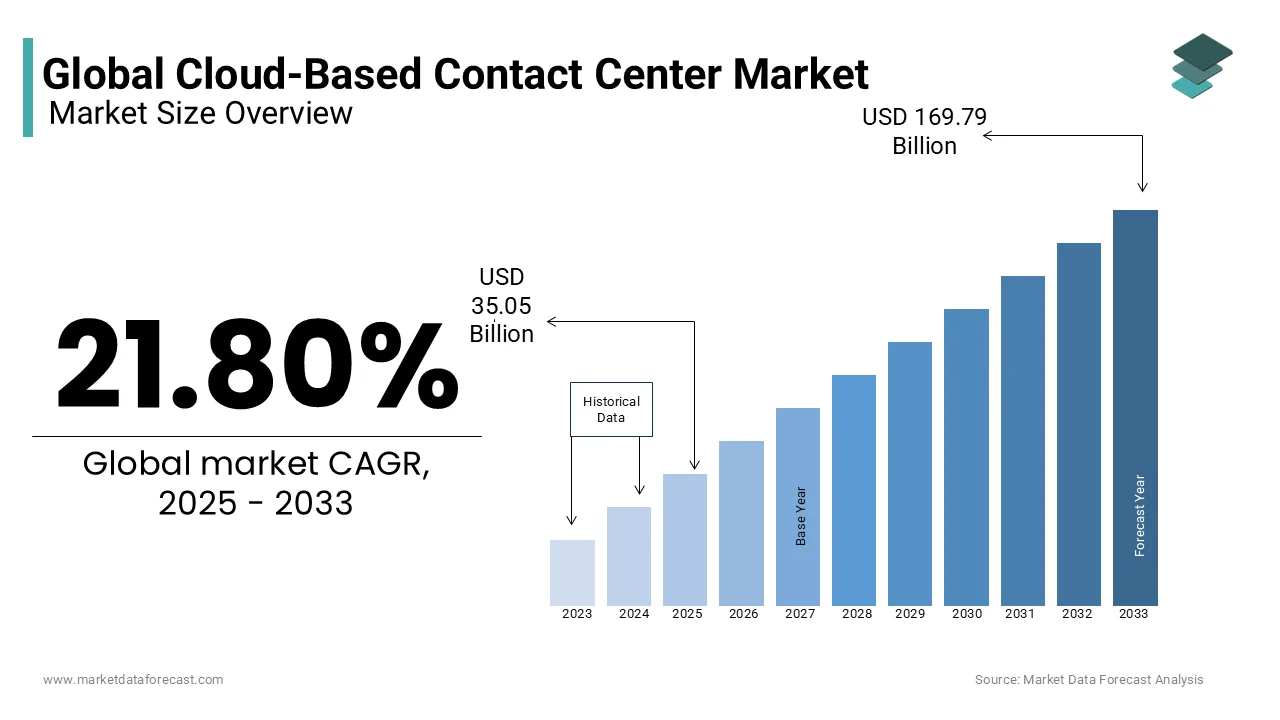

The global cloud-based contact center market size was valued at USD 28.78 billion in 2024. The global market is expected to grow at a CAGR of 21.8% from 2025 to 2033 and to be worth USD 169.79 billion by 2033 from USD 35.05 billion in 2025.

The cloud-based contact center market is quickly gaining traction to satisfy consumer expectations and drive customer loyalty. In Today’s AI era, customers prefer faster and smarter responses and query resolution, which is increasing the demand for Cloud-based Contact Center as a Service (CCaaS) platforms or solutions. These platforms are available from any Internet-linked device and location, making them appropriate for hybrid and remote teams seeking to remove the necessity for expensive on-premises hardware. Companies depend greatly on cloud computing trends due to their support in development, adjustability, and focus on operating their activities.

- According to research, about 66 percent of call centers utilize cloud-based solutions, which are improving their scalability and distant work abilities.

In the last few years, contact centers have transformed tremendously, with the emergence of new powerful solutions, intuitive AI, and novel communication lines or sources for empowering and uniting distributed groups. Their value has risen considerably as customer emphasize more on their experience over product features and prices. Nowadays, virtually every company, whether small or large, has its own call center solution. 8*8, Amazon Web services, Anaya, Cisco, Content Guru, Evolve IP, etc., are some of the known vendors in this market.

MARKET DRIVERS

The Cost-Effectiveness of Cloud-Based Contact Centers

The growing demand for remote work solutions and the cost-effectiveness of cloud-based contact centers compared to on-premises solutions are majorly driving global market growth. According to a study, by 2025, over 95 percent of new digital work assignments and loads will be cloud-based. Customer relationship management (CRM) contact centers are rapidly developing from primary models in which operations are delivered in a single channel to multi-channel, multi-function units. Contact centers in the modern era handle inbound and outbound calls, emails, web queries, and chats from all over the world. Organizations utilize robust Social Media, Mobile, Analytics, and Cloud (SMAC) technology in their contact centers to obtain better results. By addressing evolving client preferences and the need for multi-channel consistency, these technologies help enterprises increase the agility of their business operations. Communication as a service, social media capabilities to handle social media queries, smartphone access to provide contact center agents with relevant real-time information, video enablement to engage in face-to-face video calls, virtual contact centers to reduce costs and complexities, and advanced analytics to analyze unstructured data are all capabilities that modern contact centers are focusing on.

Rapid Adoption of Advanced Technologies Such As AI

The increasing adoption of artificial intelligence and other modern technologies is propelling the growth of the cloud-based contact center market. As per Covin, 80 percent of contact centers employ AI-powered technologies to improve customer engagement, conversation, and complaint resolution. Companies are using artificial intelligence (AIaaS) as a service to enhance their overall performance. They hire this AI technology over the Internet at affordable rental costs. It saves them from incurring heavy expenditure on building their own. Still, instead, they can integrate strong AI solutions from service vendors to automate repetitive jobs, gain insights, or analyze data without the expenses and complications of building an in-house AI version.

MARKET RESTRAINTS

Data Security and Privacy Issues

Concerns about data security and privacy, resistance to change from traditional call center models, and connectivity and network reliability issues are hampering the growth of the global cloud-based contact center market. In today's digital age, access to critical information has produced a slew of issues. Businesses that keep sensitive information have become a common target for cybercriminals, which is one of these difficulties. Contact centers are no exception, as they often handle a lot of sensitive consumer data. These centers collect and preserve a lot of information about their customers, which makes them a tempting target for cybercriminals.

MARKET OPPORTUNITIES

Emerging Technologies

The cloud-based contact center market is expected to register a higher growth rate in the coming years owing to the incorporation of emerging technologies like Virtual Reality (VR), Augmented Reality (AR), and the Internet of Things (IoT). These will also transform the way cloud call center operates. For example, IoT systems furnish contact center agents with live information regarding a client’s service or product application, providing them with proactive and more informed assistance. Similarly, agents can put to use VR and VR technologies to build immersive training surroundings, through which they will be capable of engaging and closing different customer conditions in a simulated manner. They can also assist consumers in figuring out complex issues visually by giving help throughout those situations where such assistance would be much more difficult. Additionally, the expansion of the market is facilitated by the deeper implementation of AI and automation. The progress of automated customer service and AI so far is among the most important developments that will determine or shape the future of call centers. According to Levity, automation is projected to accelerate business efficiency by up to 40 percent by 2035, and 96 percent of call centers already perceive artificial intelligence as a critical technology to support their operations.

MARKET CHALLENGES

High Attrition Rates

High attrition rates are one of the primary challenges encountered by the cloud-based contact center market. According to the 2022 NICE WEM Global survey, the attrition rates in the call centers are towering at 42 percent. This can be attributed to burnout because of the impractical performance expectations and mental or emotional stress in the job environment owing to rude consumers. This is a major problem as people working under pressure regularly switch jobs with the desire to get a better employment package. Moreover, the market players also struggled due to the lack of clarity on employee’s career opportunities for development and progress, the absence of shift choices or flexible schedules, and insufficient agent training. A published study revealed that only 1 in 3 customer service representatives are sincerely involved, and disconnected representatives are about 84 percent more likely inclined to search for a new employment or corporate job. The average cost of substituting client service representatives is 14113 dollars per employee.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

21.8% |

|

Segments Covered |

By Solution, Service, Application, Deployment Mode, Organization Size, Vertical and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Cisco Systems, Genesys, Five9, New Voice Media, Oracle, 3clogic, Aspect Software, Nice Ltd, Connect First, Avaya, Vonage, Talkdesk and Others. |

SEGMENTAL ANALYSIS

By Solution Insights

The security segment is expected to lead the market in the forecast period owing to the presence of personal information that these systems use to serve customers, which are expected to witness an explosion of security intrusions and need to enhance security and active corporate vigilance to accomplish these security standards. Moreover, making sure of privacy and information security in contact center activities is important to safeguard sensitive client data, maintain legal compliance, and strengthen confidence with consumers. As per a study by Venafi, 81 percent of companies have suffered or faced a cloud-associated security incident in the last quarter of 2021 and throughout 2022, with nearly half (45 percent) experiencing at least four occurrences.

By Service Insights

Based on service, a managed service is expected to lead the market in the forecast period. This is because the managed service focuses on the service quality and end-user experience while delivering speed, cost optimization, and quality of service.

By Deployment Mode Insights

The public cloud segment is believed to dominate under this category of the cloud-based contact center market. Amazon Web Services (AWS) and Microsoft Azure are spearheading the segment's market growth. The primary reasons for companies to choose the public cloud are cost efficiency, constant maintenance and updates, better security measures, data analytics capabilities, flexibility and support for remote working, etc. As per the Flexera 2024 report, Microsoft Azure and Amazon Web Services (AWS) continue to be the most increasingly used cloud platforms. Furthermore, 49 percent of participants use AWS for important tasks or jobs, 45 percent utilize Azure, and 21 percent employ Google Cloud Platform.

By Organization Size Insights

The small and medium enterprise segment is the biggest category, with a notable portion of the cloud-based contact center market. They are the dominant cloud acceptors, though there is little drop in this rate compared to 2023. Presently, 61 percent of SMEs are operating in the public cloud, which declined from 67 percent in 2023; on the other hand, 60 percent of their information continues to be on the public cloud

The large enterprise segment also witnessed significant growth in the cloud-based contact center market. These organizations are believed to attain the most market share as the majority are the early acceptors of innovative technologies. In addition, the decrease in capital expenditure and functional expenses and the huge consumer base are other key drivers elevating the segment’s market size. According to the study published in Cloudzero, over 94 percent of companies with above 1000 employees have loads of work in the cloud.

By Vertical Insights

The BFSI segment is the largest segment in the cloud-based contact center market. A diverse portfolio, increasing digital transformation, and constant rollout of technological developments have compelled this segment to be the biggest customer of this market. Moreover, BFSI is also one of the most targeted industries in terms of cyberattacks, ransomware attacks, fake calls, data breaches, etc. Hence, it becomes crucial to have a dedicated team for inbound and outbound calls and other services, whether in-house or third-party, which ultimately expands the segment’s market share.

REGIONAL ANALYSIS

The North American region held a 38% share of the global market in 2024. This is due to increased internet penetration and acceptance of cloud-based services from remote infrastructure, which allows for lower-cost remote operations. Furthermore, the presence of big cloud-based solution providers is projected to boost the region's market expansion. Furthermore, the increasing usage of cloud-based solutions across a variety of industries is expected to fuel robust demand in this region.

The Asia Pacific area is predicted to grow at a CAGR of 26.4% over the forecast period. The increased use of cloud-based contact centers by large, small, and medium organizations in the Asia Pacific region is responsible for this increase. The market is also being driven by the growing number of data center firms, startups, and clients in the region that are adopting new technologies. Additionally, higher spending from various industrial and corporate activities is expected to give new avenues for the cloud-based contact center market in the coming years.

The Europe Cloud-Based Contact Center Market is predicted to grow at a CAGR of 21% over the forecast period. Europe is home to some of the world's most well-known technology hubs, as well as a key driver and adopter of modern technology. Due to economic and regulatory concerns, several companies in the region have moved to the cloud and enabled employee mobility. Bulgaria, Poland, and Romania have all committed to upgrading their digital infrastructures, while Ukraine is on track to double its ICT R&D investment by 2020. The German contact center market is booming, and it's helping companies all around the world with their CRM needs in Europe and beyond. As a result of the adoption of cloud-based services in Germany, the United Kingdom, and Spain, the European market is expected to develop throughout the forecast period.

The LAMEA Cloud-Based Contact Center Market Size is estimated to grow at a 26.2% CAGR over the forecast period. During the study period, Brazil, which presently has the largest market share in the area, is likely to remain a significant market. Argentina's manufacturing market is expected to increase at a 28.8% compound annual growth rate (CAGR). The UAE market for telecom and information technology is expected to develop at a CAGR of 25.4%. At the same time, Nigeria will remain Africa's most dominant market.

KEY MARKET PARTICIPANTS

Cisco Systems, Genesys, Five9, New Voice Media, Oracle, 3clogic, Aspect Software, Nice Ltd, Connect First, Avaya, Vonage and Talkdesk are some of the notable companies in the global cloud-based contact center market.

RECENT MARKET HAPPENINGS

- In June 2024, Microsoft Press released the launch of Dynamic 365 Contact Center, which is a Copilot-first cloud-based contact center. It provides Generative AI to each consumer engagement channel. From 1st July 2024, it became available and is an independent Contact Center As a Service (CCaaS) solution for connecting to favored custom apps or customer relationship management systems (CRMs).

- In March 2024, Salesforce added new features to its Service Cloud that furnish supervisors and agents with automation abilities, content generation, and AI-powered insights to support turning contact centers into sales drivers. Moreover, it is powered by the Einstein 1 platform of Salesforce, which allows people who manage these services, to utilize Einstein and Data Cloud to determine recurring problems, suggest the next action based on client or consumer feedback, and analyze service discussions and talks to recommend methods and approaches for faster resolution of cases.

MARKET SEGMENTATION

This research report on the global cloud-based contact center market has been segmented and sub-segmented based on solution, service, application, deployment mode, organization size, vertical and region.

By Solution

- Automatic Call Distribution (ACD)

- Agent Performance Optimization (APO)

- Dialers

- Interactive Voice Response (IVR)

- Computer Telephony Integration (CTI)

- Reporting and analytics

- Security

- Others (issue tracking, omnichannel, and mobile care solutions)

By Service

- Professional Service

- Managed Service

By Application

- Call Routing and Queuing

- Data Integration and Recording

- Chat Quality and Monitoring

- Real-Time Decision-Making

- Workforce Optimization (WFO)

By Deployment Mode

- Public cloud

- Private cloud

- Hybrid cloud

By Organization Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Consumer goods and retail

- Government and public sector

- Healthcare and life sciences

- Manufacturing

- Media and entertainment

- Telecommunication and Information Technology-Enabled Services (ITES)

- Others (transportation and logistics, and education

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What factors are driving the growth of the cloud-based contact center market globally?

Factors driving growth include the need for flexibility, scalability, cost-effectiveness, and the demand for omnichannel customer engagement solutions, all of which are addressed by cloud-based contact center services.

Which regions are experiencing the highest growth in the adoption of cloud-based contact centers?

North America and Europe are leading in the adoption of cloud-based contact centers, with Asia-Pacific also witnessing rapid growth due to increasing digital transformation initiatives.

Who are the major companies in the global cloud-based contact center market?

Cisco Systems, Genesys, Five9, New Voice Media, Oracle, 3clogic, Aspect Software, Nice Ltd, Connect First, Avaya, Vonage and Talkdesk are some of the major players in the global cloud-based contact center market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]