Global Clinical Laboratory Tests Market Size, Share, Trends & Growth Forecast Report By Test Type, Service Provider, End-User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Clinical Laboratory Tests Market Size

The size of the global clinical laboratory tests market was worth USD 202.7 billion in 2024. The global market is anticipated to grow at a CAGR of 6.23% from 2025 to 2033 and be worth USD 349.2 billion by 2033 from USD 215.3 billion in 2025.

Clinical laboratories are healthcare facilities providing a wide range of laboratory procedures, including clinical chemistry, which measures the levels of chemical compounds in body fluids and tissues that help physicians treat and diagnose patients. These are run by medical technologists trained to perform various tests on samples of biological specimens of patients, which is an essential aspect of meeting medical and public health needs. Several tests detect and measure almost any type of chemical component in blood or urine, including enzymes, hormones, blood sugar, electrolytes, lipids (fats), other metabolic substances, and proteins.

MARKET DRIVERS

The growing prevalence of chronic diseases and other diseases such as tuberculosis, cardiovascular diseases, and the diabetic population across the world is increasing the need for clinical laboratory tests and, thus, contributing to the market growth. The growing prevalence of specific diseases, diabetes, and cardiovascular disorders, the leading cause of death worldwide, and the growing need to treat these diseases are expected to drive the market growth. The rising prevalence of lifestyle-related diseases such as smoking, obesity, unhealthy diets, kidney and lipid-related disorders, and increased patient awareness are leading to the increased pool of patients requiring clinical laboratory testing, driving the demand for point-of-care lipid testing.

With the advent of global laboratory standards, accreditation of clinical laboratories has recently gained widespread acceptance. Various laboratory guidelines have been devised to control laboratory testing practices, preserve the precision and dependability of laboratory testing, and preserve their quality. Risk management in clinical laboratories is essential. To introduce risk management concepts directly to the clinical laboratory, collecting and treating specimens, and disposal of laboratory waste, the Clinical Laboratory Standards Institute (CLSI) has created a guide. These factors are expected to drive the global clinical laboratories market.

The clinical laboratory tests market is further anticipated to grow over the forecast period owing to many factors like growing innovative solutions, implementing laboratory automation systems to optimize efficiency and eliminate, and expanding the geriatric population, which is leading to chronic disorders due to aging. The rapid growth of research centers and increased investments by healthcare companies in R&D activities due to rising awareness among patients and increased demand for more lab tests are reducing the complexity of the current healthcare system and accelerating market growth.

MARKET RESTRAINTS

Some of the restraints for the market growth include the need for improved laboratory capacity for Providing high-quality diagnostic tests, reduced profit margins due to risks associated with LDTs, which might lead to delayed newly designed tests introduction in markets, lack of specific regulatory requirements for diagnostic activities in emerging countries unlike regulatory frameworks in the developed countries, and lack of skilled, knowledgeable workers in the laboratory for clinical tests.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Test Type, Service Provider, End-User & Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Quest Diagnostics, Inc., Laboratory Corporation of America, LLC, Eurofins Scientific, and Others. |

SEGMENTAL ANALYSIS

By Test Type Insights

Based on the test type, the BMP segment is anticipated to account for a leading share of the clinical laboratory tests market during the forecast period. Basic metabolic tests have grown because of the growing adoption of clinical laboratory testing. BMP test measures eight different substances in the blood provides essential information on the body's metabolism and provides tests for glucose, calcium, sodium, and urea nitrogen.

On the other hand, the complete blood count (CBC) segment is also anticipated to account for a considerable share of the market during the forecast period owing to its advantages of diagnosing a variety of health conditions, measuring the number of red blood cells (RBC), white blood cells (WBC), and platelets (PLT), and monitor how the body is affected by different illnesses or medical treatments.

By Service Provider Insights

Based on the service provider, the independent lab segment is anticipated to show notable growth over the forecast period owing to increasing acceptance of digital pathology and increased demand for home diagnostic tests.

The hospital laboratory segment is expected to showcase a healthy CAGR during the forecast period. This is attributed to increased research activities to develop innovative services, the rising prevalence of cancer in the population, and the growing demand for clinical chemistry services in hospitals.

By End-User Insights

Based on the end-user, the central laboratory segment is anticipated to have the fastest CAGR during the forecast period. Central laboratories provide a worldwide network of laboratories with high market penetration and procedural volumes. In addition, clinical research sponsors rely on central laboratories since testing processes are harmonized through various identical instruments, which process samples from the hospital's inpatient and outpatient departments.

The primary clinics segment is also foreseen to account for a substantial share of the market owing to the growing focus on laboratory services to improve performance and due to their benefits of providing accessible, affordable, and universal health coverage for the individual and the community. In underdeveloped private healthcare facilities, deficient rural areas of resources constrained developing nations like India, for which these primary health centers oversee offering essential, therapeutic, and preventive services.

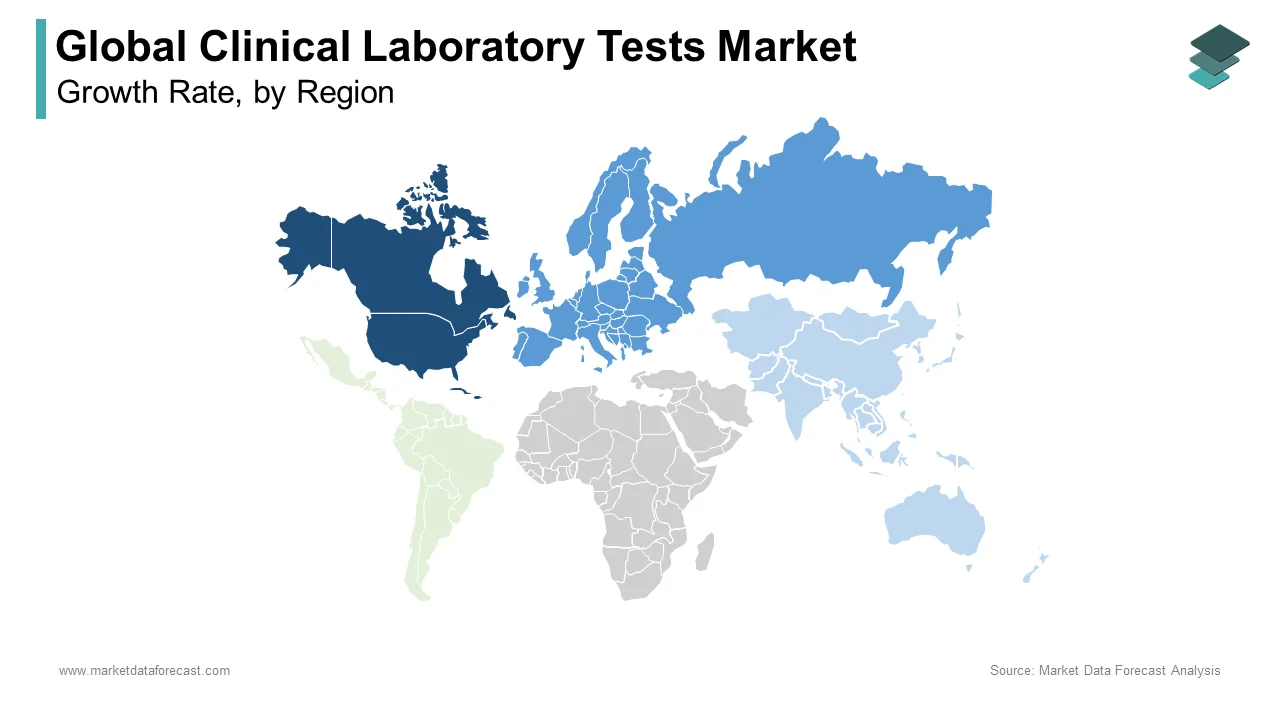

REGIONAL ANALYSIS

North America is expected to dominate the market over the forecast period due to well-developed healthcare infrastructure, strict regulatory structure for approving new tests, sophisticated economies, increased government investments, low costs of testing, encouragement of routine examinations by high insurance coverage, higher rate of adoption of advanced technologies in the development of health care and pharmaceutical facilities and a growing number of centers of research.

The region of Europe has been estimated to hold a significant market share owing to the booming of foreign industries, advanced automotive technology, and monumental achievements from abroad. Also, one of the largest clinical laboratory services companies in Europe has been possible due to the collaboration of Labco and syllabi, operating on three continents in 35 countries and performing around 400 million clinical tests annually. As a result, innovative testing approaches that get quicker results and can look at numerous variables simultaneously are more likely to be developed.

The region of Asia-Pacific is anticipated to show the highest growth rate due to drivers like the increased availability of clinical trials, increased investment in clinical laboratory testing, growing regulatory support, Rising government spending on healthcare infrastructure development, Presence of significant untapped prospects in the form of unmet medical demands, rapid urbanization, expanding scientific studies, growing chronic disease prevalence, growing number of hospitalized patients and huge population.

However, the gap between the availability of high-quality clinical laboratory tests in low- and middle-income countries led to an unmet need in the clinical laboratory testing market, which justifies the low CAGR in Latin America, the Middle East, and Africa.

KEY MARKET PARTICIPANTS

Companies playing an influential role in the global clinical laboratory tests market profiled in this report are Quest Diagnostics, Inc., Laboratory Corporation of America, LLC, Eurofins Scientific, Fresenius Medical Care, NeoGenomics Laboratories Inc., Siemens Healthineers, OPKO Health, Inc., Abbott Laboratories, Inc., Charles River Laboratories International, Inc., Sonic Healthcare Ltd., and Genoptix, Inc.

RECENT HAPPENINGS IN THIS MARKET

- In October 2022, TRIMEDX, a leading provider of clinical technology, announced a collaboration with Indiana University Health medical device cybersecurity to provide new opportunities for healthcare professionals and the cybersecurity industry and to test medical device security by developing a cybersecurity lab.

- In October 2022, C LabTech, a subsidiary of GC Biopharma in South Korea and an FDA-registered, CAP and ISO-accredited specialty laboratory with life-saving plasma testing, selects 1health.io, an industry-leading software company that is revolutionizing the way laboratories are expanding testing to national markets, to bring their innovative new lab tests directly to consumers.

- In August 2021. Illumina bought GRAIL. GRAIL is a cancer testing company, and this corporate action was formed to provide life-saving multi-cancer early-detection tests to patients who are in need.

- In September 2020, LabCorp and Infirmary Health announced a strategic partnership. This action aims to provide laboratory services to patients and providers.

MARKET SEGMENTATION

This research report on the global dental market has been segmented and sub-segmented based on the test type, service provider, end-user, and region.

By Test Type

- Metabolic Panel Tests

- Basic Metabolic Panel (BMP)

- Complete Blood Count (CBC)

- Electrolytes Testing

- HGB/HCT Tests

- Hba1c Tests

- Renal Panel Tests

- Lipid Panel Tests

- Bun Creatinine Tests

- Liver Panel Tests

By Service Provider

- Independent and Reference Laboratories

- Hospital-Based Laboratories

By End-User

- Primary Clinics

- Central Laboratories

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What was the size of the clinical laboratory tests market worldwide in 2024?

The global clinical laboratory tests market size was valued at USD 202.7 billion in 2024.

Which region had the leading share in the global clinical laboratory tests market in 2024?

Geographically, the North American region was the largest region in the global clinical laboratory tests market in 2024.

Which region is anticipated to grow the fastest in the global clinical laboratory tests market?

The Asia-Pacific has a better chance to register the fastest growth in the global clinical laboratory tests market.

Which are the leading companies in the global clinical laboratory tests market?

Quest Diagnostics, Inc., Laboratory Corporation of America, LLC, Eurofins Scientific, Fresenius Medical Care, NeoGenomics Laboratories Inc., Siemens Healthineers, OPKO Health, Inc., Abbott Laboratories, Inc., Charles River Laboratories International, Inc., Sonic Healthcare Ltd., and Genoptix, Inc. are a few of the major players in the global clinical laboratory tests market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com