Global Clinical Diagnostics Market Size, Share, Trends & Growth Forecast Report By Type of Test (Lipid Panels, Infectious Disease Testing, Complete Blood Count, Metabolic Panel Testing, Abnormal Metabolic Panel Results, Other Tests) Product Type (Assays and Kits, Instruments, Reagents, Software and Services), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2024 To 2032

Global Clinical Diagnostics Market Size

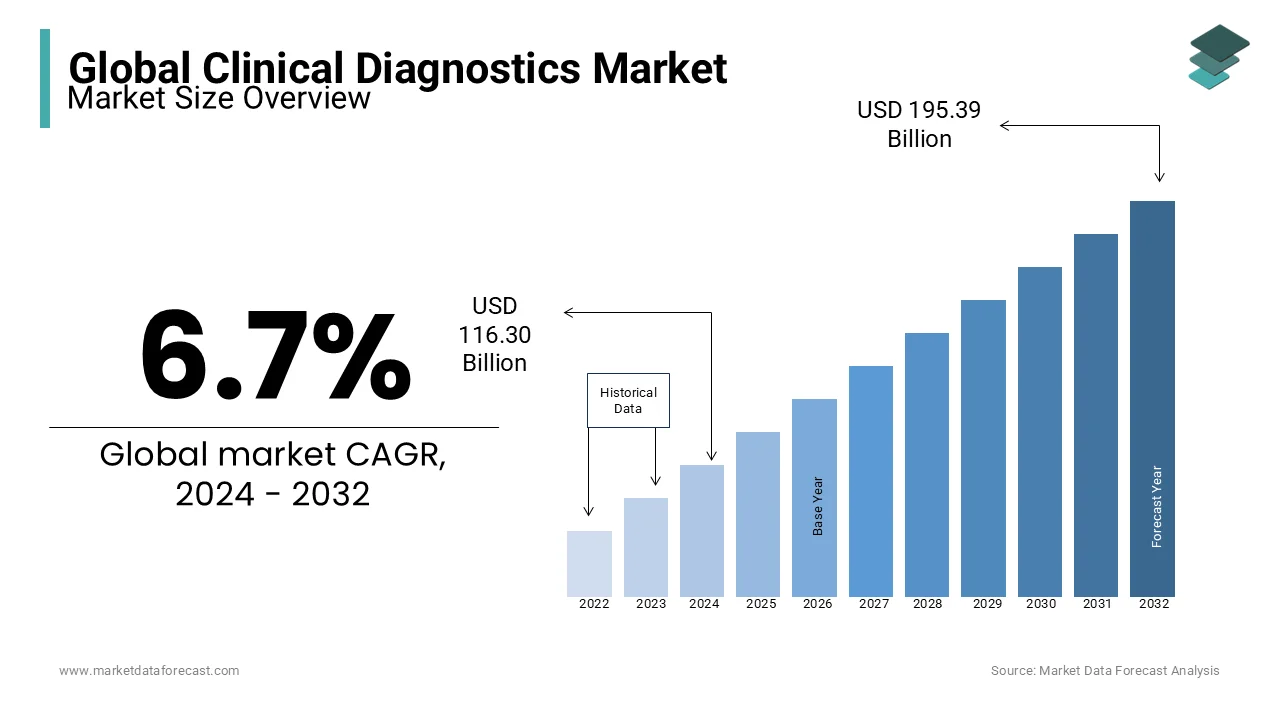

The size of the global clinical diagnostics market was worth USD 109 billion in 2023. The global market is anticipated to grow at a CAGR of 6.7% from 2024 to 2032 and be worth USD 195.39 billion by 2032 from USD 116.30 billion in 2024.

Clinical diagnostics plays a vital role in modern healthcare by focusing on the detection, monitoring, and management of diseases. It encompasses diverse technologies, including molecular diagnostics, immunoassays, point-of-care (POC) testing, and hematology.

MARKET TRENDS

Rising Adoption of Molecular Diagnostics

Molecular diagnostics has become a cornerstone of precision medicine by enabling highly specific detection of genetic, infectious, and oncological diseases. Technologies like real-time PCR and next-generation sequencing (NGS) are witnessing rapid adoption due to their sensitivity and accuracy. For instance, NGS is pivotal in oncology for identifying actionable mutations, with applications increasing by 15-20% annually. During the COVID-19 pandemic, molecular diagnostics scaled dramatically, with over 300 million PCR tests performed in 2022 in the U.S. alone. Advances in cost-efficiency and portability are further driving its use in point-of-care settings that ensures faster diagnosis and personalized treatment planning.

Growth of Point-of-Care (POC) Diagnostics

Point-of-care diagnostics is transforming patient care by offering rapid and near-patient testing solutions. This trend gained momentum during the COVID-19 pandemic, with POC tests reducing result turnaround times by over 80% compared to centralized testing. POC devices, such as glucose meters and handheld hematology analyzers, are widely adopted for chronic disease management and have helped millions of diabetes patients globally. The global POC diagnostics penetration rate in rural healthcare facilities increased by 25% over the past five years, highlighting its role in improving healthcare access. This trend supports decentralized healthcare delivery and fosters timely decision-making, particularly in underserved regions.

MARKET DRIVERS

Rising Prevalence of Chronic and Infectious Diseases

The growing burden of chronic conditions such as diabetes, cancer, and cardiovascular diseases is a primary driver for clinical diagnostics. According to the WHO, diabetes affected 422 million people globally in 2022, while cancer cases are projected to rise by 47% by 2040. Additionally, outbreaks like COVID-19 highlighted the critical need for infectious disease diagnostics with PCR tests becoming the global standard. The increasing frequency of such conditions underscores the demand for early and accurate diagnostic solutions those are essential for effective disease management and control.

Technological Advancements in Diagnostics

Innovations in diagnostic technologies, such as high-throughput sequencing, multiplex assays, and AI-powered tools, are revolutionizing the market. AI integration in diagnostic imaging, for example, reduces error rates by up to 30%. Meanwhile, lab automation and digital pathology enhance efficiency and scalability in clinical settings. These advancements improve diagnostic precision, reduce processing times, and enable personalized medicine significantly boosting adoption rates worldwide.

Demand for Decentralized and Accessible Testing

The push for decentralized diagnostics, including at-home and point-of-care testing, has surged post-COVID-19. For instance, the demand for home-based glucose monitors and rapid antigen tests rose by 40% in 2021. Decentralized testing improves accessibility, particularly in rural or underserved regions, and supports rapid decision-making in critical care. This shift aligns with patient preferences for convenience, reducing healthcare system burdens and enabling broader diagnostic reach.

MARKET RESTRAINTS

High Costs of Advanced Diagnostic Technologies

The adoption of cutting-edge diagnostics, such as next-generation sequencing (NGS) and digital pathology, is often limited by high costs. An NGS test can range from $500 to $3,000 per sample, creating barriers for widespread use, particularly in low- and middle-income countries. Similarly, sophisticated imaging tools and lab automation systems require substantial capital investment. This financial burden restricts access, especially in public healthcare settings is likely to slow down the market growth despite technological advancements.

Regulatory and Compliance Challenges

Stringent regulatory frameworks for clinical diagnostics, such as FDA approvals and ISO certifications to create hurdles for market entry. For example, the average time for U.S. FDA approval of novel diagnostic tools is 1-2 years which delays commercialization. Post-market surveillance and compliance with constantly evolving quality standards further strain resources, particularly for smaller firms. These factors slow innovation and product rollout, impacting market expansion.

Shortage of Skilled Professionals

A significant restraint in the clinical diagnostics market is the global shortage of skilled laboratory technicians and pathologists. According to a 2023 report by the WHO, nearly 50% of low-income countries face critical shortages in clinical laboratory staff with compromising diagnostic accuracy and turnaround times. Additionally, the complexity of advanced tools like AI-driven platforms requires specialized training which is not universally accessible. This gap hampers the adoption of sophisticated diagnostics and affects service delivery quality.

MARKET OPPORTUNITIES

Expansion of Companion Diagnostics

Companion diagnostics (CDx) offer a significant growth opportunity as they enable personalized medicine by identifying patients most likely to benefit from specific therapies. With over 60% of cancer therapies now requiring CDx testing, their demand is surging. For example, CDx solutions for immunotherapy drugs like pembrolizumab have seen adoption rates grow by 25% annually. As biopharmaceutical companies increasingly align drug development with CDx, collaborations are driving innovation by enhancing treatment efficacy and opening new revenue streams.

Advances in Liquid Biopsy Technologies

Liquid biopsies are transforming non-invasive diagnostics with applications in oncology, prenatal testing, and infectious diseases. This technology eliminates the need for surgical biopsies by reducing patient risk and cost. According to recent studies, liquid biopsy adoption in cancer diagnostics grew by 30% between 2020 and 2023 by identifying tumor DNA with up to 85-90% sensitivity. Its potential to detect diseases at early stages creates opportunities for mass screening and disease monitoring, particularly in oncology.

Emerging Markets and Healthcare Infrastructure Development

Rapidly growing healthcare infrastructure in emerging markets, such as India and Brazil, presents vast opportunities for clinical diagnostics. These regions are witnessing a surge in public-private partnerships to improve diagnostic access with the Indian diagnostics sector growing at 12-15% annually. Additionally, government initiatives to promote early disease detection, such as India’s Ayushman Bharat program are fostering demand for affordable diagnostics. This untapped potential in underserved regions drives market expansion globally.

MARKET CHALLENGES

Data Integration and Interoperability Issues

A significant challenge in clinical diagnostics is the lack of seamless integration across diagnostic platforms and healthcare IT systems. Over 30% of laboratories report difficulties in consolidating data from different diagnostic devices into electronic health records (EHRs). This fragmentation delays diagnostic workflows and hinders the transition to fully digitized laboratories. Interoperability standards like HL7 and FHIR are underutilized with complicating data sharing that solely impacts clinical decision-making.

Supply Chain Disruptions

The COVID-19 pandemic exposed vulnerabilities in the diagnostic supply chain, leading to reagent shortages and delayed equipment deliveries. For instance, global shortages of PCR reagents in 2021 affected test availability in many regions. Dependence on centralized manufacturing and logistical bottlenecks exacerbate these issues, particularly in low-resource settings which is impacting timely diagnostics delivery.

Patient Data Privacy Concerns

The rising use of AI-powered diagnostic tools and cloud-based data systems has raised concerns about patient data security. A 2023 report highlighted that healthcare accounted for 44% of ransomware attacks globally that often targeting diagnostic data. Stricter regulations like GDPR and HIPAA increase compliance costs, and breaches can lead to severe reputational and legal consequences for diagnostic providers, deterring broader adoption of digital diagnostics solutions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

6.7% |

|

Segments Covered |

By Type of Test, Product Type, Application, End-user, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Roche Diagnostics, Abbott Laboratories, Thermo Fisher Scientific, Danaher Corporation, Siemens Healthineers, BioMérieux, Qiagen N.V., Becton, Dickinson and Company (BD), PerkinElmer, Inc., Hologic, Inc., and Others. |

SEGMENT ANALYSIS

By Type of Test Insights

Complete Blood Count tests constitute the largest segment, with approximately 25% of the global clinical diagnostics market share. Complete blood count tests are fundamental in evaluating overall health and detecting a wide range of disorders, including anemia, infection, and leukemia. Their routine use in annual check-ups and pre-surgical assessments underscores their importance. The high prevalence of conditions like anemia is affecting over 1.6 billion people worldwide, which is more likely to drive the demand for CBC tests. Additionally, the simplicity, cost-effectiveness, and rapid turnaround of CBC tests contribute to their widespread adoption in both developed and

Infectious Disease Testing is estimated to grow with a projected Compound Annual Growth Rate (CAGR) of 7.5% over the next five years. This surge is propelled by the increasing incidence of infectious diseases, such as COVID-19, HIV, and hepatitis necessitating prompt and accurate diagnostics. For instance, the global burden of hepatitis B and C affects over 325 million individuals that is to highlight the critical need for effective testing. Advancements in molecular diagnostics, including Polymerase Chain Reaction (PCR) and rapid antigen tests, have enhanced the sensitivity and specificity of infectious disease detection. Moreover, global health initiatives and government funding aimed at controlling infectious outbreaks further bolster the growth of this segment that is emphasizing its pivotal role in public health management.

By Product Type Insights

Reagents represent the largest product segment, with 40.3% of the global market share. Reagents are essential chemicals used in diagnostic tests to detect, measure, or examine other substances. Their widespread application across various diagnostic procedures, including immunoassays, molecular diagnostics, and clinical chemistry, level up their significance. The continuous need for reagents in routine testing is coupled with advancements in reagent formulations enhancing test accuracy and efficiency shall drive their dominant market position.

The Software and Services segment is experiencing the fastest growth, with a projected Compound Annual Growth Rate (CAGR) of 8% over the next five years. This rapid expansion is fueled by the increasing integration of digital technologies in diagnostics, such as Laboratory Information Management Systems (LIMS) and data analytics platforms. These solutions streamline laboratory workflows is likely to improve data management and facilitate compliance with regulatory standards. The growing emphasis on personalized medicine and the need for efficient handling of large datasets further propel the demand for advanced software solutions and associated services in the diagnostics field.

By Application Insights

The infectious diseases segment is leading at 60.1% of the global clinical diagnostics market share. This dominance is driven by the high prevalence of infectious diseases worldwide, including respiratory infections, HIV/AIDS, tuberculosis, and, notably, the COVID-19 pandemic. For instance, as of 2023, over 38 million people globally were living with HIV/AIDS underscoring the critical need for effective diagnostic solutions. The continuous emergence of new pathogens and the necessity for rapid and accurate diagnostics to control outbreaks further bolster this segment's prominence.

The Cancer diagnostics segment is experiencing the fastest growth, with a projected Compound Annual Growth Rate (CAGR) of 8% over the next five years. This acceleration is attributed to the rising global cancer burden, with an estimated 19.3 million new cases and 10 million deaths in 2020 alone. Advancements in molecular diagnostics, such as liquid biopsies and next-generation sequencing, have enhanced early detection and personalized treatment strategies which is driving demand in this segment. Additionally, increasing awareness and screening programs contribute to the rapid expansion of cancer diagnostics is aiming to improve patient outcomes through timely intervention.

By End User Insights

Diagnostic Laboratories represent the largest end-user segment, accounting for approximately 45% of the global market share. These laboratories specialize in conducting a wide array of tests, including molecular diagnostics, immunoassays, and clinical chemistry analyses. Their centralized operations enable high-throughput testing, cost-efficiency, and the ability to handle complex diagnostic procedures. The reliance on diagnostic laboratories is further emphasized by their role in managing large volumes of tests during health crises, such as the COVID-19 pandemic where they processed millions of samples globally.

Conversely, the Point-of-Care Testing (POCT) segment is experiencing the fastest growth with a projected Compound Annual Growth Rate (CAGR) of 9% over the next five years. POCT allows for immediate diagnostic results at or near the site of patient care to enhance decision-making and patient management. The increasing demand for rapid diagnostics especially in emergency settings and remote areas is driving the growth rate of this segment. Technological advancements have led to the development of portable and user-friendly POCT devices, expanding their application across various healthcare settings. For instance, the widespread use of rapid antigen tests during the COVID-19 pandemic highlighted the importance and potential of POCT in managing infectious diseases.

REGIONAL ANALYSIS

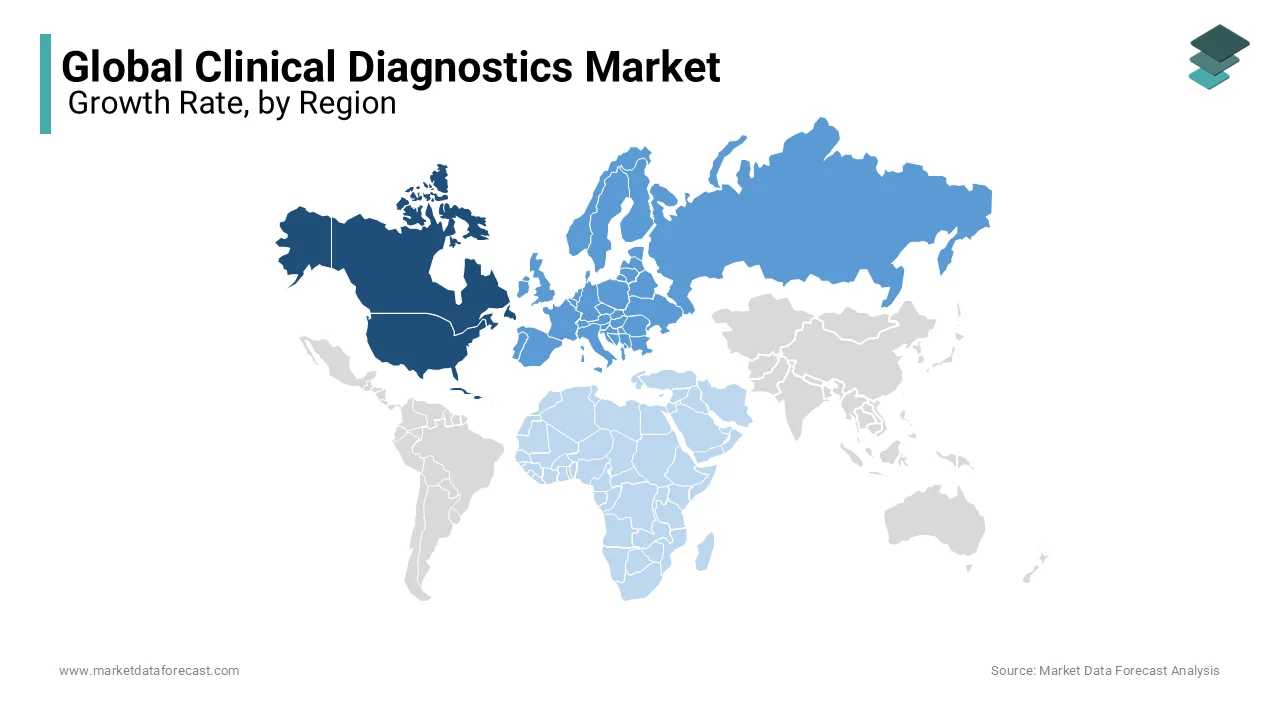

North America holds a dominant position, accounting for approximately 40.2% of the market share. The United States leads this region, driven by advanced healthcare infrastructure, high adoption of innovative diagnostic technologies, and substantial healthcare expenditure. The region is projected to maintain a steady Compound Annual Growth Rate (CAGR) of around 5% over the next five years, supported by continuous technological advancements and a growing emphasis on early disease detection.

Europe is leading with 30.1% to the global market share. Countries like Germany, the United Kingdom, and France are at the forefront, benefiting from robust healthcare systems and significant investments in research and development. The European market is expected to experience a CAGR of approximately 6% owing to increasing demand for personalized medicine and the integration of advanced diagnostic tools.

The Asia-Pacific region is emerging as the fastest-growing market, with a current share of around 20.2%. Nations such as China, India, and Japan are leading this growth, attributed to expanding healthcare infrastructure, rising healthcare expenditure, and a growing prevalence of chronic diseases. The region is anticipated to achieve a remarkable CAGR of about 8% in the coming years, driven by increasing awareness of early disease detection and the adoption of advanced diagnostic technologies.

Latin America holds a smaller market share, approximately 5%, with Brazil and Mexico being key contributors. The region is projected to grow at a CAGR of around 4%, supported by improving healthcare facilities and a gradual increase in the adoption of diagnostic services.

The Middle East and Africa region accounts for about 5% of the global market share. Countries like Saudi Arabia, South Africa, and the United Arab Emirates are leading in this area. The market is expected to grow at a CAGR of approximately 5% with investments in healthcare infrastructure and initiatives to enhance diagnostic capabilities.

KEY MARKET PLAYERS

Companies playing a prominent role in the global clinical diagnostics market include Roche Diagnostics, Abbott Laboratories, Thermo Fisher Scientific, Danaher Corporation, Siemens Healthineers, BioMérieux, Qiagen N.V., Becton, Dickinson and Company (BD), PerkinElmer, Inc., Hologic, Inc., and Others.

RECENT HAPPENINGS IN THE MARKET

- In May 2022, Ortho Clinical Diagnostics shareholders approved the merger with Quidel Corporation. This approval enabled the creation of a combined entity with expanded diagnostic capabilities and a broader global reach.

- In October 2022, Thermo Fisher Scientific, a leader in scientific instrumentation, acquired The Binding Site Group, a specialty diagnostics firm, for £2.25 billion. This acquisition is expected to enhance Thermo Fisher's specialty diagnostics portfolio, particularly in immune system disorders.

- In February 2022, Labcorp, a global life sciences company, acquired Personal Genome Diagnostics, a cancer genomics specialist, for $450 million. This acquisition was intended to expand Labcorp's oncology portfolio and enhance its precision medicine capabilities.

- In July 2023, Thermo Fisher Scientific completed the acquisition of CorEvitas, a provider of real-world evidence solutions, for $912.5 million. This acquisition aimed to strengthen Thermo Fisher's clinical research and patient registry services.

- In August 2023, Danaher Corporation, a global science and technology innovator, entered into a definitive agreement to acquire Abcam, a life sciences company, for approximately $5.7 billion. This acquisition was intended to expand Danaher's life sciences portfolio and enhance its diagnostics capabilities.

- In August 2024, Labcorp acquired select assets of Invitae, a genetic testing company, for $234 million. This acquisition aimed to enhance Labcorp's genetic testing capabilities and expand its precision medicine offerings.

- In October 2023, Thermo Fisher Scientific announced the acquisition of Olink, a proteomics company, for $3.1 billion. This acquisition is expected to strengthen Thermo Fisher's position in proteomics and support biomarker discovery and development.

MARKET SEGMENTATION

This research report on the global clinical diagnostics market has been segmented and sub-segmented based on type of test, product type, application, end-user, and region.

By Type of Test

- Lipid Panels

- Infectious Disease Testing

- Complete Blood Count

- Metabolic Panel Testing

- Abnormal Metabolic Panel Results

- Other Tests

By Product Type

- Assays and Kits

- Instruments

- Reagents

- Software and Services

By Application

- Infectious Diseases

- Cancer

- Cardiovascular Disease

By End User

- Diagnostic Laboratories

- Hospitals and Clinics

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is the clinical diagnostics market growth rate during the projection period?

The global clinical diagnostics market is expected to grow with a CAGR of 6.7% between 2024-2032.

What can be the total clinical diagnostics market value?

The global clinical diagnostics market size is expected to reach a revised size of USD 195.39 billion by 2032.

What are the top 5 key players in the clinical diagnostics market?

Roche Diagnostics, Abbott Laboratories, Thermo Fisher Scientific, Danaher Corporation, and Siemens Healthineers are top key players in the clinical diagnostics market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]