Global Clean Beauty Market Size, Share, Trends, & Growth Forecast Report – Segmented By Product (Skincare, Makeup, Hair Care and Fragrances), Distribution Channel (Online, Retail Store and Subscription Boxes) and Region (North America, Europe, APAC, Latin America, Middle East and Africa) – Industry Analysis (2025 to 2033)

Global Clean Beauty Market Size

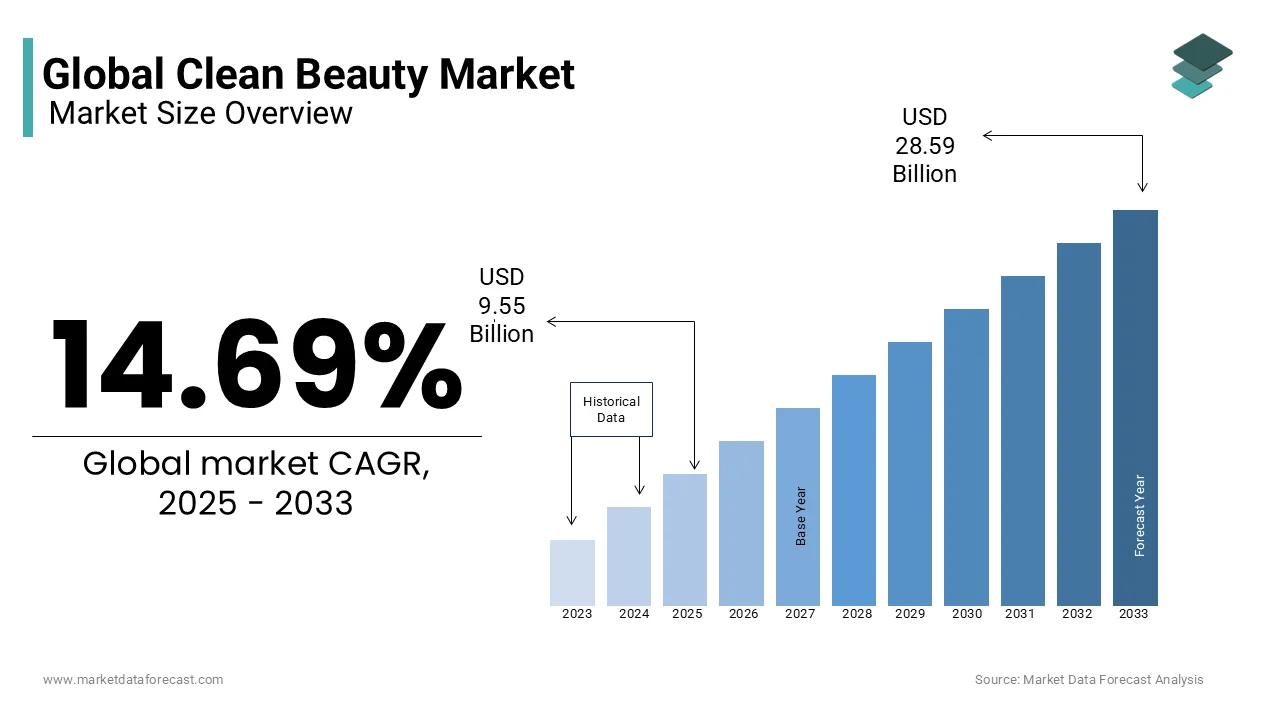

The Global clean beauty market size was valued at USD 8.33 billion in 2024. The global market size is expected to grow at a CAGR of 14.69% from 2025 to 2033 and be worth USD 28.59 billion by 2033 from USD 9.55 billion in 2025.

MARKET DRIVERS

The growing emphasis from people on health and safety is further propelling the growth of the clean beauty market. The rising awareness among consumers is a significant driver of the global clean beauty market growth. There is a well-informed customer base, so there's a heightened demand for products that align with their health and environmental concerns. Consumers are now very aware of the health risks of synthetic chemicals in traditional beauty products. This knowledge has propelled the clean beauty market into the spotlight, as individuals are actively seeking safer alternatives that are free from harmful ingredients. Moreover, the eco-conscious consumer is also choosing environmental implications for their beauty choices. They now prefer products with minimal environmental impact, made with natural components, which often include sustainable sourcing and recyclable packaging. This focus on personal health has led to the rapid growth of the clean beauty market, making it a significant and important trend in the beauty market growth.

Growing unease regarding the potential health risks linked to commonly used ingredients in traditional cosmetics has triggered a surge in demand for safer alternatives. As informed by past research and a desire for more natural solutions, consumers have become highly conscious about the products they apply to their skin. This has led to a shift towards clean beauty products that are free from these harmful substances. Also, consumers are now trying to minimize their exposure to these harmful ingredients by seeking formulations with natural and organic components that are safer and healthier for their skin. As a result, the clean beauty market growth has flourished, offering a wide range of products that prioritize both personal well-being and product safety for those who want to look and feel good without compromising on health.

MARKET RESTRAINTS

The higher price points associated with clean beauty products present a significant restraint to the clean beauty market. While these products are celebrated for their use of premium, natural, and organic ingredients, this quality comes at a cost that can deter price-sensitive consumers. The perception of clean beauty as a premium segment of the market can create a financial barrier for many individuals, also limiting its accessibility. Clean beauty products often require more rigorous ingredient sourcing, environmentally responsible production methods, and eco-friendly packaging, all of which contribute to their elevated price. As a result, consumers on tighter budgets may opt for conventional cosmetics that are more affordable despite potential health and environmental concerns, which is negatively affecting the clean beauty market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

14.69% |

|

Segments Covered |

By Product, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Burt's Bees, The Honest Company, Dr. Bronner's, Ilia Beauty, RMS Beauty, Coola, Juice Beauty, Alima Pure, Tata Harper, W3LL PEOPLE, 100% Pure, Jane Iredale, Kosas, Osea Malibu, Herbivore Botanicals, Pai Skincare, Beautycounter, Vapour Organic Beauty and Thrive Causemetics. |

SEGMENTAL ANALYSIS

By Product Insights

The skincare segment had the largest share of the global clean beauty market in 2024. Skincare products are dominating the market share for maintaining healthy and radiant skin. Clean skincare appeals to a wide range of consumers who are concerned about the health risks that are associated with synthetic chemicals in products. This emphasis on natural and organic ingredients in clean skincare increases with a wide trend towards wellness and self-care, making it a core component of the clean beauty movement.

The makeup segment is another lucrative segment in the worldwide market. Makeup also holds the second largest share in the market as it reformulates without synthetic ingredients while maintaining high-performance standards. Clean makeup products also have made more advancements in the market share.

The fragrances segment is anticipated to grow at a healthy CAGR during the forecast period. Fragrances, particularly natural and organic perfumes and scents, have a dedicated following as consumers seek clean alternatives to conventional synthetic fragrances. Although fragrances represent a smaller segment within the clean beauty market, they cater to individuals who want to avoid artificial scents and irritating chemicals commonly found in traditional perfumes. Clean fragrances not only offer a pleasant olfactory experience but also align with the broader trend of choosing products that are gentle on both personal health and the environment.

By Distribution Channel Insights

The online segment led the market in 2024 and is expected to grow at the highest CAGR during the forecast period. E-commerce platforms and brand websites provide consumers with a convenient and extensive selection of clean beauty products. It is also attributed to factors like convenience, accessibility, and the ability to research and compare products easily.

The retail stores segment is growing at a promising CAGR during the forecast period. Retail stores include specialty boutiques, health food stores, and natural product retailers. However, they have faced increased competition from online sales due to the convenience and broader product range available on the internet.

The subscription boxes segment is gaining traction and is expected to register a steady CAGR in the coming years. Subscription box services deliver a curated selection of clean beauty products to subscribers regularly. While they offer a unique way to discover new products, subscription boxes represent a smaller share of the clean beauty market. The dominance of this channel may be limited due to the subscription model not appealing to all consumers and a lack of customization.

REGIONAL ANALYSIS

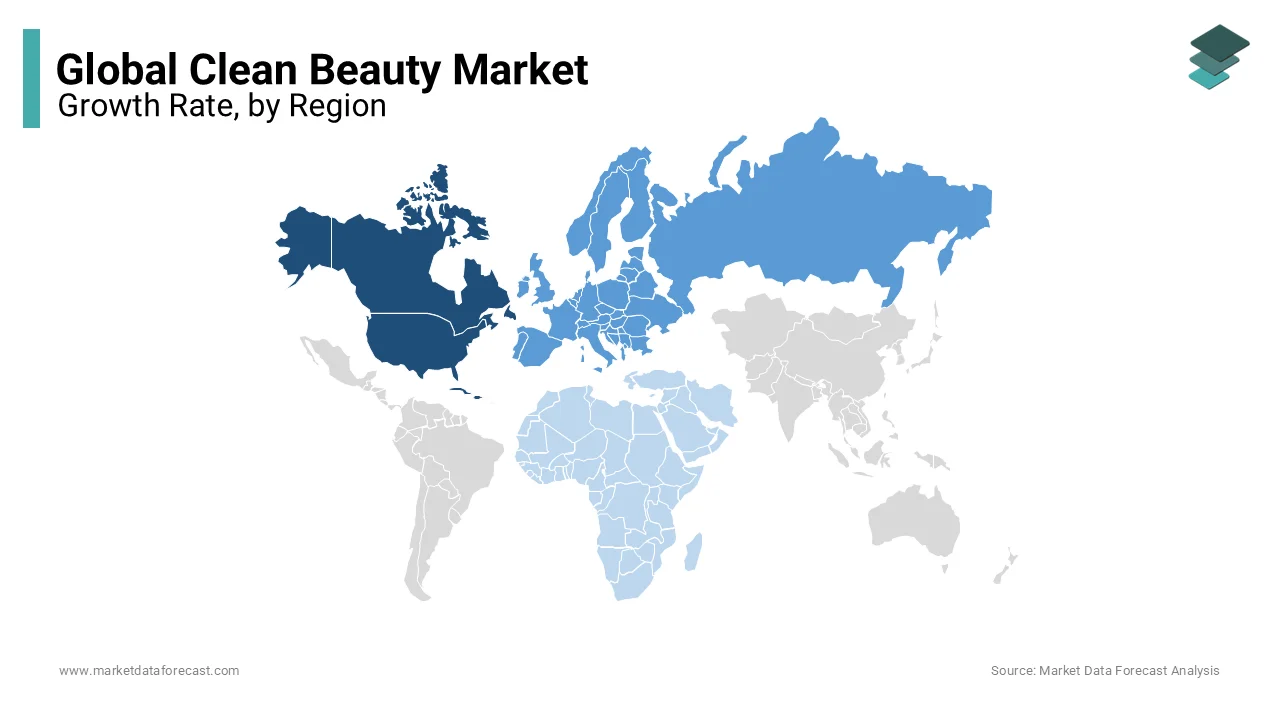

North America had the leading share of the global market in 2024. North America, particularly the United States and Canada, has played a significant role in driving the clean beauty movement. The region has witnessed a surge in clean beauty brands, both established and emerging. The dominance of North America can be attributed to the strong consumer awareness of clean beauty, the presence of influential beauty retailers, and a robust e-commerce ecosystem. The Clean Beauty Market in North America has gained significant traction due to consumer demand for safe, natural products.

Europe holds the second biggest CAGR in the clean beauty movement, with a rich history of valuing natural and organic ingredients. European countries have regulations concerning cosmetics, which have pushed the brands to adopt cleaner formulations. The clean beauty market in Europe is substantial, with a strong importance on organic and eco-friendly products.

The Asia-Pacific region is also rapidly growing in terms of clean beauty market presence. Also, K-beauty brands have popularized the concept of clean beauty with an emphasis on innovative formulations and natural ingredients. Asia-Pacific's region is fuelled by a desire for effective, gentle, and safe skincare products.

Latin America is also showing a growing interest in clean beauty products. Consumers in countries like Brazil and Mexico are seeking alternatives to traditional cosmetics that often contain synthetic ingredients. Also, the clean beauty market is primarily driven by the appeal of clean, natural ingredients that align with the region's natural resources.

Middle East and Africa are emerging markets for clean beauty; they are not as dominant as the other regions mentioned. Factors like climate and consumer preferences have contributed to slower adoption, but a growing awareness of ingredient safety and environmental concerns is driving increased interest in clean beauty.

KEY MARKET PLAYERS

Burt's Bees, The Honest Company, Dr. Bronner's, Ilia Beauty, RMS Beauty, Coola, Juice Beauty, Alima Pure, Tata Harper, W3LL PEOPLE, 100% Pure, Jane Iredale, Kosas, Osea Malibu, Herbivore Botanicals, Pai Skincare, Beautycounter, Vapour Organic Beauty and Thrive Causemetics are some of the major companies in the global clean beauty market.

RECENT HAPPENINGS IN THE MARKET

- In 2024, Dr. Bronner introduced organic and sustainable packaging for its clean beauty products, aligning with its eco-friendly values.

- In 2024, Juice Beauty launched clean and organic skincare collections and extended its commitment to eco-friendly packaging.

- In 2024, RMS Beauty introduced innovative, clean makeup products and emphasized the use of raw, food-grade, and organic ingredients.

MARKET SEGMENTATION

This research report on the global clean beauty market has been segmented and sub-segmented based on product, distribution channel, and region.

By Product

- Skincare

- Makeup

- Haircare

- Fragrances

By Distribution Channel

- Online

- Retail Stores

- Subscription Boxes

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the projected size of the global clean beauty market by 2033?

Advancements like AI-driven ingredient analysis, sustainable packaging solutions, and 3D printing for cosmetics are driving innovation in the clean beauty market.

2. What factors are driving growth in the clean beauty market?

The market is expected to grow from USD 9.55 billion in 2025 to USD 28.59 billion by 2033, at a CAGR of 14.69%.

3. What trends are shaping the clean beauty market?

Key drivers include increasing consumer awareness of harmful ingredients, demand for eco-friendly and non-toxic products, and the influence of social media and beauty influencers.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]