Global Cigarette Market Size, Share, Trends, & Growth Forecast Report Segmented By Type (Light, Medium, Others), Distribution Channel, and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Cigarette Market Size

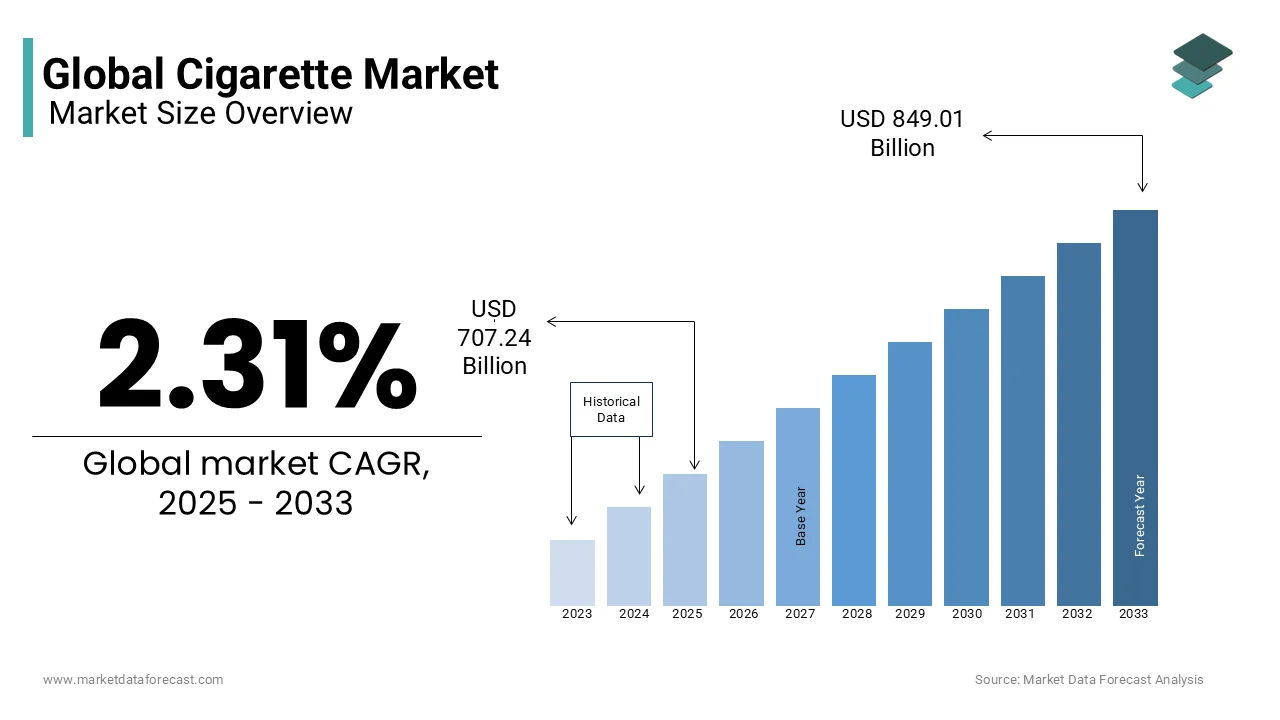

The global Cigarette market size was valued at USD 691.27 billion in 2024 and is expected to reach USD 849.01 billion by 2033 from USD 707.24 billion in 2025. The market is projected to grow at a CAGR of 2.31%.

Cigarette is a form of tobacco product designed for smoking. Traditionally, cigarette market has been dominated by major corporations such as Altria Group, Inc., British American Tobacco, and Philip Morris International. These entities have established extensive supply chains to cater to a global consumer base. In recent years, the cigarette market has experienced notable shifts. For instance, in the United States, cigarette sales have been on a decline. According to the Centers for Disease Control and Prevention (CDC), annual U.S. sales of cigarette packs decreased by approximately 27% from 2015 to 2021 which dropped from 12.5 billion packs to 9.1 billion. Conversely, alternative nicotine products have gained traction. The CDC Foundation reported that from February 2020 to December 2023, total e-cigarette unit sales in the U.S. increased by 42.8% rising from 15.6 million units to 22.9 million units.

MARKET DRIVERS

Marketing and Promotional Strategies

The cigarette industry's substantial investment in marketing and promotional activities significantly influences consumer behavior and sustains market demand. In 2022, major cigarette companies in the United States allocated approximately $8.01 billion to advertising and promotion, with price discounts to retailers and wholesalers comprising 85.9% of this expenditure, as reported by the Federal Trade Commission. These price discounts effectively lower the retail cost of cigarettes, making them more accessible to price-sensitive consumers and potentially encouraging increased consumption. The Centers for Disease Control and Prevention highlights that such pricing strategies can particularly impact youth and low-income populations, who are more responsive to price fluctuations. This extensive marketing expenditure underscores the industry's commitment to maintaining and expanding its consumer base despite public health initiatives aimed at reducing smoking prevalence.

Economic Contributions and Government Revenues

The cigarette market plays a pivotal role in the economies of several countries is serving as a significant source of government revenue through taxation. For instance, in China, the tobacco industry is a major contributor to the national economy. In 2023, China produced 2.4 trillion cigarettes, with national tobacco sales accounting for approximately 47% of the global market, as reported by the Financial Times. This production generated substantial tax revenue, underscoring the industry's economic importance. Similarly, in Indonesia, the tobacco sector contributes significantly to state revenue through excise duties, with the cigarette industry providing approximately 35 trillion Indonesian Rupiah in excise duty in a recent year, according to data from the Indonesian Ministry of Finance. These economic benefits create a complex dynamic for governments, balancing public health concerns with fiscal dependencies on tobacco-related income.

MARKET RESTRAINTS

Government Regulations and Taxation

Stringent government regulations and increased taxation have significantly curtailed cigarette consumption. For instance, the World Health Organization reports that raising cigarette excise taxes by approximately US$0.80 per pack could elevate retail prices by 42% by leading to a 9% reduction in smoking rates and potentially resulting in up to 66 million fewer adult smokers globally. Such fiscal policies, coupled with advertising bans and public smoking restrictions, have been instrumental in decreasing smoking prevalence. The Centers for Disease Control and Prevention notes that comprehensive smoke-free laws and tobacco price increases are effective strategies in reducing smoking rates. These regulatory measures not only deter initiation but also encourage cessation thereby posing a substantial restraint on the cigarette market.

Public Health Campaigns

Public health campaigns have played a pivotal role in diminishing cigarette consumption. The Centers for Disease Control and Prevention highlights that mass media interventions can effectively reduce smoking prevalence. For example, the "Tips From Former Smokers" campaign led to an estimated 1.6 million smokers attempting to quit, with at least 100,000 successfully quitting immediately following the campaign. Such initiatives raise awareness about the health risks associated with smoking, alter social norms, and motivate individuals to quit thereby exerting downward pressure on the cigarette market.

MARKET OPPORTUNITIES

Emerging Markets in Developing Countries

The cigarette industry is experiencing growth in developing nations, where rising incomes and evolving social norms contribute to increased tobacco consumption. For instance, in Indonesia, cigarette production reached 316 billion units in 2016 by positioning the country as the second-largest cigarette market globally. This surge is attributed to a growing population and relatively lenient tobacco regulations. Similarly, in the World Health Organization's Eastern Mediterranean Region, cigarette consumption has escalated by over one-third since 2000 which is indicating significant market expansion. These trends present substantial opportunities for the cigarette industry to tap into new consumer bases in emerging economies.

Product Diversification and Innovation

The cigarette market is capitalizing on product diversification and innovation to attract and retain consumers. A notable example is the increasing popularity of menthol cigarettes which comprised 36% of the U.S. market among major manufacturers in 2022, as reported by the Federal Trade Commission. Additionally, the rise of alternative nicotine products, such as nicotine pouches has opened new revenue streams. The Centers for Disease Control and Prevention notes that U.S. sales of nicotine lozenges, pucks, and pouches more than doubled from $452.76 million in 2020 to $1.06 billion in 2022. These innovations cater to evolving consumer preferences by providing avenues for market growth amidst declining traditional cigarette use.

MARKET CHALLENGES

Illicit Trade and Counterfeit Products

The proliferation of illicit cigarette trade poses a significant challenge to the cigarette market. In the United States, the Tax Foundation estimated that in 2017, New York State lost approximately $1.63 billion in tax revenue due to black market cigarette sales. This illegal trade undermines public health efforts by making cheaper, unregulated products more accessible, thereby sustaining consumption levels and complicating regulatory enforcement.

Evolving Consumer Preferences

Shifts in consumer preferences toward alternative nicotine products, such as e-cigarettes and nicotine pouches, present a formidable challenge to the traditional cigarette market. The Centers for Disease Control and Prevention reported that U.S. sales of nicotine lozenges, pucks, and pouches more than doubled from $452.76 million in 2020 to $1.06 billion in 2022. This trend indicates a growing consumer inclination toward smoke-free alternatives which is driven by perceptions of reduced harm and societal shifts toward healthier lifestyles. Consequently, traditional cigarette manufacturers face declining sales and must adapt by diversifying their product portfolios to include alternative nicotine delivery systems.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

2.31% |

|

Segments Covered |

By Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

British American Tobacco PLC, Altria Group Inc., Japan Tobacco International, ITC Limited, Philip Morris Products SA, and others |

SEGMENTAL ANALYSIS

By Type Insights

The light cigarettes segment held 60.8% of the global cigarette market share in 2024. Their popularity stems from perceived lower tar and nicotine content, appealing to health-conscious smokers transitioning from medium or full-flavored options. The U.S. Food and Drug Administration (FDA) highlights that light variants account for over 70% of sales in developed regions like North America and Europe, where regulatory pressures and anti-smoking campaigns are stronger. This segment's leadership underscores its role in retaining consumer loyalty while aligning with stricter health regulations by making it a critical revenue driver for tobacco companies.

The others segment, including flavored and specialty cigarettes is anticipated to grow at faster CAGR of 8.5% from 2025 to 2033. This growth is fueled by rising demand among younger demographics, particularly in Asia-Pacific and Africa, where flavored options like menthol and fruit-infused variants are gaining traction. The Food and Agriculture Organization (FAO) reports that flavored cigarettes account for over 30% of new product launches with innovative marketing strategies targeting millennials and Gen Z. Governments, however, are increasingly regulating these products due to their appeal to younger audiences. Despite regulatory challenges, this segment’s expansion leverages its importance in diversifying product portfolios and attracting niche markets.

By Distribution Channel Insights

The tobacco shops segment led the cigarette market by occupying a share of 45% in the global market in 2024. These shops are popular because they offer specialized products and expert advice. The U.S. Centers for Disease Control and Prevention (CDC) notes that in developed markets tobacco shops contribute over 60% of total sales. Shoppers value the wide selection of brands and easy access to premium products. Tobacco shops are vital for manufacturers as they help maintain revenue streams even as smoking rates decline. Their role in the industry remains unmatched.

The online stores segment is predicted to showcase a CAGR of 12.3% from 2025 to 2033. This growth is fueled by rising internet use and the convenience of shopping online. The European E-Commerce Association reports that urban areas see a 20% annual increase in online cigarette sales. Younger consumers prefer this channel due to discreet delivery options and access to global brands. Secure payment systems also boost buyer confidence. Governments are working to regulate this space to prevent underage purchases. Despite regulatory challenges online stores are reshaping how cigarettes are sold, and their rapid rise highlights their potential to transform the cigarette market.

REGIONAL ANALYSIS

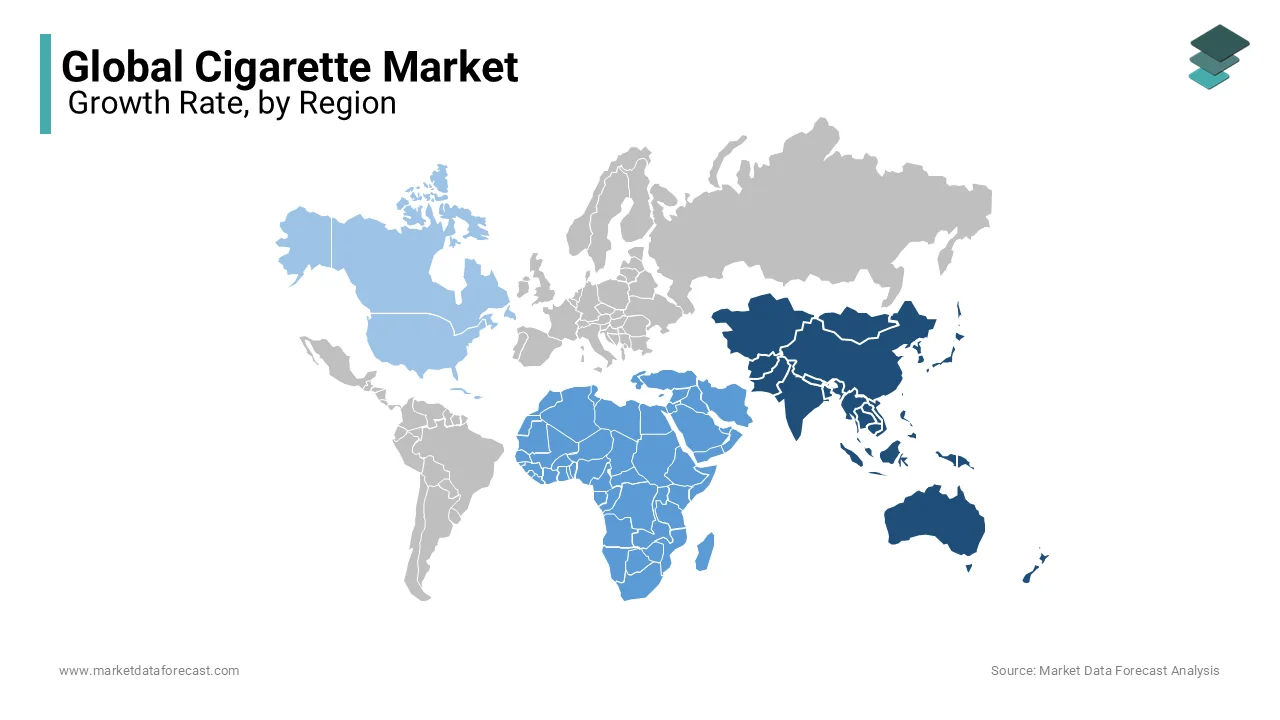

The Asia-Pacific regional market dominated the cigarette market worldwide and accounted for 40.6% of the global market share in 2024. The high smoking prevalence particularly in countries like China and India is majorly contributing to the dominance of Asia-Pacific in the global market. The Food and Agriculture Organization (FAO) highlights that over 50% of the world’s smokers are located in this region. China alone accounts for nearly 40% of global cigarette consumption due to its massive population and deeply rooted smoking culture. Affordable pricing and widespread cultural acceptance of smoking ensure sustained demand. Even though smoking rates are declining in some areas the sheer size of the population ensures Asia-Pacific remains a critical hub for manufacturers.

The market in Middle East and Africa is the fastest-growing region in the global cigarette market with a CAGR of 6.8% from 2025 to 2033. This rapid growth is fueled by rising urbanization and increasing disposable incomes especially in Sub-Saharan Africa. The African Development Bank reports that urban populations in the region are growing at 3.5% annually which boosts demand for affordable tobacco products. Weak regulatory frameworks in some countries also make cigarettes more accessible to consumers. Governments are attempting to implement anti-smoking campaigns but enforcement remains inconsistent. This segment’s rapid expansion highlights its importance as an emerging market where tobacco companies can explore new opportunities despite challenges.

North America and Europe are experiencing steady declines in cigarette consumption due to stringent anti-smoking laws and heightened health awareness. The U.S. Centers for Disease Control and Prevention (CDC) notes a 2% annual drop in smoking rates in these regions. Latin America shows moderate growth supported by economic recovery and cultural habits that favor smoking. The Food and Agriculture Organization (FAO) predicts steady demand in rural parts of Africa and Latin America where traditional smoking practices remain prevalent. Collectively these regions will continue to play a vital role in diversifying revenue streams for tobacco companies while facing challenges such as stricter regulations and shifting consumer preferences toward healthier lifestyles.

KEY MARKET PARTICIPANTS AND COMPETITIVE LANDSCAPE

British American Tobacco PLC, Altria Group Inc., Japan Tobacco International, ITC Limited, Philip Morris Products SA are playing a dominating role in the global cigarette market.

The global cigarette market is characterized by intense competition among a few dominant transnational tobacco companies (TTCs), which collectively hold a substantial share of the market. According to a study published in the Tobacco Induced Diseases journal, five major TTCs such as Philip Morris International, British American Tobacco, Japan Tobacco International, Imperial Brands, and China National Tobacco Corporation shall dominate the international tobacco industry.

These companies engage in aggressive marketing strategies, brand diversification, and extensive distribution networks to maintain and expand their market shares. For instance, British American Tobacco reported a nearly 3% increase in shares after surpassing first-half profit expectations in 2024, driven by positive performance in the United States, which constitutes over 40% of its revenues.

However, the industry faces significant challenges due to shifting consumer preferences toward alternative nicotine products, such as e-cigarettes and nicotine pouches. Altria Group, known for its Marlboro cigarettes, has acknowledged that its annual adjusted profit might fall short of expectations due to increasing competition from rival vapes and persistent declines in cigarette demand.

Additionally, the rise of illicit tobacco products further intensifies competition, as these unregulated items erode the market share of established companies and complicate regulatory enforcement. For example, unauthorized disposable vapes made up 60% of the e-cigarette market that grew by 30% in 2024, posing a threat to companies like Altria in achieving their smoke-free product targets.

STRATEGIES USED BY THE MARKET PLAYERS

Innovation in Reduced-Risk Products (RRPs)

Leading companies like Philip Morris International (PMI) and British American Tobacco (BAT) have heavily invested in developing alternatives to traditional cigarettes, such as e-cigarettes, heated tobacco products, and vaping devices. These innovations cater to health-conscious consumers and align with global anti-smoking trends. By diversifying their portfolios, these players aim to offset declining cigarette sales while capturing new market segments.

Expansion into Emerging Markets

Companies are aggressively targeting high-growth regions like Asia-Pacific, Africa, and Latin America. For example, Japan Tobacco International (JTI) has expanded its distribution networks in countries like India and Indonesia, where smoking prevalence remains high. This strategy helps offset declining demand in mature markets like North America and Europe.

Brand Diversification and Premiumization

Key players focus on offering a wide range of products, from budget-friendly options to premium brands. For instance, Imperial Brands PLC emphasizes luxury brands like Davidoff to attract affluent consumers, while also maintaining affordable options for price-sensitive markets.

Strategic Acquisitions and Partnerships

Acquisitions have been a critical strategy for growth. For example, Altria Group acquired stakes in vaping companies to strengthen its presence in the next-generation product space. Similarly, partnerships with local distributors help companies penetrate untapped markets more effectively.

Sustainability Initiatives

To address environmental concerns, companies like BAT and PMI have committed to reducing their carbon footprint and adopting sustainable practices. These efforts not only comply with regulations but also enhance brand reputation among eco-conscious consumers.

Digital Transformation and E-Commerce

With the rise of online shopping, companies are investing in digital platforms to improve accessibility. For instance, KT&G Corporation has leveraged e-commerce to reach younger consumers and expand its global presence, particularly in regions with growing internet penetration.

Regulatory Compliance and Lobbying

To navigate stringent anti-smoking laws, companies actively engage in lobbying and ensure compliance with regional regulations. For example, China National Tobacco Corporation (CNTC) works closely with government bodies to maintain its dominance in the domestic market while adhering to local policies.

Focus on Rural and Underserved Areas

Companies like CNTC and ITC Limited target rural regions where smoking remains culturally ingrained. By offering affordable products and expanding distribution networks, they sustain demand in areas less affected by urban anti-smoking campaigns.

Marketing and Consumer Engagement

Strong branding and targeted marketing campaigns are vital for maintaining consumer loyalty. For instance, PMI uses social media and experiential marketing to promote its IQOS devices, appealing to tech-savvy and younger demographics.

Cost Optimization and Operational Efficiency

To counter declining margins, companies focus on streamlining operations. For example, Swedish Match AB has adopted advanced manufacturing technologies to reduce costs while maintaining quality, ensuring competitiveness in price-sensitive markets.

TOP 3 PLAYERS IN THE MARKET

Philip Morris International (PMI)

Philip Morris International (PMI) is a global leader in the cigarette market, widely recognized for its flagship brand, Marlboro, which dominates both premium and mid-tier segments. The company has positioned itself as an innovator by developing Reduced-Risk Products (RRPs), such as IQOS, to cater to health-conscious consumers seeking alternatives to traditional smoking. PMI’s extensive distribution network spans numerous countries, allowing it to maintain a strong presence in key regions like Asia-Pacific and Eastern Europe. Its focus on sustainability and harm reduction underscores its commitment to addressing evolving consumer preferences while maintaining its leadership in the tobacco industry.

British American Tobacco (BAT)

British American Tobacco (BAT) is a major player in the global cigarette market, known for iconic brands like Dunhill, Lucky Strike, and Kent, which appeal to diverse consumer preferences worldwide. The company has made significant investments in next-generation products (NGPs) by including vaping devices and heated tobacco offerings to align with global trends toward reduced-risk alternatives. BAT’s operations span across numerous countries to maintain a robust presence in both developed and emerging markets. BAT continues to solidify its position as a key influencer in the tobacco industry by prioritizing innovation and expanding its product portfolio,.

China National Tobacco Corporation (CNTC)

China National Tobacco Corporation (CNTC) is the largest cigarette manufacturer globally by primarily serving the domestic Chinese market, where smoking remains deeply rooted in cultural practices. CNTC produces an immense volume of cigarettes annually, making it a cornerstone of the global tobacco supply chain. While its international footprint is relatively limited compared to other players, its dominance in China is a country with one of the highest smoking rate that ensures its critical role in the industry. CNTC focuses on affordability and accessibility, particularly targeting rural areas where demand remains strong despite declining smoking rates in urban centers.

RECENT HAPPENINGS IN THE MARKET

- In October 2024, British American Tobacco (BAT) announced plans to launch Velo Plus, a synthetic nicotine pouch, in the United States. This initiative marks one of the first instances of a major tobacco company introducing a lab-made nicotine product. Synthetic nicotine, produced chemically in laboratories, is identical to natural nicotine derived from tobacco plants. BAT's move into synthetic nicotine products reflects a strategic effort to diversify its portfolio and adapt to evolving market dynamics. The company anticipates significant growth in the U.S. market for both vapes and nicotine pouches over the next decade, despite recent declines in combustible tobacco revenue.

MARKET SEGMENTATION

This research report on the global cigarette market has been segmented and sub-segmented based on type, distribution channel, and region.

By Type

- Light

- Medium

- Others

By Distribution Channel

- Tobacco Shops

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the projected growth of the global cigarette market from 2025 to 2033?

The global cigarette market is expected to grow from USD 707.24 billion in 2025 to USD 849.01 billion by 2033, representing a Compound Annual Growth Rate (CAGR) of 2.31%.

2. Which companies are the major players in the global cigarette market?

The market is dominated by major corporations such as Altria Group, Inc., British American Tobacco, and Philip Morris International.

3. How have cigarette sales in the United States changed in recent years?

Cigarette sales in the U.S. have declined, with annual sales decreasing by approximately 27% from 2015 to 2021, dropping from 12.5 billion packs to 9.1 billion.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]