Global Chromebook Market Size, Share, Trends & Growth Forecast Report By Product (Laptops, Convertibles, and Tablets), Screen Type (Touch Screen and Non-Touch Screen), Application (Education Sector, Corporate Sector, and Others), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Chromebook Market Size

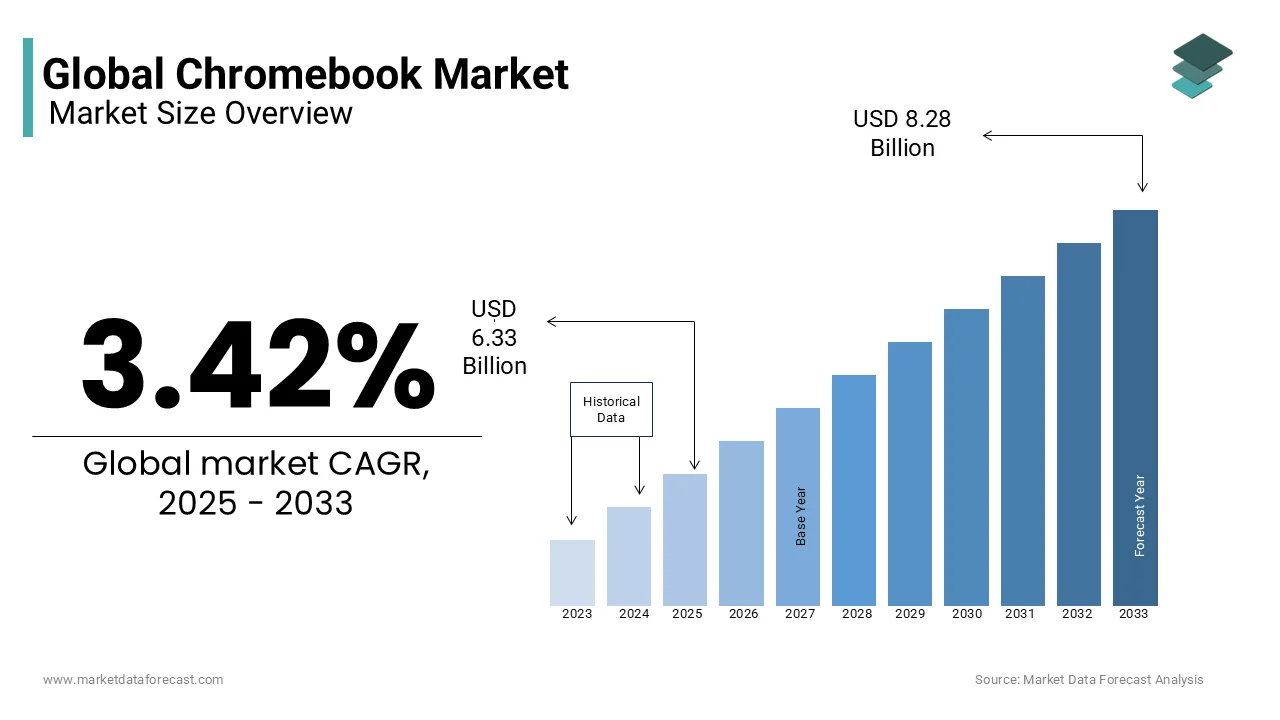

The global Chromebook market was worth USD 6.12 billion in 2024. The global market is projected to reach USD 8.28 billion by 2033 from USD 6.33 billion in 2025, growing at a CAGR of 3.42% from 2025 to 2033.

Chromebooks are a line of laptops, desktops, tablets, and all-in-one computers that run ChromeOS, a proprietary operating system developed by Google. These devices are optimized for web access and also support Android apps, Linux applications, and Progressive Web Apps, enabling offline functionality. Manufactured by various original equipment manufacturers (OEMs), Chromebooks have been available since June 15, 2011. As of 2020, Chromebooks held a market share of 10.8%, surpassing the Mac platform, with significant success in the education sector. In the second quarter of 2024, HP emerged as the leading Chromebook vendor worldwide, shipping approximately 1.67 million units. This growth is driven by the increasing demand for affordable, high-tech devices, particularly in the education sector, where students seek cost-effective yet efficient tools for learning.

The COVID-19 pandemic further accelerated Chromebook adoption, with over 30 million units shipped in 2020 as educational institutions and parents invested in devices suitable for remote learning. The combination of affordability, ease of use, and integration with Google's ecosystem has solidified Chromebooks' position in the global market, making them a preferred choice for both educational and personal use.

MARKET DRIVERS

Integration of Cloud-Based Applications

The seamless integration of Chromebooks with cloud-based applications has significantly enhanced their appeal. Users can access their data and tools from any location with internet connectivity by leveraging cloud storage and applications which is promoting flexibility and collaboration. For instance, a study by Google for Education found that 87% of teachers reported an increase in student engagement when using Chromebooks in the classroom, largely due to their ease of use and cloud capabilities. This cloud-centric approach reduces the need for extensive local storage and simplifies device management which is making Chromebooks particularly attractive to educational institutions and businesses seeking efficient and scalable solutions. The emphasis on cloud integration aligns with the increasing adoption of cloud services across various sectors and thereby further driving the demand for Chromebooks.

Affordability and Cost-Effectiveness

Chromebooks are recognized for their affordability and is offering a cost-effective alternative to traditional laptops. This economic advantage has been pivotal in their widespread adoption especially within the education sector. Educational institutions often operate under tight budgets, and the lower price point of Chromebooks enables schools to provide devices to a larger number of students and are facilitating one-to-one computing initiatives. The cost-effectiveness of Chromebooks extends beyond initial purchase prices by encompassing reduced maintenance expenses due to automatic updates and a lower susceptibility to malware and is resulting in long-term savings for institutions and individuals alike.

MARKET RESTRAINTS

Limited Offline Functionality

Chromebooks are primarily designed for cloud-based operations, which can limit their usability in environments with unreliable internet access. The overall user experience may be diminished without a stable connection and at the same time certain applications offer offline capabilities as well. In developing countries, the International Telecommunication Union (ITU) estimates that only 40% of rural areas have access to broadband internet which is making cloud-centric devices less practical for widespread use. This dependency restricts adoption in regions lacking robust internet infrastructure, potentially hindering market expansion.

Perceived Inferiority to Traditional Laptops

Despite advancements, Chromebooks are often perceived as less capable than traditional laptops running Windows or macOS. This perception stems from limitations in software compatibility and processing power, making them less suitable for resource-intensive tasks such as advanced video editing or gaming. For example, a study by G2, a software review platform found that only 30% of professional designers and video editors considered Chromebooks adequate for their workflows and is citing the lack of native support for industry-standard applications like Adobe Premiere Pro and Autodesk Maya. Consequently, consumers seeking versatile computing solutions may opt for traditional laptops, thereby constraining the Chromebook market's growth.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

The increasing emphasis on digital education in emerging economies presents a significant opportunity for Chromebook adoption. Governments and educational institutions in regions such as Asia, Africa, and Latin America are investing in affordable computing solutions to enhance learning outcomes. For example, UNESCO estimates that 70% of countries in Sub-Saharan Africa have launched national policies to integrate technology into education systems, with many prioritizing cost-effective devices like Chromebooks to bridge the digital divide. Chromebooks are known for their cost-effectiveness and ease of use and are also well-positioned to meet this demand. For instance, initiatives to integrate technology into classrooms can lead to substantial procurement of Chromebooks and thereby expanding their market presence.

Growth in Remote Work and Learning

The global shift towards remote work and online learning has heightened the demand for reliable, cloud-based devices. Chromebooks, with their seamless integration of cloud applications and robust security features, are increasingly becoming the device of choice for remote professionals and students. Similarly, a study by the International Labour Organization (ILO) revealed that 78% of remote workers globally prioritize tools that enable collaboration and data accessibility both of which are core strengths of Chromebooks due to their cloud-centric design. This trend is expected to continue, providing a sustained boost to Chromebook sales as organizations and educational institutions adopt long-term remote and hybrid models.

MARKET CHALLENGES

Short Lifespan and Limited Repairability

A notable concern is the relatively short lifespan of Chromebooks often due to hardware limitations and software support expiration dates. For instance, the Public Interest Research Group (PIRG) highlights that many Chromebooks have predetermined expiration dates, after which they no longer receive updates which is rendering them obsolete. This planned obsolescence leads to increased costs for educational institutions, as they must frequently replace devices. PIRG estimates that doubling the lifespan of the 48.1 million Chromebooks used by K-12 students in the U.S. could save taxpayers approximately $1.8 billion, assuming no additional maintenance costs.

Environmental Impact of Device Turnover

The rapid turnover of Chromebooks contributes to environmental concerns, particularly electronic waste. According to a report by the United Nations Institute for Training and Research (UNITAR), educational institutions alone account for approximately 11% of global e-waste with devices like Chromebooks being a significant portion of this waste stream. The same PIRG report emphasizes that the short lifespan of these devices leads to increased electronic waste, as schools and other institutions must frequently dispose of outdated models. This cycle not only strains financial resources but also has detrimental effects on the environment due to the accumulation of electronic waste.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.42% |

|

Segments Covered |

By Product, Screen Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Lenovo - Hong Kong, Dell - United States, Samsung - South Korea, HP (Hewlett-Packard) - United States, Acer – Taiwan, ASUS – Taiwan, Hisense – China, Haier – China, Google - United States, and CTL - United States. |

SEGMENTAL ANALYSIS

By Product Insights

The laptops segment dominated the market and accounted for 62.96% of the global market share in 2024. The domination of laptops segment in the global market is majorly attributed to extensive utilization of cloud computing, which enhances speed and performance. According to Google, Chromebooks boot up in an average of 8 seconds, significantly faster than the typical 30-45 seconds for Windows or macOS devices. Additionally, the absence of a need to store or execute software applications on the device's built-in storage space contributes to their efficiency. These advantages have led to increased student success, heightened engagement, and improved teacher-student interactions, making them particularly popular in educational settings.

The tablets segment is progressing rapidly and is likely to register a CAGR of 12.69% from 2025 to 2033. This surge is driven by their portability and versatility which is catering to users who prioritize lightweight devices that function efficiently as both a laptop and a tablet. The increasing demand for flexible computing solutions in educational and professional environments contributes to this segment's expansion. A case study from a European school system revealed that after introducing Chromebook Tablets, 85% of students reported improved engagement in interactive learning activities, while teachers noted a 30% reduction in device management challenges compared to traditional tablets. The appeal of devices that offer adaptability and ease of use is expected to continue driving the growth of Chromebook Tablets because the digital learning and remote work are becoming more prevalent.

By Screen Type Insights

The Touch Screen segment held the leading share of 52.4% in the global market in 2024. The versatility and enhanced user experience, particularly with the increasing popularity of convertible and 2-in-1 Chromebook models is primarily boosting the expansion of the segment in the global market. A case study from a U.S. school district showed that after adopting 2-in-1 Chromebooks and 80% of teachers reported improved student engagement during interactive lessons. The intuitive interface of touch screens appeals to users in educational and professional settings, facilitating interactive learning and efficient workflow management. The ability to navigate applications and content through touch inputs complements the cloud-based functionality of Chromebooks, making them a preferred choice for many consumers.

By Application Insights

The education segment led the market with 60.1% of the global market share in 2024 owing to the affordability, ease of use, and seamless integration of Chromebook with educational tools like Google Classroom. According to a report by UNESCO, 70% of schools worldwide that implemented 1:1 device programs chose Chromebooks because they provide equitable access to technology for students from diverse socioeconomic backgrounds. The devices' cloud-based nature reduces maintenance costs and enhances collaborative learning, making them a preferred choice for educational institutions aiming to provide accessible technology to students.

On the other hand, the corporate segment is estimated to grow at a CAGR of 9.23% over the forecast period owing to the increasing adoption from businesses seeking cost-effective, secure, and easily manageable devices for their workforce. A study by Cybersecurity Ventures found that 43% of cyberattacks target small businesses, making Chromebooks' enhanced security particularly attractive. Chromebooks offer robust security features, simplified IT management, and seamless integration with cloud-based applications, making them attractive for enterprises embracing remote work and cloud computing. The emphasis on data security and the need for scalable IT solutions contribute to the rising adoption of Chromebooks in the corporate environment.

REGIONAL ANALYSIS

North America held a dominant position in the Chromebook market with 53.8% of the global market share in 2024. The widespread adoption of Chromebooks in the education sector where institutions favor these devices for their affordability, ease of management, and compatibility with educational tools like Google Classroom led the market in North America in 2024. For example, a U.S.-based retail chain reported a 40% reduction in IT management costs after deploying Chromebooks across its workforce. The region's advanced technological infrastructure and emphasis on digital learning further bolster this trend.

The Asia-Pacific region is witnessing the fastest growth in the Chromebook market and is predicted to showcase a CAGR of 4.77% from 2025 to 2033. This rapid expansion is attributed to the increasing demand for affordable, cloud-centric computing solutions and particularly in the education sector. Developing economies in the region are investing heavily in digital education initiatives, and the rising digital literacy among the middle class is contributing to the growing adoption of Chromebooks. According to a study by UNESCO, 78% of countries in South Asia and Southeast Asia have launched national policies to integrate technology into classrooms, with Chromebooks being a popular choice due to their affordability and ease of use. The emphasis on cost-effective technology solutions in countries like India and China plays a significant role in this upward trajectory.

Europe has positioned itself as the second-largest market after North America. This substantial share is driven by the increasing adoption of Chromebooks in the education sector and among cost-conscious consumers. For instance, a study by European Schoolnet found that 70% of schools in Western Europe have integrated digital tools into their curricula, with Chromebooks being a popular choice due to their affordability and ease of integration with platforms like Google Classroom. European countries are leveraging Chromebooks for their affordability and cloud-based capabilities with manufacturers expanding their product offerings to meet diverse user needs.

Latin America is experiencing a steady increase in Chromebook adoption, supported by government initiatives to enhance digital education. A report by UNESCO highlights that 65% of Latin American countries have launched programs to integrate technology into classrooms, with Chromebooks being favored for their affordability and scalability. The accessibility of internet have improved and educational institutions are seeking cost-effective computing solutions which is expected to rise the demand for Chromebooks. The region's focus on integrating technology into classrooms presents significant growth potential for the Chromebook market.

The Middle East and Africa currently represent a smaller share of the global Chromebook market. However, ongoing investments in educational technology and efforts to improve internet infrastructure are creating opportunities for growth. For instance, a report by World Bank reveals that 80% of African governments have prioritized digital education as part of their national development plans, with affordable devices like Chromebooks being a key focus. The adoption of affordable and efficient computing solutions like Chromebooks is anticipated to increase because these regions continue to develop their digital capabilities.

KEY MARKET PLAYERS & COMPETITIVE LANDSCAPE

The major players in the global Chromebook market include Lenovo - Hong Kong, Dell - United States, Samsung - South Korea, HP (Hewlett-Packard) - United States, Acer – Taiwan, ASUS – Taiwan, Hisense – China, Haier – China, Google - United States, and CTL - United States.

The Chromebook market is characterized by intense competition among leading technology companies striving to capture market share through innovation, strategic partnerships, and targeted marketing efforts. Key players such as HP, Lenovo, Acer, Dell, Samsung, and ASUS are at the forefront of this competitive landscape.

HP has established a strong presence in the Chromebook market, particularly within the education sector, by offering devices that combine affordability with robust performance. Lenovo leverages its extensive global distribution network and brand reputation to appeal to both educational institutions and business users, contributing to its significant market share. Acer is recognized for its innovative designs and competitive pricing, attracting a broad consumer base seeking cost-effective computing solutions.

The competition among these companies drives continuous advancements in Chromebook technology, resulting in devices that offer improved performance, enhanced features, and greater value to consumers. This dynamic market environment benefits end-users by providing a diverse range of options tailored to various needs and preferences.

Top 3 Players in the Market

HP Inc.

HP has established itself as a leading Chromebook vendor, particularly excelling in the education sector. In the second quarter of 2024, HP shipped approximately 1.67 million Chromebooks, securing the top position in the global market. The company's success is attributed to its focus on delivering affordable and reliable devices tailored to educational institutions' needs.

Lenovo Group Limited

Lenovo has made significant strides in the Chromebook market, leveraging its strong global distribution network and brand reputation. In the same period, Lenovo maintained a substantial market share, shipping a considerable number of units worldwide. The company's diverse Chromebook portfolio appeals to both educational and business sectors, contributing to its robust market presence.

Acer Inc.

Acer has been a prominent player in the Chromebook market, known for its innovative designs and competitive pricing. In the third quarter of 2023, Acer led the market with a 25.3% share of global Chromebook shipments. The company's focus on lightweight and efficient devices has resonated with consumers seeking cost-effective computing solutions.

Top Strategies Used by the Key Market Participants

Product Innovation and Diversification

Leading companies such as HP, Acer, Lenovo, Dell, Samsung, and ASUS focus on developing innovative Chromebook models to cater to diverse consumer needs. For instance, HP introduced the Chromebook x2 11 and the Chromebase 21.5-inch All-in-One Desktop, expanding its Chrome OS ecosystem to offer greater agility and mobility for users in hybrid environments.

Strategic Partnerships and Collaborations

Industry participants emphasize collaborations and joint ventures to broaden their product offerings and reach new customer bases. These partnerships enable companies to enhance their market presence and leverage shared technologies to improve product quality and innovation.

Focus on the Education Sector

The education industry remains a primary driver of Chromebook adoption. Companies like HP and Lenovo tailor their devices to meet the specific needs of educational institutions, offering affordable, durable, and easy-to-manage Chromebooks compatible with educational tools such as Google Classroom. This focus has solidified their positions in the education sector, contributing significantly to their market share.

RECENT HAPPENINGS IN THE MARKET

- In October 2024, Samsung launched the Galaxy Chromebook Plus, featuring a 15.6-inch OLED display, Intel Core i3 processor, and advanced AI integrations such as "Help me write," "Help me read," and Live Translate. The model is priced at $699 and emphasizes portability and productivity features.

- In August 2024, CTL launched its Chromebook PX111E series for the educational sector. The series, starting at $265, offers an Intel Processor N100, 4 GB or 8 GB of RAM, and a 180-degree hinge, focusing on improved performance and security.

MARKET SEGMENTATION

This research report on the global Chromebook market is segmented and sub-segmented into the following categories.

By Product

- Laptops

- Convertibles

- Tablets

By Screen Type

- Touch Screen

- Non-Touch Screen

By Application

- Education Sector

- Corporate Sector

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the key factors driving Chromebook sales?

Affordable pricing, ease of use, security features, and seamless integration with Google Workspace make Chromebooks popular, especially in schools and businesses.

What are the primary use cases for Chromebooks?

Chromebooks are mainly used in education, remote work, cloud-based productivity, and lightweight personal computing.

What innovations are shaping the future of Chromebooks?

Advancements in ARM-based processors, touchscreen and 2-in-1 designs, better offline capabilities, and improved app compatibility are driving the next generation of Chromebooks.

How do Chromebooks compare to Windows and macOS laptops?

Chromebooks excel in simplicity, security, and affordability, while Windows and macOS laptops offer broader software compatibility and higher-end hardware options.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]