Global Chromatography Resin Market Size, Share, Trends & Growth Forecast Report By Type (Natural Polymer, Inorganic Media and Synthetic Polymer), Technique (Affinity, Hydrophobic Interaction, Ion Exchange, Size Exclusion and Multi-Modal), Application and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Chromatography Resin Market Size

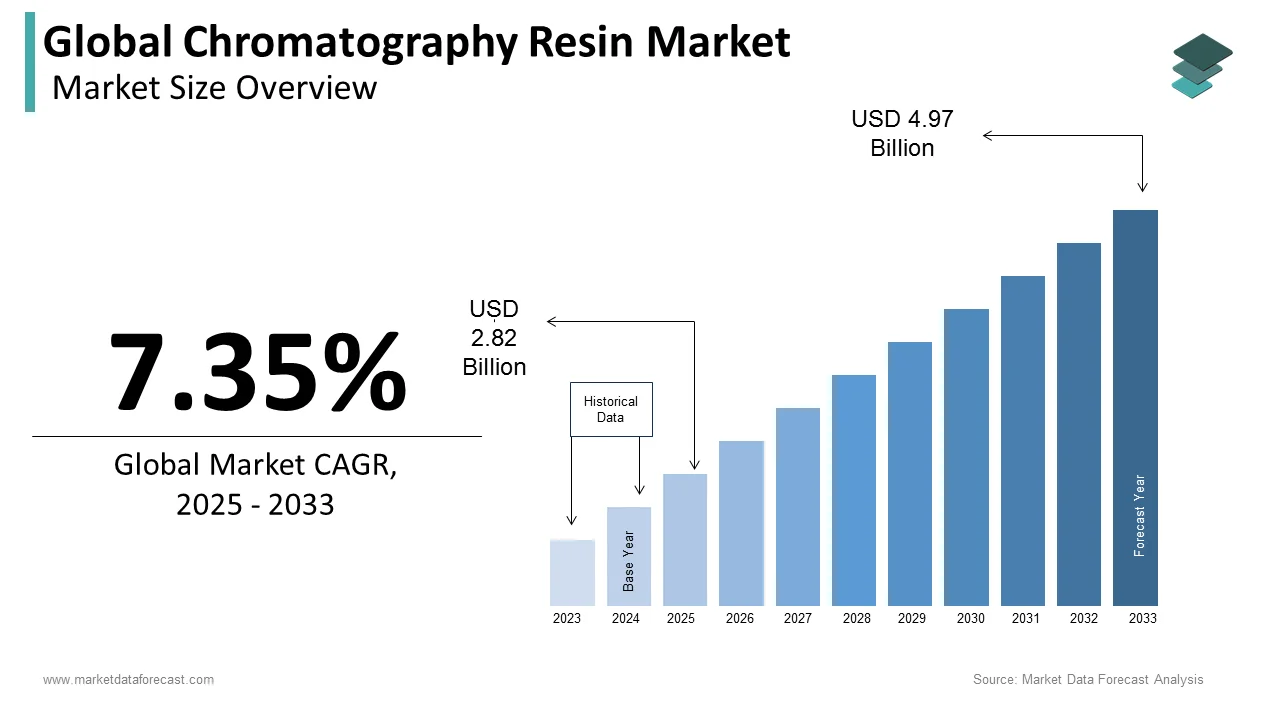

The size of the global chromatography resin market was worth USD 2.63 billion in 2024. The global market is anticipated to grow at a CAGR of 7.35% from 2025 to 2033 and be worth USD 4.97 billion by 2033 from USD 2.82 billion in 2025.

MARKET SCENARIO

Chromatography resins are used in the pharmaceutical industry for several purposes during manufacturing medicines, including chemical and biomolecular isolation, protein purification for drug delivery, and diagnostics. In addition, proteins and other biomolecules are purified and separated using chromatography resins in biotechnology, pharmacy, food processing, and environmental research. Synthetic, natural, and inorganic media are the three forms of chromatography resins. Agarose, cellulose, and dextran are examples of natural polymers, while ion exchange resins are examples of synthetic resins. Antibody manufacturing is growing in response to an increase in essential diseases worldwide. According to the World Health Organization, about 40 million people die yearly from noncommunicable diseases (NCDs), CVDs, stroke, infectious diseases, and diabetes mellitus, accounting for 81 percent of deaths. By 2025, mortality rates from NCDs are projected to rise by 17 percent.

MARKET DRIVERS

The growing demand for biopharmaceuticals is accelerating the chromatography resin market growth.

The need for biopharmaceuticals is growing significantly to address the growing disease burden of cancer, diabetes, and autoimmune disorders. As per the estimations by the American Cancer Society, an estimated 27.5 million new cancer cases are expected to be recorded per year by 2040, which is believed as a promising opportunity for the biopharmaceutical industry and is estimated to result in the growing demand for chromatography resins as these are used for purification and separation of biopharmaceuticals such as monoclonal antibodies, therapeutic antibodies, vaccines, gene therapies, and others. During the recent COVID-19 pandemic, the need for biopharmaceuticals has risen significantly for the R&D and manufacturing of COVID-19 vaccines and therapies, boosting the growth of the chromatography resin market.

The growing use of chromatography resins in diagnosing various diseases further propels the market’s growth rate.

Using chromatography resins is essential in purifying and separating blood and urine samples to diagnose various diseases. The growing demand for chromatography instruments is boosting the chromatography resin market growth. Chromatography has been used in various diagnostic applications, such as analyzing amino acids, proteins, and nucleic acids in biological samples. Chromatography resins play a vital role in the diagnosis of metabolic and genetic diseases and also in the monitoring of therapeutic drug levels in patients. The rising demand for personalized medicine is resulting in an increasing number of diagnostic tests and boosting the chromatography resin market growth.

In addition, the increasing adoption of food analytics contributes to chromatography resins growth. Nutraceuticals and food chemistry both use chromatography resins. In addition, food additives (adulteration) are detected using chromatography resins, which have become a significant concern in the food industry. The leading end-users of chromatography resins are biotechnology and pharmaceuticals, which are expected to grow in importance further. In addition to water management and environmental monitoring, chromatography resins are used in the industry. Genuine and synthetic chromatography resins are preferred to inorganic media.

MARKET RESTRAINTS

Despite the many uses, legislation related to these applications may significantly restrict the growth of the global chromatography resin market in the coming years. High costs associated with chromatography resins are limiting their adoption in some applications, which is majorly hampering the market growth. The scarcity of skilled professionals who can handle the operations of chromatography resins and the lack of access to the equipment required for chromatography in some countries are hindering the overall market's growth rate. The availability of alternative separation technologies impedes market growth. The stringent regulatory requirements, particularly in the biopharmaceutical industry, are another significant obstacle to the chromatography resin market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Technique, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Bio-Rad Laboratories Inc., GE Healthcare, Tosoh Corporation, Merck KGaA, Pall Corporation, Avantor Performance Materials Inc., Mitsubishi Chemical Corporation, Purolite Corporation, Repligen Corporation, and Thermo Fisher Scientific Inc. |

SEGMENTAL ANALYSIS

Global Chromatography Resin Market By Type

Based on type, the natural polymer segment is expected to lead the global chromatography resin market during the forecast period. The growing demand for biopharmaceuticals is majorly driving segmental growth. Due to the advantages associated with natural-based chromatography resins, such as high selectivity, binding capacity, and low cost, these resins are increasingly being used in the manufacturing of biopharmaceuticals. Natural-based chromatography resins are environmentally friendly, sustainable, and biodegradable and do not threaten the environment and human health. Due to this, these chromatography resins are growing substantially and boosting the segment's growth rate. The growing usage of natural-based chromatography resins in various applications such as food and beverage processing, water treatment, and drug discovery propels segmental growth.

On the other hand, the synthetic polymers segment is anticipated to showcase the fastest CAGR in the global chromatography resin market.

Global Chromatography Resin Market By Technique

Based on technique, the ion exchange segment had the largest share of the global chromatography resin market in 2024. The growing number of drug developmental activities by pharmaceutical companies and CROs primarily fuel the segment’s growth rate. The growing usage of ion-exchange chromatography in various applications such as F&B, chemicals, and pharmaceutical industries is further fuelling the segment's growth. The growth of the segment is further supported by the rising usage of monoclonal antibodies for therapeutic needs.

The affinity segment is predicted to hold a considerable share of the worldwide market in 2024 and is expected to grow at a noteworthy CAGR during the forecast period. The growing number of investments by governmental and non-governmental organizations in favor of the affinity chromatography technique is propelling segmental growth.

Global Chromatography Resin Market - By Application

Based on the application, the pharmaceutical and biotechnology segment accounted for the largest share of the global chromatography resin market in 2024 and is expected to continue the trend during the forecast period. Pharmaceutical and biotechnology companies are the largest consumers of chromatography resins and are majorly driving segmental growth.

The F&B segment had the second-largest share of the global market in 2024 and is expected to grow at a prominent CAGR during the forecast period. Increasing awareness among consumers around food safety and quality is driving the demand for chromatography resins and boosting segmental growth.

REGIONAL ANALYSIS

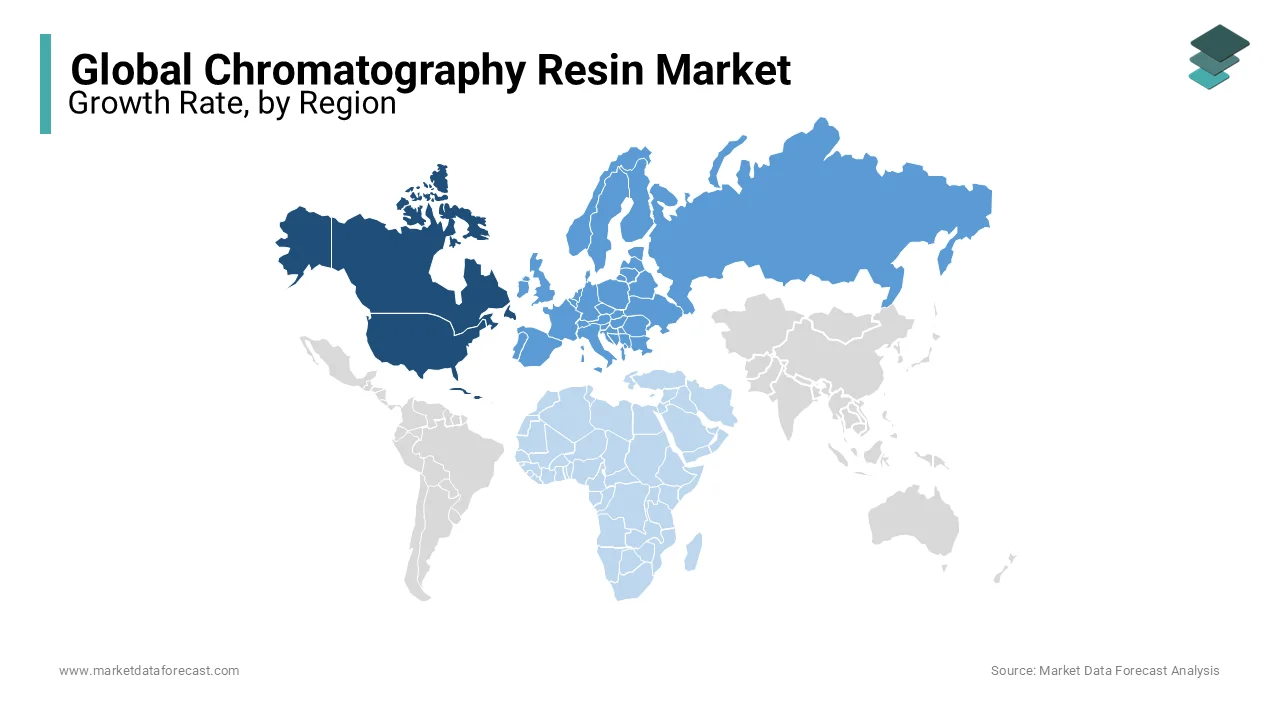

The North American chromatography resin market captured the most significant share of the worldwide market in 2024 and is expected to continue dominating the market during the forecast period. The growth of the North American market is driven by the presence of key market participants, an increasing number of pharmaceutical companies and CROs, and rising demand for biopharmaceuticals. The growing patient count suffering from genetic and metabolic diseases propels regional market growth. The U.S. held the major share of the North American market in 2024, followed by Canada.

The Europe chromatography resin market is another promising regional market for chromatography resin globally and is estimated to register a noteworthy CAGR during the forecast period. The presence of sophisticated healthcare infrastructure and a growing number of R&D activities by pharmaceutical companies are promoting the European market growth. The German market is anticipated to capture the major share of the European market during the forecast period owing to the increasing number of drug discovery activities by pharmaceutical companies.

The APAC chromatography resin market is estimated to showcase the fastest CAGR among all the regions in the worldwide market during the forecast period and occupies a substantial share of the worldwide market in 2024. Japan is expected to hold the leading share of the APAC market and is also likely to witness the highest CAGR during the forecast period.

The Latin American chromatography resin market is expected to grow steadily during the forecast period.

The MEA chromatography resin market is predicted to hold a moderate share of the global market in the coming years.

KEY MARKET PARTICIPANTS

Some of the promising companies operating in the global chromatography resin market profiled in the report are Bio-Rad Laboratories Inc., GE Healthcare, Tosoh Corporation, Merck KGaA, Pall Corporation, Avantor Performance Materials Inc., Mitsubishi Chemical Corporation, Purolite Corporation, Repligen Corporation, and Thermo Fisher Scientific Inc.

RECENT MARKET DEVELOPMENTS

- On January 10, 2019, one of the key players in the chromatography resin market Tosoh Corporation, collaborated with Semba Biosciences, Inc. This acquisition is to expand the business in bioscience.

- On March 18, 2020, Avantor Inc., a leading company in providing mission-critical products and services to customers in the Lifesciences, launched a new protein chromatography resin named PROchieva. This product is a new recombinant protein, An affinity chromatography resin that helps purify antibodies during mAbs production.

DETAILED SEGMENTATION OF THE GLOBAL CHROMATOGRAPHY RESIN MARKET INCLUDED IN THIS REPORT

This market research report on the global chromatography resin market has been segmented and sub-segmented into the following categories.

By Type

- Natural Polymer

- Inorganic media

- Synthetic Polymer

By Technique

- Affinity

- Hydrophobic Interaction

- Ion Exchange

- Size Exclusion

- Multi-Modal

By Application

- Pharmaceutical & Biotechnology

- Food & Beverage

- Water & Environmental Analysis

Frequently Asked Questions

Which segment by technique led the chromatography resin market in 2024?

Based on the application, the ion exchange segment dominated the global chromatography resin market in 2024.

How much is the global chromatography resin market going to be worth by 2033?

The global chromatography resin market size is estimated to be worth USD 4.97 billion by 2033.

Which segment by type is estimated to grow the fastest in the chromatography resin market in the coming future?

Based on type, the natural polymer segment is predicted to showcase the fastest growth rate among all in the global chromatography resin market from 2025 to 2033.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]