Global Chestnut Market Size, Share, Trends, Growth Forecast Report - Segmented By Species Type (Chinese Chestnut, European Chestnut, American Chestnut, Japanese Chestnut), Distribution Channel, Application, Region (North America, Europe, Asia-Pacific, Latin America, Middle East And Africa) – Industry Analysis From 2025 to 2033

Global Chestnut Market Size

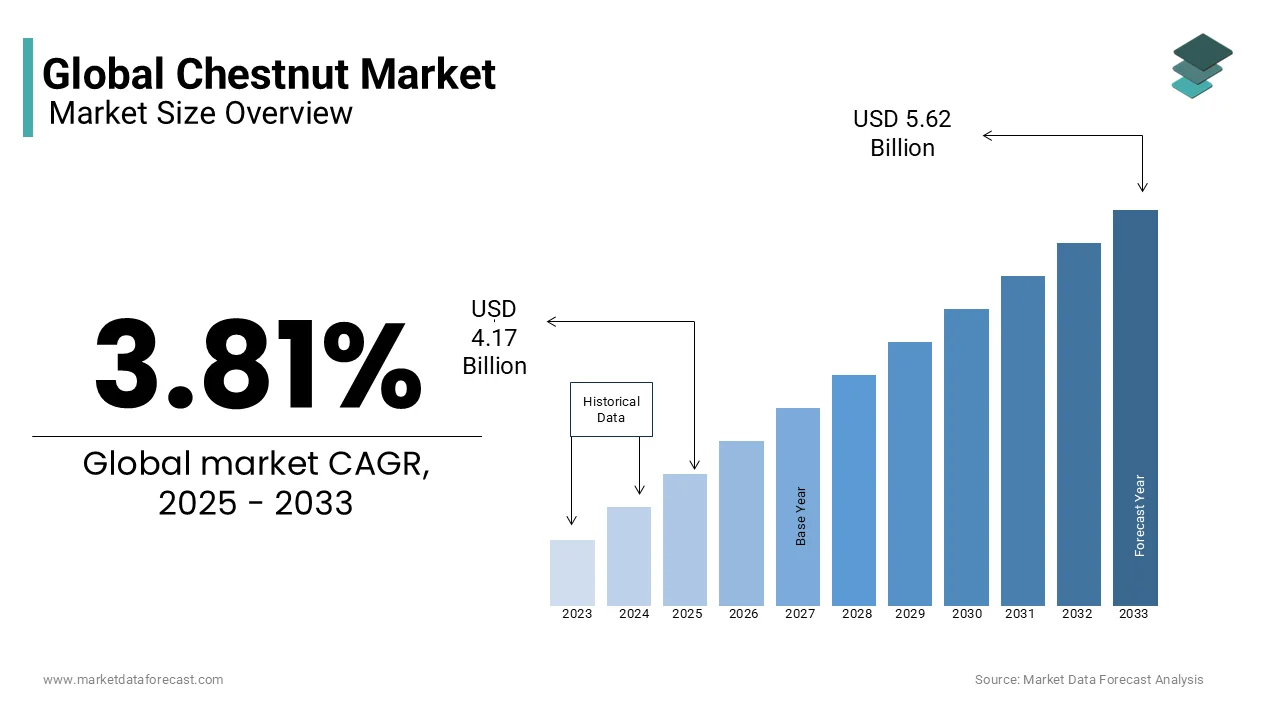

The global Chestnut market size was valued at USD 4.02 billion in 2024 and is projected to grow from USD 4.17 billion in 2025 to USD 5.62 billion by 2033, the market is expected to grow at a CAGR of 3.81% during the forecast period.

Unlike other nuts, chestnuts are low in fat but rich in complex carbohydrates, making them a unique staple food in various culinary traditions. These nutrient-dense nuts are highly valued for their high fiber content, vitamin C levels, and antioxidant properties, which contribute to their increasing popularity in both traditional and health-conscious diets. Globally, chestnut cultivation spans across temperate regions, with the highest production concentrated in Asia, Europe, and North America. China leads global production, accounting for over 70% of the world’s chestnut output, according to the Food and Agriculture Organization (FAO). Other key producing countries include Turkey, Italy, South Korea, and Spain. The United States primarily cultivates chestnuts in states like Michigan, Oregon, and California, where there is a growing interest in reviving domestic production.

From a nutritional standpoint, chestnuts are an excellent source of dietary fiber, with 100 grams providing approximately 5 grams of fiber, which aids digestion and gut health. Unlike other nuts, they have a high-water content (40-50%), making them more perishable but also useful for fresh consumption. Furthermore, one cup of roasted chestnuts provides about 45% of the recommended daily intake of vitamin C, making them unique among tree nuts. The growing interest in sustainable agriculture has also led to an emphasis on blight-resistant chestnut varieties, particularly in North America, where efforts to restore the American Chestnut Tree (Castanea dentata) are ongoing through genetic and hybrid breeding research.

MARKET DRIVERS

Increasing Demand for Nutritious Snacks

The global shift towards healthier eating habits has significantly driven the chestnut market. Chestnuts are rich in fiber, vitamins, and minerals, making them a popular choice among health-conscious consumers. According to the United States Department of Agriculture (USDA), tree nut consumption, including chestnuts, has seen steady growth, with per capita consumption increasing by approximately 10% from 2015 to 2020. The USDA's dietary guidelines emphasize the importance of nutrient-dense foods, aligning with the growing consumer preference for healthier snacks. Additionally, the Food and Agriculture Organization (FAO) reports that global chestnut production reached around 2 million metric tons in 2020, reflecting consistent demand. This rise is fueled by increased awareness of chestnuts' low-fat content and high nutritional value, making them an appealing alternative to other snacks.

Expansion of Culinary Applications

Chestnuts are gaining popularity in culinary applications, driving market growth significantly. Their versatility allows them to be used in both traditional and modern dishes, such as gluten-free flour, vegan desserts, and savory recipes. The European Commission's Directorate-General for Agriculture and Rural Development highlights that the EU is a major producer and consumer of chestnuts, with Italy and France leading the way. Eurostat data confirms that Italy produced approximately 30,000 tons of chestnuts in 2020, underscoring its significance in the region. The rise of food tourism and cultural festivals celebrating chestnuts, such as the "Castagnata" in Italy, has further boosted their visibility and consumption. These trends, combined with innovative uses in global cuisine, have expanded the culinary footprint of chestnuts worldwide.

MARKET RESTRAINTS

Limited Shelf Life and Storage Challenges

One significant restraint in the chestnut market is the limited shelf life of fresh chestnuts, which complicates storage and transportation. Chestnuts are highly perishable due to their high moisture content, making them prone to mold and spoilage if not stored under controlled conditions. The United States Department of Agriculture (USDA) highlights that improper post-harvest handling can lead to significant quality degradation, with moisture loss and microbial growth being primary concerns. While specific percentages for quality loss are not consistently documented, the USDA emphasizes the need for refrigeration or controlled atmosphere storage to preserve freshness. Additionally, the Food and Agriculture Organization (FAO) notes that inadequate post-harvest infrastructure contributes to losses in perishable crops, including chestnuts, particularly in developing regions. These challenges increase costs for producers and limit market expansion in areas lacking cold storage facilities, impacting supply chain efficiency.

Vulnerability to Climate Change and Pests

Chestnut production faces significant threats from climate change and pest infestations, acting as major restraints for the market. The European Commission's Directorate-General for Agriculture and Rural Development reports that chestnut blight, caused by the fungus Cryphonectria parasitica , remains a persistent issue, particularly in Southern Europe. This disease has historically reduced yields in affected orchards by up to 50%, according to studies published by the European Plant Protection Organization (EPPO). Furthermore, the Intergovernmental Panel on Climate Change (IPCC) highlights that rising temperatures and irregular rainfall patterns disrupt traditional growing cycles. For instance, Portugal experienced a 10% decline in chestnut production in 2021 due to prolonged droughts, as reported by the Portuguese Directorate-General for Agriculture and Rural Development. These environmental challenges increase production costs and threaten long-term sustainability, limiting market growth potential.

MARKET OPPORTUNITIES

Growing Demand for Plant-Based and Gluten-Free Products

The rising global demand for plant-based and gluten-free products presents a significant opportunity for the chestnut market. Chestnuts are naturally gluten-free and can be processed into flour, making them an ideal ingredient for gluten-free baking and vegan diets. Additionally, the Food and Agriculture Organization (FAO) highlights that the plant-based food sector is expanding rapidly, with Europe and North America leading adoption. In Europe, Italy and France have seen steady growth in chestnut-derived products, with Eurostat reporting a 4% annual increase in exports of processed chestnuts between 2018 and 2021. This positions chestnuts as a versatile, nutrient-rich alternative in these growing markets.

Expansion into Emerging Markets

Emerging markets in Asia, Africa, and Latin America offer untapped potential for the chestnut industry, driven by rising disposable incomes and changing dietary preferences. The Food and Agriculture Organization (FAO) reports that China accounts for approximately 85% of global chestnut production, reflecting its dominance and cultural integration of chestnuts in diets. Furthermore, the African Development Bank highlights that Africa’s middle class, currently estimated at 350 million people, is expected to grow significantly by 2060, creating demand for nutritious and affordable food options. Chestnuts, being rich in nutrients and adaptable to diverse cuisines, align well with these trends. Additionally, the USDA Foreign Agricultural Service notes that U.S. tree nut exports, including chestnuts, to emerging markets grew by 6% in 2021, reflecting increasing acceptance. By targeting these regions, the chestnut market can leverage globalization and dietary shifts for sustained growth.

MARKET CHALLENGES

Fluctuating Production Due to Weather Variability

Chestnut production is highly sensitive to weather conditions, making it vulnerable to fluctuations caused by climate variability. The Intergovernmental Panel on Climate Change (IPCC) highlights that irregular rainfall patterns and extreme weather events, such as droughts and frosts, have significantly impacted nut crops, including chestnuts. For instance, in 2021, Portugal experienced a notable decline in chestnut yields due to prolonged droughts, with the Portuguese Directorate-General for Agriculture and Rural Development reporting a 10% reduction in production compared to the previous year. Similarly, the United States Department of Agriculture (USDA) notes that erratic weather has led to inconsistent harvests in key chestnut-producing states like Michigan and California, where frost events have occasionally damaged flowering trees. These fluctuations disrupt supply chains and create price volatility, posing challenges for producers and retailers. As climate change intensifies, the chestnut market faces increasing uncertainty, requiring adaptive measures to mitigate risks and stabilize production.

Competition from Substitute Products

The chestnut market faces stiff competition from substitute products, such as other tree nuts and processed snacks, which limits its growth potential. According to the United States Department of Agriculture (USDA), almonds, walnuts, and pistachios dominate the global nut market, with almonds alone accounting for over 30% of total tree nut production in 2021. These substitutes often benefit from larger-scale production and aggressive marketing campaigns, overshadowing chestnuts. Chestnuts, being less familiar to many consumers, struggle to compete in terms of brand recognition and accessibility. This competitive pressure forces chestnut producers to invest heavily in marketing and product innovation to carve out a niche in an increasingly crowded market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.81% |

|

Segments Covered |

By Species Type, Distribution Channel, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Chengde Shenli Food Co. Ltd., ConAgra Foods Inc, Chestnut Growers Inc, Shandong Zhifeng Foodstuffs Co., Ltd, Tangshan Goldentang Food Co., Ltd, Qinhuangdao Yanshan Chestnut Co., Ltd., Roland Foods LLC, Clément Faugier, Route 9 Cooperative, Battistini Vivai, and others. |

SEGMENTAL ANALYSIS

By Species Type Insights

The Chinese Chestnut segment dominated the market by accounting for 85.5% of global market share in 2024. China produces approximately 1.5 million metric tons annually, driven by its favorable climate, long-standing cultivation practices, and high domestic consumption. The species' resilience to pests and adaptability to diverse growing conditions make it a preferred choice for farmers. According to the Chinese Ministry of Agriculture and Rural Affairs, exports of Chinese chestnuts grew by 4% in 2021, underscoring their global importance. The segment's leadership ensures price stability and supply chain efficiency, making it critical to meeting international demand.

Whereas, the American Chestnut segment is predicted to witness the fastest CAGR of 5.5% over the forecast period due to the restoration efforts and increasing interest in native crops. The USDA Forest Service highlights that conservation programs have successfully reintroduced blight-resistant varieties, boosting production potential. Additionally, rising consumer demand for locally sourced and sustainable foods supports adoption. The American Chestnut Foundation reports that over 70,000 blight-resistant trees have been planted since 2020, enhancing supply capacity. This segment's resurgence is vital for biodiversity and regional agricultural economies, positioning it as a key player in niche markets.

By Distribution Insights

The hypermarkets and supermarkets segment was at the forefront of the chestnut market by accounting for 40.7% of global market share in 2024. The widespread reach, convenience, and ability of hypermarkets and supermarkets to offer fresh and processed chestnuts under one roof is one of the key factors propelling the segmental expansion. The USDA highlights that over 50% of consumers prefer purchasing nuts from these outlets due to competitive pricing and product variety. Additionally, Eurostat data shows that supermarket sales of specialty foods, including chestnuts, grew by 2.5% annually between 2019 and 2021. This channel's importance lies in its ability to cater to both urban and rural populations, ensuring consistent availability and boosting consumer trust through established brands.

On the other hand, the online stores segment is anticipated to register a CAGR of 7.8% over the forecast period owing to the rising e-commerce adoption and increasing demand for home-delivered groceries. The USDA Foreign Agricultural Service notes that online sales of specialty and organic products, including chestnuts, surged by 20% during the pandemic and have remained strong post-2021. Additionally, Statista reports that global online grocery sales reached $120 billion in 2022, reflecting shifting consumer preferences. Online platforms provide convenience, wider accessibility, and detailed product information, attracting health-conscious buyers. This segment's rapid expansion underscores its importance in reaching tech-savvy consumers and expanding the chestnut market's global footprint.

By Application Insights

The food and beverage segment was the largest application segment in the chestnut market by contributing 75.5% of global market share in 2024. Chestnuts are widely used in culinary applications, including gluten-free flour, snacks, and traditional dishes, due to their nutritional value and versatility. The USDA highlights that global consumption of plant-based foods, including chestnuts, grew by 8% annually from 2018 to 2021. This segment's dominance is driven by rising health-conscious consumer trends and the growing popularity of gluten-free diets. Its importance lies in its ability to cater to diverse dietary preferences while supporting sustainable agricultural practices.

The cosmetic segment is predicted to register a CAGR of 6.2% over the forecast period due to the increasing demand for natural and organic ingredients in skincare and haircare products. The European Commission notes that the global natural cosmetics market reached $10 billion in 2022, with chestnut extracts gaining popularity for their antioxidant and moisturizing properties. Additionally, the USDA Foreign Agricultural Service highlights that exports of plant-based cosmetic ingredients grew by 12% in 2021. Chestnuts' unique composition makes them ideal for anti-aging and hydrating formulations, attracting eco-conscious consumers. This segment's rapid expansion underscores its potential to drive innovation and diversify the chestnut market's applications.

REGIONAL ANALYSIS

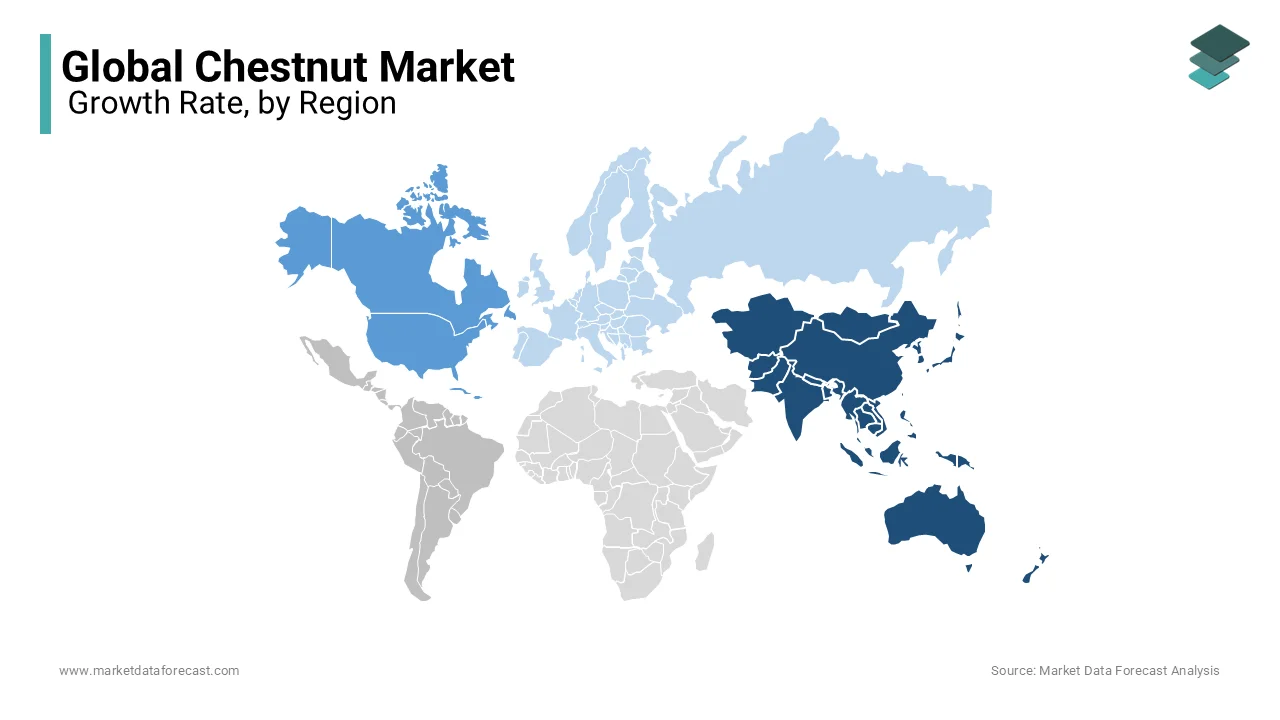

The Asia-Pacific region dominated the chestnut market in 2024. China is the largest contributor, producing approximately 1.8 million metric tons annually, driven by its cultural integration of chestnuts in traditional cuisines and festivals. The region's dominance stems from favorable climatic conditions, established cultivation practices, and robust domestic consumption. According to the Chinese Ministry of Agriculture and Rural Affairs, chestnut exports from China grew by 5% in 2021, underscoring its global importance. The region’s leadership ensures price stability and supply chain efficiency, making it pivotal for global chestnut trade.

Latin America is the fastest-growing segment in the chestnut market with a projected CAGR of 5.8%. This growth is fueled by increasing demand for gluten-free and plant-based products, particularly in countries like Brazil and Argentina. Rising urbanization and health-conscious consumer trends are driving adoption. Additionally, the USDA Foreign Agricultural Service highlights that Latin America’s chestnut exports to North America and Europe grew by 10% in 2022, reflecting its expanding role in global markets. Investments in sustainable farming practices further boost production capacity, positioning the region as a key player in meeting future demand.

North America is a steadily growing market for chestnuts, driven by increasing consumer interest in plant-based and gluten-free diets. According to the United States Department of Agriculture (USDA), U.S. chestnut imports have grown by approximately 3% annually since 2019, reflecting rising domestic demand. The USDA also notes that local production remains limited, with Michigan being the largest producer, accounting for roughly 40% of U.S. chestnut output. However, supply gaps are met through imports from China and Europe. The region's focus on organic and specialty foods has bolstered chestnut consumption, particularly during the holiday season. Looking ahead, the USDA projects steady growth, supported by urbanization and health-conscious trends.

Europe holds a significant share of the global chestnut market, with countries like Italy, France, and Spain leading production. Eurostat reports that Italy produces around 25,000 to 30,000 tons annually, primarily for domestic consumption and export. Chestnuts are deeply embedded in European culinary traditions, supporting stable demand. Eurostat data highlights a 2% annual increase in processed chestnut exports from the EU between 2018 and 2021, driven by innovation in gluten-free products.

The Middle East and Africa represent a niche but emerging market for chestnuts, with slower growth due to limited production infrastructure. The African Development Bank highlights that chestnut cultivation is gaining traction in countries like Morocco and South Africa, where favorable climates exist. However, production remains minimal, contributing less than 1% to global output. In the Middle East, chestnuts are primarily imported from Asia-Pacific and Europe, with a growing preference for gourmet and health-focused products. Despite challenges, increased agricultural investments and urbanization could drive regional demand. The African Development Bank projects a potential 3-4% annual growth in chestnut consumption post-2025, as dietary diversification gains momentum.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Chengde Shenli Food Co. Ltd., ConAgra Foods Inc, Chestnut Growers Inc, Shandong Zhifeng Foodstuffs Co., Ltd, Tangshan Goldentang Food Co., Ltd, Qinhuangdao Yanshan Chestnut Co., Ltd., Roland Foods LLC, Clément Faugier, Route 9 Cooperative, Battistini Vivai are playing dominating role in the global chestnut market.

The global chestnut market is characterized by moderate to high competition, with key players vying for market share through product innovation, geographic expansion, and sustainability initiatives. China dominates the industry, accounting for over 70% of global production, making Chinese suppliers such as Chengde Shenli Food Co., Ltd. leading players in the market. Other significant contributors include Clément Faugier (France) and Amisa (UK), which focus on value-added chestnut products.

Competition is primarily driven by the increasing demand for organic and gluten-free food products, leading companies to innovate with new product forms like chestnut flour, purée, and ready-to-eat snacks. Additionally, companies are differentiating themselves by adopting sustainable farming practices and investing in advanced processing technologies to improve quality and shelf life.

European and North American markets present growing opportunities, as chestnuts gain popularity among health-conscious consumers. However, barriers such as seasonal production, climate-related risks, and supply chain disruptions pose challenges to new entrants.

Mergers and acquisitions, along with strategic partnerships, are commonly used by key players to strengthen distribution networks and expand their market reach. With increasing investment in research and development, the competitive landscape is expected to intensify as companies strive to meet evolving consumer preferences.

STRATEGIES USED BY THE MARKET PLAYERS

Product Innovation and Diversification

Companies are focusing on developing new chestnut-based products to cater to evolving consumer preferences. This includes introducing items like chestnut flour, puree, and ready-to-eat snacks, which appeal to health-conscious consumers and those seeking gluten-free alternatives. By expanding their product portfolios, companies can attract a broader customer base and meet diverse dietary needs.

Mergers and Acquisitions

To enhance market share and expand their geographical presence, key players are engaging in mergers and acquisitions. These strategic moves allow companies to access new markets, acquire advanced technologies, and benefit from established distribution networks. Such consolidation efforts contribute to increased competitiveness and operational efficiency.

Geographic Expansion

Expanding into new regions is a common strategy among leading chestnut companies. By entering emerging markets and establishing a presence in high-demand areas, companies can tap into new customer segments and increase their global footprint. This approach helps in mitigating risks associated with market saturation in existing regions and capitalizing on growth opportunities elsewhere.

TOP 3 PLAYERS IN THE MARKET

Chengde Shenli Food Co., Ltd.

Chengde Shenli Food Co., Ltd. is a leading Chinese company specializing in the cultivation, processing, and export of chestnuts. China is the world's largest producer of chestnuts, accounting for approximately 73.3% of global production. Chengde Shenli Food Co., Ltd. contributes significantly to this output by offering a wide range of chestnut products, including fresh, dried, and processed varieties. The company's extensive supply chain and commitment to quality have established it as a major player in the international chestnut market.

Clement Faugier

Clément Faugier is a renowned French company with a rich history in chestnut processing. Established in 1882, the company is famous for its marrons glacés (candied chestnuts) and chestnut purée. France is among the top exporters of chestnuts globally, contributing approximately 6.3% to the world's chestnut exports. Clément Faugier's dedication to traditional methods and high-quality products has made it a significant contributor to the global chestnut industry.

Amisa

Amisa is a UK-based company specializing in organic and gluten-free products, including chestnut-based items. The company offers chestnut flour and other related products catering to health-conscious consumers and those with dietary restrictions. While the United Kingdom is not a major producer of chestnuts, companies like Amisa play a crucial role in importing and popularizing chestnut products in markets with limited domestic production. Their focus on organic and specialty foods contributes to the diversification and growth of the global chestnut market.

RECENT HAPPENINGS IN THE MARKET

- In October 2024, Greece, one of the world's leading chestnut producers, reported a significant decrease in chestnut yields. Extreme heat and prolonged drought conditions led to an anticipated 50% reduction in the national harvest, with some regions expecting up to a 90% decline. This situation underscores the broader impact of climate change on agriculture in southern Europe.

- In April 2024, Japanese confectionery maker Shinkinedo expanded into the beauty industry with the launch of "Chetna," a hair care brand. The products utilize upcycled chestnut skin, known for its anti-aging, antibacterial, and antioxidant properties, to promote hair growth.

MARKET SEGMENTATION

This research report on the global Chestnut market has been segmented and sub-segmented based on material, species type, application, distribution channel, application, and region.

By Species Type

- American Chestnut

- Chinese Chestnut

- European Chestnut

- Japanese Chestnut

By Distribution Channel

- Hypermarket and Supermarkets

- Convenience stores

- Online Stores

- Others

By Application

- Food and Beverage Industry

- Cosmetic Industry

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]