Global Chemical Tankers Market Size, Share, Trends & Growth Forecast Report - Segmentation by Product Type (Organic Chemicals, Inorganic Chemicals, Vegetable Oils & Fats), Fleet Type (IMO 1, IMO 2, IMO 3), Fleet Material (Stainless Steel, Coated), and Region (North America, Europe, Asia Pacific, Latin America, Middle east and Africa) – Industry Analysis (2024 to 2032)

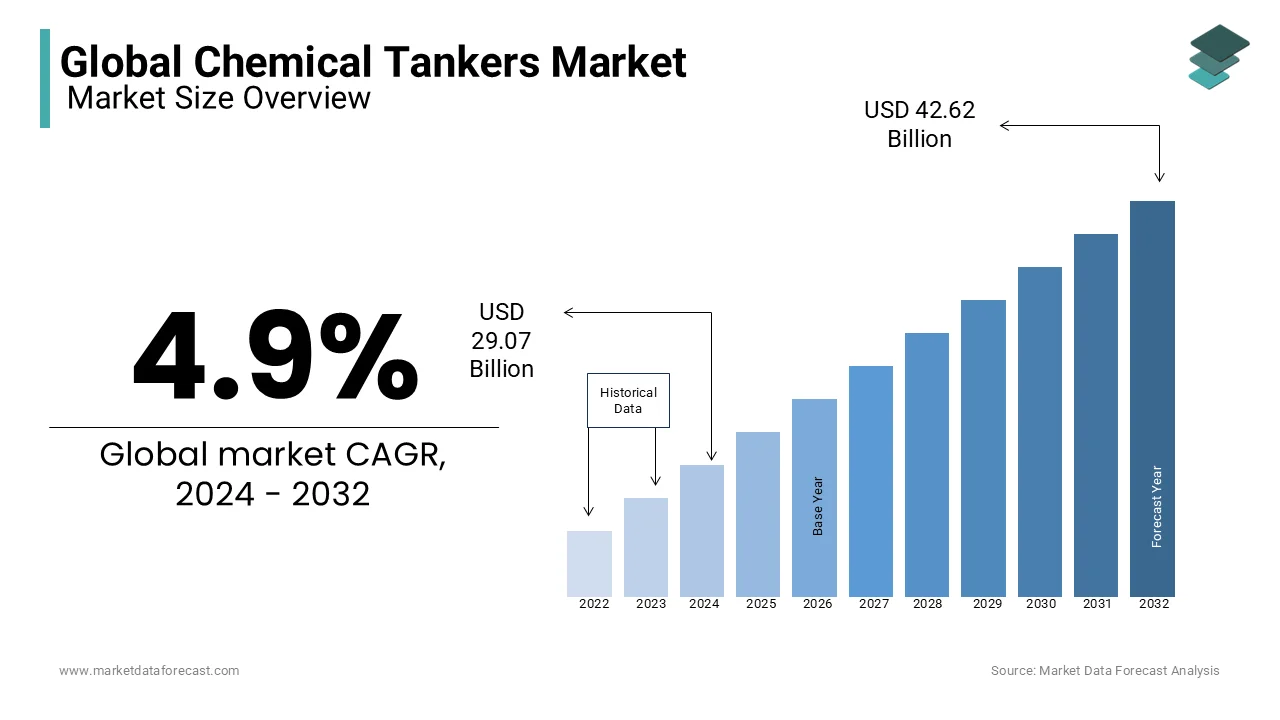

Global Chemical Tankers Market Size (2024 to 2032)

The Global Chemical Tankers Market size is expected to reach USD 29.07 billion in 2024 and is anticipated to reach a valuation of USD 42.62 billion by 2032, and is predicted to register a CAGR of 4.9% from 2024 to 2032.

Current Scenario of the Global Chemical Tanker Market

The high concentration of chemical production and the growing call worldwide are primarily responsible for the expansion of the market.

Chemical tankers are cargo ships designed to transport chemicals in bulk. These tanker trucks transport chemicals in different ways. In addition, these tankers must comply with the International Code of Bulk Chemicals (IBC Code), which defines them in three types: ST1, ST2, and ST3. ST1 carries flammable or toxic hazardous chemicals. ST2 carries chemicals with critical preventive measures. ST3 carries chemicals that require a moderate degree of contaminants. These tanker trucks help maintain the consistency of chemicals that must be transported worldwide. Additionally, these tank trucks are coated with specialized substances to determine which chemicals to ship. Tanker truck lining plays a crucial role in the transportation of chemicals due to its dangerous nature and different properties. The high concentration of chemical production and the growing call worldwide are primarily responsible for the expansion of the market. Shale gas evolution is one of the essential factors positively influencing market expansion. Organic chemicals have a wide base of applications and are attracting considerable interest due to their potential industrial uses. The participation of significant commercial activities, coupled with low charter rates for inland waterway transport, is predicted to stimulate the market during the foreseen period. Fleet operators offer innovative technology solutions to stimulate the worldwide supply of chemical tankers.

MARKET DRIVERS

The escalating development of the chemical industry is the main expansion engine of the worldwide chemical tankers market. The expansion of the chemical industries leads to the production of chemicals on a large scale, which in turn contributes to the growing call for chemical tanker trucks. Additionally, escalating call for vegetable fats, oils, and oilseeds is also predicted to drive the expansion of the global chemical tanker market during the foreseen period. Additionally, rising stringent regulations regarding the safe shipment of hazardous chemicals are also contributing to this market expansion. In addition, the call for stainless steel chemical tanker trucks has also escalated as these tanker trucks offer better resistance to chemicals. The thriving chemical industry and the growing capabilities of chemical manufacturers are driving calls for chemical tanker trucks around the world. Furthermore, the escalating call for vegetable oils and fats is also predicted to drive the expansion of the global chemical tanker market during the foreseen period.

MARKET RESTRAINTS

Environmental regulations, politics, rising costs, increased security issues and real-time tracking are hindering the expansion of the chemical tankers market growth. The tightened laws and restrictions on exhaust gas emitted by ships affect the weather and public health. For example, carbon dioxide (CO2), sulfur oxide (Sox), nitrogen oxide (NOx) and particular matter are released by vessels. Many shipping and insurance companies have increased their costs due to increased government or international pressure which is hurting the growth of the chemical tankers market size. Additionally, Marpol Annex VI restrictions with the strict requirements by the International Maritime Organization (IMO) to curb greenhouse gas discharges by at least 50 per cent by 2050.

The rising geopolitical tensions in various regions worldwide have significantly affected the security of the shipping industry. Similarly, the current disruption of shipping in the Red Sea is causing serious damage to the chemical industry's supply chain. Moreover, after COVID-19, the Russia-Ukraine war and trapped cargos at berth in the Black Sea are increasing the transportation of chemical tankers.

Furthermore, the increase in ocean freight rates and new ship-building prices is another factor derailing the growth of the chemical tanker market.

MARKET OPPORTUNITIES

The escalation in the international trade of chemicals and petrochemical products is enhancing the demand for efficient and safe transportation, which is accelerating the demand for chemical tankers, creating growth opportunities in the market. The increased utilization of chemicals in various industries such as agriculture, pharmaceuticals, manufacturing, and other industries is expected to propel the global market growth opportunities during the forecast period. There are wide complexities in the transportation of liquid chemicals such as acids, edible oils, alcohols, biofuels, and others that are too complex to handle, hazardous, corrosive, and even explosive. All these factors are increasing the demand for chemical tankers by providing market growth opportunities.

MARKET CHALLENGES

The slow expansion of crude oil manufacturing and the formulation and enforcement of petroleum fueling laws, such as conducting proper risk assessments and implementing proper spill and leak containment functions. They are a constraint on the worldwide market for chemical tankers. Low worldwide crude oil prices and declining exploration capital investment in recent years have led to the slow development of the crude oil market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

4.9% |

|

Segments Covered |

By Product, Fleet Type, Fleet Material, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East and Africa, and Others. |

|

Market Leaders Profiled |

Bahri (Saudi Arabia), Stolt-Nielsen (UK), Odfjell (Norway), Navig8 (UK), MOL Chemical Tankers (Singapore), Nordic Tankers (Denmark), Wilmar International (Singapore), MISC Berhad (Malaysia), Team Tankers (Bermuda), and Iino Kaiun Kaisha (Japan)., and Others. |

SEGMENTAL ANALYSIS

Chemical Tankers Market By Product

The organic segment held the most significant share in the global chemical tankers market and is estimated to maintain domination during the forecast period.

The increased usage of chemical tankers in various industries such as pharmaceuticals, petrochemicals, and plastics, where the manufacturing unit requires these tankers to store chemicals, augmenting the segment growth rate. The growing demand for various chemicals for different applications such as personal care and cosmetics, water treatment, food and beverages, and others is boosting the expansion of the segment revenue size. The vegetable oils and fats segment is expected to increase during the forecast period. The escalating demand for vegetable oils such as coconut, palm, mustard, soybean, and others, as well as the increased production of these oils, is boosting segment growth opportunities. The rising consumption of healthy oils among consumers is estimated to propel the market growth in the segment.

Chemical Tankers Market By Fleet Type

The IMO 2 fleet type segment dominated the global chemical tankers market with a prominent share and is expected to hold the highest CAGR during the forecast period.

The broad utilization of IMO 2 chemical tankers for storing and transporting vegetable oils and fats boosts the segment revenue growth. The IMO 2 chemical tankers are widely used in the transportation of various other chemicals such as alkanes, alkenyl, amides, and alcohols, and the growing demand for bio-based lubricants is expected to propel the segment growth rate. Various benefits of the IMO 2 chemical tankers, such as corrosion resistance, chemical attack, and ensuring the cargo remains intact during transportation, augment the segment revenue. The IMO1 segment is estimated to have considerable growth during the forecast period. The IMO 1 fleet type consists of explosives which have projection hazard but not a mass explosion hazard which is boosting the segment growth opportunities.

Global Chemical Tankers Market By Fleet Material

The coated tankers segment held the most prominent share with notable CAGR and is projected to continue the significant growth during the forecast period.

The requirement of advanced and protective initiatives during the transportation of chemicals the cargo needs to maintain high quality and vessel integrity, which is driving the segment growth. The chemical tankers have specialized coatings such as phenolic epoxy or zinc paint, which are both organic and inorganic. The stainless steel segment is estimated to have considerable growth during the forecast period. The stainless steel prevents the contamination of the final product, is easy to clean, and does not require high maintenance, propelling the global market growth.

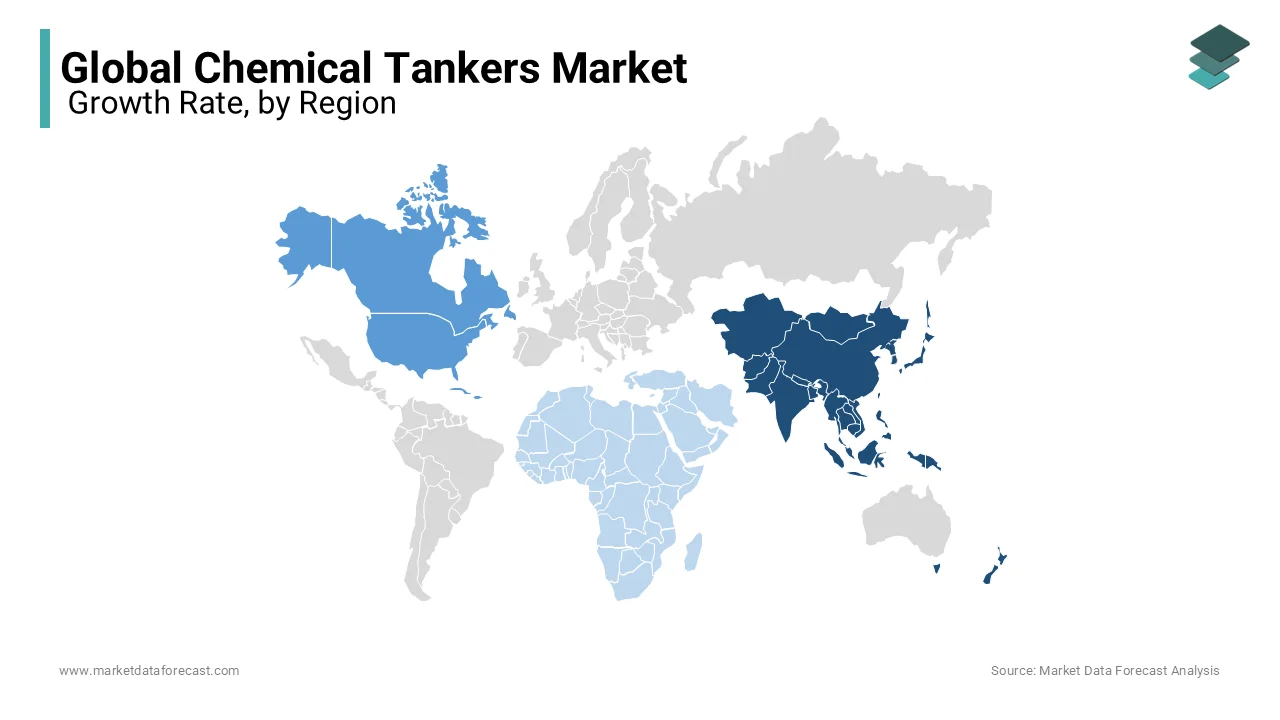

REGIONAL ANALYSIS

The Asia-Pacific region accounted for the largest share in terms of revenue in this market.

This expansion is attributed to the growing call for petrochemicals in countries such as China, India, and Singapore. Also, an increase in the number of chemical industries in South Korea and Japan and the increase in domestic chemical production in India is predicted to positively influence the expansion of this market in the coming years. The Asia-Pacific region is estimated to be the largest market for chemical tankers during the foreseen period. China is predicted to dominate the Asia-Pacific chemical tankers market during the outlook period.

The Chinese chemical tankers market is also likely to grow at the highest CAGR in terms of value and volume during the foreseen period.

The slow expansion of crude oil production and the formulation and implementation of regulations related to fuel supply is holding back the expansion of the chemical tankers market. Low international crude oil prices and reduced capital investment for exploration in recent years have resulted in slow crude oil production. In addition, low investments in crude oil exploration and production in the United States have impacted the production of shale oil in the country. Oil production has also declined in China, due to low oil prices in the country. North America is predicted to attract new competitors in the chemical tankers market due to the shale gas boom. The region is predicted to have a positive impact on ethylene production, which is also supposed to boost the supply of organic chemicals to the world. Resilient exports from the United States and the Middle East were key drivers, affecting other trade routes as well.

KEY MARKET PLAYERS

The major key players in the global chemical tankers market are Bahri (Saudi Arabia), Stolt-Nielsen (UK), Odfjell (Norway), Navig8 (UK), MOL Chemical Tankers (Singapore), Nordic Tankers (Denmark), Wilmar International (Singapore), MISC Berhad (Malaysia), Team Tankers (Bermuda), Iino Kaiun Kaisha (Japan), and others.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, Chemical tanker operator MOL Chemical Tankers announced the acquisition of Fairfield Chemical Carriers (FCC). This acquisition is expected to enhance the company portfolio.

- In February 2024, Chemship, the Rotterdam-based chemical tankers operator, launched its first ship with wind-assisted propulsion, the first chemical tanker in the world equipped with sustainable wind technology.

-

In April 2024, Rederiet MH Simonsen signed an agreement with China’s New Jiangzhou Shipbuilding for eight stainless steel chemical tankers.

DETAILED SEGMENTATION OF THE GLOBAL CHEMICAL TANKERS MARKET INCLUDED IN THIS REPORT

This research report on the global chemical tankers market has been segmented and sub-segmented based on product, shipment route, and region.

By Product

- Organic

- Inorganic

- Vegetable oils & fats

By Fleet Type

- Inland

- Coastal

- Deep-sea

By Fleet Material

- Stainless Steel

- Coated

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]