Global Cell Culture Market Size, Share, Growth & Trends Analysis Report - Segmented By Product, Application, End User and Region - Industry Forecast (2024 to 2032)

Global Cell Culture Market Size (2024 to 2032)

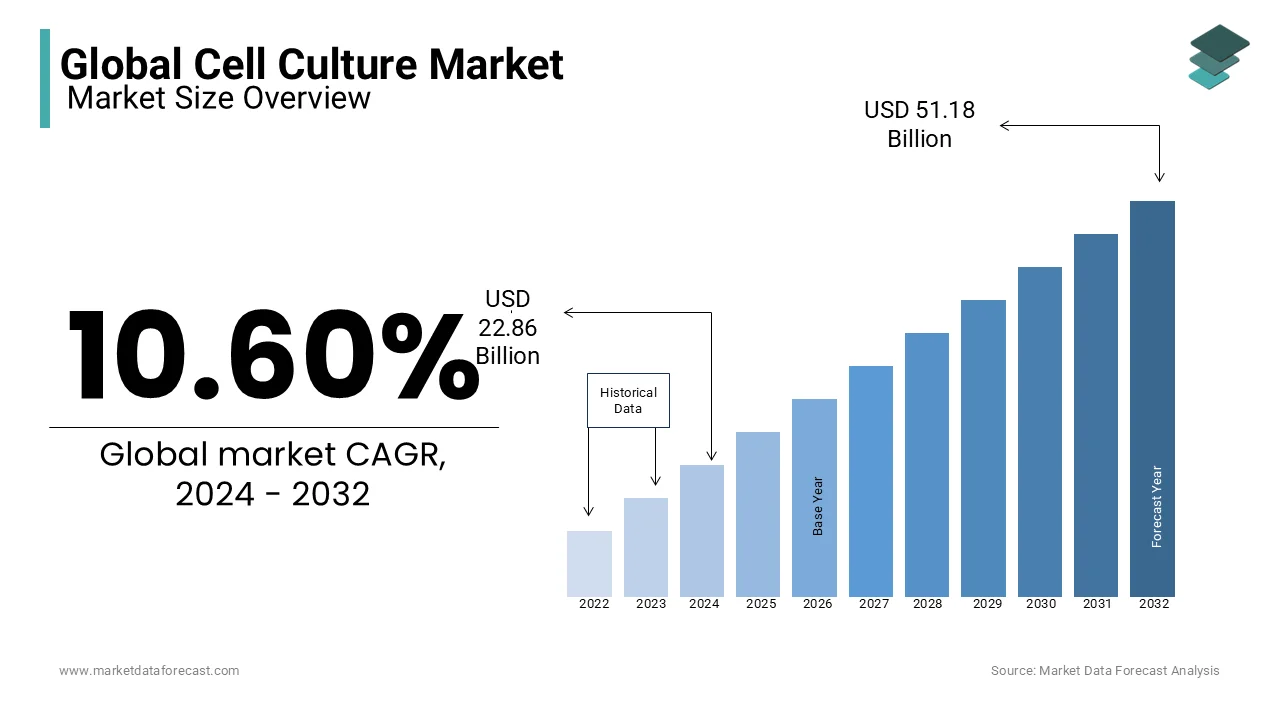

In 2023,the global cell culture market was valued at USD 20.67 Billion and it is expected to reach USD 51.18 Billion by 2032 from USD 22.86 Billion in 2024, growing at a CAGR of 10.60% during the forecast period.

MARKET DRIVERS

The growing demand for biopharmaceuticals is primarily driving the growth of the cell culture market.

The demand for biopharmaceuticals is majorly driven by the growing patient count suffering from chronic diseases, the increasing adoption of personalized medicine, and the rising number of developments in the biotechnology industry. Technologies of cell culture are required for the manufacturing of biopharmaceuticals. The need for cost-effective biopharmaceuticals is increasing significantly worldwide and cell culture technologies can help produce efficient biopharmaceuticals at a reduced cost. Cell culture technologies are further being used to monitor the quality of biopharmaceutical products to ensure their purity, potency, and safety. The demand for biopharmaceuticals is expected to accelerate in the coming years and the same is expected to result in the increasing demand for cell culture technologies and boost market growth. The rising need for cell-based therapies and regenerative medicine to address the growing burden of chronic diseases is fuelling the growth rate of the global cell culture market.

Researchers use cell culture for the development of cell-based therapies as it helps them grow and manipulate calls in a controlled environment.

In recent years, technological developments such as 3D cell culture, single-cell analysis, and gene editing techniques have contributed to the growth of the cell culture market, and the trend is predicted to continue in the coming years owing to the growing penetration of technological developments in the R&D of life sciences industry. An increasing number of initiatives and investments by the governments of various countries in favor of cell therapy technologies is positively affecting the growth rate of the market. The demand for organ transplantations is growing significantly fuelling the need for cell-based therapies and tissue engineering, which is boosting the growth of the cell culture market. Organ transplantation is crucial to people suffering from end-stage organ failure. Organ transplantation is not always advisable and faces numerous challenges such as the limited availability of donor organs, the risk of rejection, and the need for lifelong immunosuppressive therapy. Due to this, the demand for alternative approaches to treating organ failures, such as cell-based therapies and tissue engineering has been growing continuously. As per the data published by the World Health Organization (WHO), an estimated 400,000 organ transplants are being performed worldwide each year and the shortage of organ donors has become a challenge to the healthcare system. An estimated 110,000 people were on the waiting list for organs in 2020 in the United States.

In addition, the growing number of research activities by numerous pharmaceutical and biotechnological companies fuels the need for cell culture technologies for drug discovery and development and resulting in market growth. The rising usage of cell therapy technologies in the cosmetics and personal care industries for the development of new products and testing the effectiveness and safety of existing products boost the growth rate of the cell culture market. The growing importance of cell-based assays in drug discovery and development, the increasing number of advancements in stem cell research, the rising need for in-vitro testing for the safety assessment of drugs and chemicals, and increasing demand for animal-free testing methods are fuelling the growth of the cell culture market.

Furthermore, increasing usage of cell culture technologies in the F&B industry to develop plant-based proteins and the production of meat alternatives, increasing emphasis on the development of advanced biomanufacturing technologies, such as perfusion bioreactors, rising demand for CAR-T cell therapies and growing adoption of regenerative medicine are predicted to favor the cell culture market growth.

MARKET RESTRAINTS

On the other hand, the high cost of equipment and reagents used for cell culture is one of the major factors hampering the market growth. Due to these high costs, the adoption of cell culture technologies among the smaller laboratories and research facilities is being limited. The lack of infrastructure for cell-based research in some countries and the scarcity of skilled professionals who can perform cell culture research activities are limiting the market’s growth rate. The complexities associated with cell culture research and lack of funding are further hindering market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

Segments Covered |

By Product, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Thermo Fisher Scientific, GE Healthcare, Merck KGaA, Sartorius AG, Eppendorf AG, Lonza AG |

SEGMENTAL ANALYSIS

Global Cell Culture Market Analysis By Product

The consumables segment is predicted to hold a leading share of the global cell culture market during the forecast period. The segmental growth is majorly driven by the increasing demand for cell culture media and reagents for use in various applications such as biopharmaceutical production, stem cell research, and regenerative medicine. The bioreactors segment is predicted to showcase a notable CAGR during the forecast period due to the increasing usage of bioreactors in the large-scale production of cell cultures in the biopharmaceutical and biotechnology industries. The rising demand for automated and single-use bioreactors, which can reduce costs and increase productivity in the biopharmaceutical industry is further fuelling the growth rate of the bioreactors segment.

During the forecast period, the equipment segment is also predicted to showcase a promising CAGR. Factors such as demand for advanced bioreactors and cell culture vessels with automated and single-use features and increasing demand for cell and gene therapies.

Global Cell Culture Market Analysis By Application

The biopharmaceuticals segment is expected to hold the largest share of the worldwide market during the forecast period owing to factors such as increasing demand for cell culture technology in vaccine production, diagnostics, and recombinant therapeutic proteins. Using cell culture technologies, the production capacity of vaccines can be increased to meet the available demand levels. The growing usage of cell culture technologies in the manufacturing activities of recombinant therapeutic proteins is further boosting the growth rate of the segment. The rising demand for biologics is further expected to boost segmental growth during the forecast period.

The cancer research segment is estimated to capture a substantial share of the global cell culture market during the forecast period. The growing prevalence of cancer, the rising need to develop effective cancer treatment procedures and the growing usage of cell culture technologies to analyze the behavior of cancer cells and develop new cancer treatments are primarily driving segmental growth.

The stem cell technologies segment is predicted to grow at a healthy CAGR during the forecast period owing to the growing investments in stem cell research and the potential applications of stem cells in regenerative medicine.

Global Cell Culture Market Analysis By End-User

The pharmaceutical and biotechnological companies segment is expected to hold a major share of the global market during the forecast period. Factors such as the increasing number of investments by pharmaceutical and biotechnological companies in R&D to develop new drugs and therapies and the growing usage of cell culture technology for drug discovery and development are propelling segmental growth. Companies operating in the pharmaceutical and biotechnological industries are using cell culture technology to do the mass production of cells to use in drug screening, toxicology testing, and biomanufacturing of therapeutic proteins and antibodies, which is further contributing to segmental growth.

The research institutes segment is predicted to hold a considerable share of the global cell culture market during the forecast period owing to the growing usage of cell culture by the research institutes in a variety of applications such as drug discovery, and toxicology testing.

REGIONAL ANALYSIS

North America captured the largest share of the global market in 2023 and is expected to play the leading role in the worldwide market throughout the forecast period. The growth of the North American market is majorly driven by the presence of several pharmaceutical and biotechnological companies in North America, increasing investments in R&D activities and growing demand for cell culture techniques to develop new therapies and treatments. In addition, the increasing number of initiatives and funding by the North American governments for research and developmental activities in the life science industry is boosting the regional market growth. The growing patient count suffering from chronic diseases and rising demand for precision medicine across North America are further contributing to the growth of the North American market. The U.S. cell culture market had the largest share of the North American market, followed by Canada in 2023and the same trend is expected to continue during the forecast period. The presence of well-established biotech and pharma industries in the U.S. is majorly driving the U.S. cell culture market growth.

Europe occupied the second-largest share of the global market in 2023and is expected to grow at a notable CAGR during the forecast period. Factors such as the increasing investments by the pharmaceutical and biotechnological companies for the R&D around cell culture in Europe and the presence of a well-established healthcare infrastructure are propelling regional market growth. In addition, increasing awareness among people regarding the benefits of personalized medicine and rising healthcare expenditure are fuelling the cell culture market growth in Europe.

The Asia-Pacific is predicted to showcase the highest CAGR in the worldwide market during the forecast period. Growing demand for biopharmaceuticals, increasing investments by the governments of APAC countries to develop the healthcare infrastructure and expanding biotechnology and pharmaceutical industries are boosting the cell culture market growth in the Asia-Pacific region. Japan, China and India are estimated to capture the leading share of the APAC market during the forecast period.

Latin America is projected to register a moderate CAGR during the forecast period. The growth of the Latin American market is expected to be favored by factors such as increasing chronic disease patient population, increasing investments by the market participants to develop advanced treatments and rising emphasis by the Latin American governments to improve the healthcare infrastructure. Brazil, followed by Mexico held the leading share of the Latin American market in 2023.

The market in MEA is expected to progress at a sluggish growth rate during the forecast period. The rising adoption of regenerative medicine and rising demand for biopharmaceuticals are driving the MEA market growth. South Africa and Saudi Arabia are occupying the leading share of the MEA market. However, the cell culture market in MEA is expected to be hampered by the limited healthcare infrastructure and lack of funding for the research and development of cell culture.

KEY PLAYERS IN THE CELL CULTURE MARKET

This report covers Thermo Fisher Scientific, GE Healthcare, Merck KGaA, Sartorius AG, Eppendorf AG, Lonza AG, and companies that play a leading role in the global cell culture market Corning, Becton, Dickinson and Company, Promocell GmbH and Hi-Media Laboratories.

DETAILED SEGMENTATION OF THE GLOBAL CELL CULTURE MARKET INCLUDED IN THIS REPORT

This research report on the global cell culture market has been segmented and sub-segmented based on product, application, end-user, and region.

By Product

- Equipment

- Bioreactors

- Cell Culture Vessels

- Cell Culture Storage Equipment

- Cell Culture Supporting Equipment

- Consumables

- Sera, Media & Reagents

- Bioreactor Accessories

By Application

- Biopharmaceuticals

- Vaccine Production

- Diagnostics

- Recombinant Therapeutic Proteins

- Cancer Research

- Stem Cell Technologies

- Drug Screening and Development

- Tissue Engineering & Regenerative Medicine

- Other Applications

By End-User

- Pharmaceutical and Biotechnology Companies

- Research Institutes

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How much is the global cell culture market going to be worth by 2032?

As per our research report, the global cell culture market size is projected to be USD 51.18 billion by 2032.

Which region is growing the fastest in the global cell culture market?

Geographically, the North American cell culture market accounted for the largest share of the global market in 2023.

At What CAGR, the global cell culture market is expected to grow from 2024 to 2032?

The global cell culture market is estimated to grow at a CAGR of 10.60% from 2024 to 2032.

Does this report include the impact of COVID-19 on the cell culture market?

Yes, we have studied and included the COVID-19 impact on the global cell culture market in this report.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]