Global Cell and Tissue Analysis Market Size, Share, Trends & Growth Forecast Report Segmented By Technology (Biospecimen Technology, Cell Separation Technology, Cell and Tissue Characterization), End User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2024 To 2032.

Global Cell and Tissue Analysis Market Size

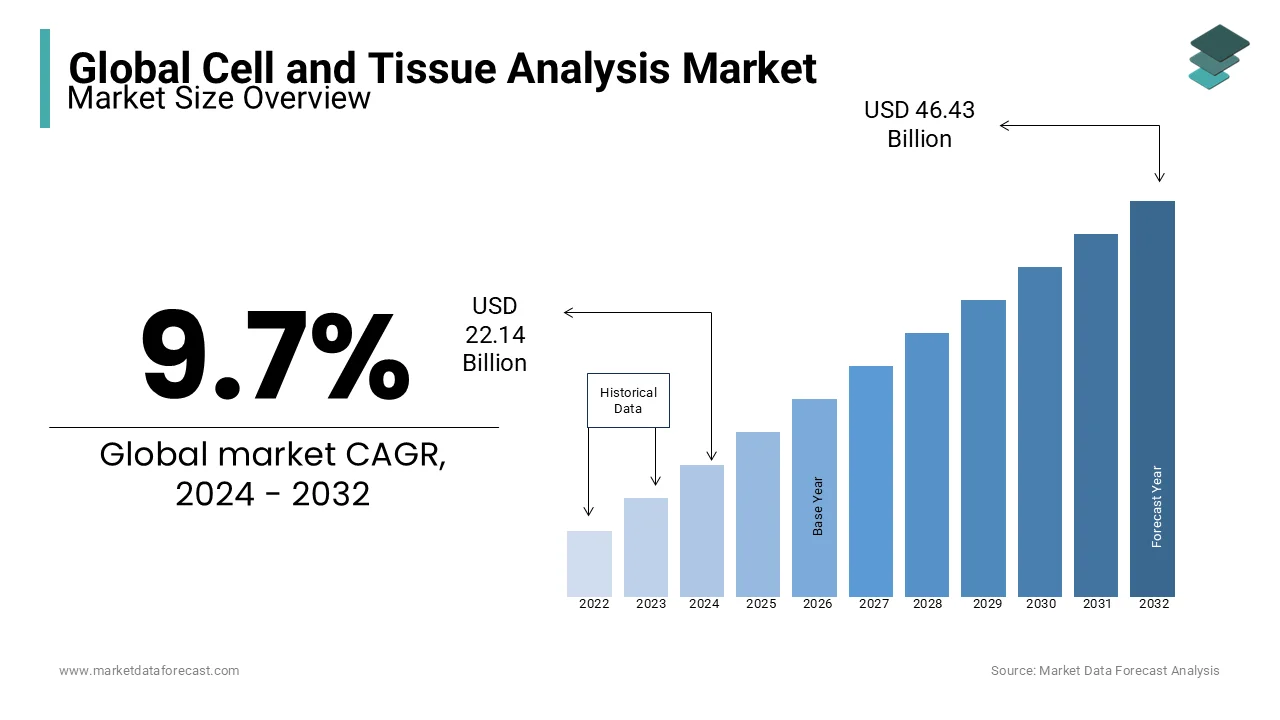

The size of the global cell and tissue analysis market was worth USD 20.18 billion in 2023. The global market is anticipated to grow at a CAGR of 9.7% from 2024 to 2032 and be worth USD 46.43 billion by 2032 from USD 22.14 billion in 2024.

Cell and tissue analysis helps researchers study cells and tissues to understand how they work and interact. It is essential for drug discovery, disease diagnosis, and personalized medicine. Tools like microscopes, flow cytometers, and spectrometers are widely used in labs and clinics. In cancer research, advanced cell analysis tools help identify differences in tumor cells, which can improve treatment outcomes. For example, tumors may have over 1 million cells that behave differently with detailed analysis. New technologies like 3D imaging and AI are making it easier to study tissues and cells quickly and accurately. AI-powered imaging systems can analyze 10,000+ cells per second by supporting progress in regenerative medicine and immunology. These innovations are helping scientists develop better treatments and improve healthcare outcomes.

MARKET DRIVERS

Growing Focus on Personalized Medicine

The shift toward personalized medicine is a major driver for the cell and tissue analysis market. Advanced analysis tools help researchers understand individual variations at the cellular level, enabling targeted therapies. For instance, analyzing a patient’s tumor microenvironment can reveal specific genetic mutations with tailored treatment plans in oncology. Studies show that precision medicine approaches improve patient outcomes by up to 30% compared to traditional treatments. This demand for personalized approaches is increasing the use of technologies like next-generation sequencing (NGS) and single-cell analysis in clinical research and diagnostics.

Advancements in Regenerative Medicine

The rise of regenerative medicine is fueling demand for cell and tissue analysis tools. Regenerative therapies rely on understanding cell behavior, tissue scaffolding, and regeneration processes. Techniques like 3D imaging and live-cell analysis are critical for developing treatments such as stem cell therapies. For example, advancements in imaging allow researchers to study tissue repair in real-time with therapy development. The global push for solutions to chronic diseases like diabetes and spinal injuries is driving investment in regenerative medicine significantly boosting the need for advanced cell and tissue analysis technologies.

MARKET RESTRAINTS

High Cost of Equipment and Technologies

The high cost of advanced cell and tissue analysis tools is a significant restraint in the market. Equipment like flow cytometers, high-resolution microscopes, and next-generation sequencing (NGS) systems can cost upwards of $500,000 each which makes them inaccessible to smaller research labs and clinics. Additionally, maintenance, software upgrades, and training for these technologies add to operational expenses. Limited budgets in academic institutions and research facilities in developing regions shall hinder widespread adoption. This cost barrier prevents many organizations from leveraging cutting-edge tools will slow down the overall growth of the market.

Complexity of Data Interpretation

The complexity of analyzing and interpreting large datasets generated by cell and tissue analysis technologies is another major challenge. Advanced tools like single-cell sequencing produce massive amounts of data that will require specialized expertise and bioinformatics software for analysis. For example, a single next-generation sequencing run can generate over one terabyte of data, making processing time-intensive and resource-heavy. A shortage of trained personnel and bioinformatics infrastructure further complicates data interpretation and is attributed to limiting the efficiency and accessibility of these technologies in broader applications like diagnostics and drug discovery.

MARKET OPPORTUNITIES

Integration of Artificial Intelligence (AI) in Analysis

The integration of AI offers significant opportunities in the cell and tissue analysis market. AI-powered tools can process large datasets quickly and provide insights with high precision that can solely enhance research and diagnostics. For instance, AI algorithms in imaging systems can identify cellular abnormalities and classify tissue samples with 95% accuracy, streamlining workflows in labs. AI is also being adopted in drug discovery, where it accelerates the identification of potential targets by analyzing thousands of cell interactions simultaneously. AI will become more accessible by opening doors for more efficient and cost-effective cellular analysis across diverse applications in the coming years.

Development of Organoid-Based Models

Organoid-based models present a growing opportunity in the market, as they mimic human tissue behavior for studying diseases and testing drugs. These 3D cell cultures provide better predictions of drug efficacy compared to traditional 2D models. For instance, organoid research in cancer therapy has improved predictive accuracy by over 30%. The use of organoids is expanding in fields like neurology and infectious diseases, which offers safer and more ethical alternatives to animal testing. Advances in imaging and analysis technologies will further enhance the utility of organoids with rapid adoption in both academic and commercial research.

MARKET CHALLENGES

Standardization Issues Across Labs and Studies

A significant challenge in the cell and tissue analysis market is the lack of standardization in protocols and methodologies. Variations in sample preparation, data acquisition, and analysis workflows lead to inconsistencies by making it difficult to reproduce results across studies or labs. For instance, studies show that over 50% of preclinical research data fails reproducibility tests, delaying drug development timelines. These inconsistencies hinder collaboration and reduce the reliability of findings, especially in multi-center studies, underscoring the need for globally accepted standards in sample processing and data interpretation.

Ethical Concerns in Tissue Sourcing

Ethical concerns around sourcing human tissues for analysis present another major challenge. Researchers face scrutiny over consent protocols, privacy, and the legality of using donor tissues for commercial applications. For instance, the use of embryonic stem cells in regenerative research remains controversial in several countries because of restrictions on access to certain biological materials. Additionally, regulatory frameworks vary widely between regions, complicating cross-border research. These ethical and regulatory hurdles limit the availability of high-quality tissue samples by slowing progress in critical areas like disease modeling and personalized medicine.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

9.7% |

|

Segments Covered |

By Technology, End-user, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Braun GmbH, Kinsa Inc., Exergen Corporation, Fridababy LLC, Vicks (Kaz USA, Inc.), iProven, Safety 1st (Dorel Industries Inc.), Beurer GmbH, Omron Healthcare, Inc., Philips Avent, and Others. |

SEGMENT ANALYSIS

By Technology Insights

The cell and tissue characterization segment dominated the market by capturing 45.3% of the global market share in 2023. This dominance is due to its critical role in identifying cellular and tissue properties, which are essential for applications such as disease diagnosis and drug development. Techniques such as flow cytometry and immunohistochemistry are widely used for their precision and efficiency. For example, flow cytometry can analyze thousands of cells per second by providing detailed information on cell size, complexity, and markers. This capability is vital for understanding disease mechanisms and developing targeted therapies.

The cell separation technology segment is estimated to grow at a CAGR of 12.8% over the forecast period. This rapid expansion is driven by advancements in isolating specific cell types from heterogeneous populations. Innovations like magnetic-activated cell sorting (MACS) and microfluidic devices have improved purity and yield in cell separation processes. These technologies are crucial for applications in regenerative medicine and personalized treatments, where obtaining specific cell types is necessary. For instance, MACS can achieve a purity of over 95% in isolating target cells, which enhances the effectiveness of subsequent analyses and therapies.

By End User Insights

The biopharmaceutical companies segment dominated the cell and tissue analysis market and occupied 50.5% of the global market share in 2023. Their leadership stems from significant investments in drug discovery, cancer research, and regenerative medicine. These companies heavily rely on advanced cell and tissue analysis tools to accelerate drug development and conduct preclinical trials. For example, high-throughput screening technologies enable biopharmaceutical firms to analyze thousands of compounds efficiently. The focus on personalized medicine and biologics further reinforces the demand for these technologies, which are likely to drive their extensive adoption in biopharmaceutical applications.

The academic and research institutes segment is the fastest-growing segment and is predicted to witness a CAGR of 12.12% during the forecast period. This growth is driven by increased funding for life sciences research and the rising adoption of cutting-edge technologies in academia. Universities and research organizations use advanced cell and tissue analysis tools to explore disease mechanisms and develop novel therapies. For instance, grant funding for biological research in the U.S. surpassed $40 billion in 2023 and is likely to boost the adoption of technologies like single-cell sequencing and 3D imaging in academic settings. These innovations are critical for advancing scientific knowledge and training the next generation of researchers.

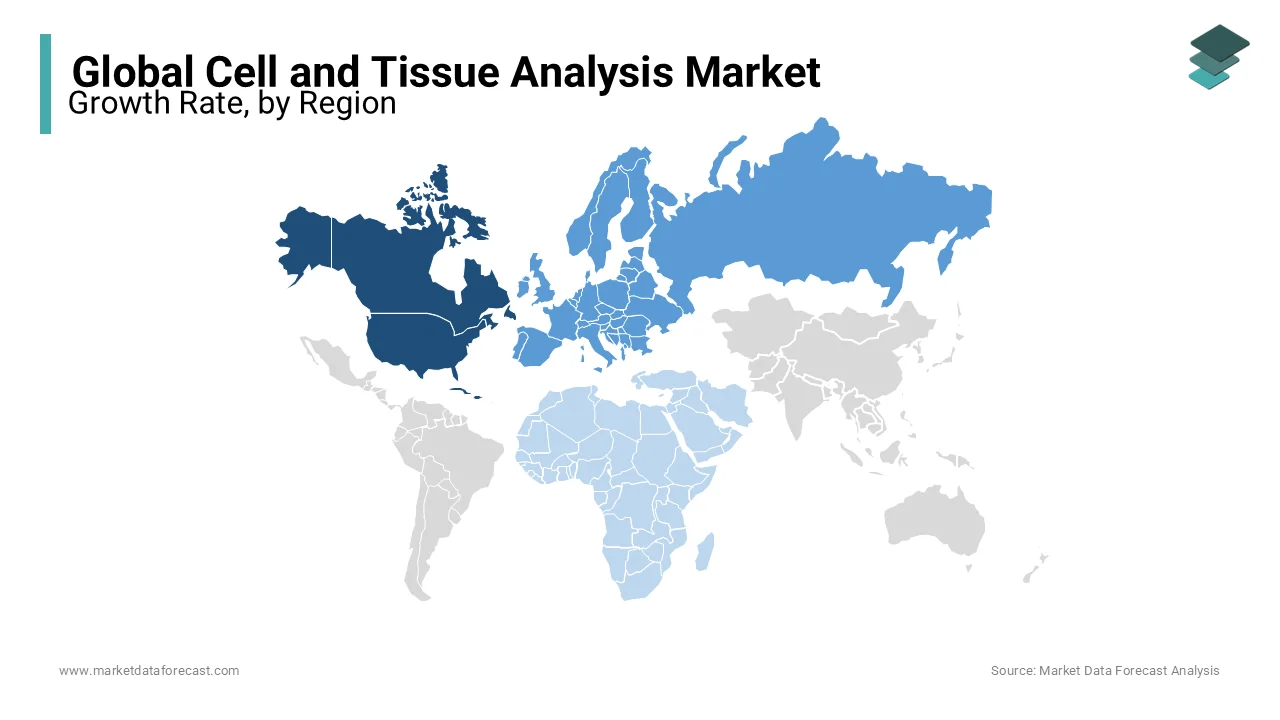

REGIONAL ANALYSIS

North America dominated the market with 40.4% of the global market share in 2023. The domination of North America in the global market is majorly driven by the robust healthcare system of North America and significant R&D spending. The U.S. is a key driver with initiatives like the National Cancer Institute’s annual funding of over $6 billion for oncology research and the $45 billion NIH budget allocated for life sciences. The region’s emphasis on precision medicine is driven by advanced single-cell sequencing and immunoassays to ensure a strong demand for cell and tissue analysis tools. Canada contributes with its expanding biopharma sector and government funding for regenerative medicine. North America is projected to grow at a CAGR of 8% with the increasing prevalence of chronic diseases and expanding research collaborations between academia and industry.

Europe is a notable regional market for cell and tissue analysis worldwide and held a substantial share of the global market in 2023, with Germany, France, and the UK as leaders. Germany, with over €12 billion in biomedical R&D funding annually, supports a thriving biotech ecosystem by focusing on cancer therapies and tissue engineering. The UK’s focus on innovation is exemplified by initiatives like the £1.6 billion Biomedical Catalyst Fund to drive the adoption of advanced imaging and analytical tools. France’s growing cell therapy research also boosts regional demand. The advancements in personalized medicine and government-backed healthcare initiatives promoting diagnostics and research technologies are further propelling the cell and tissue analysis market in Europe.

Asia-Pacific is predicted to be the fastest-growing regional market worldwide over the forecast period. The region benefits from rising investments in biotechnology and healthcare infrastructure in China, Japan, and India. China’s healthcare R&D spending increased by 10% in 2023, making it a global hub for stem cell and cancer research. Japan’s investment in regenerative medicine and advanced imaging systems further propels market growth. India, with its burgeoning biotech startups and growing funding for academic research, is expected to contribute significantly to technology adoption. Increasing cases of chronic diseases and government initiatives like China’s “Healthy China 2030” plan drive the regional demand for cell and tissue analysis tools.

Latin America is projected to experience a healthy CAGR in the global market during the forecast period. Brazil leads the region due to its expanding research sector and initiatives like the $3 billion investment in public health and biopharma R&D in 2023. The country is focusing on cell-based therapies for conditions like diabetes and cancer. Mexico also contributes with growing investments in academic and translational research. Limited access to advanced technologies remains a challenge but rising collaborations with global biotech firms are gradually improving the market outlook.

The market in the Middle East and Africa is expected to grow at a steady CAGR over the forecast period. Saudi Arabia’s Vision 2030 initiative with significant funding for healthcare R&D and education with the adoption of advanced cell and tissue analysis technologies. For example, the King Abdullah University of Science and Technology (KAUST) leads regional research in genomics and molecular biology. South Africa is focusing on improving cancer research and diagnostics through government and private sector collaboration. Increasing awareness and investments in healthcare innovation despite infrastructural challenges are expected to drive growth.

KEY MARKET PLAYERS

Companies playing a prominent role in the global cell and tissue analysis market include Thermo Fisher Scientific, Inc., Danaher Corporation (Beckman Coulter and Leica Microsystems), Becton, Dickinson and Company (BD), Merck KGaA, Agilent Technologies, Inc., PerkinElmer, Inc., Bio-Rad Laboratories, Inc., GE Healthcare (now Cytiva), Miltenyi Biotec, Abcam plc, and Others.

COMPETITIVE LANDSCAPE

The Cell and Tissue Analysis Market is highly competitive, driven by technological advancements and the growing demand for precision research in life sciences. Leading companies like Thermo Fisher Scientific, Danaher Corporation, and Becton, Dickinson and Company (BD) dominate through their broad portfolios, which include advanced imaging systems, flow cytometers, and reagents. These established players leverage significant R&D investments and global distribution networks to maintain a competitive edge.

Emerging players like Miltenyi Biotec and Abcam focus on niche areas, such as cell separation technologies and specialized antibodies, capturing market share through innovation and targeted applications. Collaboration and acquisitions are common strategies, with companies expanding their capabilities by integrating advanced tools like AI-powered imaging and single-cell sequencing. For example, recent acquisitions in the market have enabled key players to enhance their offerings in high-throughput and automated analysis solutions.

The competition is further fueled by increasing demand from biopharmaceutical companies for drug discovery and academic institutes for research. Regions like Asia-Pacific are seeing intensified competition due to rising investments in healthcare infrastructure and research, particularly in China and India. As the market evolves, the focus remains on innovation, affordability, and the development of user-friendly solutions to cater to diverse end-user needs.

RECENT MARKET DEVELOPMENTS

- In December 2023, Danaher Corporation, a global science and technology innovator, completed the acquisition of Abcam plc, a leading supplier of protein research tools. Purpose: This acquisition aims to enhance Danaher's life sciences portfolio by integrating Abcam's extensive range of antibodies and reagents, thereby strengthening its position in the research and diagnostics markets.

- In July 2024, Thermo Fisher Scientific, a global leader in scientific services, completed the acquisition of Olink Holding AB, a Swedish biotech firm specializing in proteomics. Purpose: This acquisition is expected to enhance Thermo Fisher's capabilities in protein biomarker discovery and development, strengthening its position in the life sciences market.

- In August 2023, Danaher Corporation announced a definitive agreement to acquire Abcam plc for approximately $5.7 billion. Purpose: This acquisition is intended to enhance Danaher's life sciences portfolio by integrating Abcam's extensive range of antibodies and reagents, thereby strengthening its position in the research and diagnostics markets.

- In October 2023, Thermo Fisher Scientific announced a $3.1 billion deal to acquire Olink Holding AB, a Swedish biotech firm specializing in proteomics. Purpose: This acquisition is expected to enhance Thermo Fisher's capabilities in protein biomarker discovery and development, strengthening its position in the life sciences market.

- In July 2024, Thermo Fisher Scientific completed the acquisition of Olink Holding AB, a Swedish biotech firm specializing in proteomics. Purpose: This acquisition is expected to enhance Thermo Fisher's capabilities in protein biomarker discovery and development, strengthening its position in the life sciences market.

- In December 2023, Danaher Corporation completed the acquisition of Abcam plc, a leading supplier of protein research tools. Purpose: This acquisition aims to enhance Danaher's life sciences portfolio by integrating Abcam's extensive range of antibodies and reagents, thereby strengthening its position in the research and diagnostics markets.

- In October 2023, Thermo Fisher Scientific announced a $3.1 billion deal to acquire Olink Holding AB, a Swedish biotech firm specializing in proteomics. Purpose: This acquisition is expected to enhance Thermo Fisher's capabilities in protein biomarker discovery and development, strengthening its position in the life sciences market.

- In August 2023, Danaher Corporation announced a definitive agreement to acquire Abcam plc for approximately $5.7 billion. Purpose: This acquisition is intended to enhance Danaher's life sciences portfolio by integrating Abcam's extensive range of antibodies and reagents, thereby strengthening its position in the research and diagnostics markets.

- In July 2024, Thermo Fisher Scientific completed the acquisition of Olink Holding AB, a Swedish biotech firm specializing in proteomics. Purpose: This acquisition is expected to enhance Thermo Fisher's capabilities in protein biomarker discovery and development, strengthening its position in the life sciences market.

- In December 2023, Danaher Corporation completed the acquisition of Abcam plc, a leading supplier of protein research tools. Purpose: This acquisition aims to enhance Danaher's life sciences portfolio by integrating Abcam's extensive range of antibodies and reagents, thereby strengthening its position in the research and diagnostics markets.

MARKET SEGMENTATION

This research report on the global cell and tissue analysis market has been segmented and sub-segmented based on technology, end-user, and region.

By Technology

- Biospecimen Technology

- Cell Separation Technology

- Cell and Tissue Characterization

By End User

- Biopharmaceutical Companies

- Academic and Research Institutes

- Healthcare and Clinical

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]