Global Cell Analysis Market Size, Share, Trends & Growth Forecast Report By Techniques (Molecular Approaches & Image-Based Approaches), Product (Consumables, Instruments, Software and Services), Application, End-User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033

Global Cell Analysis Market Size

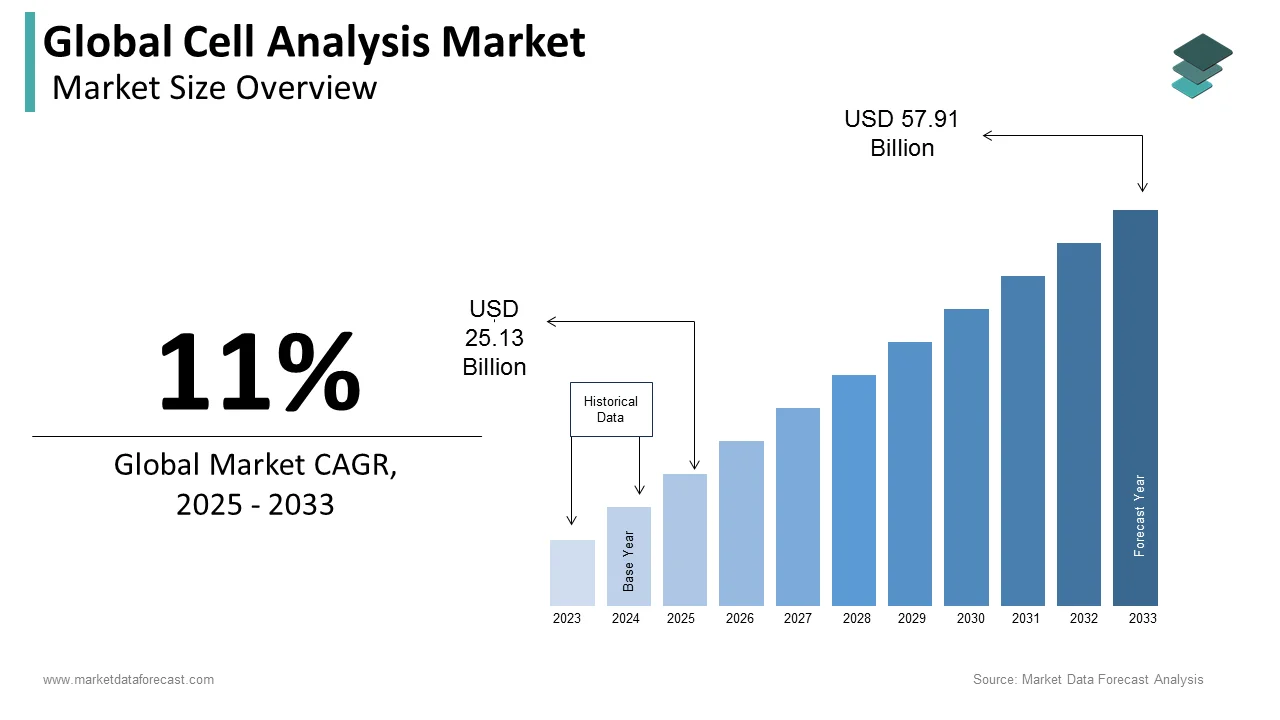

The size of the global cell analysis market was worth USD 22.64 billion in 2024. The global market is anticipated to grow at a CAGR of 11% from 2025 to 2033 and be worth USD 57.91 billion by 2033 from USD 25.13 billion in 2025.

Cell analysis ensures the discovery of quality drugs in very little time than projected. It also studies the behavior of cells in multicellular and unicellular organisms. In the process of gene identification, cell analysis plays a significant role in monitoring the genetic behavior of the organism. From this cell analysis report, one can study the complete processes of a cell, such as the growth and proliferation of a cell.

MARKET DRIVERS

The cell analysis technique is a boom for pharmaceutical companies as they can develop various drugs at low cost within the projected time period. This is considered a primary factor propelling the global cell analysis market growth. Increasing incidences of chronic diseases and other health disorders across the world are secondary factors driving the market's growth. People's demand for personalized medicine to have convenient and private treatment procedures is accelerating the growth of the market. Growing research on cells and the launch of innovative products with the help of the cell analysis process boost the demand of the Global Cell Analysis Market. The increasing geriatric population is also an attribute fuelling the rate of cell analysis market growth.

Growing awareness among individuals in the diagnosis and treatment procedures is leveraging the growth rate of the Global Cell Analysis Market. The increasing scale of biopharmaceutical & biotechnological companies is impacting the growth of the market positively. Rising expenditure on healthcare, especially in urban areas, is creating chances for the market to grow. Growth opportunities for the market lie in the increasing number of research and development institutes to improve the quality of the drugs and lavish the demand of the market. The rise in the demand for imaging techniques also escalates the cell analysis market growth.

The adaptation of flow cytometry in novel research applications like proteomics, marine cell biology, and cytogenetics has boosted the cell analysis market growth rate. Also, the rising incidences of HIV and cancer have created the demand for flow cytometry techniques for efficient diagnostics in hospitals and laboratories. Moreover, the advent of reagents and multiple probes for usage in diagnostics and drug discovery is expected to benefit the cause of cell analysis companies targeting consumers in research/academic areas and small laboratories.

Further, with the advent of cell analysis applications in the oncology domain, the market is expected to experience an unconventional growth rate in the next few years. Cancer cell analysis involves studying tumor cell biology and the development of cell-based therapies and therapeutics for cancer. Considering these novel applications, investments for research in the field of cancer are on the rise, of which cell assay-based drug developments have gained high importance and interest, thereby amplifying the growth of demand for cell analysis instruments or technologies. According to the WCR Fund, global cancer research funding increases at the rate of 10% annually, resulting in a total expenditure of $177 billion on cancer research. Adding to this trend, the UNITED STATES federal government, Cancer Research UK, and the Australian government, among others, are also investing in cancer research on a large scale. Recent developments in biomarker technology and stem cell analysis are also providing traction during the forecast period.

MARKET RESTRAINTS

The death of skilled persons in the laboratories to analyze the reports is slightly declining the global cell analysis market. The cost of installing the equipment to perform the process is a bit expensive, which slightly hampering the growth of the Global Cell Analysis Market. Lack of standardization may also degrade the demand of the market quietly. The entry of new players and increasing competition between them is a challenging factor for the market developers. Strict rules and regulations to approve new products are inhibiting the demand of the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Production Technologies, Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Becton, Dickinson and Company (United States), Thermo Fisher Scientific, Inc. (UNITED STATES), Merck KGaA (Germany), Danaher Corporation (UNITED STATES), GE Corporation (United Kingdom), Olympus Corporation (Japan), Agilent Technologies |

SEGMENTAL ANALYSIS

By Techniques Insights

The molecular approaches segment held the leading share of the global cell analysis market in 2024 and is expected to grow at a promising CAGR during the forecast period. Under the sub-segments, the PCR segment is predicted to play the leading role during the forecast period. The segmental growth is driven by the growing demand for PCR in research and clinical diagnostics. The microfluidics and microarrays segment is anticipated to register a notable CAGR during the forecast period owing to the increasing adoption of microfluidics and microarrays for high-throughput screening, drug discovery, and disease diagnosis.

The image-based approach segment is estimated to grow at a healthy CAGR during the forecast period. Under the sub-segments, the high-content screening segment is predicted to register a noteworthy CAGR during the forecast period owing to the increasing adoption of high-content screening for drug discovery, toxicity testing, and disease diagnosis. On the other hand, the cytometry and microscopy segments are predicted to witness a notable CAGR during the forecast period.

By Product Insights

The consumables segment had the largest share of the worldwide market in 2024 and is expected to grow at a healthy CAGR during the forecast period. The segmental growth is attributed to the increasing demand for cell-based assays and reagents in drug discovery, personalized medicine, and regenerative medicine. In addition, the growing prevalence of chronic diseases, such as cancer and cardiovascular diseases, is fuelling the demand for consumables and boosting the segment’s growth rate.

The instruments segment is estimated to grow at a noteworthy CAGR during the forecast period. The growth rate of the segment is majorly fuelled by the increasing adoption of advanced technologies, such as microfluidics, high-throughput screening, and next-generation sequencing and the growing demand for automated and high-throughput instruments for cell analysis.

The software and services segment is predicted to witness the fastest CAGR during the forecast period owing to the increasing demand for data analysis and interpretation tools in cell analysis, the rising complexity of cell analysis data and the need for accurate and reproducible results and increasing adoption of contract research services and outsourcing of cell analysis.

By Application Insights

The therapeutic area segment is expected to register a healthy CAGR during the forecast period. The growth of the segment is majorly driven by the growing demand for cell analysis in the diagnosis and treatment of various diseases, the rising prevalence of chronic diseases, such as cancer and cardiovascular diseases, and the need for personalized medicine and targeted therapies.

By End-User Insights

The pharmaceutical and biotech companies segment had the major share of the global cell analysis market in 2022 and is expected to grow at a prominent CAGR during the forecast period. Factors such as increasing demand for new drug development, personalized medicine, and targeted therapies, increasing prevalence of chronic diseases, the growing need for effective therapies, and increasing adoption of automation and high-throughput instruments in pharmaceutical and biotech companies primarily drive segmental growth.

REGIONAL ANALYSIS

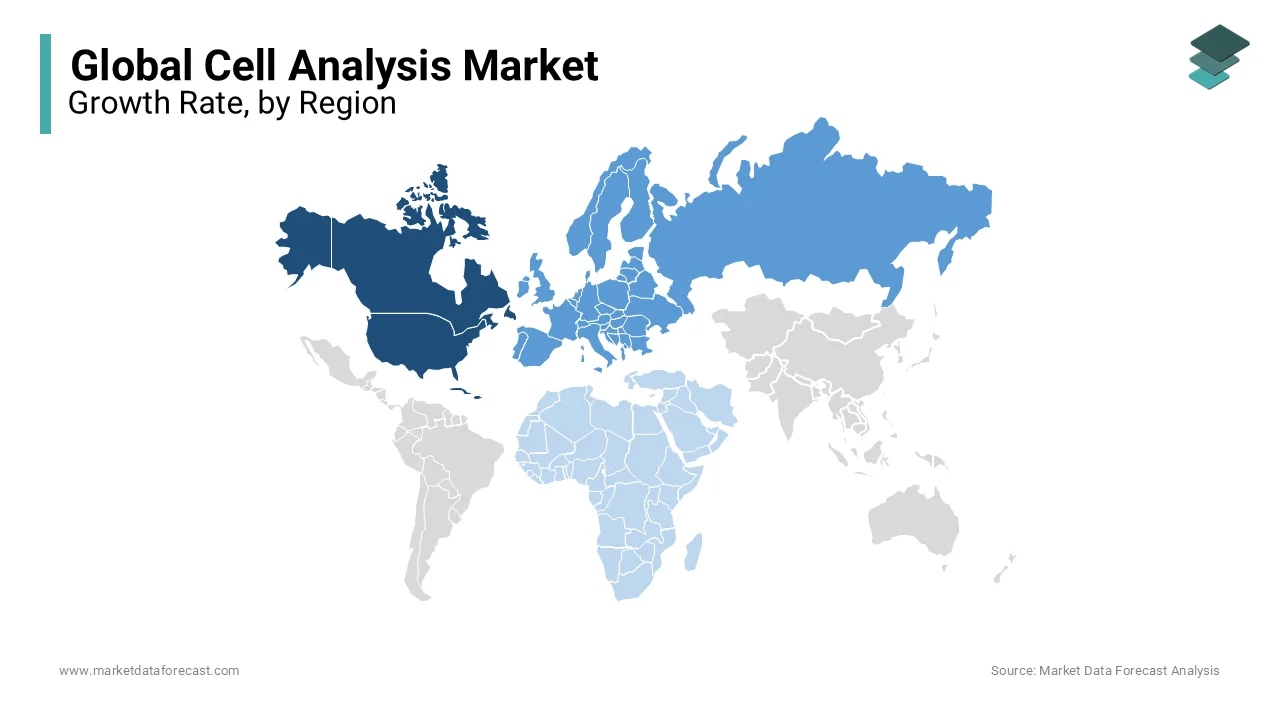

Geographically, North America held the largest share of the global cell analysis market in 2024 and the domination of the region is expected to continue during the forecast period. The growth of the North American region in the worldwide market is attributed to the growing disposable income, rising prevalence to have cost-effective drugs, and the presence of major pharmaceutical and biotech companies, academic and research institutions, and advanced healthcare infrastructure. In addition, factors such as the growing demand for personalized medicine, increasing investment in R&D activities, and the presence of key market players, such as Thermo Fisher Scientific, Becton, Dickinson and Company, and Danaher Corporation, further fuel the growth rate of the North American market. The U.S. market held around 81% of the North American market in 2022 and is expected to grow at a prominent CAGR during the forecast period.

Europe was the second biggest regional market for cell analysis worldwide in 2024 and is expected to grow at a notable CAGR during the forecast period. The growth of the European market is driven by factors such as growing funding by the European governments for R&D, increasing adoption of personalized medicine, and the presence of sophisticated healthcare infrastructure. The increasing adoption of advanced technologies and the presence of key market players, such as F. Hoffmann-La Roche Ltd and Agilent Technologies, further boost the growth of the European market. The United Kingdom, Germany, and France are predicted to account for the major share of the European market during the forecast period.

APAC is the fastest-growing regional market for cell analysis and is estimated to register the highest CAGR in the worldwide market among all the regions. Factors such as the growing patient population of various life-threatening diseases, increasing investments for R&D by private organizations and the growing number of healthcare infrastructure improvements drive the APAC market growth. China, Japan, and India accounted for the major share of the worldwide market in 2024 and the same trend is predicted to continue throughout the forecast period.

Latin America is a noteworthy regional market for cell analysis worldwide and is expected to grow at a steady CAGR during the forecast period. Mexico and Brazil are estimated to hold the major share of the Latin American market during the forecast period.

MEA had a moderate CAGR of the worldwide market in 2024 and is predicted to grow at a slow CAGR during the forecast period. South Africa, Saudi Arabia, and the United Arab Emirates are estimated to have the major share of the MEA market during the forecast period owing to the increasing government funding for healthcare infrastructure and the rising demand for personalized medicine.

KEY MARKET PARTICIPANTS

Some of the notable companies leading the global cell analysis market profiled in this report are Becton, Dickinson, and Company (United States), Thermo Fisher Scientific, Inc. (UNITED STATES), Merck KGaA (Germany), Danaher Corporation (UNITED STATES), GE Corporation (United Kingdom), Olympus Corporation (Japan), Agilent Technologies, Inc. (UNITED STATES), PerkinElmer, Inc. (UNITED STATES), Promega Corporation (UNITED STATES), Tecan Group Ltd. (Switzerland).

RECENT MARKET DEVELOPMENTS

- Product Launch - In August 2019, Agilent Technologies launched a multimode real-time cell analyzer (RTCA). This is the first kind of product introduced with the combination of non-invasive biosensors and live-cell imaging. This company has started research mainly on immuno-oncology and immunotherapy applications.

- Product Launch - On June 24, 2019, Sony launched the ID7000™ flagship spectral cell analyzer, which is capable of streamlining multicolor cell analysis for more than 44 colors. The launch of this product will empower deep insights into cell information and also boost the growth in the market.

- Product Launch - In April 2019, a product for BioPharma named Vi-CELL BLE cell viability analyzer was introduced by Beckman Coulter. This product will have high demand in the coming years as it shows great viability in monitoring the cells in laboratories.

MARKET SEGMENTATION

This research report is segmented and sub-segmented into the following categories, and the market size and forecast for each segment will be calculated until 2033.

By Techniques

-

Molecular Approaches

-

PCR

-

Sequencing

-

Microfluidics and Microarrays

-

Cell Isolation and Separation

-

-

Image-Based Approaches

-

Microscopy

-

Cytometry

-

High Content Screening

-

Spectrophotometry

-

By Product

-

Consumables

-

Assay Kits

-

Reagents

-

Microplates

-

Cell Culture Consumables

-

Others

-

-

Instruments

-

Cell Counters

-

Cell Microarrays and Microfluidics

-

Liquid Handling Systems

-

Cytometers

-

High Content Screening Systems

-

Microplate Readers

-

PCR Instruments

-

Sequencing Instruments

-

Spectrophotometers

-

Microscopes

-

Other Instruments

-

-

Software and Services

By Application

-

By Process of Application

-

Cellular Processes

-

Signal Transduction Pathway

-

Circulating Tumor Cells

-

Single-Cell Analysis

-

Epigenetic Target Analysis

-

Subpopulation Characterization

-

Drug and Candidate Screening

-

-

By Field of Application

-

Forensics

-

Therapeutics

-

Genomic Analysis

-

Stem Cell Analysis

-

Biomarker Research

-

Cell Imaging

-

Live-Cell Imaging

-

-

Diagnostics

-

-

By Therapeutic Area of Applications

-

Cancer Research

-

Genetic Testing

-

Infectious Diseases

-

Immunology

-

Others

-

By End-User

-

Hospitals

-

Academic & Research Laboratories

-

Diagnostic Laboratories

-

Pharmaceuticals and Biotech Companies

-

Contract Research Organisations

-

Cell Banks

-

Others

By Region

-

North America Cell Analysis Market

-

Europe Cell Analysis Market

-

Asia-Pacific Cell Analysis Market

-

Latin America Cell Analysis Market

-

Middle East & Africa Cell Analysis Market

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]