Global Catalog Market Size, Share, Trends, Growth Forecast Report Segmentation By Type (Digital and Print or Paper), Organization Size (Large Enterprises, and Small and Medium-sized Enterprises (SMEs)), Industry Vertical (Retail and E-commerce, Fast-Moving Consumer Goods (FMCG), Banking, Financial Services, and Insurance (BFSI), Information Technology and Telecom, Media and Entertainment, and Travel and Hospitality), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Catalog Market Size

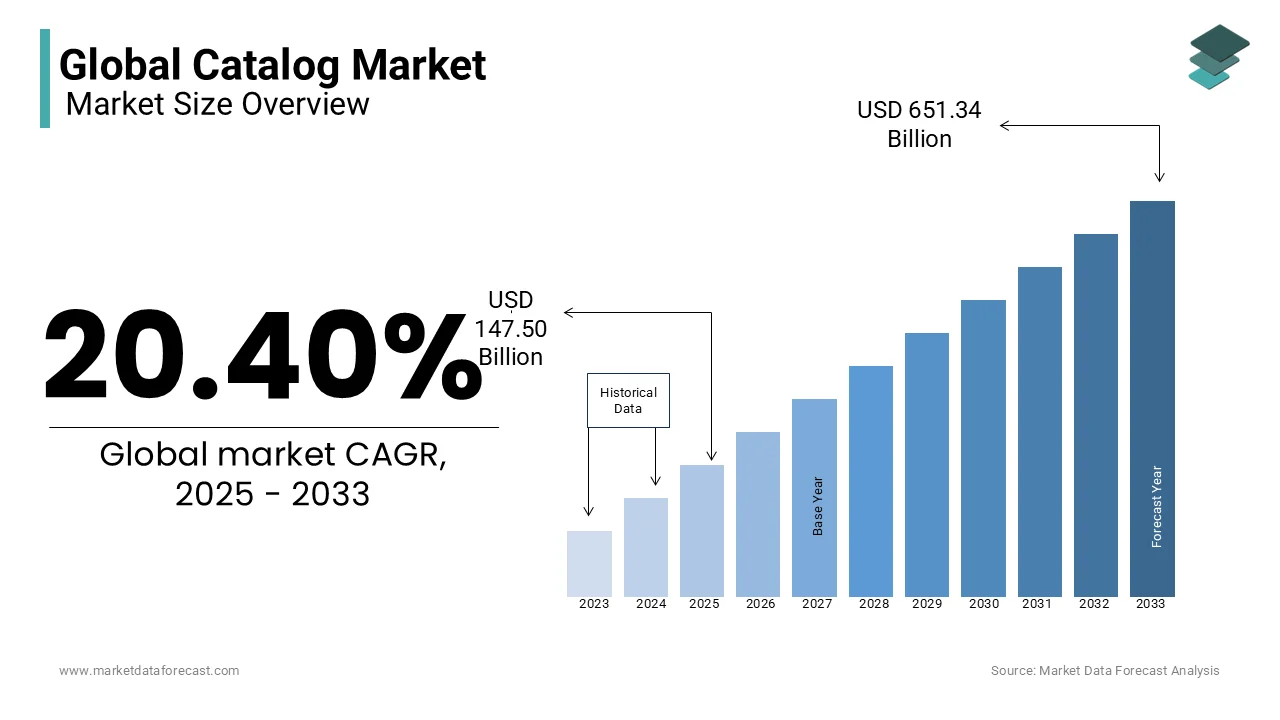

The global catalog market was worth USD 122.51 billion in 2024. The global market is estimated to reach USD 651.34 billion by 2033 from USD 147.50 billion in 2025, rising at a CAGR of 20.40% from 2025 to 2033.

The catalog market encompasses both physical and digital catalogs that businesses use to present products, services, or information for marketing and distribution purposes. These catalogs enable customers to browse offerings at their convenience, whether through printed materials or online platforms, and play a key role in influencing consumer purchasing decisions. While traditional catalogs were primarily printed and mailed, the shift to digital catalogs has become increasingly prominent with the growth of e-commerce and technological innovations.

As digital engagement continues to rise, an estimated 70% of consumers now prefer to browse and shop using digital devices, including smartphones and computers, rather than traditional in-person methods. In fact, the digital transformation has led to an overwhelming 80% of catalog sales now occurring online in developed markets like the United States and Europe. This shift reflects not only changing consumer behavior but also advancements in technology, with catalogs leveraging interactive features, such as virtual try-ons and augmented reality (AR), to enhance user experiences. In addition, data from McKinsey shows that nearly 90% of companies that use digital catalogs have observed increased engagement and customer satisfaction which is emphasizing the growing importance of online channels in product discovery. The evolving preferences of consumers for convenience and personalized experiences indicate that the catalog market will continue to adapt, with a strong focus on digital transformation and customer-centric approaches.

MARKET DRIVERS

Rapid Shift Toward Digitalization and E-commerce

One major driver of the catalog market is the rapid shift toward digitalization and e-commerce. Consumers increasingly prefer the convenience of browsing and shopping online, which is pushing businesses to invest in digital catalogs to reach broader audiences. According to the U.S. Department of Commerce, e-commerce sales in the United States reached over $870 billion in 2021, a significant jump from the previous year, reflecting an ongoing trend of consumers migrating to online shopping. This surge in digital shopping is directly influencing the catalog market, where companies are enhancing their online catalogs with interactive elements like 360-degree views, videos, and AR and is ensuring a better consumer experience and higher conversion rates.

Growing Demand for Personalized Consumer Experiences

Another key driver is the growing demand for personalized consumer experiences. Catalogs, especially digital ones, allow companies to provide tailored content and product recommendations based on user preferences and browsing history. Data from the U.S. Census Bureau indicates that in 2020, over 50% of consumers showed a preference for brands that offered personalized shopping experiences. Personalization boosts customer engagement, increases sales, and strengthens brand loyalty. Businesses are utilizing advanced data analytics and AI to create personalized catalogs that meet the unique needs of individual consumers, which has been shown to increase conversion rates and customer satisfaction and is ultimately driving growth in the catalog market.

MARKET RESTRAINTS

Environmental Impact

A significant restraint on the catalog market is the environmental impact associated with physical catalogs. The production and distribution of printed catalogs contribute to deforestation, waste, and carbon emissions. According to the U.S. Environmental Protection Agency (EPA), the paper and paperboard industry accounts for about 26% of municipal solid waste in the United States. Despite efforts to move toward more sustainable printing practices, the environmental burden remains a concern, especially as companies seek to reduce their carbon footprint. Many consumers and organizations are increasingly prioritizing eco-friendly practices which is leading some businesses to reconsider or even discontinue the use of physical catalogs in favour of digital alternatives.

Another restraint is the high costs associated with maintaining both digital and physical catalog systems. For businesses, especially small to mid-sized enterprises, the initial investment in creating high-quality digital catalogs and integrating them with e-commerce platforms can be significant. According to the U.S. Small Business Administration (SBA), nearly 20% of small businesses fail due to cash flow issues. The expenses involved in creating, updating, and managing digital catalogs as well as marketing them effectively and can strain limited budgets. Furthermore, businesses must constantly invest in new technologies to keep their catalogs engaging and competitive which can be financially prohibitive for some companies.

MARKET OPPORTUNITIES

Adoption of Augmented Reality (AR) and Virtual Reality (VR) Technologies

One significant opportunity for the catalog market lies in the increasing adoption of augmented reality (AR) and virtual reality (VR) technologies in digital catalogs. These technologies enhance customer experience by allowing consumers to virtually try products or view them in 3D. The International Trade Administration (ITA) reported that the global AR market is expected to grow at a CAGR of 43.8%, reaching $198 billion by 2025. As businesses look to engage customers more effectively, integrating AR and VR into catalogs offers a unique opportunity to increase conversion rates, reduce returns, and improve customer satisfaction. This shift towards interactive catalogs presents immense growth potential, particularly in industries like retail and home furnishings.

Growing Global Trend of Mobile Commerce

Another opportunity arises from the growing global trend of mobile commerce. According to the U.S. Census Bureau, mobile commerce sales in the U.S. accounted for nearly 45% of total e-commerce sales in 2021. This trend is expected to continue with more consumers using smartphones to browse and purchase products. Catalogs now are optimized for mobile devices can drive higher engagement and conversion as mobile commerce has become a dominant shopping method. Businesses can tap into a larger, more diverse consumer base by adapting this for mobile users and then capitalize on the increasing preference for shopping via smartphones and tablets. This opportunity could accelerate the growth of digital catalogs in various industries.

MARKET CHALLENGES

Increasing Competition From Digital-First Platforms

A major challenge in the catalog market is the increasing competition from digital-first platforms that provide more personalized and user-friendly shopping experiences. As consumers continue to prefer online shopping, catalog businesses must contend with the rise of direct-to-consumer (DTC) brands and e-commerce giants like Amazon, which have rapidly adapted to digital catalogs and personalized recommendations. The U.S. Census Bureau’s quarterly retail e-commerce report shows that e-commerce sales reached $250 billion in Q2 2022 alone and is marking a 3.3% increase from the previous quarter. This rapid shift means that traditional catalog businesses must innovate continuously to remain competitive, which can be resource-intensive and challenging for smaller players in the market.

High Operational Costs

Another challenge is the high operational costs associated with producing and maintaining both digital and physical catalogs. Creating high-quality catalogs that meet customer expectations for design, interactivity, and accessibility requires significant investment in technology and content development. The U.S. Small Business Administration (SBA) notes that nearly 80% of small businesses face financial constraints when adopting new technologies. These expenses can be particularly burdensome for small or medium-sized enterprises, especially if they have to compete with larger, more established companies that can afford more substantial investments in catalog development, marketing, and technology infrastructure.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

20.40% |

|

Segments Covered |

By Type, Organization Size, Industry Vertical, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

IBM, SAP, Oracle, Salsify, Coupa Software, ServiceNow, Proactis, Broadcom, Fujitsu, and Comarch are some of the major players in the catalog market. |

SEGMENTAL ANALYSIS

By Type Insights

The digital segment ruled the market by accounting for 74.5% of the global market share in 2024 and also is predicted to be the fastest growing segment in the global market over the forecast period. The dominance of the digital segment in the global catalog segment is majorly attributed to the widespread adoption of e-commerce and the shift toward online shopping. The rising preference for online browsing is expected to continue to drive the growth of the digital segment in the global market. According to the U.S. Census Bureau, e-commerce sales in the U.S. reached $870 billion in 2021, and digital catalogs are integral to driving these sales. The growing reliance on mobile devices and the need for businesses to provide seamless, interactive shopping experiences are key factors in the success of the digital catalog segment.

By Organization Size Insights

The large enterprises segment led the market by holding a dominant share of 63.5% of the global market in 2024. The domination of the large enterprises segment is majorlu attributed to their ability to invest in advanced technologies, including AI and machine learning, to enhance their digital catalogs. According to the U.S. Census Bureau, large enterprises in sectors such as retail, technology, and manufacturing are increasingly adopting digital catalogs to streamline their product offerings and enhance customer engagement. Their significant budgets enable them to create high-quality, interactive catalogs, which play a crucial role in driving their global sales and market reach. In the retail sector, reports indicate that over 85% of large retailers now use digital catalogs to enhance the shopping experience, enabling features like 360-degree product views and automated recommendations. Similarly, 80% of Fortune 500 manufacturers have implemented cloud-based catalog solutions to streamline product distribution and reduce manual processes.

The small and medium-sized enterprises (SMEs) segment is on the rise. This segment is anticipated to exhibit the fastest CAGR of CAGR of 10.2% from 2025 to 2033. SMEs are increasingly turning to affordable digital catalog solutions to compete with larger players. According to the U.S. Small Business Administration, over 30 million SMEs in the U.S. have embraced e-commerce, driving the demand for digital catalogs. The rise of SaaS platforms that offer cost-effective solutions and the growing need for online visibility are key drivers of this segment's rapid growth. As SMEs leverage digital catalogs to expand their market presence, this segment is expected to experience substantial growth.

By Industry Vertical Insights

The retail and e-commerce segment held 46.6% of the global market share in 2024. The lead of the retail and e-commerce segment is primarily driven by the increasing shift to online shopping and the demand for digital catalogs that provide detailed product information, personalized recommendations, and interactive features. According to the U.S. Census Bureau, U.S. e-commerce sales totalled $870 billion in 2021, a significant portion of which was driven by catalog-based sales through platforms like Amazon and Walmart. The continuous growth of online retail and the convenience of digital catalogs make this sector critical to the global catalog market's overall expansion.

On the other hand, the FMCG segment is predicted to witness the highest CAGR of 9.7% from 2025 to 2033. This growth is largely attributed to the increasing demand for FMCG companies to provide more accessible and engaging product catalogs to consumers. The FMCG sector, particularly in markets such as food and beverages, is leveraging digital catalogs to improve consumer reach and optimize supply chains. According to the International Trade Administration, the global FMCG market is expected to exceed $15 trillion by 2025, driving further investment in digital catalog strategies for better customer engagement and faster product delivery.

REGIONAL ANALYSIS

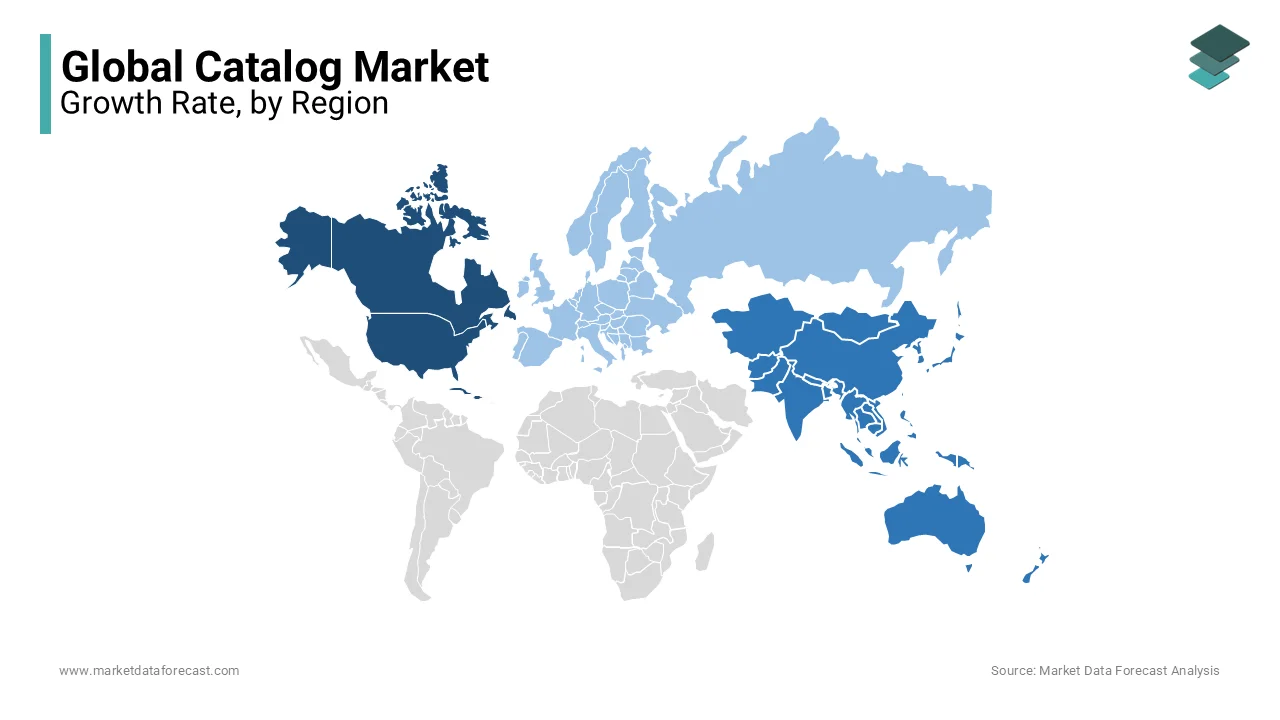

North America dominated the catalog market in 2024 by capturing 33.2% of the global market share in 2024. The domination of North American region in the global catalog market is majorly driven by the high adoption of e-commerce and digital transformation across industries. According to the U.S. Census Bureau, e-commerce sales in North America surpassed $870 billion in 2021, with projections to grow by over 10% annually through 2025. This region’s dominance is attributed to its advanced technological infrastructure, high disposable income, and robust consumer spending. The prevalence of digital catalogs in retail and direct-to-consumer brands, along with the growing use of interactive technologies, solidifies North America’s position as the leader in the global catalog market.

The Asia-Pacific is progressing at a remarkably and is likely to pose a CAGR of 8.5% over the forecast period. The rapid digitalization, increasing mobile commerce, and expanding e-commerce platforms in countries like China, India, and Japan are propelling the Asia-Pacific catalog market growth. The expanding middle class of the Asia-Pacific region and increasing internet penetration contribute to this trend. As more businesses adopt digital catalogs to enhance consumer engagement, the market in Asia-Pacific is gaining momentum. According to the International Trade Administration, mobile commerce in the region is expected to reach $3.2 trillion by 2025, fostering further market expansion.

The market in Europe is expected to see steady growth and the growth of the European market is driven by the continued expansion of e-commerce and the increasing adoption of digital catalogs. According to the European Commission, approximately 70% of Europeans shopped online in 2021, and the e-commerce sector is expected to grow at a rate of 6.4%. The shift to online catalogs is also fueled by the region’s high internet penetration and technological advancements. With a focus on sustainability and eco-friendly practices, many European businesses are transitioning from print to digital catalogs, reducing operational costs while catering to the environmentally-conscious consumer base.

Latin America is poised for notable growth in the global catalog market. The growing internet access and mobile commerce adoption in Latin America are driving the regional market expansion. The International Telecommunication Union (ITU) reports that over 60% of the Latin American population is projected to access the internet via smartphones by 2025, supporting the expansion of digital catalogs. As online shopping habits become more entrenched, the digital catalog market is expected to benefit from the rise of e-commerce platforms, particularly in Brazil and Mexico. Additionally, the growing middle-class population and improving logistics infrastructure in the region will play a crucial role in fueling market growth in the coming years.

The market in the Middle East and Africa is expected to grow moderately in the coming years, driven by rising internet penetration and increasing e-commerce activity. According to the International Trade Administration, e-commerce in the Middle East surged by 20% annually, with the UAE and Saudi Arabia leading digital adoption. The Gulf Cooperation Council (GCC) countries have some of the highest internet penetration rates, with UAE at 99% and Saudi Arabia at 97%, driving demand for digital catalogs and online product listings. The region's growing young, tech-savvy population is driving the shift toward digital catalogs, and businesses are increasingly investing in e-commerce and catalog technologies to cater to this demand. As internet penetration rises in Africa, digital catalog use is also anticipated to expand, contributing to overall market growth in the region.

KEY MARKET PLAYERS

IBM, SAP, Oracle, Salsify, Coupa Software, ServiceNow, Proactis, Broadcom, Fujitsu, and Comarch are some of the major players in the catalog market.

COMPETITIVE LANDSCAPE

The competition in the catalog market is intense, driven by the rise of e-commerce and digital transformation. As traditional print catalogs decline, digital catalogs have become a dominant force, allowing companies to reach a broader audience with greater convenience. Major players like Amazon, Walmart, and Target lead the way by offering extensive online catalogs, backed by robust logistics, personalized customer experiences, and advanced technologies like artificial intelligence and machine learning. These companies have established strong market positions by continuously enhancing their catalogs through innovative features such as product recommendations, virtual try-ons, and integrated omnichannel solutions.

However, competition is not limited to large retailers. Small and medium-sized businesses (SMBs) are increasingly leveraging digital platforms to develop their catalogs and connect with niche markets. The entry of direct-to-consumer (DTC) brands and startups further intensifies the competition, as these businesses adopt agile and personalized catalog strategies to differentiate themselves. Additionally, regional players in emerging markets, particularly in Asia-Pacific and Latin America, are also gaining traction by offering localized catalogs to meet unique consumer demands.

To stay competitive, companies in the catalog market must continually invest in technology, expand their product offerings, and adapt to changing consumer preferences. As digital catalogs become more interactive and immersive, the competition will only intensify, leading to increased innovation and market consolidation.

RECENT HAPPENINGS IN THE MARKET

- On March 15, 2024, Amazon announced a $500 million investment in artificial intelligence (AI) technologies aimed at improving its product catalog management. This investment focuses on automating product categorization and enhancing search functionalities to provide a more personalized shopping experience. The initiative is expected to streamline catalog operations and improve customer satisfaction.

- On April 10, 2024, Walmart announced a strategic partnership with a leading digital catalog solutions provider, investing $200 million to integrate advanced digital catalog technologies into its operations. This collaboration aims to enhance Walmart's online product offerings and improve inventory management, aligning with the company's commitment to digital transformation.

Top 3 Players In The Market

Amazon

Amazon has significantly influenced the global catalog market through its vast digital catalog of products across various categories, including electronics, apparel, groceries, and more. With over 300 million active customer accounts, Amazon's catalog is one of the largest and most diverse globally. The company leverages advanced AI and machine learning technologies to personalize its catalog for users, recommending products based on past purchases, searches, and browsing behavior. According to Statista, Amazon’s net revenue from worldwide e-commerce sales reached $469.8 billion in 2021, reflecting the immense scale and success of its digital catalog strategy. Additionally, Amazon's catalog has become an essential tool for millions of small and medium-sized enterprises (SMEs) worldwide to sell their products, further solidifying its dominance in the market.

Walmart

Walmart has emerged as a significant player in the global catalog market, especially through its online store. In 2021, Walmart's global e-commerce sales exceeded $90 billion, with a substantial portion of those revenues generated through its digital catalog. Walmart's catalog includes a broad range of products, from groceries to electronics, supported by seamless integrations with its physical stores. The company's catalog strategy focuses heavily on enhancing the customer experience through innovations like virtual try-ons for fashion and beauty products. Walmart’s adoption of omnichannel strategies, allowing consumers to shop online and pick up items in-store, has further increased engagement with its catalog. Walmart’s digital catalog strategy has also been enhanced by its expanding use of AI and analytics to offer personalized experiences to customers.

Target

Target has made impressive strides in integrating its digital catalog with e-commerce, which contributed significantly to the retailer's growth in recent years. In 2021, Target’s digital sales grew by 50%, with more consumers s hopping via its online catalog. Target offers a diverse product catalog, including fashion, electronics, and home goods, making it one of the major players in the global market. The company has focused on enhancing user experience by implementing personalized recommendations and AI-driven search functionalities. Additionally, Target’s partnerships with other e-commerce platforms have expanded its catalog reach, allowing it to tap into new customer segments. According to the U.S. Census Bureau, retail e-commerce sales by U.S. businesses in 2021 were estimated to have surpassed $900 billion, with Target contributing significantly to this number through its innovative catalog strategy.

Top Strategies Used By The Key Market Participants

Investment in Technology and Personalization

Leading catalog companies like Amazon, Walmart, and Target have heavily invested in advanced technologies, such as artificial intelligence (AI), machine learning (ML), and data analytics, to enhance the customer experience and improve the efficiency of their catalogs. Amazon, for example, utilizes AI algorithms to personalize recommendations, providing a customized catalog to each user based on their browsing history, past purchases, and preferences. Walmart and Target also leverage similar technologies, improving search functionalities and product recommendations to boost customer engagement. Personalized experiences have been proven to increase conversion rates and customer satisfaction, making them a key part of the catalog market strategy.

Omnichannel Integration

Omnichannel retail strategies have been increasingly adopted by catalog market leaders, allowing customers to engage with catalogs across multiple platforms, both online and offline. Walmart and Target, for example, offer customers the ability to browse digital catalogs online and pick up items in-store or have them delivered. This integration helps enhance the customer experience and drive sales by making it easier for consumers to shop across multiple touchpoints. It also strengthens customer loyalty, as consumers can interact with the catalog in whichever way is most convenient for them, whether it be via mobile, desktop, or in-store.

Expanding Product Range and Partnerships

To stay competitive, companies are continually expanding their catalogs with new product categories and partnering with other brands or third-party sellers. Amazon has been a prime example, offering a wide array of products from small and medium-sized enterprises (SMEs) through its marketplace, further diversifying its catalog offerings. Similarly, Target has forged partnerships with top brands and local businesses, broadening its product catalog and attracting a larger customer base. By expanding product ranges and collaborating with other brands, these companies strengthen their catalogs and offer consumers more variety, which is crucial in retaining and growing market share.

Focus on Sustainability and Eco-Friendly Practices

Sustainability has become a significant focus for leading catalog companies, especially in light of growing consumer awareness about environmental issues. Many companies are adopting eco-friendly catalog practices, such as transitioning from printed to digital catalogs to reduce waste and carbon emissions. Amazon has made strides in improving the sustainability of its operations, including using renewable energy in its data centers and warehouses. Similarly, Walmart has committed to achieving zero emissions by 2040, with a focus on reducing plastic packaging and increasing product recyclability. Sustainability initiatives not only appeal to environmentally conscious consumers but also align with global regulatory trends, ensuring these companies remain ahead of the curve.

Enhancing Mobile and Digital Catalog Capabilities

As mobile commerce continues to rise, leading catalog companies are optimizing their digital catalogs for mobile platforms. This is essential for tapping into the growing number of consumers who prefer to shop on mobile devices. Walmart, for example, has heavily focused on enhancing its mobile app and ensuring that its digital catalog is easy to navigate on smartphones and tablets. By making catalogs mobile-friendly and incorporating features such as mobile payment systems, product reviews, and one-click purchasing, these companies improve customer convenience and drive higher engagement rates. Mobile optimization has become critical in the modern catalog market, especially as mobile commerce grows globally.

MARKET SEGMENTATION

This research report on the global catalog market is segmented and sub-segmented into the following categories.

By Type

- Digital

- Print or Paper

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Industry Vertical

- Retail and E-commerce

- Fast-Moving Consumer Goods (FMCG)

- Banking, Financial Services, and Insurance (BFSI)

- Information Technology and Telecom

- Media and Entertainment

- Travel and Hospitality

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the advantages of a catalog market?

Catalogs provide a structured shopping experience, reach a broad audience, and allow businesses to showcase products with detailed descriptions and images.

What industries use catalog marketing?

Industries such as fashion, home decor, electronics, food, and office supplies commonly use catalog marketing to reach customers globally.

How do businesses distribute catalogs to customers?

Catalogs are distributed via mail, email, websites, and social media platforms, depending on whether they are physical or digital.

How can businesses make their catalogs more effective?

High-quality images, engaging product descriptions, clear pricing, and interactive digital features help attract and retain customers.

4o

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]