Global Cassava Flour Market Size, Share, Trends, & Growth Forecast Report - Segmented By Source (Organic, Conventional), Application (Sweeteners, Chips, Feed), End Use (Household Use, Food and beverage industry, Animal Feed, and others), And Region (North America, Europe, APAC, Latin America, Middle East And Africa) – Industry Analysis (2024 To 2032)

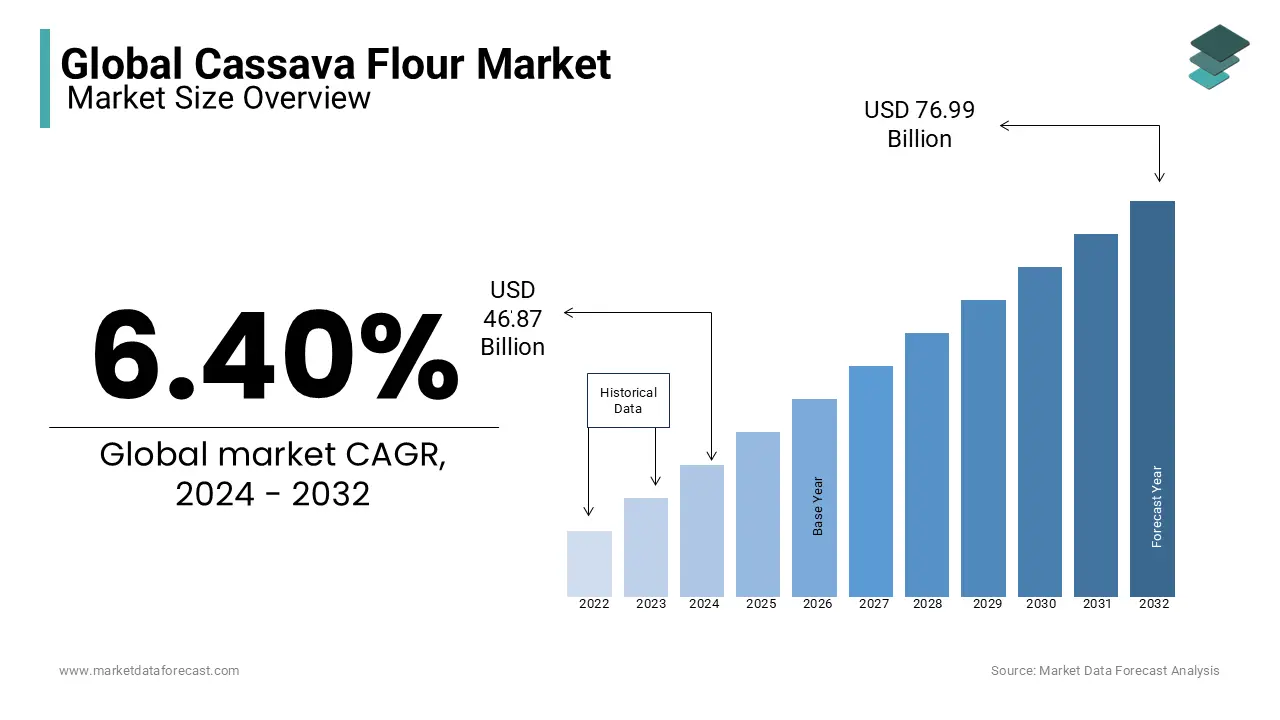

Global Cassava Flour Market Size (2024 To 2032)

The size of the global cassava flour market is expected to be worth USD 46.87 billion in 2024 and grow at a CAGR of 6.40% from 2024 to 2032 to achieve USD 76.99 billion by 2032.

A versatile gluten-free alternative to traditional flour, cassava flour originates from the cassava tuber. Cassava is the third-largest source of dietary carbohydrates in the tropics, following rice and maize. The cassava roots are peeled, dried, and crushed to produce fine, flavorless flour, which is white. This flour is naturally free of grains and suitable for a variety of dietary restrictions, such as gluten-free and paleo dietary plans. It has a similar texture to wheat flour and can be used in baking, frying, and as a thickening agent. Cassava flour is high in carbs and retains more fiber than other gluten-free flour. Blood sugar and cholesterol regulation, weight loss, and gastrointestinal health can all benefit from cassava flour.

MARKET DRIVERS

One of the major drivers of market growth is the rising trend of gluten-free products.

Recently, more people are opting for gluten-free diets as they are becoming more aware of health and overall wellness. Due to health considerations and dietary preferences, there is an increasing demand for cassava flour due to its nutritional and health benefits. Consumers with celiac disease or gluten sensitivity, as well as those looking for healthier solutions, are attracted to it because of its capacity to replicate the texture of wheat flour while being free from gluten.

Another significant driver of the cassava flour market growth is the growing demand for functional foods globally. As health-conscious consumers are increasingly preferring functional foods, the demand for cassava flour is increasing among these people. Cassava flour fits in perfectly with the functional food trend owing to its naturally higher fiber content, gluten-free qualities, and potential health benefits. As a result of its ability to fulfill various dietary requirements and support a balanced diet, it is in high demand as an ingredient for foods that promote healthy digestion, disease prevention, and overall well-being. This demand promotes innovation, product diversification, and promotional strategies that make use of cassava flour, hence enhancing its significance in the functional food market.

Also, the growing awareness about the nutritional benefits of cassava flour is propelling the cassava flour market demand. Cassava flour is becoming more popular as consumers grow more informed about the composition and significance of the foods they prefer as a result of its unique qualities. Cassava flour, which is especially high in carbohydrates and fiber, offers itself as a potential source of long-lasting energy and better digestive health. Cassava flour's ability to satisfy dietary restrictions is further enhanced as it is a gluten-free alternative. Cassava flour is gaining popularity as a more nutritious alternative as it has more fiber than other gluten-free flour. This nutritional enrichment is contributing to boosting the demand for the market.

A substantial opportunity for the cassava flour market growth is offered by expanding the food and beverage industries globally. As these industries are growing rapidly, there is an increased demand for various kinds of ingredients, which helps them to attract a larger consumer base. Cassava flour is important for product innovation and diversification as consumer preferences shift towards healthier, gluten-free, plant-based, and more natural alternatives. Cassava flour meets the market's demand for adaptable, clean-label ingredients and takes into consideration changing dietary trends ranging from functional foods to plant-based substitutes to gluten-free baked products. The addition of it to several products, such as bakery products, drinks, snacks, and ethnic cuisines, can not only satisfy consumer demand but also boost market expansion by fulfilling the changing requirements of the food and beverage industry. This can help the market to grow significantly in the coming years.

MARKET RESTRAINTS

One of the major restraints on the cassava flour market expansion is the limited knowledge and awareness about cassava flour.

Many consumers, chefs, and manufacturers are still unaware of the advantages and uses of cassava flour. Due to this, there is less demand for cassava flour, and people prefer to buy other alternatives available in the market as they are aware of them. This lack of understanding of cassava flour can result in hesitation to try products made with it, uncertainty when adding it to culinary creations, and missed opportunities for new food products made from cassava flour. This is majorly restraining the expansion of the market size.

Another considerable restraint for the market demand is the growing competition from other alternative flours. Numerous kinds of alternative flours, including almond flour, coconut flour, and chickpea flour, have become effective alternatives to traditional wheat flour due to the rising popularity of gluten-free and healthier diets. These substitutes draw attention from consumers and shift demand away from cassava flour as they have a range of nutrients and distinctive flavors. The availability of these other flour substitutes in the market is significantly restricting the demand for cassava flour and, hence, declining the shares of the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

6.40% |

|

Segments Covered |

By Source, Application, End-user, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC; PESTLE Analysis. Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Siemens Healthineers, Abbott Laboratories, Inc., Roche Diagnostics, Anthonys Goods, Otto's Naturals, American Key Food Products, Food to Live, GEM Farmers Way, Pamelas Products, Ciranda, Carrington Farms |

SEGMENTAL ANALYSIS

Global Cassava Flour Market Analysis By Source

By source, the organic segment is anticipated to dominate the cassava flour market growth during the forecasted period. The conventional segment is expected to grow at the fastest rate in the coming years. Conventional cassava flour is produced by traditional farming practices, which may include chemicals like pesticides and fertilizers. Compared to organic cassava flour, this segment is cost-effective and hence attracts a broader consumer base. This factor is influencing the shares of the market.

Global Cassava Flour Market Analysis By Application

By application, the sweeteners segment is anticipated to rule the cassava flour market share during the projected period. The natural sugars in cassava flour can be extracted and produce sweeteners that can replace refined sugars in various foods and beverages. These sweeteners can satisfy the requirements of consumers seeking healthier alternatives with less glycemic index. However, the chips segment is expected to grow significantly in the upcoming years. Because making gluten-free and grain-free snack chips with cassava flour is an increasingly popular trend, these chips provide an alternative to traditional potato or corn chips and are an excellent choice for consumers with dietary restrictions or those looking for unique and interesting snack options, leading to a boost in the demand for cassava flour in this segment.

Global Cassava Flour Market Analysis By End Use

By end use, the food and beverage industry segment are dominating the cassava flour market share during the anticipated period. Cassava flour is widely used in the preparations of food and beverages. It is used as an essential ingredient in gluten-free pasta, baked goods, snacks, and other food products. Its adaptability and nutritional benefits make it an attractive option for producers aiming to satisfy a wide range of dietary preferences, gluten-free demands, and health-conscious consumers. This is leading to boosting the demand for cassava flour in this segment. However, the animal feed segment is expected to grow at the fastest rate during the forecasted period. Cassava flour is valued for the energy it offers to livestock diets and the amount of carbohydrates it contains. This promotes the growth and overall health of the animals, which is promoting the market demand.

REGIONAL ANALYSIS

By region, North America is anticipated to rule the cassava market shares during the projected period. Owing to the enhanced production of cassava in the region, this availability of raw material leads to the production of an increased amount of cassava flour and, hence, the rising use of it in gluten-free baking and cooking processes at households & commercial levels. Also, the expanding food and beverage industries are contributing to an increase in the demand for cassava flour in this region. However, Asia Pacific is expected to grow at the fastest CAGR during the forecasted period.

KEY MARKET PLAYERS

Major Key Players in the global cassava flour market are Siemens Healthineers, Abbott Laboratories, Inc., Roche Diagnostics, Anthonys Goods, Otto's Naturals, American Key Food Products, Food to Live, GEM Farmers Way, Pamelas Products, Ciranda, Carrington Farms

DETAILED SEGMENTATION OF THE GLOBAL CASSAVA FLOUR MARKET INCLUDED IN THIS REPORT

This research report on the global cassava flour market has been segmented and sub-segmented based on source, application, end user, and region.

By Source

- Organic

- Conventional

By Application

- Sweeteners

- Chips

- Feed

By End Use

- Household Use

- Food & Beverage industry

- Animal Feed

- Others

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. How is cassava flour produced?

Cassava flour is produced by grating and drying the cassava root, then milling it into a fine powder. This process typically involves peeling the cassava, grating it into a pulp, fermenting it (in some cases), drying it, and finally grinding it into flour.

2. What are the challenges in the cassava flour market?

Challenges include maintaining consistent quality and supply, addressing concerns about cyanide content (which can be toxic if not properly processed), and competition from other gluten-free flours like almond flour and coconut flour.

3. What are the uses of cassava flour?

Cassava flour can be used as a 1:1 substitute for wheat flour in many recipes, making it versatile for baking bread, cakes, cookies, and other baked goods. It's also used as a thickening agent in sauces, soups, and gravies.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]