Global Casino Market Size, Share, Trends, & Growth Forecast Report Segmented By Type (Land-Based Casino Gaming, Online Casino Gaming), End-User, and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Casino Market Size

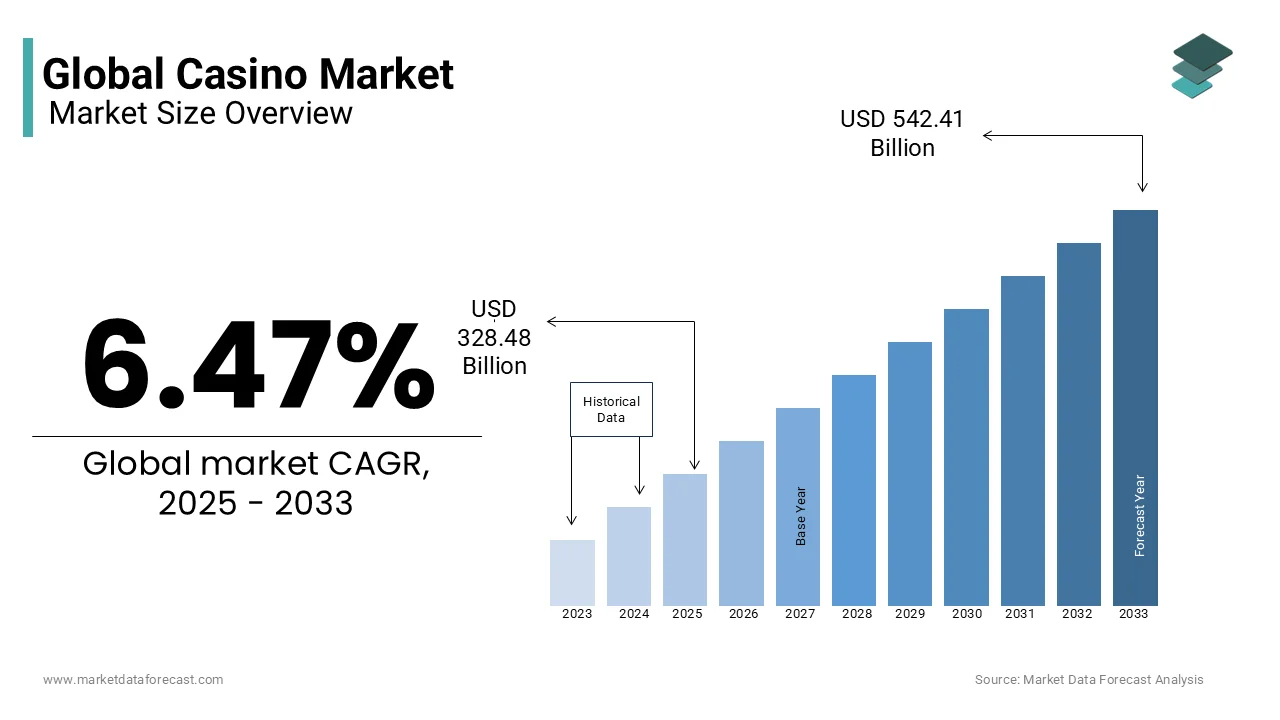

The global casino market size was valued at USD 308.52 billion in 2024 and is projected to grow from USD 328.48 billion in 2025 to USD 542.41 billion by 2033, the market is expected to grow at a CAGR of 6.47% during the forecast period.

CURRENT SCENARIO

The Casino market is a significant segment of the global gambling and entertainment industry. It encompasses a wide range of gaming establishments that offer games of chance, skill-based games, and live entertainment experiences. Casino operate through various models, including land-based venues, riverboat Casino, and online platforms, each catering to distinct consumer demographics. The market has evolved significantly over the years and is driven by technological advancements, regulatory shifts, and changing consumer preferences.

The global Casino market has witnessed substantial growth due to the growing legalization and rising adoption of Casino in emerging economies. According to the American Gaming Association (AGA), the global casino industry generated over $261 billion in revenue in 2022 which is reflecting robust demand and resilience post-pandemic. Las Vegas, Macau, and Singapore remain major gambling hubs with Macau alone contributing $22.8 billion in gross gaming revenue (GGR) in 2023, as reported by the Macau Gaming Inspection and Coordination Bureau. Meanwhile, the rise of digital gambling platforms has been transformative, with the online casino sector expected to grow significantly in the coming years.

Consumer behavior in the Casino market is increasingly influenced by integrated resort models, where Casino are bundled with luxury hotels, entertainment complexes, and fine dining options. Additionally, regulatory frameworks, such as the legalization of sports betting in the U.S. following the 2018 Supreme Court ruling, have further expanded opportunities for operators. The convergence of physical Casino and digital platforms is set to redefine market trends in the coming years owing to the continuous evolution of the industry.

MARKET DRIVERS

Expansion of Legalized Gambling

The growing legalization of gambling activities across various countries is a major driver of the Casino market, fostering industry expansion and boosting revenue generation. Governments worldwide recognize the economic benefits of regulated gambling, including increased tax revenues and job creation. In the United States, commercial gaming revenue hit a record $66.5 billion in 2023, marking an 11.6% increase from the previous year, according to the American Gaming Association (AGA). Similarly, Canada’s regulated gambling industry contributed over $17 billion to the national economy, as reported by the Canadian Gaming Association. In Asia, the Philippines' gross gaming revenue reached $5.1 billion in 2023, as stated by the Philippine Amusement and Gaming Corporation (PAGCOR), showcasing the region’s growing market potential.

Technological Advancements and Digital Transformation

The rapid integration of digital technology and innovation in Casino has significantly shaped market growth, enhancing customer experience and operational efficiency. The proliferation of cashless gaming, blockchain-based transactions, and AI-driven personalization has transformed both land-based and online Casino. Additionally, the U.K. Gambling Commission reported that 42% of all gambling transactions in the country occurred online in 2023, reflecting a shift toward digital gaming. Virtual reality (VR) and augmented reality (AR) are also reshaping the casino landscape, offering immersive experiences that attract tech-savvy gamblers.

MARKET RESTRAINTS

Stringent Regulatory Frameworks and Compliance Costs

The Casino market faces significant regulatory challenges due to governments imposing strict licensing requirements, taxation policies, and anti-money laundering (AML) compliance measures. These regulations increase operational costs and limit market expansion in certain regions. In the United States, gross gaming revenue (GGR) is subject to federal and state taxes ranging from 6.75% to 50%, according to the American Gaming Association (AGA). Similarly, the U.K. Gambling Commission reported that operators paid £3.2 billion in gambling duties in 2023, affecting profitability. In Macau, China’s intensified oversight led to a 50% decline in VIP gambling revenues between 2019 and 2022, as per the Macau Gaming Inspection and Coordination Bureau, illustrating the impact of regulatory restrictions on high-stakes gaming.

Rising Concerns Over Gambling Addiction and Social Impact

The increasing awareness of problem gambling and its social consequences has led to stricter gambling policies and consumer protection measures which is restraining market growth. Governments are imposing tighter restrictions to address addiction-related concerns, impacting casino revenues. The National Council on Problem Gambling (NCPG) in the U.S. estimates that around 2 million Americans suffer from severe gambling addiction, prompting enhanced regulatory scrutiny. In Australia, the Australian Gambling Research Centre (AGRC) reported that the government imposed a $10,000 annual loss limit on online betting accounts in 2023 to curb problem gambling. Moreover, the European Gaming and Betting Association (EGBA) found that 23% of gambling-related revenue in the EU is generated from high-risk gamblers, leading to stronger consumer protection laws.

MARKET OPPORTUNITIES

Expansion of Integrated Resort (IR) Developments

The increasing popularity of integrated resorts (IRs) presents a significant growth opportunity for the global Casino market. IRs combine Casino with luxury hotels, shopping centers, convention spaces, and entertainment venues and is attracting a diverse customer base beyond traditional gamblers. In Japan, the government approved the development of its first casino resort in Osaka, projected to generate $8.5 billion in annual revenue by 2030, according to the Japan Tourism Agency. Similarly, Singapore’s Marina Bay Sands and Resorts World Sentosa contributed over $4.1 billion in gross gaming revenue (GGR) in 2023, as reported by the Singapore Tourism Board. The investments in such large-scale casino developments are expected to surge as governments are increasingly favouring IRs to boost tourism and economic activity.

Growth of Online and Mobile Gambling

The rapid rise of online and mobile gambling is creating immense opportunities for the Casino market, driven by advancements in digital payment methods, mobile gaming applications, and live dealer technology. In the United Kingdom, the Gambling Commission reported that online gambling accounted for 42% of the total gambling revenue in 2023, underscoring the increasing shift to digital platforms. Additionally, the legalization of online gaming in several U.S. states, including Michigan and New Jersey, contributed to $5.4 billion in iGaming revenue in 2023, as reported by the American Gaming Association (AGA), highlighting the sector’s growth potential.

MARKET CHALLENGES

Economic Uncertainty and Recession Risks

The Casino market is highly sensitive to economic downturns, as discretionary spending on gambling and entertainment declines during financial crises. Economic slowdowns lead to reduced consumer footfall in Casino and lower betting volumes, directly impacting industry revenues. The International Monetary Fund (IMF) projected that global economic growth would slow to 2.9% in 2024, raising concerns over declining consumer spending. In the United States, the American Gaming Association (AGA) reported that Las Vegas Strip casino revenue fell by 9.3% during the 2008-2009 recession, illustrating the industry's vulnerability to economic shocks. Similarly, Macau’s casino GGR plummeted by 79.3% in 2020 amid the COVID-19 economic slowdown which demonstrats how external economic factors disrupt market performance, as per the Macau Gaming Inspection and Coordination Bureau.

Cybersecurity Threats and Fraud in Online Gambling

The increasing reliance on digital platforms in the gambling industry has heightened cybersecurity risks, making online Casino and payment systems vulnerable to data breaches, fraud, and money laundering. The Federal Trade Commission (FTC) in the U.S. recorded a 45% rise in online fraud cases linked to gambling transactions in 2023, reflecting the growing risks associated with digital gaming. Additionally, the European Union Agency for Cybersecurity (ENISA) warned that online gambling platforms remain prime targets for cyberattacks, with reported losses exceeding €1.3 billion in 2023 due to data theft and fraudulent activities. The regulatory bodies are tightening security requirements which is compelling online casino operators to necessarily invest heavily in cybersecurity infrastructure to prevent financial losses and maintain consumer trust.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.47% |

|

Segments Covered |

By Type, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Las Vegas Sands Corporation, MGM Resorts International, Caesars Entertainment, Wynn Resorts, Galaxy Entertainment Group, Melco Resorts & Entertainment, SJM Holdings, Aristocrat Leisure Limited, Evolution Gaming, Flutter Entertainment, and others. |

SEGMENT ANALYSIS

By Type Insights

The land-based casino gaming remained as the largest segment in the global Casino market in 2024 by holding 70.1% market share. According to the Gambling Commission's Industry Statistics, the non-remote betting sector, which includes land-based Casino, reported a Gross Gambling Yield (GGY) of £2.5 billion, a 15.4% increase from the previous period. This growth underscores the enduring appeal of physical casino venues which offer immersive experiences, social interaction, and entertainment options beyond gambling. Iconic destinations like Las Vegas and Macau continue to attract millions of visitors annually, contributing significantly to the market's revenue. The tangible atmosphere and direct engagement provided by land-based Casino play a crucial role in maintaining their leading position in the industry.

Conversely, the online casino gaming segment is the Soaring segment in the market and is estimated to register CAGR of 12.1% in the coming years. The Gambling Commission's November 2024 report indicates that the Remote Casino, Betting, and Bingo sector accrued a GGY of £6.9 billion, with online casino games alone generating £4.4 billion, of which £3.6 billion was from slots games. This growth is driven by technological advancements, increased internet accessibility, and the convenience of gambling from home. The proliferation of mobile devices and innovative features like live dealer games have enhanced the online gaming experience, attracting a broader audience. The flexibility and accessibility of online platforms are pivotal factors contributing to their rapid expansion in the global Casino market.

By End User Insights

The gambling enthusiasts segment represented as the most extensive end-user segment by accounting for 55.3% of the global market share in 2024. This dominance is attributed to their consistent engagement with various gambling activities, including casino games, sports betting, and online gaming platforms. Their regular participation and higher expenditure levels significantly contribute to the market's revenue, underscoring their importance in sustaining and driving the growth of the gambling industry. According to the National Council on Problem Gambling (NCPG), around 26% of the global adult population participates in some form of gambling annually, with some regions exhibiting even higher engagement rates.

On the other hand, the gambling enthusiasts segment is projected to be the fastest growing and exhibit a CAGR of 6.8% over the forecast period owing to the factors such as the increasing legalization of gambling activities in various regions, technological advancements enhancing the gaming experience, and the rising popularity of online and mobile gambling platforms. The expansion of digital gambling options provides enthusiasts with greater accessibility and convenience, further fueling their engagement and spending in the market. The sustained interest and evolving preferences of this segment are pivotal in shaping the future landscape of the global Casino market.

The dabblers segment is also growing but at a slower pace i.e. at a CAGR of 5.57% compared to Gambling Enthusiasts. Research indicates that approximately 56% of global adults engage in gambling at least once a year, with a significant portion falling into the Dabbler category. In the United States, a study by the National Council on Problem Gambling (NCPG) found that roughly 40% of adults gamble occasionally, participating in activities such as lotteries, casual casino visits, or social betting. Similarly, in the UK, the Gambling Commission reports that 32% of the population participates in gambling activities infrequently, reflecting a sizable portion of low-frequency bettors

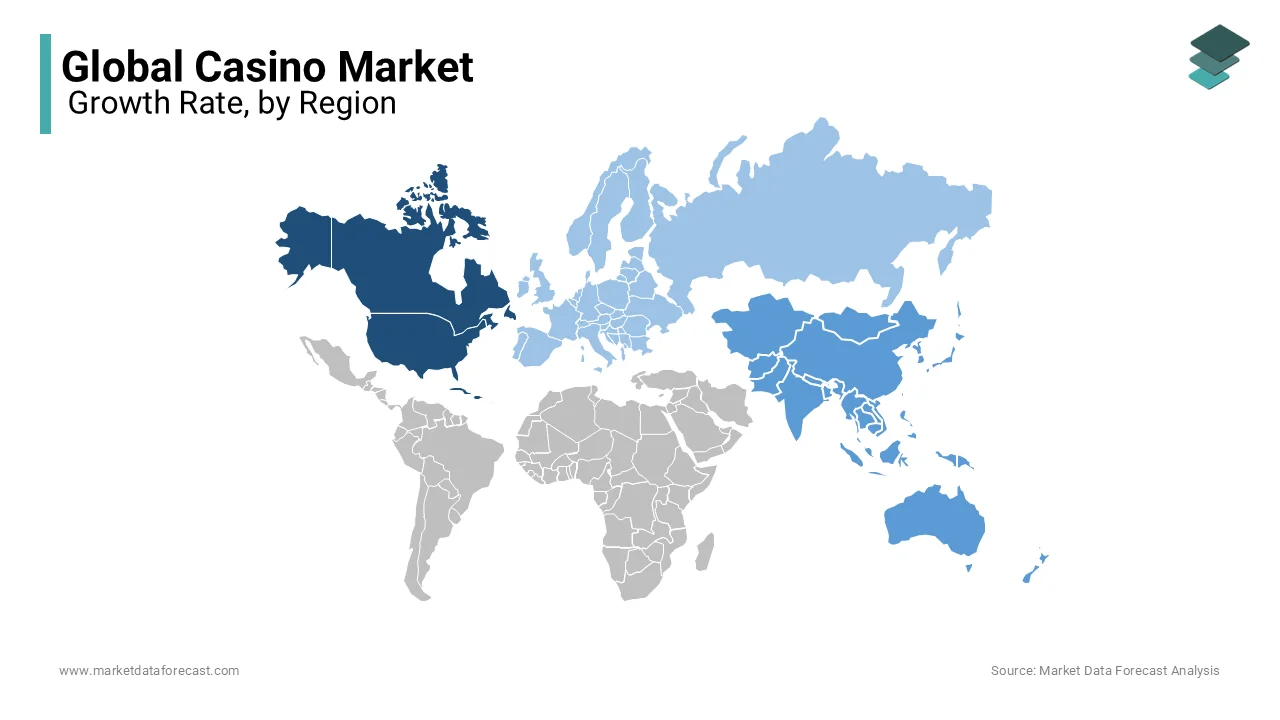

REGIONAL ANALYSIS

North America dominated the Casino market worldwide by accounting for 45.9% of the global market share in 2024. The United States leads the region with commercial gaming revenue reaching a record $66.5 billion in 2023, driven by strong growth in land-based Casino, sports betting, and online gaming. Nevada which is home to Las Vegas—generating $8.7 billion in casino revenue alone in 2023 and remains a global gambling hub. The legalization of sports betting in multiple U.S. states and Canada’s expanding casino industry have reinforced North America’s leadership, with rising consumer spending on entertainment fueling long-term market growth.

The Asia-Pacific region is the rapidly growing regional segment for Casino and is projected to expand at a CAGR of 12.3% from 2025 to 2033. The growth of the Asia-Pacific market is driven by Macau, which generated $22.8 billion in gross gaming revenue (GGR) in 2023, reclaiming its status as the world's largest casino market. Singapore's Marina Bay Sands and Resorts World Sentosa collectively contributed over $4.1 billion in revenue in 2023, as per the Singapore Tourism Board. Japan’s entry into the market with its first integrated casino resort in Osaka, expected to generate $8.5 billion annually by 2030 which further boosts the sector. Rising middle-class income and tourism growth in emerging markets like the Philippines and Vietnam are accelerating regional expansion.

The Casino market in Europe remains stable and is primarily supported by a strong regulatory framework and a growing online gambling sector. According to the U.K. Gambling Commission, the European gambling market generated over £3.2 billion in gambling tax revenues in 2023, with the United Kingdom, Germany, and France leading the industry. The online casino sector is expanding rapidly, with digital gambling accounting for 42% of total gambling revenue in the U.K. in 2023. Additionally, Germany’s regulated gambling market saw €13.4 billion in total revenue, as per the Federal Statistical Office of Germany. The market’s stability is reinforced by strict regulations and consumer protection measures, ensuring steady growth in the coming years.

The Latin American Casino market is rapidly expanding and is driven by regulatory reforms and economic development. Brazil, the largest market in the region, legalized sports betting and online Casino, with the Ministry of Finance projecting $2.1 billion in gambling revenue by 2027. Mexico’s land-based casino industry remains strong, with over 400 licensed gaming establishments generating an estimated $1.5 billion in revenue annually, according to the Mexican Gaming Association. Argentina is also witnessing market expansion, with online gaming platforms contributing to 15% of total gambling revenues in 2023, as per the Argentine Lottery and Betting Commission. As regulatory frameworks become more structured, Latin America is set for significant growth in both land-based and online Casino.

The Middle East & Africa casino market faces slow growth due to strict Islamic laws restricting gambling in most Middle Eastern countries. However, some regions are seeing development. Dubai has approved the construction of its first integrated resort casino, expected to generate over $1 billion annually by 2030, according to the UAE Tourism Authority. In Africa, South Africa remains the largest gambling market, with the South African National Gambling Board reporting $2.7 billion in total gaming revenue in 2023. Other African countries, including Kenya and Nigeria, are expanding their regulated casino markets, though strict licensing and taxation policies remain barriers to rapid growth in the region.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

The major key players in the global casino market are Las Vegas Sands Corporation, MGM Resorts International, Caesars Entertainment, Wynn Resorts, Galaxy Entertainment Group, Melco Resorts & Entertainment, SJM Holdings, Aristocrat Leisure Limited, Evolution Gaming, Flutter Entertainment, and others.

The global Casino market is highly competitive, with key players competing across land-based, online, and integrated resort segments. The market is dominated by industry giants such as Las Vegas Sands, MGM Resorts International, Wynn Resorts, Caesars Entertainment, and Galaxy Entertainment, each leveraging large-scale operations and premium customer experiences to maintain their dominance. Las Vegas and Macau remain the most competitive regions, with Macau alone generating $22.8 billion in gross gaming revenue (GGR) in 2023, according to the Macau Gaming Inspection and Coordination Bureau.

Competition is intensifying as Asian markets, particularly Singapore, Japan, and the Philippines, emerge as major gambling hubs. With Japan’s first integrated resort set to open in Osaka, generating a projected $8.5 billion in annual revenue, global operators are investing heavily in these high-growth regions. The rise of online Casino and mobile gambling platforms has further heightened competition, with companies like BetMGM, 888 Holdings, and DraftKings expanding digital gaming services. According to the American Gaming Association (AGA), the U.S. online gaming market grew by 35% in 2023, reflecting a shift in consumer preferences.

With ongoing mergers, acquisitions, and technological advancements, competition will continue to shape the Casino market, pushing operators to innovate and expand globally.

STRATEGIES USED BY THE MARKET PLAYERS

Expansion of Integrated Resort (IR) Developments

Leading casino operators such as Las Vegas Sands, MGM Resorts, and Wynn Resorts focus on integrated resort (IR) models, which combine Casino with luxury hotels, entertainment complexes, shopping malls, and convention centers. This strategy helps attract a diverse customer base, including tourists, business travelers, and casual gamers. According to the Las Vegas Sands 2023 Annual Report, its Marina Bay Sands in Singapore and The Venetian in Macau contributed over 75% of its total gaming revenue, demonstrating the success of the IR approach. The $8.5 billion Osaka integrated casino project, led by MGM Resorts, is expected to further boost this model.

Digital Transformation and Online Gaming Expansion

With the rise of online and mobile gambling, major players are investing heavily in digital gaming platforms. MGM Resorts, through its BetMGM platform, captured 27% of the U.S. online casino market in 2023, as per the American Gaming Association (AGA). Similarly, Wynn Resorts has expanded its online casino and sports betting operations in the U.S. and Europe, targeting digital-savvy gamblers. These companies are leveraging AI, blockchain technology, and virtual reality (VR) gaming to enhance user experience and increase engagement.

Geographic Expansion into Emerging Markets

Key casino operators are expanding their presence in high-growth markets such as Asia-Pacific and Latin America, where demand for gambling is rising. Macau remains a focal point, with Las Vegas Sands and Wynn Resorts generating over 60% of their revenues from their Macau properties, as per the Macau Gaming Inspection and Coordination Bureau. Latin America is another target, with MGM Resorts planning strategic investments in Brazil, following the legalization of sports betting and casino gaming.

Strategic Partnerships and Mergers & Acquisitions (M&A)

Casino operators are engaging in mergers, acquisitions, and partnerships to strengthen market presence and diversify offerings. MGM Resorts acquired LeoVegas for $607 million in 2022, expanding its online gaming portfolio, while Caesars Entertainment merged with Eldorado Resorts in a $17.3 billion deal, increasing its footprint in the U.S. and international markets. These strategic moves allow companies to enhance their gaming platforms, expand customer bases, and leverage brand synergies.

Sustainability and ESG Initiatives

Environmental, Social, and Governance (ESG) initiatives are becoming a critical strategy for long-term success in the Casino market. Las Vegas Sands invested $200 million in sustainability projects, including energy-efficient casino operations and water conservation programs, as per the Las Vegas Sands Sustainability Report 2023. Similarly, MGM Resorts has committed to reducing carbon emissions by 50% by 2030, aligning with global sustainability trends. These initiatives enhance brand reputation and attract eco-conscious customers.

TOP 3 PLAYERS IN THE MARKET

Las Vegas Sands Corp.

Las Vegas Sands Corp. is the largest casino operator in the world, contributing significantly to the global Casino market through its integrated resort model. The company operates high-profile Casino, including Marina Bay Sands in Singapore and The Venetian in Macau, two of the world's highest-grossing casino resorts. According to the Las Vegas Sands 2023 Annual Report, the company generated $10.3 billion in total revenue in 2023, with over $7.5 billion coming from its Macau operations alone. Its focus on luxury casino resorts with hotels, shopping centers, and entertainment facilities has positioned it as a market leader, particularly in Asia-Pacific and North America.

MGM Resorts International

MGM Resorts International is one of the most prominent names in the casino industry, with properties in Las Vegas, Macau, and other major gambling hubs. According to the MGM Resorts 2023 Financial Report, the company generated $16.2 billion in total revenue, with its Las Vegas properties contributing $9.5 billion. MGM has been a major player in expanding online gaming through its BetMGM platform, which has captured about 27% of the U.S. online casino market, as per the American Gaming Association (AGA). The company is also investing heavily in sports betting and digital casino gaming, positioning itself for future market expansion.

Wynn Resorts Ltd.

Wynn Resorts is known for its high-end casino resorts, particularly in Las Vegas and Macau. The company recorded $7.4 billion in total revenue in 2023, with Macau operations accounting for 60% of its earnings, as reported by the Macau Gaming Inspection and Coordination Bureau. Wynn’s strategy focuses on the luxury gaming segment, targeting high-net-worth individuals and VIP gamblers. The company's investment in Wynn Palace in Macau and Wynn Las Vegas has strengthened its market share, making it a key player in the industry. With plans for further expansion in Asia and digital gaming, Wynn remains a formidable competitor in the global Casino market.

RECENT HAPPENINGS IN THE MARKET

- In July 2024, Apollo Funds announced the acquisition of International Game Technology's (IGT) gaming and digital divisions, along with Everi Holdings, in an all-cash deal valued at $6.3 billion. This strategic move aims to merge IGT's gaming and digital operations with Everi's gaming and fintech segments, creating a comprehensive gaming entity under Apollo's ownership. The transaction is anticipated to close by the third quarter of 2025, subject to regulatory and shareholder approvals.

- In May 2024, Brightstar Capital Partners entered into a definitive agreement to acquire PlayAGS, Inc. (AGS), a global gaming supplier specializing in slot machines, table games, and interactive products, for approximately $1.1 billion. The deal, approved by AGS's Board of Directors, offers shareholders $12.50 per share in cash, representing a 41% premium over the company's 90-day volume-weighted average share price. This acquisition is expected to bolster Brightstar's presence in the gaming industry by leveraging AGS's diverse product portfolio.

MARKET SEGMENTATION

This research report on the global casino market has been segmented and sub-segmented based on type, end-user, and region.

By Type

- Land-Based Casino Gaming

- Online Casino Gaming

By End-User

- Gambling Enthusiasts

- Dabblers

- Lottery Loyalists

- Unengaged Audience

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]