Global Carmine Market Size, Share, Trends & Growth Forecast Report Segmented By Form (Powder, Liquid, Crystal), Application, End User, And Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 To 2033

Global Carmine Market Size

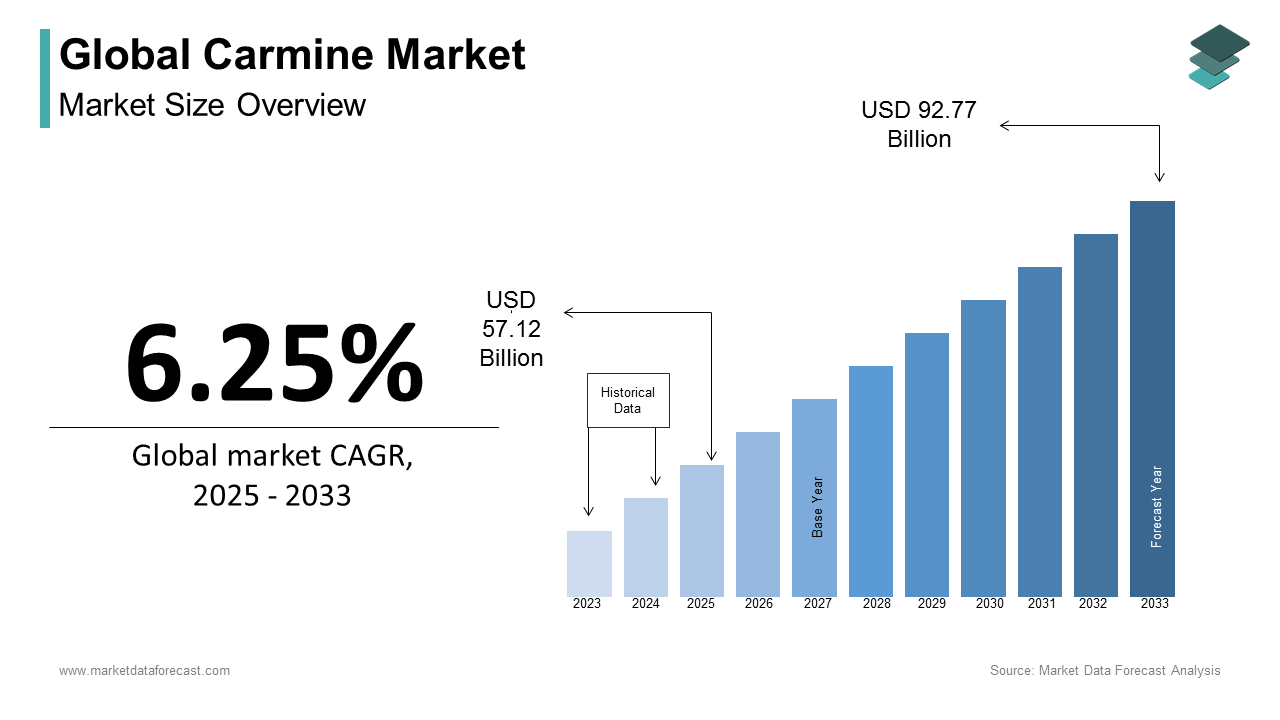

The global carmine market size was calculated to be USD 53.76 billion in 2024 and is anticipated to be worth USD 92.77 billion by 2033 from USD 57.12 billion In 2025, growing at a CAGR of 6.25% during the forecast period.

Carmine is a vibrant red pigment derived from the cochineal insect (Dactylopius coccus) that has long been prized for its natural origin and intense coloration. Traditionally used in textiles and art, carmine has evolved into a critical ingredient across diverse industries by including food, cosmetics, pharmaceuticals, and beverages.

The global demand for carmine is closely tied to its role in meeting regulatory and consumer preferences for natural ingredients. A Similarly, the European Commission reported that over 50% of cosmetic formulations now incorporate natural pigments which is driven by growing concerns about skin sensitivities and environmental sustainability. The World Health Organization underscores the importance of reducing exposure to synthetic chemicals in food and personal care products that further bolster the appeal of natural alternatives like carmine.

The importance of sustainable farming practices to ensure consistent quality and availability is increasing in every region. The Food and Agriculture Organization reports that cochineal farming supports over 30,000 small-scale farmers in these regions by contributing significantly to rural livelihoods. Beyond its industrial applications, carmine’s cultural significance in traditional dyeing techniques persists in Latin America, where indigenous communities have utilized cochineal for centuries. This blend of heritage and modern utility positions carmine as a cornerstone of the natural colorants landscape.

MARKET DRIVERS

Growing Consumer Demand for Clean-Label Products

The global shift toward clean-label products is a major driver of the carmine market. According to the Food and Agriculture Organization, over 60% of consumers in developed regions now prioritize natural and minimally processed ingredients in their purchases. This trend is particularly evident in Europe where the European Food Safety Authority mandates transparent labeling of synthetic additives, pushing manufacturers to adopt natural alternatives like carmine. The World Health Organization reported that artificial colorants have been linked to health concerns such as allergies and hyperactivity in children, further accelerating the transition. In response, the food and beverage industry has seen a 25% annual increase in product launches featuring natural colorants since 2018, as reported by the International Trade Centre. Carmine’s stability and vibrant hue make it a preferred choice with its sustained demand in this evolving consumer landscape.

Stringent Regulations on Synthetic Colorants

Stringent regulations on synthetic colorants are propelling the adoption of carmine across industries. The European Commission has banned or restricted several synthetic dyes including Red 40 and Yellow 5 due to potential health risks by compelling manufacturers to seek safer alternatives. Similarly, the Food and Drug Administration enforces strict labeling requirements for synthetic additives is driving companies to reformulate products with natural pigments. The World Health Organization reports that regulatory actions have reduced the use of synthetic colorants by 30% in key markets over the past five years. Additionally, the Food and Agriculture Organization notes that compliance with these regulations has increased production costs for synthetic dyes by making natural options like carmine more economically viable. These regulatory pressures ensure carmine remains a critical solution for meeting global safety standards while addressing consumer concerns about chemical exposure.

MARKET RESTRAINTS

Limited Geographical Supply of Cochineal Insects

The carmine market faces significant constraints due to the limited geographical supply of cochineal insects which are primarily farmed in Peru and Mexico. The Food and Agriculture Organization states that these two countries account for nearly 95% of global cochineal production that is making the supply chain highly vulnerable to regional disruptions such as climate change or pest infestations. For instance, the United Nations Environment Programme reports that erratic rainfall patterns in Latin America have reduced cochineal yields by up to 15% in recent years. This geographic concentration also leads to logistical challenges, with transportation costs increasing by 20% during peak demand periods. Additionally, the European Commission reported that over-reliance on a few regions creates risks of price volatility is impacting industries dependent on stable carmine supplies. These limitations hinder scalability and pose long-term challenges for meeting rising global demand.

Health Concerns Among Specific Consumer Groups

Health concerns among specific consumer groups present another restraint for the carmine market. The Food and Drug Administration acknowledges that carmine can cause allergic reactions in sensitive individuals for those with asthma or food intolerances. The World Health Organization reports that approximately 5% of the population exhibits adverse reactions to carmine that is limiting its acceptance in certain markets. Furthermore, the European Food Safety Authority mandates strict labeling requirements for carmine which has led to a 10% decline in its use in hypoallergenic cosmetics since 2020. While carmine remains widely used, these health-related challenges drive some manufacturers to explore alternative natural colorants. The International Trade Centre notes that this trend has resulted in a 12% annual growth in the adoption of substitutes like beetroot or anthocyanin-based pigments that further promoting the growth rate of carmine market.

MARKET OPPORTUNITIES

Expansion into Emerging Markets with Rising Middle-Class Populations

Emerging markets in Asia-Pacific and Africa present significant growth opportunities for the carmine market which is driven by rising middle-class populations and increased consumer spending. The United Nations Economic and Social Commission for Asia and the Pacific reports that the Asian middle class is projected to grow by 50% by 2030 by reaching over 3.5 billion people. This demographic shift fuels demand for premium food, beverages, and cosmetics, where natural colorants like carmine are highly valued. Additionally, the African Development Bank reported that urbanization rates in Africa exceed 4% annually by creating new avenues for carmine adoption in packaged goods. The Food and Agriculture Organization notes that sustainable sourcing initiatives can further enhance carmine’s appeal in these regions where eco-consciousness is gaining traction.

Development of Innovative Applications in Pharmaceuticals and Nutraceuticals

The pharmaceutical and nutraceutical industries offer untapped potential for carmine as a natural coloring agent in tablets, capsules, and supplements. The World Health Organization emphasizes the growing demand for visually appealing yet safe formulations with global nutraceutical sales expected to reach $722 billion by 2030. Carmine’s stability and non-toxic properties make it ideal for these applications in pediatric and geriatric products. The European Medicines Agency reports that over 60% of consumers prefer medications with natural ingredients is driving manufacturers to reformulate products accordingly. Furthermore, the Food and Drug Administration reported that regulatory support for natural additives in pharmaceuticals has increased adoption rates by 18% since 2019. Carmine producers can capitalize on this trend and establish a strong foot hold in the rapidly expanding healthcare sector.

MARKET CHALLENGES

Vulnerability to Climate Change and Environmental Factors

Carmine production faces significant challenges due to its susceptibility to climate change and environmental disruptions. The United Nations Framework Convention on Climate Change reports that rising global temperatures have led to a 10% decline in cochineal insect populations in key farming regions over the past decade. Erratic weather patterns, such as prolonged droughts or unseasonal rainfall will further exacerbate yield instability. The Food and Agriculture Organization reported that Latin American farmers experienced a 25% reduction in cochineal harvests during extreme weather events in 2022 alone. Additionally, the World Meteorological Organization predicts that climate-related risks could increase production costs by up to 30% in vulnerable regions by 2030. These environmental challenges threaten the sustainability of carmine supply chains which is requiring urgent adaptation strategies to mitigate long-term impacts.

Ethical Concerns and Consumer Perception of Animal-Derived Products

Ethical concerns surrounding the use of animal-derived products pose a growing challenge for the carmine market. The European Commission notes that over 40% of consumers in Europe now prioritize vegan and cruelty-free alternatives that is driven by rising awareness of animal welfare issues. This shift has led to a 15% annual decline in carmine adoption within vegan-certified products since 2020. Furthermore, the Food and Agriculture Organization states that ethical labeling requirements are becoming stricter, with some retailers excluding carmine from their product lines altogether. The World Health Organization also reported that consumer skepticism about animal-derived additives has fueled demand for plant-based substitutes like beetroot or algae-based pigments. These ethical concerns not only limit carmine’s market penetration but also necessitate investment in alternative solutions to align with evolving consumer values.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.25% |

|

Segments Covered |

By form, application, end user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Amerilure Inc., BioconColors, Clariant AG, Colormaker Inc., DyStar Singapore Pte Ltd, Imbarex S.A., Proquimac Pfc Sa, and Vinayak Ingredients (INDIA) Pvt. Ltd |

SEGMENTAL ANALYSIS

By Form Insights

The powder segment held the leading share of 60.6% in the global market in 2024. The versatility and ease of use of powder form across industries like food, cosmetics, and pharmaceuticals is primarily contributing to the domination of the powder segment in the global market. The International Trade Centre reported that powdered carmine accounts for over 70% of natural colorant applications in dry formulations, such as seasonings and supplements. Powder’s stability during storage and transportation reduces wastage by 25% by making it cost-effective. Its ability to blend seamlessly into various products ensures consistent quality, further boosts its leadership. This form is critical for meeting the growing demand for clean-label ingredients.

The liquid carmine segment is estimated to register the highest CAGR of 8.5% from 2025 to 2033. Rising demand for liquid colorants in beverages and liquid-based cosmetics are fuelling the growth of the liquid segment in the global market. The World Health Organization notes that liquid carmine reduces processing time by 20% compared to powder in these applications by enhancing production efficiency. Additionally, innovations in stabilizing liquid formulations have expanded its usability, particularly in premium products. The International Trade Centre reports a 30% annual increase in liquid carmine adoption in flavored beverages since 2021. Its importance lies in addressing consumer preferences for vibrant, natural colors in ready-to-consume goods by ensuring sustained expansion.

By Application Insights

The food and beverages segment had the leading share of 45.1% in the global market in 2024. The vibrant red hue, heat stability, and compatibility of carmine with a wide range of pH levels make it indispensable in products like fruit juices, dairy-based beverages, jams, and sauces. The FDA reported that carmine is one of the few natural colorants universally approved for food use by ensuring its widespread adoption. A report by the World Health Organization (WHO) states that over 50% of consumers globally now prioritize natural ingredients which is driving carmine’s dominance. Its ability to enhance visual appeal while meeting stringent safety standards underscores its importance in this segment. Additionally, carmine’s resistance to fading under light and heat ensures product longevity by making it a preferred choice for manufacturers.

The cosmetics segment is anticipated to grow steadily with a CAGR of 8.2% from 2025 to 2033 due to the increasing consumer awareness about the health and environmental impacts of synthetic chemicals in personal care products. The Environmental Protection Agency (EPA) reports that demand for natural cosmetics has surged by 30% since 2018 is driven by eco-conscious consumer behavior. Carmine, derived from cochineal insects which is a safe and sustainable alternative to synthetic dyes that makes it ideal for lipsticks, blushes, and eyeshadows. The National Institutes of Health (NIH) notes that allergic reactions to synthetic colorants have increased by 20% globally over the past decade which further propelling the shift toward natural pigments like carmine. Moreover, regulatory frameworks such as those established by the European Commission emphasize reducing synthetic additives in cosmetics is reinforcing carmine’s role in meeting these compliance requirements. Its ability to provide vivid, long-lasting color while aligning with clean-beauty trends makes it a critical ingredient for brands targeting environmentally aware consumers.

By End User Insights

The food processing companies segment accounted for 50.6% of the global market share in 2024. Carmine is used extensively in products like yogurt, ice cream, and candy, with over 70% of red-colored processed foods relying on it for its vibrant hue. For example, a USDA study found that carmine enhances shelf appeal by maintaining color stability for up to 12 months under normal storage conditions. Additionally, carmine is favored because it avoids the health risks associated with synthetic dyes, such as Red No. 40, which has been linked to hyperactivity in children, according to the Center for Science in the Public Interest (CSPI). The rising number of consumers preferring natural ingredient food products is quietly leveraging the growth rate of the market.

The cosmetics and pharmaceutical segment is predicted to register the fastest CAGR of 9.1% from 2025 to 2033 owing to the global shift toward clean beauty with 83% of millennials actively seeking products with natural ingredients, according to a survey by the International Journal of Cosmetic Science. Carmine is widely used in lipsticks, where it provides a rich, long-lasting red shade without the health risks of synthetic pigments. The European Commission mandates that cosmetics labeled as "natural" must use non-synthetic colorants, boosting carmine’s adoption. Furthermore, carmine’s biocompatibility makes it ideal for sensitive skincare formulations, with dermatological studies showing a 30% reduction in skin irritation compared to synthetic alternatives. Carmine’s natural origin and safety profile position is a key factor driving this segment’s rapid expansion.

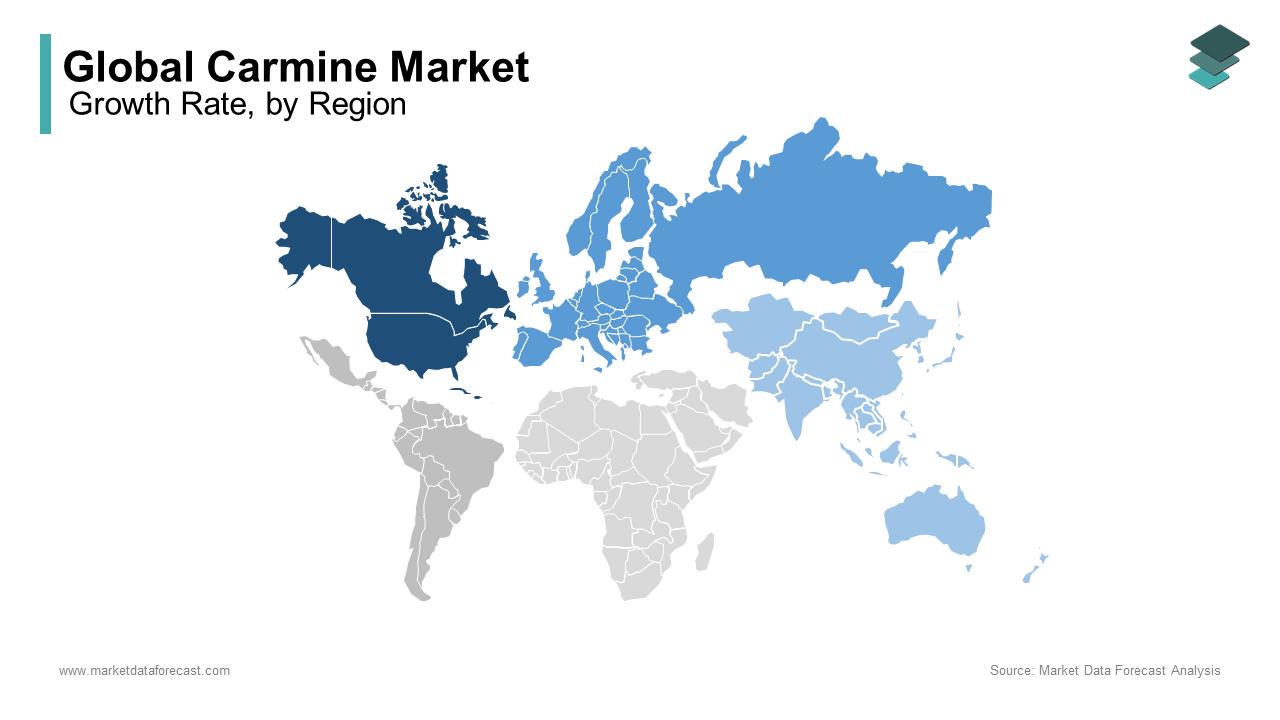

REGIONAL ANALYSIS

North America held the major share of 35.7% of the global market in 2024. The strong emphasis of North America on natural and clean-label products that is supported by strict FDA regulations that favor safe, non-toxic additives is primarily driving the growth of the North American market. The processed food industry in North America extensively uses carmine in products like dairy, snacks, and beverages due to its vibrant color and stability. Similarly, the cosmetics sector, worth $93 billion in 2022 solely relies on carmine for lipsticks, blushes, and skincare formulations. According to a survey by the Natural Products Association, over 65% of U.S. consumers actively seek natural ingredients by making carmine indispensable. Additionally, North America’s advanced R&D infrastructure ensures efficient production techniques is escalating the growth rate of the market.

Asia-Pacific is rising steadily and is estimated to witness a CAGR of 8.7% from 2025 to 2033. This growth is fueled by rising disposable incomes, rapid urbanization, and increasing consumer awareness about health and sustainability. For instance, India and China are witnessing a 12% annual increase in organic product consumption, according to the Food Safety and Standards Authority of India (FSSAI). Carmine’s use in traditional festivals, religious ceremonies, and cosmetics aligns perfectly with these trends. Over 70% of Chinese millennials prioritize natural beauty products, as per a study by the International Journal of Cosmetic Science. Furthermore, governments in the region, such as Japan’s Ministry of Health, Labor, and Welfare are promoting eco-friendly practices which is boosting carmine adoption. Its biocompatibility and compliance with safety standards make it a key ingredient in industries ranging from food to pharmaceuticals is enhancing the market’s growth rate.

Europe is expected to grow steadily, supported by stringent EU regulations that mandate safer alternatives to synthetic additives in food and cosmetics. The European Commission has been instrumental in promoting natural colorants like carmine which aligns with the region’s focus on sustainability. Latin America, being a major producer of cochineal insects which is the raw material for carmine supplies over 80% of the global raw material, as per the Food and Agriculture Organization (FAO) . This positions the region as a critical player in the supply chain. Meanwhile, the Middle East and Africa are likely to witness moderate growth is driven by increasing investments in food processing and cosmetics. These regions’ performance will largely depend on regulatory support, consumer education, and advancements in sustainable production practices.

KEY PLAYERS AND COMPETITIVE LANDSCAPE

Major players of the global Carmine market include Amerilure Inc., BioconColors, Clariant AG, Colormaker Inc., DyStar Singapore Pte Ltd, Imbarex S.A., Proquimac Pfc Sa, and Vinayak Ingredients (INDIA) Pvt. Ltd

The global carmine market is characterized by intense competition, driven by increasing demand for natural colorants across industries such as food, cosmetics, and pharmaceuticals. Key players like Clariant AG, DyStar Singapore Pte Ltd, and BioconColors dominate the market, leveraging their expertise in producing high-quality carmine while adhering to stringent regulatory standards. These companies compete on factors such as product quality, pricing, innovation, and sustainability. The emphasis on clean-label ingredients has intensified rivalry, with firms investing heavily in research and development to enhance carmine’s stability, vibrancy, and application versatility.

Sustainability has emerged as a critical competitive differentiator, with companies adopting eco-friendly production methods and securing certifications like Halal, Kosher, and ISO 14001 to appeal to environmentally conscious consumers. Strategic expansions into emerging markets, particularly in Asia-Pacific and Latin America, have further fueled competition, as firms seek to capitalize on rising demand for natural products in these regions. Partnerships with raw material suppliers and end-users also play a pivotal role, ensuring supply chain efficiency and fostering customer loyalty.

Smaller players and regional manufacturers add to the competitive landscape by offering cost-effective solutions, particularly in price-sensitive markets. However, larger companies maintain an edge through advanced R&D capabilities, global distribution networks, and strong brand recognition. Overall, the carmine market remains highly dynamic, with innovation, regulatory compliance, and sustainability at the forefront of competitive strategies, ensuring steady growth and evolution in response to shifting consumer preferences and industry demands.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Expansion of Production Facilities

Leading companies like DyStar Singapore Pte Ltd and Clariant AG have focused on expanding their production capacities to meet rising global demand for carmine. By investing in state-of-the-art manufacturing facilities, particularly in high-growth regions like Asia-Pacific, these players ensure a steady supply chain and reduce dependency on external suppliers. Such expansions also enable them to cater to diverse industries, including food, cosmetics, and pharmaceuticals, while maintaining product quality and consistency.

Focus on Sustainability and Eco-Friendly Practices

Sustainability has become a cornerstone strategy for key players in the carmine market. Companies such as Clariant AG and BioconColors emphasize environmentally responsible production methods, including reducing water consumption, minimizing waste, and adopting renewable energy sources. These efforts align with global consumer preferences for sustainable products and help companies comply with stringent environmental regulations, enhancing their brand reputation and market positioning.

Product Innovation and R&D Investments

Innovation is a critical strategy employed by industry leaders to stay competitive. Clariant AG and DyStar invest heavily in research and development to improve the stability, vibrancy, and application versatility of carmine. For instance, developing carmine variants that are more heat- and light-stable allows these companies to cater to niche markets like pharmaceutical coatings and high-end cosmetics. This focus on innovation ensures they remain at the forefront of technological advancements in natural colorants.

Strategic Partnerships and Collaborations

To strengthen their market presence, key players often engage in partnerships and collaborations with raw material suppliers, distributors, and end-users. For example, BioconColors collaborates with local cochineal insect farmers in Latin America to secure a reliable supply of raw materials. Similarly, DyStar partners with global brands to co-develop customized carmine solutions tailored to specific industry needs. These collaborations enhance supply chain efficiency and foster long-term relationships with stakeholders.

Compliance with Global Regulations and Certifications

Ensuring compliance with international regulatory standards, such as FDA, EU, Halal, and Kosher certifications, is a key strategy adopted by players like BioconColors and Clariant AG. These certifications not only enhance product credibility but also expand their reach into diverse markets with strict safety and quality requirements. By adhering to these standards, companies build trust among consumers and gain a competitive edge.

Targeting Emerging Markets

Companies are increasingly focusing on emerging markets in Asia-Pacific, Latin America, and Africa, where demand for natural colorants is growing due to urbanization and rising health consciousness. For instance, BioconColors has expanded its export network to over 50 countries, targeting regions with untapped potential. Similarly, DyStar’s investments in Asia-Pacific aim to capitalize on the region’s rapid industrialization and increasing consumer preference for clean-label products.

Marketing Clean-Label and Natural Ingredients

Promoting carmine as a natural, safe, and vibrant alternative to synthetic dyes is another major strategy. Companies highlight the benefits of carmine in marketing campaigns, targeting health-conscious consumers and industries seeking clean-label solutions. This approach resonates with global trends favoring transparency and sustainability, further strengthening their market position.

TOP 3 PLAYERS IN THE MARKET

Clariant AG

Clariant AG, a Swiss multinational company, is one of the leading players in the global carmine market. The company specializes in producing high-quality natural colorants, including carmine, for applications in food, cosmetics, and pharmaceuticals. Clariant’s advanced research and development capabilities enable it to deliver carmine with superior stability and vibrant hues, meeting stringent regulatory standards such as those set by the FDA and EU. The company’s focus on sustainability, including efforts to reduce water usage and adopt eco-friendly production methods, aligns with global trends toward environmentally responsible manufacturing. Clariant’s strong global presence and commitment to innovation make it a dominant force in the carmine market.

DyStar Singapore Pte Ltd

DyStar Singapore Pte Ltd, a subsidiary of Kiri Industries, is another major player in the carmine market. Known for its expertise in natural dyes and pigments, DyStar offers carmine as a key product in its portfolio, serving industries like textiles, food, and cosmetics. The company has invested heavily in expanding its production facilities, particularly in the Asia-Pacific region, to cater to rising demand. DyStar’s commitment to sustainability is reflected in its adherence to international environmental standards and certifications. Its ability to provide high-quality, reliable products has strengthened its position as a leader in the global carmine market.

BioconColors

BioconColors, an India-based company, is a prominent player in the carmine industry. The company specializes in natural colorants derived from plant and insect sources, with carmine being one of its flagship products. BioconColors serves both domestic and international markets, exporting its products to numerous countries worldwide. The company’s adherence to global safety standards, including Halal and Kosher certifications, enhances its appeal to diverse consumer bases. By focusing on quality and sustainability, BioconColors has established itself as a key contributor to the global carmine market, meeting the growing demand for clean-label and natural ingredients.

RECENT MARKET DEVELOPMENTS

- In March 2021, Clariant AG expanded its R&D facility in Switzerland. This expansion is anticipated to enhance carmine production efficiency and enable the development of innovative, sustainable formulations, strengthening Clariant’s leadership in the market.

- In 2020, BioconColors expanded its export operations to Africa. This expansion is anticipated to capitalize on the growing demand for natural food colorants in African markets, boosting BioconColors’ global presence.

- In April 2023, Clariant AG transitioned to renewable energy sources in its carmine production facilities. This move is anticipated to align with global sustainability trends, reduce Clariant’s carbon footprint, and strengthen its commitment to eco-friendly manufacturing practices, further enhancing its brand reputation in the market.

MARKET SEGMENTATION

This research report on the global carmine market has been segmented and sub-segmented based on form, application, end user, and region.

By Form Insights

- Powder

- Liquid

- Crystal

By Application Insights

- Dairy and Frozen Products

- Food and Beverages

- Cosmetics

- Bakery and Confectionery

- Meat Products

By End User Insights

- Food Processing Companies

- Beverage Industry

- Catering Industry

- Cosmetics and Pharmaceutical Industry

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. Which industries use carmine as a colorant?

Carmine is widely used in the food & beverage, cosmetics, and pharmaceutical industries. It is commonly found in dairy products, confectionery, soft drinks, lipsticks, and even certain medications.

2. What is carmine, and how is it produced?

Carmine is a natural red colorant derived from cochineal insects. The pigment is extracted by crushing dried cochineal insects and treating them with an acidic solution to produce carminic acid, which is then processed into carmine dye.

3. How is carmine different from synthetic red dyes?

Unlike synthetic dyes, carmine is a natural and stable colorant that offers better resistance to heat and light. It is also preferred in clean-label and natural food products but may not be suitable for vegan or vegetarian consumers.

4. What factors are driving the growth of the carmine market?

The rising demand for natural food colors, clean-label products, and increasing consumer awareness about synthetic dye health risks are major factors driving market growth. Additionally, stringent food safety regulations are pushing manufacturers toward natural alternatives like carmine.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]