Global Cardiac Marker Testing Market Size, Share, Trends & Growth Forecast Report By Type (Troponin I & T, CK-MB, Myoglobin, BNP and HsCRP), Product (Reagents and Instruments), Disease (Acute Coronary Syndrome, Myocardial Infarction and Congestive Heart Failure), Testing (Lab and POC) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2025 to 2033

Global Cardiac Marker Testing Market Size

The global cardiac marker testing market was valued at USD 3.88 billion in 2024. The global market is expected to grow at a CAGR of 8.89% from 2025 to 2033 and be worth USD 8.34 billion by 2033 from USD 4.22 billion in 2025.

Cardiac markers are used in treating and risk stratification patients with suspected coronary acute syndrome (ACS). Troponin I and T, HDCRP, myoglobin, CK-MB, and other cardiac marker tests are among the most common. When the heart is stressed or injured, substances called cardiac markers are released into the blood. Hormones, enzymes, and proteins are examples of these markers. These biomarkers can detect various heart disorders, including acute coronary syndrome, cardiac ischemia, and conditions involving obstructed blood flow to the heart. Physicians perform cardiac marker tests over several hours to keep track of the blood sugar increase and determine the severity of a heart attack.

MARKET DRIVERS

Y-O-Y growth in the aging population and growing funds by various organizations to encourage experiments and clinical trials in marker testing for examining the novel markers of the heart are driving the global cardiac marker testing market growth. Increasing incidences of heart-related diseases and spending significantly on R&D activities are fuelling the market demand. Furthermore, the demand is expected to develop as people become more aware of the importance of early diagnosis and the growing need to prevent cardiac disorders like heart failure, heart attack, ACS, and others. In addition, increased coronary disease prevalence, an aging population, more clinical trials for cardiac biomarker detection, and increased support from public-private organizations for cardiac biomarker studies drive the cardiac marker testing market.

Additionally, Growth in point-of-care testing and growing demand for the latest treatment procedures are the factors that are accelerating the market. Also, increasing awareness of the benefits of early diagnosis and preventing heart diseases like heart attacks are driving market growth. Furthermore, the rising need to advance healthcare services and rising healthcare expenditure and disposable incomes in developing countries are pushing market growth.

MARKET RESTRAINTS

Unfavourable reimbursement policies and stringent rules and regulations by the government are the factors that are hampering the global cardiac marker testing market growth. The cardiac markers are not used for diagnosing the myocardial blood supply to the heart or the tissue region that causes death. In addition, problems related to storage and preservation of sample collection and the amount paid for the cause of suffering are restraining the Growth. Factors like correct and early outcomes and cardiac POC testing are the factors that drive market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2023 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Product, Disease, Testing, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Market Players |

Getinge Group, Medtronic PLC, LivaNova PLC, XENIOS Roche Diagnostics Ltd., Abbott Laboratories, Siemens AG, Danaher Corporation, Alere Inc., bioMérieux SA, LSI Medience Corporation, Ortho Clinical Diagnostics, Randox Laboratories Ltd and Guangzhou Wondfo Biotech Co. Ltd. |

SEGMENTAL ANALYSIS

By Type Insights

The troponin cardiac biomarkers segment is forecasted to lead the global cardiac marker testing market during the forecast period due to its efficiency and accuracy in test results to diagnose cardiovascular disorders. In addition, the segment is also leading the revenue due to professionals' familiarity with the segment.

However, the BNP segment is expected to show fast Growth during the forecast period due to its increasing usage for detecting heart damage and stress. Additionally, many enterprises are now taking initiatives to make cardiac marker testers of this type, further promoting the segment's Growth.

By Product Insights

The reagent segment is expected to dominate the market during the forecast period due to its applications in vitro test kits and laboratories. In addition, the reagents are a significant part of the research and development of cardiac diseases and drugs and help build a better future for the markers.

The instruments segment, however, is also expected to grow during the forecast period due to the rising need for cardiac diagnostic and treatment devices in healthcare settings. For example, cardiac marker analyzers are used to provide point-of-care solutions supporting the segment's establishment.

By Disease Insights

The myocardial infarction segment is one of the fastest-growing segments, credited to its increase in the rate of sedentary lifestyle among individuals, alcohol consumption, smoking, and unhealthy food habits, resulting in obesity.

However, the congestive heart failure segment is also expected to show significant growth during the forecast period due to the rising cases of the problem. According to statistics, nearly 6 million Americans and around 670,000 people are diagnosed with heart failure yearly. Therefore, the prevalence of the disease is helping the market grow.

By Testing Insights

The laboratory testing segment is predicted to lead the global cardiac marker testing market. The rising research and development in the field of cardiac market testing from biotechnological, pharmaceutical and healthcare device companies are boosting the revenue of the segment.

However, the point-of-care testing segment offers the highest growth rate in this market segment. It can be credited to the availability of easy-to-use kits in ambulances, and affordability for patients at the point-of-care diagnostic tool reduces hospital expenditure, thereby increasing the adoption rate of new diagnostic tools.

REGIONAL ANALYSIS

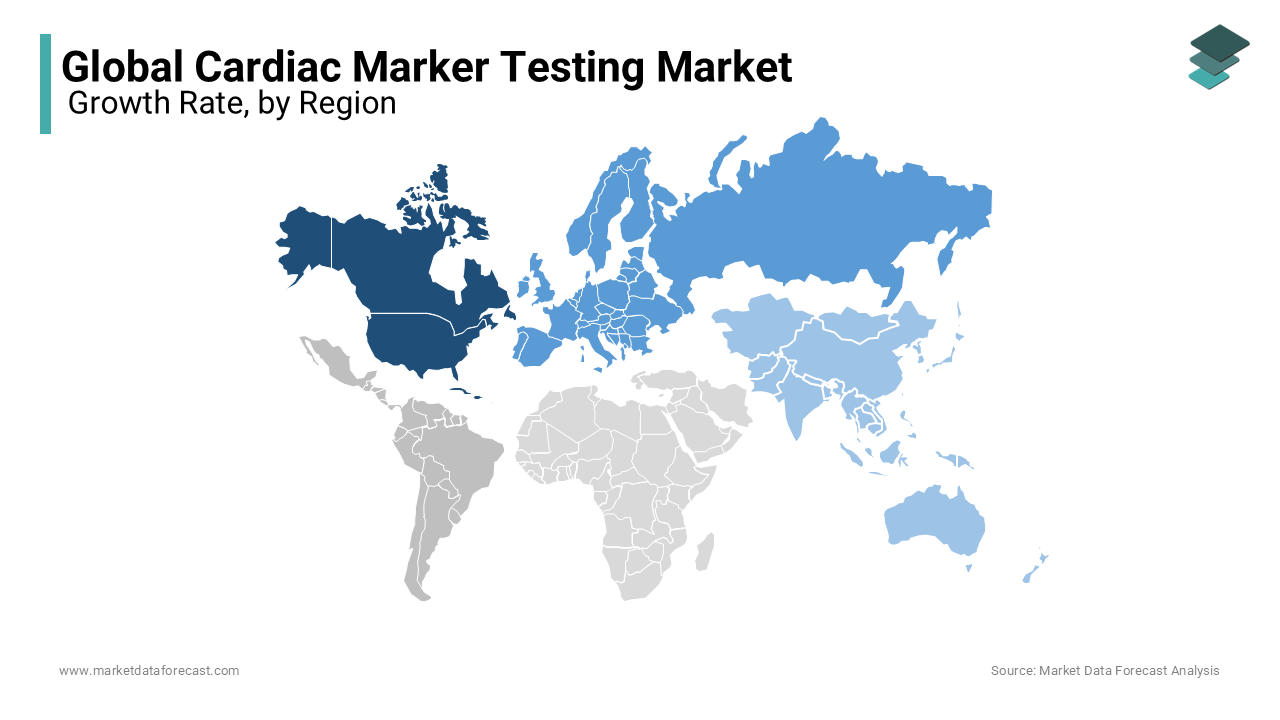

The North American market is predicted to hold the largest share of the global cardiac marker testing market, followed by Europe during the forecast period. Because of the prevalence of cardiovascular disorders, public and private investments, NIH funding for creating novel cardiac biomarkers, and the growing geriatric population, North America is expected to be the largest market. Furthermore, government and research institutes have taken measures to fight critical cardiac diseases and increase R&D activities related to cardiac biomarkers, driving market growth in North America.

However, the Asia-Pacific market is to register the fastest CAGR during the forecast period owing to the presence of emerging markets, including India and China, which have become attractive destinations for companies engaged in developing and marketing cardiac biomarkers. The rising prevalence and incidence of cardiovascular diseases are among the major driving factors for the market growth in China and India. In addition, increased healthcare spending by a more extensive population base, transformation of healthcare facilities, and the penetration of clinical laboratory technology are driving the Asia-Pacific market. Along with this, demand in Asia-Pacific is expected to expand due to an increase in research-based pharmaceutical companies' interest in developing novel biomarkers and increasing the number of patients suffering from cardiovascular diseases.

KEY MARKET PLAYERS

Some of the notable companies dominating the global cardiac marker testing market profiled in the report are Getinge Group, Medtronic PLC, LivaNova PLC, XENIOS Roche Diagnostics Ltd., Abbott Laboratories, Siemens AG, Danaher Corporation, Alere Inc., bioMérieux SA, LSI Medience Corporation, Ortho Clinical Diagnostics, Randox Laboratories Ltd and Guangzhou Wondfo Biotech Co. Ltd.

RECENT HAPPENINGS IN THE MARKET

- In May 2022, Quidel Corporation, a significant healthcare diagnostic devices manufacturer, developed a cardiac triage panel to support emergency heart cases at the ED. The device aids in diagnosing myocardial infarction and has been approved by the FDA for use. The device eradicates the uncertainty of results from an EKG in an emergency and helps enhance point-of-care diagnosis.

- In October 2022, the biopharmaceutical enterprise Bridge Pharma announced the Phase 2 study of BBP-418 in patients with limb-girdle muscular dystrophy type 2i (LGMD2i) 12-month results, along with its partner ML bio solutions.

- In October 2022, A study from BioRegenex, a regenerative therapeutics company with microvascular health solutions, revealed that people with obesity risk contracting cardiovascular diseases. Using GlycoCheck, an FDA-registered Class 1 medical testing device, the study proved that patients with obesity were at a higher risk of cardiac problems.

MARKET SEGMENTATION

This research report on the global cardiac marker testing market has been segmented and sub-segmented based on type, product, disease, testing, and region.

By Type

- Troponin I & T

- CK-MB

- Myoglobin

- BNP

- HsCRP

By Product

- Reagent

- Instrument

- Chemiluminescence

- Immunofluorescence

- Immunochromatography

- ELISA

By Disease

- Acute Coronary Syndrome

- Myocardial Infarction

- Congestive Heart Failure

By Testing

- Lab

- POC

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

who are the key players of the the global cardiac marker testing market ?

Getinge Group, Medtronic PLC, LivaNova PLC, XENIOS Roche Diagnostics Ltd., Abbott Laboratories, and Siemens AG, are some of the key players in the global cardiac marker testing market.

what is the compound annual growth rate (CAGR%) of the global cardiac marker testing market during the forecast period?

The global cardiac marker testing market is expected to grow at a CAGR of 8.89% during the forecast period.

which region accounted for the largest share in the global cardiac marker testing market ?

The North American market is predicted to hold the largest share of the global cardiac marker testing market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]