Global Cardiac Assist Devices Market Size, Share, Trends & Growth Analysis Report – Segmented By Type (Ventricular Assist Devices (VAD) (RVAD, LVAD, Bi-VAD and External Ventricular Assist Devices), IABP and Total Artificial Heart) & Region - Industry Forecast from (2024 to 2032)

Cardiac Assist Devices Market Size (2024 to 2032)

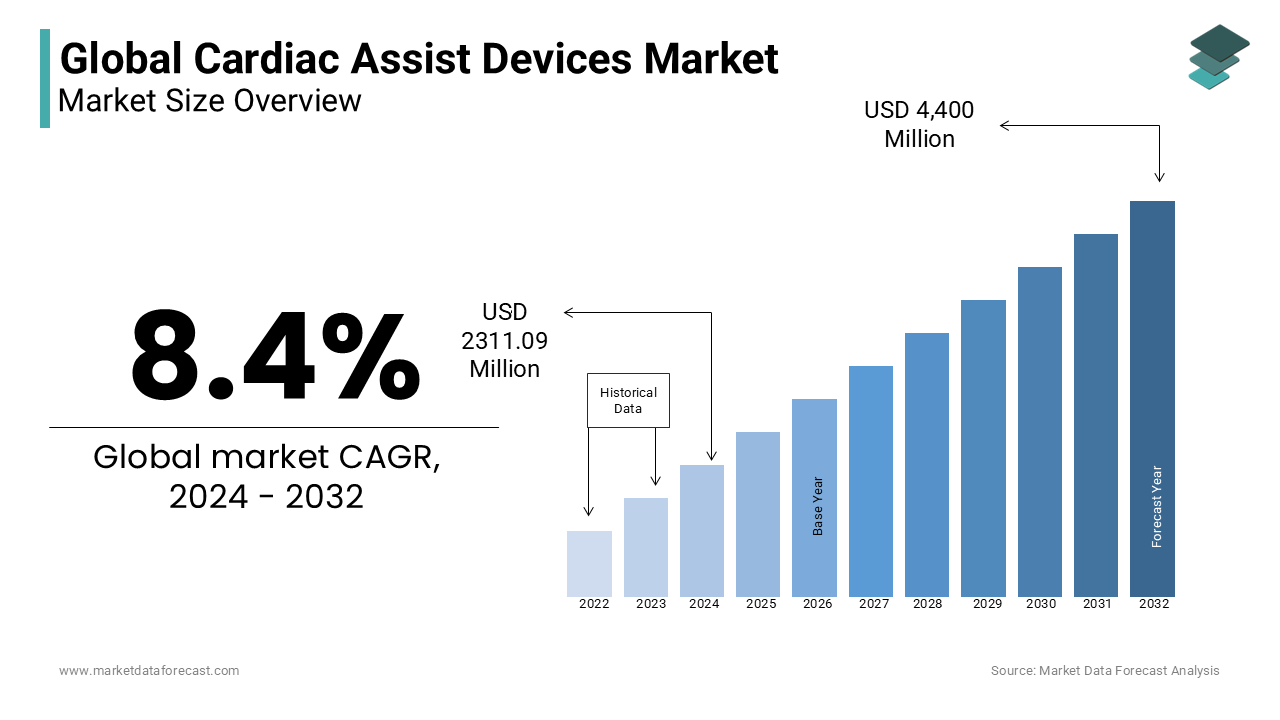

In 2023, the global cardiac assist devices market was valued at USD 2132 million and it is expected to reach USD 4400 million by 2032 from USD 2311.09 million in 2024, growing at a CAGR of 8.4 % during the forecast period.

Current Scenario of the Cardiac Assist Devices Market

Assist devices are mechanical pumps that connect with the heart to increase pumping efficiency and maintain optimal blood flow throughout the body. Cardiac-assist devices treat end-stage heart failure based on the individual's demands. These are meant to assist the heart in operating normally by taking over its function when it gets weak. It circulates blood throughout the body via the heart and has the power to distribute sufficient blood. The intra-aortic balloon pump is a long, narrow balloon that regulates blood flow through the aorta, the largest blood vessel in the body. According to blood flow, the gadget expands and contacts. As a result, it gets smaller while the heart beats, allowing blood to circulate freely throughout the body.

When the heart relaxes, it expands to keep more blood in the heart. These devices help maintain a constant blood flow to the heart and do not require mechanical bearings. It also serves as a transplant bridge, is available in miniature sizes, and provides life-saving support for heart patients recovering from or waiting for a heart transplant.

MARKET DRIVERS

YOY growth in the incidences of cardiovascular devices is majorly promoting the global cardiac assist devices market growth.

According to World Health Organization (WHO), 17.9 million deaths happened from cardiovascular diseases in 2019, 32% of the overall deaths worldwide. Heart attack and stroke accounted for the leading share of deaths from CVDs. Cardiac assist devices are used as mechanical pumps for patients with weak hearts and reduce the risk of death due to heart failure, a dominant factor influencing the growth of the cardiac assist devices market. Changes in the schemes by the government and the introduction of reimbursement policy in support of ordinary people to have heart surgeries free of cost drive the market's growth. The rise in concern about health is also one of the factors accelerating the market's growth. In addition, the decreasing number of heart donors drives the growth rate of the cardiac assist devices market to an extent. Cardiac assistance devices promote assistance until the heart recovers after the transplantation, and it is also a long-term device. The attribute, as mentioned above, is making the market share expand. In addition, the growing aging population worldwide is anticipated to promote the growth rate of the global cardiac assist devices market.

According to World Health Organization (WHO), almost one person in every six people is expected to be over 60. In addition, rising research and development institutes in the medical sector are also fuelling the market's growth. Also, focusing on developing new devices and adding advanced features to existing ones is lucrative for setting up growth opportunities for the cardiac assist devices market. Furthermore, increasing demand for novel treatment procedures is surging the growth rate of the cardiac assist device market. In addition, the need to increase the survival rate is increasing the market's growth rate.Technological advancements are further accelerating the market's growth rate.

As technology advances, the number of dependable ventricular assist devices (VAD) has grown, providing more effective patient treatment choices. Furthermore, the government has boosted financing for research and development projects in advanced medical treatment alternatives, emphasizing patient safety. The significant market advantage is technological advancements in innovative product development. New product innovations are likely to attract investments from private equity and venture capital firms due to ongoing investments in technical upgrades (VCs). Wireless power through transcutaneous energy transfer has also been developed by LVAD manufacturers (TET).

MARKET RESTRAINTS

However, increasing risk factors during blood clots and bleeding procedures is undoubtedly a restraining factor for the global cardiac assist devices market to grow. In addition, the cost of installing the equipment is expensive, slowly hindering the market's growth rate. Furthermore, the need for more skilled persons performing the procedure with the latest equipment degrades the market's growth. Moreover, the procedure is complicated and should be done under some experts' guidance with specially designed equipment. Therefore, it remained a challenging factor for the growth of the cardiac assist device market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

Segments Covered |

By Type and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Market Leader profiled |

Thoratec Corporation, Berlin Heart GmbH, Abiomed, Inc., HeartWare International, Jarvik Heart, Inc |

SEGMENTAL ANALYSIS

Cardiac Assist Devices Market By Type

The ventricular assist device (VAD) segment is anticipated to be accounting for the largest share of the cardiac assist devices market during the forecast period owing to the growing awareness of treatment procedures and rising support from the government through investments. In addition, the LVAD sub-segment has the highest market share due to the increasing number of sudden heart strokes. A left ventricular assist device (LVAD) helps people in the last stage of heart failure. This battery-operated device helps pump blood from the left ventricle to the rest of the body and is used mainly in situations such as a patient waiting for a heart transplant. The LVAD helps to restore the failing heart saving the patient from needing transplantation. The FDA approved the LVAD device in 2008 for use in patients awaiting transplantation.

The RVAD segment is expected to be the second-largest in 2023 and grow at a healthy CAGR during the forecast period. These devices pump blood from the right ventricle or right atrium into your pulmonary artery and the lungs. This device is used after heart surgery to stabilize heart function and in patients waiting for transplant surgeries. Therefore, increasing the number of heart-related surgeries demands the segment's growth.

On the other hand, the total artificial heart (TAH) segment is estimated to do well during the forecast period. Due to increasing cases of blockage in the heart valves, the segment has rising demand. This total artificial heart device is placed in the chest to replace the damaged heart ventricles and values for proper heart function to avoid risky situations.

REGIONAL ANALYSIS

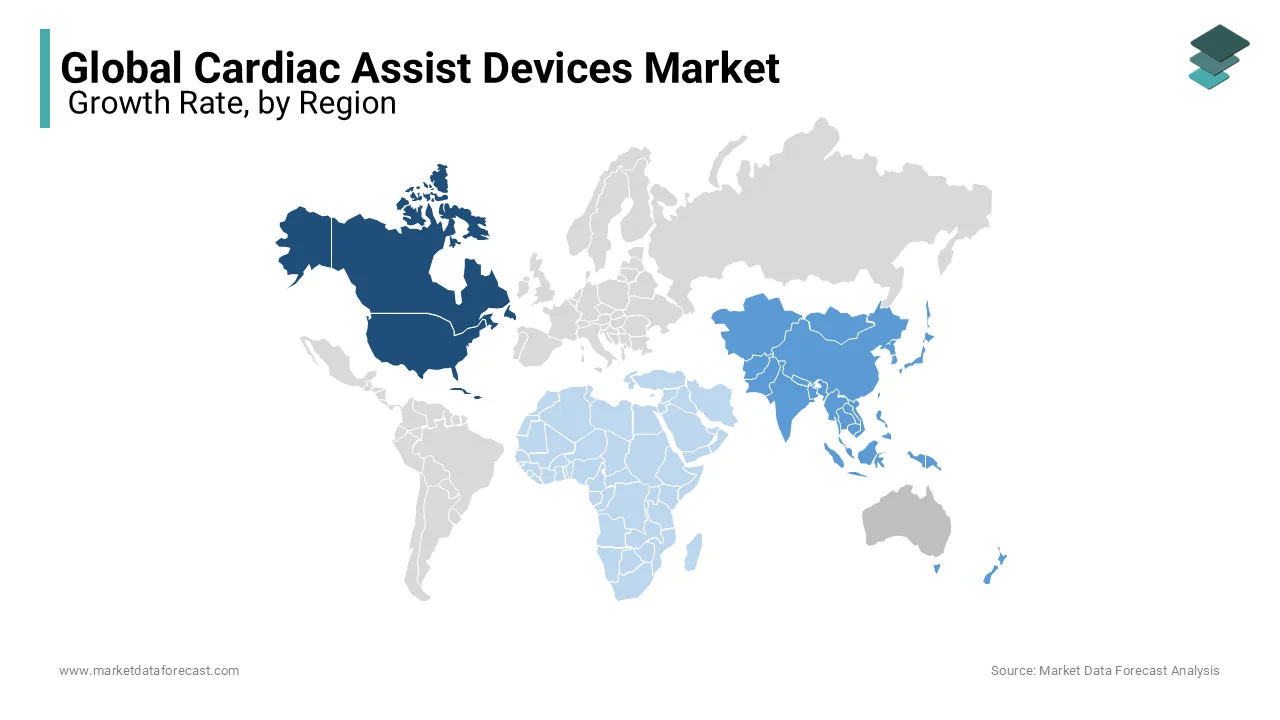

Geographically, the North American cardiac assist devices market accounted for most of the global market share in 2023, and the region's domination is likely to continue during the forecast period owing to the increasing per capita income in developed and developing countries. In North America, U.S. and Canada are potential countries and account for most of the regional market share and manufacturing cardiac assist devices with the latest advanced technologies, which is expected to boost the overall growth of the regional market. In addition, the growing usage of cardiac assist devices for patients who undergo high-risk angioplasty procedures and those who are in cardiogenic shock and need vital blood flow to their heart muscles is further propelling the regional market growth. In addition, nearly 2000 LVADs are implanted in the US each year which demands an increase in the production of the devices.

The cardiac assist devices market in APAC registered a substantial share worldwide in 2023 with the rise in heart failure incidences. The increasing aging population and demand for effective treatment procedures at any cost are broadening the market's growth rate. According to a recent survey, nearly 13 million people suffer from cardiac failure in China, which drives market growth. Launching experimental programs for developing cardiac assist devices in China helps manufacture better cardiac assist devices that reduce the side effects and increase the patient's life. Therefore, many researchers are working together to develop the devices according to the patient's personalized conditions and increase the success rate. Japan maintains the register for providing support in designing cardiac assist devices to meet the conditions of approval and authorization from the government for use on patients.

The European cardiac assist devices market has been growing faster in recent years and is predicted to hit the highest CAGR in the coming years. Increasing the construction activities of hospitals with the latest equipment is leveraging the market's growth. For example, nearly 1000 permanent VAD surgeries are undergone in Germany each year. In addition, increasing awareness programs about heart-related surgeries and the type of heart patients also help the demand of the market growth.

The Latin American cardiac assist devices market is predicted to register a steady CAGR during the forecast period. The presence of emerging economies, improvements in the healthcare infrastructure, and the growing adoption of medical devices to enhance the quality of treatment procedures are propelling market growth in Latin America.

The cardiac assist devices market in MEA is anticipated to hold a moderate global market share during the forecast period. The growing awareness among the people and increasing investments to develop healthcare infrastructure are favoring regional market growth. However, poor awareness levels are hampering the market growth in this region.

KEY PLAYERS IN THE CARDIAC ASSIT DEVICES MARKET

The report profiled companies that dominate the global cardiac assist devices market are Thoratec Corporation, Berlin Heart GmbH, Abiomed, Inc., HeartWare International, Jarvik Heart, Inc., Terumo Corporation, Calon Cardio-Technology Ltd., CardiacAssist, Inc., CardioBridge GmbH, Carmat SAS. Thoratec Corporation is the leading provider of Ventricular Assist Devices, controlling nearly half of the European Market; it also occupies a prime position in the US market, accounting for 75% of the market. MAQUET GmbH & Co occupies the second position with the dominance of about 15% of the market

RECENT MARKET DEVELOPMENTS

-

In 2022, Abiomed announced that it had gotten approval for the Impella RP Flex with SmartAssist, a safe and effective treatment of acute right heart failure for up to 14 days.

-

CARMAT received FDA clearance in 2021 to undertake an Early Feasibility Study (EFS) in the United States for their TAH. As a result, the world's most advanced total artificial heart designer and developer have released an update on its early feasibility study (EFS) in the United States, which aims to address an unmet medical need by providing a treatment option to people with end-stage biventricular heart failure.

- Abbott obtained FDA clearance in 2020 for the HeartMate 3 Heart Pump to be used in juvenile patients with advanced refractory left ventricular heart failure with revised labeling.

- In 2020, the LLC 50cc TAH-t system, which SynCardia Systems launched, got approval and was used by many cardiac transplant-eligible patients at risk of imminent death from biventricular failure.

- Medtronic's wholly implantable left ventricular assist device got FDA "Innovative Device Designation" in 2019. (LVAD).

DETAILED SEGMENTATION OF THE GLOBAL CARDIAC ASSIT DEVICES MARKET INCLUDED IN THIS REPORT

This research report has segmented and sub-segmented the global cardiac assist devices market based on type and region.

By Type

- Ventricular Assist Devices (VAD)

- Right Ventricular Assist Device (RVAD)

- Left Ventricular Assist Device (LVAD)

- Bi-Ventricular Assist Device (Bi-VAD)

- External Ventricular Assist Devices

- Intra-Aortic Balloon Pumps (IABP)

- Total Artificial Heart (TAH)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What will be the size of cardiac assist devices market by 2032?

The size of the cardiac assist devices market is predicted to reach USD 4.400 million by 2032.

Which segment is expected to lead the cardiac assist devices market during the forecast period?

By type, the ventricular assist device is expected to lead the global cardiac assist devices market during the forecast period 2024 to 2032.

Which region is accounted for the majority of the global market share during the period?

North America region is accounted for the largest market share during the forecast period 2024 to 2032.

Who are the key market players in the global cardiac assist devices market?

Promising Companies leading the global cardiac assist devices market profiled in the report are Thoratec Corporation, Berlin Heart GmbH, Abiomed, Inc., HeartWare International, Jarvik Heart, Inc., Terumo Corporation, Calon Cardio-Technology Ltd., CardiacAssist, Inc., CardioBridge GmbH, Carmat SAS.,

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]