Global Car Insurance Market Size, Share, Trends, COVID-19 Impact & Growth Forecast Report, Segmented By Coverage (Third-Party Liability Coverage, Collision, Comprehensive, Personal injury protection, Medical payments coverage, And Uninsured and Underinsured motorist coverage), Distribution Channel (Insurance Agents & Brokers, Direct Response, Banks, And Others), Vehicle Age (New Vehicle and Used Vehicle), Application (personal Vehicle And Commercial Vehicle), And By Region (North America, Europe, Asia – Pacific, Latin America, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Car Insurance Market Size

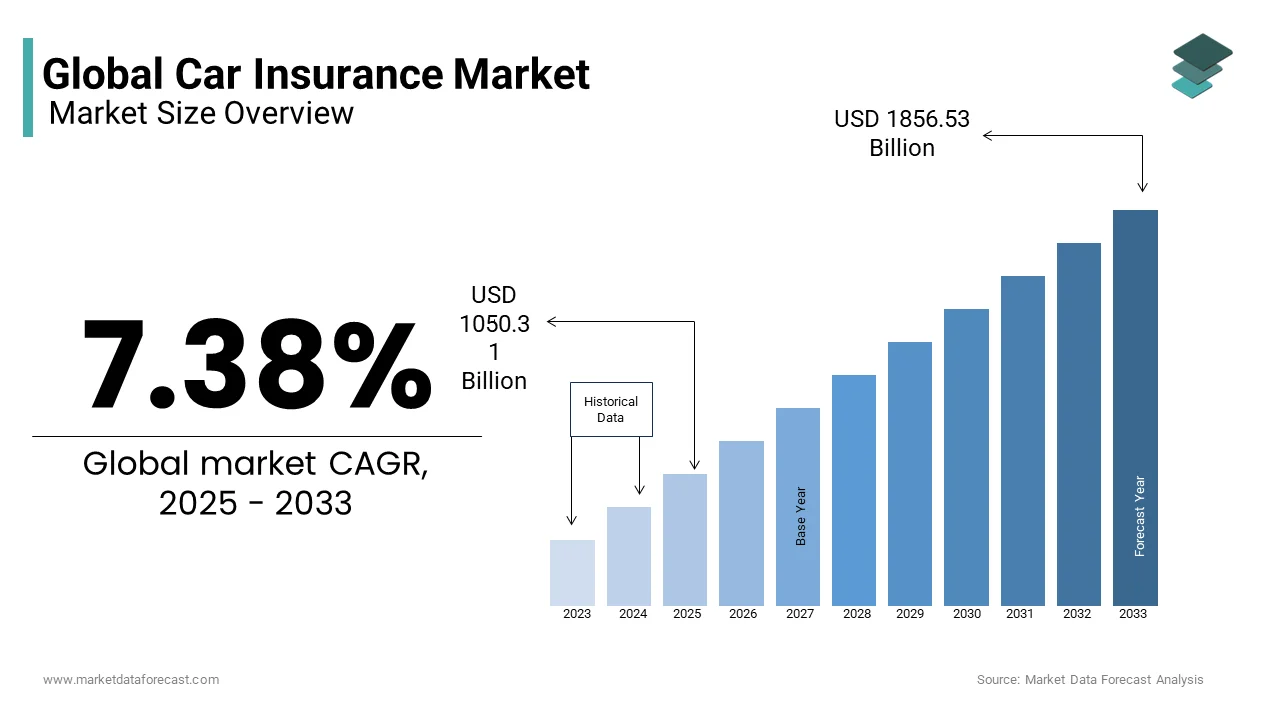

The global car insurance market size was valued at USD 978.12 billion in 2024 and is anticipated to reach USD 1050.31 billion in 2025 from USD 1856.53 billion by 2033, growing at a CAGR of 7.38% during the forecast period from 2025 to 2033.

Current Scenario of The Global Car Insurance Market

The car insurance market has started to grow at a steady rate after the slight decrease in the inflation rate in the United States and European countries. On the other hand, Asia Pacific is the fastest-growing industry in this market. Moreover, online platforms are quickly gaining ground in this industry landscape. This includes using different platforms, websites, mobile applications, purchases through digital payment apps, and emerging technologies to communicate with consumers, which also gives quotes and information and provides claim processing. In addition, the green commercial vehicles category is growing at a rapid pace. This can be due to increased focus by governments worldwide to shift the public towards public vehicles to reduce carbon and other harmful gas emissions by private cars.

MARKET DRIVERS

The rising number of ownerships in emerging economies is driving the car insurance market.

The steady growth in car ownership volume in India, China, and the United States are major contributors to the industry’s progress. Moreover, the rise of non-life insurance in Latin American countries, including Costa Rica, Uruguay, and Nicaragua, witnessed maximum concentration levels. Furthermore, the rising sales of electric vehicles and hybrid plugin cars in developed nations like the United States and China are boosting market growth and encouraging other regional economies to follow the trend. The rising digital distribution channels are expanding the market size. This includes mobile apps, comparison websites, online brokers, embedded insurance, social media, telematics, AI chatbots, blockchain and others. The integration of artificial intelligence for enhancing customer experience is believed to propel the car insurance market growth. The use of more intelligent and generative AI-powered chatbots for immediate answering of regular questions and interactions is accelerating global market growth.

Technological advancements in car insurance are likely to propel the global market growth.

The growth of InsurTech and telematics-supported usage-based insurance (UBI) programs has revolutionized the car insurance sector. It offers safer drivers to gain the benefits of insurance discounts. Also, better transparency and control over rates by UBI initiatives will further the market growth. For instance, in the US both pay-as-you-drive and pay-how-you-drive programs have more than 41 million drivers. Additionally, the increased adoption of digital motor insurance in Asia Pacific is also presenting opportunities for companies operating in the global car insurance market.

MARKET RESTRAINTS

Higher insurance premiums restrict the growth rate of the car insurance market.

Supply chain issues, inflation, and costly car accidents have been significantly influencing the higher insurance premiums. Moreover, the market is further affected by the inflated prices for insurance renewals. Similarly, the rates for certain models in 2024 have over a quarter of the overall cost of a new car. In addition, factors involving increased repairing costs of rising complicated vehicles and more storm damage because of climate change are elevating the insurance rates. This high Consumer Price Index (CPI) is hampering the expansion of the car insurance market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.38% |

|

Segments Covered |

By Coverage, Distribution Channel, vehicle Age, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Allianz (Germany), State Farm (US), AXA (France), Geico (US), Progressive (US), Zurich Insurance Group (Switzerland), Liberty Mutual Insurance Group (US), Travelers Companies Inc. (US), Berkshire Hathaway Inc. (US), Generali Group (Italy), Aviva plc (UK), Munich Re Group (Germany), American International Group (AIG) (US), Ping An Insurance Group (China), Chubb Limited (Switzerland), China Life Insurance Company Limited (China), Admiral Group plc (UK), Sompo Japan Nipponkoa Insurance Inc. (Japan), Mapfre Group (Spain), and Prudential plc (UK). |

SEGMENT ANALYSIS

By Coverage Insights

The comprehensive segment outperformed other categories and emerged as the most dominating segment in the global market in 2023 and is estimated to maintain its supremacy in the global market in the coming years. In the United States, a large section of drivers has comprehensive collision coverage. Apart from purchasing liability car insurance, comprehensive coverage is the popular choice for about 79 percent of insured drivers, and 75 percent also buy collision coverage. So, the collision segment is the second leading segment in this market. For instance, the main reason for the death of U.S. teens is motor vehicle crashes. As per updated data as of 2024, annually more than 7.3 million motor vehicle road accidents happen in the US. Another emerging industry is the Asia Pacific.

By Distribution Channel Insights

The direct response segment dominated the market in 2023 and is predicted to be the leading category of the car insurance market throughout the forecast period. This can be attributed to the robust network of insurance and automobile companies. Moreover, the post-recovery of the automobile sector with increased demand for electric vehicles is fueling the segment’s growth. Though it remains at the top, its market share is slowly decreasing. For example, net premiums from direct sales accounted for 67 percent in 2022, down from 69 percent five years ago.

By Vehicle Age Insights

The new vehicle segment is bigger in terms of revenue and customer acquisition than the used vehicle segment. It is predicted to experience a higher CAGR in the coming years due to increased demand for electric vehicles and hybrid plug-in battery-powered vehicles. Moreover, increased government support and initiatives for the sale of EVs are expected to influence the market size of this segment. Further, the growth in fire incidence and out-of-control issues in self-driven and feature-rich EVs are driving customers to buy comprehensive coverage plans.

By Application Insights

The personal vehicles segment holds more than 50% of the car insurance market. The growing sales of compact and mid-size sedan cars are taking the segment forward. Besides this, in emerging countries like India, cars are viewed as a status symbol, and with the increase in disposable income, the sale of cars has significantly surged in the past few years. Also, the migration of the population to urban or metro cities for better living standards is contributing to the growth of this segment’s market demand.

REGIONAL ANALYSIS

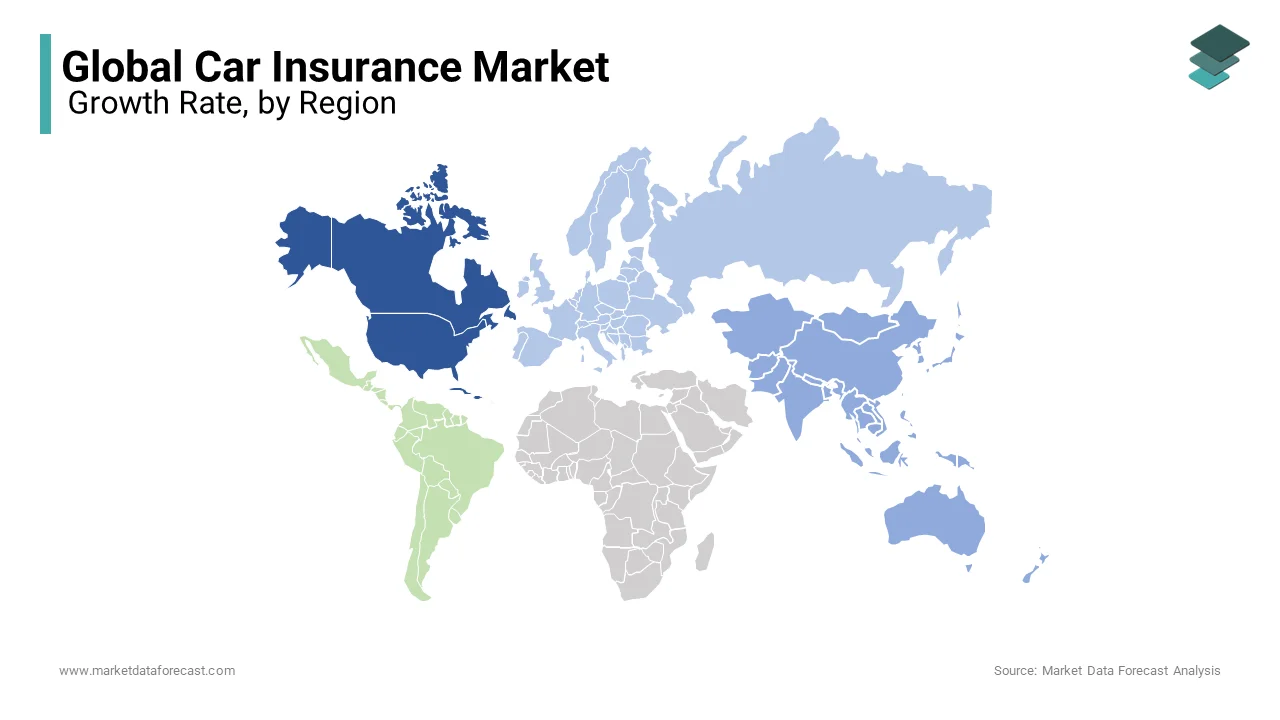

North America dominated the car insurance market in 2024.

North America remains the largest car insurance market and is expected to propel significantly in the coming years. The United States dominates the regional industry with an overall premium, including life and non-life, of approximately 2.8 trillion. Similarly, the Canadian industry is also a major player in this market, with 92.64 percent of people surveyed having car insurance. However, the average price of auto insurance in the US has increased by more than 22 percent, and close to 50 percent of customers are actively looking for a new plan. Whereas, in Canada, as per a survey, 41 percent are satisfied, and 18 percent are very satisfied.

Asia-Pacific is predicted to showcase rapid growth in the global market during the forecast period.

Asia Pacific is the fastest-growing car insurance market with China and Japan leading the industry by total premium value. The emerging markets in this region, especially India, are anticipated to outpace the developed European markets. This trend is projected to occur until the end of 2024 and continue in 2025. Moreover, the shift towards digital moto insurance is raising the demand for more online car insurance policy options, customer service, and coverage. Other key industries in the region are South Korea, Taiwan, Australia, and Hong Kong. But, the cost of car insurance premiums in Australia and New Zealand have considerably surged i.e. 47 per cent increase. So, a persistent rise in its price can decrease the region's market size.

Europe is estimated to progress at a moderate pace in the global market during the forecast period.

This can be due to the economic impacts of the Ukraine-Russia war, inflated food and energy prices, and increased tariffs on electric vehicles imported from China. In June 2024, the European Union recently announced the implementation of additional tariffs ranging between 17.4 percent and 38.1 percent, apart from the current EU charge of 10 percent. Consequently, this will elevate the cost of car insurance premiums in the EU countries, ultimately affecting the regional market. In addition, the prominent players in this industry are the UK, France, Germany, and Italy. Other key countries include the Netherlands, Spain, Ireland, Switzerland and Luxembourg.

The Middle East is believed to drive forward at a notable growth rate during the forecast period.

Saudi Arabia and the United Arab Emirates are dominating the regional market. Moreover, high competition and substantial pressure on premium rates are pushing the UAE’s market further. Similarly, in recent times, insurance players in the UAE have declined to provide comprehensive insurance coverage for Tesla EVs due to heavy repair costs, absence of repair proficiency, and growing accident numbers. On the other hand, South Africa is another key market that is facing a big energy crisis which has hugely impacted its economy and compelled the insurance and other companies to raise premiums and exchange rates for repairs.

Latin America is estimated to register notable growth in the global market in the coming future.

Despite this, the industry dynamics will remain complex at least in the upcoming few years. Moreover, the recovery of the automobile industry is propelling the region’s market growth. Automobiles account for around 17 per cent of overall premiums in the area and grew by 25 per cent. In addition, the non-life insurance sector surpassed the life sector in terms of growth.

KEY MARKET PLAYERS

Allianz (Germany), State Farm (US), AXA (France), Geico (US), Progressive (US), Zurich Insurance Group (Switzerland), Liberty Mutual Insurance Group (US), Travelers Companies Inc. (US), Berkshire Hathaway Inc. (US), Generali Group (Italy), Aviva plc (UK), Munich Re Group (Germany), American International Group (AIG) (US), Ping An Insurance Group (China), Chubb Limited (Switzerland), China Life Insurance Company Limited (China), Admiral Group plc (UK), Sompo Japan Nipponkoa Insurance Inc. (Japan), Mapfre Group (Spain), and Prudential plc (UK) are currently playing a major role in the global market.

RECENT HAPPENINGS IN THE MARKET

- In June 2024, Mbank and Policybazar. signed a contract to provide its customers with a digital platform for car, travel, health, and life insurance products. This collaboration will see Mbank using Policybazaar. ae‘s online platform for greater online comfort.

- In June 2023, the United Arab Emirates implemented a new law under which all foreign vehicles coming into the country by land at Ghuwaifat Port Station should be covered under insurance according to the latest resolution by the Federal Authority for Identity, Citizenship, Customs and Port Security (ICP).

MARKET SEGMENTATION

This market research report on the global car insurance market has been segmented and sub-segmented based on coverage, distribution channel, vehicle age, application and region.

By Coverage

- Third-Party Liability Coverage

- Collision

- Comprehensive

- Personal Injury Protection

- Medical Payments Coverage

- Uninsured And Underinsured Motorist Coverage

- Others

By Distribution Channel

- Insurance Agents & Brokers

- Direct Response

- Banks

- Others

By Vehicle Age

- New Vehicle

- Used Vehicle

By Application

- Personal Vehicles

- Commercial Vehicles

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current market size of the global car insurance market?

The global car insurance market size was valued at USD 1050.31 billion in 2025 and climb the market value to USD 1856.53 billion by 2033.

What are factors are driving the global car insurance market?

The key drivers include increasing vehicle ownership, regulatory requirements mandating insurance coverage, rising awareness about financial protection, technological advancements in insurance products, and the development of telematics and usage-based insurance.

What are the main challenges faced by the car insurance market?

The market challenges include high competition leading to price wars, fraudulent claims, regulatory changes, economic downturns affecting disposable income, and the impact of emerging technologies like autonomous vehicles.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]