Global Canvas Market Size, Share, Trends & Growth Forecast Report Segmented By Type (Plain Canvas , Duck Canvas), Application, And Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 To 2033

Global Canvas Market Size

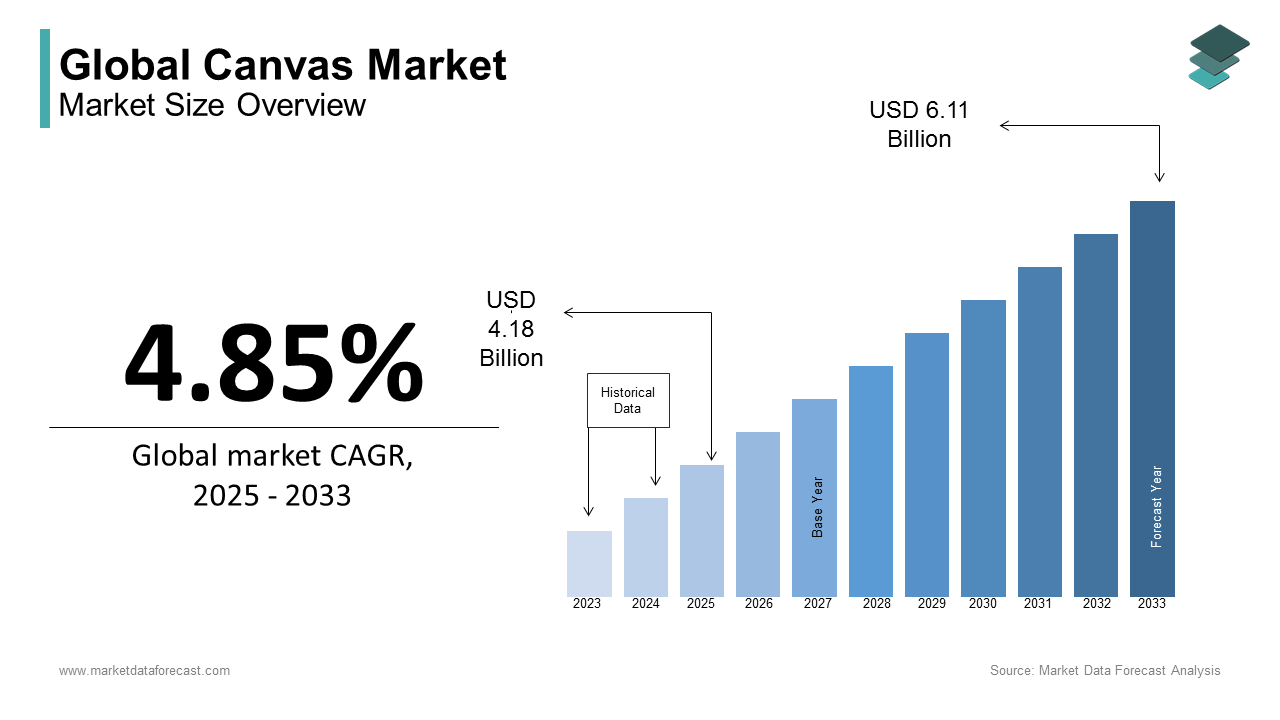

The global canvas market size was calculated to be USD 3.99 billion in 2024 and is anticipated to be worth USD 6.11 billion by 2033 from USD 4.18 billion In 2025, growing at a CAGR of 4.85% during the forecast period.

Canvas fabric is a durable, plain-woven textile traditionally made from cotton or linen. Its strength, versatility, and breathability make it a preferred material for various applications, including apparel, home décor, industrial equipment, outdoor gear, and artistic canvases. The material's robustness and ability to withstand heavy wear have positioned it as a staple in multiple industries for centuries.

One of the most notable applications of canvas fabric is in the fashion industry, where it is extensively used in footwear, bags, and jackets. According to the Textile Exchange, organic cotton production grew by 10% in 2023, reflecting an increasing demand for sustainable textiles, including canvas. This shift has led manufacturers to explore eco-friendly and recycled canvas alternatives, aligning with the broader global sustainability movement.

The outdoor and industrial sectors also heavily rely on canvas for applications such as tents, sails, tarpaulins, and protective coverings. The global demand for durable, weather-resistant materials has driven innovations in waterproofed and waxed canvas, particularly in military and adventure gear. The U.S. military, for example, continues to utilize canvas-based textiles for rucksacks, shelters, and uniforms, emphasizing its resilience and adaptability.

In the art industry, canvas fabric remains the primary medium for painting. As industries seek more durable and sustainable textile solutions, canvas fabric continues to evolve while maintaining its historical relevance.

MARKET DRIVERS

Increasing Demand for Sustainable Art Supplies

The canvas market is significantly driven by the growing demand for sustainable art supplies, as artists and consumers prioritize eco-friendly products. The sustainable art supplies worldwide is projected to grow and is driven by increasing environmental awareness. Industries adopting sustainable practices, including art materials, have reduced their carbon footprint. Additionally, the European Commission highlights that incentives for eco-friendly production have led to a 25% increase in companies using recycled or organic materials in their products. Art schools and workshops are also contributing to this trend, fostering a new generation of environmentally conscious artists.

Rising Popularity of DIY Art and Home Decor Trends

The canvas market is also propelled by the rising popularity of DIY art and home decor trends, fueled by social media platforms like Pinterest and Instagram. The National Endowment for the Arts notes that 54% of American adults engage in creative activities annually, including painting and crafting, often using canvases as a medium. Furthermore, Etsy reported a 94% increase in searches for DIY art kits between 2020 and 2022, reflecting heightened consumer demand. Social media influencers and virtual art classes have played a pivotal role in popularizing these trends, with platforms like YouTube seeing a 40% rise in views for DIY art tutorials. This cultural shift underscores canvases as essential tools for creativity and home customization.

MARKET RESTRAINTS

Fluctuating Prices of Raw Materials

The canvas market faces significant challenges due to the fluctuating prices of raw materials, such as cotton and synthetic fibers. According to the U.S. Department of Agriculture (USDA), global cotton prices have experienced a 30% increase in volatility over the past three years, driven by factors like extreme weather events and supply chain disruptions caused by the COVID-19 pandemic. This instability directly impacts canvas production costs, as cotton remains a primary material for canvas manufacturing. Additionally, the World Trade Organization reports that geopolitical tensions, such as trade restrictions and tariffs, have further strained global supply chains, exacerbating shortages. These factors create financial strain for small-scale artists and businesses, limiting their ability to afford high-quality canvases and hindering market growth.

Environmental Regulations on Manufacturing Processes

Stringent environmental regulations on manufacturing processes pose another major restraint for the canvas market. The European Environment Agency highlights that textile manufacturing contributes approximately 20% of global industrial water pollution, prompting governments to enforce stricter emission and waste management standards. Compliance with these regulations often requires significant investments in eco-friendly technologies, which can increase production costs by 15-20%, as reported by the U.S. Environmental Protection Agency. Smaller manufacturers, in particular, struggle to meet these requirements due to limited financial resources, as noted by the European Commission in a 2021 report on SMEs in the textile industry. This regulatory pressure not only raises operational costs but also slows down production timelines, creating barriers to scalability and innovation within the canvas industry.

MARKET OPPORTUNITIES

Expansion of Online Art Platforms and E-Commerce

The canvas market is poised to benefit significantly from the rapid expansion of online art platforms and e-commerce. According to the U.S. Census Bureau, e-commerce sales in the arts, entertainment, and recreation sector grew by 36% between 2019 and 2022, driven by increased internet accessibility and consumer preference for online shopping. The National Endowment for the Arts highlights that substantial number of professional artists now use digital platforms to sell their work, creating a surge in demand for high-quality canvases. This digital transformation presents a lucrative opportunity for the canvas market to expand its reach and customer base.

Growing Adoption of Digital Art Tools and Hybrid Mediums

The canvas market also stands to gain from the growing adoption of digital art tools and hybrid mediums, which blend traditional and digital techniques. The art schools reporting a 20% increase in courses combining traditional and digital methods over the past five years. This trend not only broadens the application of canvases but also attracts tech-savvy creators, positioning the canvas market at the intersection of tradition and innovation.

MARKET CHALLENGES

Rising Competition from Alternative Materials

The canvas fabric market faces a significant challenge from the rising competition posed by alternative materials such as synthetic fibers and non-woven fabrics. These materials are increasingly being used in industries traditionally dominated by canvas, such as outdoor gear and home furnishings. The European Commission highlights that synthetic alternatives now account for over 70% of textile production in certain sectors, due to their resistance to moisture, wear, and UV exposureThis trend forces canvas manufacturers to innovate or risk losing market share to more affordable and versatile substitutes.

Impact of Global Supply Chain Disruptions

Global supply chain disruptions present another major challenge for the canvas fabric market, affecting both raw material availability and production timelines. The International Cotton Advisory Committee (ICAC) highlights that geopolitical tensions and trade restrictions have further exacerbated these issues, with cotton exports from key producers like India and the United States declining by 10% in 2022. These disruptions not only inflate prices but also limit access to essential materials, hindering production capacity and creating uncertainty in meeting consumer demands. This ongoing challenge threatens the stability and growth of the canvas fabric market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.85% |

|

Segments Covered |

By type, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Whaleys Bradford, Serena & Lily, Dimension Polyant, Contender Sailcloth, Bainbridge International, Challenge Sailcloth, Doyle, British Millerain, IYU Sailcloth, Mazu Sailcloth, and Mack Sails |

SEGMENTAL ANALYSIS

By Type Insights

The plain canvas segment dominated the market by holding 55.8% of the global canvas market share in 2024. The dominance of plain canvas segment is majorly driven by its versatility and widespread use in art, home decor, and industrial applications. Additionally, the rise of DIY art projects and online platforms like Etsy has further boosted demandPlain canvas’s affordability and adaptability make it indispensable for both amateur and professional artists, solidifying its leadership in the market.

However, the duck canvas segment is the fastest-growing segment and is expected to grow at a CAGR of 6.8% over the forecast period owing to the increasing use in durable applications such as outdoor gear, workwear, and upholstery, as noted by the U.S. Department of Commerce. Duck canvas’s strength and resistance to wear and tear make it ideal for these purposes. Additionally, the growing trend of sustainable fashion, as emphasized by the United Nations Alliance for Sustainable Fashion , has spurred interest in durable, reusable materials. As industries prioritize longevity and eco-friendliness, duck canvas emerges as a critical segment driving innovation and market expansion.

By Application Insights

The tent segment had the largest share of the 30.3% of the worldwide market in 2024 due to the growing popularity of outdoor recreational activities and adventure tourism, with the U.S. Department of Commerce reporting a 10% annual increase in camping equipment sales from 2020 to 2022. Canvas tents are favored for their durability, weather resistance, and eco-friendly properties, making them ideal for both recreational and emergency shelter applications. Additionally, government initiatives promoting eco-tourism, such as those highlighted by the European Environment Agency, have further boosted demand. The versatility of canvas tents ensures their indispensability, solidifying their position as the largest and most critical segment in the canvas market.

The automotive fabric is segment is projected to witness the highest CAGR of 7.5% over the forecast period due to the increasing use of canvas in car interiors, seat covers, and protective covers due to its durability and aesthetic appeal. The global automotive industry is shifting toward sustainable materials, with canvas being a key player in this transition. Rising vehicle production in emerging markets like India and China, as noted by the International Organization of Motor Vehicle Manufacturers, which reported a 4% annual increase in global vehicle production in 2022, further accelerates demand. Additionally, consumer preferences for durable, reusable, and eco-friendly materials align with the growing trend of sustainability. As automakers prioritize longevity and environmental responsibility, automotive fabric emerges as a critical driver of innovation and growth in the canvas market.

REGIONAL ANALYSIS

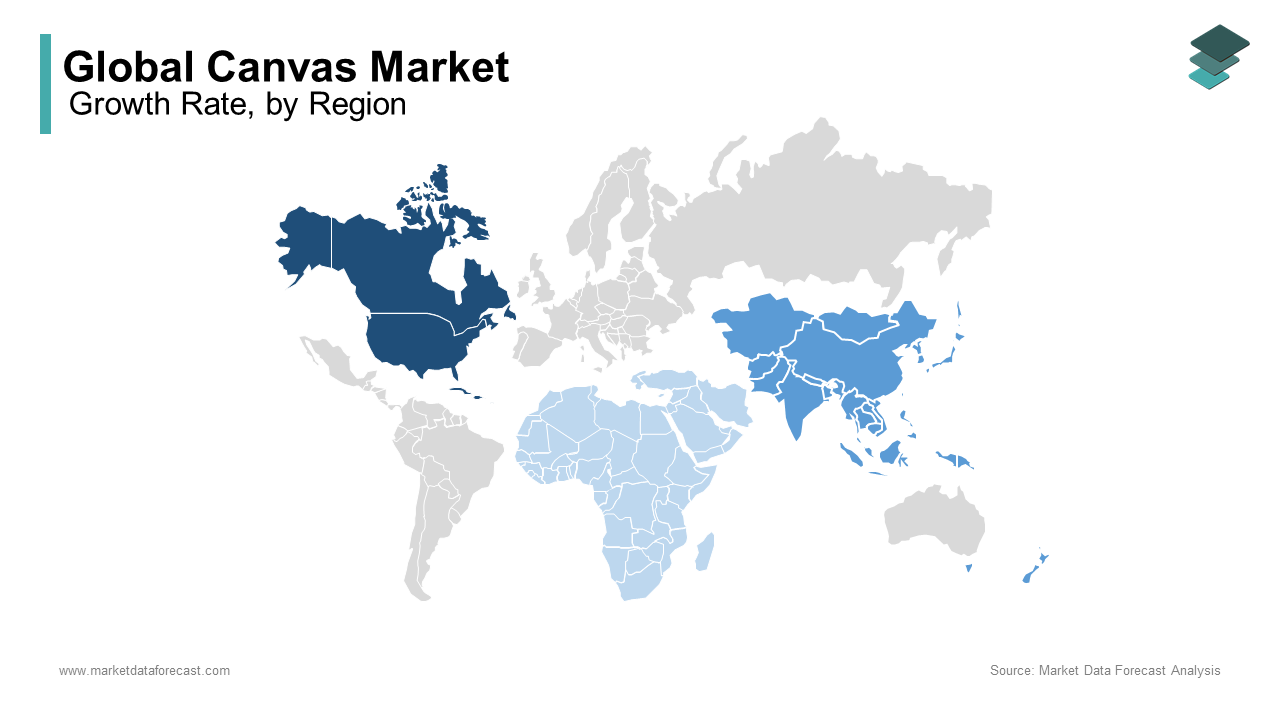

North America dominated the canvas market by holding a 30.2% market share in 2024. The region's leadership is driven by its thriving art industry, high disposable incomes, and increasing demand for sustainable art supplies. The National Endowment for the Arts reports that 45% of U.S. adults engage in at least one form of creative activity annually, boosting canvas consumption. Additionally, the presence of major manufacturers and e-commerce platforms like Etsy enhances accessibility, with Etsy reporting a 94% increase in searches for DIY art kits between 2020 and 2022. North America’s emphasis on home decor trends and personalized art further solidifies its dominance, making it a hub for innovation and premium canvas products.

The Asia-Pacific region is the fastest-growing segment in the canvas market with a CAGR of 7.8% . This growth is fueled by rapid urbanization, rising disposable incomes, and a growing art community in countries like China and India. The United Nations Conference on Trade and Development highlights that the region accounts for significant portion of global art material consumption. Government initiatives, such as India’s National Education Policy 2020, which emphasizes arts education, further accelerate demand. The proliferation of online art platforms and cross-border e-commerce has expanded market access, positioning Asia-Pacific as a key driver of future growth.

Europe holds a significant share of the global canvas market. The region benefits from its rich artistic heritage and strong cultural emphasis on art education, with countries like France, Italy, and Germany leading in art material consumption. Stringent environmental regulations have driven demand for sustainable canvases. Additionally, the rise of art tourism, particularly in cities like Paris and Florence, has bolstered demand. While growth is steady, challenges like economic uncertainties in certain regions, such as Eastern Europe, may slow expansion. However, Europe’s focus on sustainability and premium products ensures its continued importance in the global canvas market.

Latin America is projected to grow at a moderate . This growth is fueled by increasing participation in cultural festivals, art tourism, and government initiatives promoting creativity, such as Mexico’s National Culture Program. The Inter-American Development Bank highlights that rising urbanization and disposable incomes are driving demand for home decor and DIY art projects. However, economic disparities and limited access to high-quality materials remain challenges. Despite these hurdles, the region’s untapped potential and growing interest in creative industries position it for steady growth in the coming years.

The Middle East and Africa are expected to witness gradual growth. Urbanization and government investments in creative industries, such as Saudi Arabia’s Vision 2030 and South Africa’s Creative Industries Growth Strategy, are key drivers of demand. South Africa and Nigeria are emerging markets due to their growing art communities and increased access to online platforms. However, challenges like economic instability and limited infrastructure hinder rapid expansion. Despite these obstacles, the region’s focus on cultural preservation and rising youth engagement in creative activities present opportunities for long-term growth in the canvas market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Major Players of the global canvas market include Whaleys Bradford, Serena & Lily, Dimension Polyant, Contender Sailcloth, Bainbridge International, Challenge Sailcloth, Doyle, British Millerain, IYU Sailcloth, Mazu Sailcloth, and Mack Sails

The global canvas market is characterized by intense competition, driven by a mix of established manufacturers, regional players, and emerging companies focusing on innovation and sustainability. The industry serves a diverse range of applications, including fashion, home décor, industrial uses, military supplies, and outdoor gear, making it highly fragmented and competitive.

Key players, such as Whaleys Bradford, British Millerain, Dimension-Polyant, and Serena & Lily, compete based on product quality, durability, and innovation. These companies invest in research and development (R&D) to introduce advanced canvas fabrics with improved water resistance, fire retardancy, and eco-friendly features. Sustainability has become a major competitive factor, as consumers increasingly prefer organic and recycled canvas materials.

Regional manufacturers, particularly in India, China, and Bangladesh, add to the competition by offering cost-effective solutions for mass production, appealing to price-sensitive buyers. Meanwhile, strategic partnerships, acquisitions, and technological advancements are common strategies among major companies to expand market share.

With increasing demand for durable and versatile textiles, the canvas market continues to evolve, pushing companies to differentiate through material innovation, branding, and sustainable practices. As a result, competition remains dynamic, with both established and new players striving to strengthen their global presence.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Product Diversification and Innovation

One of the most effective strategies employed by key players in the canvas fabric market is continuous product diversification and innovation. Companies such as British Millerain have been at the forefront of developing advanced canvas fabrics with enhanced properties such as water resistance, UV protection, and fire retardancy. By investing in research and development, these companies cater to a wide range of industries, including outdoor gear, military equipment, fashion, and industrial applications. This approach not only helps them expand their market reach but also enables them to differentiate their products from competitors, ensuring sustained customer interest and loyalty.

Strategic Partnerships and Collaborations

Leading canvas fabric manufacturers such as Dimension-Polyant leverage strategic partnerships and collaborations to enhance their market presence. By working closely with other industry leaders, suppliers, and technology developers, they can combine expertise and resources to create high-performance canvas fabrics. These collaborations often lead to innovations in production techniques, improved product durability, and increased distribution channels. Partnering with brands across various industries also helps canvas manufacturers enter new markets, allowing them to expand their footprint globally while maintaining a competitive edge.

Sustainability Initiatives

With growing consumer awareness and regulatory pressures around environmental sustainability, companies like Serena & Lily are prioritizing eco-friendly production methods and materials. They focus on using organic cotton, recycled fabrics, and environmentally responsible dyeing processes to reduce their carbon footprint. Additionally, many canvas fabric manufacturers are adopting sustainable supply chain practices, minimizing waste, and ensuring ethical labor standards. By aligning with the increasing consumer demand for sustainable products, these companies not only contribute to environmental conservation but also attract a loyal customer base that values ethical and eco-conscious brands. This strategic focus on sustainability strengthens their position in the market and enhances brand reputation.

TOP 3 PLAYERS IN THE MARKET

Whaleys Bradford

Whaleys Bradford is a renowned textile manufacturer based in the United Kingdom, specializing in high-quality canvas and other fabrics. The company offers a diverse range of canvas materials catering to various industries, including fashion, art, and industrial applications. Their commitment to quality and innovation has solidified their position as a leading supplier in the global canvas market.

Serena & Lily

Serena & Lily is a U.S.-based home décor and lifestyle brand known for its premium canvas products. The company integrates canvas fabrics into a variety of home furnishings, such as upholstery, bedding, and accessories, emphasizing both aesthetic appeal and durability. Their distinctive designs and focus on quality have made them a significant contributor to the canvas fabric market, particularly in the home décor segment.

Dimension-Polyant

Dimension-Polyant, headquartered in Germany, is a leading manufacturer of sailcloth and technical fabrics, including specialized canvas materials. The company is recognized for its advanced production techniques and high-performance fabrics used in marine, outdoor, and industrial applications. Their innovative approach and dedication to quality have established them as a key player in the global canvas fabric industry.

RECENT MARKET DEVELOPMENTS

- In September 2024, Trader Joe's announced the relaunch of their popular mini canvas tote bags, set for release on September 18, 2024. Initially launched in March, these $2.99 bags became a viral sensation, quickly selling out and gaining significant consumer demand.

- In December 2024, Fashion brand Tibi collaborated with L.L.Bean to reimagine the classic Boat and Tote bag. Priced at $475, the new design combines luxury fashion elements with the functional appeal of traditional canvas totes.

- In February 2024, Bharat Tex 2024 at Bharat Mandapam, New Delhi took place. The event focused on the entire textiles value chain, including canvas fabrics, with participation from over 100 countries. It aimed to boost trade, investment, and exports in the textile sector.

MARKET SEGMENTATION

This research report on the global canvas market has been segmented and sub-segmented based on type, application, and region.

By Type

- Plain Canvas

- Duck Canvas

By Application

- Tent

- Luggage Fabric

- Automotive Fabric

- Apparel

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. Which types of canvas are most commonly used in the market?

The most commonly used types of canvas include plain canvas, duck canvas, and waxed canvas, each serving different applications.

2. Who are the key players in the global canvas market?

Leading companies in the canvas industry include Cottonsafe Natural Mattress, ICF Mercantile, Dimension Polyant, and American Canvas Products.

3. What factors are driving the growth of the canvas market?

Increasing demand for eco-friendly, durable, and versatile materials in fashion, outdoor gear, and home décor is driving the market growth.

4. How is sustainability impacting the canvas market?

Consumers and industries are shifting towards organic and recycled canvas materials, promoting sustainable and biodegradable products.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]