Global Canopy Market Size, Share, Trends, & Growth Forecast Report Segmented By Material (PTFE, ETFE, and PVC), Application (Shade Canopy and Event Or Large Canopy), End-use (Residential and Non-residential), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Canopy Market Size

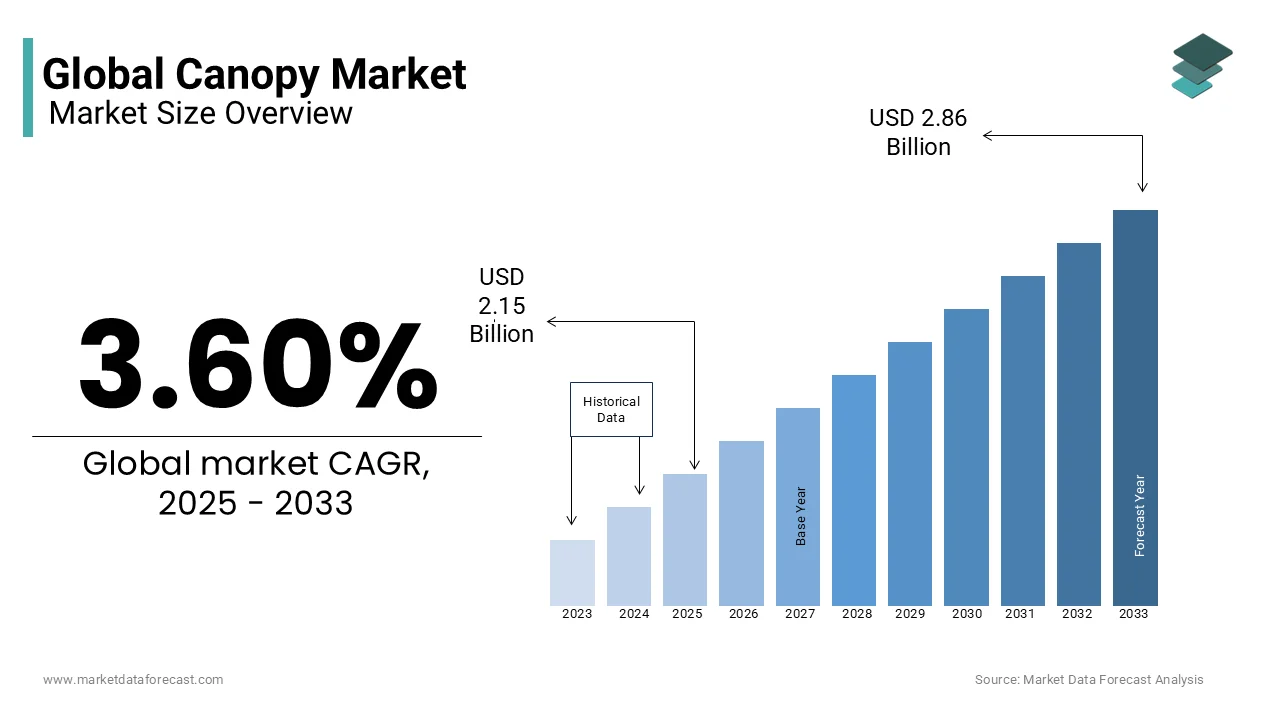

The global canopy market was valued at USD 2.86 billion in 2024. The global market is estimated to reach USD 2.86 billion by 2033 from USD 2.15 billion in 2025, rising at a CAGR of 3.60% from 2025 to 2033.

Canopies are typically constructed from materials like polyester, polyethylene, or canvas and supported by durable frames made from steel, aluminum, or fiberglass and serve as versatile solutions for outdoor settings. These include patios, gardens, carports, event venues, and temporary industrial storage. The evolution of canopy designs from traditional fixed structures to retractable, pop-up, and eco-friendly solar-integrated canopies which reflects the growing demand for adaptable, sustainable, and visually appealing outdoor solutions.

Several societal and environmental trends contribute to the rising prominence of canopies. For instance, climate change and the increase in extreme weather events have heightened awareness of the need for UV protection and weather-resistant structures. According to the World Health Organization, over 1.5 million skin cancer cases are diagnosed annually worldwide which is prompting both individuals and businesses to invest in sun-protective solutions like UV-resistant canopies. Additionally, the global push toward sustainable living has encouraged the development of eco-friendly canopy materials, such as recycled fabrics and solar-powered models that align with broader environmental goals.

Urbanization trends also play a key role in canopy adoption. The United Nations reports that by 2050, nearly 68% of the world’s population will live in urban areas which is driving the need for efficient use of outdoor spaces in increasingly dense cities. This shift has led to the proliferation of canopies in urban parks, rooftop gardens, and outdoor dining areas by providing both functional and aesthetic benefits.

MARKET DRIVERS

Rising Demand for Outdoor Recreational Spaces

The increasing popularity of outdoor recreational activities is a significant driver of the canopy market. As more individuals and families seek outdoor experiences, the demand for protective structures like canopies has surged by providing shade and shelter in diverse settings such as parks, beaches, and campsites. According to the U.S. National Park Service, over 312 million recreational visits were recorded in 2022 is reflecting a growing inclination towards outdoor activities. This trend has also been mirrored globally, with the United Nations World Tourism Organization reporting a steady rise in eco-tourism and outdoor adventure travel. The need for flexible, portable shade solutions in these environments has fueled the adoption of canopies is catering to both individual consumers and commercial enterprises offering outdoor services.

Urbanization and Expansion of Public Infrastructure

The rapid pace of urbanization and the concurrent development of public infrastructure have significantly influenced the canopy market. The need for shaded public spaces such as transit stops, pedestrian walkways, and outdoor communal areas becomes increasingly important as urban areas expand. The United Nations projects that 68% of the global population will reside in urban centers by 2050 which is emphasizing the demand for functional outdoor infrastructure. Moreover, initiatives like the European Green Deal which focuses on sustainable urban development, encourage the integration of environmentally friendly canopies in public spaces.

MARKET RESTRAINTS

High Costs of Quality Materials and Installation

The cost of high-quality materials and installation serves as a significant restraint in the canopy market. Durable canopies, particularly those made from UV-resistant fabrics, corrosion-proof metals, and advanced weatherproofing technologies, can be expensive to produce and install. This cost barrier limits adoption, especially among price-sensitive consumers and small businesses. According to the U.S. Bureau of Labor Statistics, the Producer Price Index (PPI) for construction materials rose by 19% between 2020 and 2022 which is driven by inflation and supply chain disruptions. Additionally, labor costs have increased due to shortages in skilled workers, further elevating installation expenses. These factors can deter potential buyers from investing in high-end canopy solutions that may slow market growth in cost-conscious regions.

Environmental Regulations and Sustainability Challenges

Stringent environmental regulations regarding material usage and sustainability practices can hinder the canopy market's growth. Governments worldwide are increasingly enforcing regulations that limit the use of non-recyclable materials and promote eco-friendly alternatives which can increase production costs and complicate supply chains. For example, the European Union’s Waste Framework Directive mandates strict recycling and waste reduction targets is affecting industries reliant on synthetic fabrics and non-biodegradable materials. Furthermore, the U.S. Environmental Protection Agency’s (EPA) guidelines on volatile organic compounds (VOCs) impact the production of certain coatings and fabrics used in canopies. Compliance with these regulations requires additional investment in sustainable materials and processes is potentially limiting profitability and discouraging smaller manufacturers from entering the market.

MARKET OPPORTUNITIES

Integration of Solar Technology in Canopies

The integration of solar technology into canopy structures presents a significant growth opportunity in the market. Solar canopies not only provide shade but also generate renewable energy which is aligning with global sustainability goals. This dual functionality appeals to both commercial and residential users looking to reduce energy costs and carbon footprints. The U.S. Department of Energy reports that solar installations increased by 34% in 2021 alone, with solar energy contributing nearly 5% to the national electricity mix. Additionally, government incentives, such as the Investment Tax Credit (ITC) in the United States, further encourage the adoption of solar-integrated structures. The growing emphasis on renewable energy and energy-efficient infrastructure creates a favorable environment for the expansion of solar canopy solutions in urban and commercial spaces.

Growth of the E-commerce and Event Management Sectors

The rapid expansion of e-commerce and the event management industry offers another significant opportunity for the canopy market. The rise of online retail has increased demand for temporary storage solutions and sheltered outdoor logistics operations, where canopies serve as cost-effective, flexible options. Simultaneously, the event management sector, encompassing festivals, exhibitions, and corporate gatherings, relies heavily on customizable canopy structures. According to the U.S. Census Bureau, e-commerce sales in the United States reached $1.03 trillion in 2022, a 7.7% increase from the previous year. This growth is combined with the resurgence of in-person events post-pandemic which drives the demand for versatile canopy solutions that cater to diverse business needs.

MARKET CHALLENGES

Supply Chain Disruptions and Material Shortages

Supply chain disruptions and material shortages pose a critical challenge to the canopy market by affecting both production timelines and cost structures. The COVID-19 pandemic exposed vulnerabilities in global supply chains which is leading to delays in sourcing raw materials like steel, aluminum, and specialized fabrics essential for canopy manufacturing. The U.S. Census Bureau’s Small Business Pulse Survey reported that 60% of manufacturers faced significant supply chain disruptions in 2021which is a trend that has continued due to geopolitical tensions and transportation bottlenecks. These disruptions result in increased lead times, fluctuating material costs, and limited availability of high-quality products which hampers manufacturers' ability to meet growing consumer demand particularly in fast-developing regions.

Weather-Related Wear and Maintenance Challenges

Canopies, while designed to withstand various environmental conditions, face durability issues in regions with extreme weather. High winds, heavy snowfall, and prolonged UV exposure can cause fabric degradation, frame corrosion, and structural instability is necessitating frequent maintenance or replacement. The National Oceanic and Atmospheric Administration (NOAA) reported that the U.S. experienced 18 separate billion-dollar weather and climate disasters in 2022, including severe storms and hurricanes which is increasing the risk of canopy damage. This vulnerability leads to higher maintenance costs and discourages investment in regions prone to extreme weather. Additionally, consumers may opt for more permanent, weather-resistant structures is limiting the market for traditional canopy products.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.60% |

|

Segments Covered |

By Material, Application, End-use, and Country |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Eide Industries, Inc., ADVANCED DESIGN AWNINGS & SIGNS, SUNAIR AWNINGS., Shade Structures, Inc., Canopies UK Ltd., Lawrence Fabric, Inc., Impact Canopies USA, KD KANOPY, INC., and JAY JAY Enterprise. |

SEGMENTAL ANALYSIS

By Material Insights

The polyvinyl chloride (PVC) segment dominated the canopy market with 45.3% of the global market share in 2024. The widespread use of PVS is due to its cost-effectiveness, flexibility, and durability in diverse environmental conditions. It is highly resistant to UV radiation, moisture, and mildew which is suitable for both residential and commercial applications. The U.S. Environmental Protection Agency reports that PVC is one of the most produced synthetic plastic polymers globally with annual production exceeding 40 million tons. This large-scale production drives down costs are making PVC an affordable option for consumers and businesses. Furthermore, its ease of fabrication and maintenance has solidified its position as the preferred material in moderate climate zones where extreme weather resilience is less critical.

The ethylene tetrafluoroethylene (ETFE) canopies segment is predicted to register a CAGR of 7.5% over the forecast period. The appeal of ETFE lies in its lightweight, high-transparency, and exceptional durability. It offers superior resistance to extreme temperatures, chemicals, and UV radiation, with a lifespan of over 30 years. The U.S. Department of Energy emphasizes ETFE’s outstanding thermal insulation properties which contribute to energy-efficient building designs by reducing heating and cooling costs. Additionally, ETFE is fully recyclable which aligned with global sustainability goals. The growing adoption of ETFE in high-profile architectural projects, such as the U.S. Bank Stadium in Minnesota, showcases its versatility and environmental benefits is driving its rapid expansion in the commercial and public infrastructure sectors.

By Application Insights

The shade canopies segment held the largest share of 55.8% of the global canopy market share in 2024. The dominance of shade canopy segment is majorly driven by widespread residential and commercial use, including patios, gardens, outdoor dining areas, and carports. The rising demand for UV protection and outdoor comfort has significantly boosted this segment. According to the U.S. Environmental Protection Agency, Americans spend over 90% of their time indoors with increased awareness of the health benefits of outdoor exposure has fueled interest in shaded outdoor spaces. The affordability, versatility, and ease of installation of shade canopies make them a popular choice across diverse applications by maintaining their leading market position.

The event or large canopies segment is expected to grow at a CAGR of 6.5% during the forecast period due to the resurgence of outdoor events, festivals, and corporate gatherings post-pandemic. The U.S. Bureau of Economic Analysis reports that the arts, entertainment, and recreation sector grew by 14% in 2022, reflecting a strong rebound in public events and activities. Event canopies offer customizable, large-scale solutions for temporary venues, making them indispensable for event organizers. Additionally, the increasing popularity of outdoor weddings, trade shows, and exhibitions has amplified the demand for durable, weather-resistant canopies, driving rapid growth in this segment globally.

By End-use Insights

The non-residential segment led the market by holding 60.6% of global canopy market share in 2024. Factors such as widespread use in commercial spaces, hospitality, event management, and public infrastructure are boosting the domination of the non-residential segment in the global market. Canopies are integral to outdoor dining areas, retail spaces, and large-scale events by providing both functional shelter and aesthetic appeal. According to the U.S. Census Bureau, non-residential construction spending reached $503 billion in 2022 by reflecting continued investment in commercial infrastructure. The increasing number of outdoor events, coupled with the expansion of urban public spaces will further reinforces the non-residential segment's leadership, as businesses prioritize flexible, weather-resistant solutions for customer engagement and operations.

The residential canopy market is emerging swiftly and is estimated to post a CAGR of 5.8% during the forecast period due to factors such as rising home improvement trends, increased interest in outdoor living spaces, and heightened awareness of UV protection. The pandemic accelerated the desire for functional outdoor areas, with homeowners investing in canopies for patios, gardens, and carports. The U.S. Department of Housing and Urban Development reported that residential construction permits increased by 13% in 2021, reflecting a broader trend toward home enhancements. Furthermore, the emphasis on energy-efficient and aesthetically pleasing outdoor solutions contributes to the growing demand for customizable and durable canopies in residential settings.

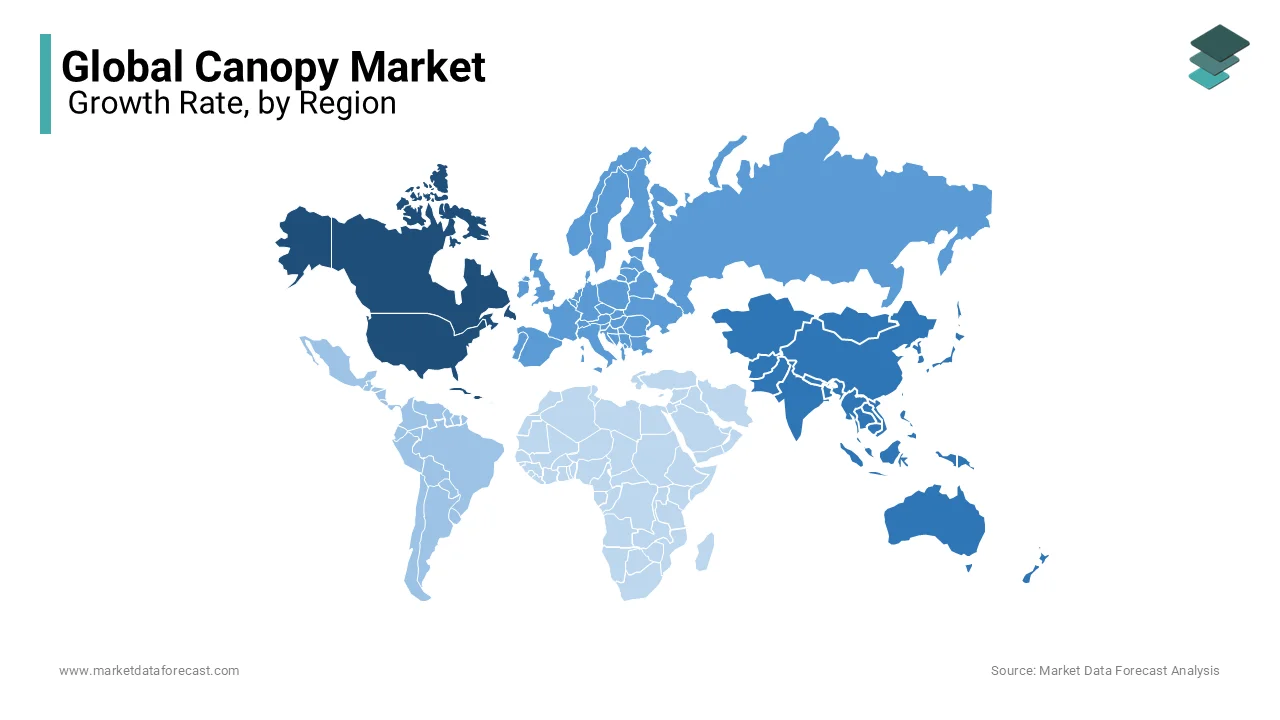

REGIONAL ANALYSIS

North America was the leading regional segment for canopy worldwide in 2024 and held 35.3% of the global market share in 2024. The domination of North America in the global market is driven by the region's strong demand for outdoor recreational spaces, robust construction industry, and growing hospitality sector. The U.S. Census Bureau reported that outdoor living products, including canopies, saw a 14% increase in sales in 2022 which is reflecting rising consumer interest. Additionally, the prevalence of outdoor events, festivals, and commercial applications such as outdoor dining areas contributes to sustained demand. The region’s emphasis on high-quality, weather-resistant, and aesthetically pleasing canopies further solidifies its leading position in the global market.

The Asia-Pacific region is the fastest-growing segment in the canopy market and is projected to expand at a CAGR of 6.5% from 2025 to 2033. Rapid urbanization, infrastructure development, and increased disposable incomes are driving the demand for canopies across residential, commercial, and industrial sectors. The United Nations reports that Asia is home to 54% of the global urban population, with urbanization rates expected to rise significantly by 2050. Additionally, countries like China and India are investing heavily in public spaces and tourism infrastructure, increasing canopy adoption. The region’s focus on sustainable development and eco-friendly solutions also fosters demand for innovative canopy products.

Europe remains a strong player in the canopy market which is driven by stringent environmental regulations and a well-established event management industry. The European Union’s Green Deal encourages sustainable outdoor solutions such as eco-friendly canopies. Latin America shows moderate growth potential is supported by tourism expansion and increasing investments in outdoor recreational infrastructure. The Middle East and Africa are poised for steady growth due to rising urbanization and infrastructure projects. The World Bank reports that urban populations in the Middle East are expected to grow by 50% by 2040 by creating new opportunities for canopy installations in public and commercial spaces. However, extreme weather conditions may pose challenges in these regions.

KEY MARKET PLAYERS

The major players in the global canopy market include Eide Industries, Inc., ADVANCED DESIGN AWNINGS & SIGNS, SUNAIR AWNINGS., Shade Structures, Inc., Canopies UK Ltd., Lawrence Fabric, Inc., Impact Canopies USA, KD KANOPY, INC., and JAY JAY Enterprise.

Top 3 Players in the Market

Eide Industries, Inc.

Eide Industries, Inc. is a leading manufacturer in the global canopy market, renowned for its custom-designed tensile structures, awnings, and canopies. Headquartered in California, Eide specializes in providing high-quality, durable, and architecturally advanced fabric structures for commercial, industrial, and government applications. The company’s focus on innovation and engineering excellence has positioned it as a key player, particularly in the non-residential sector. Eide’s projects often include large-scale installations for stadiums, airports, and public spaces, emphasizing both functionality and aesthetic appeal. Their commitment to sustainability, with the integration of eco-friendly materials and energy-efficient designs, has further solidified their leadership in the market.

SUNAIR Awnings

SUNAIR Awnings is a prominent player in the global canopy and shading solutions market, with a strong reputation for manufacturing high-quality retractable awnings, pergolas, and canopies. Established in 1978 and based in Maryland, USA, SUNAIR serves both residential and commercial clients, offering a diverse product range that combines durability, design flexibility, and technological innovation. The company’s focus on motorized and automated shading systems caters to the growing demand for smart home and commercial solutions. SUNAIR’s extensive distribution network across North America and Europe enhances its market reach, while its commitment to using sustainable materials aligns with global environmental standards.

Canopies UK Ltd.

Canopies UK Ltd., based in Lancashire, England, is a leading manufacturer and supplier of high-quality canopies and covered outdoor solutions across the UK and Europe. The company specializes in bespoke canopy designs for sectors such as education, healthcare, hospitality, and retail. Known for its durable and weather-resistant products, Canopies UK emphasizes safety, compliance, and aesthetic customization. Their commitment to innovation is evident in the development of products like retractable roof systems and modular canopies, addressing diverse client needs. Canopies UK’s strong market presence in Europe, combined with its focus on customer-centric design and installation services, contributes significantly to the global canopy market.

TOP STRATEGIES USED BY THE KEY PARTICIPANTS

Product Innovation and Technological Integration

Key players in the canopy market, such as Eide Industries, Inc. and SUNAIR Awnings, focus heavily on product innovation to differentiate themselves. This includes the development of motorized and automated canopies, integration with smart home technologies, and the use of advanced materials like UV-resistant fabrics and corrosion-proof metals. For example, SUNAIR’s focus on motorized retractable awnings meets the rising demand for convenience and energy efficiency in both residential and commercial sectors.

Customization and Design Flexibility

Companies like Canopies UK Ltd. and Shade Structures, Inc. leverage customization to cater to diverse customer needs across different sectors. They offer bespoke canopy solutions tailored for educational institutions, healthcare facilities, and commercial spaces. This strategy allows them to serve niche markets while ensuring compliance with local building codes and aesthetic preferences, thus expanding their market share.

Sustainability and Eco-Friendly Solutions

With growing environmental concerns, key players are adopting sustainable materials and eco-friendly manufacturing processes. Companies are increasingly integrating solar technology into their canopy designs, offering dual-purpose solutions that provide shade while generating renewable energy. This aligns with global sustainability initiatives and attracts environmentally conscious consumers and businesses.

Strategic Partnerships and Collaborations

Collaborations with architectural firms, construction companies, and municipalities help major players secure large-scale projects. For instance, Eide Industries often partners with public sector clients for infrastructure projects like stadiums and transportation hubs, ensuring a steady flow of high-value contracts. Such partnerships also enhance brand visibility and market credibility.

Geographic Expansion and Distribution Networks

To strengthen their global footprint, companies like Impact Canopies USA and KD Kanopy, Inc. focus on expanding their distribution channels and establishing regional offices in high-growth markets such as Asia-Pacific and Latin America. This enables faster delivery times, better customer service, and localized marketing efforts that resonate with regional consumer preferences.

Mergers, Acquisitions, and Strategic Investments

Some key players engage in mergers and acquisitions to diversify their product portfolios and expand their market reach. Acquiring smaller, specialized firms allows them to integrate new technologies and expertise into their existing offerings. Strategic investments in R&D further support continuous product improvement and innovation.

Emphasis on Marketing and Brand Positioning

Strong brand positioning through targeted marketing campaigns, participation in international trade shows, and digital marketing efforts helps companies maintain a competitive edge. Highlighting their commitment to quality, durability, and innovation through case studies, customer testimonials, and sustainability reports builds trust and loyalty among customers.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, Eide Industries, Inc. opened a new 50,000 square-foot manufacturing facility in California. This expansion is expected to enhance their production capacity for custom canopy solutions and strengthen their position in the market.

- In July 2023, ADVANCED DESIGN AWNINGS & SIGNS launched a new line of eco-friendly awnings made from recycled materials. This move aligns with the growing demand for sustainable building products and enhances their competitive edge.

- In September 2023, SUNAIR AWNINGS introduced a smart canopy system integrated with IoT technology. This innovation allows users to control shading solutions remotely via mobile applications, positioning the company as a leader in tech-driven canopy solutions.

- In January 2024, Shade Structures, Inc. secured a major contract to provide custom canopy solutions for an urban park redevelopment project in Texas. This project is expected to boost their visibility in large-scale public infrastructure developments.

- In November 2023, Canopies UK Ltd. partnered with a leading architectural firm to design and install bespoke canopies for a series of luxury hotels across Europe. This collaboration is anticipated to expand their presence in the hospitality sector.

- In May 2023, Lawrence Fabric, Inc. invested in advanced fabrication technology, reducing production times by 20%. This investment is set to improve product quality and enhance their competitiveness in the market.

- In August 2023, Impact Canopies USA expanded its product line to include inflatable event tents. This diversification aims to meet evolving demands in the event management industry and broaden their product offerings.

- In October 2023, KD KANOPY, INC. launched a new range of customizable pop-up canopies with enhanced durability. This product line targets the growing market for portable and resilient outdoor solutions, strengthening their market presence.

- In December 2023, JAY JAY Enterprise entered into a distribution agreement with a major retail chain in Asia-Pacific. This partnership is expected to significantly expand their market reach in the rapidly growing region.

- In February 2024, Vitabri introduced a modular canopy system designed for quick assembly and disassembly. This innovation caters to clients needing flexible, temporary shelter solutions and positions Vitabri as a leader in modular canopy technology.

MARKET SEGMENTATION

This research report on the global canopy market is segmented and sub-segmented into the following categories.

By Material

- PTFE

- ETFE

- PVC

By Application

- Shade Canopy

- Event Or Large Canopy

By End-use

- Residential

- Non-residential

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What kind of products can I find at Canopy Market?

The market offers fresh produce, street food, fashion, and handmade crafts. Independent artisans and designers showcase unique goods. There's a mix of vintage, contemporary, and specialty products.

Does Canopy Market have vegetarian and vegan food options?

Yes, there are plenty of vegetarian and vegan food options available. Many vendors specialize in plant-based and organic dishes. It’s a great spot for diverse dietary preferences.

Can I pay with a credit or debit card at Canopy Market?

Most vendors accept credit and debit cards for convenience. Some may still prefer cash, so carrying both is recommended. Contactless payments are widely accepted.

Does Canopy Market host special events or live music?

Yes, the market frequently hosts live music, special events, and themed weekends. Guest chefs, pop-up stalls, and entertainment add to the experience. Check their schedule for upcoming events.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]