Global Canned Meat Market Size, Share, Trends & Growth Forecast Report Segmented By Product Type ( Luncheon Meat, Ham, Sausage, Bacon, Corned Beef, Others), Distribution Channel, And Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 to 2033

Global Canned Meat Market Size

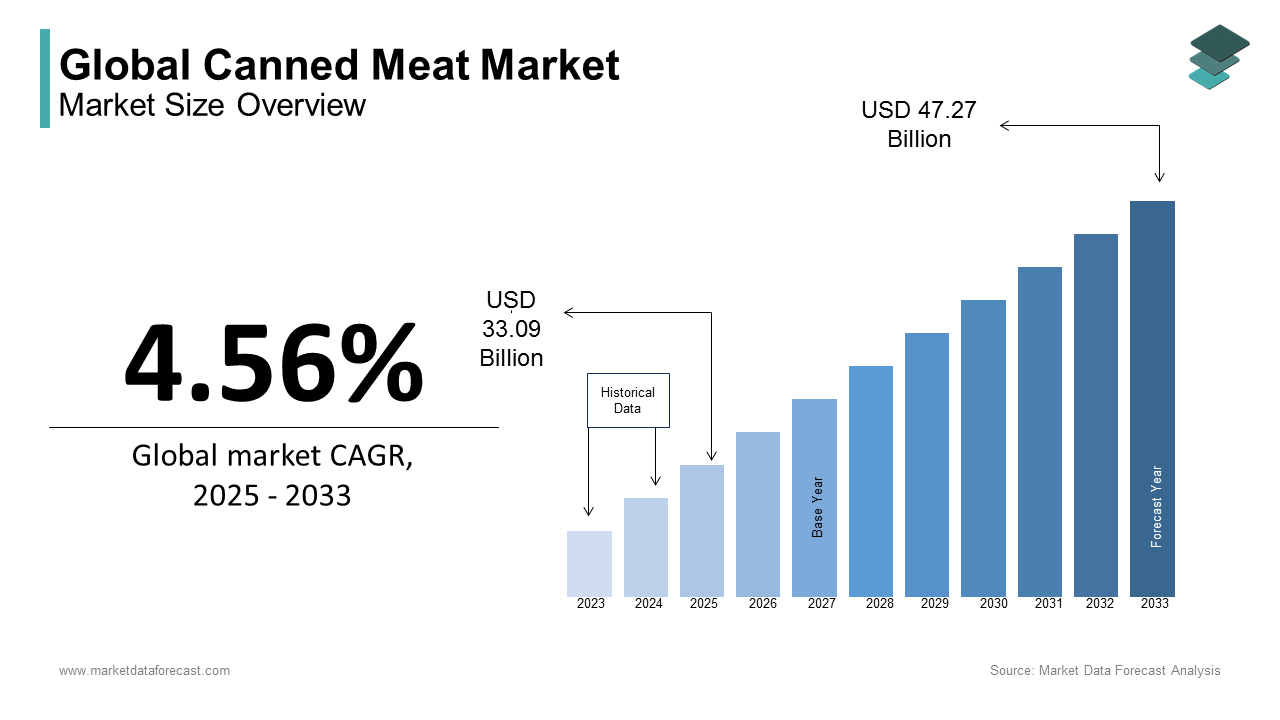

The global canned meat market size was calculated to be USD 31.65 billion in 2024 and is anticipated to be worth USD 47.27 billion by 2033 from USD 33.09 billion In 2025, growing at a CAGR of 4.56% during the forecast period.

Canned meat consists of processed meat products sealed in airtight containers to enhance shelf life and preserve nutritional value. The canning process involves cooking, curing, and vacuum-sealing meat products which is followed by heat sterilization to prevent microbial growth. This method allows meats like beef, pork, chicken, and seafood to remain safe for consumption without refrigeration by making them essential for households, military rations, emergency food supplies, and outdoor activities.

Rising urbanization and changing consumer lifestyles have increased the demand for ready-to-eat foods with canned meat serving as a convenient protein source. According to the Food and Agriculture Organization (FAO), global meat production reached approximately 360 million metric tons in 2023 by highlighting the steady availability of raw materials for the canned meat industry. Additionally, the World Health Organization (WHO) states that processed meats contribute significantly to global protein intake by reinforcing their role in food security. Innovations in packaging and preservation continue to enhance product quality and appeal.

MARKET DRIVERS

Rising Demand for Convenience Foods

The increasing demand for convenience foods significantly drives the canned meat market. According to the U.S. Department of Agriculture (USDA), the average American spent approximately 37 minutes daily on food preparation and cleanup in 2022 with a preference for time-saving meal options. Canned meats offer a ready-to-eat solution by aligning with the fast-paced lifestyles of modern consumers. Additionally, the USDA reported that in 2021, 58% of U.S. households’ food expenditures were on easy-to-prepare foods by indicating a substantial market for convenient products like canned meats. The demand for canned meat continues to expandwith more consumers seeking quick and high-protein meal solutions with extended shelf life across both developed and emerging markets.

Urbanization and Changing Lifestyles

Urbanization and evolving lifestyles contribute to the growing popularity of canned meat products. The United Nations Department of Economic and Social Affairs (UN DESA) reported that as of 2022, 56.2% of the global population lived in urban areas with projections reaching 60.4% by 2030. Urban dwellers often face time constraints with the increasing consumption of processed and ready-to-eat foods. Additionally, UN DESA noted that urban households allocate a larger portion of their budget to processed foods, including canned meats when compared to rural households. Urban consumers rely more on preserved protein-rich options like canned meat with busy work schedules and limited access to fresh ingredients which is fueling market growth.

MARKET RESTRAINTS

Expansion into Emerging Markets

The rapid urbanization in emerging economies presents a significant opportunity for the canned meat industry. The United Nations Department of Economic and Social Affairs (UN DESA) reported that as of 2022, 56.2% of the global population resided in urban areas, with projections reaching 60.4% by 2030. This urban growth is particularly pronounced in regions like Asia and Africa, where rising middle-class populations are seeking convenient and affordable protein sources. The Food and Agriculture Organization (FAO) notes that meat consumption in developing countries has been steadily increasing, indicating a growing market for canned meat products.

Supply Chain Vulnerabilities

The canned meat industry is susceptible to disruptions in the meat supply chain, which can affect production and availability. The USDA notes that the meatpacking sector is highly concentrated, with the four largest firms handling 85% of all steer and heifer purchases. This concentration can lead to supply bottlenecks, especially during events like pandemics or natural disasters, resulting in decreased production capacity and increased prices. Such supply chain vulnerabilities pose significant challenges to the stability and growth of the canned meat market.

MARKET OPPORTUNITIES

Rising Demand in Food Assistance Programs

Government food assistance programs present a significant opportunity for the canned meat market. The U.S. Department of Agriculture (USDA) frequently issues purchase requests for canned meats to support various nutrition assistance initiatives. For instance, in January 2025, the USDA announced a solicitation for canned meats by indicating ongoing procurement to meet program needs. These consistent purchases not only provide nutritious options to beneficiaries but also offer a stable demand channel for canned meat producers by ensuring a reliable market segment.

Potential in Export Markets

The global demand for convenient and long-shelf-life food products creates opportunities for canned meat exports. The Food and Agriculture Organization (FAO) notes that developing countries' share of world beef exports was projected to reach 48% in the early 2000s, up from 37% in 2003 by highlighting the growing role of these markets in global meat trade. Export-oriented industries, particularly in regions like South America, have capitalized on this trend by suggesting that other producers could similarly benefit by targeting emerging markets with suitable canned meat products.

MARKET CHALLENGES

Market Saturation and Stagnation

In certain regions, the canned meat market has reached a point of saturation, leading to stagnation in growth. For instance, the Hong Kong canned food market experienced robust annual growth rates of 10% to 15% until 1996. However, since then, the market has remained relatively stagnant. This plateau is attributed to market saturation and changing consumer preferences. The demand for canned meat products may have peaked is presenting challenges for further expansion.

Decline in Canned Meat Production Due to Fresh Meat Availability

The availability of fresh, chilled, and frozen meat products has led to a decline in canned meat production in some areas. In Russia, for example, canned meat production decreased by 11% as consumers had greater access to fresh meat options in shops and farmers' markets. This shift in consumer preference towards fresh meat products poses a challenge to the canned meat industry, as it must compete with the appeal of fresh alternatives.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.56% |

|

Segments Covered |

By Product Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Hormel Foods Corporation (U.S.), Conagra Brands, Inc. (U.S.), Tyson Foods, Inc. (U.S.), Berkshire Hathaway (Daisy Brand) (U.S.), Campbell Soup Company (U.S.), Nestlé S.A. (Switzerland), Unilever PLC (U.K./Netherlands), BRF S.A. (Brazil), Marfrig Global Foods S.A. (Brazil), and Cargill, Incorporated (U.S.) |

SEGMENTAL ANALYSIS

By Product Type Insights

The luncheon meat segment was the largest segment in the global market in 2024 and accounted for 35.8% of the global market share. The domination of luncheon segment is primarily driven by its widespread availability, affordability, and versatility in culinary applications. The UK Department for Environment, Food & Rural Affairs highlights that luncheon meat sales exceeded €12 billion in Europe in 2022 with over 60% of households purchasing it regularly. Its long shelf life and convenience make it a staple in emergency food supplies and daily meals alike. Luncheon meat’s prominence underscores its role as a key driver of the canned meat market by ensuring consistent demand across diverse consumer demographics.

The sausage segment is likely to be the most promising segment in the canned meat market over the forecast period and is likely to register a CAGR of 8.5%. The growing preference from consumers for ready-to-eat protein-rich foods among urban populations is one of the key factors propelling the rapid expansion of the sausages segment in the global market. France’s National Institute for Agricultural Research notes that sausage consumption in Europe increased by 20% between 2020 and 2022 which is driven by innovations such as organic and low-sodium variants. Additionally, Italy’s Ministry of Health reports that sausages fortified with probiotics and plant-based ingredients have attracted health-conscious consumers by boosting sales by 25%. The segment’s growth highlights its adaptability to evolving dietary trends and its potential to capture emerging markets by making it a critical focus for manufacturers aiming to diversify their product portfolios.

By Distribution Channel Insights

The supermarkets and hypermarkets segment held the dominating share of 50.9% in the global market in 2024. The widespread presence of supermarkets, extensive product range, and consumer trust in these established retail formats are contributing to the segmental growth. The UK Office for National Statistics highlights that over 70% of canned meat purchases occur in supermarkets and hypermarkets with annual sales exceeding €20 billion in Europe. These outlets benefit from strong supply chain networks and promotional strategies, such as discounts and bundled offers, which drive customer loyalty. Their prominence underscores their critical role in ensuring accessibility and affordability of canned meat products for a broad demographic, making them indispensable to the market.

The online retail segment is projected to grow at a CAGR of 12.44% during the forecast period. This rapid growth is fueled by the increasing penetration of e-commerce platforms and changing consumer shopping behaviors, particularly among younger demographics. France’s National Institute for Statistics and Economic Studies notes that online sales of canned meat grew by 40% between 2020 and 2022 with the convenience and doorstep delivery options. Additionally, Italy’s Ministry of Economic Development reports that subscription-based models and personalized recommendations have increased repeat purchases by 30%. The segment’s expansion highlights its ability to cater to modern lifestyles and its potential to reshape traditional retail dynamics which is positioning it as a key driver of future market growth.

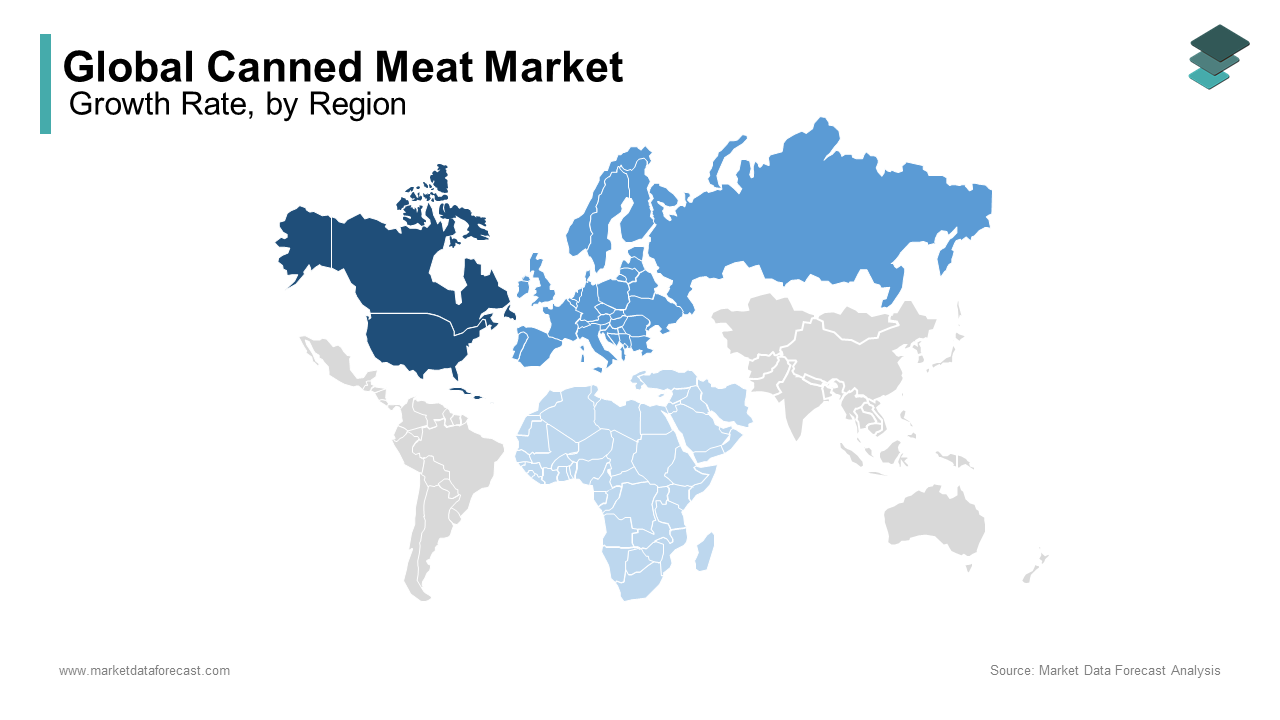

REGIONAL ANALYSIS

North America led the canned meat market in 2024 by holding 35% of the global market share. The United States is the primary driver of this dominance, with a well-established retail infrastructure and strong consumer preference for convenient and shelf-stable protein sources. The region benefits from advanced food processing technologies and stringent safety regulations enforced by agencies like the Food and Drug Administration (FDA) to ensure high-quality products that foster consumer trust. Additionally, North America's robust export capabilities make it a key player in meeting global demand. This leadership underscores its critical role in shaping global supply chains and maintaining stability in the canned meat industry.

The Asia-Pacific region is the fastest-growing regional segment in the global canned meat market and is expected to progress at a CAGR of 6.2% from 2025 to 2033. This rapid growth is fueled by rising urbanization, increasing disposable incomes, and shifting dietary preferences in countries like China and India where convenience foods are gaining traction. A report by the Food and Agriculture Organization (FAO) highlights that growing health awareness has led consumers to seek fortified and nutrient-rich canned meats. Furthermore, the proliferation of e-commerce platforms across the region has significantly improved accessibility to these products which is driving adoption rates. For instance, online grocery sales in Asia-Pacific grew by 25% in 2022 , as reported by McKinsey & Company which further accelerated the market expansion. This trend positions Asia-Pacific as a pivotal hub for innovation, production, and consumption in the global canned meat industry.

Europe represents a mature and stable market for canned beverages, with Germany and the UK leading consumption. Canned beverages account for approximately 40% of total beverage sales in these countries which is driven by the popularity of craft beer, energy drinks, and RTD cocktails. The European Commission highlights that sustainability trends have further boosted demand for recyclable aluminum cans by aligning with the region’s stringent environmental regulations. Western Europe’s focus on premiumization, such as luxury canned wines and organic soft drinks, has also contributed to steady growth. Increasing urbanization and disposable incomes are expected to drive the market growth further in coming years.

Latin America is an emerging market with significant potential, particularly in Brazil and Mexico. Mexico’s strong beer culture is dominated by brands like Corona and Modelo which has also driven demand for canned alcoholic beverages. However, economic volatility and currency fluctuations pose challenges. Despite this, the International Trade Administration notes that growing health awareness and convenience trends will likely sustain steady growth in the coming years.

The canned meat market in Middle East and Africa is still at nascent stage but rapidly evolving markets for canned beverages. South Africa leads the region, with the South African Beverage Association reporting a 15% increase in canned soft drink sales in 2022 which is driven by tourism and outdoor lifestyles. The United Nations Conference on Trade and Development highlights that the UAE’s duty-free zones and luxury events have made it a hub for imported canned beverages. In Sub-Saharan Africa, rising urbanization and youth populations present untapped opportunities. The African Development Bank states that improving distribution networks and affordability will be key to unlocking growth by making these regions critical for long-term expansion.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Major Players of the global canned meat market include Hormel Foods Corporation (U.S.), Conagra Brands, Inc. (U.S.), Tyson Foods, Inc. (U.S.), Berkshire Hathaway (Daisy Brand) (U.S.), Campbell Soup Company (U.S.), Nestlé S.A. (Switzerland), Unilever PLC (U.K./Netherlands), BRF S.A. (Brazil), Marfrig Global Foods S.A. (Brazil), and Cargill, Incorporated (U.S.)

The global canned meat market is highly competitive, characterized by the presence of established multinational corporations and regional players striving to capture market share. Key players such as Hormel Foods, Conagra Brands, and Tyson Foods dominate the industry, leveraging their strong brand recognition, extensive distribution networks, and economies of scale. These companies focus on product innovation, introducing healthier and fortified variants to cater to evolving consumer preferences, while also expanding into emerging markets like Asia-Pacific and Africa to tap into growing demand.

Competition is further intensified by regional brands that offer localized products at competitive prices, particularly in Latin America and the Middle East. For instance, BRF S.A. and Marfrig Global Foods have gained traction in South America by emphasizing affordability and cultural relevance. Additionally, smaller firms are adopting niche strategies, such as organic and plant-based canned meats, to differentiate themselves. The rise of e-commerce has also leveled the playing field, enabling smaller brands to reach global consumers through platforms like Amazon and Alibaba.

To maintain their edge, leading companies are investing in sustainability initiatives, strategic acquisitions, and digital transformation. A report by McKinsey & Company highlights that cost optimization and vertical integration are critical for profitability amid fluctuating raw material prices. Overall, the competitive landscape is shaped by innovation, geographic expansion, and adaptability to consumer trends, ensuring dynamic growth and diversification in the canned meat market.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Product Innovation and Diversification : Leading companies like Hormel Foods and Tyson Foods focus on introducing innovative products to cater to evolving consumer preferences. For instance, Hormel has expanded its SPAM line with low-sodium, gluten-free, and flavored variants to appeal to health-conscious consumers. Similarly, Tyson Foods has introduced plant-based and fortified canned meats to align with trends like veganism and nutrient enrichment.

Expansion into Emerging Markets: Key players are aggressively targeting high-growth regions like Asia-Pacific, Latin America, and Africa . For example, Conagra Brands has invested in localized marketing campaigns and distribution networks to penetrate markets in India and China. The Food and Agriculture Organization (FAO) highlights that emerging markets are critical for long-term growth due to rising urbanization and disposable incomes, making geographic expansion a priority strategy.

Sustainability and Eco-Friendly Practices: Sustainability is a growing focus, with companies adopting eco-friendly packaging and sustainable sourcing practices. Nestlé S.A. and Unilever PLC have committed to reducing plastic use and ensuring ethical sourcing of raw materials. These initiatives not only comply with regulatory standards but also resonate with environmentally conscious consumers, enhancing brand reputation.

Strategic Acquisitions and Partnerships: Mergers and acquisitions are key strategies to consolidate market share. For instance, Tyson Foods acquired smaller regional brands to strengthen its presence in specific markets. Similarly, BRF S.A. partnered with local distributors in Africa to enhance its supply chain efficiency. According to McKinsey & Company, such collaborations enable companies to leverage synergies and expand their product portfolios.

Digital Transformation and E-Commerce: With the rise of online shopping, companies like Hormel and Conagra have invested heavily in e-commerce platforms to improve accessibility. This digital shift ensures wider reach and convenience for consumers.

Brand Marketing and Consumer Engagement: Strong branding and targeted marketing campaigns are vital for maintaining consumer trust. Hormel’s SPAM brand, for example, uses nostalgic advertising and social media engagement to connect with younger audiences. Similarly, Campbell Soup Company leverages storytelling to highlight the nutritional benefits of its canned meat products, reinforcing its market position.

Cost Optimization and Vertical Integration: Companies like Tyson Foods and Marfrig Global Foods employ vertical integration by controlling the entire supply chain from farming to processing so as to reduce costs and ensure consistent quality. This strategy enhances profitability and strengthens resilience against market fluctuations, as noted by the U.S. Department of Agriculture (USDA).

TOP 3 PLAYERS IN THE MARKET

Hormel Foods Corporation (U.S.)

Hormel Foods is a global leader in the canned meat market, primarily due to its iconic SPAM brand, which has become synonymous with canned meat worldwide. The company holds a significant share of the global market with SPAM products available in over 40 countries and generating annual revenues exceeding $1 billion from its branded portfolio. Hormel’s success stems from its focus on quality, shelf-stable protein products that cater to diverse consumer preferences. Hormel’s innovation in product offerings, such as low-sodium and flavored variants, has helped it maintain leadership. Additionally, its strong distribution network and marketing strategies have solidified its dominance in North America and Asia-Pacific.

Conagra Brands, Inc. (U.S.)

Conagra Brands is another major player, known for its Armour and Libby’s brands, which are staples in the canned meat industry. Conagra leverages its expertise in processed foods to meet consumer demand for convenient, affordable protein sources. Its commitment to sustainability and cost-effective production has strengthened its position. Furthermore, Conagra’s focus on expanding its presence in emerging markets, particularly in Asia and Latin America, highlights its strategic growth initiatives.

Tyson Foods, Inc. (U.S.)

Tyson Foods is a powerhouse in the global protein market, including canned meats, with a diversified portfolio that includes brands like Hillshire Farm and Jimmy Dean . Tyson’s annual revenue exceeds $40 billion with a substantial portion derived from its processed meat segment. The company’s vertical integration from poultry farming to processing ensures consistent quality and cost efficiency. Tyson’s emphasis on innovation, such as introducing plant-based and fortified canned meat options, aligns with evolving consumer trends. Additionally, its robust export capabilities have enabled it to penetrate international markets, particularly in Europe and Asia-Pacific, further solidifying its global influence.

RECENT HAPPENINGS IN THE MARKET

- In January 2023, Hormel Foods Corporation launched SPAM Plant-Based products. This launch is anticipated to allow Hormel to expand its portfolio and cater to vegan and flexitarian consumers, strengthening its market presence.

- In March 2022, Tyson Foods, Inc. acquired a minority stake in The Better Meat Co., a plant-based protein company. This acquisition is anticipated to allow Tyson to diversify its offerings and establish a foothold in the alternative protein space, enhancing its innovation capabilities.

- In November 2022, Conagra Brands, Inc. partnered with Amazon for exclusive online promotions of Armour canned meats. This partnership is anticipated to allow Conagra to boost accessibility and reach tech-savvy consumers, reinforcing its digital strategy.

- In June 2023, Nestlé S.A. introduced eco-friendly recyclable packaging for its canned meat products. This initiative is anticipated to allow Nestlé to address environmental concerns and enhance its brand reputation as a sustainability-focused company.

- In August 2022, Unilever PLC expanded canned meat distribution in Africa through partnerships with local retailers. This expansion is anticipated to allow Unilever to increase its footprint in underserved markets and strengthen its commitment to addressing food security challenges.

- In February 2023, BRF S.A. launched affordable canned chicken products in Brazil and Southeast Asia. This launch is anticipated to allow BRF to capture price-sensitive consumers and solidify its position as a provider of accessible protein solutions.

- In July 2022, Marfrig Global Foods S.A. invested $50 million in automation for canned meat production facilities. This investment is anticipated to allow Marfrig to improve operational efficiency, reduce costs, and ensure consistent product quality.

- In September 2022, Campbell Soup Company relaunched Swanson canned meats with low-sodium options. This relaunch is anticipated to allow Campbell to target health-conscious consumers and reinforce its focus on nutritious meal solutions.

- In April 2023, Cargill, Incorporated signed a supply chain agreement with African distributors for fortified canned meats. This agreement is anticipated to allow Cargill to address nutritional needs in underserved regions while expanding its regional presence.

- In December 2022, Berkshire Hathaway (Daisy Brand) acquired a regional canned meat brand in Europe. This acquisition is anticipated to allow Berkshire Hathaway to diversify its product offerings and strengthen Daisy Brand’s market position in Europe.

MARKET SEGMENTATION

This research report on the global canned meat market has been segmented and sub-segmented based on product type, distribution channel, and region.

By Product Type

- Luncheon Meat

- Ham

- Sausage

- Bacon

- Corned beef

- Others

By Distribution Channel

- Supermarket/hypermarkets

- Specialty Stores

- Online Retail

- Others

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. Which factors are driving the growth of the canned meat market?

The market is driven by increasing demand for convenience foods, longer shelf life of canned products, rising urbanization, and growing military and emergency food supplies.

2. What are the key trends in the canned meat market?

Trends include rising consumer preference for ready-to-eat meals, increasing demand for organic and preservative-free canned meat, advancements in food processing technology, and expansion of distribution channels (e-commerce, supermarkets, etc.).

3. How is the global canned meat market expected to grow in the coming years?

The market is projected to grow due to increasing disposable income, expanding retail networks, growing fast-food culture, and rising consumption in emerging economies.

4. Who are the major players in the canned meat industry?

Leading companies include Hormel Foods Corporation, Conagra Brands, Campbell Soup Company, JBS S.A., and Danish Crown, among others.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]