Global Cannabis Testing Market Size, Share, Trends, COVID-19 impact & Growth Forecast Report – Segmented By Product & Software, Testing Procedures (Terpene Profiling, Potency Testing, Residual Solvent Screening, Pesticide Screening, Genetic Testing, Heavy Metal Testing and Microbial Analysis), End Users & Region - Industry Forecast from 2024 to 2032

Global Cannabis Testing Market Size

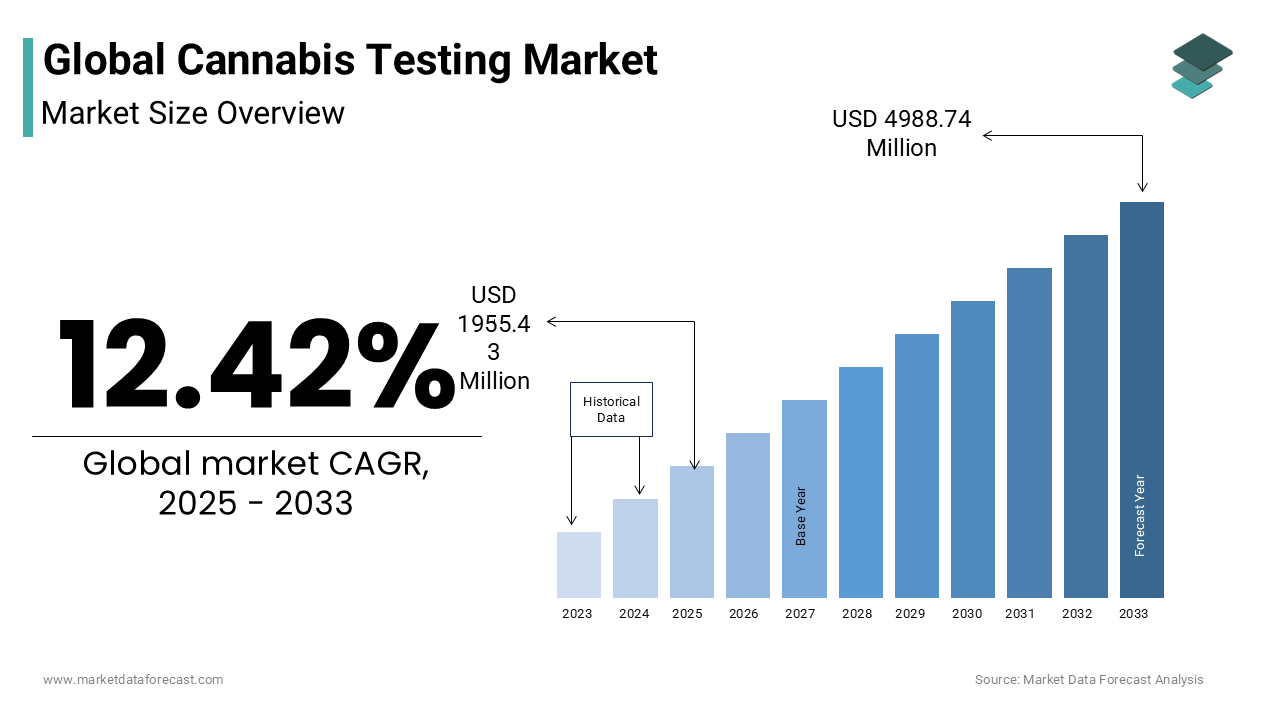

The global cannabis testing market size was valued at USD 1739.40 million in 2024. During the forecast period, the cannabis testing market is forecasted to hike at a CAGR of 12.42%. This market was worth USD 1955.43 million in 2025 and is estimated to grow by USD 4988.74 million by 2033.

Current Scenario of the cannabis testing market

The global cannabis testing market has accounted for considerable growth in the past years and is anticipated to have notable growth during the forecast period. Unlike alcohol, cannabis cannot have valid detection in a shorter period. Cannabis use can be highly detectable through urinalysis, saliva tests, and hair analysis. The Duquenois-Levine test is the most commonly used screening test, but it also definitely does not provide confirmation regarding the presence of cannabis. The shortage of suitable tests for the intoxication levels of cannabis is a significant concern, especially regarding intoxicated driving. In urine testing, marijuana use can be detected within 3 to 5 days after exposure for infrequent users, about 1 to 15 days for heavy users, and 1 to 30 days for chronic users. This more extended period for the confirmation of the cannabis presence is enhancing the investments in research activities to develop innovative methods for testing, which contributes to the global market growth.

MARKET DRIVERS

The growing legalization of cannabis and increasing support from the governments of various countries for cannabis are propelling the global cannabis testing market growth.

The increase in the medicinal use of cannabis would stimulate the medical cannabis market, having a favorable effect on the development of the cannabis testing market. Growing drug usage for medicinal reasons has contributed to the legalization of cannabis in different countries worldwide. Legal cannabis is beneficial in numerous medical uses, such as decreasing chemotherapy-related nausea, stimulating appetite in AIDS patients, managing muscle spasms in multiple sclerosis patients, and reducing intraocular pressure in patients with glaucoma. Owing to its medicinal effects, policymakers have legalized the use of medical cannabis in different countries.

The growing support from the governments of several countries to conduct cannabis testing further promotes the cannabis testing market growth.

The trend of appropriation of the cannabis test measure is expanding. A few government departments are conducting laboratory studies on cannabis products needed to support the growth of the cannabis industry. Regulatory bodies have started restricting residual solvents, bug sprays, contaminants, heavy metals, microorganisms, and mycotoxins for plant testing. It also led to numerous new laboratories, mainly where growth is high.

Rising awareness and adoption of LIMS in labs testing cannabis is anticipated to boost the cannabis testing market.

Among various testing methods, cannabis usage by taking urine samples can be detected up to 2-5 days after exposure in infrequent users and up to 15 days in heavy users. Through saliva testing, usage can be detected in a short time window of only three days, but the advantage is that it can detect compounds with concentrations of less than 0.5 ng/mL. Though blood testing is not frequently used as the procedure is invasive, it can detect usage within 12-24 hours in infrequent users and seven days in heavy users. Finally, hair testing has the special feature of detecting use even after 90 days of exposure and can detect concentrations as low as one pg/mg of sample.

Furthermore, increasing economies of developing countries in APAC and the Middle East region is expected to increase opportunities for the stakeholders in these regions. In addition, the need for more testing laboratories to meet the demand of growing cannabis producers worldwide will likely create opportunities for the cannabis testing market during the forecast period. Strict federal guidelines for safety testing must be met by prescription distributors before opioid use and expand understanding of cannabis through promotions, seminars, and workshops. Increased discovery and production of a potential therapeutic medication for chronic disorders by major healthcare companies and increased use of cannabis in leisure and personal use further expand the worldwide demand for cannabis testing.

The emerging countries are expected to provide notable growth potential to the cannabis testing industry. The growing legalization of cannabis, medical acceptance, change in societal shifts among the people, and the supportive regulatory framework across the countries are boosting the market growth opportunities of cannabis testing. Most of these countries are producing their own cannabis, which is enhancing the demand for cannabis testing facilities, which ensures quality, safety, and compliance with international standards, which is contributing to the global cannabis testing market expansion. The escalation in establishing several cannabis testing laboratories positively influences market growth.

MARKET RESTRAINTS

Factors such as the high cost of analytical instruments, lack of specialized laboratories, and high start-up costs for cannabis testing laboratories hamper the growth of the cannabis testing market. In addition, the lack of industry standards for cannabis testing and the high cost of installing a cannabis test facility restrict the market’s growth rate. Furthermore, the lack of trained experts in cannabis testing is one of the main issues facing the industry for cannabis testing. If the legal cannabis industry expands, the demand for laboratory-tested cannabis will also increase. However, the initial cost to set up cannabis testing labs and the cost of the cannabis testing instruments are very high. In addition, the basic criteria to be met require the testing instrument, inventory control, quality control, trained employees, data management, and administrative functions to set up a research facility. Also, the lack of uniform test requirements would further impede the future demand for cannabis testing. Moreover, new entrants are investing in the cannabis testing industries due to favorable government funding, shortage of providers and manufacturers in developing markets, and attractive growth prospects for the cannabis testing market in the coming years.

The lack of standardized protocols from various regional authorities for the approval and testing of various cannabis products regarding the safety of human consumption will act as a significant challenge for the market expansion. The requirement of different testing procedures for products infused with cannabis, such as candles, edibles, transdermal patches, and e-liquids, results in inconsistent testing results regarding product quality. The growing costs of the novel equipment for cannabis testing limit the market growth due to the presence of restricted market growth. The increasing legalization of cannabis products across various countries may inhibit the adoption of cannabis testing, which reduces the growth potential of the cannabis testing labs.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

Segments Covered |

By Testing Procedures, End User, Product & Software, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Agilent Technologies, Inc., Shimadzu Corporation, Waters Corporation, PerkinElmer, Inc., AB SCIEX LLC, Millipore Sigma, Restek Corporation, LabLynx, Inc. (U.S.), Steep Hill Labs, Inc., PharmLabs, LLC, SC Laboratories, Inc. |

SEGMENTAL ANALYSIS

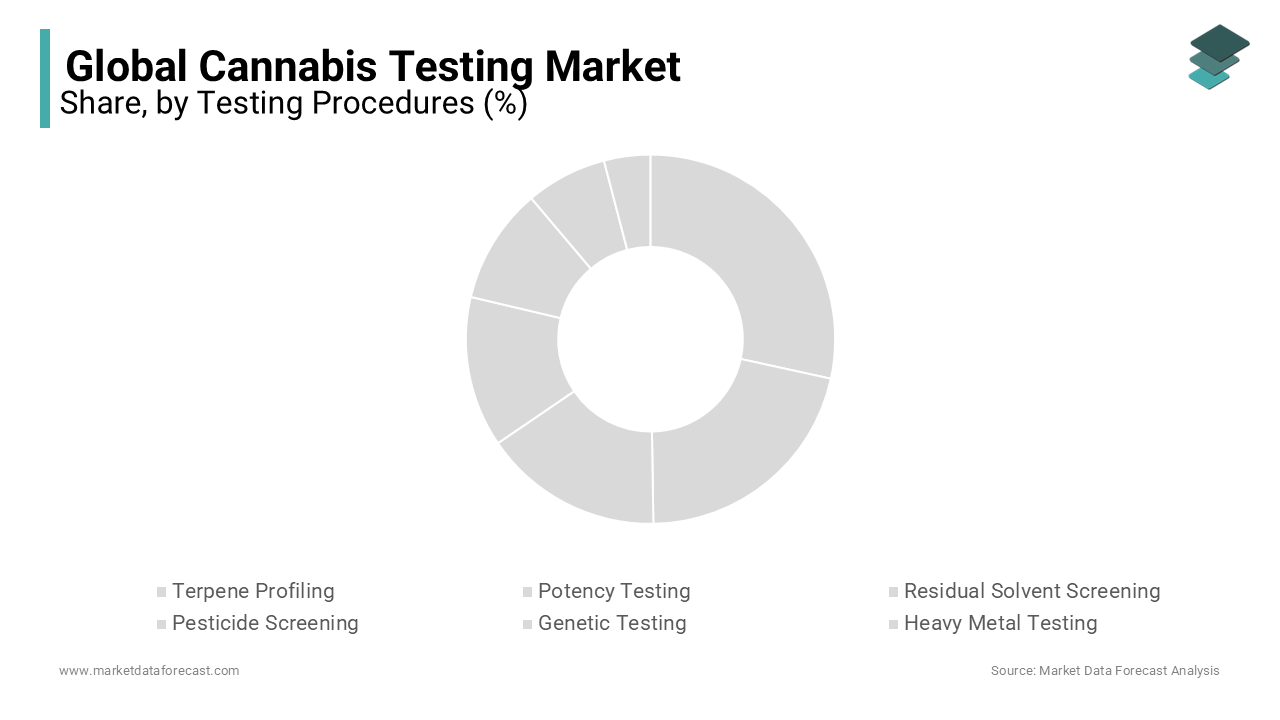

Global Cannabis Testing Market By Testing Procedures

Based on the testing procedure, in 2023, the potency testing segment accounted for the largest share and is predicted to grow at a CAGR of 21.7% during the forecast period owing to the presence of contributing factors such as a rise in the usage of effective potency testing techniques like GC (Gas Chromatography) and HPLC (High-performance Liquid Chromatography) to test samples, growth in demand to examine the potency of various cannabinoids especially CBD (Cannabidiol), and THC (Tetrahydrocannabinol) in the cultivation of cannabis.

Global Cannabis Testing Market By End-User

Based on end-users, the cannabis laboratories segment accounts for the largest market share due to the rising demand for cannabis testing software in labs. Furthermore, it is expected to grow rapidly during the forecast period due to the escalation of legalization procedures to use cannabis worldwide for medical and recreational purposes. In addition, various authorities' stringent regulations to ensure superior quality cannabis products and patient safety are increasing cannabis testing lab activities, eventually resulting in the growth of the cannabis testing market during the forecast period.

The cannabis cultivators segment is expected to showcase promising growth during the forecast period and is predicted to register a CAGR of 60% from 2024 to 2029. This segment is strongly driven by factors such as the rise in research activities and growth in the numerous research centers and laboratories by government and private in numerous countries by imposing strict rules and regulations on the THC content of cannabis products.

REGIONAL ANALYSIS

During the forecast period, the cannabis drug manufacturers segment is forecasted to exhibit a healthy CAGR due to the rise in acceptance rate and numerous clinical trial centers by prominent key players such as Solvay Pharmaceutical, Sanofi, and Pfizer.

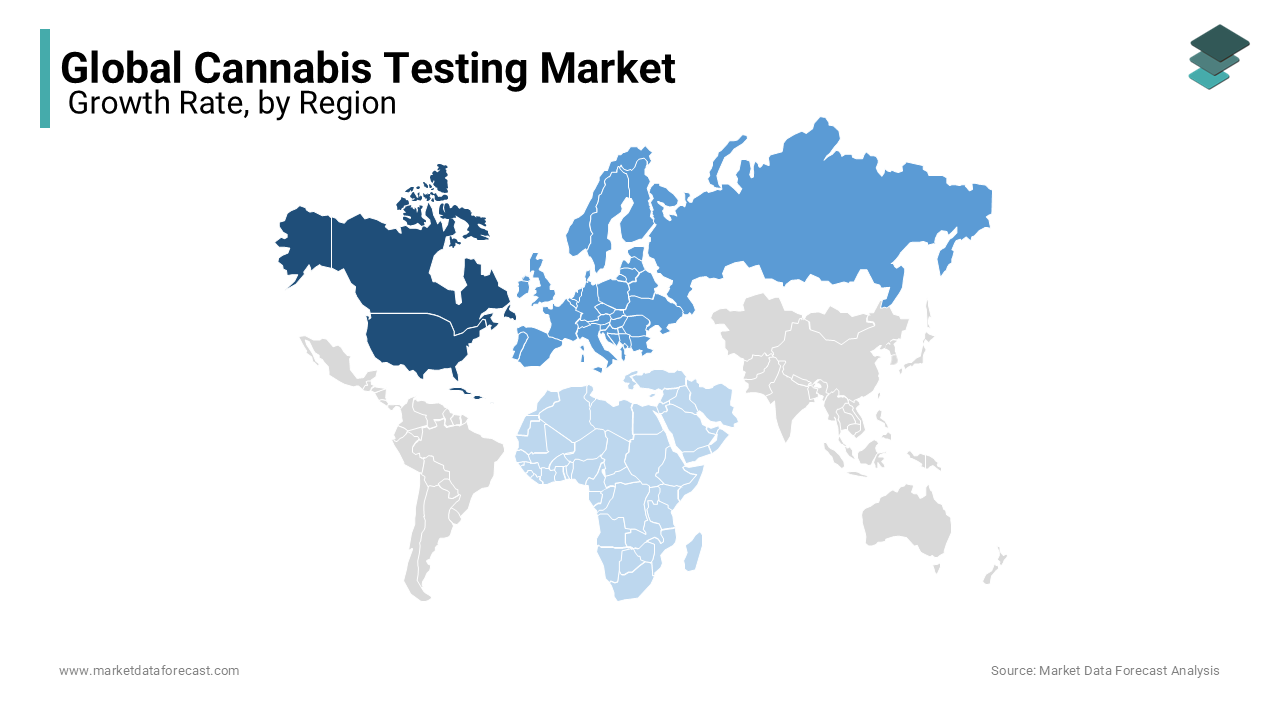

Geographically, the North American cannabis testing market had the largest share globally in 2023, accounting for around 34%, and is also the fastest-growing market. The North American market is majorly supported by the increase in the number of testing laboratories, the government's growth of guidelines for cultivators of marijuana, and the presence of many cultivators.

The European cannabis testing market is predicted to register a substantial share in the global market during the forecast period. The increasing legalization of cannabis in major European countries and the increasing use of the herb in drug production and research were expected to fuel the demand for cannabis testing services.

The Asia-Pacific cannabis testing market is expected to witness the highest growth rate during the forecast period. Growing awareness about drug testing and price reduction are these countries' major driving factors. In addition, factors such as the increasing biopharmaceutical sector, rising life science research, rising investments by pharmaceutical and biotechnology firms, the growing number of cannabis testing labs in the country, and the legalization of cannabis for medicinal use are projected to push the industry further. Also, high population countries like China and India, a spike in the number of incidents involving cannabis intoxication and acceptance of developments from western regions regarding medicinal and recreational cannabis usage powered the Asia Pacific market.

The Latin American cannabis testing market is expected to capture a considerable share of the worldwide market in the coming years.

The cannabis testing market in MEA is predicted to register a moderate CAGR during the forecast period.

KEY PLAYERS IN THE GLOBAL CANNABIS TESTING MARKET

Some of the notable participants leading the global cannabis testing market profiled in this report are Agilent Technologies, Inc., Shimadzu Corporation, Waters Corporation, PerkinElmer, Inc., AB SCIEX LLC, Millipore Sigma, Restek Corporation, LabLynx, Inc. (U.S.), Steep Hill Labs, Inc., PharmLabs, LLC, SC Laboratories, Inc., Digipath Labs, Inc., CannaSafe Analytics, Accelerated Technology Laboratories, Inc.

These business leaders have adopted different tactics, such as mergers and acquisitions, to secure a better position in the cannabis testing market.

RECENT MARKET DEVELOPMENTS

- In August 2024, the National Institute of Standards and Technology researchers are considering a new approach of two breath tests administered roughly within an hour. If the research gets a positive result, then this test becomes the first-ever roadside test for cannabis use, which involves two breath tests given at specific intervals.

- In January 2024, the Ontario Cannabis store announced the introduction of a THC testing program. The program involves the provincial cannabis wholesaler, which chooses cultivars with high THC content, which arrive at its warehouse for secondary testing.

- In October 2023, Nova Analytic Labs (Nova) collaborated with Certified Testing and Data (CTND) and launched a cannabis testing method in New York City.

- In April 2023, the California Department of Cannabis Control (DCC) announced the USD 20 million issue for around 16 academic institutions for research to evaluate the complete impact of cannabis.

- In January 2021, MCR Labs, a Massachusetts-based cannabis testing firm, opened a laboratory in Allentown and started to approve and analyze product samples for medical marijuana licensees.

- In January 2019, Digipath, Inc. announced an agreement with Cannabis, Inc. to increase its market share in cannabis testing and strengthen its position in the domestic and international cannabis testing market.

DETAILED SEGMENTATION OF THE GLOBAL CANNABIS TESTING MARKET INCLUDED IN THIS REPORT

This research report on the global cannabis testing market has been segmented and sub-segmented testing procedures, end-users, products & software, and regions.

By Testing Procedures

- Terpene Profiling

- Potency Testing

- Residual Solvent Screening

- Pesticide Screening

- Genetic Testing

- Heavy Metal Testing

- Microbial Analysis

By End-user

- Cannabis Cultivators

- Laboratories

- Drug Manufacturers & Dispensaries

- Research Institutes

By Product & Software

- Analytical Instruments

- Consumables and Software

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What was the market size of cannabis testing in 2023?

The global cannabis testing market size was worth USD 1539.3 million in 2023.

At what CAGR, the Europe region is growing in the global cannabis testing market?

The cannabis testing market in Europe is projected to showcase a CAGR of 12.1% from 2024 to 2032.

Which segment by testing procedure held the largest share in the cannabis testing market?

Agilent Technologies, Inc., Shimadzu Corporation, Waters Corporation, PerkinElmer, Inc., AB SCIEX LLC, Millipore Sigma, Restek Corporation, LabLynx, Inc. (U.S.), Steep Hill Labs, Inc., PharmLabs, LLC, SC Laboratories, Inc., Digipath Labs, Inc., CannaSafe Analytics, Accelerated Technology Laboratories, Inc. are a few of the major players in the cannabis testing market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]