Global Candle Market Size, Share, Trends & Growth Forecast Report - Segmented By Product Type (Pillars, Votive, Tapers and Container Candle), Wax Type, Distribution Channel, and Region (North America, Europe, APAC, Latin America, Middle East and Africa) - Industry Analysis (2025 to 2033)

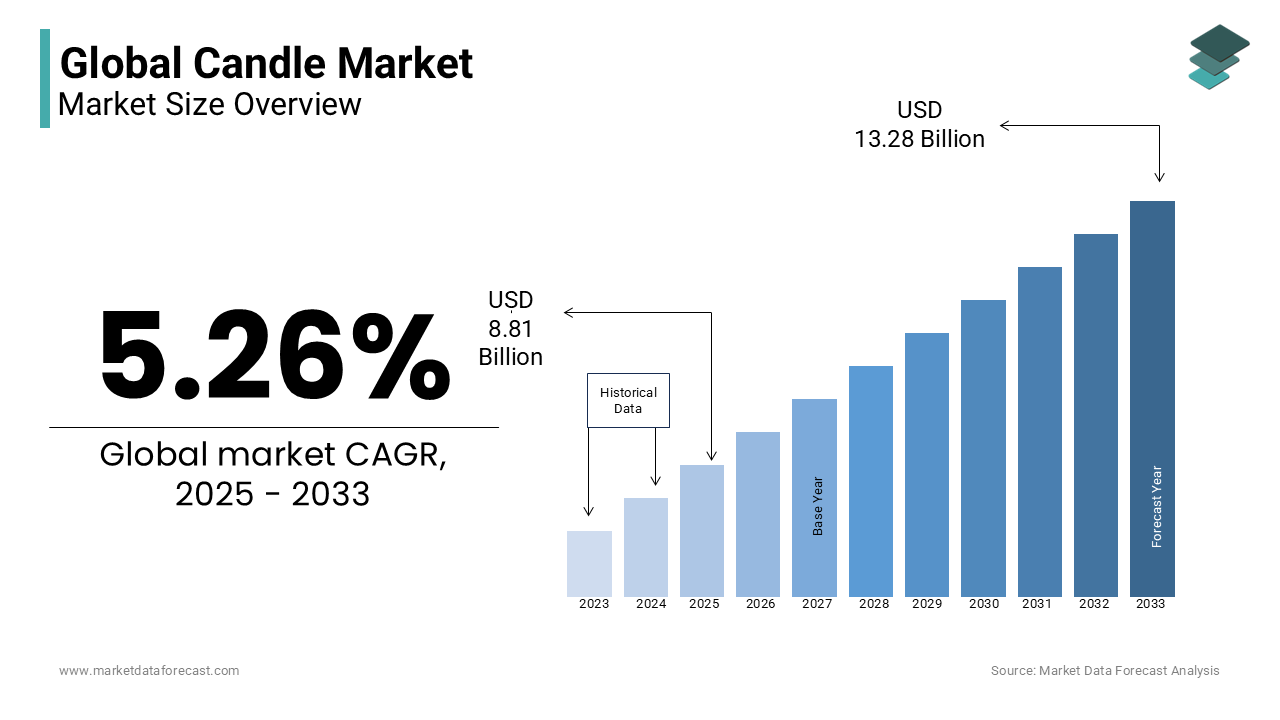

Global Candle Market Size (2025 to 2033)

The Global Candle market was valued at USD 8.37 billion in 2024. The global market size is expected to grow at a CAGR of 5.26% from 2025 to 2033 and be worth USD 13.28 billion by 2033 from USD 8.81 billion in 2025.

The candle market has transitioned from being a mere source of illumination to a lifestyle and wellness essential, widely used for ambiance, aromatherapy, and religious or cultural purposes. Candles are integral to various traditions with an estimated 70% of households in the United States using them for home décor and relaxation, according to the National Candle Association. The demand for scented candles has surged with fragrances like lavender and vanilla being the most preferred due to their stress-relieving properties.

The rise in self-care routines has further driven candle consumption with over 60% of consumers associating scented candles with mental well-being and stress reduction, as per a survey by the American Psychological Association. Additionally, candle usage peaks during the winter months and festive seasons, with Christmas and Diwali witnessing some of the highest sales globally. The increasing use of sustainable and natural waxes, such as soy and beeswax is also shaping consumer preferences toward eco-friendly options.

MARKET DRIVERS

Rising Consumer Demand for Home Ambiance and Aromatherapy

The candle market is experiencing significant growth due to consumers' increasing focus on enhancing home ambiance and engaging in aromatherapy practices. According to the U.S. Bureau of Economic Analysis, personal consumption expenditures (PCE) on household goods have seen a consistent rise by indicating a growing investment in home-related products. In 2023, PCE increased by 6.4% nationally with housing and utilities being significant contributors to this growth. This trend reflects consumers' desire to create comfortable and aesthetically pleasing living environments. The National Candle Association reports that approximately 35% of candle sales occur during the holiday season by highlighting the importance of ambiance in consumer purchasing decisions. Additionally, the U.S. Environmental Protection Agency notes a growing awareness among consumers regarding indoor air quality by leading to a demand for candles made from natural waxes such as soy and beeswax which emit fewer pollutants compared to traditional paraffin candles. This emphasis on creating a pleasant home environment has led to a surge in demand for candles with those infused with essential oils known for their therapeutic benefits.

Increasing Preference for Natural and Eco-Friendly Products

Consumers are increasingly favoring natural and eco-friendly products which is a trend that significantly impacts the candle market. The U.S. Department of Agriculture's Economic Research Service reported that organic retail sales exceeded $52 billion in 2021 which is accounting for about 5.5% of all retail food sales. This rise in organic consumption reflects a broader shift towards sustainable and environmentally friendly products. In the candle industry, this translates to a growing demand for candles made from natural waxes such as soy and beeswax which are perceived as healthier and more sustainable alternatives to traditional paraffin wax. The U.S. Environmental Protection Agency has highlighted concerns regarding indoor air quality which is leading consumers to seek products that minimize indoor pollution. Natural candles emit fewer volatile organic compounds which align with this consumer preference for eco-friendly and health-conscious products. This shift towards natural and sustainable goods is driving innovation in the candle market with manufacturers developing products that cater to eco-conscious consumers.

MARKET RESTRAINTS

Safety Concerns Associated with Candle Usage

The candle market faces significant challenges due to safety concerns. According to the National Fire Protection Association (NFPA), candles were responsible for an annual average of 7,400 home fires between 2015 and 2019, resulting in 90 deaths, 670 injuries, and approximately $291 million in direct property damage. Notably, December is the peak month for candle-related fires with Christmas Day experiencing a 2.5 times higher incidence than the daily average. These statistics underscore the potential hazards associated with candle use by leading to increased regulatory scrutiny and consumer hesitancy which can restrain market growth.

Fluctuations in Raw Material Costs

The candle industry is also impacted by fluctuations in raw material costs such as paraffin wax which is derived from petroleum. The U.S. Energy Information Administration (EIA) reports that paraffin wax is a byproduct of petroleum refining which is making its price susceptible to crude oil market volatility. For instance, significant changes in capital expenditures and market dynamics were observed during the oil price collapse of 2014 which affected the supply chain of petroleum-derived products. Additionally, the U.S. Department of Agriculture (USDA) notes that the supply and pricing of alternative natural waxes such as soy and beeswax can be influenced by agricultural factors. These fluctuations can lead to inconsistent pricing and supply challenges by impacting manufacturers' ability to maintain stable pricing for consumers.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

The candle industry has significant growth potential in emerging markets where rising disposable incomes and urbanization are driving demand for lifestyle products. According to the U.S. International Trade Commission, U.S. exports of candles have seen an upward trend is indicating increasing international demand. The U.S. Census Bureau reports that emerging economies are experiencing rapid urbanization which is leading to a growing middle class with increased purchasing power. This demographic shift presents an opportunity for candle manufacturers to introduce their products to new consumer bases seeking home décor and aromatherapy items.

Product Diversification and Innovation

Innovating and diversifying product lines offer substantial opportunities within the candle market. The U.S. Patent and Trademark Office has noted an increase in patents filed for novel candle designs and formulations by reflecting a trend towards unique and multifunctional products. For instance, the development of candles with embedded essential oils caters to the growing consumer interest in wellness and aromatherapy. Additionally, the U.S. Department of Agriculture highlights a rise in the production of organic agricultural products, providing opportunities for candles made from organic soy or beeswax. Companies can meet consumer demand for innovative and eco-friendly products with these trends that is augmented to expand the growth rate of the market.

MARKET CHALLENGES

Environmental Concerns Related to Candle Emissions

The candle industry faces challenges due to environmental concerns associated with emissions from certain types of candles. The U.S. Environmental Protection Agency (EPA) has identified that some candles, particularly those made from paraffin wax, can release volatile organic compounds (VOCs) and particulate matter when burned. These emissions contribute to indoor air pollution which is potentially affecting respiratory health. The EPA's studies on indoor air quality have highlighted the need for consumers to be aware of the types of candles they use and the potential pollutants emitted. This growing awareness has led to increased scrutiny of candle compositions and has prompted consumers to seek out cleaner-burning alternatives is posing a challenge for manufacturers relying on traditional materials.

Competition from Alternative Home Fragrance Products

The candle market is also challenged by the rising popularity of alternative home fragrance products, such as essential oil diffusers and air fresheners. According to the U.S. Bureau of Labor Statistics (BLS), consumer spending on household supplies which includes air fresheners and similar products has seen a notable increase. This trend indicates a shift in consumer preferences towards flameless and potentially safer options for home fragrance. The convenience and perceived health benefits of these alternatives are attracting consumers which is thereby intensifying competition and posing a challenge to traditional candle sales.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.26% |

|

Segments Covered |

By Product Type, Wax Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

|

Market Leaders Profiled |

Yankee Candles, Thymes, White Barn Candles, Jo Malone, Village Candles, NEST, Slatkin & Co., Malin + Goetz, Colonial Candle and Diptyque |

SEGMENTAL ANALYSIS

By Product Type Insights

The container candles segment held the leading position in the global candles market by capturing 40.8% of the global market share in 2024. The versatility, safety, and aesthetic appeal by making them ideal for home decor and aromatherapy is one of the major factors propelling the expansion of the container candles segment in the global market. The National Candle Association highlights that container candles account for over 50% of candle sales in the U.S. due to their long burn time and ease of use. Additionally, the Environmental Protection Agency notes that container candles are preferred for their reduced risk of fire hazards compared to other types. This makes container candles the leading product in the market by catering to both functional and decorative needs.

The pillar candles segment is on the rise and is estimated to register the fastest CAGR of 6.5% from 2025 to 2033 owing to their durability, long burn time, and increasing use in events and home decor. The U.S. Department of Commerce states that pillar candle sales have risen by 12% annually which is fueled by their popularity in weddings and festive occasions. Additionally, the World Health Organization emphasizes the use of pillar candles in relaxation and meditation practices by boosting their demand. These factors highlight the importance of pillar candles in driving the market growth and meeting diverse consumer preferences.

By Wax Type Insights

The paraffin wax segment held the largest share 30% of the global market in 2024. This dominance is primarily due to the affordability and widespread availability of paraffin wax with a cost-effective choice for both manufacturers and consumers. The National Candle Association notes that more than 1 billion pounds of wax are used annually in U.S. candle production with paraffin being a significant component. Its versatility allows for a variety of candle types and fragrances is catering to diverse consumer preferences.

The soy wax candles segment is estimated to do well over the forecast period by witnessing a CAGR of 7.5% from 2025 to 2033. This growth is driven by increasing consumer demand for natural and eco-friendly products. The U.S. Department of Agriculture reports a rise in soybean production by supporting the availability of soy wax. Soy wax is biodegradable and burns cleaner than paraffin by emitting fewer pollutants which appeals to environmentally conscious consumers. Additionally, soy wax's ability to hold fragrance well enhances its appeal in the scented candle market.

By Distribution Channel Insights

The offline distribution channel led the market by capturing a global market share of 65.6% in 2024. The National Retail Federation reports that over 70% of consumers prefer purchasing candles in-store to assess fragrance and quality before buying. Additionally, the U.S. Department of Commerce highlights that offline channels benefit from impulse purchases and immediate product availability by making them a preferred choice for consumers. This dominance underscores the importance of physical retail in the candle market.

The online distribution channel is the fastest-growing segment and is predicted to showcase a CAGR of 8.2% from 2025 to 2033. This growth is driven by the convenience, wider product selection, and competitive pricing offered by e-commerce platforms. The U.S. Department of Commerce states that online candle sales have increased by 15% annually which is fueled by the rise of digital shopping and home delivery services. Additionally, the World Economic Forum highlights that the COVID-19 pandemic accelerated the shift to online shopping with consumers prioritizing safety and convenience. These factors underscore the importance of online channels in shaping the future of the candle market.

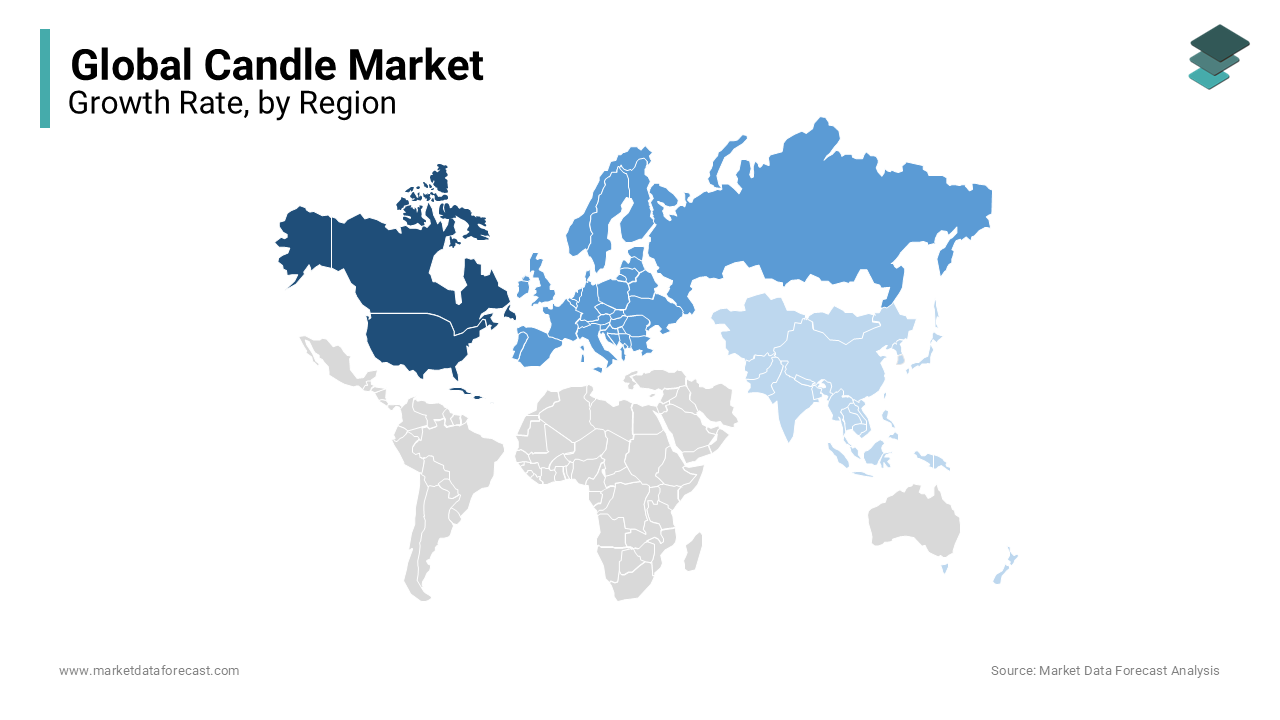

REGIONAL ANALYSIS

In 2024, North America led the global candle market by accounting for approximately 32% of the total market share. This dominance is attributed to high consumer spending on home décor and wellness products. According to the U.S. Census Bureau, spending on home furnishings and household equipment increased by 7.2% from 2022 to 2023 by reflecting a growing interest in creating aesthetically pleasing living spaces. The region's robust e-commerce infrastructure further facilitates easy access to a wide variety of candle products by enhancing market growth.

The Asia-Pacific region is projected to experience the fastest growth in the candle market with a Compound Annual Growth Rate (CAGR) of 8.5% from 2025 to 2033. This rapid expansion of the market in this region is driven by a rising millennial population and increased consumer spending. Key players are expanding into new locations and diversifying product portfolios to spread awareness regarding the brand and the usage of candles. For instance, in January 2022, Diptyque launched a candle collection in China with unique fragrances to cater to the growing demand for luxury home décor items. The region's changing consumer preferences towards fashion and home decor also contribute to this growth.

In Europe, candles have deep cultural roots and are often associated with warmth, coziness, and tradition. The concept of hygge is originated from Scandinavian culture which creates a warm and inviting atmosphere with candles playing a central role. This cultural association has made candles a staple in many European households where they are used to create ambiance during long winters and to enhance intimate gatherings.

Latin America and the Middle East & Africa regions are also expected to witness growth in the coming years. In Latin America, increasing urbanization and a growing middle-class population are driving demand for home décor products. The Middle East & Africa region is experiencing a rise in tourism and hospitality sectors, leading to increased use of candles in hotels, restaurants, and spas to create a luxurious ambiance.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Yankee Candle, Price's Candles, Gies Kerzen, Bolsius, Liljeholmens Stearinfabriks AB, Cathedral Candle Company, Voluspa, P.F. Candle Company, Alene Candles, Paramold Manufacturing are some of the major players in the global candles market.

The global candle market is highly competitive, driven by a mix of established brands, private label manufacturers, and emerging artisanal players. The market is characterized by product innovation, brand differentiation, and a growing focus on sustainability, with companies competing on fragrance variety, packaging, and eco-friendly materials.

Major players such as Yankee Candle (Newell Brands), SC Johnson (Glade), and Bolsius dominate the market through strong distribution networks and brand loyalty. Private label brands, including store-branded candles from retailers like Walmart and Target, have also gained significant traction, offering affordable alternatives to premium brands.

The luxury and artisanal segment is growing, with brands like Diptyque, Voluspa, and Jo Malone catering to consumers seeking premium, hand-poured, and exotic fragrance candles. Meanwhile, sustainability and wellness trends are intensifying competition, with brands increasingly shifting toward soy, beeswax, and coconut wax candles to attract eco-conscious consumers.

E-commerce and social media marketing have further increased competition, enabling smaller brands to reach global audiences. As demand for home décor and aromatherapy candles rises, companies must continuously innovate to maintain market share and brand relevance.

STRATEGIES USED BY THE MARKET PLAYERS

Product Innovation & Premium Offerings

Leading companies like Yankee Candle (Newell Brands) and SC Johnson (Glade) continually introduce new fragrances, seasonal collections, and premium candle designs to cater to evolving consumer preferences. Luxury brands such as Diptyque and Jo Malone focus on high-end, artisanal candles with sophisticated fragrance blends, appealing to niche markets. Additionally, the rising demand for wellness and aromatherapy products has led to the development of essential oil-infused candles, which are marketed for their relaxation and therapeutic benefits.

Sustainability & Eco-Friendly Practices

With increasing consumer awareness about environmental impact, major players are prioritizing sustainability. Companies like Bolsius and P.F. Candle Co. have shifted towards natural wax alternatives, including soy, beeswax, and coconut wax, to reduce reliance on paraffin-based candles. Many brands are also incorporating biodegradable packaging and recyclable materials, making their products more eco-friendly. Additionally, manufacturers such as Alene Candles are investing in carbon-neutral production processes and ethical sourcing, further reinforcing their commitment to sustainability.

E-Commerce & Digital Marketing Expansion

The rise of e-commerce has transformed the candle market, allowing brands to reach a global audience. Many companies have adopted Direct-to-Consumer (DTC) models, leveraging their websites and third-party platforms like Amazon, Walmart, and Etsy to drive sales. Subscription-based services have also gained traction, providing customers with curated candle collections tailored to seasonal trends. Furthermore, social media marketing and influencer collaborations have become key tactics, with brands investing in visually appealing content, interactive campaigns, and celebrity endorsements to enhance customer engagement.

Mergers, Acquisitions, & Partnerships

Strategic mergers and acquisitions have helped market leaders expand their dominance. Newell Brands’ acquisition of Yankee Candle strengthened its position as a market leader in the scented candle segment. Many luxury brands, such as Diptyque, have also engaged in exclusive designer collaborations and limited-edition collections, further elevating their brand appeal. These partnerships enable companies to attract a broader consumer base while maintaining exclusivity.

Global Expansion & Retail Growth

To tap into emerging markets, several candle brands are focusing on international expansion. Companies like Voluspa and Jo Malone are establishing a strong presence in Asia-Pacific and the Middle East, where demand for premium home fragrances is rising. Retail expansion strategies include opening flagship stores, pop-up shops, and forming exclusive partnerships with high-end department stores to increase brand visibility and enhance customer experience.

TOP 3 PLAYERS IN THE MARKET

SC Johnson & Son, a privately held American multinational, owns the Glade brand, which is a prominent name in the home fragrance sector. The company's extensive distribution network and continuous innovation in fragrance technology have solidified its position as a leader in the candle market. SC Johnson's commitment to sustainability and consumer-driven product development contributes significantly to its market share.

Newell Brands, through its subsidiary Yankee Candle, has a substantial footprint in the global candle industry. Yankee Candle is renowned for its wide array of scented candles and accessories, catering to a broad consumer base. In recent years, Yankee Candle's revenue has remained stable, peaking at $864 million in 2020, with e-commerce sales reaching record heights during the same period. This robust performance underscores the brand's adaptability and strong consumer loyalty.

L Brands, the parent company of Bath & Body Works, has made significant contributions to the candle market. Bath & Body Works offers a diverse range of scented candles that have gained popularity for their quality and variety. The brand's focus on seasonal and themed collections, coupled with an engaging in-store experience, has bolstered its market position. L Brands' strategic marketing and product diversification have been pivotal in capturing a substantial share of the candle market.

RECENT HAPPENINGS IN THE MARKET

- In February 2022, with the launch of the Studio Collection, Yankee Candle introduced a simple, sophisticated candle design. The pioneer in home fragrance introduces its new Studio Collection, which has a selected selection of beloved Yankee Candle smells housed in simple and stylish glass containers with a sleek, geometric design in trendy colors. The Studio Collection was created by Yankee Candle fragrance specialists with the goal of creating a welcoming environment that would fit into any house.

- In March 2021, Yorkshire candle and soap manufacturers faced a second epidemic acquisition. Supplies for Candles LTD, situated in Yorkshire, has spent £2.5 million in the acquisition of the company Glass Print Ltd, new product inventory, and the purchasing of a 20,000-square-foot warehouse at Mexborough, South Yorkshire near its headquarters, with the intention of generating 30 new employments in the region.

MARKET SEGMENTATION

This research report on the global candles market has been segmented and sub-segmented based on product type, wax type, distribution channel, and region.

By Product Type

- Votive

- Container Candles

- Pillars

- Tapers

- Others

By Wax Type

- Paraffin

- Soy Wax

- Beeswax

- Palm Wax

- Others

By Distribution Channel

- Online

- Offline

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

Positive and negative scenarios of the market during the ongoing pandemic

The positive side is that people started using all sorts of candles like LEDs and etc., the downside is that there was a problem with the supply chain system.

Impact on various sectors facing the greatest drawbacks of the candle market?

Manufacturing, transportation and logistics, and retail and consumer goods are the drawbacks.

What is the Candle Market's estimated size and growth rate?

The global candle market is anticipated to increase at US$ 10,156.05 Million by 2027, with a growing CAGR 5.26%

What are the companies involved in the candle industry?

The major players are Yankee Candles, Thymes, White Barn Candles, Jo Malone, Village Candles, NEST, Slatkin & Co, Malin + Goetz, Colonial Candle, Diptyque.

What is the hindering factor that is not letting the market to grow?

The hindering factor is that LED candles are expected to rise in popularity due to their evident benefits over conventional candles.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]