Global Cancer Profiling Market Size, Share, Trends & Growth Forecast Report By Technology, Technique, Application and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Cancer Profiling Market Size

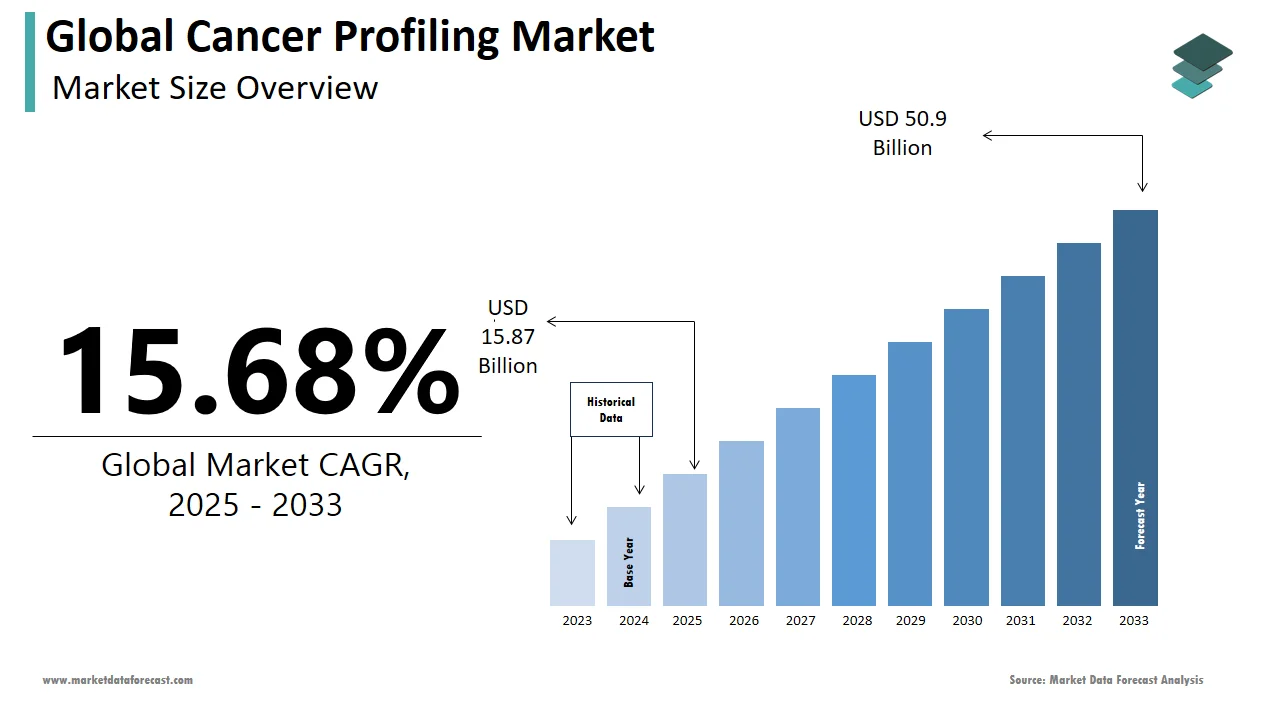

The size of the global cancer profiling market was worth USD 13.72 billion in 2024. The global market is anticipated to grow at a CAGR of 15.68% from 2025 to 2033 and be worth USD 50.9 billion by 2033 from USD 15.87 billion in 2025.

MARKET DRIVERS

Increasing incidences of various cancer diseases and the rise in living standards are significant factors propelling the growth of the cancer profiling market.

The number of people affected by cancer is significantly boosting the market for cancer profiling. As per facts published by the American Cancer Society, an estimated 1.8 million new cancer cases were detected in 2018, and the incidence of cancer is projected to increase more in the coming future. Adopting a sedentary lifestyle and changes in food habits could lead to getting diagnosed with cancer.

The growing number of advancements in clinical molecular diagnostics and increasing research on biomarkers have opened the door to the possibility of new pharmacological targets and treatment alternatives in the field of oncology. In clinical trials, biomarkers are frequently used as diagnostic tools, targets for individualized treatment, and stand-ins for main outcomes. The expansion of basic and clinical research in a wide variety of therapeutic areas over the past several years has sparked interest in the discovery of novel biomarkers that are superior to those already in use in terms of their sensitivity and specificity. This trend is predicted to accelerate the utilization of biomarkers in the proper profiling of cancer and drive market growth.

The growing investments for the R&D around cancer profiling the developed and developing countries propel the market growth. Cancer tumor profiling evaluates the properties and metabolism of the cells and understands the molecular level while diagnosing. The growing prevalence of effective treatment procedures and the rise in the geriatric population further accelerate the growth of the cancer profiling market. Growth opportunities for the market lie in the increasing demand for targeted therapies where the patient has a prominent response to the therapy. Also, the growing prevalence of effective treatment procedures at any cost and the rise in the use of biomarkers for treating cancer is further anticipated to boost the growth rate of the cancer profiling market.

MARKET RESTRAINTS

High costs of cancer profiling tests and treatments, limited reimbursement policies and coverage for cancer profiling procedures and stringent regulatory requirements and approval processes for new profiling technologies primarily hamper the cancer profiling market growth. Lack of standardized protocols and guidelines for cancer profiling, ethical concerns and patient privacy issues related to genetic profiling and data sharing and poor awareness and understanding of cancer profiling among healthcare providers and patients hinder the growth of the cancer profiling market. Challenges in integrating complex profiling data into clinical decision-making, limited access to advanced profiling technologies and specialized laboratories in certain regions, limited availability of targeted therapies and personalized treatment options based on profiling results and resistance and skepticism from traditional healthcare systems and practitioners towards adopting profiling approaches are some of the other significant roadblocks to the growth of the cancer profiling market.

Impact Of COVID-19 on The Global Cancer Profiling Market

The coronavirus outbreak has implemented strict regulations with minimizing contact and adhering to lockdown policies, thus impacting routine cancer screening. During 2020- 2021, there was a notable decrease in cancer diagnoses as few symptoms were mistaken for COVID-19 infections like lung cancer or mild respiratory illness. Studies claim that cancer patients may be more vulnerable to COVID-19 than people without cancer. Testing for cancer has been halted to concentrate on tending to the pressing concerns of the patients and reducing the likelihood of the Sars-Cov-2 virus spreading further. However, according to the American Cancer Society, most hospitals in the United States are set to begin cancer testing after carefully considering the advantages and hazards of doing so and making sure that their personnel and patients are safeguarded from the COVID-19 virus to the greatest extent feasible. Because of the COVID-19 outbreak, there has been a substantial reduction in the number of resources committed to cancer testing and detection. However, a significant number of COVID-19 patients had cancer; consequently, this condition is now believed to be a risk factor for COVID-19. Because of this, it is hoped that progress will be made in the field of cancer research as more studies are carried out to gain a better understanding of the characteristics of the infection. Over the forecast period, it is anticipated that there will be a consistent rise in demand for diagnostic and prognostic tests related to most cancers, as well as personalized treatment. Factors such as a shortage of skilled professionals due to the displacement of medical workers and technical difficulties in sample collection and storage severely challenged the studied market during the pandemic. However, precision medicine has a potential growth opportunity that can help identify patients who may need cancer treatment with NGS or genomic biomarkers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

15.68% |

|

Segments Covered |

By Technology, Technique, Application, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Illumina, Inc. (US), QIAGEN N.V. (Germany), NeoGenomics Laboratories, Inc. (U.S.), HTG Molecular Diagnostics, Inc. (U.S.), Genomic Health Inc. (U.S.), Caris Life Sciences (U.S.), Helomics Corporation (U.S.), NanoString Technologies, Inc. (U.S.), Sysmex Corporation (Japan), RiboMed Biotechnologies, Inc. (U.S.), Guardant Health, Inc. (U.S.), and Foundation Medicine (U.S.), and Others. |

SEGMENTAL ANALYSIS

By Technology Insights

Based on the technology, the NGS segment is predicted to hold the major share of the global market and grow at the fastest CAGR during the forecast period. Factors such as high-throughput sequencing capabilities enabling comprehensive genomic profiling, rapid advancements in NGS technologies that are reducing costs and improving efficiency, and rising demand for precision medicine and personalized treatment approaches majorly drive the growth of the NGS segment.The PCR segment is also predicted to account for a considerable share of the global market during the forecast period. PCR is a widely used technique for detecting specific DNA sequences with high sensitivity. The broad range of applications of PCR including mutation analysis, gene expression profiling and viral detection and rapid adoption of PCR in research, clinical diagnostics, and drug development propel the growth of the PCR segment.

By Technique Insights

Based on the technique, the genomics segment is expected to occupy the largest share of the global market during the forecast period owing to the growing demand for personalized medicine and rising disposable income. The growing understanding of the genetic basis of cancer and the role of specific gene mutations, increasing demand for personalized medicine and targeted therapies based on genomic profiling drive the growth of the genomics segment. The growing number of advancements in genomic technologies, such as next-generation sequencing (NGS) to enable cost-effective and high-throughput analysis of genetic information and an increasing number of collaborations between research institutions, pharmaceutical companies and diagnostic laboratories for genomics-based cancer research fuel the growth rate of the genomics segment.The proteomics segment is projected to witness the fastest CAGR during the forecast period. The growing recognition of the importance of protein-level analysis for understanding cancer biology and identifying potential drug targets is one of the key factors driving segmental growth. Technological advancements in proteomic techniques such as high-resolution mass spectrometry and protein microarrays and rising focus on biomarker discovery and validation for early cancer detection, patient stratification and treatment monitoring drive the growth of the proteomics segment.

By Application Insights

Based on the application, the personalized medicine segment is estimated to hold the largest share of the global market during the forecast period. The growing understanding of the genetic and molecular basis of cancer, advancements in genomic and proteomic technologies, rising demand for personalized treatment strategies to improve patient outcomes and minimize side effects and supportive government initiatives and funding for precision medicine research and adoption drive the growth of the personalized medicine segment in the cancer profiling market.The biomarker discovery segment is expected to witness a healthy CAGR during the forecast period. The rising emphasis on early cancer detection and screening programs, growing focus on precision medicine and targeted therapies and advancements in high-throughput technologies propel the growth of the biomarker discovery segment.

REGIONAL ANALYSIS

Geographically, North America accounted for the largest share of the global cancer profiling market in 2024 and the regional domination of North America is most likely to continue in the global market during the forecast period. The rapid adoption of technological advancements in cancer profiling techniques, the growing prevalence of cancer and the rising demand for personalized medicine majorly drive the growth of the North American cancer profiling market. Favorable reimbursement policies for cancer profiling procedures, the presence of major market players and research institutions, the presence of strong healthcare infrastructure, rising awareness about cancer diagnostics and supportive government initiatives for cancer research further fuel the growth rate of the North American market. The U.S. captured around 50% of the North American market share in 2024 and is expected to grow at a healthy CAGR during the forecast period. The rapid adoption of precision medicine approaches in cancer treatment in the U.S. primarily drive the U.S. market growth.

Europe occupied a substantial share of the global market in 2024 and is expected to grow at a noteworthy CAGR during the forecast period. The rising focus on precision medicine and personalized cancer treatment, growing Rising cancer prevalence and increasing demand for early detection methods in Europe majorly propel the European market growth. The growing number of collaborations between academic institutions and healthcare organizations for cancer research, the presence of a supportive regulatory environment and favorable reimbursement policies in Europe contribute to the regional market growth. Technological advancements in genomic and proteomic technologies and growing investments in cancer research and development favor the cancer profiling market in the European region. Germany led the market in Europe in 2024 and is expected to grow at a prominent CAGR during the forecast period owing to the rapid adoption of next-generation sequencing technologies for cancer profiling.

APAC is the most lucrative regional market for cancer profiling and is anticipated to witness the highest CAGR during the forecast period. The growing cancer burden, increasing awareness about early detection and personalized treatment, rising healthcare expenditure and infrastructure development and the expansion of pharmaceutical and biotechnology companies in the APAC region majorly propel the APAC market growth. The presence of a large population base, high prevalence of certain types of cancers, growing focus on precision medicine initiatives and government support and rising adoption of advanced cancer profiling technologies further drive the APAC market growth. China held the major share of the APAC market in 2024, followed by India and the same pattern is expected to continue during the forecast period owing to the growing investments in precision medicine and oncology research.

Latin America is expected to hold a considerable share of the global market during the forecast period due to the rising cancer incidence, growing need for accurate diagnosis and treatment, initiatives of Latin American governments to improve cancer care and access to diagnostics and favorable reimbursement policies for cancer profiling procedures.

The cancer profiling market in the Middle East and Africa is projected to have a steady CAGR in the coming years owing to the growing awareness of treatment procedures and the implementation of various techniques in diagnostics centers.

KEY MARKET PARTICIPANTS

Some of the most promising companies in the global cancer profiling market profiled in this report are Illumina, Inc. (US), QIAGEN N.V. (Germany), NeoGenomics Laboratories, Inc. (U.S.), HTG Molecular Diagnostics, Inc. (U.S.), Genomic Health Inc. (U.S.), Caris Life Sciences (U.S.), Helomics Corporation (U.S.), NanoString Technologies, Inc. (U.S.), Sysmex Corporation (Japan), RiboMed Biotechnologies, Inc. (U.S.), Guardant Health, Inc. (U.S.), and Foundation Medicine (U.S.)

RECENT MARKET HAPPENINGS

- In June of 2022, Avesthagen Limited and Wipro Limited entered a long-term strategic partnership with the intention of Avesthagen's genetic testing portfolio being commercialized through the partnership.

- In May of 2022, QIAGEN introduced a new diagnostic test known as the therascreen EGFR plus PCR kit. This test is used for doing sophisticated EGFR mutation analysis.

- A leading provider of cancer-focused genetic testing services and global oncology contract research services, NeoGenomics, Inc., January 2022 announced a strategic partnership with the Biomarker Collaborative to facilitate the formation of support groups for cancer patients who test positive for specific biomarkers. The goal of this partnership is to make it easier for cancer patients to connect and share their experiences.

- HTG Molecular Technologies, Inc. has developed a product for tumor profiling called Edge Seq mouse mRNA tumor response panel. The significant applications of this product are analysis of immune response to xenografts, detailed investigational research of therapeutics, and oncogenesis modeling. This tumor response panel enables the profiling of various samples, such as extracted RNA samples, FFPE tissue, and cell lines.

MARKET SEGMENTATION

This market research report on the global cancer profiling market has been segmented and sub-segmented based on the technology, technique, application, and region.

By Technology

- Next-generation Sequencing (NGS)

- Polymerase Chain Reaction (PCR)

- Immunohistochemistry (IHC)

- In Situ Hybridization (ISH)

- Fluorescence In Situ Hybridization (FISH)

- Chromogenic In Situ Hybridization (CISH)

- Microarray

- Others

By Technique

- Genomics

- Proteomics

- Epigenetics

- Metabolomics

By Application

- Personalized Medicine

- Diagnostics

- Biomarker Discovery

- Prognostics

- Research Applications

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

Which segment by technology accounted for the major share of the cancer profiling market?

Based on technology, the NGS segment led the cancer profiling market in 2024.

How much was the global cancer profiling market worth in 2024?

The global cancer profiling market size was valued at USD 13.72 billion in 2024.

Which region led the cancer profiling market in 2024?

Among all the regions, the North American region accounted for the major share of the global market in 2024.

Who are the major players in the cancer profiling market?

Illumina, Inc. (US), QIAGEN N.V. (Germany), NeoGenomics Laboratories, Inc. (U.S.), HTG Molecular Diagnostics, Inc. (U.S.), Genomic Health Inc. (U.S.), Caris Life Sciences (U.S.), Helomics Corporation (U.S.), NanoString Technologies, Inc. (U.S.), Sysmex Corporation (Japan), RiboMed Biotechnologies, Inc. (U.S.), Guardant Health, Inc. (U.S.), and Foundation Medicine (U.S.) are some of the prominent companies in the global cancer profiling market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]