Global Camping Tent Market Size, Share, Trends & Growth Forecast Report Segmented By Product (Tunnel, Dome, Geodesic), Distribution Channel, End-Use, And Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 To 2033

Global Camping Tent Market Size

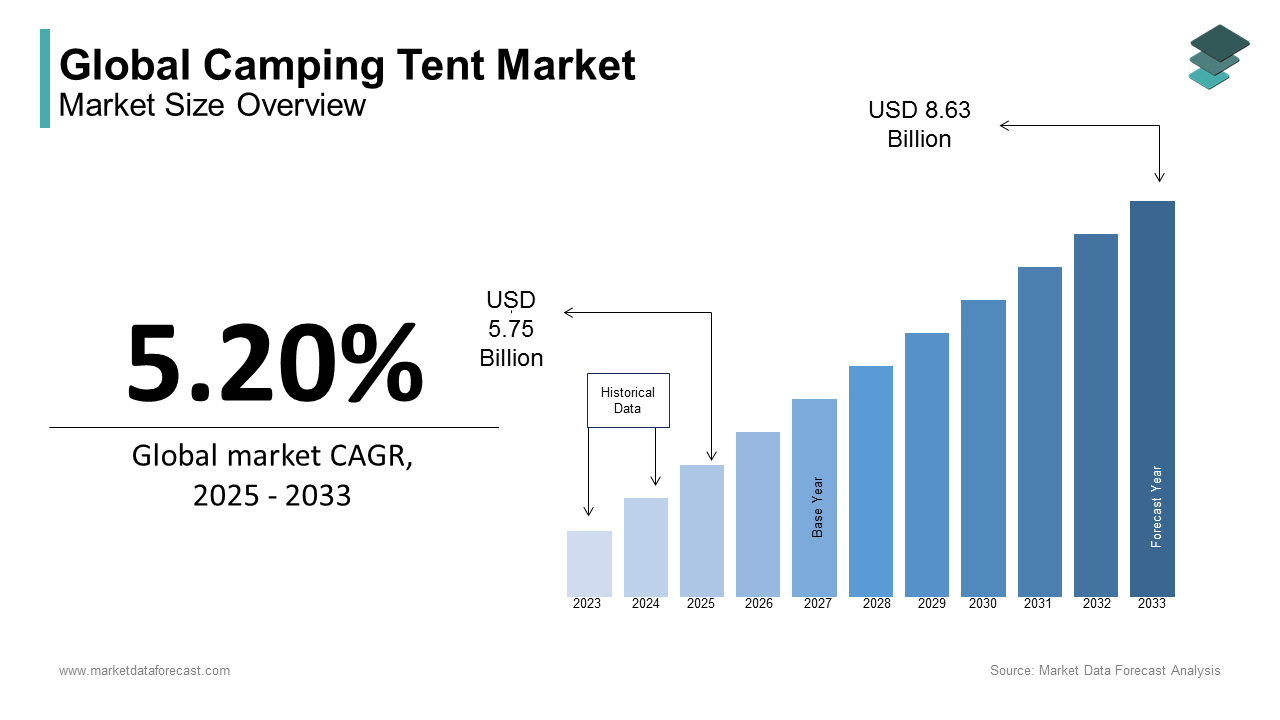

The global camping tent market size was calculated to be USD 5.47 billion in 2024 and is anticipated to be worth USD 8.63 billion by 2033 from USD 5.75 billion In 2025, growing at a CAGR of 5.20% during the forecast period.

Camping tents market are portable shelters designed to facilitate immersive experiences in natural environments. Camping tents have evolved significantly from basic, rudimentary structures to advanced, high-performance gear tailored for diverse terrains and weather conditions. These products cater to a broad spectrum of users, ranging from casual campers and adventure enthusiasts to survivalists and humanitarian organizations. The growing global interest in outdoor activities is evident in participation rates, with the Outdoor Foundation reporting that over 48 million Americans went camping at least once in 2021, reflecting a notable increase compared to pre-pandemic levels. This surge in outdoor engagement has been attributed to heightened awareness of mental and physical health benefits associated with nature-based activities.

Beyond recreational use, camping tents play a critical role in disaster relief and humanitarian efforts, providing temporary shelter for displaced populations. According to the United Nations High Commissioner for Refugees (UNHCR), as of mid-2023, over 110 million people worldwide were forcibly displaced due to conflict, persecution, or natural disasters, highlighting the urgent need for reliable and rapidly deployable shelter solutions. Additionally, the rise of "glamping" or glamorous camping has redefined traditional camping by blending luxury with nature. A survey conducted by KOA, a leading campground operator in the United States, revealed that 53% of campers expressed interest in upscale camping options, driving demand for premium tents equipped with enhanced comfort features such as improved insulation, ventilation, and modular designs.

As societal trends increasingly emphasize health, wellness, and environmental stewardship, camping tents serve not only as functional tools but also as enablers of meaningful connections with the outdoors. This dual functionality ensures their enduring relevance across both recreational and humanitarian contexts.

MARKET DRIVERS

Growing Participation in Outdoor Recreation

The increasing participation in outdoor recreational activities has emerged as a significant driver of the camping tent market. The U.S. Bureau of Economic Analysis (BEA) reported that the outdoor recreation economy accounted for $459.8 billion in gross output in 2021, underscoring its growing importance in consumer lifestyles. This trend is further supported by data from the National Park Service, which recorded over 297 million recreational visits to national parks in 2021, marking one of the highest annual totals in recent history. The rise in outdoor activities is fueled by heightened awareness of mental and physical health benefits, with studies such as those published by the American Psychological Association linking time spent in nature to reduced stress and improved well-being. Additionally, the COVID-19 pandemic accelerated this shift as individuals sought safe, open-air alternatives to indoor gatherings. This surge in demand for outdoor experiences has directly contributed to increased sales of camping tents, as they serve as essential equipment for such pursuits.

Rising Demand for Disaster Relief and Emergency Shelters

The escalating frequency and intensity of natural disasters have significantly driven the demand for camping tents, particularly in disaster relief and emergency shelter applications. According to the National Oceanic and Atmospheric Administration (NOAA), the United States experienced 18 separate billion-dollar weather and climate disasters in 2022, highlighting the urgent need for reliable temporary shelters. Similarly, the Internal Displacement Monitoring Centre (IDMC) reported that over 32.6 million people were displaced globally due to natural disasters in 2022, emphasizing the scale of humanitarian needs. In such scenarios, camping tents are widely utilized for their portability, ease of deployment, and cost-effectiveness. Governments and humanitarian organizations rely heavily on these products to provide immediate shelter solutions during crises. For instance, the Federal Emergency Management Agency (FEMA) distributed thousands of tents during hurricane response efforts in recent years, underscoring their critical role in emergency preparedness and recovery operations.

MARKET RESTRAINTS

Fluctuating Raw Material Costs

The camping tent market faces significant challenges due to fluctuating raw material costs, which impact production expenses and profitability. The U.S. Bureau of Labor Statistics reported that the Producer Price Index (PPI) for textiles and fabric materials increased by 12.3% in 2022 reflecting rising costs of essential inputs like polyester and nylon. These materials are critical for manufacturing durable and weather-resistant tents, and their price volatility creates uncertainty for manufacturers. Additionally, global supply chain disruptions, as highlighted by the U.S. Census Bureau, have further exacerbated the issue, leading to delays and increased transportation costs. For instance, the Drewry World Container Index indicated that shipping container prices surged during the pandemic, with freight rates increasing by nearly 300% at their peak. These economic pressures often result in higher retail prices for consumers, potentially dampening demand. As a result, manufacturers must balance cost management with maintaining product quality, posing a persistent restraint on market growth.

Environmental Concerns and Sustainability Challenges

Environmental concerns and sustainability challenges present another major restraint for the camping tent market. The Environmental Protection Agency (EPA) has emphasized the growing need for industries to adopt sustainable practices, as traditional tent materials like PVC coatings and synthetic fabrics contribute to environmental degradation. A study published by the International Union for Conservation of Nature (IUCN) highlighted that microplastics from textile waste, including outdoor gear, are increasingly found in waterways, raising ecological concerns. While eco-friendly alternatives such as biodegradable fabrics exist, they often come at a higher cost and limited scalability. Furthermore, the Outdoor Industry Association noted that consumer demand for sustainable products is rising, but many manufacturers struggle to meet these expectations without compromising affordability or performance. This gap between environmental responsibility and market feasibility poses a significant challenge, restraining the industry's ability to fully align with global sustainability goals.

MARKET OPPORTUNITIES

Expansion of Eco-Friendly and Sustainable Products

The growing demand for eco-friendly and sustainable camping tents presents a significant opportunity for the market. The Environmental Protection Agency (EPA) has emphasized the need for industries to reduce environmental footprints by adopting greener practices. This trend is particularly relevant for the camping tent industry, where innovations in biodegradable fabrics and recycled materials are gaining traction. For instance, a survey conducted by the Outdoor Industry Association revealed that over 55% of outdoor enthusiasts prioritize purchasing products made from sustainable materials. Manufacturers investing in green technologies, such as tents made from recycled polyester or natural fibers, can tap into this expanding consumer base. By aligning with global sustainability goals, companies can enhance brand loyalty and capture a competitive edge in the evolving outdoor recreation market.

Rising Popularity of Adventure Tourism and Remote Travel

The increasing popularity of adventure tourism and remote travel offers another lucrative opportunity for the camping tent market. The United Nations World Tourism Organization (UNWTO) reported that nature-based tourism accounted for approximately 20% of all international trips in 2022, with travelers seeking unique, off-the-beaten-path experiences. This shift is supported by data from the National Park Service, which recorded over 311 million recreational visits to national parks in 2022, many of whom engaged in activities like backpacking and wilderness camping. Additionally, the Adventure Travel Trade Association noted that adventure tourism grew by 15% globally between 2019 and 2022, driven by a desire for immersive outdoor experiences. As travelers venture into more rugged terrains, the demand for lightweight, durable, and weather-resistant tents is expected to surge. Companies that innovate to meet the needs of adventure tourists, such as modular designs or extreme-weather gear, can capitalize on this growing trend and expand their market share significantly.

MARKET CHALLENGES

Intense Market Competition and Price Wars

The camping tent market faces significant challenges due to intense competition and price wars among manufacturers, which can erode profit margins and hinder innovation. The U.S. Census Bureau highlights that the outdoor recreation industry is highly fragmented, with thousands of companies vying for market share as of 2022. This saturation often leads to aggressive pricing strategies, particularly among budget-friendly brands targeting cost-conscious consumers. For instance, the National Retail Federation reported that promotional discounts on outdoor gear increased by approximately 12% during peak seasons like summer and holiday periods in 2022. While this benefits consumers, it pressures manufacturers to cut costs, potentially compromising product quality or limiting investment in research and development. Smaller players, in particular, struggle to compete with established brands that dominate distribution channels. This competitive landscape poses a persistent challenge for businesses striving to differentiate themselves while maintaining profitability.

Vulnerability to Seasonal Demand Fluctuations

Seasonal demand fluctuations present another major challenge for the camping tent market, as sales are heavily influenced by weather patterns and vacation cycles. The U.S. Bureau of Economic Analysis notes that outdoor recreation spending is highly seasonal, with over 60% of annual revenue typically generated between April and September. This seasonality creates cash flow challenges for manufacturers and retailers, who must manage inventory and production cycles carefully. Additionally, the National Oceanic and Atmospheric Administration (NOAA) reported that extreme weather events, such as unseasonably cold springs or prolonged rainy seasons, can disrupt demand. For example, NOAA data revealed that an unusually wet summer in parts of the United States in 2022 led to a measurable decline in camping-related activities in affected regions. Businesses reliant on predictable seasonal trends face difficulties in forecasting and resource allocation, making it harder to sustain consistent growth throughout the year.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.20% |

|

Segments Covered |

By Product, Distribution Channel, End-Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

AMG-Group, Hilleberg the Tentmake, JOHNSON OUTDOORS INC., The North Face, A VF Company, Newell Brands, Oase Outdoors ApS, Big Agnes, Inc., Exxel Outdoors, LLC, Simex Outdoor International GmBH, and The Coleman Company, Inc. |

SEGMENTAL ANALYSIS

By Product Insights

The dome tents segment dominated camping tent market by accounting for 40.6% of the global market share in 2024. Th versatility, ease of setup, and affordability of dome tents is majorly propelling the growth of the dome tents segment in the global market. According to the National Park Service, dome tents are particularly favored in regions like North America and Europe due to their lightweight design and ability to withstand moderate weather conditions. Additionally, advancements in fabric technology, such as improved waterproofing and UV resistance, have enhanced their durability, further boosting demand. As a staple in the camping industry, dome tents cater to a broad audience, ensuring their continued leadership and importance in the market.

The geodesic tents segment is growing rapidly and is anticipated to register a CAGR of 8.5% over the projection period. This growth is driven by increasing participation in extreme outdoor activities such as mountaineering and alpine trekking. For instance, the National Park Service reported a 20% rise in backcountry camping permits issued in 2022, reflecting growing interest in rugged terrains. Geodesic tents are favored for their superior stability and wind resistance, making them essential for harsh environments. Governments promoting adventure tourism, such as New Zealand’s Department of Conservation, further amplify demand. Their ability to cater to niche markets ensures their rapid expansion, positioning geodesic tents as a critical segment for future innovation and premium product development.

By Distribution Channel Insights

The offline segment dominated the camping tent market by accounting for 65.4% of global market in 2024. This leadership is driven by the widespread presence of brick-and-mortar stores, including sporting goods retailers and outdoor specialty shops, which provide consumers with hands-on product experiences. The National Retail Federation highlights that offline channels are particularly favored by older demographics who prioritize in-store consultations and product demonstrations. Additionally, offline sales benefit from impulse purchases during peak seasons like summer holidays and winter sports events. As a trusted and traditional purchasing method, offline distribution remains critical for reaching rural and underserved markets, ensuring its continued dominance and importance in the camping tent industry.

Whereas, the online segment is predicted to expand at a CAGR of 12.2% over the forecast period owing to the rising internet penetration, increasing smartphone usage, and the convenience of e-commerce platforms. For instance, the U.S. Department of Commerce reported that e-commerce sales grew by 9.7% in 2022, with outdoor gear being a significant contributor. Millennials and Gen Z, who prioritize convenience, variety, and fast delivery, are driving this trend. Online platforms also enable manufacturers to reach global audiences and leverage data analytics for personalized recommendations, enhancing customer engagement. As digital adoption accelerates, online distribution is poised to reshape the camping tent market, making it a pivotal channel for innovation and accessibility.

By End-use Insights

The individual segment led the camping tent market by capturing 65.7% of the global market share in 2024. The domination of the individual segment is primarily driven by the growing popularity of outdoor recreational activities among families and adventure enthusiasts. The National Park Service recorded over 297 million recreational visits to national parks in 2022, underscoring the strong demand for personal camping gear. Individuals prioritize affordability, portability, and ease of use, making this segment critical for manufacturers. Additionally, the rise of glamping and eco-tourism has further fueled demand. As a cornerstone of the camping tent industry, the individual segment ensures steady revenue streams and reflects evolving consumer lifestyles.

However, the commercial end-use segment is the progressing promisingly and is estimated to grow at a CAGR of 8.2% during the forecast period owing to the rising demand for organized outdoor events, adventure tourism, and corporate retreats. For instance, the International Congress and Convention Association noted a 12% increase in outdoor event bookings globally in 2022. Commercial users, including tour operators and hospitality providers, require durable, high-capacity tents, driving innovation in product design. Governments promoting eco-tourism, such as Costa Rica’s Sustainable Tourism Plan, further amplify demand. As businesses increasingly invest in experiential travel offerings, the commercial segment is poised to become a key driver of market expansion and premium product development.

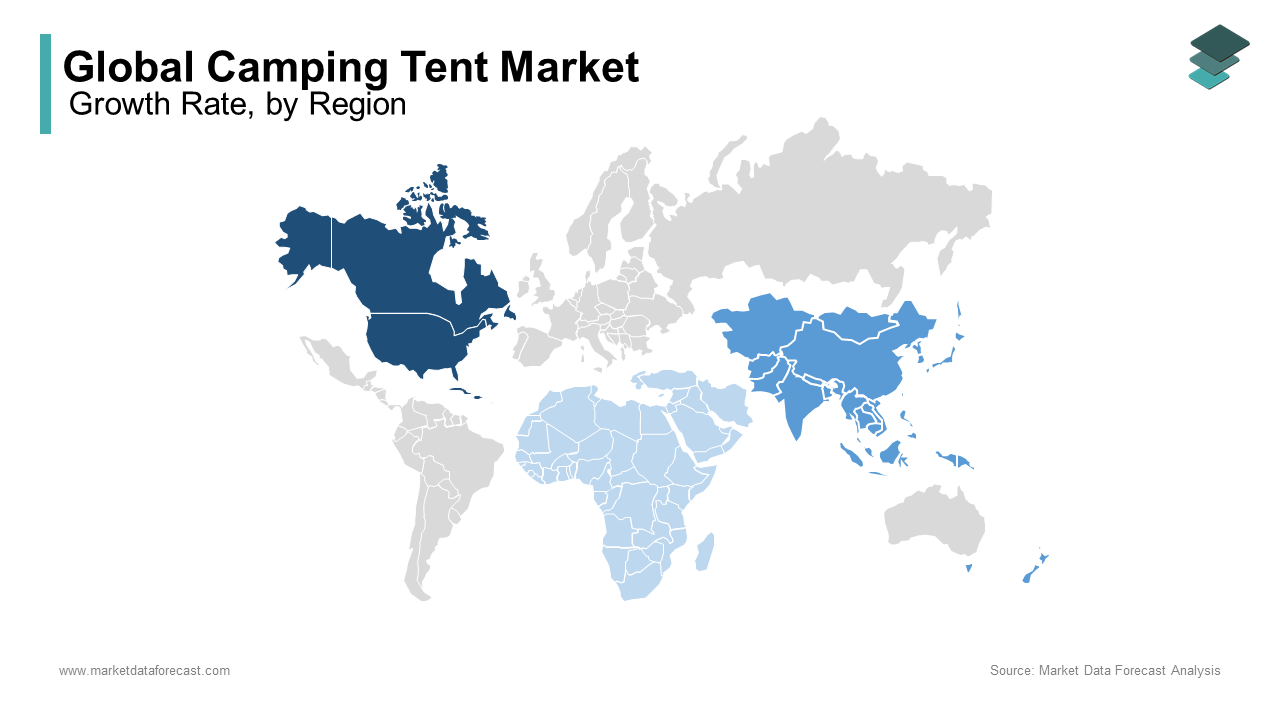

REGIONAL ANALYSIS

North America had the largest regional segment for camping rents globally by holding 35.2% of the global market share in 2024. The domination of North America in the global market is driven by high disposable incomes, a strong outdoor recreation culture, and extensive access to natural parks. The National Park Service reported over 297 million recreational visits to national parks in 2022, underscoring the demand for camping gear. Additionally, the growing popularity of glamping and eco-tourism has further fueled sales. North America’s robust retail infrastructure and technological advancements in tent manufacturing, such as lightweight materials, solidify its position as a hub for innovation and consumer adoption.

The Asia-Pacific region is the emerging regional market for camping tents and is expected to progress at a CAGR of 7.8% over the forecast period. Factors such as rapid urbanization, rising disposable incomes, and increasing interest in adventure tourism are propelling the camping tents market in the Asia-pacific region. For instance, the Indian Ministry of Tourism noted a 40% increase in domestic tourism in 2022, while China’s outdoor recreation sector expanded by 10% annually, as reported by the China Tourism Academy. Government initiatives promoting eco-tourism, such as India’s "Dekho Apna Desh" campaign, are further boosting demand. The region’s large population base and untapped rural markets present significant opportunities for manufacturers to innovate and cater to diverse consumer preferences.

Europe is a mature and stable market for camping tents and is predicted to account for a prominent share of the global market during the forecast period. The strong outdoor recreation culture and government initiatives promoting sustainable tourism are boosting the European camping tents market growth. The European Environment Agency reports that over 30% of Europeans regularly participate in outdoor activities, driving consistent demand for camping gear. Countries like Germany, France, and the UK are key contributors, with Germany accounting for approximately 20% of Europe’s camping tent sales in 2022, according to the European Outdoor Group. The region benefits from well-established national parks and eco-tourism programs, such as the European Green Belt initiative. While growth is moderate compared to emerging markets, Europe’s focus on premium and eco-friendly products ensures steady revenue streams.

Latin America shows promising potential for the camping tent market, fueled by rising ecotourism investments and growing interest in outdoor adventures. According to the Inter-American Development Bank, ecotourism initiatives in Brazil and Argentina have grown by 10% annually since 2020. The region's diverse landscapes, including the Amazon rainforest and Patagonia, attract adventure seekers, boosting demand for durable and weather-resistant tents. Governments are also promoting domestic tourism, with Mexico reporting a 15% increase in national park visits in 2022, as per the Mexican Ministry of Tourism. While the market is still developing, Latin America’s young population and increasing urbanization present significant opportunities.

The Middle East and Africa represent emerging markets with moderate but steady growth potential for the camping tent industry. The African Union’s tourism framework emphasizes nature-based tourism, which is expected to drive demand for camping gear, particularly in South Africa and Kenya. Similarly, the Middle East is witnessing a rise in outdoor leisure activities, supported by government initiatives like Saudi Arabia’s Vision 2030, which promotes desert tourism. According to the World Travel & Tourism Council, the Middle East’s outdoor tourism sector grew by 7% in 2022, while Africa’s ecotourism market expanded by 4%. Despite challenges such as limited infrastructure and economic disparities, these regions offer untapped opportunities.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Major Players of the global camping tent market include AMG-Group, Hilleberg the Tentmake, JOHNSON OUTDOORS INC., The North Face, A VF Company, Newell Brands, Oase Outdoors ApS, Big Agnes, Inc., Exxel Outdoors, LLC, Simex Outdoor International GmBH, and The Coleman Company, Inc.

The global camping tent market is highly competitive, driven by increasing outdoor recreation activities, rising eco-conscious consumer preferences, and advancements in tent technology. Major players like The North Face, Coleman, and Big Agnes dominate the industry, offering a diverse range of products tailored to different consumer segments. While The North Face leads in high-performance and premium-quality tents for extreme conditions, Coleman captures the mass-market segment with affordable and easy-to-use options. Big Agnes, on the other hand, specializes in ultralight, high-tech tents designed for backpackers and adventure enthusiasts.

Competition is further intensified by innovation and product differentiation. Companies are investing in smart tent technology, lightweight materials, and modular designs to enhance user experience. Sustainability has also become a key competitive factor, with brands incorporating recycled materials and eco-friendly production methods to attract environmentally conscious consumers.

The market also sees significant rivalry from new entrants and private labels, particularly in the e-commerce sector. Online platforms like Amazon, REI, and Backcountry allow direct-to-consumer brands to challenge established companies with cost-competitive products. Strategic collaborations, product diversification, and aggressive marketing efforts continue to shape the industry, ensuring a dynamic and rapidly evolving competitive landscape.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Innovation and Product Development

Key players in the camping tent industry focus heavily on innovation to differentiate their products and enhance user experience. Companies like The North Face invest in advanced materials such as geodesic dome structures and weather-resistant fabrics to improve durability and protection in extreme conditions. Big Agnes is leading the way in smart tent technology, integrating features like climate control and real-time weather monitoring to enhance comfort and safety. Meanwhile, Coleman continues to refine its instant tent designs, making camping more accessible for beginners and families by offering easy-to-assemble tents.

Sustainability and Eco-Friendly Initiatives

With growing consumer awareness of environmental issues, key players are prioritizing sustainability to strengthen their market position. The North Face and Big Agnes use recycled and eco-friendly materials in their tents, reducing their carbon footprint. Coleman has also started incorporating greener manufacturing processes, ensuring that its products align with sustainable practices. These initiatives help companies appeal to environmentally conscious consumers and maintain a competitive edge in the market.

Strategic Collaborations and Partnerships

Companies are leveraging strategic partnerships to enhance their offerings and expand their market reach. In June 2024, Coleman partnered with REI to co-develop eco-friendly camping tents, combining their expertise to meet increasing consumer demand for sustainable products. Similarly, in July 2024, The North Face collaborated with Big Agnes to integrate smart technology into their tents, introducing features like weather-adaptive ventilation and automated climate control. These partnerships allow companies to merge their strengths, resulting in more innovative and competitive products.

TOP 3 PLAYERS IN THE MARKET

The North Face is one of the most recognized brands in the global outdoor gear industry and a subsidiary of VF Corporation. It is known for its high-performance camping tents, designed to withstand extreme weather conditions. The company heavily invests in innovation, utilizing advanced materials like geodesic dome structures and weather-resistant fabrics that offer superior durability and protection. The North Face also integrates cutting-edge technology in its tents, ensuring lightweight and compact designs suitable for mountaineering and backpacking. Furthermore, the brand is committed to sustainability, incorporating eco-friendly materials and responsible manufacturing practices to reduce its environmental footprint.

Coleman, a subsidiary of Newell Brands, is a dominant player in the camping tent market, known for offering durable, affordable, and user-friendly tents. Unlike premium outdoor brands, Coleman focuses on providing high-quality products accessible to mass-market consumers, making camping more affordable for beginners and families. The company offers a diverse range of tents, including instant, dome, and cabin-style models, catering to different outdoor needs. In recent years, Coleman has made significant strides toward sustainability by incorporating recycled materials in its tent production and adopting greener manufacturing practices. Its reputation for reliability and affordability keeps it a favorite among casual campers worldwide.

Big Agnes has established itself as a leader in lightweight and high-performance camping tents, particularly appealing to backpackers and adventure enthusiasts. The brand is renowned for using ultralight materials without compromising on durability and protection. Recently, Big Agnes has been at the forefront of smart tent innovation, incorporating features like climate control and real-time weather monitoring to enhance outdoor experiences. Sustainability is also a core focus for the company, with initiatives such as using recycled fabrics and committing to carbon-neutral manufacturing processes. Its continuous efforts to improve design, functionality, and eco-friendliness make it a top choice among serious campers and hikers.

RECENT HAPPENINGS IN THE MARKET

- In June 2024, Coleman and REI announced a partnership to co-develop a new line of eco-friendly camping tents. This collaboration is expected to enhance durability and sustainability features, meeting the rising demand for environmentally conscious outdoor gear.

- In July 2024, The North Face and Big Agnes entered into a strategic collaboration to design a new series of smart camping tents. This initiative aims to integrate climate control and real-time weather monitoring technologies, enhancing outdoor comfort and safety.

MARKET SEGMENTATION

This research report on the global camping tent market has been segmented and sub-segmented based on product, distribution channel, end use, and region.

By Product

- Tunnel

- Dome

- Geodesic

By Distribution Channel

- Offline

- Online

By End-use

- Commercial

- Individual

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. Which type of camping tent is most popular in the market?

The most popular types of camping tents include tunnel, dome, and geodesic tents, with demand varying based on outdoor activities and consumer preferences.

2. Who are the primary consumers of camping tents?

Outdoor enthusiasts, campers, hikers, and adventure travelers are the main consumers of camping tents.

3, What factors are driving the growth of the camping tent market?

The market is driven by increasing outdoor recreational activities, rising disposable incomes, and growing eco-tourism trends.

4. How is technology influencing the camping tent market?

Advancements such as lightweight materials, waterproof coatings, smart tents with solar panels, and eco-friendly designs are shaping the industry.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]