Global Cabinet Market Size, Share, Trends, & Growth Forecast Report Segmented By Type (Kitchen Cabinets, Bathroom Cabinets, Entertainment Center Cabinets, Home Office Cabinets, and Other Cabinets), End-User, Distribution Channel, and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Cabinet Market Size

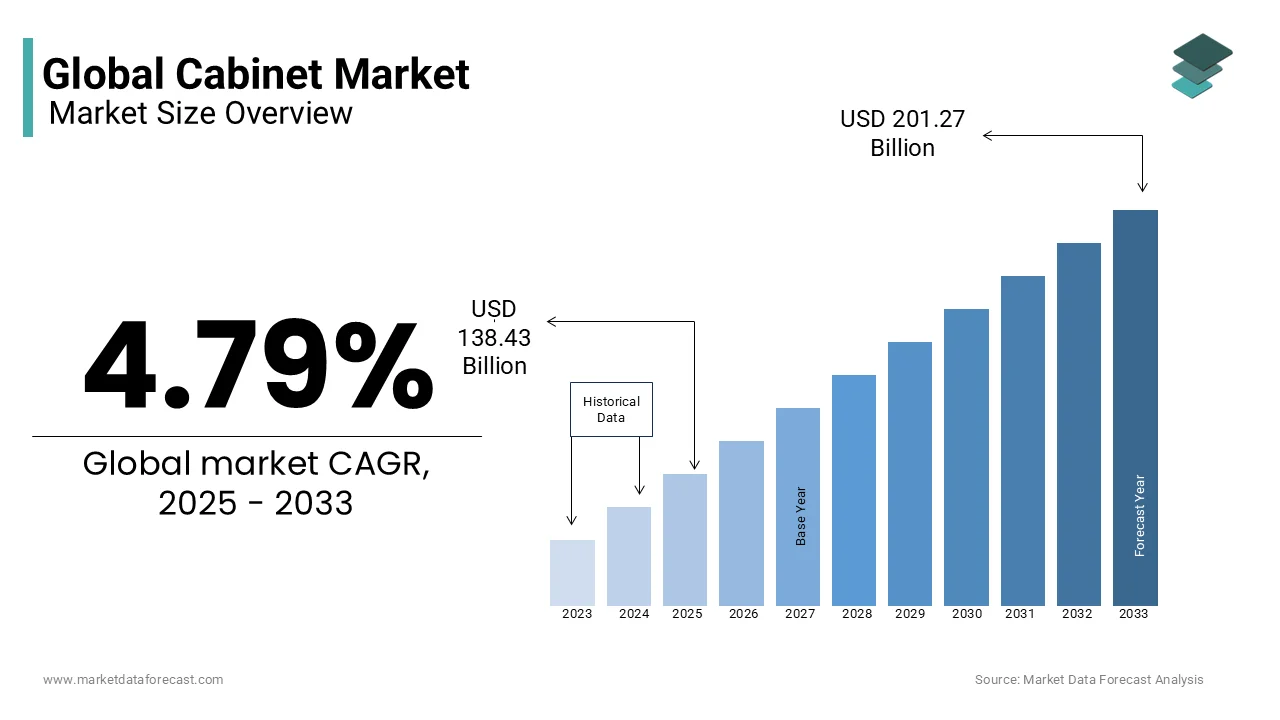

The global Cabinet market size was valued at USD 132.10 billion in 2024 and is expected to reach USD 201.27 billion by 2033 from USD 138.43 billion in 2025. The market is projected to grow at a CAGR of 4.79%.

The cabinet market involves the production and sale of storage units like kitchen cabinets, bathroom vanities, and office storage solutions. These cabinets are essential in both homes and businesses for organizing spaces and enhancing interior designs.

The construction industry plays a big role in cabinet demand. The United Nations stresses that the global urban population is expected to reach 68% by 2050 and is leading to more housing projects and renovation activities. According to the U.S. Census Bureau, home improvement spending in the U.S. increased by 17% in the last five years, showing a rising interest in home upgrades. Additionally, the European Commission states that 40% of energy consumption in the region comes from buildings, increasing the demand for energy-efficient home solutions, including modern cabinets.

The residential sector holds the largest market share, driven by new housing projects and home renovations. Urbanization and rising disposable incomes have led to more people investing in modern, functional cabinetry. In commercial spaces like offices and retail stores, there's a growing need for efficient storage solutions, contributing to market expansion.

Technological advancements have also influenced the market. Manufacturers now offer cabinets with smart features, such as integrated lighting and automated systems, appealing to tech-savvy consumers. Moreover, the trend towards eco-friendly products has led companies to use sustainable materials, aligning with global environmental goals.

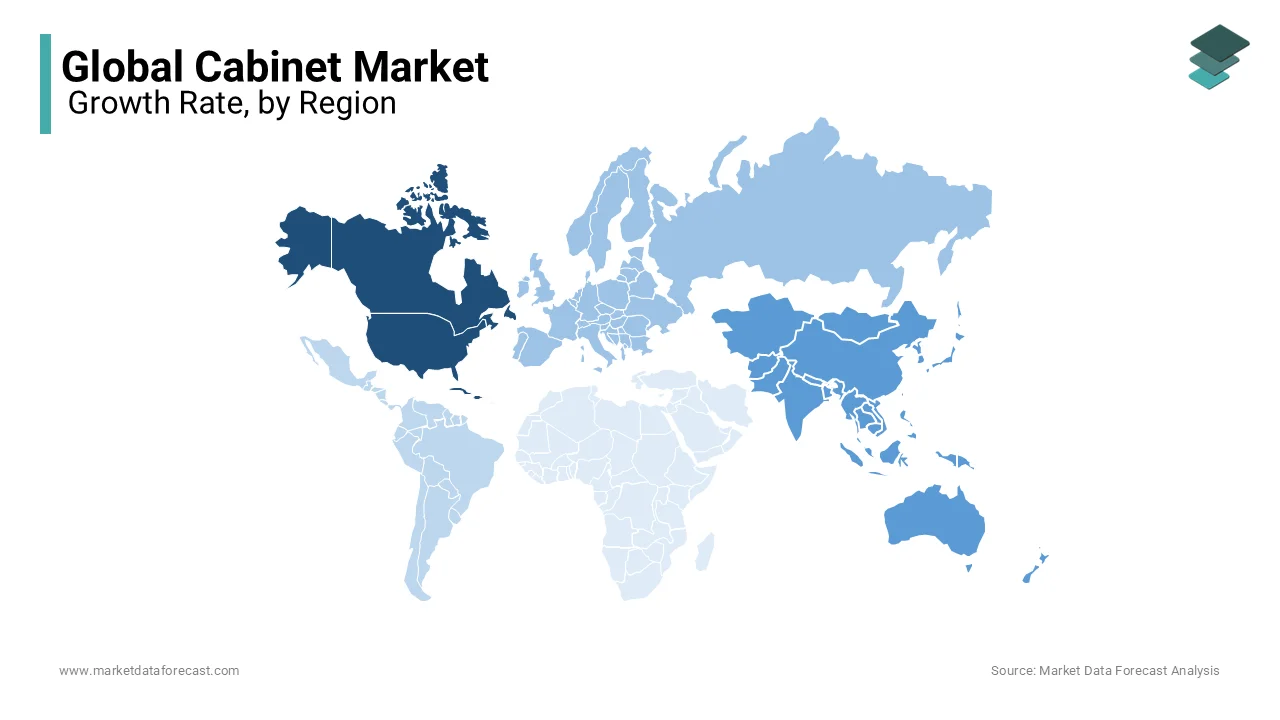

Regionally, Asia-Pacific leads in market growth due to rapid urbanization and population growth. North America and Europe also show significant demand, especially for high-quality and customized cabinets.

MARKET DRIVERS

Urbanization and Population Growth

The need for housing is increasing because more people are moving to cities. The United Nations projects that by 2050, 68% of the world's population will live in urban areas. This urban growth leads to more homes and apartments, boosting the demand for cabinets in kitchens, bathrooms, and storage areas. In countries like India, the urban population is expected to reach 60% by 2030, according to the World Bank. This shift requires more residential construction, directly increasing the need for cabinetry. Additionally, urban living often means smaller living spaces, prompting a demand for efficient and space-saving cabinet designs. As cities expand, the cabinet market benefits from the continuous need for functional and stylish storage solutions.

Government Initiatives Promoting Housing

Governments worldwide are implementing policies to boost housing development. For example, the United States has introduced tax incentives for first-time homebuyers, encouraging more people to purchase homes. The U.S. Department of Housing and Urban Development identifies that these initiatives have led to a 10% increase in homeownership rates over the past five years. Similarly, China's government has invested heavily in affordable housing projects, aiming to build millions of new housing units by 2025, as noted by the Ministry of Housing and Urban-Rural Development. These policies result in increased residential construction, subsequently driving the demand for cabinets in new homes.

MARKET RESTRAINTS

Economic Downturns

Economic slowdowns can significantly impact the cabinet market. During recessions, consumers tend to reduce spending on home renovations and new constructions. The International Monetary Fund observed that the global economy contracted by 3.5% in 2020 due to the COVID-19 pandemic. This contraction led to a decrease in housing starts and remodeling projects, reducing the demand for cabinets. Additionally, unemployment rates tend to rise during economic downturns, leading to decreased disposable income and, consequently, lower spending on non-essential items like new cabinetry. Manufacturers may face reduced sales volumes during these periods, affecting their profitability.

Fluctuating Raw Material Prices

The cost of raw materials, such as wood and metal, directly affects cabinet manufacturing. According to the World Bank, global timber prices increased by 15% in 2021 due to supply chain disruptions and increased demand. Such fluctuations can lead to higher production costs for cabinet makers, which may be passed on to consumers, potentially reducing demand. Additionally, volatile material prices can make it challenging for manufacturers to maintain consistent pricing strategies, affecting their competitiveness in the market. Companies may need to explore alternative materials or adjust their supply chains to mitigate these challenges.

MARKET OPPORTUNITIES

Technological Advancements in Manufacturing

The integration of technology in manufacturing presents significant opportunities for the cabinet market. The U.S. Department of Commerce says that adopting advanced manufacturing technologies can increase production efficiency by up to 30%. Implementing automation and robotics allows for precise and faster cabinet production, reducing labor costs and minimizing errors. Additionally, technologies like 3D printing enable manufacturers to create intricate designs and customized cabinets, catering to diverse consumer preferences. Embracing these advancements can lead to higher-quality products and the ability to meet increasing demand more effectively.

Sustainable and Eco-Friendly Products

Consumers are increasingly seeking environmentally friendly products. The Environmental Protection Agency notes that 75% of consumers consider sustainability when making purchasing decisions. Cabinet manufacturers can capitalize on this trend by using sustainable materials, such as reclaimed wood or low-VOC finishes. Additionally, obtaining certifications like the Forest Stewardship Council (FSC) label can enhance a company's reputation and appeal to eco-conscious customers. Offering green products not only meets consumer demand but also contributes to environmental conservation efforts, potentially opening new market segments.

MARKET CHALLENGES

Supply Chain Disruptions

Global supply chains are susceptible to disruptions from events like natural disasters or pandemics. The World Trade Organization reported a 5.3% decline in global trade volumes in 2020 due to COVID-19. Such disruptions can lead to shortages of essential materials, delaying production schedules for cabinet manufacturers. Dependence on international suppliers may exacerbate these issues which showcases the need for more resilient and localized supply chains. Companies must develop strategies to mitigate risks, such as diversifying suppliers or increasing inventory buffers, to maintain operational continuity during unforeseen events.

Skilled Labor Shortages

The cabinet market relies on skilled craftsmen for quality production. However, the U.S. Bureau of Labor Statistics projects a 3% decline in employment for carpenters from 2019 to 2029, indicating a shrinking workforce. This shortage can lead to increased labor costs and challenges in meeting production demands. Additionally, the lack of skilled workers may impact product quality, affecting customer satisfaction and brand reputation. To address this challenge, companies may need to invest in training programs or adopt automation technologies to compensate for the labor gap.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.79% |

|

Segments Covered |

By Type, End-User, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

American Woodmark Corporation, Fortune Brands Home & Security, Howden Joinery, Inter IKEA Holding SA, Nobia, Hanssem, LIXIL Sunwave, Takara Standard, Cleanup Corporation, Kohler Co., KraftMaid , and others |

SEGMENTAL ANALYSIS

By Type Insights

The Kitchen cabinets prevailed in the cabinet market and held a 60.8% market share in 2024. They are dominating because kitchens are central to homes and is driving demand for style and function. The U.S. Census Bureau reported a 6.9% rise in new home construction in 2023, with many needing kitchen upgrades. The National Kitchen & Bath Association states kitchen remodels accounted for 24% of a $79.63 million market in 2017. This exhibits their importance for storage and home appeal, making them a top choice for homeowners looking to improve living spaces efficiently.

The Home office cabinets segment is the rapidly expanding category with a CAGR of 6.4% during the forecast period. They’re rising due to increased remote work. The U.S. Bureau of Labor Statistics observes 37% of workers teleworked in 2023, up from 22% in 2019, boosting demand for organized workspaces. The U.S. Census Bureau indicates a 5.4% increase in home office renovations in 2022. These cabinets are vital for managing cables and clutter, supporting productivity as work-from-home trends grow, making them essential for modern home setups.

By End User Insights

The residential segment spearheaded the cabinet market by capturing a substantial portion of market share due to most cabinets are installed in homes for storage and design. The U.S. Census Bureau says 1.5 million new homes were built in 2023 are increasing cabinet needs. As per a report by the U.S. Department of Housing and Urban Development, $522 billion was spent on home improvements in 2022, often including cabinets. This shows their key role in enhancing home comfort and functionality for families across the country.

The commercial segment moves ahead at the fastest pace and is expected to grow with a CAGR of 6.6%. It is driven by rising demand in offices, hotels, and restaurants. The U.S. Bureau of Economic Analysis states commercial construction spending rose 8.2% in 2023. The U.S. Travel Association witnesses a 12% increase in hotel projects in 2022, needing efficient cabinets. These are crucial for storage and modern aesthetics in business spaces, supporting growth as commercial sectors expand to meet new demands and trends.

By Distribution Channel Insights

The Home centers segment led with a 45.8% market share in cabinet sales in 2024. They are popular because customers can see and test products firsthand. The U.S. Census Bureau states $448 billion in home improvement store sales in 2023. The U.S. Bureau of Labor Statistics says these stores employ over 1.2 million workers, providing expert advice. This makes them essential for trust and convenience, helping buyers choose cabinets confidently for home projects.

The Online stores segment is the fastest-growing channel with a CAGR of 10.7%.The growth comes from easy access and internet use. The U.S. Census Bureau says e-commerce sales hit $1.1 trillion in 2023, up 7.6%. The U.S. Department of Commerce shared that 89% of households had internet in 2022, aiding online shopping. These stores matter for their variety and fast delivery, appealing to busy customers seeking convenience in cabinet purchases.

REGIONAL ANALYSIS

North America commanded the cabinet market with a 40.5% market share in 2024. It is the biggest region as people spend a lot on home upgrades and new houses. The U.S. Census Bureau says 1.5 million homes started construction in 2023. The U.S. Department of Housing and Urban Development reports $522 billion went to home improvements in 2022. Many want stylish kitchens and better storage. The strong economy and love for home design keep North America ahead. This region is super important for cabinet companies looking to make big sales.

Asia-Pacific is moving forward at a fastest rate in the cabinet market with a CAGR of 6%. Cities are getting bigger and people have more money. The United Nations says 54% lived in urban areas in 2023 up from 50% in 2018. According to the World Bank, China’s GDP rose 5.2% in 2023 giving people more to spend. Small apartments need smart cabinets. This region matters a lot because urban growth means more homes need furniture fast. Companies can sell tons here as cities keep expanding.

Europe’s cabinet market will grow steadily over the next few years. The Eurostat agency says residential building went up 3.2% in 2023. People want modern eco-friendly cabinets for their homes. The push for energy-efficient living will help sales rise. Europe’s stable economy and focus on green design make it a solid market. Cabinet makers can expect good steady demand here. Countries like Germany, France, and the UK have strong economies that allow people to invest in high-quality home improvements. Additionally, European consumers prefer high-end, well-crafted cabinets, pushing manufacturers to focus on design and durability. With stable economic conditions and a growing preference for stylish, sustainable furniture, Europe remains a promising market for cabinet manufacturers and suppliers.

Latin America’s cabinet market will see moderate growth soon. The World Bank says 82% of people lived in cities in 2023. More homes and fixes will boost cabinet use. Growth won’t be fast but it will keep moving up. The region’s urban shift and steady building make it a decent spot for sales. However, economic challenges in some countries could slow rapid expansion. Affordability is a major factor, with many buyers preferring cost-effective, durable options over luxury designs. Local manufacturers have an advantage in supplying budget-friendly products, while international brands focus on high-end customers. Despite fluctuations in economic growth, urbanization and continuous housing development will keep Latin America’s cabinet market moving forward.

The Middle East and Africa will grow slowly but surely. The United Nations says construction spending reached $120 billion in 2023. Fancy homes and new cities need cabinets. Growth will take time as economies develop. This region offers chances for sales as building projects increase over the years. Countries like the UAE and Saudi Arabia are investing heavily in infrastructure and residential projects, leading to increased sales of high-end cabinets. Meanwhile, Africa’s developing economies are slowly boosting their housing sectors, creating future opportunities for cabinet manufacturers. However, economic disparities and slower income growth in some areas may limit mass adoption of premium products. Many consumers prioritize affordability, making the demand for low-cost, durable cabinets higher. As more construction projects emerge, the market will grow steadily, offering long-term potential for manufacturers.

KEY MARKET PARTICIPANTS AND COMPETITIVE LANDSCAPE

American Woodmark Corporation, Fortune Brands Home & Security, Howden Joinery, Inter IKEA Holding SA, Nobia, Hanssem, LIXIL Sunwave, Takara Standard, Cleanup Corporation, Kohler Co., KraftMaid are playing dominating role in the global cabinet market

The cabinet market is very competitive. Many companies make and sell cabinets for kitchens, bathrooms, and offices. Some companies focus on high-quality custom cabinets while others sell affordable ready-made options. Big companies like Oppein Home Group, Masco Corporation, and MasterBrand Cabinets lead the market. They have strong brands and large customer bases.

Smaller companies also compete by offering unique designs, lower prices, or fast delivery. Online shopping has changed the market. More people buy cabinets online, so companies work hard to improve their websites and online services. Digital marketing and customer reviews help businesses attract more buyers.

Innovation is important in this industry. Companies use new materials and designs to create cabinets that last longer and look better. Eco-friendly cabinets made from recycled wood or sustainable materials are becoming more popular. Partnerships with home improvement stores and builders help companies reach more customers. Some companies also expand to new countries to grow their business.

Price competition is strong. Some customers want cheap cabinets while others pay more for quality and design. Companies must balance cost, quality, and customer service to stay successful. The market will keep changing as new trends and technologies appear.

TOP 3 PLAYERS IN THE MARKET

Oppein Home Group Inc.

Oppein Home Group Inc., based in China, is recognized as one of the leading cabinet manufacturers globally. The company offers a comprehensive range of products, including kitchen cabinets, wardrobes, and customized home furniture. Oppein's growth strategy focuses on innovation and expanding its product lines to cater to diverse customer needs. Their significant contribution to the global cabinet market is evident through their extensive product offerings and commitment to quality, which have solidified their position as a top player in the market.

Masco Corporation

Masco Corporation, headquartered in the United States, is a prominent entity in the cabinet manufacturing sector. The company specializes in home improvement and building products, with a strong emphasis on kitchen and bath cabinetry. Masco's growth is driven by its focus on innovation, quality, and customer satisfaction. Their contribution to the global cabinet market includes offering a wide range of cabinetry solutions that cater to various consumer preferences, thereby enhancing their market share and influence in the market.

MasterBrand Cabinets Inc.

MasterBrand Cabinets Inc., a subsidiary of Fortune Brands Home & Security, is a leading cabinet manufacturer in the United States. The company offers a diverse portfolio of cabinetry products under various brands, catering to different market segments from stock to custom cabinetry. MasterBrand's growth strategy involves continuous product innovation and expansion into new markets. Their significant contribution to the global cabinet market is reflected in their ability to meet diverse consumer needs, thereby maintaining a strong market presence and driving industry standards.

STRATEGIES USED BY THE MARKET PLAYERS

Digital Marketing and Online Presence Enhancement

Leading cabinet manufacturers are increasingly investing in robust digital marketing strategies to strengthen their market position. By optimizing their websites for search engines (SEO), they improve visibility to potential customers searching for cabinetry solutions. Pay-per-click (PPC) advertising campaigns targeting specific keywords, such as "custom kitchen cabinets" or "bathroom vanity cabinets near me," attract highly motivated leads ready to make purchasing decisions. Additionally, active engagement on social media platforms allows these companies to showcase their craftsmanship, share customer testimonials, and interact directly with consumers, thereby building brand loyalty and expanding their reach.

Product Innovation and Customization

To meet evolving consumer preferences, top cabinet manufacturers focus on product innovation and offering customizable solutions. This approach includes developing new designs, incorporating sustainable materials, and providing a range of finishes and styles to cater to diverse tastes. By allowing customers to tailor products to their specific needs and preferences, companies enhance customer satisfaction and differentiate themselves from competitors. This strategy not only attracts a broader customer base but also fosters repeat business and positive word-of-mouth referrals.

Strategic Partnerships and Industry Collaborations

Establishing strategic partnerships with interior designers, architects, and home improvement retailers enables cabinet manufacturers to expand their market presence and reach new customer segments. Collaborations with market professionals facilitate the integration of cabinetry products into larger design projects, increasing brand visibility and credibility. Participating in market events, trade shows, and workshops also allows companies to showcase their products, stay updated on market trends, and network with potential business partners, thereby strengthening their position in the competitive cabinet market.

RECENT HAPPENINGS IN THE MARKET

- In March 2025, Moduline, a custom kitchen and cabinet manufacturer, submitted a development application to the Hinchinbrook Shire Council for a new 4,830 sqm factory. The facility will include automated storage, panel processing, machine shops, and a display area. This development aims to expand Moduline’s manufacturing capabilities and enhance its market presence.

MARKET SEGMENTATION

This research report on the global cabinet market has been segmented and sub-segmented based on type, end-user, distribution channel, and region.

By Type

- Kitchen Cabinets

- Bathroom Cabinets

- Entertainment Center Cabinets

- Home Office Cabinets

- Other Cabinets

By End User

- Residential

- Commercial

By Distribution Channel

- Home Centers

- Flagship Stores

- Specialty Stores

- Online Stores

- Other Distribution Channels

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the projected size of the global cabinet market by 2033?

The global cabinet market is expected to reach USD 201.27 billion by 2033

2. What factors are driving the growth of the global cabinet market?

Key drivers include increasing demand for home renovations, urbanization, and the growing need for space-efficient and aesthetically appealing cabinetry solutions. Additionally, advancements in materials and design are enhancing market growth.

3. Which regions are leading the demand for cabinets globally?

Regions like North America, Europe, and Asia-Pacific are significant contributors due to their large housing markets and increasing investments in residential and commercial infrastructure.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]