Global Butter and Ghee Market Size, Share, Trends & Growth Forecast Report By Volume (Imports and Exports), Distribution Channel (Retail Stores, Supermarkets, Hypermarkets) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis (2025 to 2033)

Global Butter and Ghee Market Size

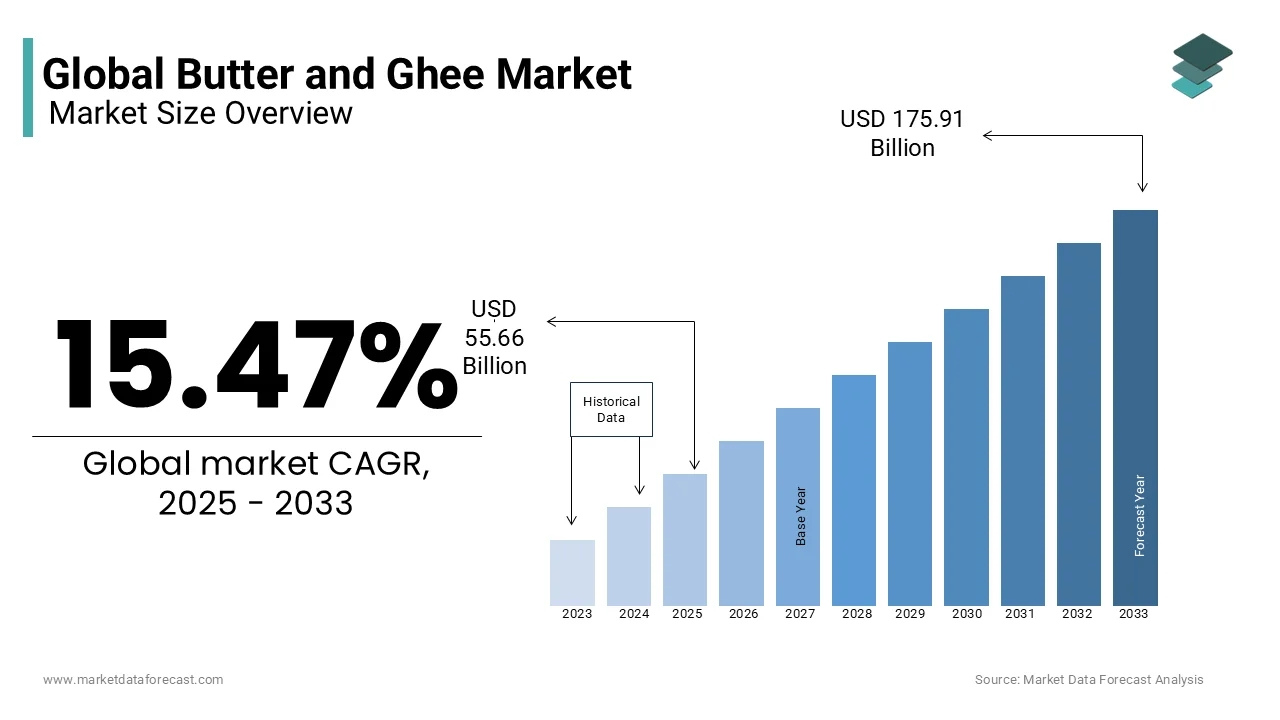

The Global Butter and Ghee market size was valued at USD 48.20 billion in 2024. The global market size is expected to reach USD 175.91 billion by 2033 from USD 55.66 billion in 2024. The market's promising CAGR for the predicted period is 15.47%.

The disposal of milk solids and water gives ghee a higher smoke point, which makes it appropriate for cooking at high temperatures. Ghee produced using bovine milk detoxifies and sustenance the body, helps vitality, and improves memory power. Then again, ghee sourced from wild ox's milk helps fortify the body, restoring eye issues and expanding the shine of the skin. In general, ghee has been utilized as a fundamental element for the arrangement of a few nourishment things, such as natural balms, for treating afflictions like rashes and minor consumptions.

The global butter and ghee market has been growing steadily over the last few years and is expected to continue the same trend during the forecast period. Ghee has experienced a re-emergence within the wellness and health community in the last few years. As consumers want an organic and wholesome substitute for processed raw materials, ghee becomes a leader, progressively accepting this for its culinary adaptability and nutritional prowess. According to the World Population Review, in butter, New Zealand commands the world community by quite a lot, with a consumption rate of about 3.9 kilograms per capita, and these figures have stayed relatively steady during the last few years. Other nations with greater consumption of butter are Iceland, Denmark, France, India, and Belarus. Butter and ghee are popular worldwide for their culinary and nutritional value and are used in various cuisines and dietary practices. The demand for butter and ghee has never gone down in the last decade as the usage of these products is continuously increasing due to their rich flavor profile and associated health benefits. In countries such as India, Pakistan, and Bangladesh, the demand for ghee is high as it is increasingly used in cooking and also holds cultural and religious significance. The consumption of butter is high in regions such as the United States, Canada, and various European nations, and these countries consider butter as a kitchen essential. During the forecast period, the demand for butter and ghee products is expected to soar further due to the changing preferences of consumers and increasing sales for these products over online platforms, which will propel global market growth. However, the growth rate of milk production in key regions has been declining. According to the University of Wisconsin-Madison, milk prices globally surged by 1.7 percent month-over-month, leading to 19.50 dollars per cwt of solid gathered milk for May 2024. Butter prices and SMP primarily fuel this rise.

MARKET DRIVERS

The growing population worldwide, rising disposable income, simple accessibility, and increasing awareness about the advantages of ghee have contributed to the expansion of the butter and ghee market. As per the World Population Review, the population of North America is 613 million, which grew from 598 million in 2015. The United States holds a 57 percent share of the region’s overall population. At present, ghee is seeing a heightening demand across the world because of an expansion in expendable wages, which has empowered buyers from lower salary gatherings to manage its cost. Furthermore, as ghee doesn't require refrigeration and is rack stable, it is favored over other choices, such as margarine. Aside from this, an ascent in the number of eateries offering customary Indian nourishment likewise gives a lift to ghee's general utilization. In addition, various specialists in the nation prescribe moderate usage of ghee every day as it helps decrease irritation, build solid bones, and improve assimilation. Be that as it may, the broad contamination of ghee, particularly with refined and hydrogenated vegetable oils, is upsetting the market development worldwide.

Comprehensively, the market for clarified butter is growing because of its improved properties over unsalted or ordinary butter and because of rising familiarity with its advantages among purchasers. Globalization has interconnected the world and has changed the taste examples of shoppers, making them additionally ready to find new dishes and make themselves mindful of the medical advantages being offered by the items/fixings they devour. Individuals are becoming more well-being cognizant and looking for items in their eating regimens that give them certain advantages. Because of the extensive use of clarified butter in the nourishment business and family unit, the market for ghee and butter is relied upon to develop in the determined period. Niter kibbeh, a prepared explained butter used in Ethiopian nations, and Manteiga-da-Terra, a Brazilian explained spread item, are broadly utilized structures in different parts of the world.

MARKET RESTRAINTS

Butter and ghee utilization in the U.S. expanded step by step over the period under survey on the background of populace development, rising creation of bread, pastry kitchen and dessert shop, just as growing nourishment industry in general; improving coordination and transportation of solidified items likewise, establish the variables. Then again, solid rivalry with substitute items like margarine obliges the market execution, particularly in bread and pastry kitchen fragments. Another limitation is expanding consciousness of substantial nourishment issues, which advances lessening the utilization of fats. No extreme changes are healthy in utilization designs with respect to butter; in this way, the butter and ghee market is relied upon to hold its present pattern and increment on regular by +1.6% every year from 2018 to 2025, which ought to carry the market volume to 967K tons by 2025.

The utilization of ghee has expanded, as it is plentiful in fat solvent nutrients A, D, and E, helps in building solid bones, improves absorption, and decreases aggravation. The plenty of medical advantages and high entrance into the developing business sector are the key drivers of the global butter and ghee market development. Further, high discretionary cash flow and populace blast are relied upon to introduce rewarding chances to showcase players. Be that as it may, overconsumption of ghee could prompt cardiovascular illnesses, which is also negatively impacting the growth of the global butter and ghee market.

MARKET OPPORTUNITIES

Food production without agriculture is expected to have potential opportunities for the expansion of the butter and ghee market. Health is one of the key reasons why animal-free butter is needed. Another trend justifying this is the growing popularity of vegan butter due to rising awareness about health and well-being. So, in the coming years, the demand for animal-based butter is believed to elevate further. The enormous amount of food made by agriculture worldwide involves, accordingly, large areas of land that are not accessible to natural ecosystems, greenhouse gases (GHGs) that emirate the environment, and water resources that are utilized and contaminated. Measures to lower such effects are needed. A growing number of scientific research and commercial projects in 2024 have shown that consumable compounds can be produced through chemical and biological methods without relying on agricultural resources. According to a study Published in Nature Sustainability, palm oil and soy are currently the two biggest oil crop emitters of GHGs and users of agricultural land. Specifically, soybeans cultivated in Argentina, Brazil, and the United States account for 79 Mha (i.e., 65 percent of land utilized globally for palm oil), and contributing to these, the oil palm made in Malaysia and Indonesia represent 1.26 Gt CO2-eq discharge every year (about 78 percent of land-use discharge worldwide from palm oil and soy agriculture).

MARKET CHALLENGES

The growing misconception and misunderstanding impede the expansion of the butter and ghee market. A common belief is that ghee considerably increases levels of bad cholesterol (LDL), thus raising the danger of heart disease. This understanding originated from elevated levels of saturated fat. According to a systematic literature search on PubMed, between 1st January 1990 and 10th April 2023, it was found that 246 articles were written; of these, 83 were duplicate ones that were removed. An extra 54 papers were considered unrelated after a complete assessment of their abstracts and titles. In the end, 109 studies that satisfy the selection parameters were involved in this review. Moreover, there are several gaps between modern literature and classical Ayurveda, which causes different opinions and beliefs in society. Like, Ayurveda focuses on the gastrointestinal (GI) health advantages of ghee, which holds around 11 percent of its references; on the other hand, advanced scientific literature emphasizes this beneficial region in less than 1 percent of studies. Therefore, this substantially affects the growth rate of this market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

15.47% |

|

Segments Covered |

By Volume, Distributional Channel and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Terra Food LLC, Avn Products, SEWRI Trading Company, Worldlink Entt, Mousa Al Mazim General Trading, Umang Dairies Limited, Prime Lac Supplies, Export Company MARSHO |

SEGMENTAL ANALYSIS

By Volume Insights

The import segment is the more prominent category and is believed to witness significant developments in the forecast period for the butter and ghee market. The decline in milk production across the world is the primary reason behind the increasing import of dairy products, including ghee and butter. This led to a surge in the segment’s market share. According to the International Farm Comparison Network (IFCN), in the last two decades, milk production was at its lowest point in 2022. There was an exceptionally low supply growth of only +0.8 percent in 2022, different from the long-term average of 2.3 percent from 2001 to 2021. Severe weather phenomena and inflation affected the entire sector and, thus, the producers. Both were found to be a main challenge in several regions worldwide.

By Distributional Channel Insights

The supermarket segment is leading the offline distribution channel with a notable share of the butter and ghee market. Despite the fast growth of online channels, this segment continues to stay relevant in the market. This is because, most of the time, discounts are available on these items in stores, and there are high delivery and other costs in quick or instant delivery in online grocery apps. However, due to the cost of living crisis and inflation, the sale of these products has decreased to an extent. For instance, the interim financial results of the AUGA group for the 1 year ended 31 December 2023 were released, showing lower performance of the dairy segment.

REGIONAL ANALYSIS

Asia Pacific is leading the butter and ghee market and is expected to maintain its position during the forecast period. India is commanding the regional market growth as the largest producer of ghee. As per IFCN research, India continues to be the biggest producer of milk. But, in 2022, its growth rate was just 2 percent in contrast to 5.2 percent in the last 10 years. The region also imports a major amount of butter and ghee due to a reduction in milk production. Other key players in the APAC market are New Zealand, China, and Australia. Hence, the Asia Pacific is anticipated to expand in the estimation period.

North America holds a significant share of the butter and ghee market. According to the U.S. Dairy Export Council, in April 2024, the year-over-year (YOY) dairy exports in milk solids equivalent terms (MSE) by the country increased by 3 percent. The shipments of U.S. butterfat, including anhydrous milkfat (AMF) and butter also surged, experiencing their foremost monthly YOY rise since November 2022. The exports of butter climbed 23 percent, i.e., more than 481 MT, and AMF quantity over twofold (+399 MT). The U.S. sent out 34K vast amounts of butter in 2017, which equaled $139M; this number, be that as it may, represented just 4% of U.S. Butter yield. The volume of fares roller-drifted over the period under survey, yet in the course of the most recent three years, it had been expanding bit by bit in the wake of bottoming out in 2015. In 2017, Canada (15K tons) established the principal goal of U.S. Butter trades, with a portion of 43% of the complete figure. Mexico (4K tons) remains the second significant goal, with a share of 12%. From 2007-2017, the offer traded to Canada expanded (+39 rate focuses), while the proposal sent to Mexico remained moderately unaltered. Outside these two heads, in 2024, American butter is being sent out to Saudi Arabia, Korea, Egypt, Peru, and different nations; every one of these provisions stays irrelevant and doesn't influence the market fundamentally.

Ireland rose as the biggest provider of spread to the U.S. The volume of absolute U.S. spread imports totaled 46K tons in 2017, expanding quickly in the course of the most recent year. In terms of esteem, it was compared to $238M. Imports took off recognizably from 2014 to 2017, driven by expanding supplies of Irish butter; be that as it may, these volumes stay irrelevant in the entire market scale. Consequently, Ireland (23K tons) developed as a critical provider of spread into the U.S., containing approx. 47% of absolute U.S. imports in 2017. Given that substantial development, Ireland outstepped New Zealand regarding the volume of imports. New Zealand currently positioned second with 6.5K tons in 2017, which represented 14% of the total imports. The portion of New Zealand diminished significantly by - 40 rate focuses against 2007. Mexico (6.2K tons) comprised the third most prominent provider of butter, with its offer expanding from 1% in 2007 to 13% in 2017.

KEY MARKET PARTICIPANTS

Companies playing a notable role in the global butter and ghee market include Terra Food LLC, Avn Products, SEWRI Trading Company, Worldlink Entt, Mousa Al Mazim General Trading, Umang Dairies Limited, Prime Lac Supplies and Export Company MARSHO.

RECENT HAPPENINGS IN THE MARKET

- In July 2024, Savor, a California-based start-up, reported that it had made a special butter. This is an animal-free butter and is made from carbon dioxide. The company asserts that it tastes the same as traditional butter. For this, it utilizes a thermochemical procedure, which separates carbon dioxide from the air and merges it with oxygen and hydrogen to make fat synthetically.

- Tridge is a global trade ecosystem in the food and agriculture industry that combines professional networks and data intelligence to make trustworthy products. They have the complete import data for Ghee Butter, including top importing countries, import markets, and average import prices.

- Indian dairy producer Creamy Foods Limited, based in Uttar-Pradesh, has purchased GEA's first BUE butter manufacturer. The BUE 6000 will enter service in February 2019 with other Allied equipment.

MARKET SEGMENTATION

This research report on the global butter and ghee market has been segmented and sub-segmented based on volume, distribution channel, and region.

By Volume

- Imports

- Exports

By Distribution channels

- Retail Stores

- Supermarkets

- Hypermarkets

- E-retailers

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the expected market size of the Global Butter and Ghee Market by 2033?

The market is projected to reach USD 175.91 billion by 2033.

2. Which region is leading the global Butter and Ghee Market?

The Asia Pacific region is leading the Butter and Ghee Market and is expected to maintain its position during the forecast period.

3. Which companies are playing a notable role in the global Butter and Ghee Market?

Several key companies are contributing to the growth of the global Butter and Ghee Market, including Terra Food LLC, Avn Products, SEWRI Trading Company, Worldlink Entt, Mousa Al Mazim General Trading, Umang Dairies Limited, Prime Lac Supplies and Export Company, and MARSHO.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]