Global Business Management Consulting Service Market Size, Share, Trends & Growth Forecast Report by Type (Operations Advisory, Financial Advisory, Technology Advisory, Strategy Advisory and HR Advisory), Target (First, Second and Third Tiers) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Business Management Consulting Service Market Size

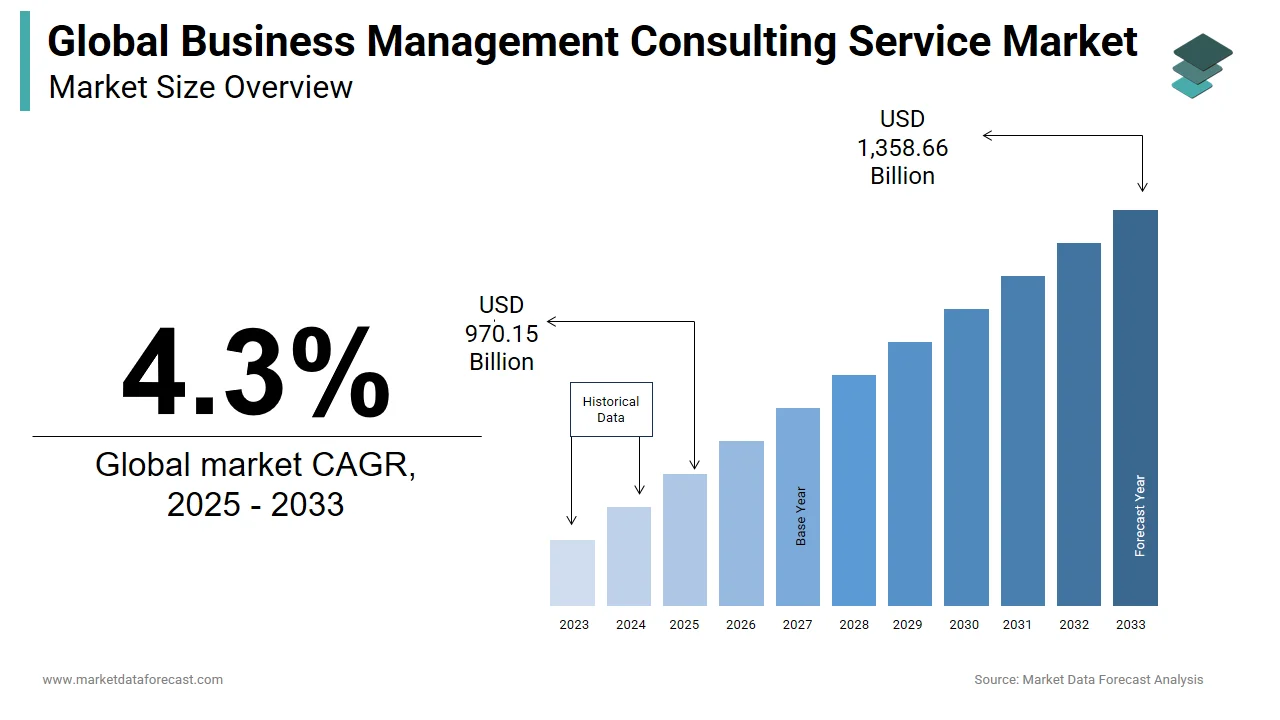

The global business management consulting services market was worth USD 930.15 billion in 2024. The global market is estimated to grow at a CAGR of 4.3% from 2025 to 2033 and be worth USD 1,358.6 billion by 2033 from USD 970.15 billion in 2025.

The demand for consulting services is fueled by the need for outside help from several enterprises, charitable organizations, and government agencies. Business management consulting advises organizations on the best ways to manage and operate their company. Management consulting organizations provide recommendations on a local and worldwide level to assist businesses in developing acceptable strategies to launch, evolve, and cut costs. The business management consulting service market comprises entities that sell management consulting and related goods and provide advice and assistance on organizational planning, financial budgeting, marketing strategies, human resource practices, administration policies, and production and logistics scheduling.

MARKET DRIVERS

Organizations continuously attempt to cut expenses and improve efficiency so that cost savings can be passed on to customers to stay competitive.

As a result, demand for business process improvements and operational efficiency consultancy is increasing. Agile, Artificial Intelligence, and analytics are three technical skill sets that MNCs actively seek consulting advice for. In addition, corporate buyers are increasingly interested in digital marketing and transformation consulting as product and service companies invest more in user experience design, customer-focused data analytics, and customer engagement tactics.

Regulatory developments such as the US Tax Reform, BREXIT, and the EU GDPR (General Data Protection Regulation) have increased consulting demand across all main service lines. Multinationals will seek high-value assistance to be compliant with regulations, fuelling demand for management and law consulting.

MARKET RESTRAINTS

The significant growth of the freelance consulting industry can be attributed to the pricing and flexibility afforded by independent/freelance consultants.

For instance, separate consulting accounts for 10% of the USD 10 billion consulting sector in the United Kingdom. As a result, traditional consulting firm/industry revenues are projected to be eaten up by the consulting freelance industry soon. Large corporations are forming in-house consulting units and promoting former consultants to senior roles, reducing their need for outside consultants. Time constraints for cultivating client relationships, consultants' desire to give more value to clients at the exact cost, and insufficient time to adequately respond to client RFIs/RFPs are a few more factors limiting the consulting sector's growth, revenues, and clientele. In the Internet age, consultants' tools, templates, and models, considered intellectual capital, can no longer be kept private. In addition, the consulting industry is affected by the democratization of knowledge.

The market's growth may also be hampered by rising costs, shrinking margins, and improvements in artificial intelligence, with the idea of replacing management consultants.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.3% |

|

Segments Covered |

By Type, Target, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Bain & Co, Boston Consulting Group, McKinsey & Company, EY, Kearney, L. E. K. Consulting, Oliver Wyman, Roland Berger, Accenture, Booz Allen Hamilton, KPMG, PwC Consulting, and others |

SEGMENTAL ANALYSIS

By Type Insights

During the forecast period, the strategy advisory segment is expected to have strong growth. Depending on the organization's demands, the service comprises providing advice on strategy concepts such as business strategy and operational approaches, all while maintaining adequate time management. In addition, professionals in the industry are attempting to determine the best course to adapt to emerging developments such as artificial intelligence, analytics, cybersecurity, and digital transformation.

By Target Insights

The target market is bifurcated into the first tier, the second tier, and the third tier. Customers in the first tier, those with revenues of more than $3 million, are more accustomed to outsourcing and may feel more at ease employing Growth Management and Strategies on a retainer basis. Strategically, a retainer helps sustain steady cash flow, even if these customers require more services than they have paid for in any given month. This issue will be discussed further in the Personnel section.

Customers in the second tier, with revenues ranging from $501K to $3 million, are often ecstatic to have progressed from the home office stage to a new level of stability. These businesses can be the most difficult to work with if they are self-funded because they are typically unwilling to part with company shares and still need to understand what kind of marketing expenditure is required to expand a business at this time. Based on a bid cycle and a needs study, the company will serve these small enterprises.

Customers on the third tier are more accessible to spot and more common than the others. These small firms make between $200K and $500K in revenue, are generally run from home, and have a solid understanding of their market and potential, but struggle to execute their plans successfully or follow through on wealth-generating growth initiatives. To maintain a steady revenue stream, the idea is to supply these enterprises with a quick needs analysis and focus on such clients.

REGIONAL ANALYSIS

In 2020, Western Europe dominated the worldwide management consulting services industry, accounting for 45 percent of the total. The second-largest area, North America, accounted for 29% of the market. Africa was the smallest region in the global management consulting services market.

During the forecast timeline, the APAC Business Management Consulting Services market is expected to increase at a compound annual growth rate (CAGR) of 2.8 percent, reaching US$106.4 billion. China, closely followed by Australia, was the largest market for consulting services in the Asia-Pacific region. The Chinese market was estimated to be worth 5.9 billion dollars, while the Australian market was worth 5.8 billion dollars. Beyond 2021, Japan will be the second-largest country, with a market share of 28.8%, followed by India with an 8.5% market share. The growing e-commerce industry has increased the need for hardware and software solutions in the IT and telecom industries, resulting in the growth of the system design and integration market. Furthermore, the rise of local specialized suppliers and the growing presence of global technology vendors would propel the system design and integration market forward.

The European consulting market is expanding healthily, with management consulting services in Eastern Europe seeing increasing uptake. In the previous five years, lesser-known European countries such as Romania, Ukraine, Bulgaria, and Poland have experienced rapid growth. In comparison to Western countries, the market in these countries has roughly doubled. The realization of the high-value proposition of management consulting, even in countries with limited financial resources, is a significant element. Financial consultancy is the region's fastest-growing industry, as large corporations compete for the net tax credit.

Brazil is by far the most critical market in South America. However, due to recent political and economic difficulties, the market has grown slower than the rest of the continent. As a result, the growth of the much smaller markets of Argentina, Chile, and Colombia has surpassed that of Brazil.

The United States (US) is the world's largest revenue-generating consulting service market because it is home to top global consultant companies that serve a wide range of end-user verticals. Furthermore, the highly unpredictable market across the US economy, combined with ongoing government regulatory reforms, is leading corporations to seek aid in their financial operations across the country from management consulting firms. As a result, there will be approximately 734,000 management consultants in 2020. The most pressing issue in the regional industry is attracting and creating new enterprises, with 40% of senior executives considering this a top challenge.

KEY MARKET PLAYERS

Companies playing a leading role in the global business management consulting service market include Bain & Co., Boston Consulting Group, McKinsey & Company, EY, Kearney, L. E. K. Consulting, Oliver Wyman, Roland Berger, Accenture, Booz Allen Hamilton, KPM,G and PwC Consulting. Deloitte is the most prominent consulting firm in the world, with an annual revenue of $47.6 billion.

RECENT MARKET HAPPENINGS

- Today, Oliver Wyman, a worldwide management consulting firm and a Marsh McLennan subsidiary, announced that it has agreed to buy Huron's biosciences strategy consulting practice. Huron is known for its skilled life sciences strategy work, which includes assisting customers with their most demanding commercial, marketing, pricing, market access, and R&D dilemmas. Therefore, many of the world's most prominent pharmaceutical, biotechnology, diagnostics, and medical device firms have long trusted Huron's senior specialists as trusted consultants.

- All for One Group SE, a major IT/SAP, strategy, and management consulting firm listed on the Frankfurt Stock Exchange's Prime Standard, has agreed to buy out all of the shares of ASC Management Consulting AG and Advanced Solutions Consulting GmbH, both based in Switzerland.

- In October 2021, Deloitte purchased Odysseus, a firm that specializes in building and delivering ServiceNow solutions. Odysseus will become part of Deloitte's Consulting business, specifically the Technology unit.

- Umlaut, an engineering consulting and services firm in Aachen, Germany, has been acquired by Accenture. The move will significantly expand Accenture's deep engineering capabilities, enabling companies to utilize digital technologies such as cloud, artificial intelligence, and 5G to transform how they design, engineer, and manufacture products while embedding sustainability.

MARKET SEGMENTATION

This research report on the global business management consulting service market has been segmented and sub-segmented based on type, target, and region.

By Type

- Operations Advisory

- Financial Advisory

- Technology Advisory

- Strategy Advisory

- HR Advisory

By Target

- First Tier

- Second Tier

- Third Tier

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Frequently Asked Questions

What are the key drivers of growth in the Business Management Consulting Service market?

Key drivers of growth include globalization, digital transformation, regulatory changes, the increasing complexity of business operations, and the need for companies to remain competitive through strategic improvements.

How has digital transformation impacted the Business Management Consulting Service market?

Digital transformation has significantly impacted the market by increasing demand for consulting services related to IT strategy, cybersecurity, data analytics, and digital marketing. Consulting firms are now integrating digital solutions into their service offerings to help clients navigate and leverage technological advancements.

What are the primary challenges faced by the Business Management Consulting Service market?

Primary challenges include the high level of competition, the need for continuous innovation, maintaining a skilled workforce, adapting to regulatory changes, and managing client expectations in a rapidly changing business environment.

What future trends are expected to shape the Business Management Consulting Service market?

Future trends include increased adoption of artificial intelligence and machine learning, greater emphasis on cybersecurity consulting, the rise of remote consulting services, and a focus on innovation and agile business models to respond to dynamic market conditions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]