Global Buckwheat Market Size, Share, Trends & Growth Forecast Report - Segmented By Application (Beverage Industry, Food Industry, Textile Industry, Cosmetics Industry And Others), Form (Raw, Unhulled And Roasted), Distribution Channel (Retailers, Supermarkets, Convenience Stores, Online Stores And Others) And Region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa, and Rest of the world) – Industry Analysis (2024 to 2032)

Global Buckwheat Market Size (2024 to 2032)

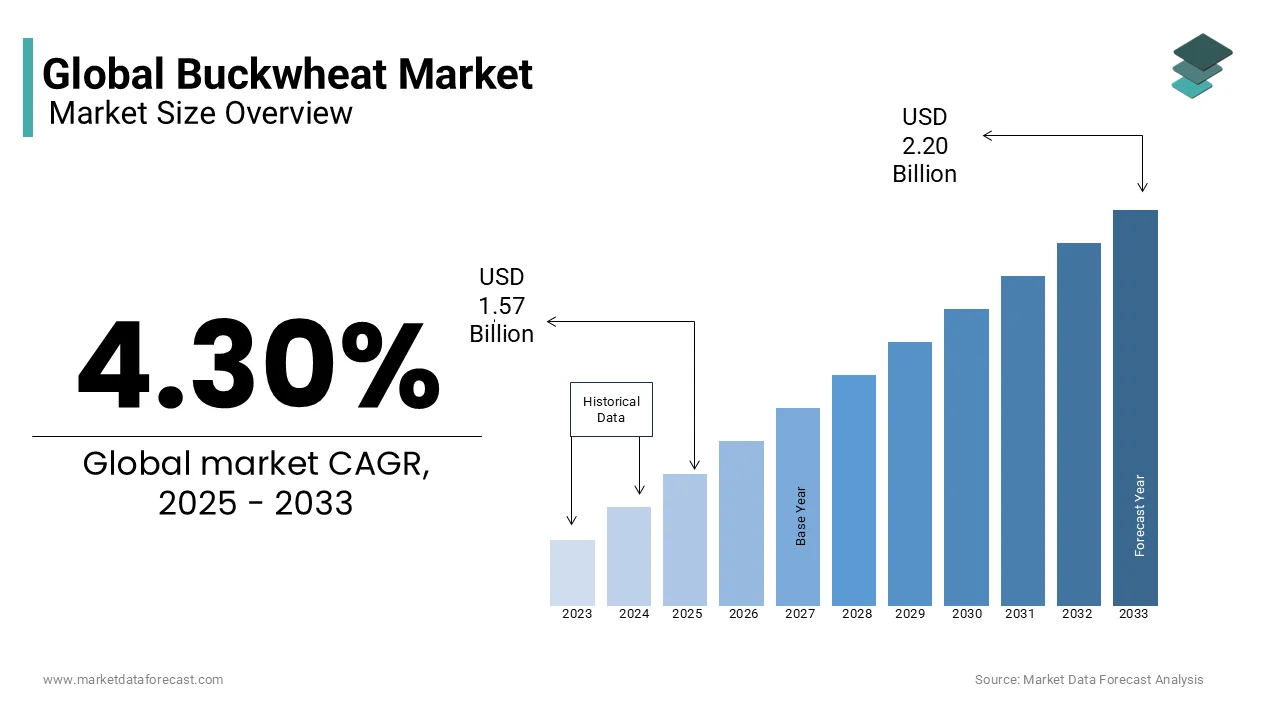

The size of the global buckwheat market is estimated to grow from USD 1.5 billion in 2024 to USD 2.10 billion in 2032, with a CAGR of 4.3% throughout the foreseen period (2024 to 2032).

Current Scenario of The Global Buckwheat Market

The buckwheat market is steadily growing with Asia Pacific and Europe being the potential. Additionally, due to the excess supply of buckwheat in Lithuania and Poland from 2022 and 2023.

There was a record harvest in Poland in 2022 but the supply reduced majorly in 2023 because of low yield. In recent times, the demand for buckwheat-based foods has surged due to several nutritious properties and health advantages. Also, there is rising traction for gluten-free products has led to growing consumption of buckwheat as it can be utilized for manufacturing these foods.

Moreover, buckwheat farming is economically and environmentally sustainable owing to the minimization of the application of agricultural materials like artificial fertilizers, chemicals, and fossil fuels. Further, a 2021 study states that buckwheat requires less irrigation and helps the problem of freshwater scarcity. This also reduces harmful environmental effects, which improve the ecosystem and habitats worldwide. Additionally, it enhances soil qualities such as porosity, water retention, texture, and nutrient content. However, considering the sudden climate changes and other global warming impacts the thin roots of buckwheat can get damaged, as per an August 2023 study. Also, common buckwheat is more climate-sensitive than Tartary buckwheat since there are considerable differences between species.

Buckwheat is popular for its nutritional value, versatility, and resilience in diverse climates. Buckwheat contains a good amount of protein, fiber and essential minerals and is used in a variety of cuisines worldwide. The usage of buckwheat is high in the regions where gluten-free alternatives are sought after. The global buckwheat market has experienced prominent growth in recent years. The growing number of health-conscious people and trends in dietary diversity have been contributing to the global buckwheat market, and these trends are likely to continue driving the global market growth during the forecast period. Across the world, high production and consumption of buckwheat can be noticed in China, Russia, Ukraine and Poland. In China, buckwheat has a special place and is being used in various dishes that range from noodles to pancakes. In Russia and Ukraine as well, buckwheat is one of the most commonly used ingredients in the cooking and holds importance in traditional dishes like Kasha. The consumption of buckwheat is expected to surge in the coming years due to the increasing awareness among consumers regarding the nutritional potential of buckwheat and the potential role that buckwheat can play in addressing the food security challenges and the global buckwheat market is estimated to witness steady growth during the forecast period.

MARKET DRIVERS

The rising awareness of the nutritional profile of buckwheat is majorly propelling global market growth.

Increasing demand for healthy and nutritional food products due to increasing health awareness is increasing the demand for buckwheat and its products. Several applications of buckwheat in the beverage and cosmetics industry and growing demand for gluten-free and organic food are expected to drive the buckwheat market.

The ability of buckwheat to treat varicose veins is a primary factor driving the global buckwheat market expansion.

The prevalence of varicose vein conditions has increased worldwide for a number of reasons, including factors of age, obesity, pregnancy, and standing and sitting cross-legged for a more extended period. For example, according to the International Journal of Research in Medical Sciences, in India, 46.7% of women and 27.8% of men suffered from varicose veins, and 49.3% of women and 18.9% of men had symptoms. The aspect driving the growth of the market is venous buckwheat which is also known to help treat obesity, cardiovascular disease, and arthritis. As per the National Center for Chronic Disease Prevention and Health Promotion, about 610,000 individuals suffer from heart disease each year in the United States, which means that one in four deaths is due to heart disease. Based on this fact, coronary heart disease is among the most common forms of heart disease, resulting in the death of more than 370,000 people a year.

The increase in the geriatric population, the increased incidence of sports-related injuries, bone density problems, and a deficiency of various minerals, vitamins, and essential fats due to unhealthy lifestyles and work schedules are some additional factors that lead to various chronic musculoskeletal problems. For example, according to a report, in 2017, people over 60 made up 13% of the world's total population, which has registered around 962 million people, and that number is expected to reach 1.4 billion in 2030 and reach 2.1 billion by 2050. Manufacturers aiming to make their products visible to a broader consumer base and selling products on e-commerce platforms and mobile apps and applying sound marketing strategies are currently a key trend seen in the market. This development is anticipated to gain popularity in the upcoming years and significantly boost growth in the global market.

MARKET RESTRAINTS

However, the decrease in the production of buckwheat in recent years due to the availability of alternative ways to improve soil fertility and reported issues of allergic reactions to buckwheat products are restraining market growth. Decreased buckwheat production, the availability of compromised or adulterated quality buckwheat, and buckwheat as a potential allergen for some people are some of the factors that could slow the growth of the market. Furthermore, high-quality buckwheat is expensive, which might also restrain the market. Also, to some extent, the market could be hampered by a lack of awareness about buckwheat, its benefits, and the availability of other superfoods.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

4.3% |

|

Segments Covered |

By Application, Form, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Birkett Mills, Krishna India, Homestead Organics, UA Global Inc, Galinta IR Partneriai, Ningxia Newfield Foods, Sichuan Huantai Industrial, Wels Ltd, Jinan Jinnuoankang Biotech. |

SEGMENTAL ANALYSIS

Global Buckwheat Market Analysis By Application

The food segment was the biggest segment by application in the global market and captured a share of 51.9% of the worldwide market share in 2023.

The domination of the food segment in the global market is likely to continue throughout the forecast period. Buckwheat is a staple ingredient in various dishes and the usage of buckwheat in the food industry has been gradually growing over the last few years. Snacks, breakfast, flour, cereals and noodles are commonly known for their nutrients among people. Also, an individual’s sensitivity to gluten is attracting them towards such foods. Moreover, the rising need for buckwheat extract in beauty products because of its antioxidant qualities is elevating the market growth. Further, goods aiming especially at highlighting skin renewal, skin aging, and brightening are pushing forward the market considerably. In addition, the textile industry is also the end-user of buckwheat seeds for several applications. Cushions and pillows use this as filling materials. The mattresses manufacturing is fuelling the buckwheat demand greatly owing to their steadiness and capability to adapt to the body’s shape. The rising trend of healthy and nutritious food is influencing the segment’s market share. The rising interest from consumers for gluten-free and allergen-friendly food options, the growing popularity of buckwheat-based products among individuals with dietary restrictions, and increasing awareness among people regarding the nutritional profile of buckwheat such as high fiber content, essential amino acids and beneficial effects on heart health are majorly driving the growth of the food segment in the global market.

On the other hand, the cosmetics segment is predicted to grow at the fastest CAGR in the global buckwheat market during the forecast period.

The usage of buckwheat in the skincare formulations has seen a rise in the recent years. Buckwheat extracts various skin-friendly properties such as antioxidant properties, skin-soothing benefits, and potential anti-aging effects, and this awareness among the manufacturers of skincare products has increased considerably and resulted in high usage. This trend is expected to accelerate in the coming years and boost the expansion of the cosmetics segment in the global market during the forecast period. Furthermore, factors such as an increase in the demand for natural and plant-based skincare solutions and the rising popularity of clean beauty are anticipated to propel the growth of the cosmetics segment in the global market.

Global Buckwheat Market Analysis By Form

The raw grains segment led the buckwheat market in 2023, accounting for 40.7% of the global market share, and is estimated to register a healthy CAGR during the forecast period.

Raw buckwheat grains have a longstanding tradition and are being used in a variety of dishes worldwide that include soups, salads, and porridge. This is because of the rising awareness of health benefits. Also, customers are looking for wholesome foods such as Weet Bix multigrain owing to its mix of four raw grains, more digestible fiber and important vitamins and minerals. Moreover, Europe is one of the potential markets because of the increasing attention towards speciality and healthy grains with value addition are raising the significance in the regional industry. The growing interest from consumers for whole grains and plant-based foods is propelling the growth of the raw grains segment in the global market. For instance, an estimated 25% of the consumers who are into plant-based diets prefer to consume raw buckwheat grains as part of their diet. An increase in the awareness of the health benefits of raw buckwheat grains is further boosting the growth rate of the segment in the global market.

On the other hand, the roasted grains segment is also projected to register a healthy CAGR in the global market in the coming years. The busy lifestyles have shifted the consumer preference for handy and ready-made food choices, which is contributing to the growth of the roasted grains segment in the global market.

The Unhulled segment held a substantial share of the global market in 2023 and is predicted to grow at a promising CAGR during the forecast period. Unhulled buckwheat grains have gained recognition as a traditional and culturally significant ingredient. An increase in the preference from consumers for ancient grains and heritage foods and growing awareness of gluten-free diets and the suitability of buckwheat as a gluten-free alternative in various culinary applications are promoting the growth of the Unhulled segment in the global market.

Global Buckwheat Market Analysis By Distribution Channel

The supermarkets segment dominated the market in 2023 and had 42.7% of the global market share and the supremacy of the supermarkets segment is expected to continue during the forecast period.

Supermarkets are the major distribution centers for the buckwheat market. Japan, China and Russia have the highest demand for buckwheat products. Moreover, in Japan, MaxValu, Life, York, Valor and Maruestu are the top supermarkets accounting for around 20 percent of this distribution channel. Also, there is a strong regional presence of these big supermarket chains serving multiple consumer segments. But, this segment is anticipated to witness stagnation in the coming five years because online grocery platforms or shopping is rapidly growing. So, online stores with home delivery services are sharply expanding due to the increase in the use of smartphones and access to stable internet connections. Supermarkets are one of the major distribution channels for buckwheat products. The domination of the supermarket segment is primarily attributed to the convenience of one-stop shopping for groceries and the expanding global footprint of supermarket chains.

The retailer segment is another major segment and is projected to grow at a steady CAGR during the forecast period. Factors such as rising interest in healthy and sustainable food options, increasing demand for gluten-free and plant-based products, and the convenience of shopping at brick-and-mortar stores are boosting the growth of the retailer segment in the global market.

REGIONAL ANALYSIS

Asia-Pacific (APAC) buckwheat market is estimated to represent a significant part in terms of rate in the market.

Due to the consumption of buckwheat and high production in the regions, particularly in China in this region. The raising awareness of the health benefits of consuming buckwheat and multi-country APAC-based products, increasing income levels and willingness to spend on superfoods, and the availability of products on the e-commerce platform are critical factors estimated to drive the growth of the APAC Buckwheat market in large measure.

North American buckwheat market is anticipated to experience a high growth rate due to the growing preference for superfoods, the prevalence of various diseases and lifestyle disorders, and the ability to spend in the market of North America.

Furthermore, the strength of buckwheat to treat varicose veins is associated with more people suffering from varicose vein problems for various reasons, such as obesity, age factors, the nature of work, pregnancy, etc. They are additional factors that drive demand for buckwheat products. For example, according to a report published by the American Society for Vascular Surgery, at least 20 to 25 million people in the United States suffer from varicose veins. In addition, statistics show that almost 17% of the male population and nearly 33% of the female population suffer from this disease. According to research in the Vascular Diseases Foundation Newsletter, in the spring of 2005, many people could not lead a healthy life due to varicose disorder compared to people with high blood pressure.

The European market is assumed to achieve a significantly higher share of the world market.

Due to the increased consumption of buckwheat and high levels of production and harvest in Eastern Europe, where it is commonly called "Kasha". MEA and Latin American markets are foreseen to have a moderately high-value share in the target market, due to increased awareness of healthy foods. Still, the presence of several low-income and underdeveloped countries could hamper demands for buckwheat in the regions.

KEY PLAYERS IN THE BUCKWHEAT MARKET

Birkett Mills, Krishna India, Homestead Organics, UA Global Inc, Galinta IR Partneriai, Ningxia Newfield Foods, Sichuan Huantai Industrial, Wels Ltd and Jinan Jinnuoankang Biotech are some of the prominent players in the global buckwheat market.

RECENT HAPPENINGS IN THE MARKET

- In December 2023, Big Bold Health, a U.S.-based company that manufacturers various wellness products launched their product called “100% Organic Himalayan Tartary Buckwheat Sprout Powder,” which promotes the immune system and contributes to the gur and microbiome health.

- In November 2023, researchers at the University of New Hampshire are exploring a new crop, which will be a particular buckwheat type and could develop further in more unsettled weather.

- In September 2023, Maine Crisp rebranded as Better With Buckwheat. It will inherit the product line of Maine Crisp and launch buckwheat-based innovations in extra snacking segments for gluten-free producers.

DETAILED SEGMENTATION OF GLOBAL BUCKWHEAT MARKET IS INCLUDED IN THIS REPORT

This research report on the global buckwheat market has been segmented and sub-segmented based on Application, Form, Distribution Channel, ®ion.

By Application

- Beverage Industry

- Food Industry

- Textile Industry

- Cosmetics Industry

- Other applications

By Form

- Raw Grains

- Unhulled Grains

- Roasted Grains

By Distribution Channel

- Retailers

- Supermarkets

- Convenience stores

- Online stores

- Other Channels

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East, and Africa

Frequently Asked Questions

1.What is buckwheat?

Buckwheat is a pseudo-cereal grain that is often used as a substitute for wheat in cooking. It's gluten-free and has a unique, nutty flavor.

2.Where is buckwheat grown?

Buckwheat is grown in various parts of the world, including Russia, China, Ukraine, and the United States. It thrives in cooler climates and is often grown as a cover crop or in rotation with other crops.

3.What are the health benefits of buckwheat?

Buckwheat is rich in nutrients like protein, fiber, and various minerals. It's also gluten-free, making it a good option for people with celiac disease or gluten sensitivity. Additionally, it has been linked to improved heart health and better blood sugar control.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]