Global Brushless Dc Motor Market Size, Share, Trends, & Growth Forecast Report By Type (Inner Rotor and Outer Rotor), End-User, Speed, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Brushless DC Motor Market Size

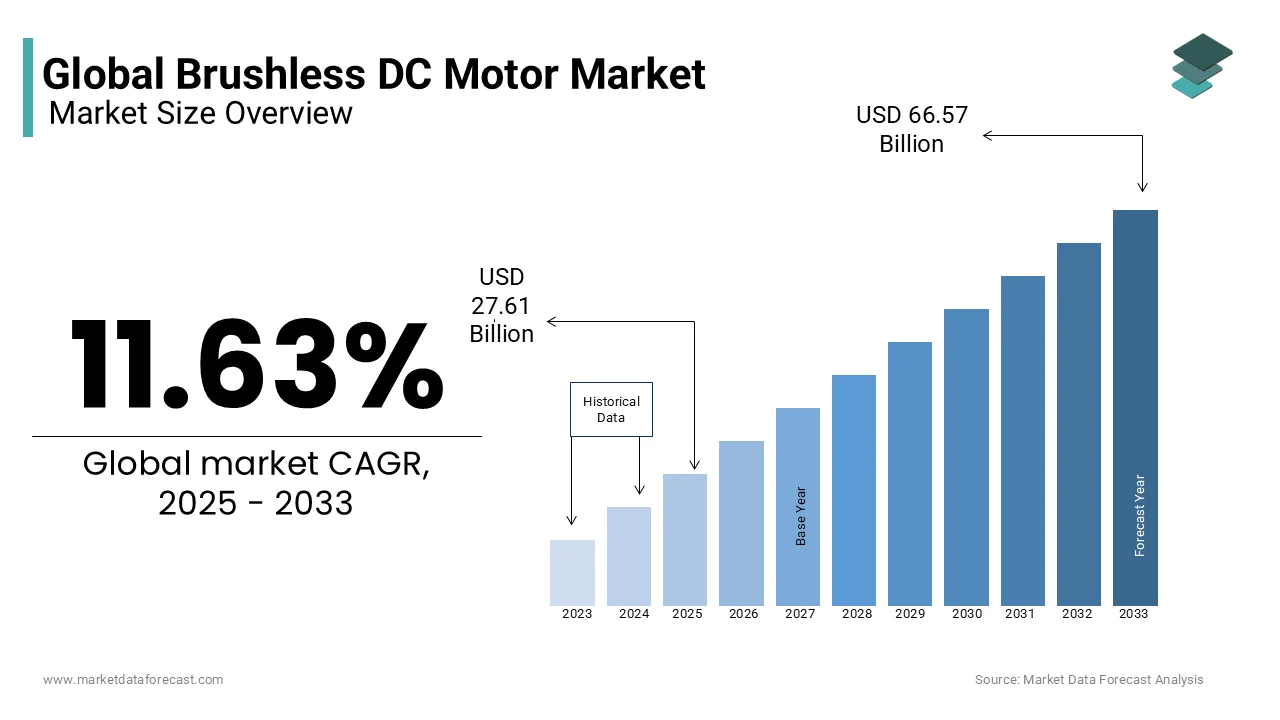

The size of the global brushless DC motor market was worth USD 24.73 billion in 2024. The global market is anticipated to grow at a CAGR of 11.63% from 2025 to 2033 and be worth USD 66.57 billion by 2033 from USD 27.61 billion in 2025.

A Brushless DC (BLDC) motor is an electric motor that operates without the brushes found in traditional motors. Instead, it uses electronic controllers to switch the current, resulting in higher efficiency, reduced maintenance, and longer lifespan. These characteristics make BLDC motors ideal for various applications, including electric vehicles, industrial machinery, HVAC systems, and consumer electronics.

BLDC motors are known for their high efficiency which often achieves rates between 85% and 90%, as noted by Pelonis Technologies. This efficiency means they convert a great portion of electrical energy into mechanical energy reduces energy consumption and operational costs.

In industrial automation, BLDC motors are valued for their precise control and reliability. Etonm Motor sheds light on their use in CNC machines and robotics, where consistent torque and speed are crucial for accurate operations.

The automotive industry, particularly the electric vehicle (EV) segment, relies heavily on BLDC motors. Their efficiency and durability make them suitable for EVs, contributing to longer driving ranges and reduced maintenance needs.

In consumer electronics, BLDC motors are used in devices like fans, air conditioners, and washing machines. Their quiet operation and energy efficiency enhance user comfort and reduce electricity bills.

MARKET DRIVERS

Increasing Demand for Energy-Efficient Solutions

The global push for energy efficiency is a key driver for brushless DC motors. According to the U.S. Department of Energy, electric motors consume about 45% of global electricity, and transitioning to high-efficiency motors like brushless DC can reduce energy consumption by up to 30%. These motors achieve efficiencies of 85% to 90% when compared to 70% to 75% for traditional brushed motors. The International Energy Agency (IEA) states that adopting energy-efficient technologies could reduce global electricity demand by 12% by 2040. Industries such as HVAC, automotive, and appliances are prioritizing these motors to meet energy-saving regulations which is driving their adoption globally.

Advancements in Automation and Robotics

The rapid growth of automation and robotics is fueling demand for brushless DC motors. The International Federation of Robotics (IFR) reports that over 517,000 industrial robots were installed globally in 2022, with precision motors being critical components. These motors offer superior speed control, reduced wear, and high torque-to-weight ratios is making them ideal for robotic systems. The U.S. Bureau of Labor Statistics stresses that automation could boost manufacturing productivity by 25% by 2030. So, as industries embrace Industry 4.0 technologies, the need for reliable and efficient motors like brushless DC is expected to grow significantly.

MARKET RESTRAINTS

High Initial Costs and Investment Barriers

The high upfront cost of brushless DC motors remains a significant barrier to adoption. The U.S. Department of Commerce pointed out that these motors can cost 20-25% more than traditional motors due to advanced materials and electronic controllers. Retrofitting existing machinery with brushless DC systems adds further expenses and that is limiting adoption in small and medium enterprises. The National Institute of Standards and Technology observes that while long-term savings exist, initial costs deter many businesses, especially in developing economies. This financial hurdle slows market penetration, particularly in regions with limited access to capital.

Complexity in Design and Maintenance

The intricate design and specialized maintenance needs of brushless DC motors present challenges. NASA emphasizes that these motors require sophisticated control systems, including sensors and inverters, adding complexity. The U.S. Department of Energy recognized that diagnosing electronic failures demands skilled technicians is increasing operational costs. In remote areas, the lack of technical expertise exacerbates these issues. This complexity not only raises total ownership costs but also limits accessibility for users without advanced capabilities hinders broader adoption.

MARKET OPPORTUNITIES

Growth in Electric Vehicle Adoption

The rise of electric vehicles (EVs) presents a major opportunity for brushless DC motors. The International Energy Agency (IEA) reports that global EV sales reached 10.5 million units in 2022 and accounted for 14% of total car sales. These motors are integral to EV powertrains due to their efficiency and compact size. The U.S. Environmental Protection Agency (EPA) emphasizes that EVs powered by brushless DC motors achieve energy efficiencies exceeding 90%. With governments offering incentives for EV adoption, the demand for these motors in the automotive sector is set to grow exponentially.

Expansion in Renewable Energy Applications

The renewable energy sector offers significant opportunities for brushless DC motors, particularly in solar and wind systems. The U.S. Energy Information Administration (EIA) states that renewables accounted for 20% of U.S. electricity generation in 2022, with projections reaching 44% by 2050. These motors are used in solar trackers and improves energy capture by up to 25%. The Global Wind Energy Council (GWEC) acknowledged that wind turbines with brushless DC motors exhibit enhanced reliability. As nations pursue climate goals, integrating these motors into renewable energy infrastructure will expand significantly.

MARKET CHALLENGES

Supply Chain Disruptions and Material Shortages

Supply chain disruptions and shortages of rare earth metals challenge brushless DC motor manufacturers. The U.S. Geological Survey (USGS) reports that China produces over 60% of global rare earth elements are creating supply vulnerabilities. Materials like neodymium and dysprosium, essential for motor magnets, face price volatility due to scarcity. According to the World Trade Organization (WTO), geopolitical tensions and export restrictions exacerbate these issues. Manufacturers experience delays and increased costs which is impacting production timelines and market growth.

Regulatory Compliance and Standardization Issues

Navigating regulatory compliance and standardization poses challenges for the brushless DC motor market. The International Electrotechnical Commission (IEC) states that varying regional standards complicate product design and certification. For example, the European Union’s REACH regulations impose strict substance restrictions, requiring material reformulations. The U.S. Federal Trade Commission (FTC) observes that non-compliance can lead to penalties and market bans, adding burdens. The lack of universal standards creates confusion, hindering seamless global trade and adoption of these technologies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

11.63% |

|

Segments Covered |

By Armored Type, Core Type, End User, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

AMETEK (US), Allied Motion (US), Nidec Corporation (Japan), Johnson Electric (China), and Minebea Mitsumi (Japan) are the leading players in the brushless DC motor market. Maxon Motor (Switzerland), Regal Beloit Corporation (US), Oriental Motor (Japan), Portescap (US), ElectroCraft (US), and Others. |

SEGMENT ANALYSIS

By Type Insights

The Inner Rotor segment is the biggest category in the Brushless DC Motor market and held a 60.9% market share in 2024. The segment is prevailing because of it’s small, efficient, and great for cars and robots. The U.S. Department of Energy reports electric motors, like inner rotor ones, use 70% of industrial electricity, showing their key role. They save energy too and the U.S. Energy Information Administration says motor systems can cut energy use by 30%. This makes them important for industries wanting to lower costs and work better, keeping Inner Rotor on top.

The Outer Rotor segment grows fastest with a CAGR of 7.5% from 2025 to 2033. The booming phase is linked to it being quiet and strong, perfect for gadgets and medical tools. The U.S. Bureau of Labor Statistics says consumer electronics output rose 15% from 2020 to 2023, needing these motors. The National Institutes of Health reports medical device production grew 12% yearly, favouring outer rotor efficiency. It’s vital for quiet, energy-saving tech—like fans and drones. With more people buying smart devices, this segment’s growth helps make life easier and greener, says the U.S. Department of Energy.

By End-User Insights

The Automotive segment gained the top spot in the Brushless DC Motor market and captured a 34.6% share in 2024 owing to the electric vehicles (EVs) need these efficient motors. The U.S. Department of Energy says EVs saved 1.5 million barrels of oil in 2022, proving their value. The International Energy Agency indicated that EV sales hit 14 million in 2023, up 35% from 2022, driving motor demand. This segment matters for cleaner travel and cutting pollution which is making cars more eco-friendly and efficient for everyone.

The Consumer Electronics segment advances rapidly with a CAGR of 10% from 2024 to 2033. It’s speeding up due to smart devices like phones and appliances need less noise and efficient motors. The U.S. Census Bureau reports electronics sales grew 8% yearly from 2020 to 2023. Statista says smartphone shipments hit 1.4 billion in 2023, up 5%, boosting motor use. The National Renewable Energy Laboratory remarks a 20% efficiency gain in appliances, showing this segment’s role in better tech. It’s key for making everyday gadgets smarter and greener, meeting people’s demand for high-quality products.

By Speed Insights

The 501-2000 RPM segment is the largest in the Brushless DC Motor market and possessed a 38.1% market share in 2024. The segment grew because of its wide use in automotive and consumer electronics, where moderate speed and efficiency are key. The U.S. Department of Energy reports electric motors account for 70% of industrial electricity use, with this range being optimal for pumps and fans. The U.S. Energy Information Administration stresses a 25% energy efficiency gain in such systems which is drawing attention to its importance in reducing costs and supporting sustainable tech across industries.

The 2001-10000 RPM segment is the swiftest growing with a CAGR of 8.5% from 2025 to 2033 owing to demand in medical devices and industrial tools needing precision and power. The U.S. Bureau of Labor Statistics says medical equipment production rose 10% yearly from 2020 to 2023 and is driving motor use. The National Institutes of Health reports a 15% increase in high-speed dental tool adoption, favoring this range. Its importance lies in enabling advanced healthcare and automation, with the U.S. Department of Energy noting a 20% efficiency boost in high-speed applications which is supporting innovation and energy savings.

REGIONAL ANALYSIS

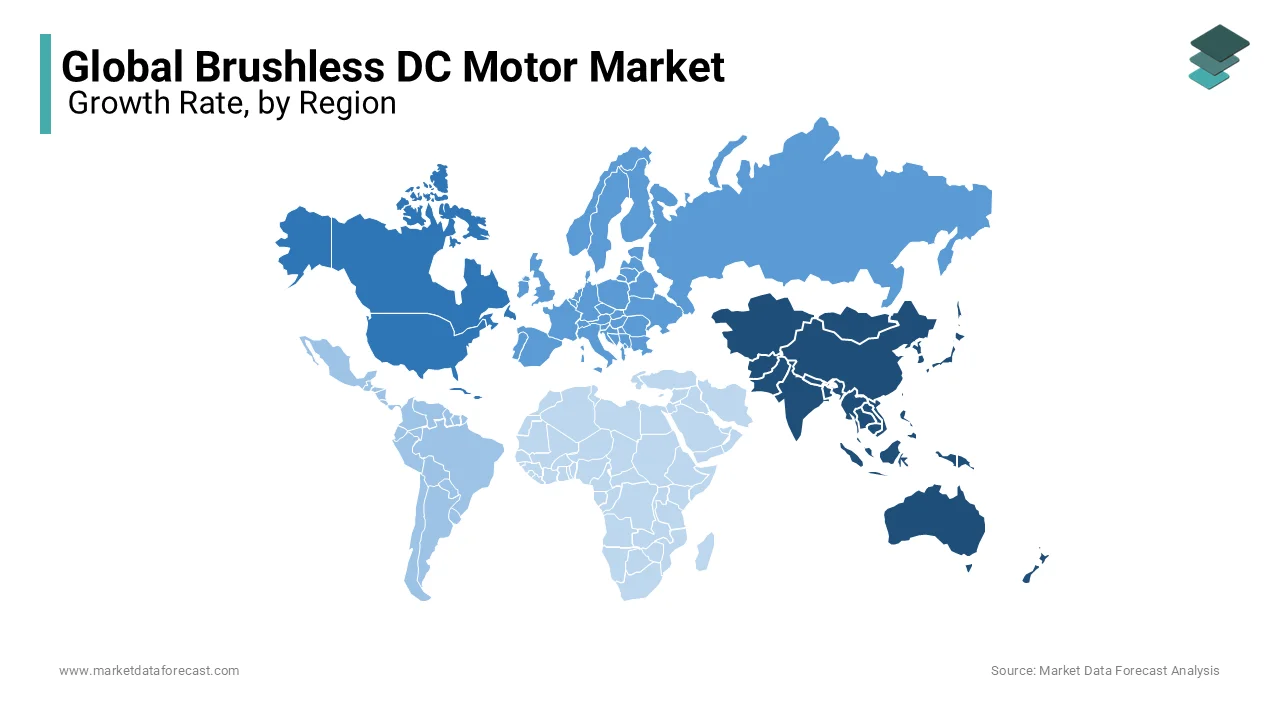

Asia-Pacific led the Brushless DC Motor market by having a 50.4% share in 2024 because of massive manufacturing and electric vehicle (EV) growth. The International Energy Agency reports China sold 8.1 million EVs in 2023, half of global sales, needing lots of motors. The U.S. Department of Energy says motors use 68% of industrial electricity in Asia, showing their huge role. This region matters as a production powerhouse, especially in China and India, driving global supply and tech advances with its large factories and demand.

North America accelerates at fastest rate and is expected to expand at a CAGR of 6.4% during the forecast period. It’s speeding up due to electric vehicles (EVs) and automation demand. The U.S. Department of Energy says U.S. EV sales reached 1.2 million in 2023, up 40% from 2022, boosting motor needs. The U.S. Bureau of Labor Statistics reports manufacturing automation rose 7% yearly from 2020 to 2023, using efficient motors. It’s vital for tech innovation and green energy, with the National Renewable Energy Laboratory noting a 15% efficiency gain in motor systems, helping sustainability and cutting costs across industries.

Europe’s Brushless DC Motor market will grow steadily, driven by electric vehicles and green policies. The International Energy Agency says Europe sold 3 million EVs in 2023, up 20% from 2022, increasing motor demand. The European Environment Agency reports industrial energy use fell 10% from 2015 to 2023, thanks to efficient motors. Germany and France lead in automation and renewable energy, making Europe strong in this market. It will keep growing as it focuses on lowering emissions and improving tech with these motors over the next few years.

Latin America’s Brushless DC Motor market will see moderate growth, fueled by industry and cities. The U.S. Energy Information Administration says electricity demand grew 12% from 2018 to 2023, with motors key in factories. The World Bank reports urban population reached 82% in 2023, raising appliance use with these motors. Brazil and Mexico are boosting EV production, helping the market expand. In the coming years, it will grow as the region improves energy use and builds more factories, supporting economic and urban progress with these motors.

The Middle East and Africa will grow slowly in the Brushless DC Motor market, led by energy and building projects. The U.S. Energy Information Administration says energy use rose 15% from 2018 to 2023, with motors vital in oil and construction. The United Nations reports Africa’s urban population hit 45% in 2023, up 5% in five years, increasing appliance demand. South Africa and UAE will drive growth with renewable energy and upgrades, pushing the market forward steadily as they focus on efficiency and modern systems.

KEY MARKET DEVELOPMENTS

The major players in the Brushless Dc motor market include AMETEK (US), Allied Motion (US), Nidec Corporation (Japan), Johnson Electric (China), Minebea Mitsumi (Japan), Maxon Motor (Switzerland), Regal Beloit Corporation (US), Oriental Motor (Japan), Portescap (US), and ElectroCraft (US).

TOP 3 PLAYERS IN THE MARKET

Nidec Corporation

Nidec Corporation, founded in 1973 and headquartered in Kyoto, Japan, is a global leader in the design and manufacturing of electric motors, including brushless DC (BLDC) motors. The company has established a dominant position in the BLDC motor market by offering a diverse product range that caters to various industries such as automotive, industrial, and consumer electronics. Nidec's commitment to innovation is evident through its continuous development of energy-efficient and high-performance motor solutions, which align with the growing demand for sustainable technologies. Their global presence and extensive manufacturing capabilities have strengthened their status as a top player in the BLDC motor market.

Maxon Motor

Established in 1961 and based in Switzerland, Maxon Motor specializes in high-precision drive systems, including BLDC motors renowned for their precision, efficiency, and versatility. The company's products are widely utilized in high-performance sectors such as robotics, medical technology, and aerospace. Maxon's dedication to quality and innovation has led to the development of custom motor solutions that meet the stringent requirements of these industries. Their ability to provide tailored solutions has reinforced their strong position in the global BLDC motor market.

ABB Ltd.

ABB Ltd., headquartered in Zurich, Switzerland, is a multinational corporation specializing in power and automation technologies. The company offers a comprehensive range of BLDC motors known for their energy efficiency and reliability. ABB's BLDC motors are integral components in various applications, including industrial machinery, HVAC systems, and renewable energy projects. Their focus on integrating advanced technologies into motor design has contributed significantly to the advancement of the BLDC motor market, ensuring they remain at the forefront of market developments.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Product Innovation and Technological Advancement

Nidec Corporation and other leading BLDC motor manufacturers prioritize continuous product innovation to gain a competitive edge. Nidec has focused on replacing traditional AC motors and brushed DC motors with advanced BLDC motors that offer greater energy efficiency, precision, and durability. The company invests heavily in research and development to create compact, lightweight, and high-performance motors for industries such as automotive, consumer electronics, and industrial automation. Advanced control algorithms and sensorless designs are incorporated to enhance motor efficiency and reliability. By consistently introducing cutting-edge solutions, Nidec strengthens its market dominance while meeting the growing demand for energy-efficient and smart motor technologies in various applications.

Strategic Acquisitions and Partnerships

To expand their market presence and diversify product portfolios, key BLDC motor manufacturers, including Nidec Corporation, employ strategic acquisitions and partnerships. Nidec has acquired several motor companies worldwide, enhancing its technological capabilities and geographic reach. These acquisitions enable the integration of advanced motor control technologies, strengthening the company’s position in sectors such as electric vehicles, industrial automation, and robotics. Collaborations with automotive and electronics firms also facilitate the adoption of BLDC motors in next-generation applications. By leveraging acquisitions and strategic alliances, leading manufacturers accelerate innovation, expand their customer base, and create synergies that drive long-term growth in the competitive BLDC motor market.

Focus on Energy Efficiency and Sustainability

Companies such as ABB Ltd. emphasize energy efficiency and sustainability as core strategies for market growth. BLDC motors inherently consume less power compared to traditional motors, making them a preferred choice for environmentally conscious industries. ABB develops high-efficiency BLDC motors that align with global sustainability goals and regulatory requirements for energy conservation. These motors are extensively used in HVAC systems, electric vehicles, and industrial automation, reducing carbon footprints and operational costs. By investing in eco-friendly technologies and promoting the adoption of energy-efficient motors, ABB strengthens its brand reputation while contributing to a greener future. This focus ensures sustained demand and long-term market leadership.

COMPETITIVE LANDSCAPE

The Brushless DC (BLDC) motor market is highly competitive because many companies make these motors for different industries. Big companies like Nidec Corporation ABB Ltd and Maxon Motor lead the market. They focus on making new and better motors to stay ahead. Many smaller companies also compete by making special motors for unique needs.

Companies use different strategies to win in the market. Some focus on new technology to make motors more powerful and efficient. Others try to lower prices to attract more buyers. Some companies buy smaller motor businesses to grow faster. Partnerships with car and electronics companies also help businesses sell more BLDC motors.

The demand for BLDC motors is growing because they use less energy and last longer. Many industries need them including electric vehicles home appliances and industrial machines. The growing use of electric cars is also pushing companies to make stronger and smarter BLDC motors.

Competition in the market is tough but this helps in making motors better and more affordable. Companies that keep improving their products and finding new customers will stay strong. In the future, more companies will enter the market making it even more competitive and innovative.

RECENT MARKET DEVELOPMENTS

- In March 2024, the Indian government introduced the Electric Mobility Promotion Scheme (EMPS) with a ₹500 crore allocation to support electric two-wheelers and three-wheelers. Given that BLDC motors are widely used in these vehicles, the scheme is expected to boost the BLDC motor market.

- In September 2024, India announced stricter localization norms for electric vehicle (EV) manufacturers under the PM e-DRIVE subsidy initiative, effective from April 2025. This regulation mandates local sourcing and assembly of key components, including BLDC motors, to boost domestic manufacturing and reduce import dependency.

- In September 2024, ElectroCraft introduced the "EZ Drive," a motor drive specifically designed for BLDC motors. This product aims to enhance efficiency and user-friendliness across various applications, including industrial automation and medical equipment.

MARKET SEGMENTATION

This research report on the global brushless Dc motor market is segmented and sub-segmented into the following categories.

By Type

- Inner Rotor

- Outer Rotor

By End-User

- Consumer Electronics

- Automotive

- Manufacturing

- Medical Devices

By Speed

- <500 RPM

- 501-2000 RPM

- 2001-10000 RPM

- >10000 RPM

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is the Brushless DC Motor Market growth rate during the projection period?

The Global Brushless DC Motor Market is expected to grow with a CAGR of 11.63% between 2025 to 2033.

What can be the total Brushless DC Motor Market value?

The Global Brushless DC Motor Market is expected to reach a revised size of USD 66.57 billion by 2033.

Name any three Brushless DC Motor Market key players?

Johnson Electric (China), MinebeaMitsumi (Japan), and Maxon Motor (Switzerland) are the three Brushless DC Motor Market key players.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com