Global Bronchoscopy Market Size, Share, Trends & Growth Forecast Report By Product (Bronchoscopes, Imaging systems, Accessories and Others), Application, Usability, Patient, End-User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) – Industry Analysis (2025 to 2033)

Global Bronchoscopy Market Size

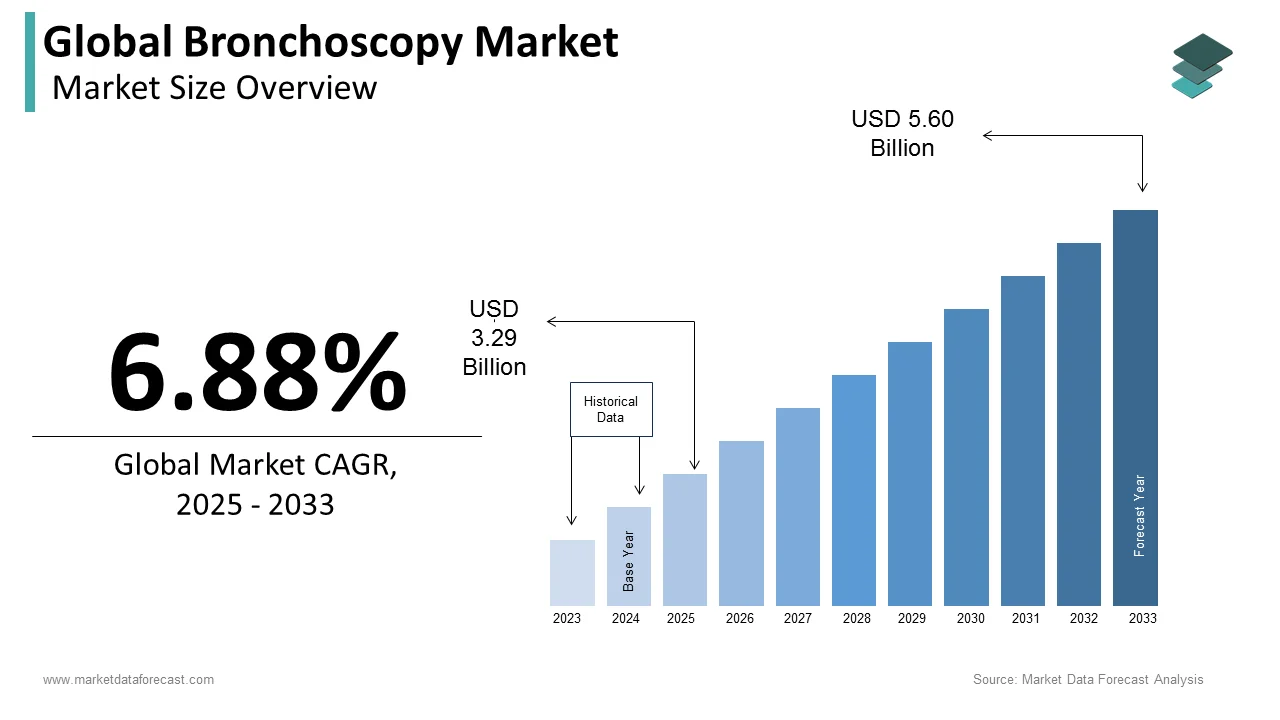

The size of the global bronchoscopy market was valued at USD 3.08 billion in 2024. The global market size is expected to grow at a CAGR of 6.88% from 2025 to 2033 and be worth USD 3.29 billion in 2025 and USD 5.60 billion by 2033.

The bronchoscopy focused on diagnostic and therapeutic devices for respiratory conditions is advancing owing to the increasing respiratory illnesses such as lung cancer, COPD and tuberculosis. As per the data of the World Health Organization (WHO), respiratory diseases as one of the top causes of death globally, with over 3 million fatalities due to COPD annually. This rising disease burden fuels the demand for bronchoscopic procedures. Technological advancements such as minimally invasive techniques like endobronchial ultrasound (EBUS) and electromagnetic navigation support precise diagnostics and targeted treatments and allow for safer, quicker recovery with minimal tissue damage. Disposable bronchoscopes are gaining attention due to their ability to minimize infection risk and ensure sterility, which is a critical factor, particularly in high-turnover settings like hospitals and clinics.

MARKET TRENDS

Rise of Disposable Bronchoscopes

Disposable bronchoscopes are gaining momentum due to their ability to reduce cross-contamination risks. Unlike reusable scopes, disposable models eliminate the need for complex sterilization processes, a critical factor in preventing infections. According to a study published by the American Journal of Infection Control, infections associated with reusable endoscopes occur in up to 1% of cases, pushing healthcare providers to seek safer alternatives. The global increase in hospital-acquired infections (HAIs) has intensified the focus on single-use devices, making disposable bronchoscopes particularly popular in high-turnover settings such as emergency and intensive care units.

Integration of Advanced Imaging Techniques

Advances in imaging technologies, including endobronchial ultrasound (EBUS) and electromagnetic navigation, are transforming bronchoscopy by enabling more accurate and minimally invasive diagnostics. EBUS, for instance, enhances the detection and staging of lung cancer without the need for surgical biopsy, helping clinicians access difficult-to-reach lung areas. Studies show that EBUS improves diagnostic accuracy by 90% or more in certain cancers. This technology is becoming essential as the prevalence of lung cancer rises globally, with over 2.2 million new cases each year according to the World Health Organization, making early and accurate diagnosis increasingly valuable.

MARKET DRIVERS

Growing Prevalence of Respiratory Diseases

Chronic respiratory diseases, particularly COPD, lung cancer, and infections like tuberculosis, are significant drivers of the bronchoscopy market. The World Health Organization reports over 3 million COPD-related deaths annually, while lung cancer remains the leading cause of cancer deaths globally, with 2.2 million new cases each year. This high incidence of respiratory conditions amplifies the need for early and accurate diagnostic tools, such as bronchoscopy, which can detect and monitor diseases at earlier stages, ultimately improving patient outcomes.

Aging Population and Growing Vulnerability

As global populations age, respiratory issues associated with aging, including susceptibility to infections and chronic diseases, are on the rise. The United Nations estimates that by 2050, 1 in 6 people globally will be over 65. This demographic shift intensifies demand for bronchoscopy, particularly as elderly patients often require safer, minimally invasive diagnostic and treatment options. Additionally, age-related immune decline makes older adults more prone to respiratory conditions, further fueling the demand for advanced bronchoscopy procedures.

Healthcare Focus on Infection Control and Safety

Infection prevention has become a core priority for healthcare providers, particularly in light of recent health crises. The Centers for Disease Control and Prevention (CDC) has highlighted the risks associated with reusable devices, linking improper sterilization to heightened infection risks. Disposable bronchoscopes, designed to be single-use, align with hospitals’ infection control policies, thereby reducing the likelihood of cross-contamination. This shift towards safer, disposable devices supports the growing emphasis on patient safety and has become a significant driver in the bronchoscopy market.

MARKET RESTRAINTS

High Costs of Advanced Bronchoscopic Equipment

The bronchoscopy market faces cost challenges, particularly with advanced equipment such as endobronchial ultrasound (EBUS) and electromagnetic navigation systems. These technologies are essential for precision but come at a premium, often exceeding $100,000 per system, which can be prohibitive for smaller hospitals and clinics. Additionally, the cost of disposable bronchoscopes, although beneficial for infection control, is higher on a per-use basis compared to traditional reusable bronchoscopes, limiting adoption in resource-constrained healthcare settings. This high cost restricts accessibility, particularly in emerging markets with limited healthcare budgets.

Limited Access to Skilled Professionals

Bronchoscopy procedures require specialized training, and there is a shortage of skilled pulmonologists and respiratory specialists in many regions. According to a report from the Global Burden of Disease study, rural and underserved areas have limited access to trained professionals, impacting the availability of bronchoscopy as a diagnostic tool. Additionally, advanced procedures like EBUS demand specific expertise, and training programs can be costly and time-intensive. This skills gap hinders the widespread adoption of complex bronchoscopy techniques and limits the reach of advanced diagnostics in many healthcare systems.

Risks of Procedure-Related Complications

While generally safe, bronchoscopy is not without risks, including bleeding, infection, and pneumothorax (collapsed lung). Studies indicate that complications occur in about 1–3% of cases, depending on the procedure type and patient condition. These risks may deter patients and healthcare providers from opting for bronchoscopy, particularly in routine or less critical cases. Additionally, the perception of procedural risk can affect the market's growth as more minimally invasive alternatives and imaging technologies become available, offering less invasive ways to achieve similar diagnostic outcomes without direct lung intervention.

MARKET OPPORTUNITIES

Expansion of AI-enhanced bronchoscopy

Artificial intelligence (AI) in bronchoscopy is emerging as a transformative opportunity, enabling enhanced image analysis, real-time guidance, and improved diagnostic accuracy. AI algorithms can assist clinicians in detecting lung nodules, interpreting complex images, and even predicting malignancy with high precision. Studies show that AI-assisted bronchoscopy can reduce procedure time and increase diagnostic accuracy, particularly in lung cancer detection. As AI technologies evolve, integrating them into bronchoscopy systems presents significant potential for both diagnostic and procedural improvements, appealing to hospitals aiming to boost accuracy and efficiency.

Growing Demand for Telemedicine and Remote Diagnostics

The global expansion of telemedicine creates a unique opportunity for remote bronchoscopy support and diagnostics, particularly in rural and underserved regions. Advanced bronchoscopy systems can now be remotely monitored or guided, allowing specialists to assist local healthcare providers via telemedicine platforms. This trend supports market growth by making bronchoscopy accessible to areas lacking specialized pulmonologists. The telemedicine sector is forecasted to grow rapidly, which aligns with the push for remote solutions and could lead to increased adoption of bronchoscopy in decentralized settings, improving global respiratory healthcare access.

Rising Investments in Minimally Invasive Therapies

Investments in minimally invasive medical technologies are driving innovation in bronchoscopy, particularly in therapeutic applications like bronchial thermoplasty for asthma and endobronchial valve placement for emphysema. These procedures reduce patient recovery time and lower complication rates, making them attractive alternatives to traditional surgeries. With respiratory diseases projected to remain a major health concern worldwide, healthcare systems and investors are prioritizing funding for less invasive bronchoscopy-based treatments. This shift not only enhances the versatility of bronchoscopy but also attracts investments, stimulating further advancements and growth in therapeutic bronchoscopy applications.

MARKET CHALLENGES

Regulatory Hurdles and Compliance Requirements

The bronchoscopy market faces stringent regulatory challenges, as each new device and technique must meet high standards for safety and efficacy. Obtaining FDA approval or CE marking for advanced bronchoscopy equipment can be time-consuming and costly, slowing market entry. For example, the U.S. FDA's classification of bronchoscopes as Class II medical devices requires rigorous testing and documentation. Compliance with these regulatory standards across multiple regions adds complexity, particularly for companies entering international markets, where additional local approvals and inspections are necessary before devices can be marketed and adopted widely.

Limited Infrastructure in Emerging Markets

While demand for bronchoscopy is increasing globally, many emerging markets still lack the necessary healthcare infrastructure, including high-tech equipment, sterile environments, and skilled staff, to support these procedures. In regions with limited healthcare budgets and fewer specialized medical facilities, access to advanced bronchoscopy remains low, impeding broader market growth. According to the World Bank, many low- and middle-income countries face resource constraints that make acquiring and maintaining bronchoscopy equipment difficult. This challenge limits the market’s expansion potential and hampers equitable access to quality respiratory care in underserved areas.

Reimbursement Issues and Variable Insurance Coverage

Reimbursement policies for bronchoscopy procedures vary widely between countries and even within regions, creating financial barriers for patients and healthcare providers. In certain healthcare systems, the high cost of advanced bronchoscopy may not be fully covered by insurance, discouraging use. Additionally, coverage inconsistencies for specific procedures, such as EBUS or disposable bronchoscopes, affect hospital budgeting and patient affordability. According to industry reports, inconsistent reimbursement is a key obstacle to adoption, as healthcare providers must navigate complex policies and often struggle to justify high-cost procedures, which can limit demand and restrict technology adoption.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.88% |

|

Segments Covered |

By Product, Application, Usability, Patient, End-User and Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Olympus Corporation, Karl Storz SE & Co. KG., Fujifilm Holdings Corporation, Boston Scientific Corporation, Ambu A/S, Pentax Medical (HOYA Corporation), Cook Medical, Richard Wolf GmbH, Smith & Nephew and Medi-Globe Corporation |

SEGMENTAL ANALYSIS

By Product Insights

The bronchoscopes segment dominated the market by accounting for 46.4% of the global market share in 2023. This dominance is due to the central role bronchoscopes play in both diagnostic and therapeutic procedures for respiratory conditions such as lung cancer, chronic obstructive pulmonary disease (COPD), and infections. Traditional bronchoscopes are widely used for direct visualization, biopsy, and minimally invasive procedures, providing essential support for early disease detection and management. Disposable bronchoscopes are particularly important in infection control, reducing cross-contamination risks in healthcare settings. With respiratory diseases causing millions of deaths annually, demand for bronchoscopes remains high, sustaining this segment’s lead.

The imaging systems segment is growing rapidly and is estimated to grow at the fastest CAGR of 9.88% over the forecast period. This rapid growth is driven by the increasing adoption of advanced imaging technologies like endobronchial ultrasound (EBUS) and electromagnetic navigation. These imaging systems significantly enhance diagnostic accuracy by enabling real-time visualization and detailed examination of lung structures, which is critical in staging lung cancer and guiding minimally invasive interventions. With global lung cancer cases rising to 2.2 million annually, high-precision imaging has become indispensable in respiratory care, fueling demand for sophisticated imaging systems.

By Application Insights

The diagnostic bronchoscopy segment held the largest share of 62.9% of the worldwide market share in 2023. The growth of the segment is majorly driven by the high prevalence of respiratory diseases requiring accurate diagnosis, including lung cancer, tuberculosis, and chronic obstructive pulmonary disease (COPD). Diagnostic procedures like endobronchial ultrasound (EBUS) and transbronchial needle aspiration (TBNA) enable detailed examination and biopsy collection, allowing early and precise disease staging. Given that lung cancer is the leading cause of cancer-related deaths worldwide, with over 2.2 million cases annually, the need for diagnostic bronchoscopy is critical for early intervention, driving its dominant position in the market.

The therapeutic bronchoscopy segment is anticipated to grow at the fastest CAGR of 8.84% over the forecast period. This rapid growth is attributed to the increasing demand for minimally invasive treatment options in managing complex respiratory conditions. Therapeutic bronchoscopy procedures, such as bronchial thermoplasty for severe asthma and endobronchial valve placement for emphysema, offer effective, less invasive alternatives to traditional surgery, reducing recovery time and procedural risks. With chronic respiratory diseases on the rise, therapeutic bronchoscopy's role in offering targeted interventions is becoming crucial, leading to heightened adoption and growth in this segment as healthcare systems prioritize advanced, patient-centered care.

By Usability Insights

The reusable equipment segment dominated the market by capturing 58.2% of the global market share in 2023. Traditionally, reusable bronchoscopes have dominated due to their lower cost per procedure over time and widespread adoption in hospitals and clinics with established sterilization facilities. Reusable bronchoscopes provide high-quality imaging and are suitable for frequent use, making them a cost-effective choice in high-volume settings. However, sterilization processes are labor-intensive and must meet strict infection control standards to prevent hospital-acquired infections (HAIs), a critical issue highlighted by the CDC. Despite these challenges, their established presence and durability keep them at the forefront.

The disposable equipment is growing rapidly and is expected to register the fastest CAGR of 11.74% over the forecast period. This rapid expansion is driven by the rising focus on infection control and the prevention of cross-contamination, especially in high-risk settings. Disposable bronchoscopes eliminate the need for complex sterilization, significantly reducing the risk of HAIs. For instance, the American Journal of Infection Control notes a rising preference for single-use bronchoscopes in intensive care units and emergency departments. Additionally, with more hospitals aiming to meet stricter infection standards, the convenience and safety offered by disposables make them increasingly important in modern respiratory care.

By Patient Insights

The adult patient segment led the market by occupying a share of 78.3% of the global market in 2023. This dominance is primarily due to the higher prevalence of respiratory conditions such as chronic obstructive pulmonary disease (COPD), lung cancer, and bronchial infections among adults, particularly older adults. According to the World Health Organization, COPD alone affects over 200 million people globally, with incidence rates rising with age. Adults are also more likely to be exposed to risk factors like smoking, occupational hazards, and pollution, further increasing the demand for bronchoscopy procedures for diagnosis and management in this demographic.

The pediatric segment is expected to exhibit a CAGR of 8.12% over the forecast period. The growth in pediatric bronchoscopy is driven by an increased focus on early detection and treatment of respiratory issues in children, such as congenital airway abnormalities, foreign body aspiration, and asthma. Innovations in pediatric-specific bronchoscopy equipment designed for smaller anatomies have made procedures safer and more accessible for young patients. With respiratory issues among children rising due to factors like pollution and infections, pediatric bronchoscopy is becoming more important for timely and effective respiratory care in this sensitive population.

By End-User Insights

Hospitals and clinics were the largest consumers of bronchoscopy, and this segment accounted for 74.7% of the global market share in 2023. The high patient volume, advanced infrastructure, and availability of skilled specialists within these settings majorly drive the domination of the hospitals and clinics segment. Hospitals and clinics are better equipped with advanced bronchoscopy systems, including diagnostic and therapeutic tools like endobronchial ultrasound (EBUS), which require substantial capital investment and specialized staff. According to the American Hospital Association, hospitals are the primary sites for complex diagnostic procedures, including bronchoscopy, particularly for critical cases requiring immediate care or postoperative monitoring, solidifying their lead in this segment.

The ambulatory surgical centers (ASCs) segment is estimated to witness the fastest CAGR of 9.94% over the forecast period. ASCs are increasingly popular due to their cost-effectiveness, shorter patient wait times, and efficient outpatient care model, making bronchoscopy procedures more accessible for patients. ASCs also lower procedure costs by up to 45% compared to hospitals, a factor especially appealing to healthcare systems focusing on value-based care. As minimally invasive bronchoscopy techniques gain traction, ASCs are becoming an ideal choice for outpatient procedures, particularly for diagnostic bronchoscopies, driving the rapid growth in this end-user segment.

REGIONAL ANALYSIS

North America dominated the market bronchoscopy market by accounting for 36.1% of the global market share in 2023 and the growth of the North American market is majorly driven by the high prevalence of respiratory diseases, advanced healthcare infrastructure, and significant adoption of bronchoscopy technologies. The U.S. and Canada drive the region’s dominance, with the U.S. particularly benefiting from robust healthcare spending and continuous innovations in minimally invasive procedures. The leadership of the North American region in the global market is likely to continue owing to technological advances and the increasing demand for infection control solutions.

Europe follows closely and captured 27.9% of the global market share in 2023. The market growth in Europe is fuelled by strong healthcare systems, increased funding for respiratory disease management, and a growing aging population. Key markets like Germany, France, and the UK lead due to the early adoption of advanced medical technologies and supportive healthcare policies. Europe is expected to experience steady growth over the forecast period and is further likely to be driven by initiatives promoting early disease diagnosis and ongoing healthcare innovation.

Asia-Pacific is currently the third-largest region. However, the Asia-Pacific region is projected to be the fastest-growing regional market and is predicted to showcase a CAGR of 9.08% over the forecast period owing to the rising prevalence of respiratory disease, increasing healthcare investments, and greater awareness of diagnostic options. Major contributors include China, Japan, and India, with China showing notable growth due to expanding healthcare infrastructure and government efforts to improve respiratory care. Asia-Pacific is poised for significant future expansion, with the potential to become a leading market as economic development enhances access to advanced medical devices.

Latin America holds a smaller share of the worldwide market currently but is projected to register a healthy CAGR during the forecast period due to the growing respiratory disease awareness and healthcare infrastructure improvements, particularly in Brazil and Mexico. Brazil’s large healthcare market is a primary growth driver, reflecting improving access to bronchoscopy as healthcare resources expand.

The market in the Middle East and Africa region accounts for a modest share of the global bronchoscopy market. Investments in healthcare infrastructure in more developed areas such as the UAE and Saudi Arabia, though limited access to advanced medical technology and economic challenges in other areas restrict broader adoption, are propelling the market growth in MEA. Ongoing initiatives to improve healthcare infrastructure and increase respiratory disease awareness will support gradual market expansion in this region.

KEY MARKET PLAYERS

Companies playing a leading role in the global bronchoscopy market include Olympus Corporation, Karl Storz SE & Co. KG., Fujifilm Holdings Corporation, Boston Scientific Corporation, Ambu A/S, Pentax Medical (HOYA Corporation), Cook Medical, Richard Wolf GmbH, Smith & Nephew and Medi-Globe Corporation.

RECENT MARKET HAPPENINGS

- In May 2024, Cook Medical, a global medical device company, launched the EchoTip AcuCore™ Endoscopic Ultrasound (EUS) Biopsy Needle in the United States. This 22-gauge needle is designed for fine needle biopsies of submucosal and extramural lesions, mediastinal masses, lymph nodes, and intraperitoneal masses within or adjacent to the gastrointestinal tract. The AcuCore needle features a Franseen tip made of a cobalt-chromium alloy, allowing physicians to puncture tissue with flexibility, minimal force, and controlled precision.

- In February 2023, Fujifilm Holdings Corporation, a leader in imaging and information technology, launched the EB-710P Slim Video Bronchoscope in India. This shall enhance Fujifilm's product portfolio and expand its market presence in the bronchoscopy segment.

- In September 2023, Ambu A/S, known for single-use endoscopy solutions, expanded its bronchoscopy portfolio by launching the Ambu® aScope™ 5 Broncho, a next-generation single-use bronchoscope.

MARKET SEGMENTATION

This research report on the global bronchoscopy market is segmented and sub-segmented into product, application, usability, patient and region.

By Product

- Bronchoscopes

- Imaging systems

- Accessories

- Others

By Application

- Diagnostic Bronchoscopy

- Therapeutic Bronchoscopy

By Usability

- Disposable Equipment

- Reusable Equipment

By Patient

- Adults

- Paediatrics

By End-Users

- Hospitals and clinics

- Ambulatory Surgical Centers (ASCs)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How big is the bronchoscopy market?

The global bronchoscopy market size was worth USD 3.29 billion in 2024.

What is the expected CAGR of the bronchoscopy market over the next few years?

The global bronchoscopy market is anticipated to grow at a CAGR of 6.88% over the forecast period.

Which segment by product had the leading share of the global bronchoscopy market in 2024?

The bronchoscopes segment held the leading share of the worldwide market in 2024.

Who are the key players in the bronchoscopy market?

Olympus Corporation, Karl Storz SE & Co. KG., Fujifilm Holdings Corporation, Boston Scientific Corporation, Ambu A/S, Pentax Medical (HOYA Corporation), Cook Medical, Richard Wolf GmbH, Smith & Nephew and Medi-Globe Corporation are a few of the notable companies in the bronchoscopy market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]