Global Brass Market Size, Share, Trends, & Growth Forecast Report Segmented By Type (Brass Wires, Brass Rods, Brass Strips), Application, and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Brass Market Size

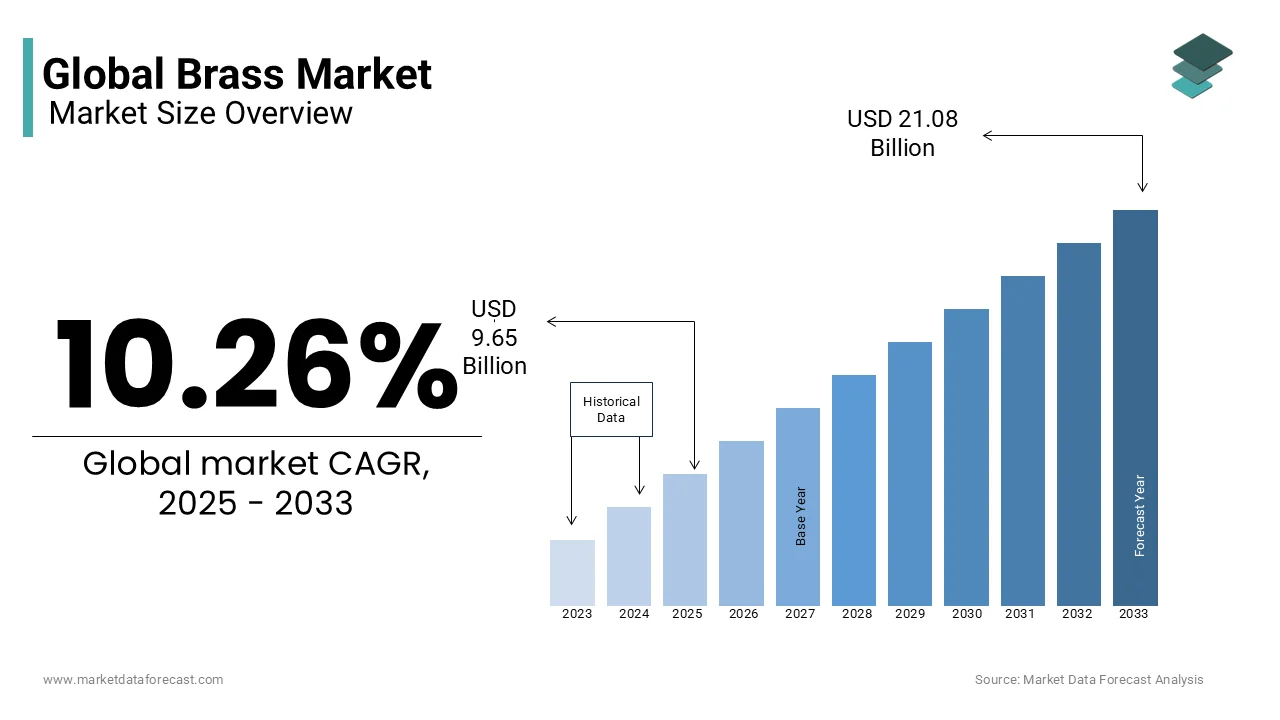

The global Brass market size was valued at USD 8.75 billion in 2024 and is expected to reach USD 21.08 billion by 2033 from USD 9.65 billion in 2025. The market is projected to grow at a CAGR of 10.26%.

Brass is an alloy primarily composed of copper and zinc and is renowned for its excellent machinability, corrosion resistance, and acoustic properties that is making it indispensable in various applications. In the United Kingdom, as of early 2025, the average price for brass scrap is approximately ranges between £3.00 to £3.20 per kilogram. This valuation underscores the material's significant recyclability and the economic incentives associated with its recovery. The recycling of brass not only conserves resources but also reduces energy consumption and environmental impact. According to the U.S. Geological Survey, a substantial portion of brass products is derived from recycled materials, highlighting the alloy's sustainability. This high recyclability rate contributes to the efficient utilization of resources and aligns with global environmental objectives.

In the United States, the Environmental Protection Agency notes that construction and demolition waste, including metals and brass have a minimum recycling rate of approximately 70% which is reflecting the effectiveness of recycling programs and the material's inherent value. This high rate of recycling contributes to the efficient utilization of resources and aligns with global environmental objectives.

MARKET DRIVERS

Infrastructure Development and Urbanization

The surge in global infrastructure projects and rapid urbanization greatly influences the demand for brass. Brass is extensively utilized in plumbing, heating, and cooling systems due to its durability and corrosion resistance. The United Nations reports that by 2050, approximately 68% of the world's population is projected to reside in urban areas, up from 55% in 2018. This urban expansion necessitates substantial construction activities and thereby increasing the consumption of brass in building infrastructures. Additionally, the versatility of brass in architectural applications owing to its aesthetic appeal and malleability and further amplifies its demand in the construction sector. The ongoing development of smart cities and the refurbishment of aging infrastructure in developed nations also contribute to the heightened utilization of brass components.

Advancements in Electrical and Electronics Industry

Technological progressions in the electrical and electronics industry serve as a major catalyst for the brass market. Brass's excellent electrical conductivity and resistance to corrosion make it an ideal material for connectors, terminals and various electronic components. The International Energy Agency indicates that global electricity demand is anticipated to grow by 2.1% annually through 2040 which is driven by increasing digitalization and the proliferation of electric vehicles. This escalating energy demand necessitates the expansion of electrical grids and the production of electronic devices and thereby bolstering the requirement for brass components. Furthermore, the miniaturization trend in electronics, coupled with the rise of renewable energy installations that underscores the need for reliable and efficient conductive materials like brass is ensuring its sustained demand in the industry.

MARKET RESTRAINTS

Environmental Regulations and Compliance

Stringent environmental regulations is a serious constrain for the brass market. The production of brass involves processes that can emit pollutants, necessitating adherence to environmental standards. For instance, the U.S. Environmental Protection Agency (EPA) enforces regulations under the Clean Air Act, which mandates industries to limit hazardous air pollutants. Compliance with such regulations often requires substantial investment in pollution control technologies and sustainable practices which is increasing operational costs. Additionally, the European Union's REACH regulation imposes strict controls on the use of certain chemicals in manufacturing, affecting the types of materials and processes that can be utilized in brass production. These regulatory frameworks compel manufacturers to continually adapt their operations is posing challenges in terms of cost and technological innovation.

Competition from Alternative Materials

The brass market faces tough competition from alternative materials such as aluminum and plastics. Aluminum, for example, offers a favorable strength-to-weight ratio and excellent corrosion resistance which is making it a preferred choice in automotive and aerospace applications. The aluminum production in the United States reached approximately 1.1 million metric tons in 2020 which is reflecting its widespread adoption. Similarly, advanced plastics have been increasingly utilized in plumbing and electrical applications due to their lightweight nature and cost-effectiveness. The versatility and continual development of these alternative materials pose a substantial challenge to the brass industry as manufacturers and consumers seek materials that offer similar or superior properties at a lower cost.

MARKET OPPORTUNITIES

Renewable Energy Infrastructure Expansion

The global shift towards renewable energy sources presents a significant opportunity for the brass market. Brass components are integral in renewable energy systems particularly in wind turbines and solar panels due to their excellent conductivity and corrosion resistance. The International Energy Agency reports that renewable energy capacity is expected to expand by 50% between 2019 and 2024 which is led by solar photovoltaic installations. This surge in renewable infrastructure necessitates substantial quantities of durable and efficient materials like brass and thereby driving its demand. As countries invest in sustainable energy solutions to meet climate goals, the brass industry stands to benefit from increased utilization in energy generation equipment.

Advancements in Additive Manufacturing

The emergence of additive manufacturing is commonly known as 3D printing and offers new avenues for brass applications. This technology enables the production of complex brass components with reduced material waste and enhanced design flexibility. The U.S. Department of Energy highlights that additive manufacturing can significantly reduce energy consumption in manufacturing processes. By adopting 3D printing techniques, industries can efficiently produce customized brass parts for sectors such as aerospace, automotive, and healthcare. The precision and efficiency afforded by additive manufacturing not only enhance product performance but also open new markets for brass applications and thereby fostering innovation and growth within the industry.

MARKET CHALLENGES

Volatility in Raw Material Prices

The brass market encounters key challenges due to fluctuations in the prices of its primary constituents, copper and zinc. According to the U.S. Geological Survey, copper prices have experienced considerable volatility which is influenced by factors such as global demand shifts and geopolitical tensions. Similarly, zinc prices are subject to market dynamics including supply disruptions and changes in industrial consumption patterns. This volatility complicates cost forecasting and pricing strategies for brass manufacturers, potentially impacting profitability and market stability.

Trade Barriers and Market Access Restrictions

Trade barriers including tariffs and non-tariff measures pose substantial challenges to the brass market. The UK's Department for Business and Trade reported that in the fiscal year ending 2025, 39 market access barriers were resolved that is indicating the prevalence of such obstacles. These barriers can limit market entry, increase compliance costs, and disrupt supply chains, thereby hindering the global competitiveness of brass producers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.26% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Truchum, Ahxinke, Diehl Metall, Powerway, Chaplin Wire, BREMA, Metal Alloys Corporation, Laxmi Wire, Dhara Brass Wire, Super Metal, and others |

SEGMENTAL ANALYSIS

By Type Insights

The brass rods segment was the leading segment in the global market in 2024 and accounted for a significant share of the global market. The extensive application of brass rods in manufacturing components for industrial machinery, automotive parts, and plumbing fixtures is majorly contributing to the domination of the segment in the global market. The U.S. Geological Survey highlights that brass rods are favored for their excellent machinability and strength, making them indispensable in producing precision parts. Their widespread use in critical infrastructure and durable goods underscores their leading position in the market.

The brass wires segment is another leading segment and is anticipated to expand at a CAGR of 4.8% over the forecast period owing to the increasing utilization in electrical connectors, springs, and jewelry due to their superior corrosion resistance and workability. The U.S. Geological Survey notes that brass wires are essential in electrical applications, benefiting from the rising demand for electronic devices and advancements in electrical infrastructure. Their adaptability and performance in various applications contribute to their accelerated market growth.

By Application Insights

In the brass market, the automotive segment stood as the largest application segment in 2024 and occupied the major share of the worldwide market in 2024. The growth of the automotive segment in the global market is primarily attributed to extensive use of brass material in manufacturing various automotive components, including radiators, fuel systems, and electrical connectors, owing to its excellent thermal conductivity and corrosion resistance. The U.S. Department of Energy highlights that brass's superior properties enhance vehicle performance and longevity, making it indispensable in automotive applications. The continual growth of the automotive industry, with global vehicle production reaching over 90 million units in recent years, further cements this segment's leading position in the brass market.

The electric appliances segment is predicted to witness a notable CAGR of 5.2% over the forecast period due to the increasing demand for electrical appliances globally, where brass is utilized in components such as terminals, connectors, and switches due to its excellent electrical conductivity and durability. The International Energy Agency reports a significant rise in global electricity demand, which correlates with the heightened production of electric appliances. Additionally, the trend towards energy-efficient appliances necessitates the use of high-quality conductive materials like brass, further propelling growth in this segment.

REGIONAL ANALYSIS

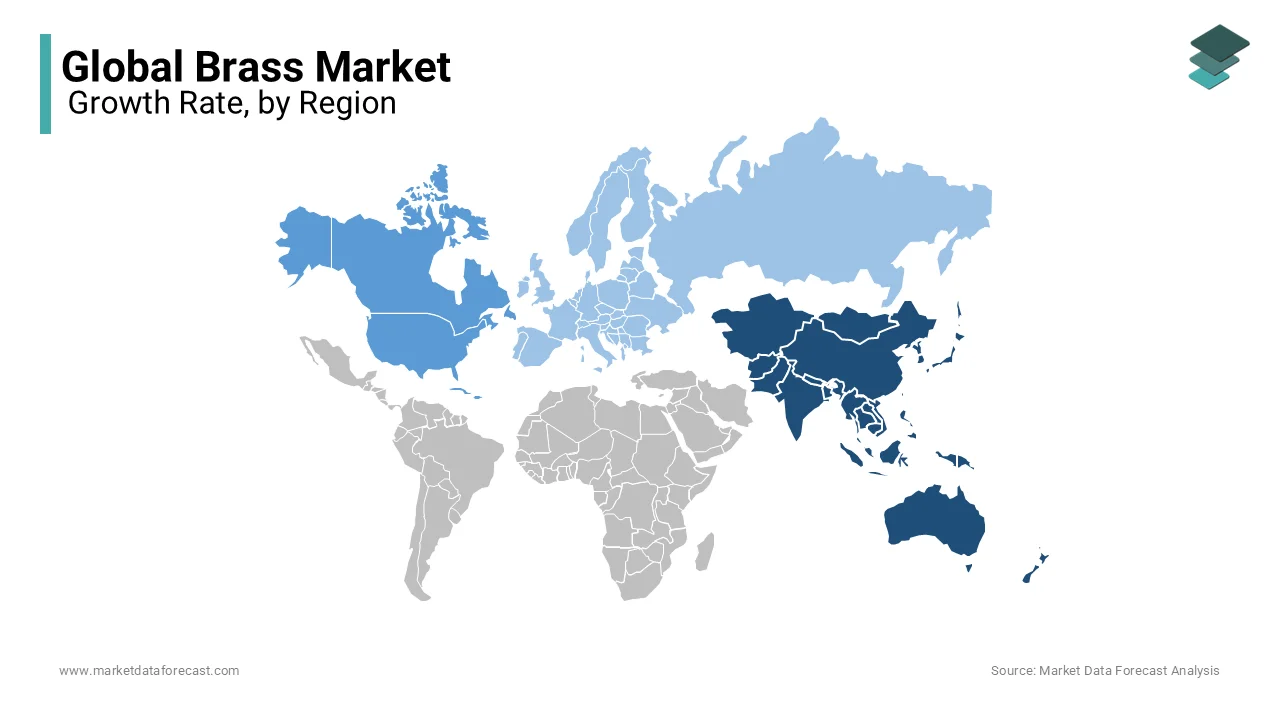

The Asia-Pacific region holds a dominant position in the global brass market and had 42.3% share of the global market in 2024. The rapid industrialization and urbanization in countries such as China and India are propelling the brass market expansion in the Asia-Pacific region. According to United Nations (UN) estimates, India's population reached 1,425,775,850 in April 2023, making it the world's most populous country, overtaking China. This vast population base fuels significant demand in construction, automotive and electronics sectors where brass is extensively utilized. The region's abundant availability of raw materials and cost-effective labor further bolster its leading position in the brass industry.

North America is anticipated to experience the fastest growth in the brass market with a notable CAGR of 6.9%. This acceleration is attributed to advancements in manufacturing technologies and a resurgence in the automotive and construction industries. The U.S. Census Bureau reported that in 2021, the total value of construction put in place was approximately $1.6 trillion indicating robust activity in the sector. Additionally, according to the United States Environmental Protection Agency, ongoing initiatives to promote sustainable materials which include the recycling of non-ferrous metals like brass. These factors contribute to the region's rapid market expansion.

The brass market in Europe is expected to maintain steady growth and is primarily supported by the automotive and construction industries. According to the European Automobile Manufacturers' Association, Europe produced approximately 10.9 million passenger cars in 2022 that is reinforcing its position as a major hub for vehicle manufacturing. Brass components are widely used in automotive electrical connectors, fuel systems, and radiators due to their durability and corrosion resistance. Additionally, the European Green Deal has introduced sustainability regulations and is encouraging the use of recyclable materials like brass. Infrastructure investments across Germany, France, and the UK also contribute to consistent demand because brass remains essential for plumbing and industrial applications.

Latin America is set for moderate growth and is driven by expanding construction and manufacturing activities. The Economic Commission for Latin America and the Caribbean reports that regional infrastructure investment is increasing with Brazil and Mexico leading the way. These countries are witnessing rapid urbanization having over 80% of their populations residing in cities as per the United Nations. The growing need for durable piping systems in water supply and sanitation and coupled with investments in industrial machinery is fueling demand for brass products. However, economic fluctuations and regulatory challenges may moderate the market's overall expansion.

The Middle East and Africa are projected to witness gradual growth in the brass market. This can be propelled by investments in infrastructure and energy sectors. According to the African Development Bank, infrastructure development in Africa requires annual investments of between $130 billion and $170 billion and is highlighting strong demand for construction materials including brass. Additionally, the Middle East's rapid expansion of desalination plants and oil refineries increases the need for corrosion-resistant brass fittings and valves. Gulf Cooperation Council (GCC) countries including the UAE and Saudi Arabia are actively diversifying their economies and is promoting industrial growth that supports the demand for brass-based components in machinery and electrical applications.

KEY MARKET PARTICIPANTS AND COMPETITIVE LANDSCAPE

Truchum, Ahxinke, Diehl Metall, Powerway, Chaplin Wire, BREMA, Metal Alloys Corporation, Laxmi Wire, Dhara Brass Wire, Super Metal Industries are playing dominating role in the global brass market.

The global brass market is characterized by intense competition among key players striving for market share through product innovation, cost efficiency, and strategic partnerships. The industry is fragmented, with several established manufacturers and new entrants competing to provide high-quality brass products for various applications, including automotive, construction, electronics, and plumbing.

Leading companies such as Wieland Group, Truchum, and SAN-ETSU METALS Co., Ltd. maintain their competitive edge through advanced manufacturing processes, superior product quality, and strong distribution networks. The market competition is also driven by pricing strategies, raw material availability, and technological advancements. Companies that can offer cost-effective and high-performance brass alloys gain a significant advantage.

Sustainability and regulatory compliance play a crucial role in market competition. Businesses investing in eco-friendly production methods, efficient recycling, and sustainable sourcing of raw materials can attract environmentally conscious customers and gain a competitive edge. Additionally, geographical expansion and mergers and acquisitions are common strategies used by leading players to strengthen their market positions.

With increasing demand for brass in industries like renewable energy and 5G infrastructure, competition is expected to intensify, compelling companies to focus on continuous innovation, operational efficiency, and customer-centric solutions.

STRATEGIES USED BY THE MARKET PLAYERS

Product Innovation

Companies invest in research and development to create new and improved brass alloys with enhanced properties, such as increased corrosion resistance and better machinability. This focus on innovation allows them to meet evolving industry demands and maintain a competitive edge.

Cost Optimization

Implementing lean manufacturing practices and optimizing supply chains are key strategies to reduce production costs and improve overall efficiency. By streamlining operations, companies can offer competitive pricing while maintaining product quality.

Strategic Partnerships

Collaborating with industry leaders, research institutions, and technology providers enables companies to leverage complementary expertise and stay ahead of the competition. These partnerships can lead to advancements in product development and expanded market reach.

Diversification

Exploring new applications and markets for brass products, such as in the renewable energy sector or additive manufacturing (3D printing), allows companies to tap into emerging opportunities and reduce dependence on traditional markets.

Sustainability Initiatives

Emphasizing sustainability through efficient recycling processes and environmentally friendly practices is becoming increasingly important. Companies focusing on sustainability can enhance their market appeal and comply with evolving environmental regulations.

TOP 3 PLAYERS IN THE MARKET

Wieland Group

Wieland Group is a leading global manufacturer of semi-finished and special products in copper and copper alloys, including brass. The company offers a wide range of brass products such as rods, wires, and strips, serving various industries including automotive, electronics, and construction. Wieland's commitment to innovation and quality has solidified its position as a top supplier in the brass market.

Truchum

Truchum is a significant player in the brass industry, known for its extensive production of brass wires and rods. The company caters to diverse applications, including industrial machinery, automotive, and electrical components. Truchum's focus on technological advancement and adherence to high manufacturing standards contribute to its strong presence in the global brass market.

SAN-ETSU METALS Co., Ltd.

SAN-ETSU METALS Co., Ltd. specializes in the production of high-quality brass products, particularly brass rods and wires. The company's products are widely used in applications such as mechanical fasteners, rivets, and high-strength welding sutures. Their dedication to precision manufacturing and quality assurance has established them as a trusted supplier in the brass industry.

RECENT HAPPENINGS IN THE MARKET

- In September 2024 , Wieland Group , a global leader in copper and brass products, acquired with the brass division of Aurubis AG , Europe’s largest copper producer, in a deal estimated at €2 billion . This merger is anticipated to create one of the largest brass manufacturers globally, enhancing production capacity and strengthening supply chain resilience in the automotive, electronics, and construction industries.

- In December 2024, Sprayking Limited, a prominent company in brass components landscape, reported that its subsidiary, Narmadesh Brass Industries Limited, has secured a significant export order for 100 tons of brass billets worth 5 million rupees.

MARKET SEGMENTATION

This research report on the global brass market has been segmented and sub-segmented based on type, application, and region.

By Type

- Brass Wires

- Brass Rods

- Brass Strips

By Application

- Meshes

- Springs

- Cables and Wires

- Mechanical Fasteners

- Rivets

- High-strength Welding Suture

- Machines

- Automotive

- Electric Appliances

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the current size of the global brass market?

As of 2024, the global brass market was valued at approximately USD 8.75 billion.

2. What is the projected growth of the brass market in the coming years?

The market is expected to reach USD 21.08 billion by 2033, growing at a compound annual growth rate (CAGR) of 10.26% from 2025 to 2033.

3. What factors are driving the growth of the brass market?

Key drivers include infrastructure development, rapid urbanization, and advancements in the electrical and electronics industries. Brass's durability and corrosion resistance make it essential in plumbing, heating, and cooling systems. Additionally, its excellent electrical conductivity makes it ideal for connectors and terminals in electronic components.

4. What challenges does the brass market face?

The market faces challenges such as stringent environmental regulations related to production processes and fluctuations in raw material prices, particularly copper and zinc.

5. Who are the key players in the brass market?

Major industry participants include Wieland-Werke AG, Aurubis AG, and IMI plc, among others.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]