Global Bowling Market Size, Share, Trends & Growth Forecast Report By Lane Material (Wooden Lane, Synthetic Lane), End User (Theme Parks, Shopping Malls), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 to 2033.

Global Bowling Market Size

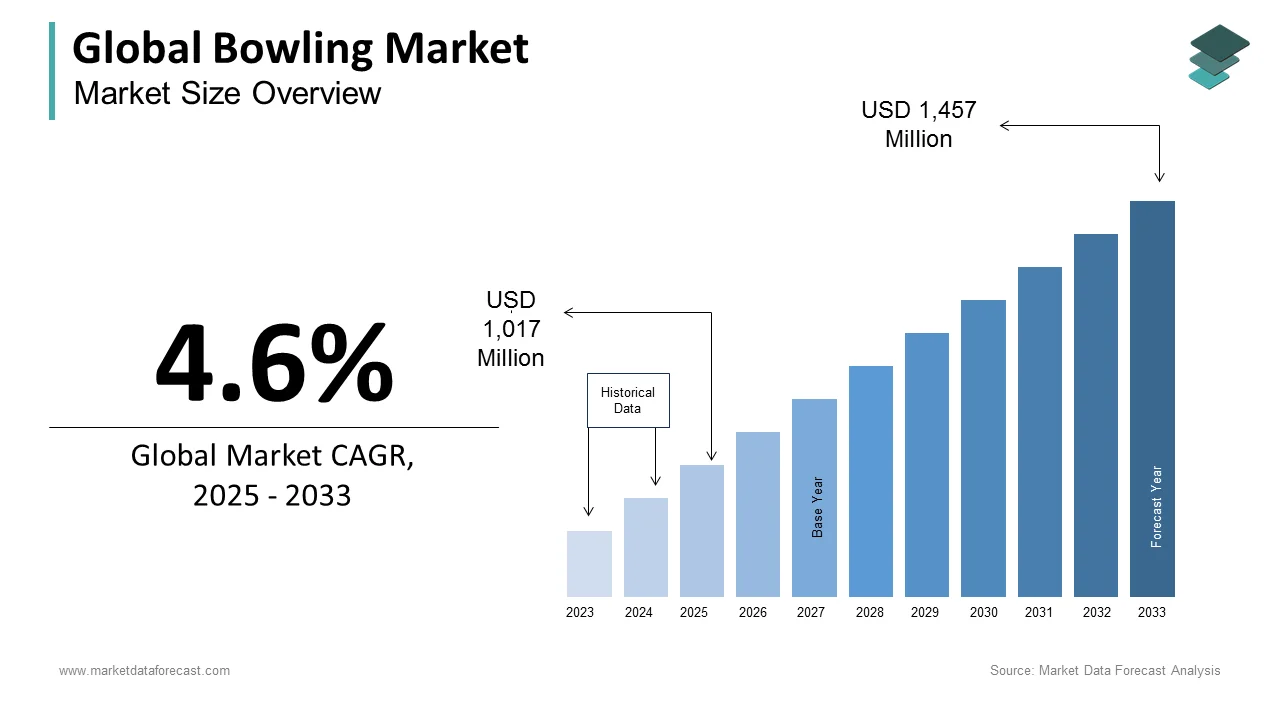

The size of the global bowling market was worth USD 972 million in 2024. The global market is anticipated to grow at a CAGR of 4.6% from 2025 to 2033 and be worth USD 1,457 million by 2033 from USD 1,017 million in 2025.

Bowling serves as both a recreational activity and a competitive sport, attracting a wide range of participants, from casual players to professional athletes. The market has evolved significantly, with modern bowling centers offering a blend of entertainment, dining, and social experiences, making it a popular choice for families and groups. According to the U.S. Census Bureau, there are approximately 3,000 bowling centers operating in the United States which is generating significant economic activity. The Bureau of Labor Statistics reports that the leisure and hospitality sector which includes bowling alleys employs over 16 million people in the U.S. by highlighting the industry's role in job creation. Additionally, the National Sporting Goods Association states that bowling is one of the most participated sports in the country with over 67 million Americans bowling at least once a year.

Globally, bowling has gained traction as a recreational activity, particularly in regions like Europe and Asia. For instance, the European Bowling Federation notes that bowling participation has grown by 15% in the past decade which is driven by the sport's accessibility and social appeal. Furthermore, the World Health Organization emphasizes the health benefits of bowling, such as improved physical fitness and mental well-being which have contributed to its popularity among diverse age groups.

MARKET DRIVERS

Rising Popularity of Recreational and Social Activities

The growing demand for recreational and social activities is a key driver of the bowling market. According to the U.S. Bureau of Labor Statistics, spending on entertainment and recreation activities increased by 5.2% in 2022 with a shift in consumer preferences toward experiential leisure. Bowling is a social and family-friendly activity that has benefited from this trend. The National Sporting Goods Association reports that over 67 million Americans participated in bowling in 2022 by making it one of the most popular recreational sports. This surge in participation is fueled by the sport’s accessibility and the rise of modern bowling centers that combine entertainment, dining, and gaming experiences to attract a broader audience.

Health and Wellness Trends

The increasing focus on health and wellness is driving the growth of the bowling market. According to the World Health Organization, physical inactivity is a leading risk factor for global mortality is prompting individuals to seek accessible forms of exercise. Bowling will burn approximately 150-300 calories per hour that offers a low-impact workout suitable for all age groups. The Centers for Disease Control and Prevention highlights that regular participation in moderate physical activities like bowling can reduce the risk of chronic diseases by 20-30%. This health benefit coupled with the sport’s social appeal has made bowling a popular choice for individuals seeking both physical activity and leisure which is boosting market growth.

MARKET RESTRAINTS

Economic Sensitivity

The bowling sector is notably vulnerable to economic downturns. During recessions, discretionary spending on leisure activities by including bowling is often declines as consumers prioritize essential expenses. For instance, during the 2007–2009 recession, the leisure and hospitality sector which encompasses bowling centers has experienced substantial employment declines. The U.S. Bureau of Labor Statistics reported that these sectors are highly susceptible to economic fluctuations with employment levels closely mirroring broader economic cycles. This economic sensitivity poses challenges for bowling centers in maintaining consistent revenue streams during downturns.

Declining League Participation

Another significant challenge is the industry's reliance on league participation, which has been declining over the years. League bowlers provide a steady source of income; however, there has been a noticeable shift towards casual play. The U.S. Bowling Congress has observed a decrease in sanctioned league bowlers which impacts the financial stability of many bowling centers. This decline necessitates that centers adapt by diversifying their offerings to attract a broader customer base.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Lane Material, End-user, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Brunswick Bowling Products LLC, QubicaAMF Worldwide LLC, Bowlero Corp, Hollywood Bowl Group PLC, Ten Entertainment Group PLC, Ebonite International, Murrey International, US Bowling Corporation, Storm Products, Inc., MOTIV Bowling, and Others. |

MARKET OPPORTUNITIES

Rise of Competitive Socializing

The increasing popularity of "competitive socializing" offers a substantial opportunity for the bowling sector. This trend involves combining social activities with friendly competition, appealing to a broad demographic seeking interactive entertainment. In the United Kingdom, for example, the number of competitive socializing venues has risen by 40% since 2018 and reaching nearly 600 locations. This surge reflects a growing consumer preference for experiential outings over traditional leisure activities. By integrating additional attractions such as arcade games, laser tag, or themed events, bowling centers can enhance their appeal and attract a wider audience. This approach not only diversifies revenue streams but also positions bowling alleys as multifaceted entertainment hubs by catering to varied consumer interests.

Post-Pandemic Recovery and Growth

The post-pandemic landscape presents a unique opportunity for the bowling industry to rebound and expand. According to the U.S. Census Bureau, bowling centers experienced a significant revenue decline of 46.2% during the pandemic which dropped from $4.1 billion in 2019 to $2.2 billion in 2020. As restrictions have eased and consumer confidence returns, there is potential for a strong recovery. By implementing health and safety measures, modernizing facilities, and offering promotions to entice patrons back with bowling centers can leverage the anticipated resurgence in demand for in-person social activities. Additionally, engaging marketing campaigns that highlight the safety and enjoyment of bowling can attract both returning and new customers by facilitating a robust recovery and setting the stage for future growth.

MARKET CHALLENGES

Economic Sensitivity

The bowling sector is notably vulnerable to economic downturns. During recessions, discretionary spending on leisure activities, including bowling, often declines as consumers prioritize essential expenses. For instance, during the 2007–2009 recession, the leisure and hospitality sector, which encompasses bowling centers that experienced substantial employment declines. The U.S. Bureau of Labor Statistics reported that these sectors are highly susceptible to economic fluctuations with employment levels closely mirroring broader economic cycles. This economic sensitivity poses challenges for bowling centers in maintaining consistent revenue streams during downturns.

Declining League Participation

Another significant challenge is the industry's reliance on league participation which has been declining over the years. League bowlers provide a steady source of income. However, there has been a noticeable shift towards casual play. The U.S. Bowling Congress has observed a decrease in sanctioned league bowlers which impacts the financial stability of many bowling centers. This decline necessitates that centers adapt by diversifying their offerings to attract a broader customer base.

SEGMENT ANALYSIS

By Lane Material Insights

The synthetic lane segment led the bowling market by holding a market share of 65% in 2024. The popularity of synthetic lane is driven by their durability, low maintenance requirements, and consistent playing surface is enhancing the bowling experience. Synthetic lanes are also more cost-effective over time compared to wooden lanes, as they require fewer repairs and are resistant to warping. The National Bowling Association highlights that over 70% of new bowling centers in the U.S. are opting for synthetic lanes due to their longevity and performance. This makes synthetic lanes the preferred choice for modern bowling facilities by ensuring their leading position in the market. This growth is driven by their advantages over traditional wooden lanes, including lower maintenance costs, resistance to environmental changes, and enhanced gameplay consistency. The World Bowling Organization notes that synthetic lanes are increasingly adopted in emerging markets where new bowling centers are being established. Additionally, the U.S. Department of Commerce states that synthetic lanes reduce operational downtime by 30% by making them a cost-effective solution for bowling alley owners. These factors underscore the importance of synthetic lanes in driving the future of the bowling industry.

By End User Insights

The shopping malls segment accounted for the leading share of 55% in the global market in 2024. Bowling alleys in shopping malls attract a large customer base due to their convenient locations and integration with retail and dining options. The International Council of Shopping Centers reports that malls with entertainment facilities, such as bowling alleys shall experience a 20% increase in foot traffic. This synergy between retail and recreation makes shopping malls a preferred location for bowling centers is driving their dominance in the market and enhancing their importance as a key revenue generator for the bowling industry.

The theme parks segment is another major end-user in the global market and is esteemed to witness a CAGR of 7.5% from 2025 to 2033. This growth is driven by the increasing demand for family-friendly entertainment and the integration of bowling alleys into theme park attractions. For example, the Themed Entertainment Association states that theme parks incorporating bowling experiences have seen a 15% rise in visitor engagement. Additionally, the U.S. Department of Commerce highlights that theme parks are investing heavily in diversified entertainment options to boost attendance. This trend underscores the importance of theme parks in expanding the bowling market and attracting new audiences.

REGIONAL ANALYSIS

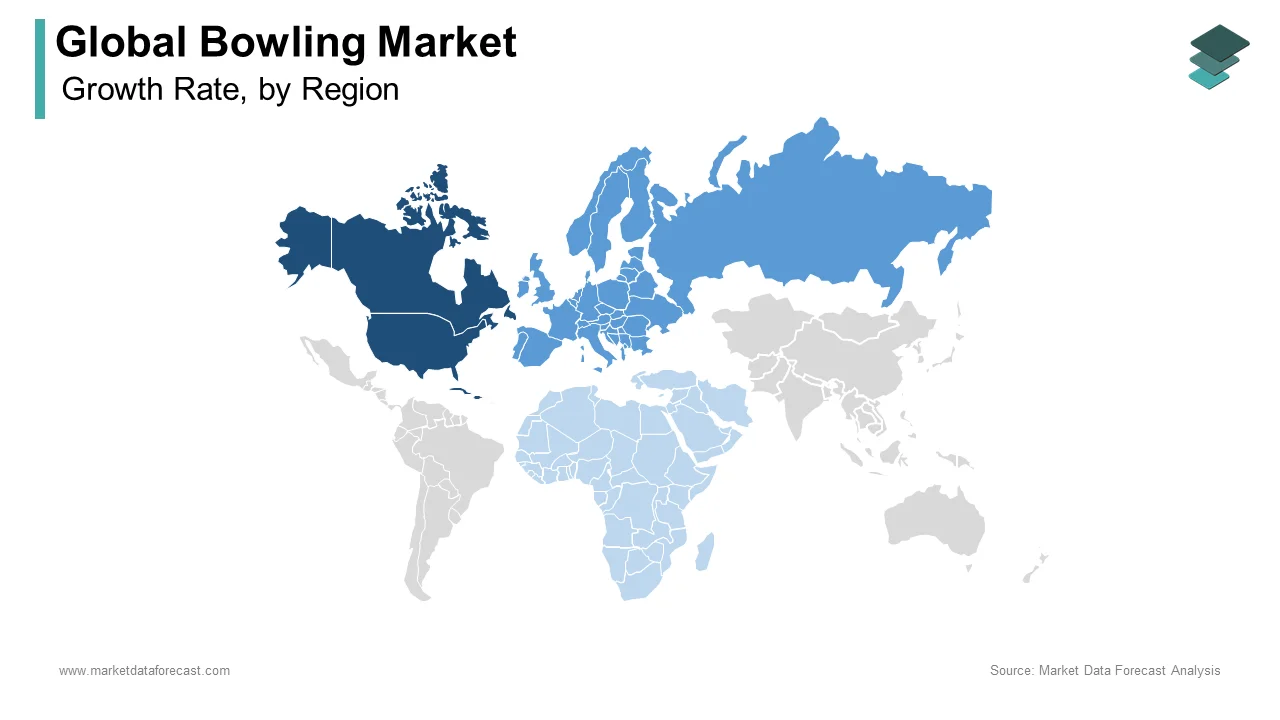

North America holds the largest share in the global bowling market and had 32.4% of the global market share in 2024. This leading position is attributed to the region's well-established bowling infrastructure and the sport's popularity as a recreational activity. According to the United States Bowling Congress (USBC), over 67 million individuals in the U.S. bowled at least once in 2022 which is indicating a strong participation rate. The presence of numerous bowling centers and a culture that embraces bowling contribute significantly to North America's market dominance.

The bowling market has gained immense popularity in the Asia-Pacific region in the recent years and this regional segment is anticipated to exhibit a CAGR of 4.7% over the forecast period. This rapid expansion is driven by increasing urbanization and rising disposable incomes in countries such as China, India, Japan, and Thailand. For instance, China's urban population is anticipated to increase from 2.3 billion in 2019 to 3.5 billion by 2050, according to the United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP). This urban growth has led to a 35% increase in bowling centers in major Asian cities between 2015 and 2022, as reported by the Asian Bowling Federation. The growing middle-class population and a cultural shift towards diverse recreational activities further fuel the market's expansion in this region.

Europe is expected to have the prominent growth opportunities during the forecast period. The presence of historic bowling alleys, especially in countries like the UK and Germany, combined with the increasing trend of modern boutique bowling centers is driving Europe bowling market growth. Additionally, the growing popularity of indoor recreational activities due to unpredictable weather conditions is further boosting the market in this region.

The bowling market in Latin America is anticipated to see moderate growth. Urbanization and rising disposable incomes in countries like Brazil and Mexico are contributing to the development of new entertainment venues, including bowling centers. However, economic fluctuations and competition from other recreational activities may pose challenges to more robust growth.

The Middle East and Africa are emerging markets for bowling, with potential for growth as the regions invest in expanding their entertainment and leisure sectors. The development of new shopping malls and entertainment complexes in countries such as the United Arab Emirates and South Africa presents opportunities for the establishment of modern bowling centers. Nevertheless, cultural preferences and economic disparities across the regions may influence the pace of market development.

KEY MARKET PLAYERS

Companies playing a prominent role in the global bowling market include Brunswick Bowling Products LLC, QubicaAMF Worldwide LLC, Bowlero Corp, Hollywood Bowl Group PLC, Ten Entertainment Group PLC, Ebonite International, Murrey International, US Bowling Corporation, Storm Products, Inc., MOTIV Bowling, and Others.

TOP 3 PLAYERS IN THE MARKET

Bowlero Corporation

As the largest ten-pin bowling center operator worldwide, Bowlero Corporation operates over 325 centers, primarily in the United States. Their brands include Bowlero, Bowlmor Lanes, and AMF Bowling. In 2022, the company reported substantial revenues, reflecting its dominant market position. In September 2019, Bowlero expanded its influence by acquiring the Professional Bowlers Association (PBA), further solidifying its role in both recreational and professional bowling sectors.

Brunswick Bowling Products LLC

Founded in 1845, Brunswick has a long-standing history in the bowling industry. The company offers a comprehensive range of products, including bowling balls, pins, and scoring systems, as well as the design and installation of bowling centers. Brunswick's extensive product line and global reach have made it a trusted name among both recreational bowlers and professionals.

QubicaAMF Worldwide LLC

Established through a merger between AMF Bowling and Qubica in 2005, QubicaAMF is recognized as the world's largest manufacturer of bowling and mini-bowling products. The company is known for pioneering innovations in automatic pinsetters and scoring systems, transforming traditional bowling into a modern, tech-driven sport. Their products are utilized in numerous bowling centers globally, contributing significantly to the industry's advancement.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Diversification of Entertainment Offerings

Companies are expanding beyond traditional bowling to include various entertainment options. For instance, Bowlero Corporation has acquired entertainment venues and water parks, rebranding as Lucky Strike Entertainment to reflect its broader focus.

Modernization and Technological Integration

Investing in modern technologies enhances customer experience and operational efficiency. Implementing online booking systems and mobile applications facilitates convenient reservations and loyalty programs, attracting a tech-savvy clientele.

Enhancing Food and Beverage Services

Developing comprehensive food and beverage offerings increases customer dwell time and boosts revenue. Organizing themed events, such as beer tastings or cocktail nights, complements the bowling experience and appeals to a wider audience.

Strategic Marketing and Branding

Effective marketing campaigns and rebranding efforts help companies stay relevant. For example, Bowlero's rebranding to Lucky Strike Entertainment signifies its expansion into diverse entertainment sectors.

Geographic Expansion: Expanding into new markets increases customer reach. Lane7's recent entry into the European market with a venue in Berlin exemplifies this approach.

COMPETITIVE LANDSCAPE

The global bowling market is experiencing dynamic competition characterized by strategic expansions, technological advancements, and diversification of entertainment offerings. Leading companies such as Bowlero Corp, Hollywood Bowl Group PLC, and Ten Entertainment Group PLC are at the forefront of these developments.

Bowlero Corp, the largest operator of bowling centers in the U.S., is rebranding to Lucky Strike Entertainment as it diversifies into broader family entertainment venues and water parks. This strategic move, effective December 12, 2024, includes changing its stock ticker from BOWL to LUCK, signaling a shift into the expansive U.S. market for location-based entertainment. Despite this diversification, Bowlero continues to expand its bowling locations, with bowling revenue still seeing growth. Additionally, non-bowling revenue streams such as food, beverages, and amusement parks are contributing significantly to the company's top line.

In the UK, Hollywood Bowl Group PLC, the largest ten-pin bowling operator, reported record annual revenue of £230.4 million, a 7.2% increase from the previous year. This growth is driven by strong performances at its 13 Canadian locations, where sales surged 42% to £30.7 million. However, in the UK, like-for-like sales remained flat, and revenue for its mini-golf centers declined due to the rise in competitive socializing venues. CEO Stephen Burns noted a significant increase in the number of experiential leisure activities since 2019. Hollywood Bowl aims to cater to active families rather than Gen Z consumers targeted by new activity-based bars. Despite an expected post-pandemic slowdown, the company foresees core profits exceeding £65 million, surpassing analyst expectations. Hollywood Bowl expanded into Canada in 2022 and aims to have 130 venues across the UK and Canada by 2035.

Ten Entertainment Group PLC has also shown significant growth, with sales up nearly 40% compared to pre-pandemic levels. The company operates multiple entertainment centers across the UK, offering a combination of bowling and other leisure activities. This diversification strategy has enabled it to attract a broad customer base seeking varied entertainment options.

RECENT MARKET DEVELOPMENTS

- September 2019, Bowlero Corporation, the largest operator of bowling centers in the U.S., acquired the Professional Bowlers Association (PBA). This acquisition aimed to integrate professional bowling events with their recreational venues, enhancing brand prestige and attracting bowling enthusiasts.

- May 2023, Bowlero Corporation purchased all 14 locations of Lucky Strike Lanes across nine states. This move expanded Bowlero's footprint in the upscale bowling segment, appealing to a more diverse customer base.

- December 2024, Bowlero Corporation rebranded as Lucky Strike Entertainment. This rebranding signified the company’s diversification into broader family entertainment venues and water parks, positioning it to capture a larger share of the location-based entertainment market.

- May 2022, Hollywood Bowl Group acquired the Canadian Splitsville brand. This acquisition marked Hollywood Bowl’s first international expansion, aiming to establish a presence in the Canadian market.

- 2023, Hollywood Bowl Group reported record annual revenue of £230.4 million, a 7.2% increase from the previous year. This growth was attributed to strong performances at its Canadian locations and plans to open more sites to meet rising demand.

- November 2023, Lane7, a boutique bowling operator, opened its first European site in Berlin. This expansion into the European market aimed to broaden Lane7’s international presence and attract a diverse clientele.

- December 2024, Bowlero Corporation acquired Boomers Parks. This acquisition expanded Bowlero’s entertainment offerings beyond bowling, incorporating amusement parks to diversify revenue streams.

- 2023, Hollywood Bowl Group announced plans to have 130 venues across the UK and Canada by 2035. This long-term expansion strategy aims to solidify the company’s market leadership and cater to growing demand.

- 2024, Pinstripes, a bowling-themed restaurant chain, introduced community-friendly events such as kids' clubs, comedy nights, and yoga classes. These initiatives were designed to attract a broader customer base and enhance customer engagement.

- 2023, Lane7 reported £22.3 million in sales with a pre-tax profit of £5.1 million for the year ending October 2023. This financial growth reflects the company’s successful expansion strategy and operational efficiency.

MARKET SEGMENTATION

This research report on the global bowling market has been segmented and sub-segmented based on lane material, end-user, and region.

By Lane Material

- Wooden Lane

- Synthetic lane

By End User

- Theme Parks

- Shopping Mall

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1 1. What is the current size and projected growth of the global bowling market?

In 2024, the global bowling market is valued at USD 972 million. It is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 4.6% from 2025 to 2033, reaching an estimated USD 1,457 million by 2033.

2. What factors are driving the growth of the bowling market?

The market's expansion is primarily driven by the rising popularity of recreational and social activities. Modern bowling centers that offer a combination of entertainment, dining, and gaming experiences are attracting a broader audience. Additionally, health and wellness trends contribute to growth, as bowling provides a low-impact physical activity suitable for all age groups.

3. How does bowling contribute to health and wellness?

Bowling offers a low-impact form of exercise that can burn approximately 150-300 calories per hour. Regular participation in activities like bowling can reduce the risk of chronic diseases by 20-30%, according to the Centers for Disease Control and Prevention. This makes it an appealing option for individuals seeking both physical activity and leisure.

4. What challenges does the bowling market face?

The bowling sector is sensitive to economic downturns. During recessions, discretionary spending on leisure activities, including bowling, often declines as consumers prioritize essential expenses. For example, during the 2007–2009 recession, the leisure and hospitality sector, which encompasses bowling centers, experienced substantial economic challenges.

5. How has bowling's popularity evolved globally?

Globally, bowling has gained traction as a recreational activity, particularly in regions like Europe and Asia. The European Bowling Federation notes that bowling participation has grown by 15% in the past decade, driven by the sport's accessibility and social appeal. Additionally, the World Health Organization emphasizes the health benefits of bowling, such as improved physical fitness and mental well-being, which have contributed to its popularity among diverse age groups.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]