Global Border Security Market Size, Share, Trends, & Growth Forecast Report – Segmented by Platform (Ground, Aerial & Naval), System (Laser, Radar, Camera, Wide Band Wireless Communication, Perimeter Intrusion, Unmanned Vehicles, C2C, Biometric Systems and Others), & Region - Industry Forecast From 2024 to 2032

Global Border Security Market Size (2024 to 2032)

The global border security market was worth USD 38.64 billion in 2023. The global market is predicted to reach USD 42.66 billion in 2024 and USD 94.14 billion by 2032, growing at a CAGR of 10.4% over the forecast period.

Border security serves to safeguard the country and international borders from illegal smuggling and terrorist activities. Illegal drug, weapon, and contraband movement across the border is tackled by border security. Border security systems include lasers, cameras, and radar. Surveillance capabilities, real-time target images, and precise target location capabilities are enhanced by installing border security systems. In addition, border security forces regularly monitor the data to develop enhanced security tactics to offer its citizens a superior level of safety.

MARKET DRIVERS

The growth of the global border security market is primarily driven by instability across borders due to rising geopolitical instabilities and territorial struggles.

Military and defense forces readily adopt unmanned defense systems, fuelling the necessity for advanced border security. Furthermore, increasing terrorist threats and geopolitical instabilities are important driving factors in the border security market. In addition, illegal smuggling and immigration activities across borders necessitate the adoption of border security systems. As a result, surveillance aircraft, ground attack helicopters, transport helicopters, patrol aircraft, marine vessels, amphibious aircraft, and submarines for border security are being procured at an increasing rate fuelling the demand for enhanced border security systems over the forecast period.

Modernization of the overall defense systems, including the existing border security technology, is serving the market with tremendous growth opportunities. The trend of autonomous technology is leading to the technological advancement in unmanned systems needing constant surveillance by the rival countries. Governments in developing countries actively invest in developing their overall defense forces, including border security, in avoiding military superpowers' oppression.

MARKET RESTRAINTS

The restraining factors prevalent in the market are strict government rules related to border security systems production and the falling defense expenditure by developed countries. Stringent government rules and regulations are a major restraining factor. Vendors are required to follow local and foreign regulations. The result of failing to adhere to the norms are criminal, civil, and administrative liabilities. In addition, developed countries have witnessed a declining government expenditure hindering the market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

10.4% |

|

Segments Covered |

By Platform, System, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Raytheon Company, Lockheed Martin Corporation, Thales SA, BAE Systems PLC, Flir Systems, Elbit Systems, Saab AB, Northrop Grumman Corporation, Finmeccanica SPA, Safran, Israel Aerospace Industries Ltd., Rockwell Collins, and Airbus Group SE |

SEGMENTAL ANALYSIS

Global Border Security Market Analysis By Platform

The ground segment held the most significant global border security market share. The segment is expected to retain its dominance in the forecast period with a significant compound annual growth rate (CAGR). Radars, lasers, cameras, and others are mainly included in the ground-based border security systems. To provide enhanced security to its citizens, countries like India and China actively procure advanced security systems assisted by trained personnel. On the other hand, the sea-based segment is likely to project a significant growth rate due to the growing competition in the international waters and overlapping claims.

Global Border Security Market Analysis By System

The radar segment accounted for the most significant global border security market share. Biometric systems are likely to project the highest compound annual growth rate (CAGR) during the forecast period. The primary purpose of a biometric system is to track illegal activities across the border.

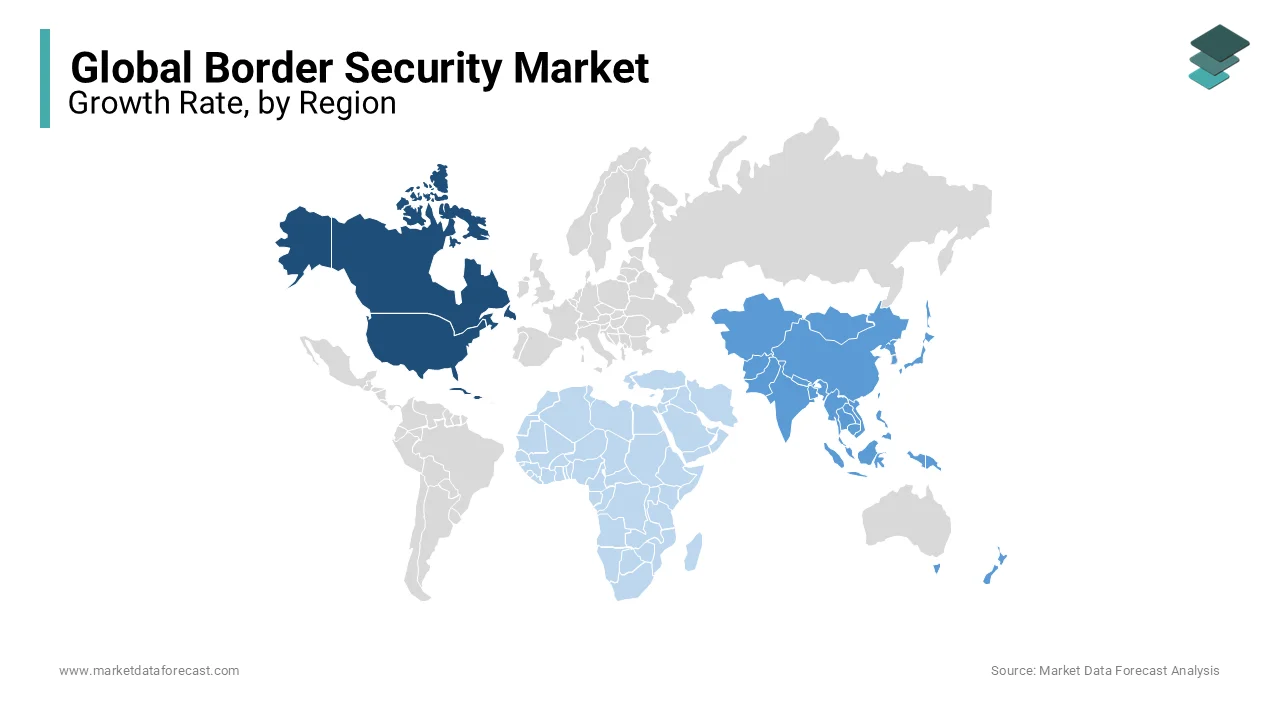

REGIONAL ANALYSIS

Based on the global border security market share, the recent past was dominated by North America owing to the defense expenditure of the U.S.

Developed countries have been collaborating to establish well-defined borders to avoid conflict with enhanced border security systems for surveillance. The highest compound annual growth rate (CAGR) is anticipated to be held by the Asia Pacific over the forecast period. The growth can be attributed to the growing territorial conflict among military superpowers like India and China. Asian countries are heavily investing in the technological advancement of the defense systems and the up-gradation of existing border security systems. The current ongoing border issues in the Asia Pacific region are between India – China, India- Pakistan, and China-Japan. Southern countries are developing systems to bust smuggling routes through detection and interception.

The Middle East and North American local vendors are the primary threat to the global players in the border security market. With similar quality and reliability, local vendors fulfill the needs with a fraction of the cost quoted by the global players.

KEY MARKET PLAYERS

Raytheon Company, Lockheed Martin Corporation, Thales SA, BAE Systems PLC, Flir Systems, Elbit Systems, Saab AB, Northrop Grumman Corporation, Finmeccanica SPA, Safran, Israel Aerospace Industries Ltd., Rockwell Collins, and Airbus Group SE are a few of the prominent companies operating in the global border security market profiled in this report.

The market is highly fragmented. Global defense systems and technology providers dominate the market. However, local players across the globe are strong enough to compete with global defense systems and technology providers. With global leaders’ partnership, local players supply subsystems of a larger project/network.

RECENT MARKET DEVELOPMENTS

-

In 2016, UAE signed a collaboration contract to purchase eight drones made in Italy. The €316 million contract includes the purchase of eight Piaggio P.1HH Hammerhead UAVs.

-

In 2015, Saudi Arabia built a 600-mile-long ‘Great Wall’ TO build a shield against the terrorist organization ISIS. In addition, a state-of-the-art Spexer 2000 radar was installed. The radar could detect pedestrians and helicopters from 17 and 36 kilometers.

DETAILED SEGMENTATION OF THE GLOBAL BORDER SECURITY MARKET INCLUDED IN THIS REPORT

This research report on the global border security market has been segmented and sub-segmented based on the platform, system, and region.

By Platform

- Ground

- Aerial

- Naval

By System

- Laser

- Radar

- Camera

- Wide Band Wireless Communication

- Perimeter Intrusion

- Unmanned Vehicles

- C2C

- Biometric Systems

- Others

By Region

- North America

- Latin America

- Europe

- Middle East & Africa

- Asia Pacific

Frequently Asked Questions

What are the key drivers of the global Border Security Market?

The key drivers include increasing geopolitical tensions, rising illegal immigration, growing cross-border terrorism, advancements in surveillance and detection technologies, and the need for nations to protect their sovereignty and ensure the safety of their citizens.

What are the main types of technologies used in border security?

The main types of technologies used in border security include biometric systems (fingerprint, facial recognition), unmanned aerial vehicles (UAVs), ground surveillance radar, thermal imaging systems, motion sensors, integrated communication systems, and cybersecurity solutions.

What are the main challenges faced by the border security market?

Challenges include high costs of advanced technologies, privacy and ethical concerns, integration complexities with existing systems, the need for continuous upgrades, and the evolving nature of security threats which require adaptive and flexible solutions.

What is the future outlook for the border security market?

The future outlook is positive, with continuous technological advancements and increasing investments expected. The focus will likely shift towards more integrated and intelligent systems, greater use of AI and machine learning, and enhanced international cooperation to address cross-border threats effectively.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]